November 2024

Robot as a Service Market (By Enterprise Size: Small & Medium Enterprises, Large Enterprises; By Application: Handling, Assembling And Disassembling, Dispensing, Processing, Welding And Soldering, Others; By Industry Vertical: BFSI, Défense, Healthcare, Automotive, Manufacturing, Retail, Telecom & IT, Logistics & Transportation, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

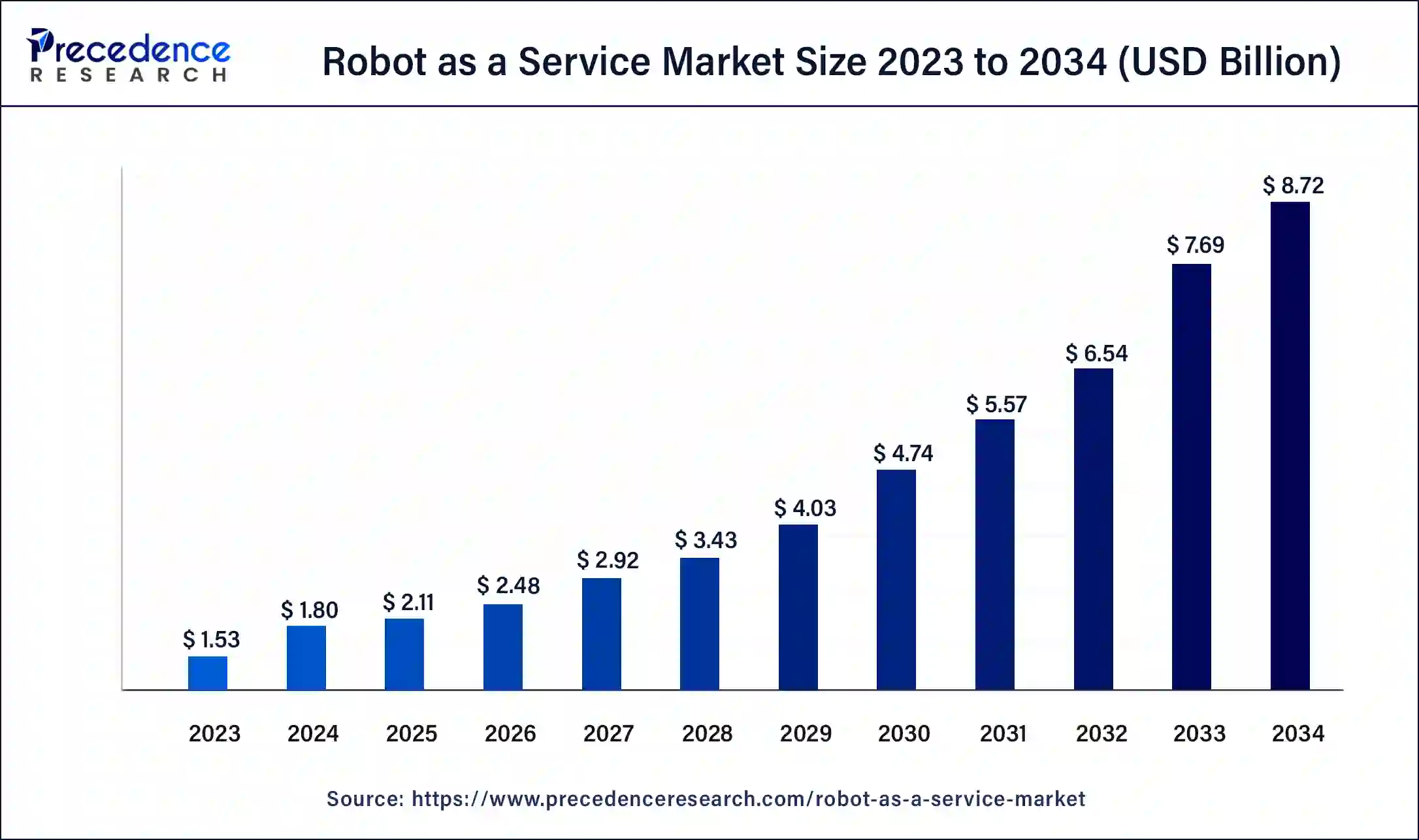

The global robot as a service market size was USD 1.53 billion in 2023, calculated at USD 1.80 billion in 2024 and is expected to reach around USD 8.72 billion by 2034, expanding at a CAGR of 17% from 2024 to 2034. The robot as a service market size reached USD 580 million in 2023. The rising demand for automation in diverse sectors such as healthcare, logistics, defense, manufacturing, and others has extensively changed the workflow of these industries, driving the market globally.

