October 2024

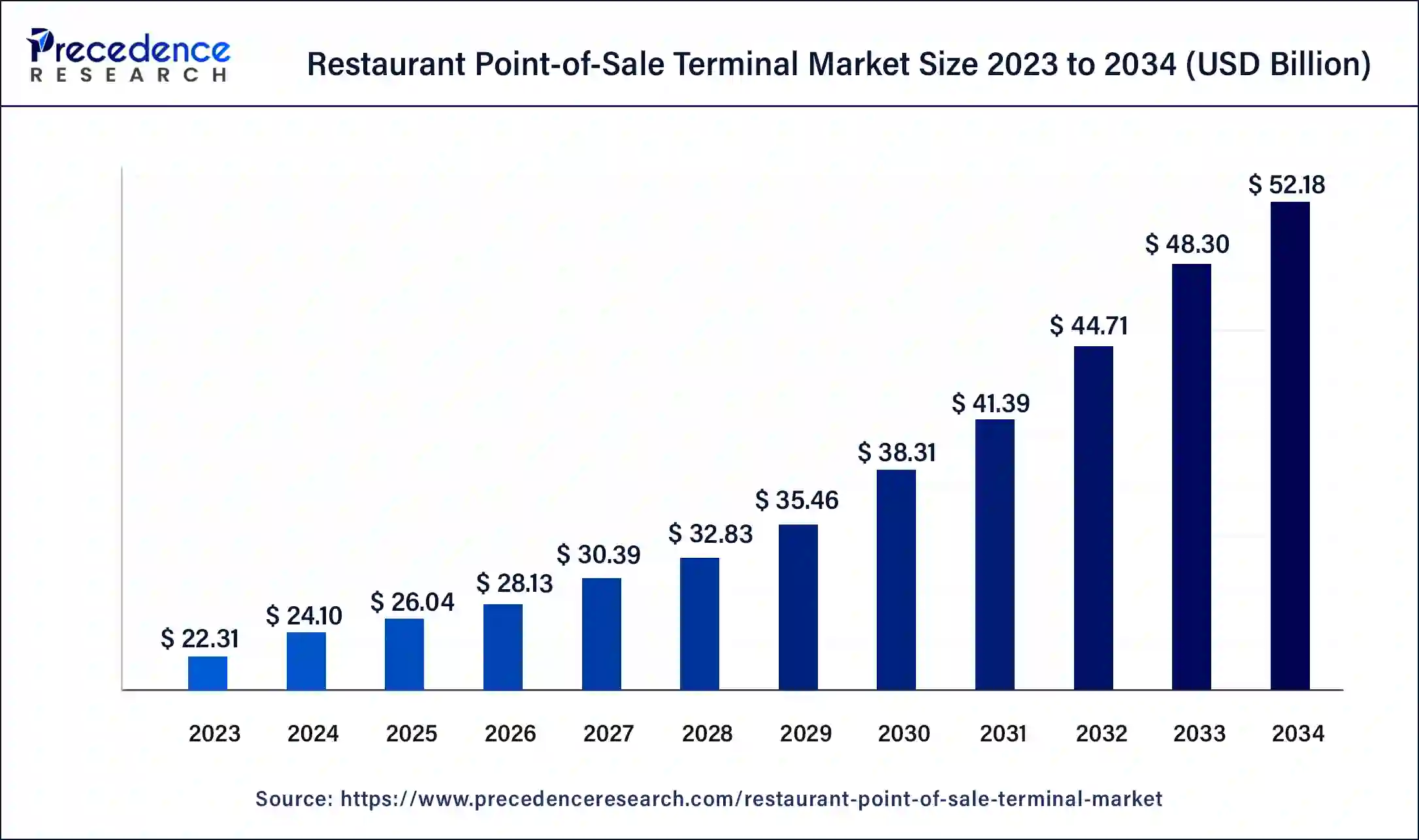

The global restaurant point-of-sale terminal market size surpassed USD 22.31 billion in 2023 and is estimated to increase from USD 24.10 billion in 2024 to approximately USD 52.18 billion by 2034. It is projected to grow at a CAGR of 8.03% from 2024 to 2034.

