January 2025

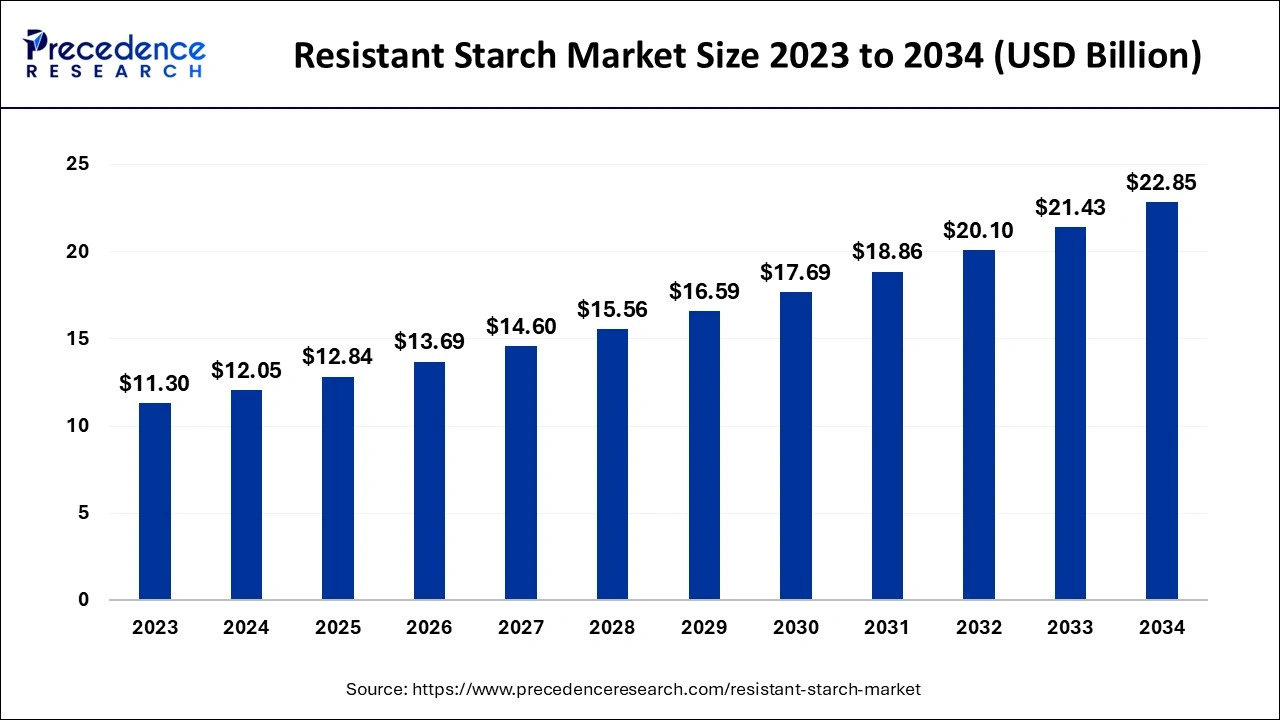

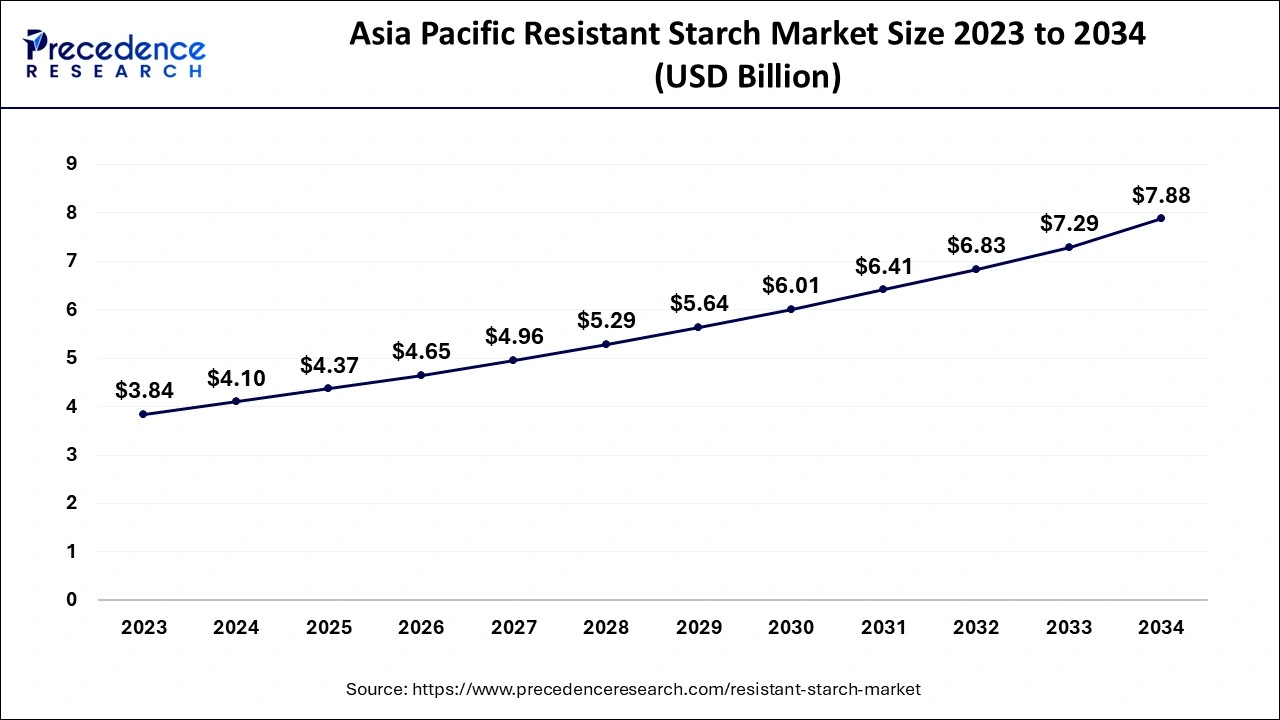

The global resistant starch market size is evaluated at USD 12.05 billion in 2024, grew to USD 12.84 billion in 2025 and is projected to reach around USD 22.85 billion by 2034. The market is expanding at a solid CAGR of 6.61% between 2024 and 2034. The Asia Pacific resistant starch market size is calculated at USD 4.1 billion in 2024 and is expected to grow at a solid CAGR of 6.75% during the forecast year.

The global resistant starch market size accounted for USD 12.05 billion in 2024 and is predicted to surpass around USD 22.85 billion by 2034, growing at a solid CAGR of 6.61% from 2024 to 2034. The resistant starch market continues to grow because of the increased health consciousness, demand for functional food products, diabetes management solutions, and application in various products.

The Asia Pacific resistant starch market size is exhibited at USD 4.1 billion in 2024 and is anticipated to be worth around USD 7.88 billion by 2034, growing at a solid CAGR of 6.75% from 2024 to 2034.

