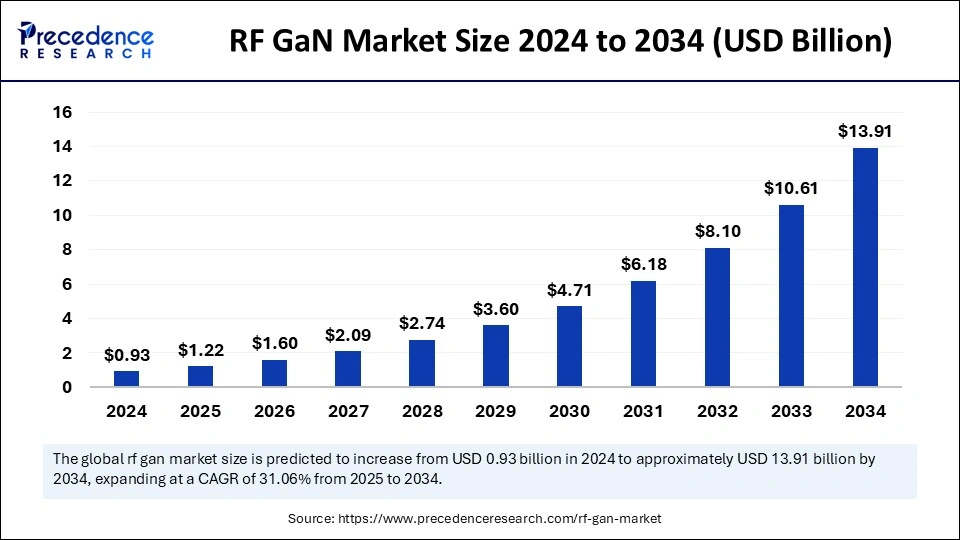

The global RF GaN market size is calculated at USD 1.22 billion in 2025 and is forecasted to reach around USD 13.91 billion by 2034, accelerating at a CAGR of 31.06% from 2025 to 2034. The North America market size surpassed USD 400 million in 2024 and is expanding at a CAGR of 31.21% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global RF GaN market size accounted for USD 0.93 billion in 2024 and is predicted to increase from USD 1.22 billion in 2025 to approximately USD 13.91 billion by 2034, expanding at a CAGR of 31.06% from 2025 to 2034. RF Gallium Nitride (GaN) technology maintains high growth rates because of increasing demand in 5G infrastructure, aerospace, defense, and telecommunications, offering higher efficiency and power.

Artificial Intelligence improves GaN-based RF system performance through better power management, continuous monitoring, and self-diagnosis functions. Artificial intelligence systems enable military operation through enhanced radar and communication capabilities by adjusting to changing environmental conditions, which provides more reliable and efficient performance. The merger of Artificial Intelligence with RF GaN technology shows great potential to push major industrial improvements in telecommunications defense, and electric vehicles through better efficient solutions.