The global restaurant point-of-sale terminal market size is projected to be worth around USD 52.18 billion by 2034 from USD 24.10 billion in 2024, at a CAGR of 8.03% from 2024 to 2034. Increasing food service outlets across the globe need the technology to seamlessly streamline operations, which enhances efficiency and overall turnover of the restaurants, fuelling the growth of the restaurant point-of-sale terminal market.

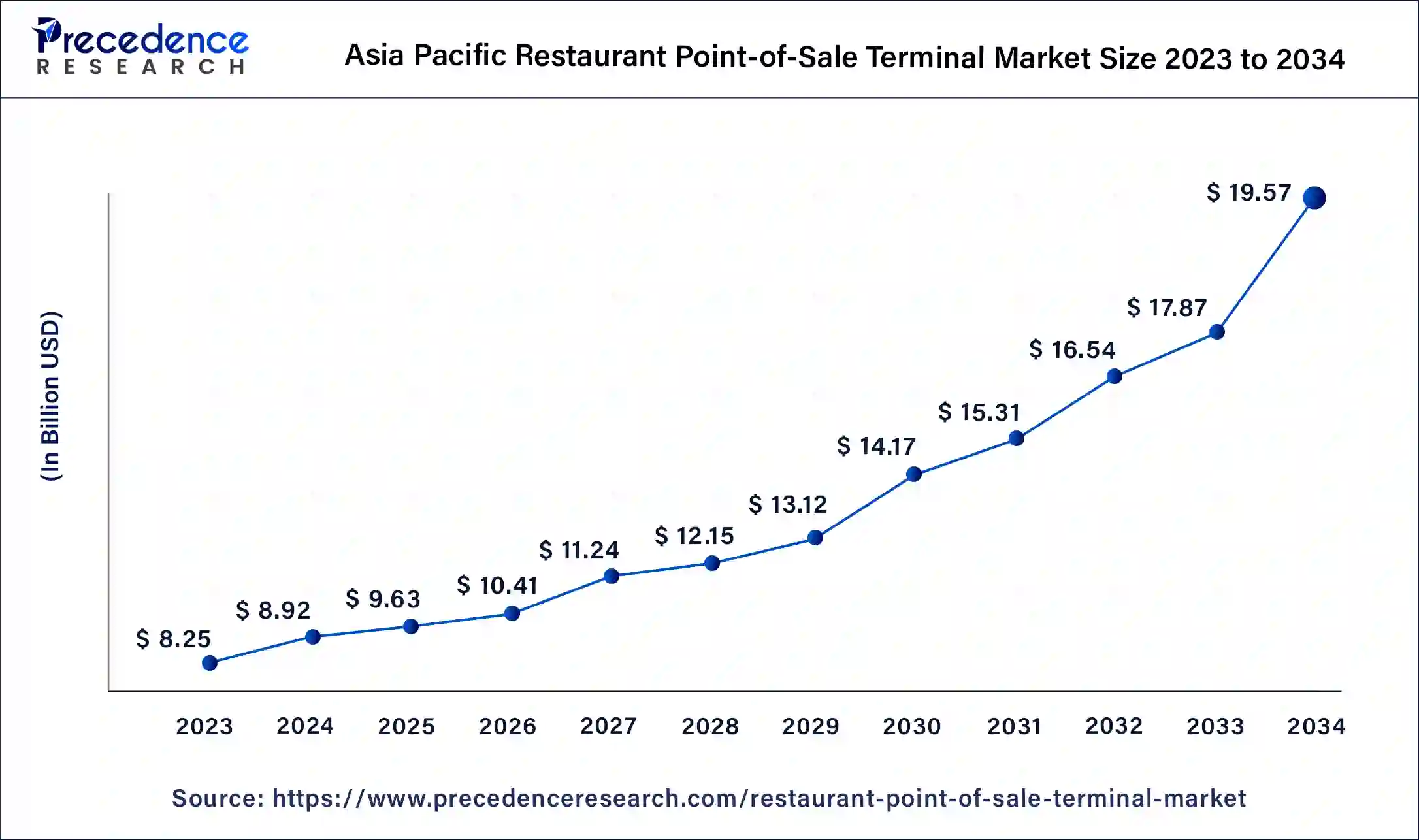

The Asia Pacific restaurant point-of-sale terminal market size was exhibited at USD 8.25 billion in 2023 and is projected to be worth around USD 19.57 billion by 2034, poised to grow at a CAGR of 8.16% from 2024 to 2034.