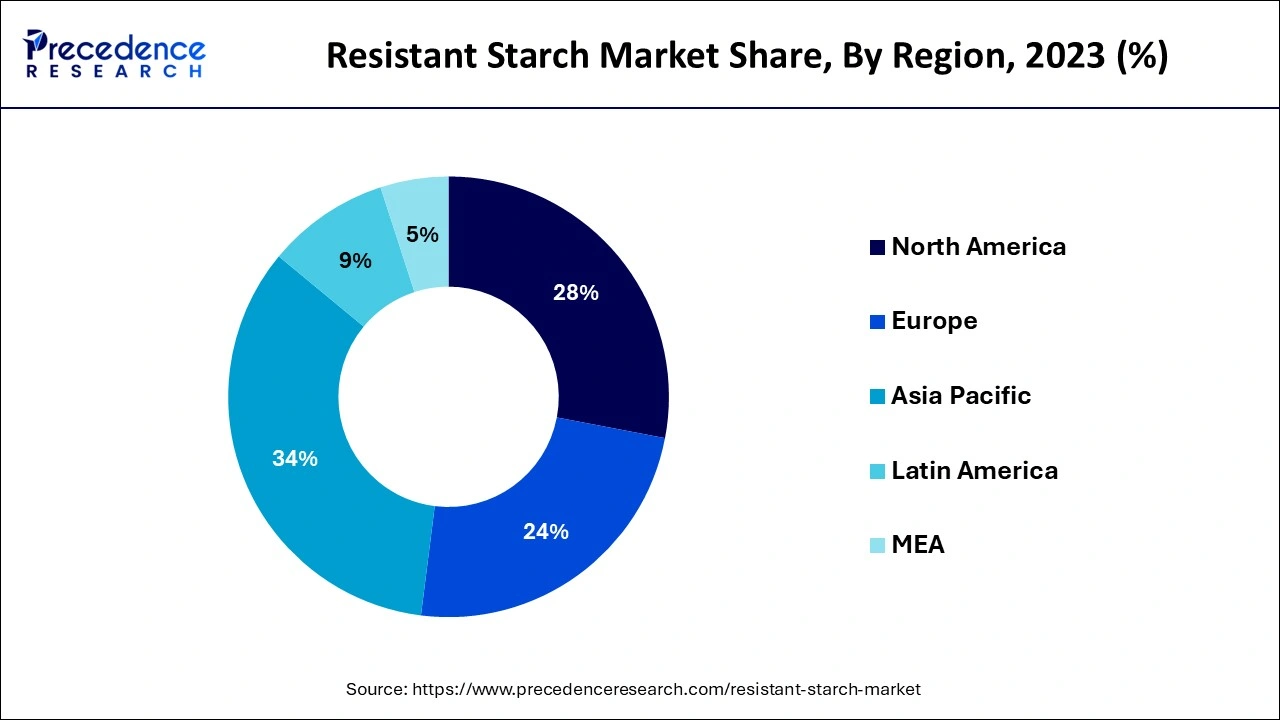

Asia Pacific accounted for the largest share of the resistant starch market in 2023. Asia Pacific showed leadership in the consumption of resistant starch, which is attributed to China and Japan. This growth is attributed to the growth in processed foods as more people look for convenience food. Trends in the health sector, as well as an increased understanding of digestive health and weight management, have strengthened the resistant starch market. Urbanization is increasing the rate at which people change their diet to consume efficient foods. New product development by the market leaders in the food industry is adding significance to the use of resistant starch across various products.

North America is anticipated to witness the fastest growth in the resistant starch market during the forecasted years. Factors such as improving consumer awareness and other health conditions that are associated with lifestyle, including obesity and diabetes, have increased the need for resistant starch. Vegetables such as potatoes, bread & bakery products, and pasta & noodles are one of the most widely distributed sources of resistant starch in North America. An increase in the population of the global food industry resulted in the introduction of new products containing resistant starch into snacks, bakery, and dairy.

Resistant starch (RS) can be naturally food-derived and found in bananas, potatoes, or whole grains. It can also be added to manufacturing food products as an ingredient. Resistant starch is the physical term used to refer to dietary starch that is ‘resistant’ to digestion in the small bowel. It is a type of nutrient that may assist the body with issues involving digestion, weight loss, disease prevention, and more. Resistant starch is a source of food for the microbiome within the bowel, which ferments it into compounds that are useful for healthy bowels and against gut and other diseases.

| Report Coverage | Details |

| Market Size by 2034 | USD 22.85 Billion |

| Market Size in 2024 | USD 12.05 Billion |

| Market Size in 2025 | USD 12.84 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.61% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Source, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Growth of applications of resistant starch in the food industry

Resistant starch products can be used as a direct replacement for all or a portion of the flour in baked goods, including bread, cakes, cookies, and other prepared baked products, such as pizza dough, as well as in pasta or noodles. The resistant starch market can be divided into categories such as dairy products, bakery products, sugar confectionery, and convenience foods.