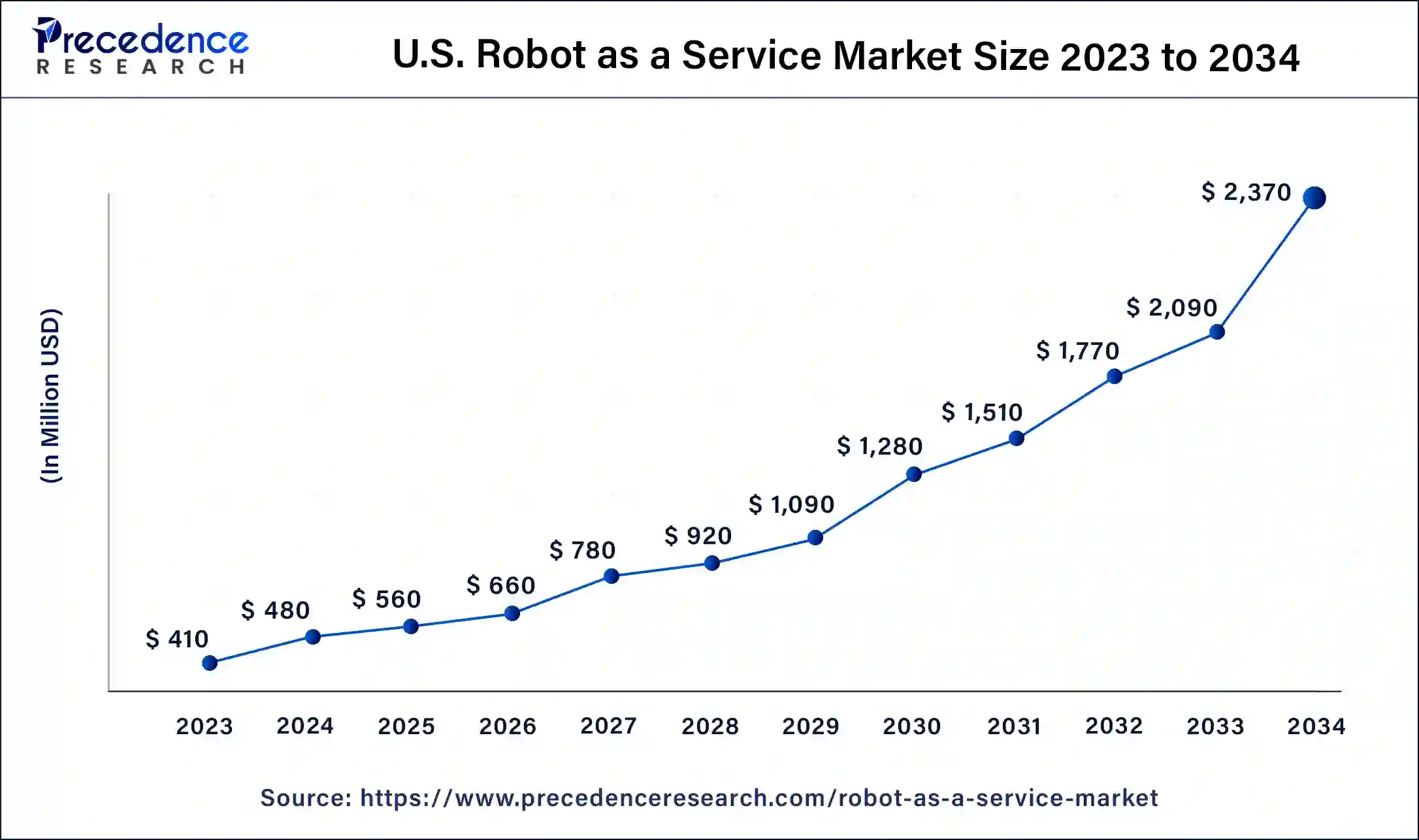

The U.S. robot as a service market size was estimated at USD 410 million in 2023 and is predicted to hit around USD 2,370 million by 2034 at a CAGR of 17.31% from 2024 to 2034.