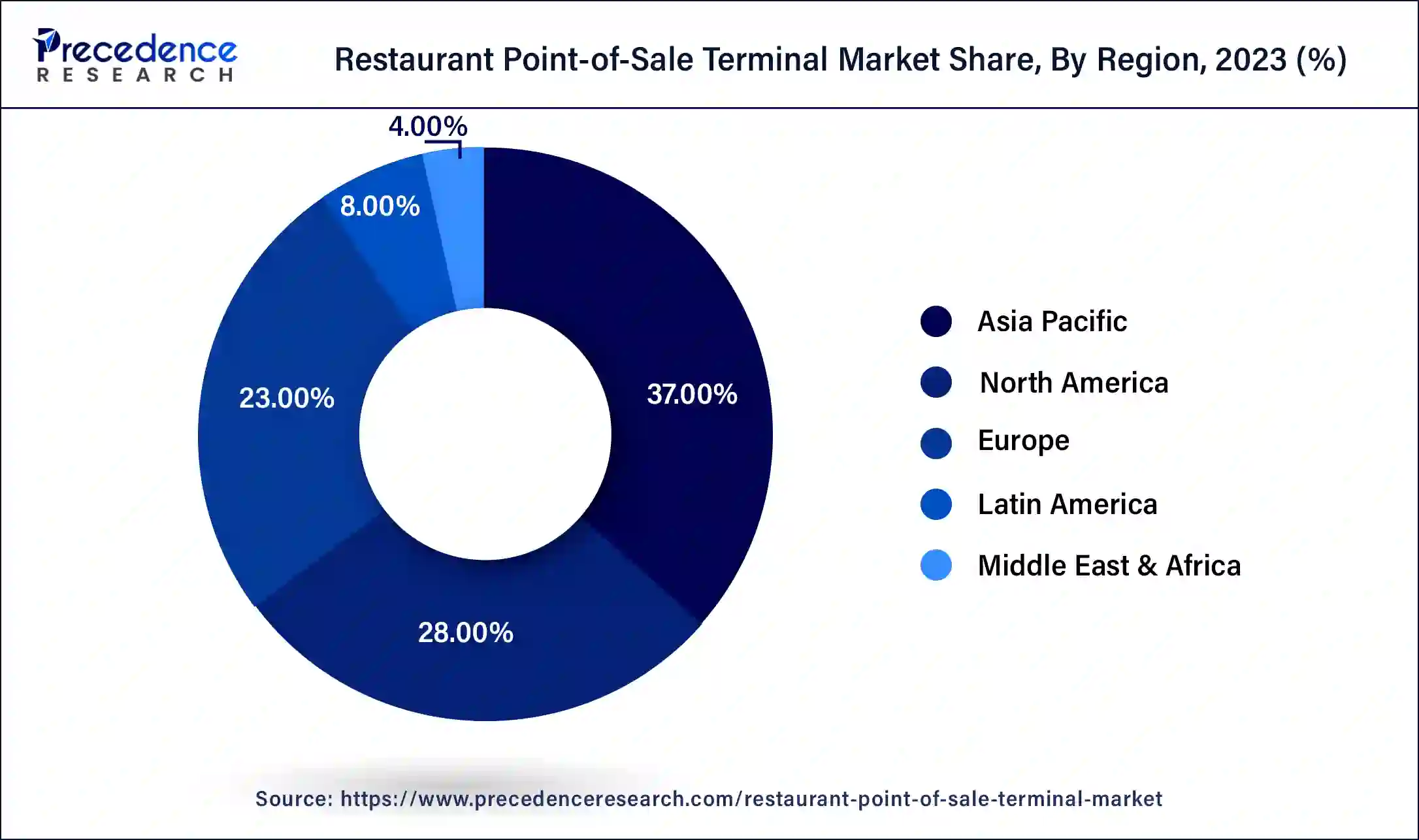

Asia Pacific registered the largest share of the restaurant point-of-sale terminal market in 2023. The growth of the Asia Pacific region is due to the fast-paced urbanization in economically emerging countries such as China, India, Japan, and Malaysia. Moreover, people living away from their jobs are major contributors to the food sector's rapid expansion, specifically in urban and suburban areas. To manage these masses, the POS terminal is a popular choice made among Indian restaurant owners to streamline operations.

