August 2024

Reverse Factoring Market (By Category: Domestic, International; By Financial Institution: Banks, Non-banking Financial Institutions; By End-use: Manufacturing, Transport & Logistics, Information Technology, Healthcare, Construction, Others (Retail, Food & Beverages, Among Others)) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

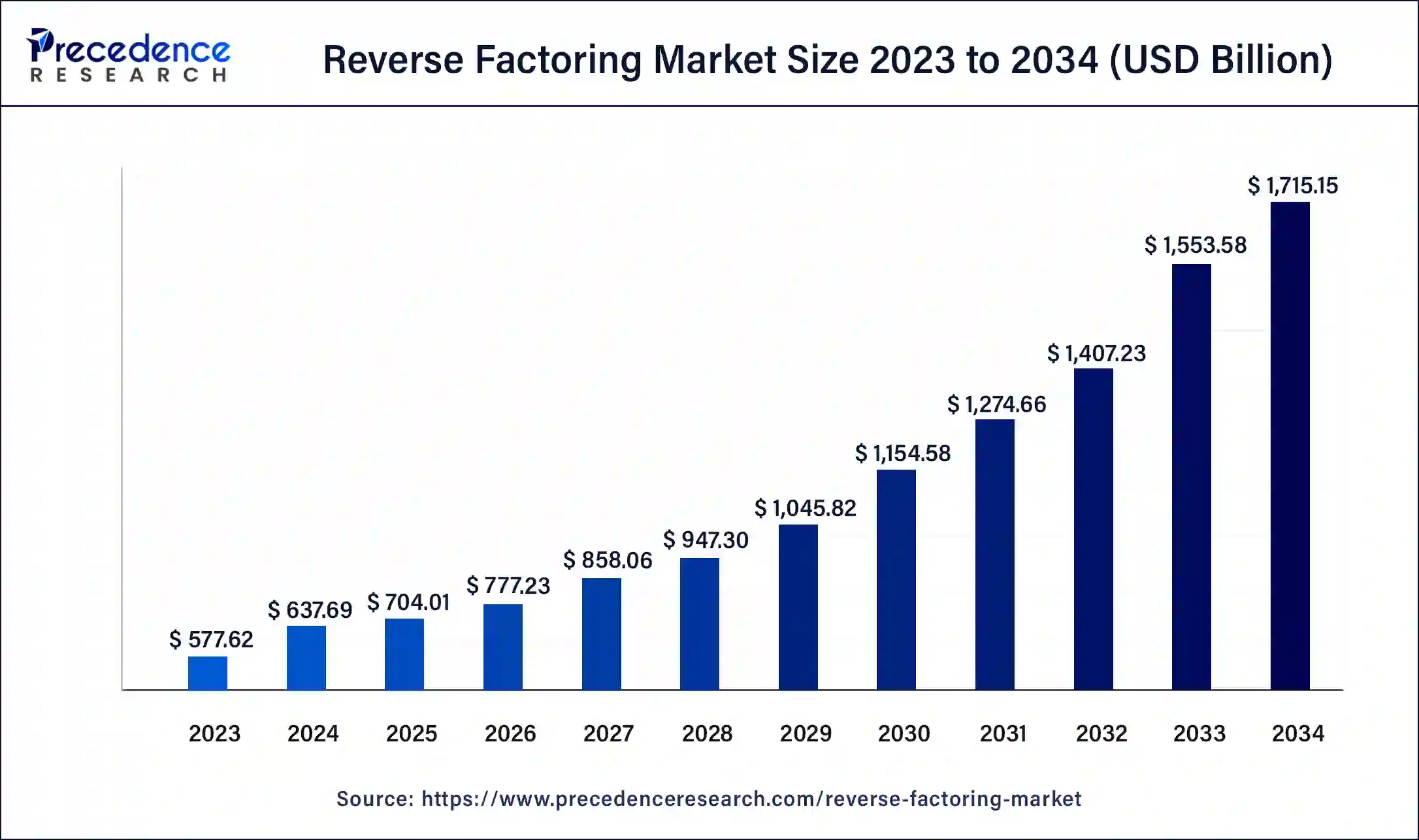

The global reverse factoring market size was USD 577.62 billion in 2023, accounted for USD 637.69 billion in 2024, and is expected to reach around USD 1,715.15 billion by 2034, expanding at a CAGR of 9.3% from 2024 to 2034.

