October 2024

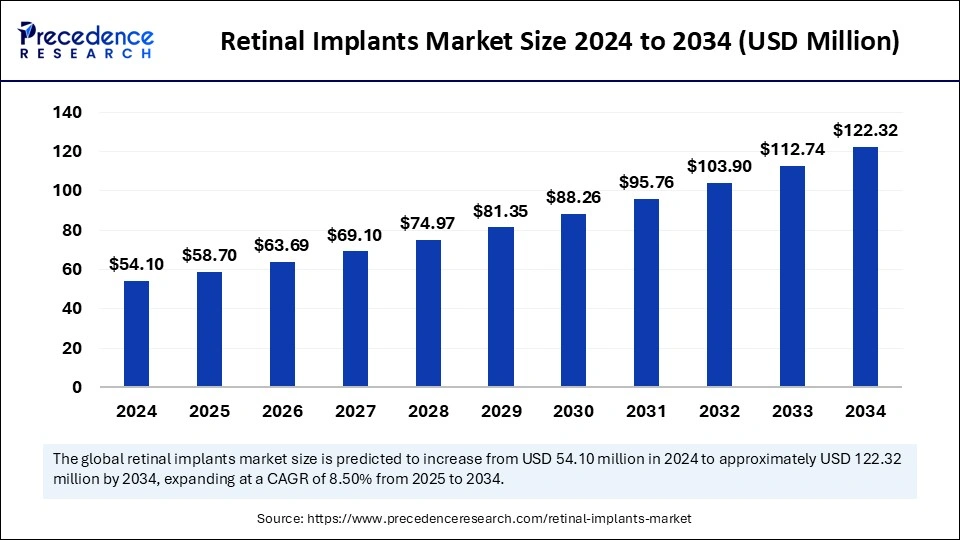

The global retinal implants market size is calculated at USD 58.70 million in 2025 and is forecasted to reach around USD 122.32 million by 2034, accelerating at a CAGR of 8.50% from 2025 to 2034. The North America market size surpassed USD 20.56 million in 2024 and is expanding at a CAGR of 8.64% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global retinal implants market size accounted for USD 54.10 million 2024 and is predicted to increase from USD 58.70 million in 2025 to approximately USD 122.32 million by 2034, expanding at a CAGR of 8.50% from 2025 to 2034. The retinal implants market is expanding rapidly due to the increase in retinal degenerative diseases, such as age-related macular degeneration and retinitis pigmentosa, necessitating early diagnosis and efficient therapies. Moreover, the need for customized vision restoration solutions and the emphasis on non-invasive and minimally invasive technologies in ophthalmic care are stimulating market growth.

Artificial intelligence (AI) is transforming the market for retinal implants by enhancing device functionality, surgical accuracy, and patient success rates. AI algorithms are embedded in implant devices to better analyze visual information, allowing for improved signal transmission to the brain. AI is also employed for individualized treatment planning, real-time image analysis, and predictive analytics to track disease progression and implant performance. These developments enhance the efficiency and convenience of retinal implants. Analytics-driven by AI plays a key role in preoperative planning and postoperative treatments, forecasting surgical results, tracking the performance of the implant and directing rehabilitation, minimizing complications, and achieving improved long-term outcomes. In addition, AI can help in the design and development of sophisticated retinal implants with enhanced functionality.