In this market, India is the frontier, which aids market expansion due to the substantial proliferation of the food sector. The rise of Western culture and lifestyle and the increase in disposable income allow people to spend more on foods from various outlets. India has become a frontier in cashless/digital payment over the recent years since it's easier to adopt the digital payment mode. According to the data published by PWc, the Indian payments handbook's new-age products, such as UPI, have seen a surge in the Indian payment method.

| Transaction volume of UPI (INR trillion) | Financial Year |

| 139 | 2022-2023 |

| 208 | 2023-2024 |

| 291 | 2024-2025 |

| 366 | 2025-2026 |

Data about UPI transactions in India

North America contributes significantly towards the restaurant point-of-sale terminal market with a rapidly growing CAGR. The growth of this region is attributed to the higher adoption rate for POS terminals in the food sector by leading countries like the U.S. and Canada in North America. As the POS system provides efficient services to consumers with robust technological infrastructure provision, it has been adopted by many key players in the market, and it is becoming more popular in North America due to its technological advantages in gathering insights from collective data.

The restaurant point-of-sale terminal market is expected to proliferate exponentially during the foreseeable period due to its advanced benefits like order management, contactless payment, menu management, and customer management, which will eventually lead to market expansion on a global level. The POS terminal is basically a compact system of hardware and software that is used to process transactions and manage payments in a more efficient way.

The point-of-sale terminal is used as a crucial component in effective day-to-day management, which ensures operational efficiency and consumer satisfaction. To operate seamlessly, the restaurant POS system has functions like billing, payroll data management, and recorded sales data, including inventory control. Owing to such a comprehensive offering, the restaurant point-of-sale terminal market is propelling in the forward direction on a wider scale.

AI Impact on the Market

An indispensable trend of AI in every sector has affected the restaurant POS terminals market further due to the unprecedented advantages offered by machine learning, data analytics, and AI. Technology's role in restaurants is evolving with time to witness a tangible benefit. AI is being utilized in the restaurant point-of-sale terminal market to facilitate consumer services and back-house operations.

AI-powered chatbots and voice and message assistants are rearranging the ordering process either online or in restaurants while offering a more interactive and efficient consumer experience. AI-driven analytics can forecast the consumer's preferences according to their past recorded data and enable restaurants to shuffle their menu or tailor it according to the demand from buyers, helping to promote their very own brand on a wider scale with minimum efforts and in an efficient way. In the restaurant point-of-sale terminal market, AI technology can further streamline inventory management, help minimize waste, and predict the demand from the masses.

Top software used for the restaurant POS terminal market

| Software Name | Key Features |

| Lavu |

|

| Square |

|

| Toast |

|

| Spot on |

|

| Clover |

|

| Lightspeed |

|

| Report Coverage | Details |

| Market Size by 2034 | USD 52.18 Billion |

| Market Size in 2023 | USD 22.31 Billion |

| Market Size in 2024 | USD 24.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.03% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Component, Deployment, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cultivation of consumer’s loyalty

The significant driving factor for the restaurant point-of-sale terminal market is cultivating consumer loyalty with the help of technology. As consumers, loyalty is considered a valuable commodity in the business sector as it is essential to keep the businesses on track by strengthening the roots in the market.

According to the principle of Pareto, which states about 80-20 principles of business, where 80% of enterprise profit is detected by the 20% of consumers. High consumer retention is what expands the business widely.

The same target can be achieved using POS terminals as they provide efficient consumer management and billing processes and suggest innovative ideas and gift card solutions according to the individual consumer's preferences through automatic reloads and top-ups. Nearly 60% of restaurants use the data collected from point-of-sale terminals to bolster their customer loyalty programs. Such data provision by POS terminal further refines the knowledge about consumers and suggests their engagement strategies to save for future visits by customers.