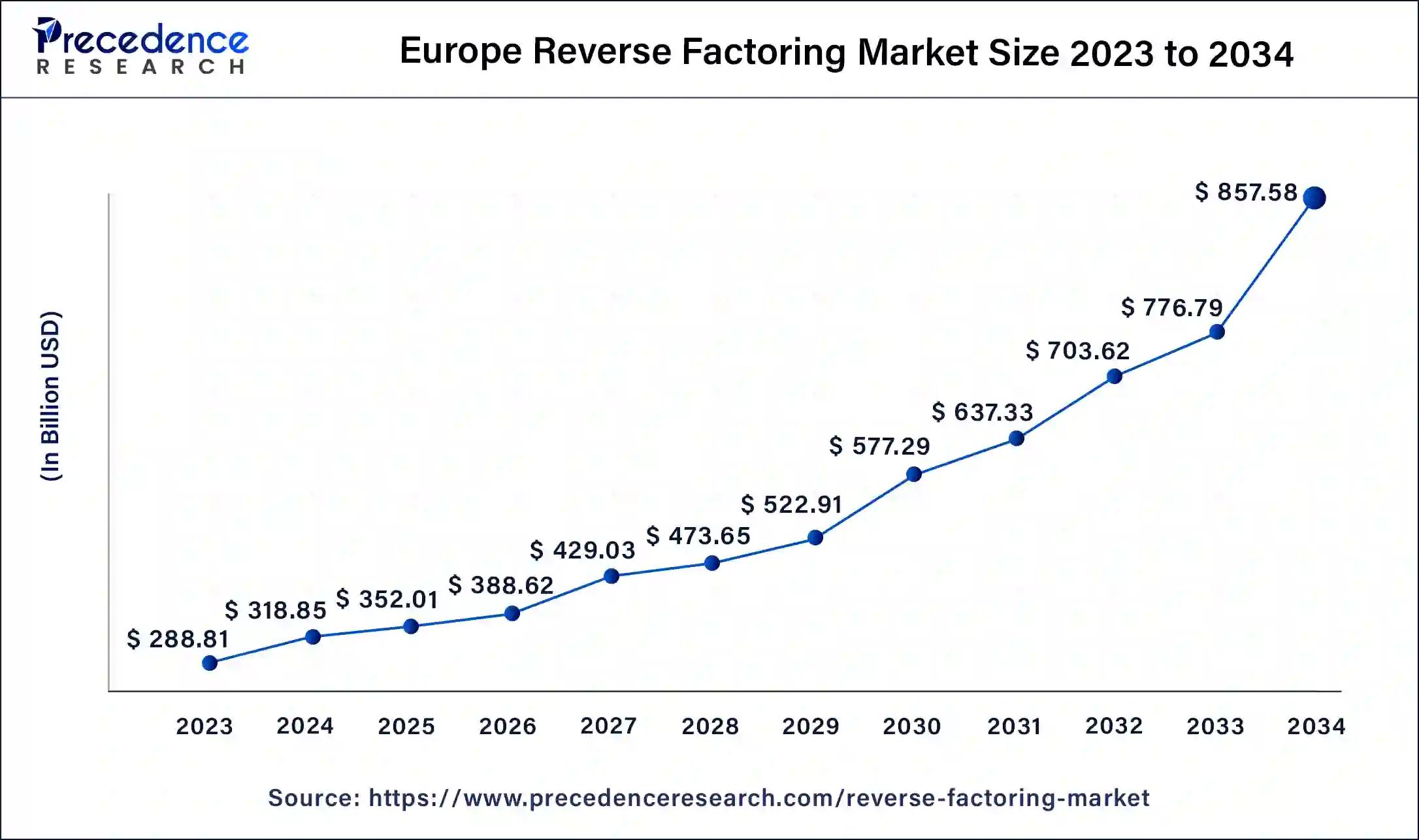

The Europe reverse factoring market size was estimated at USD 288.81 billion in 2023 and is predicted to be worth around USD 857.58 billion by 2034, at a CAGR of 9.5% from 2024 to 2034.