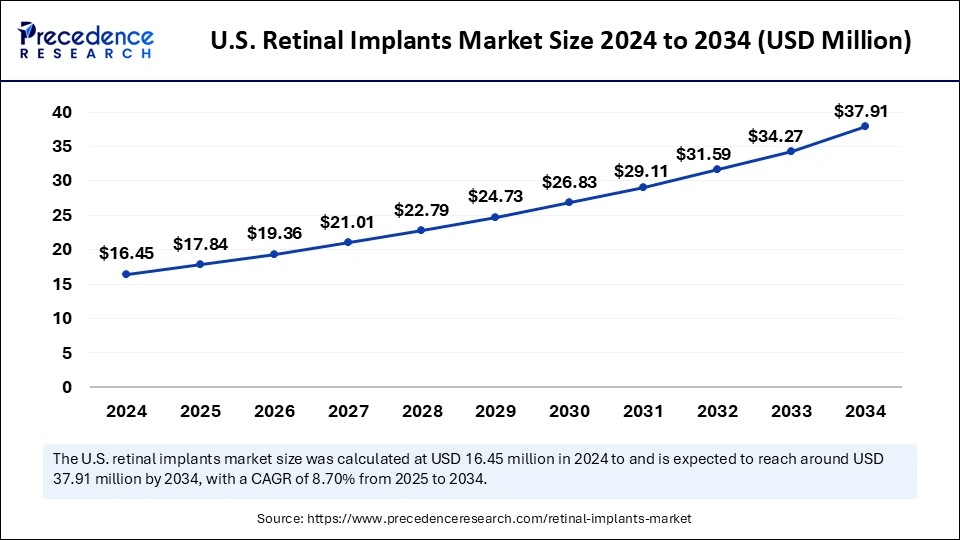

The global retinal implants market size accounted for USD 16.45 million in 2024 and is predicted to increase from USD 17.84 million in 2025 to approximately USD 37.91 million by 2034, expanding at a CAGR of 37.91% from 2025 to 2034.

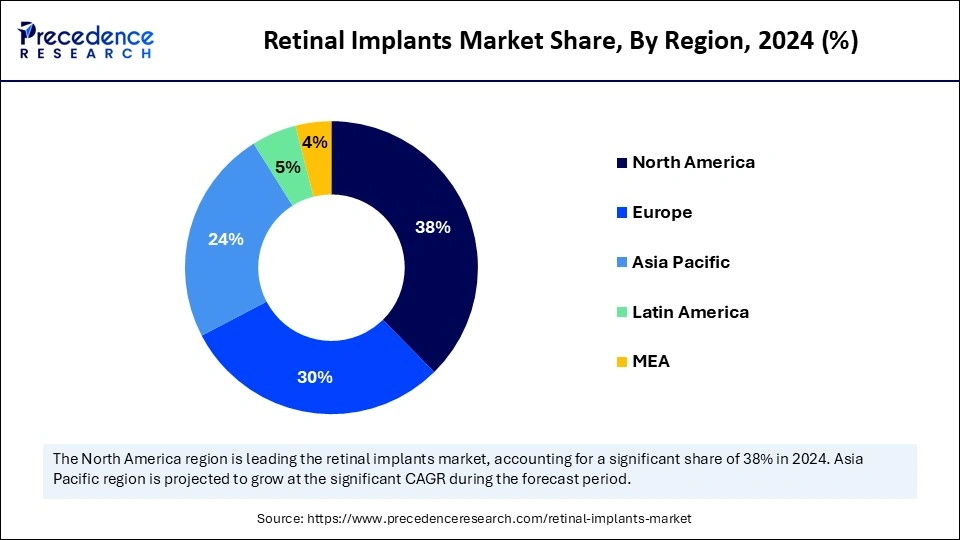

North America registered dominance in the retinal implants market by capturing the largest share in 2024. The prevalence of retinal degenerative disorders, like AMD and retinitis pigmentosa, is higher in this region, propelling the demand for retinal implants. The presence of well-established healthcare infrastructure in the region, coupled with skilled healthcare expertise, and increased investments in R&D by prominent companies, like Second Sight Medical Products and Vivani Medical, to develop advanced implants, further contributed to the region’s dominance. The availability of reimbursement policies for implant procedures and increased new product launches bolstered the market in the region.

The U.S. leads the North American retinal implants market because of its advanced healthcare infrastructure and high investments in implant technologies. With continued research funding from bodies such as the National Eye Institute, the U.S. continues to spearhead retinal implant technology growth and innovation, cementing its position as a world leader in retinal implants.

