April 2023

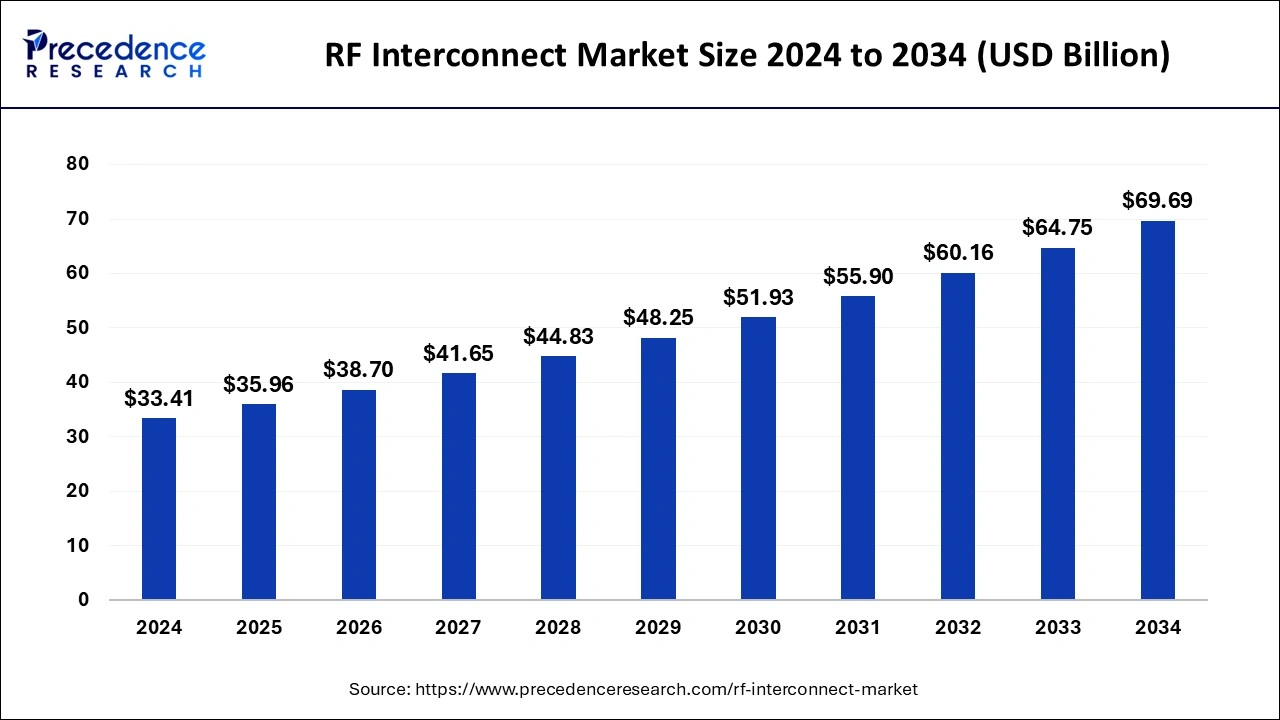

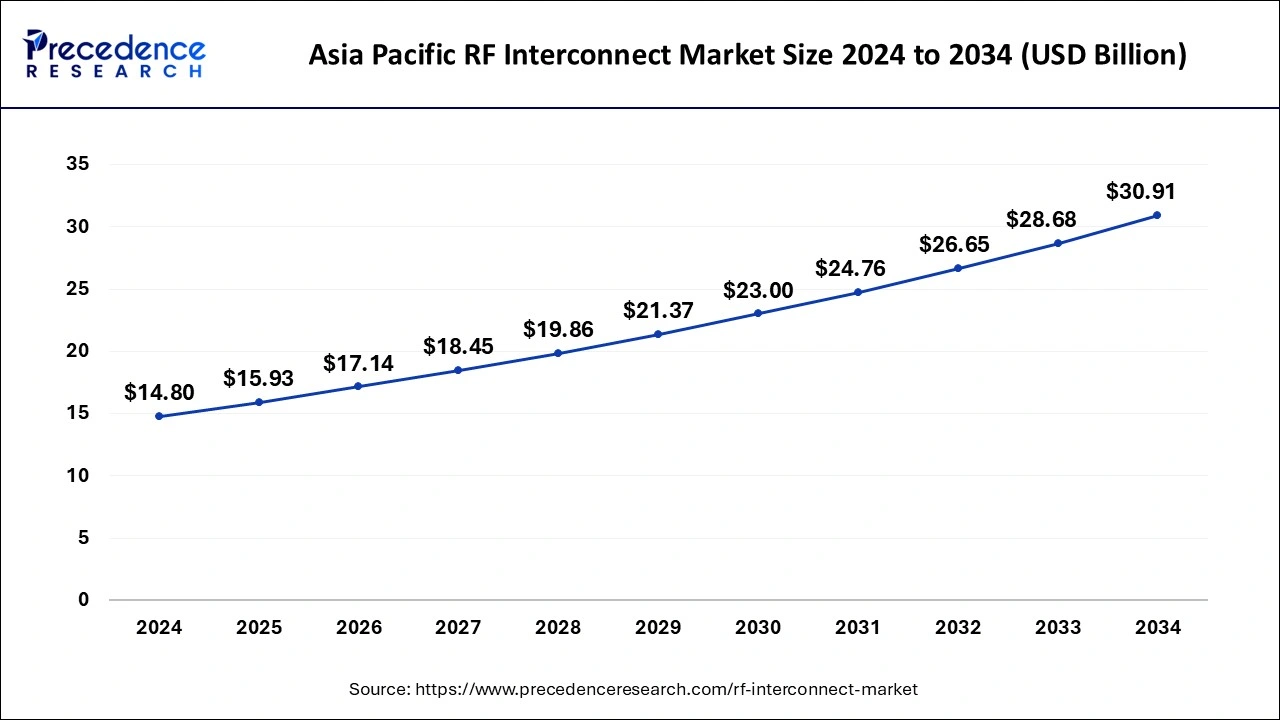

The global RF interconnect market size is estimated at USD 35.96 billion in 2025 and is predicted to reach around USD 69.69 billion by 2034, accelerating at a CAGR of 7.63% from 2025 to 2034. The Asia Pacific RF interconnect market size surpassed USD 15.93 billion in 2025 and is expanding at a CAGR of 7.64% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global RF interconnect market size was estimated for USD 33.41 billion in 2024 and is anticipated to reach around USD 69.69 billion by 2034, growing at a CAGR of 7.63% from 2025 to 2034.

Artificial intelligence is revolutionizing various industries, and the RF interconnect market is no exception. The future of 5G and 6G networks is rapidly using machine learning and artificial intelligence technologies. To generate the datasets, researchers use different storage formats and channel models. AI technologies can be used to capture material properties and complex electromagnetic effects and create models of RF interconnects. These models are helping designers to improve their reliability and performance. In addition, AI can help to improve the design of RF interconnects for specific performance metrics, such as crosstalk, return loss, and insertion loss. These advanced trends are expected to revolutionize the growth of the RF interconnect market in the coming future.

RF interconnect refers to the various components and technologies used to establish connections and transmit radio frequency (RF) signals between electronic devices, modules, or systems. These connections are crucial for wireless communication, radar systems, and other RF applications. RF interconnect components include coaxial cables, connectors, adapters, and printed circuit boards designed to handle RF frequencies effectively.

Their primary purpose is to facilitate the transfer of RF signals while minimizing loss of signal strength, interference, and impedance issues. As a result, these components are of paramount importance, ensuring the reliability and effectiveness of RF applications, which are pervasive in wireless communication, radar systems, and other high-frequency electronic technologies.