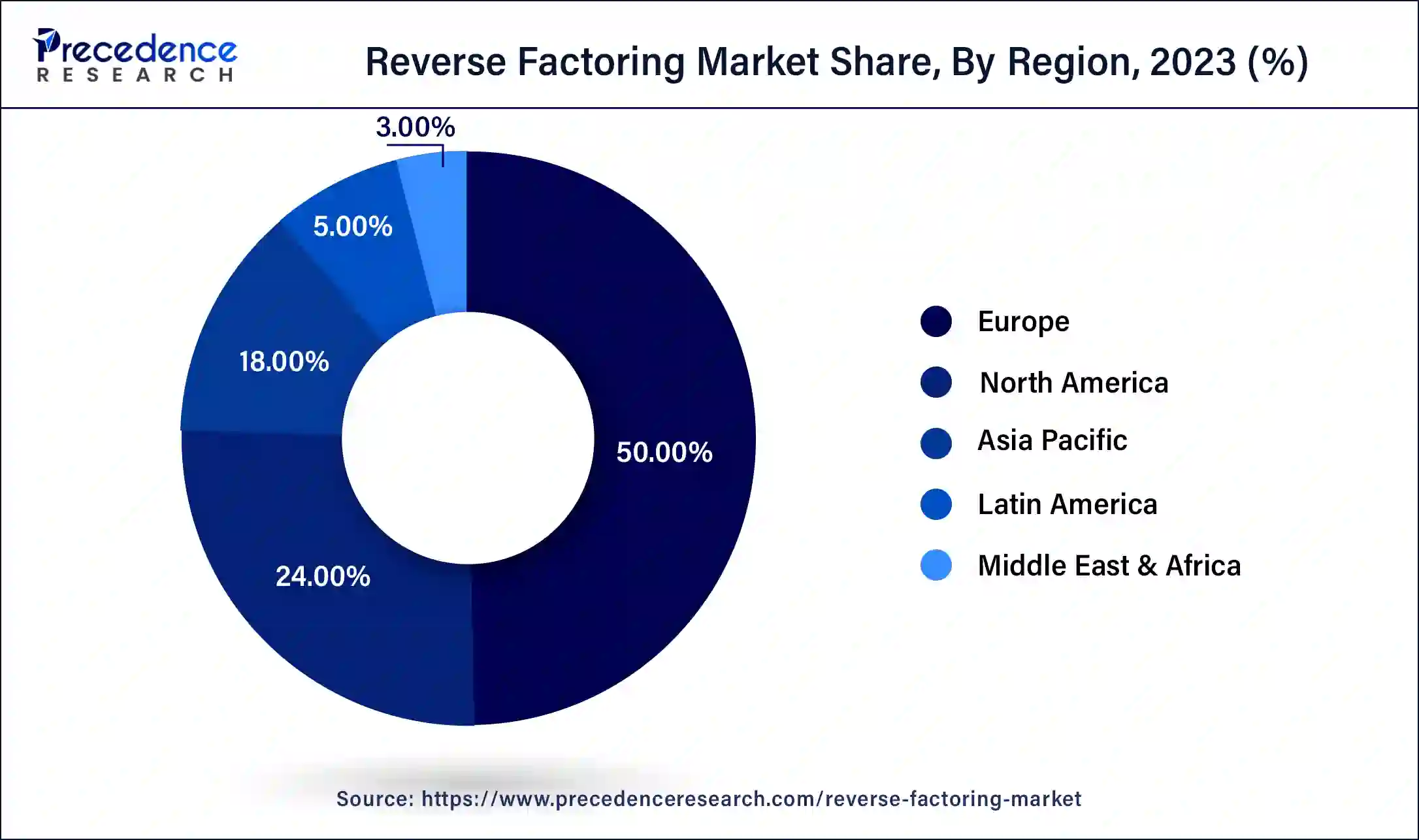

Europe held the largest market share of 50% in 2023 due to several factors. Firstly, the region boasts a mature financial services sector with well-established banking institutions that offer a wide range of supply chain finance solutions, including reverse factoring. Additionally, supportive regulatory frameworks and initiatives in Europe have encouraged the adoption of supply chain finance practices, contributing to the growth of the market. Moreover, the region's diverse industrial base and robust trade relationships foster a conducive environment for the implementation of reverse factoring programs across various sectors, further solidifying Europe's position as a key player in the market.