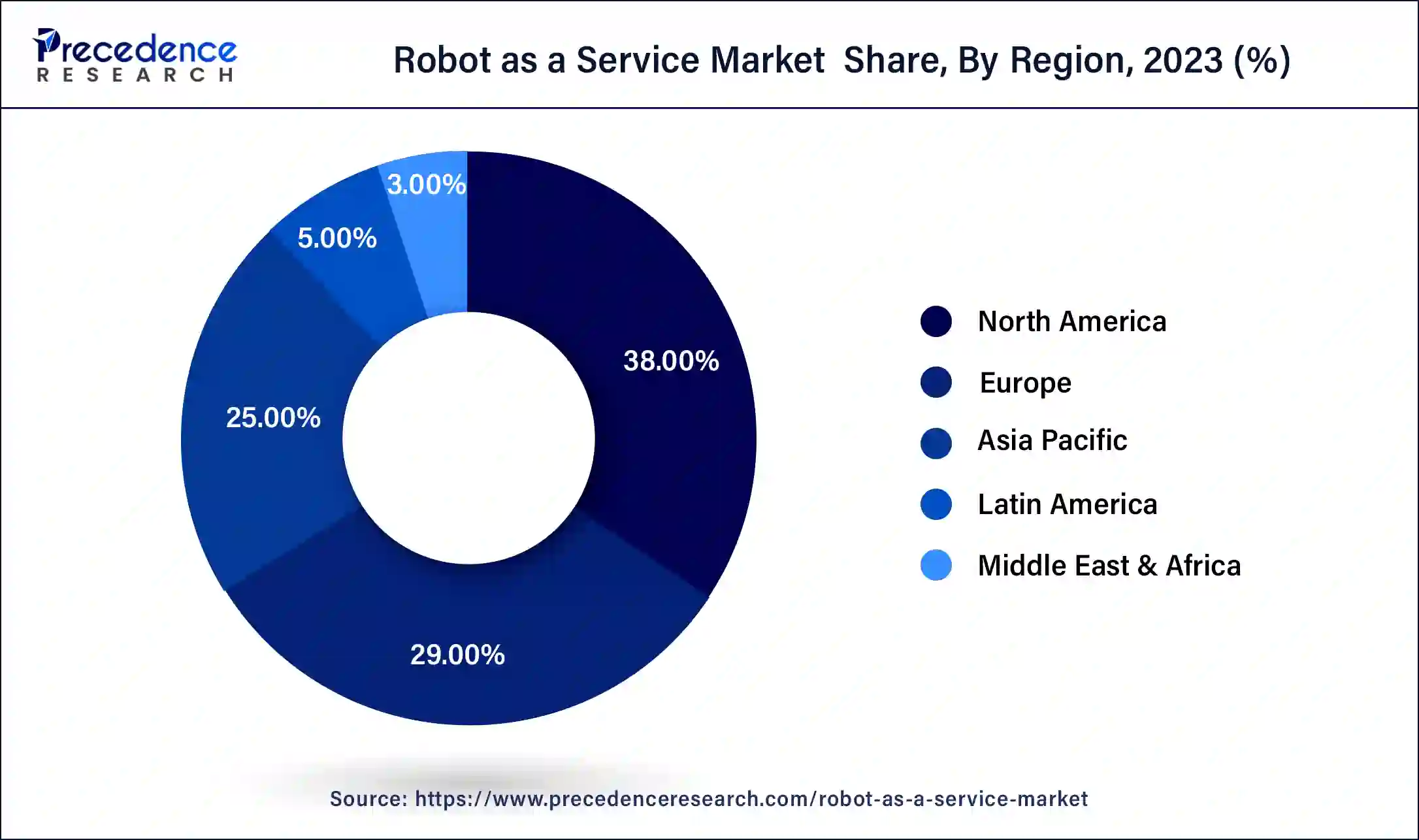

North America was estimated to generate the highest revenue in 2023 and is expected to dominate the global robots as a service market in the upcoming years. This is due to the rising adoption of automation systems across various sectors. In North America, the robotics sector is experiencing robust growth driven by several factors. The region has a strong technological infrastructure, fostering a culture of innovation that includes a diverse industrial landscape. All of these factors contribute to the rapid adoption of robotics across various sectors.