European Retinal Implants Market Trends

Europe is the second-largest market, holding a considerable share in 2024. The market in Europe is projected to grow at a notable rate in the coming years due to its advanced healthcare infrastructure, public healthcare awareness programs, and technological advancements. The CALIPSO study conducted in France illustrated the potential of retinal implants to treat conditions such as geographic atrophy (GA) and retinitis pigmentosa. Moreover, the increasing instances of retinal diseases, such as AMD and diabetic retinopathy, and increasing investments in research and development and clinical trials contribute to regional market growth.

Asia Pacific: The Fastest-growing Region

Asia Pacific is expected to emerge as the fastest-growing region in the market. This is mainly due to rising healthcare spending, increasing investments in research and development, and the growing prevalence of diseases such as AMD and retinitis pigmentosa. The growing geriatric population and increasing awareness about age-related macular degeneration, such as diabetic retinopathy, contribute to regional market expansion. As people become more aware of retinal diseases, the acceptance of sophisticated vision-restoring solutions increases. Modernization of healthcare facilities and medical tourism growth, especially in nations such as China and India, draw patients’ attention toward advanced treatments. Furthermore, increasing government initiatives to spread awareness about retinal diseases and focus on improving healthcare infrastructure support the growth of the market in the region.

The retinal implant market comprises the development, manufacturing, and distribution of medical devices that are designed to restore the vision of individuals with vision loss. The market is growing rapidly due to the rising focus on manufacturing and supplying medical devices to partially restore vision in patients with severe vision impairment from retinal degenerative diseases, such as retinitis pigmentosa and age-related macular degeneration (AMD). These implants detect external visual information and transform it into electrical signals that stimulate existing functional retinal cells or the optic nerve.

The rising investments in research and development activities to accelerate the development of sophisticated implants to treat retinal diseases are boosting the growth of the market. As awareness regarding the benefits of retinal implants increases, the market is set to grow rapidly. In addition, rising strategic partnerships between academia, research institutions, and market players to develop and commercialize innovative retinal implants contribute to market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 122.32 million |

| Market Size by 2025 | USD 58.70 million |

| Market Size in 2024 | USD 54.10 million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.50% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Prevalence of Degenerative Retinal Diseases

The rising prevalence of degenerative retinal diseases, especially among the elderly population, is driving the growth of the retinal implants market. These conditions, including AMD and retinitis pigmentosa, affect millions of patients globally and commonly result in extreme or irreversible visual impairment. The increasing geriatric population contributes immensely to broadening the patient pool for retinal diseases. As the worldwide burden of retinal disorders increases, so does the demand for retinal implants. These implants revolutionize vision care, providing hope for partial restoration of vision in previously untreatable patients.

High Cost of Implants and Associated Surgery

The market for retinal implants faces several challenges, especially due to the high cost of implants and accompanying surgery. Since the cost of retinal implants is high, it makes them inaccessible to many patients, particularly in areas where there is less developed healthcare infrastructure or reimbursement programs. The development of retinal implants is dependent on sophisticated technologies, such as microelectronics, nanotechnology, and biocompatible materials, which increase the cost of production. Insurance limitations further lower accessibility and affordability. Moreover, the implantation procedure is complex and requires skilled professionals, limiting access to treatment in certain regions.

Innovations and Breakthroughs in Technology

Technological advancements create immense opportunities in the retinal implants market. Innovations in technology enhance the effectiveness, accessibility, and affordability of retinal implants. Advanced materials and nanotechnology enable the development of biocompatible nanocomposites with palladium nanoparticles to activate injured retinal cells. Gene therapy and gene editing hold potential for the treatment of genetic retinal disorders, such as retinitis pigmentosa, through personalized approaches.

The incorporation of AI in retinal implants has the potential to enhance image processing, allowing enhanced visual perception among patients. Innovative technologies hold great potential to treat and reduce the global burden of retinal disease and revolutionize vision restoration solutions. Moreover, advances in material science enable the development of sophisticated materials for retinal implants with improved functionality.