Latin America is poised for significant growth in the reverse factoring market due to several factors. The region's diverse economy and expanding business landscape present ample opportunities for companies to optimize working capital and improve financial efficiency. Additionally, there is a growing recognition of the benefits of supply chain finance solutions like reverse factoring among businesses in Latin America, driven by the need to navigate economic volatility and enhance competitiveness. With supportive regulatory frameworks and increasing adoption of digital technologies, Latin America offers a conducive environment for the expansion of the reverse factoring market.

Meanwhile, North America is witnessing significant growth in the reverse factoring market due to several factors. Firstly, businesses in the region are increasingly focused on optimizing working capital and improving cash flow management, driving demand for innovative financing solutions like reverse factoring. Additionally, the robust presence of large corporations, particularly in sectors like healthcare, technology, and manufacturing, has led to a greater adoption of supply chain finance programs, including reverse factoring. Moreover, advancements in technology and the availability of sophisticated financial infrastructure have facilitated the implementation and scalability of reverse factoring solutions across various industries in North America.

Reverse factoring is a financial arrangement where a company (the buyer) arranges for its suppliers to be paid earlier than the agreed-upon payment terms. Instead of the supplier waiting for the buyer to pay invoices on their usual schedule, a financial institution steps in to provide early payment to the supplier, typically at a discounted rate. This allows the supplier to receive cash faster, improving their cash flow and reducing their financial stress.

The financial institution, or factor, earns a fee for facilitating this early payment. Reverse factoring benefits both the buyer and the supplier: the buyer can extend its payment terms without negatively impacting its supplier relationships, while the supplier gains access to quicker cash flow, which can help them manage their operations more effectively. Overall, reverse factoring is a mechanism that enhances liquidity and fosters better relationships throughout the supply chain.

Reverse Factoring Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 9.3% |

| Global Market Size in 2023 | USD 577.62 Billion |

| Global Market Size in 2024 | USD 637.69 Billion |

| Global Market Size by 2034 | USD 1,715.15 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Category, By Financial Institution, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Working capital optimization

Working capital optimization plays a pivotal role in driving demand for reverse factoring solutions within the market. As businesses seek to improve their financial health and operational efficiency, the need to manage working capital effectively becomes paramount. Reverse factoring offers an attractive solution by allowing companies to extend their payment terms with suppliers without negatively impacting cash flow. This flexibility enables buyers to optimize their working capital by conserving cash and deploying it more strategically across their operations, thereby enhancing overall financial performance.

Moreover, working capital optimization through reverse factoring can also foster stronger supplier relationships. By providing suppliers with early access to cash at a lower cost, reverse factoring promotes trust and collaboration. Suppliers benefit from improved liquidity and reduced financial strain, leading to enhanced stability and reliability within the supply chain. Consequently, as businesses recognize the significant advantages of working capital optimization facilitated by reverse factoring, the market demand for these solutions continues to surge, driving growth and innovation in the reverse factoring market.

Regulatory and compliance challenges

Regulatory and compliance challenges present significant hurdles for the reverse factoring market, inhibiting its growth and adoption. The evolving regulatory landscape surrounding supply chain finance, including reverse factoring, introduces complexity and uncertainty for businesses and financial institutions. Compliance with stringent regulations such as anti-money laundering (AML) and know your customer (KYC) requirements adds layers of administrative burden and costs to the implementation and operation of reverse factoring programs. These regulatory obligations may deter some businesses from adopting reverse factoring solutions due to concerns about compliance risks and potential legal consequences.

Furthermore, regulatory uncertainty and varying standards across different jurisdictions can create inconsistencies and confusion, making it difficult for businesses to navigate the regulatory landscape effectively. Lack of clarity and harmonization in regulatory frameworks may lead to delays in implementing reverse factoring programs or discourage businesses from expanding their usage of these solutions across international markets. As a result, regulatory and compliance challenges act as significant restraints on the market demand for reverse factoring, hindering its full potential to optimize working capital and strengthen supply chain financing mechanisms.