Substantial investment with high maintenance cost

The major restraining factor that negatively impacts the restaurant point-of-sale terminal market is the high initial cost for the whole setup and the substantial amount required to maintain it to operate efficiently. Further, data privacy and security also create a major concern as they expose many consumers to huge datasets about individual preferences, choices, and inclinations. This data can be stolen and manipulated in other ways to create disturbances on a social level for personal agendas.

Again, the installation process is complex and time-consuming, thus prone to technical error if it gets wrong somewhere while setting up the things regarding terminals. These complexities may create barriers to training the staff and making them used to it due to its high technicality, particularly for SMEs. Moreover, the lack of compatibility between different terminals may create hindrances to the adoption of the restaurant point-of-sale terminal market.

Cloud-based POS terminals

The significant opportunity for the proliferation of the restaurant point-of-sale terminal market is the adoption of cloud-based POS services. Cloud-based POS systems are highly scalable and make it easier to accommodate seasonal changes in terms of consumer demand and traffic. POS systems can easily add or remove devices and terminals as required, making them flexible to use.

Moreover, the cloud-based POS system further offers easier integration with other software like CRM portal-customer relationship management portal, and inventory management system to streamline all ongoing operations while allowing for viewing more comprehensive business solutions to expand the enterprise's roots in the global restaurant point-of-sale terminal market.

The fixed product segment held the largest share of the restaurant point-of-sale terminal market in 2023. The growth of this segment is attributed to various factors like increasing food outlets globally that need to manage for consumer retention rate and implementation of point of sales terminals at a large scale in the leading restaurants that need to manage and serve a large number of customers at once and having various outlets.

The mobile terminal segment expected to grow at the fastest rate in the restaurant point-of-sale terminal market over the forecast period. The demand for mobile POS terminals has seen a surge in recent years as they provide facilities like highly improved services, minimizing operational costs, precise information about menus, suggestions for selling, and the ability to attend to every customer. The invasion of communication systems in every field in terms of the availability of mobile/smartphones and tablets to almost everyone is boosting the wireless technology that, in turn, positively affects the mobile POS terminal segment in the global market.