The Asia Pacific RF interconnect market size was estimated at USD 14.80 billion in 2024 and is anticipated to be surpass around USD 30.91 billion by 2034, rising at a CAGR of 7.64% from 2025 to 2034.

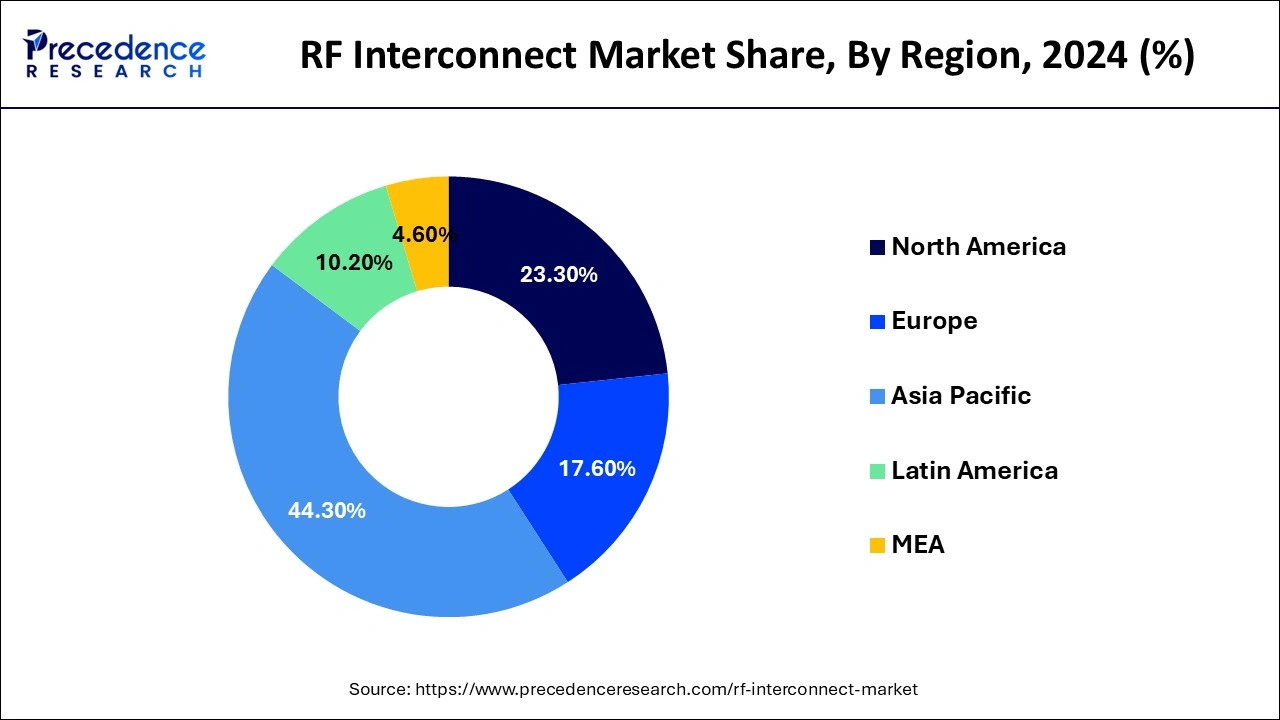

Asia Pacific has held the largest revenue share 44.30% in 2024. Asia Pacific showcases remarkable growth in the RF interconnect market due to its vast consumer electronics industry and a surge in smartphone usage. As mobile device adoption continues to rise, the demand for RF interconnect solutions, including connectors and cables, remains high. In addition, the flourishing automotive industry and the ongoing digital transformation across various sectors contribute to the expansion of RF interconnect applications in the Asia Pacific.