The Argus II segment led the retinal implants market with the largest share in 2024. This is mainly due to its effectiveness in treating retinitis pigmentosa, a widespread degenerative condition in most people, especially in the U.S. and Europe. Argus II is an epiretinal implant used to restore vision for patients with advanced-stage retinitis pigmentosa. It translates visible information into electrical impulses to restore functional vision in blind patients, creating a revolutionary alternative for patients previously with no potential treatment. Moreover, Argus II is the first FDA-approved electronic implant used as a visual prosthesis to improve the vision of people with severe retinitis pigmentosa.

The retina implant alpha AMS segment is anticipated to grow at the fastest rate during the projection period. Retina implant alpha AMS is gaining immense traction to cure advanced retinal degenerative disorders, such as AMD and retinitis pigmentosa. The rising prevalence of AMD, especially among the geriatric population, necessitates efficient treatment methods. Retina implant alpha AMS has proven effective in improving vision performance. Technological advancements have further improved the design and efficacy of the alpha AMS.

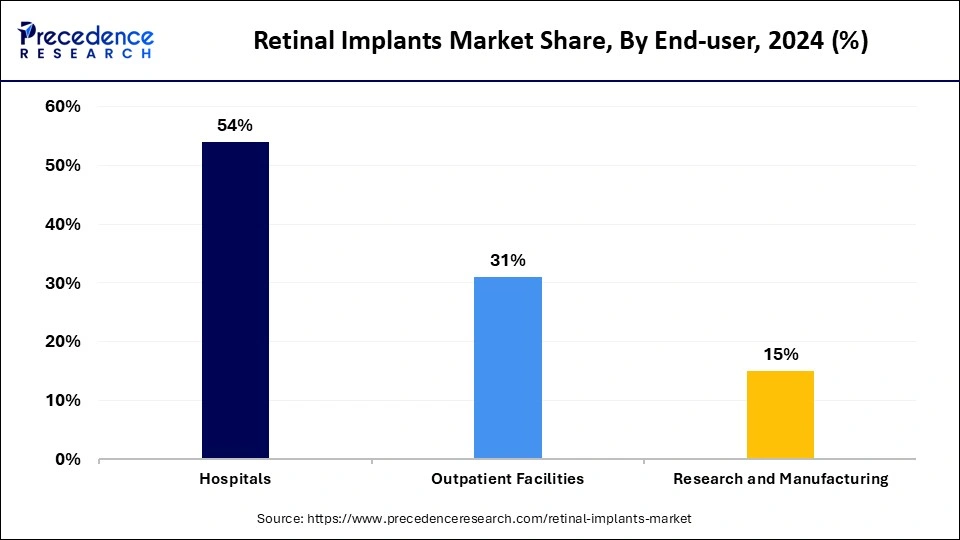

The hospitals segment dominated the retinal implants market by holding the largest share in 2024. This is mainly due to the availability of sophisticated surgical infrastructure and advanced ophthalmic care tools in hospitals that support implantation procedures. Hospitals are the preferred destination for the treatment of retinal disorders owing to their multidisciplinary expertise, which provides holistic preoperative and postoperative care. This helps improve patient outcomes and satisfaction, making them the first choice for complicated implantation procedures. Hospitals often boast advanced facilities and skilled personnel, guaranteeing high success rates in implantation procedures. They also offer multidisciplinary care, combining the expertise of ophthalmologists, anesthesiologists, and rehabilitation specialists and offering holistic preoperative and postoperative care.

The research & manufacturing segment is likely to grow at a notable rate in the coming years due to the strong emphasis on technological innovations, biocompatibility, and durability of the device. Research institutes often engage in research programs aimed at advancing implant technologies to treat retinal degenerative disorders, such as retinitis pigmentosa and AMD. Collaborations between medical centers and research institutes speed up the development of retinal implants. Advancements in research are expected to drive segmental growth, fostering the development of next-generation devices like wireless, AI-integrated, and bioengineered prostheses.

By Type

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

December 2024

December 2024