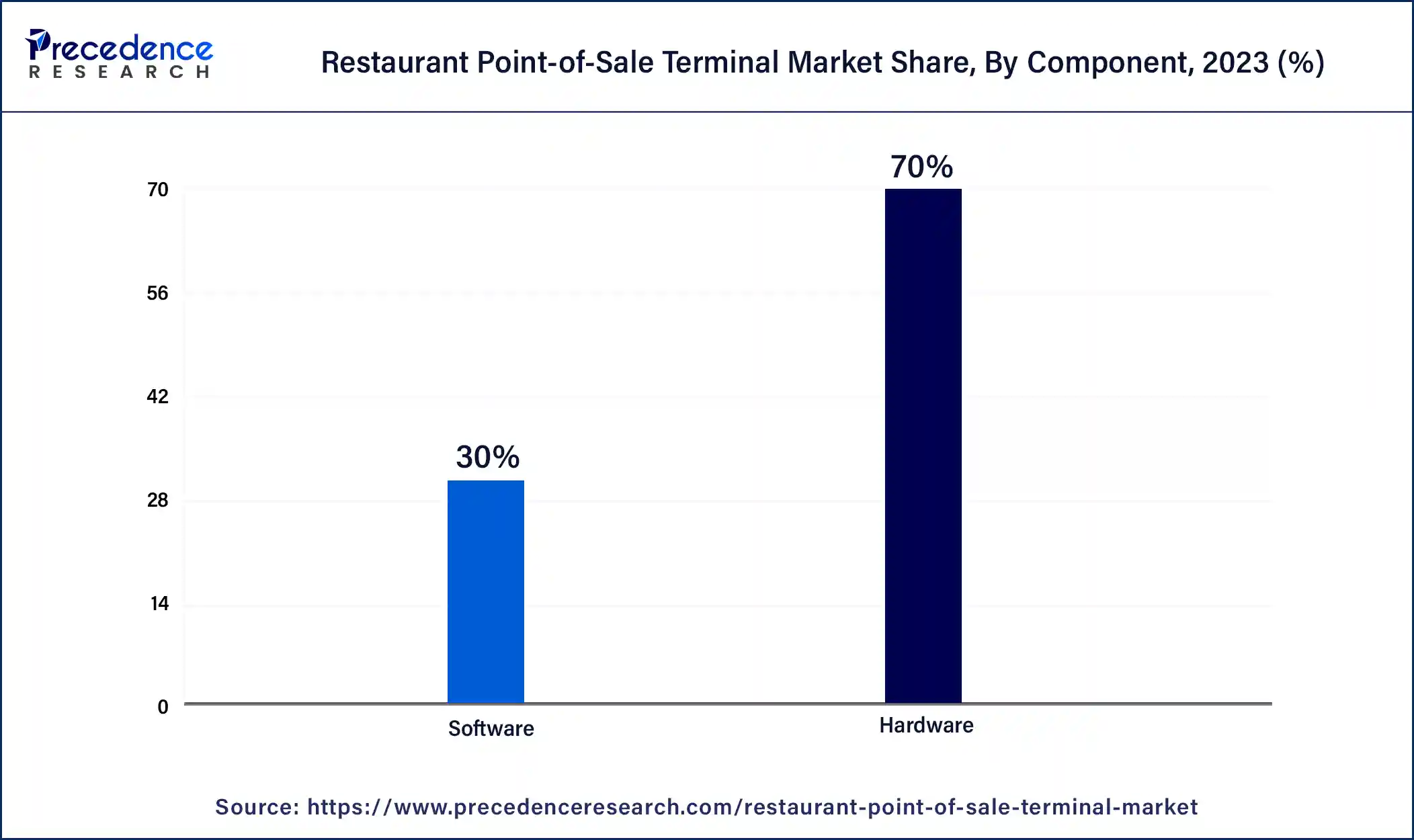

The hardware segment accounted for the largest share of the restaurant point-of-sale terminal market in 2023. The growth of this segment is due to the innovative product launches by major hardware providers for POS terminals in the market. The launch of touchscreen displays, receipt printers, and touch payment method, thermal receipt printer is further fuelling the demand for this segment in the global restaurant point of sale terminal market.

The software segment is expected to grow at an exceeding CAGR in the restaurant point-of-sale terminal market during the forecasted years. Consumers' increasing need for security and preference for privacy for data sharing is fuelling the software segment in the market. Software is necessary to facilitate the robust structure of hardware systems, which is driving the need for various software in the market.