The bakery products shall experience increased growth due to the increasing need for natural, healthy, gluten-free bakery products across the global resistant starch market. The research also suggests that bread is likely to remain the largest category of bakery products in the future because it is nutritionally rich. There are likely to be great growth prospects for bakery products in the dairy products.

Lack of awareness

The benefits of incorporating resistant starch into food products are well-known to manufacturers, but a low consumer approach toward resistant starch restricts its application. Also, strong food regulations on food products create boundaries for food safety, and labeling may pose a threat to the resistant starch market. Production limitations such as the number of procedures involved in the manufacturing processes need heavily invested in technology. There is the possibility that high intakes affect the digestive system and discourage consumers from using resistant starch.

Growing health awareness

The benefits associated with resistant starch, including enhancing digestive health, controlling blood glucose levels, obesity, and satiety, complement the consumer trend of demanding healthy foods, and therefore, it is believed that this factor will drive the resistant starch market growth. Consumer awareness of health is increased, and the use of resistant starch is deemed to be high because of its health benefits.

Resistant starch is a fiber that is essential for health and has the potential to improve digestion, lower blood sugar levels, and improve gut health. It also helps manage obesity because it creates feelings of volume and, hence, causes a reduction in the number of calories ingested. Due to the resistant starch market application in fibers in diets and various health benefits, it is slowly attracting the attention of industry players and customers, creating the need for the products.

The grains segment contributed the biggest share of the resistant starch market in 2023. The main sources include starches derived from corn, wheat, rice, potatoes, cereals, beans, and other grains that can be used to prepare resistant starches. The increasing application of functional ingredients is a reason for the consumption of resistant starch from grains. Starch from whole grain gained more attention and appreciation for the production of resistant starch that possesses inherent nutritional advantages and corresponding market associated with changes in dietary lifestyle. Whole-grain foods have carbohydrates that consist of resistant starch, and this substance is not digested in the small intestine as dietary fiber. This characteristic makes whole grains suitable for manufacturers to improve their product's fiber content and nutritional value.

The RS2 segment has held the largest share of the resistant starch market in 2023. The high crystallinity and high amylose content of RS2 derived from grain sources allow the resistant starch not to be digested by enzymes, which leads to the increasing application of the material for food purposes. RS2 is produced from high-amylose wheat and rice grains. RS2-resistant starches contain functions that lower the risk of type 2 diabetes. RS2 is the most extensively researched RS and consists of dense gelatinized whole granules that restrict access to and the action of enzymes. It also includes high amylose corn starch and uncooked potatoes.

The soups, dressings, and condiments segment led the global resistant starch market in 2023. The expansion of a new trend, which is the global consumption of soups and salads, is increasing. Growing incidences of obesity and chronic diseases have led to shifts in the eating habits of consumers, enhancing the growth rate of the market. Resistant starch can be incorporated into soups, dressings, and condiments to act as a thickening agent or to regulate the texture and stability of the food. Waxy maize processing, potato, tapioca, rice, corn, wheat, and waxy rice starches can be applied as fat mimetic in dressings, spreads, margarines, and sauces.

The meat substitutes segment is projected to witness the fastest growth in the resistant starch market during the forecast period. It is widely utilized in meat substitutes/ It influences texture and quality, retarding process degradation and resulting in non-uniformity of the final product. As meat substitutes gain widespread acceptance among consumers, manufacturers are prioritizing the production of substitutes with authentic texture, flavor, and color. Resistant starch acts as a functional ingredient in the food industry, especially in the formulation and processing of meat substitutes.

Segments Covered in the Report

By Source

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

August 2024

June 2024