Europe is estimated to observe the fastest expansion. In Europe, the RF interconnect market reflects robust growth, driven by the region's thriving aerospace and defense sectors. The demand for high-performance RF solutions for applications such as radar and satellite communications fuels market expansion. Furthermore, Europe's focus on emerging technologies like IoT and Industry 4.0 creates opportunities for RF interconnects, particularly in industrial applications and smart manufacturing processes. The region's emphasis on innovation and technological advancements sustains the growth of RF interconnect solutions.

In North America, the RF interconnect market is driven by a thriving telecommunications industry, marked by the widespread deployment of 5G networks and the continuous expansion of mobile infrastructure. Additionally, the increasing demand for RF components for military applications further propels market growth. The region experiences a strong emphasis on innovation and research in RF technology, leading to the development of advanced interconnect solutions to cater to the ever-evolving connectivity needs.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.63% |

| Market Size in 2025 | USD 35.96 Billion |

| Market Size by 2034 | USD 69.69 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Frequency, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

5G network expansion and wireless communication advancements

The expansion of 5G networks and continuous advancements in wireless communication technologies have ignited a significant surge in demand for the RF interconnect market. The deployment of 5G networks, characterized by higher frequencies and data rates, necessitates cutting-edge RF interconnect solutions to ensure the efficient and uninterrupted flow of data. These networks rely on a complex web of RF components, including connectors, cables, and antennas, to maintain low signal loss and minimize interference, crucial for the success of 5G communication. As 5G technology becomes the backbone of next-gen connectivity, the RF interconnect market benefits from this pivotal transition.

Furthermore, the ongoing evolution of wireless communication technologies, exemplified by the advent of Wi-Fi 6 and its successors, has heightened the demand for advanced RF interconnect solutions. These components are pivotal in enabling higher data transmission rates and minimizing latency in contemporary wireless communication systems.

They are the often-overlooked enablers behind the scenes, ensuring that 5G networks and advanced wireless technologies can consistently deliver the speed, reliability, and low latency crucial to modern consumers and industries. As our world grows increasingly interconnected, the RF interconnect market is poised for growth, adeptly meeting the surging demands of our data-hungry and ever-expanding digital landscape.

Complex integration, frequency and bandwidth limitations

As the demand for wireless communication and IoT devices rises, so does the need for intricate and customized RF interconnect solutions. This complexity in integration poses a significant restraint. Developing, implementing, and maintaining these complex systems can be time-consuming and expensive. Companies must overcome the challenges of integrating RF components into compact and crowded electronic devices while ensuring optimal performance, which can lead to delays and increased costs.

The RF spectrum is becoming increasingly crowded, limiting available bandwidth. With the proliferation of devices and technologies, securing sufficient bandwidth for new RF interconnect solutions is challenging. As a result, bandwidth limitations can impact the performance of RF systems, causing signal interference and reducing data transmission speeds.

The restrictions on available frequencies can also hinder the development of innovative RF solutions. These restraints collectively affect the market's potential for rapid expansion, making it crucial for industry players to invest in research and development efforts to overcome these challenges and ensure the continued growth of the RF interconnect market.

Automotive connectivity and satellite communications

The demand for RF interconnect solutions is propelled by dynamic forces, notably automotive connectivity and satellite communications. In the automotive sector, the rapid advancement of connected vehicles and autonomous driving technologies creates a substantial need for robust RF components. These components are crucial for in-car communication systems, vehicle-to-vehicle (V2V) communication, and connecting vehicles to the broader transportation infrastructure.

Simultaneously, the growing prominence of satellite communications, driven by satellite internet providers and space exploration initiatives, further intensifies the demand for RF Interconnect solutions, solidifying their role in modern connectivity and communication ecosystems.

On the other hand, satellite communications, particularly driven by emerging satellite internet constellations and expanding global connectivity initiatives, are reliant on RF Interconnect technology. The demand for seamless, high-speed, and low-latency data transmission via satellite networks necessitates advanced RF solutions that can withstand the rigors of space environments. These solutions are vital in enabling global internet access, bridging the digital divide, and supporting applications in remote areas. The combined influence of automotive connectivity and satellite communications propels the RF interconnect market forward, aligning with the global trend of increasing connectivity and data exchange across industries.