North America has a huge and considerable market for automation and robotics, with a high level of awareness and acceptance of these technologies among businesses. This creates a conducive environment for RaaS providers to offer innovative solutions fabricated to the specific needs of North American companies. As a result, the region continues to attract significant investments and partnerships, driving further expansion and innovation in the robotics industry.

In the United States and Canada, industries such as manufacturing, logistics, healthcare, and retail are increasingly turning to the robot as a service market to enhance efficiency, reduce costs, and remain competitive in the global market. The presence of leading technology companies, research institutions, and venture capital firms further accelerates the development and deployment of robotic technologies in the region.

Asia Pacific is the fastest-growing region of the robot as a service market. It is anticipated to rise further due to the increasing access to innovative technologies with automation systems. Hence, in the region, the robot-as-a-service (RaaS) industry is poised for rapid expansion and innovation. With an emerging economy, increasing population, and a higher rate of industrialization, countries like China, Japan, South Korea, and India are leading the charge in adopting robotics to drive efficiency and competitiveness across diverse industries.

Asia Pacific offers fertile and strong ground for the global market. It helps to collaborate and capitalize on the growing demand for robotics solutions in one of the world's most dynamic and rapidly evolving markets. Moreover, government initiatives aimed at promoting innovation and technological advancement, coupled with assisting regulatory frameworks, further support the growth of the robot as a service market in the region.

China specifically stands out as a major player in the global robot as a service market, with significant investments in automation and artificial intelligence. The country's "Made in China 2025" initiative aims to transform China into a global manufacturing powerhouse through the widespread adoption of robotics and automation technologies.

Japan has long been at the forefront of robotics innovation, with a strong focus on research and development. The Japanese government's support for robotics initiatives, coupled with a rapidly aging population, drives demand for robotics solutions in healthcare, eldercare, and other sectors. Moreover, South Korea is another key market in the region, with a thriving robotics industry fuelled logistics and services positions. Leading as a major player in the global robot as a service market.

India is again a leading frontier for technologically innovative solutions and adoptions with its growing economy and increasing emphasis on digitalization and automation. It presents significant opportunities for the robot as a service market. The country's large workforce and expanding industrial base create demand for robotics solutions to enhance productivity and efficiency across various sectors.

The robot as a service market is booming with every consecutive year, offering robots to businesses on a subscription basis. It's like leasing a robot rather than buying one for enterprises. This model is gaining attention from many industries because it lowers the barrier to entry for businesses wanting to adopt robotics. Companies can access advanced robotics without the high upfront costs, making it appealing across industries from manufacturing to healthcare.

In simpler terms, it's like renting a car instead of buying one. Businesses pay a fee to use robots for tasks like automation, logistics, or customer service without having to invest in full ownership of the technology. This approach allows for flexibility, scalability, and cost-effectiveness. As more industries recognize the benefits of robotics in streamlining operations and improving efficiency, the robot as a service market is expected to continue its upward trajectory on a global level, and thus, it will be a promising future opportunity for several markets.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 8.72 Billion |

| Global Market Size in 2023 | USD 1.53 Billion |

| Global Market Size in 2024 | USD 1.80 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 17% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Enterprise Size, Application, and Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Need for automation

A significant driver for the robot as a service market is the increasing demand for automation, which is driven by the need for operational efficiency and cost savings. As businesses strive to streamline processes and remain competitive in a rapidly evolving landscape, automation emerges as a compelling solution. Robots as a service offer a flexible and cost-effective approach to adopting robotics, enabling companies to leverage advanced technologies without substantially massive investments. This model allows for scalability, customization, and risk reduction.