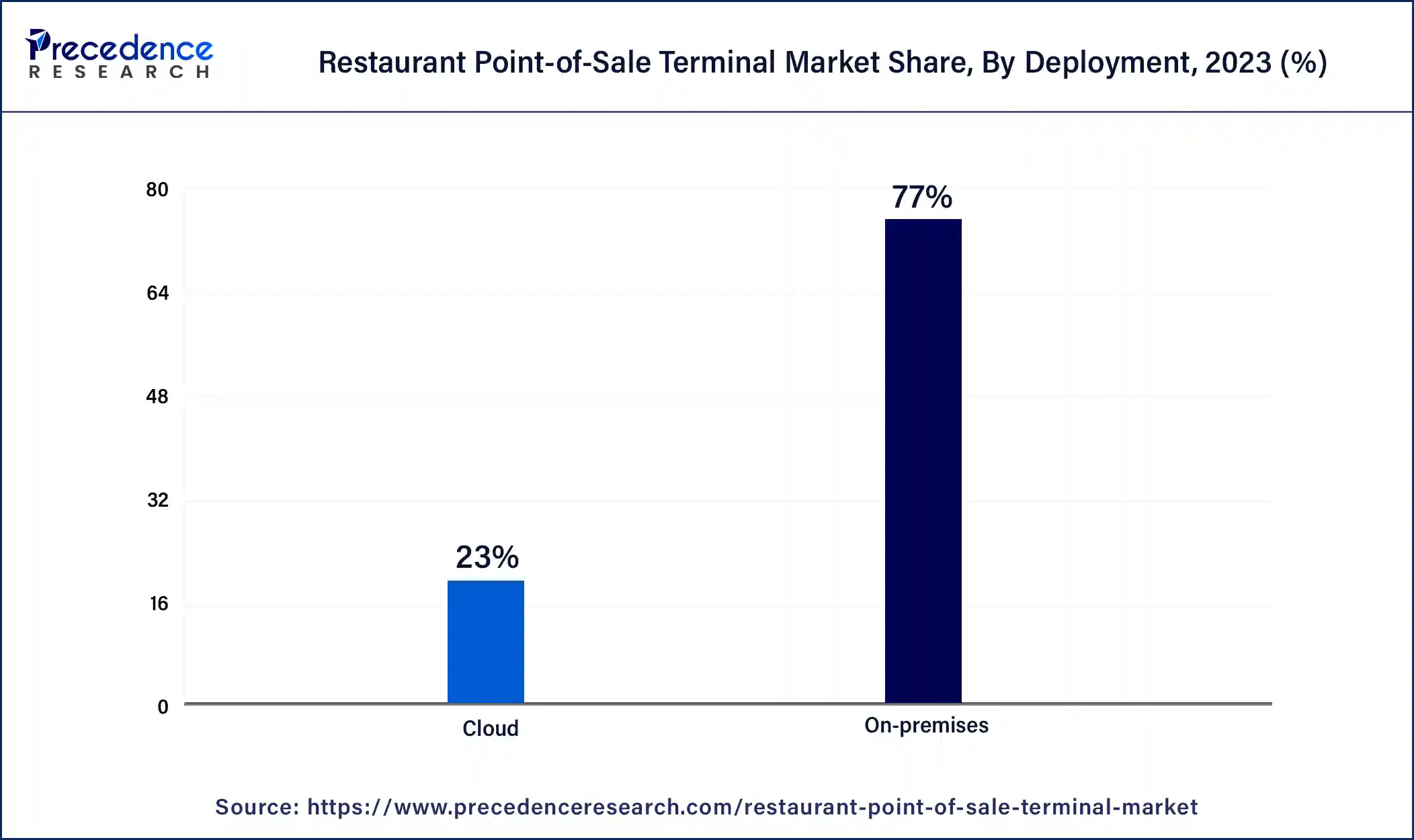

The on-premises segment captured the largest share of the restaurant point-of-sale terminal market in 2023. On-premises is preferable by many restaurant owners due to the high security and continuous live information provided by the system without downtime or low chances for failure, as an internet connection is not mandatory for its operation. Such offerings fuel this segment in the global market.

The cloud segment is anticipated to register growth at the fastest rate in the restaurant point-of-sale terminal market during the forecasted years. The growth of this segment is related to the various offerings provided by cloud-based terminals, such as improved data visibility, business mobility, high security for data, minimizing downtime during peak hours, and streamlining the data at the same time with multiple venues. The economic and security benefits provided by cloud-based services are crucial in the adoption of POS terminals, therefore fuelling the expansion of the market again on a wider scale.

The front-end segment dominated the global restaurant point-of-sale terminal market in 2023. The focus of the POS terminal is to manage the front-end tasks like accepting orders for meals, tracking the sales data, interacting with consumers during their waiting period, billing reports, etc. These are the primary functions that need to be done precisely to generate revenue; therefore, the front-end segment dominates the market globally.

The back-end segment is anticipated to register the fastest growth in the restaurant point-of-sale terminal market in the upcoming period. The growth of this segment is due to the increasing need to secure the policies of restaurants and the desire to protect the privacy of management while prohibiting the access of employees to crucial data about the company.