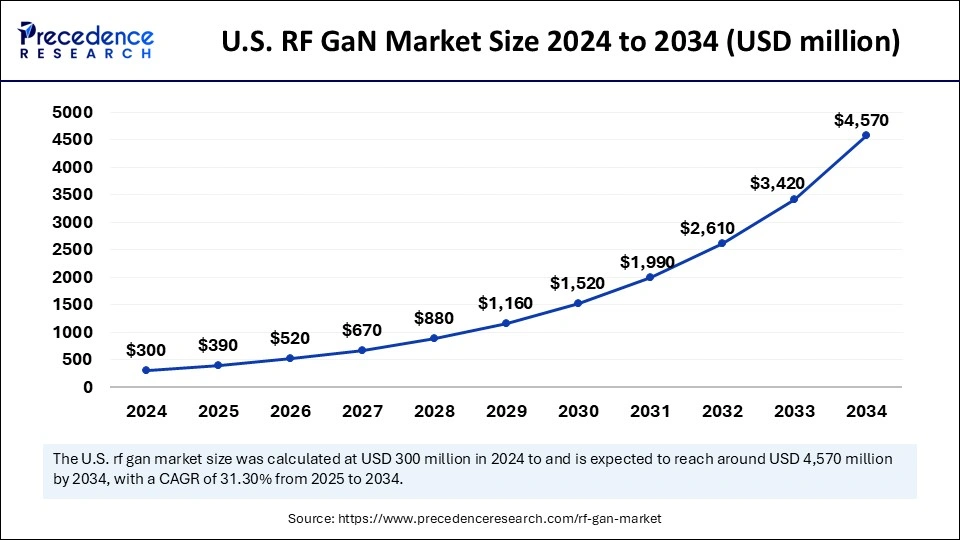

The U.S. RF GaN market size was exhibited at USD 300 million in 2024 and is projected to be worth around USD 4,570 million by 2034, growing at a CAGR of 31.30% from 2025 to 2034.

Asia Pacific Market Trends

Asia Pacific accounted for the largest share of the RF GaN market in 2024. Rapidly developing telecommunications infrastructure in the region, specifically through the 5G network expansion, has strongly increased the market demand for RF GaN-based solutions. The market continues expanding rapidly as manufacturers increasingly use RF GaN technology in consumer electronics and automotive applications. Asian nations such as China, Japan, South Korea, and India conduct significant investments in next-generation technologies, specifically targeting improvements in telecommunications and satellite communication systems.

The fast development of telecom infrastructure, including the extensive 5G network rollout across China, produces strong demand for RF GaN devices. The Chinese telecommunications infrastructure increases efficiency in signal transmission and power amplification through the strategic implementation of RF GaN solutions. China’s satellite and military programs and increasing focus on satellite communications create additional demand for GaN-based components.

North American Market Trends

North America is anticipated to witness the fastest growth in the RF GaN market during the forecasted years. The strong technological base and telecommunication network infrastructure of the region push forward RF GaN development. Advanced technologies have recently become mainstream across this region, thus transforming it into a core research and development center for RF GaN applications. Significant R&D funding enabled the development and widespread usage of RF GaN devices throughout different industries, where their applications proved essential for 5G wireless networks.

The RF GaN market has achieved exceptional strength in the United States because of its advanced technology sector and substantial investment in telecom infrastructure development. The United States is actively dedicating funds to develop 5G networks and high-tech sectors of defense and aerospace, which prompts increased acceptance of GaN-based systems.

Europe Market Trends

The European RF GaN market is expanding rapidly because of the advanced telecommunications networks, fundamental industrial capabilities as well and growing scientific research activities. RF GaN components find their primary application in wireless communication systems to enable 5G technology, thus driving market expansion. The continued heavy investments of European countries into 5G deployment require RF GaN devices to support high-performance, efficient power amplification, and signal processing. GaN suppliers gain substantial business opportunities because defense and aerospace industries need advanced communication systems, radar applications, and electronic warfare capabilities.

The RF GaN functions as a crucial semiconductor with wide-gap band capabilities, which enables the fundamental applications of high-power electronics and wireless communication, radar technologies, satellite communication, and military purposes. The RF GaN market benefits from increased RF GaN adoption in electric and hybrid vehicles to manage power conversion and vehicle control functions.

The market expands due to increased demand in 5G infrastructure and electric vehicles, and defense applications because this material enables superior performance with better signal quality at lower power consumption to serve as an essential component for next-generation communication systems. Capital expenditures in high-performance semiconductor components propel RF GaN market growth because multiple industries, such as defense, aerospace, telecommunications, and electric vehicles, show intensified demand levels.

| Report Coverage | Details |

| Market Size by 2034 | USD 13.91 Billion |

| Market Size in 2025 | USD 1.22 Billion |

| Market Size in 2024 | USD 0.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 31.06% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for telecom infrastructure

The continuous technological advancement at high speeds to meet growing data requirements and connectivity needs. RF GaN technology has become the dominant industrial solution because it delivers superior power and enhanced frequency capability. This capability presents an essential requirement for delivering top-quality media content through streaming videos, online gaming, and data-heavy services. Telecommunications networks advancing their 5G infrastructure drive up the RF GaN market. GaN technology takes hold of the telecom infrastructure sector markets because of its improved efficiency and fast speed with its minimal interference capabilities.