Ecosystem collaboration

Ecosystem collaboration presents a significant opportunity for the reverse factoring market to innovate and create value-added services. By bringing together stakeholders across the supply chain finance ecosystem, including buyers, suppliers, financial institutions, and technology providers, collaboration can drive the development of integrated solutions that address the diverse needs of businesses. For example, financial institutions can collaborate with technology providers to develop digital platforms that streamline the reverse factoring process, making it more accessible and efficient for all parties involved. Additionally, partnerships between buyers and suppliers can facilitate the adoption of reverse factoring by providing incentives and support for suppliers to join the program.

Moreover, ecosystem collaboration can foster innovation in terms of product offerings and service delivery. By pooling resources and expertise, stakeholders can experiment with new business models, such as dynamic discounting or supply chain finance marketplaces that enhance the value proposition of reverse factoring solutions. Collaborative efforts to address common pain points, such as onboarding processes, data security, and risk management, can result in standardized practices and industry-wide initiatives that promote market growth and adoption. Overall, ecosystem collaboration creates opportunities for the reverse factoring market to evolve and meet the evolving needs of businesses in an increasingly complex global economy.

The domestic segment held the highest market share of 87% in 2023. In the domestic segment of the reverse factoring market, transactions occur within a single country's borders. This segment typically involves buyers and suppliers based in the same country, facilitating local trade relationships. Recent trends in this segment include a growing adoption of digital platforms and automated solutions, simplifying the reverse factoring process for domestic businesses. Additionally, there is an increasing focus on sustainability, with companies using reverse factoring to incentivize suppliers to adhere to environmental and ethical standards within their domestic operations.

The international segment is anticipated to witness rapid growth at a significant CAGR of 11.5% during the projected period. In the international segment of the reverse factoring market, businesses engage in cross-border transactions, extending beyond domestic boundaries. This category involves global buyers and suppliers collaborating on trade agreements facilitated by reverse factoring solutions. Trends indicate a rising demand for cross-border reverse factoring due to globalization, with businesses seeking efficient financing options for their international supply chains. Additionally, advancements in technology have made cross-border transactions more accessible, contributing to the growth of this segment within the reverse factoring market.

The bank segment has held 71% market share in 2023. In the reverse factoring market, the bank segment refers to financial institutions, such as commercial banks, that provide funding and facilitate transactions between buyers and suppliers. Banks play a crucial role in offering reverse factoring solutions by extending early payments to suppliers on behalf of buyers, thereby improving cash flow and working capital management for both parties. A key trend in the bank segment of the reverse factoring market is the increasing adoption of digital platforms and automation to streamline processes and enhance efficiency. Banks are leveraging technology to offer seamless onboarding, faster approvals, and real-time visibility into transactions, making reverse factoring more accessible and attractive to businesses of all sizes.

The non-banking financial institutions (NBFIs) segment is anticipated to witness rapid growth over the projected period. Non-banking financial institutions (NBFIs) are entities that provide financial services but do not have a banking license. In the reverse factoring market, NBFIs play a crucial role by offering financing solutions to buyers and suppliers. Trends in this segment include increased participation of NBFIs due to their flexibility and ability to tailor financing options to the specific needs of businesses. Additionally, NBFIs are leveraging technology to streamline processes and enhance the accessibility of reverse factoring solutions, contributing to market growth and innovation.

The manufacturing segment has held a 30% market share in 2023. In the manufacturing segment, reverse factoring refers to the practice where manufacturers leverage their strong credit rating to help suppliers obtain financing at lower interest rates. This enables suppliers to access early payments for their invoices, improving their cash flow and operational stability. A key trend in this segment is the increasing adoption of reverse factoring by manufacturers to strengthen their supplier relationships, optimize working capital, and enhance supply chain efficiency, thereby driving overall competitiveness in the market.

The healthcare segment is anticipated to witness rapid growth over the projected period in the reverse factoring market. In the healthcare segment, reverse factoring refers to the practice where healthcare providers utilize early payment options to pay their suppliers, such as medical equipment manufacturers or pharmaceutical companies, in order to improve cash flow and manage working capital effectively. This allows healthcare institutions to ensure timely delivery of essential supplies and services while maintaining financial stability. A notable trend in the healthcare reverse factoring market is the increasing adoption of digital platforms and automated solutions, which streamline the payment process and enhance transparency in supplier financing arrangements, ultimately leading to more efficient healthcare delivery.

Segments Covered in the Report

By Category

By Financial Institution

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024