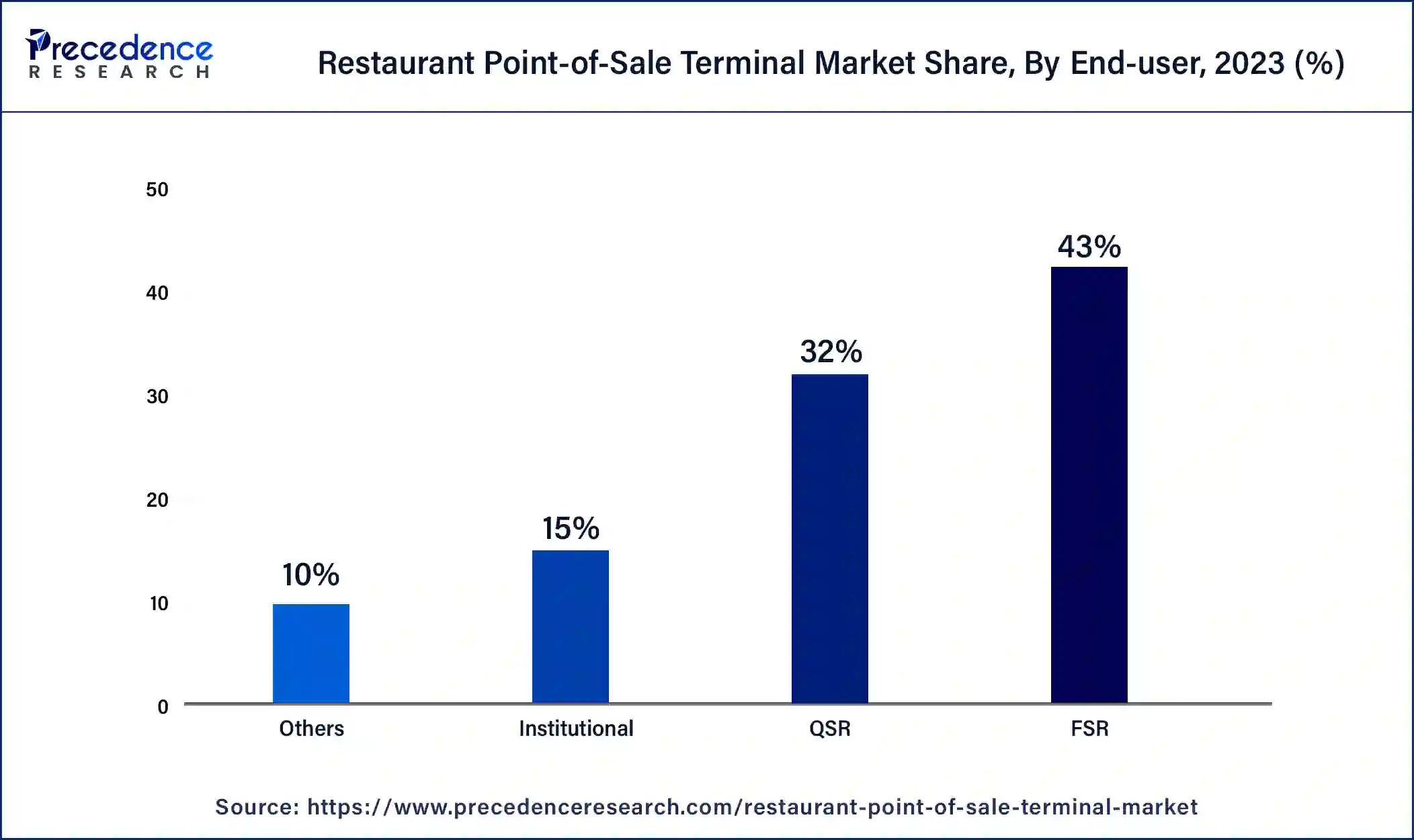

The full-service segment accounted for a substantial share in the restaurant point-of-sale terminal market in 2023. Full-service restaurants ruled the market due to their compelling offerings to customers, such as casual dining and fine dining. It includes menu offerings like various types of meals and already-planned lunch dishes. Casual dining creates major revenue due to the increasing demand for fast food eating options with affordable ranges from Pizza Hut, MacDonald, and various brands that have already adopted POS terminals for various outlets.

The quick service restaurant segment is anticipated to grow at a considerable CAGR in the restaurant point-of-sale terminal market during the foreseeable period. The QSR segment is the biggest contributor to the global market, and it is creating major turnovers as it is required to take quick orders, minimize the order turnaround time to provide faster services for consumers while attending to the maximum number of consumers in different outlets, this can be achievable with the help of POS terminals.

Segments Covered in the Report

By Product

By Component

By Deployment

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

December 2024

July 2024

July 2024