Potential use in 5G infrastructure

GaN stands out for 5G technology requirements because it possesses electrical characteristics such as excellent thermal performance, wide bandgap behavior, and exceptional electron mobility. GaN-based devices improve the transmission of high-frequency signals better than silicon-based parts at lower energy consumption levels. GaN technology operates at elevated temperatures and higher voltages without degrading transistor quality while powering 5G networks that need extended power abilities and broader frequency capability. Through GaN technologies, the cellular infrastructure gains better power efficiency and frequency capability extension. The telecom operations of the future rely heavily on GaN, which establishes itself as a vital technology for these operations.

High manufacturing costs

RF GaN market penetration faces significant limitations due to the high expenses involved in production. The materials needed for manufacturing GaN devices through gallium and nitrogen demand higher rates than the materials employed for silicon-based products. The manufacturing process of GaN layers involves greater complexity and higher expenses when compared to the simpler and less expensive silicon wafer production method. Producing GaN devices necessitates using specialized substrates either made of SiC or GaN-on-GaN, which cost significantly more than conventional silicon substrates commonly used in other semiconductors. The packaging requirements for GaN devices increase production difficulty because insufficient heat management demands complex and expense-intensive solutions.

Miniaturization of RF GaN devices

The reduction of size in consumer electronics becomes possible through compact GaN RF components, which manufacture mobiles and laptops more compact while keeping the same operational standards. In telecommunications facilities, GaN power amplifiers have become reduced in size because this trend makes base stations more compact. The market will experience substantial changes through the application of miniature GaN components in the automotive industry.

The reduction of size possible in GaN-based radar systems makes better-advanced driver-assistance systems and enables the advancement of autonomous vehicle development. GaN devices applied to electric vehicles help create more lightweight vehicles because of their decreased size, thereby enabling better energy efficiency and longer driving distances. GaN technology will lead industry innovation through future developments that will influence consumer electronics as well as telecommunications and automotive systems to meet the market need for smaller high-performance devices.

The GaN-on-Si segment accounted for the largest share of the RF GaN market. The industry relies on silicon due to its affordable production and well-established silicon manufacturing methods. GaN-on-Si technology stands out because of its reduced manufacturing expenses compared to GaN-on-SiC and other equivalent GaN technologies. Large silicon wafers serve as platforms to integrate GaN, which enables the creation of bigger device structures benefiting scalability.

The high-frequency functions enabled by GaN-on-Si technology find applications in consumer electronics devices, telecommunications systems, and various other electronic devices. The demand for cost-efficient, high-performance RF solutions expects GaN-on-Si to maintain its essential position across applications between wireless communications and consumer electronics.

The GaN-on-SiC technology will experience significant growth during the study period because it delivers superior performance through its exceptional thermal capabilities and power efficiency rate. GaN-on-SiC stands out as the preferred material choice when implementing demanding RF systems used in telecommunications, military technologies, and radar systems.

GaN-on-SiC gains popularity in RF devices because it effectively controls heat, which enhances the operational ability of devices. The implementation of GaN-on-SiC technology decreases device defects and minimizes leakage to improve both the reliability and operational lifetime of devices. GaN-on-SiC technology demands continued growth through its crucial advantages, which fit well with aerospace, defense, and high-power RF applications.

The military segment held the largest RF GaN market share in 2024. Defense system modernization creates an increasing demand for high-power semiconductor devices. GaN emerges as an optimal material for military use because it operates with excellent performance characteristics in high-power settings, thus supporting radar functions as well as communication systems and electronic warfare capabilities.

RF GaN power devices find wide application in manufacturing components for military aircraft and vehicles because they support essential operations that include surveillance, object detection, and early warning systems. The defense sector continues to grow because of increasing requirements for powerful amplifiers and transistors used for detection systems, which expands the role of GaN technology.

The RF energy segment is anticipated to show considerable growth over the forecast period. The exceptional power control features, as well as the high efficiency and heat management capabilities of GaN devices, create the optimal solution for RF energy applications where plasma lighting, medical treatments, and industrial heating operations are implemented.

The RF GaN market continues its expansion because GaN technology delivers high power while maintaining low energy loss requirements needed for high-frequency applications. The industrial growth of RF energy solutions will heavily depend on the operational capabilities of GaN-based power amplifiers to enhance system performance while reducing energy waste.

By Material Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client