The RF cable assembly segment has held largest revenue share in 2024. RF cable assemblies play a pivotal role in the RF Interconnect market. These essential components are the physical links that connect various RF devices like antennas, amplifiers, and transceivers. RF cable assemblies are prized for their flexibility and durability. They ensure reliable RF signal transmission due to their low signal loss and high shielding capabilities. With the ever-growing demand for high-quality RF connections across diverse applications, these assemblies are witnessing a surge in innovation, resulting in products that offer even better performance, reliability, and longevity.

The RF coaxial adapter segment is anticipated to expand at a significant CAGR of 8.5% during the projected period. RF coaxial adapters, conversely, serve as crucial intermediaries between RF cables and the devices they connect to. Their significance can't be overstated in facilitating seamless connections. The current trend in the RF interconnect market points toward an increasing need for smaller, higher-frequency connectors and adapters. This demand is fueled by the push for miniaturization and higher data rates in contemporary RF applications. Advances in materials and design are continually enhancing these components' performance, making them a linchpin in the ever-evolving world of RF technology.

Based on the frequency, up to 50 GHz segment is anticipated to hold the largest market share in 2024. RF interconnect solutions for frequencies up to 50 GHz address the requirements of high-frequency applications found in 5G wireless communication, radar systems, and aerospace technologies. This market segment experiences trends centered on the development of high-precision connectors and cables engineered to provide unparalleled performance, ensuring minimal signal loss and optimum signal integrity.

With the ongoing expansion of 5G networks and the rapid evolution of aerospace technologies, the RF interconnect components designed for frequencies up to 50 GHz are expected to continue their upward trajectory, marked by innovations that cater to high-frequency, high-performance applications.

On the other hand, the up to 6 GHz segment is projected to grow at the fastest rate over the projected period. RF interconnect solutions tailored for frequencies up to 6 GHz are designed to meet the specific requirements of applications operating within lower frequency ranges. This segment includes a diverse range of components such as connectors, cables, and adapters.

Notably, there is a prevailing trend in this category aimed at miniaturization and enhancing performance to cater to the demands of compact and portable consumer electronics, Wi-Fi, and bluetooth devices, aligning with the ongoing consumer preferences for smaller, more efficient electronics. As a result, the RF interconnect market for frequencies up to 6 GHz is marked by continuous efforts to reduce signal loss and improve connectivity, ensuring optimal performance in these applications.

In 2024, the telecommunications segment had the highest market share. On the basis of the end user. In the telecommunications sector, RF interconnect solutions are vital for maintaining dependable wireless communication. The prevalent industry trends in this domain are primarily centered on the swift rollout of 5G networks, the expansion of mobile infrastructure, and the growing demand for high-frequency and high-bandwidth interconnect solutions.

These trends are propelled by the increasing need for quicker data transmission, reduced latency, and enhanced network performance to meet the escalating demand for high-speed internet and uninterrupted connectivity in the telecommunications sector. As technology advances further, the RF Interconnect market retains its pivotal role in enhancing telecommunication services.

The automotive segment is anticipated to expand at the fastest rate over the projected period. The automotive sector is a prominent end user of RF Interconnect solutions. The ongoing trends in this industry revolve around the increasing integration of advanced infotainment, telematics, and connectivity systems in vehicles. Modern vehicles require efficient RF components to support functions like GPS navigation, wireless communication, and sensors for driver assistance systems.

Moreover, the rise of electric and autonomous vehicles further intensifies the need for reliable RF interconnect solutions as these technologies heavily depend on seamless communication and data exchange to ensure safe and efficient operation. As the automotive industry continues to innovate, the RF interconnect market remains a critical enabler of these advancements.

By Type

By Frequency

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2023