As technological advancements continue to enhance the capabilities of robots, their applicability expands, further driving the demand for RaaS solutions. For instance, robots are increasingly used in the manufacturing industry to perform diverse tasks such as welding, material handling, serving goods from one place to another, etc. These moves by manufacturing industries may reduce the need for a human workforce to do such a rigid task.

Moreover, the rise of Industry 4.0 and the Internet of Things (IoT) promotes integration opportunities, fuelling the growth of the RaaS market globally. As businesses seek to optimize their operations through interconnected automation systems, robots as a service is an advanced solution for it. Ultimately, the pursuit of efficiency, flexibility in work, and innovation define the significance of RaaS as a transformative force in modern business environments.

Replacement of human workforce

One of the major restraints for the robot as a service market is the potential resistance or reluctance from businesses to adopt new technologies due to concerns about job displacement or workforce disruption. While automation promises operational efficiencies and cost savings, the fear of job losses among existing employees can hinder the pace of adoption.

Companies may face internal conflicts from employees who perceive robotics as a threat to their livelihoods or job security. Additionally, there may be cultural or organizational barriers to overcome, as integrating robots into existing workflows may require significant changes to processes and workflows. Furthermore, regulatory and compliance issues surrounding the deployment of robotics in certain industries or regions may cause challenges and delays.

Addressing these concerns through effective communication, re-skilling initiatives for the existing human workforce, and regulatory frameworks is crucial to overcoming this restraint and cultivating widespread acceptance and adoption of robots as a service solution.

Integration of AI and ML

The future opportunity for the robot as a service market lies in leveraging artificial intelligence (AI) and machine learning (ML) technologies to enhance the capabilities and autonomy of robots. By integrating AI and ML capabilities into RaaS offerings, businesses can unlock new levels of potential, including enhancing efficiency, productivity, and innovation across various industries.

As AI and ML algorithms continue to advance, robots can become more intelligent, adaptable, and capable of performing complex tasks with minimal human intervention. This presents an opportunity for the robot as a service market provider to offer highly sophisticated robotic solutions that can learn and adapt to changing environments, optimize workflows, and even collaborate more effectively with human workers.

For instance, AI-powered robots can analyze data in real-time to identify patterns, make predictive decisions, and continuously improve performance over time. This not only enhances operational efficiency but also enables businesses to stay ahead of the competition and address evolving customer demands more effectively.

Moreover, AI-driven robots have the potential to revolutionize industries such as healthcare, logistics, and manufacturing by automating tasks that were previously considered too complex or time-consuming for traditional robotic solutions. As AI technology matures and becomes more accessible, the integration of AI into robots as a service solution represents a promising opportunity to drive further growth and expansion in the robotics market.

The large enterprises segment held the largest share of the market in 2023. The large enterprise segment includes enterprises with extensive resources and complex operational demands in the vast landscape of the robot as a service market. These corporations opt for RaaS solutions to harness advanced robotic capabilities without claiming direct ownership to expand themselves worldwide.

Instead of purchasing robots straightly, large enterprises choose to subscribe to RaaS providers, who offer a diverse range of robotic solutions on a subscription basis. This model enables large enterprises to access cutting-edge technology while lowering the rate of the financial risks associated with huge capital investments and ongoing maintenance costs. Moreover, RaaS facilitates scalability to enterprises, allowing large enterprises to adapt swiftly to continuously changing market dynamics and technological advancements. This can be achievable by adjusting their robotic deployments as required.

By leveraging the capabilities of the robot as a service market, large enterprises can optimize efficiency, streamline processes, and enhance productivity across various sectors. This includes manufacturing, logistics, healthcare, and other areas. Additionally, RaaS empowers large enterprises to focus on their core competencies while outsourcing robotics expertise to specialized providers. It ensures seamless integration and maximum operational efficiency for enterprises.

The small & medium enterprises segment is expected to show significant growth in the upcoming years. Small & medium enterprises, or SMEs, typically have limited resources compared to large enterprises. By embracing robots as a service, SMEs are able to gain access to cutting-edge robotic technologies without the substantial capital investment associated with purchasing and maintaining robotic equipment. RaaS providers offer flexible subscription-based models that allow SMEs to scale their robotic deployments according to their evolving needs and budgets.

This approach empowers SMEs to guide their workflows, enhance productivity, and remain competitive in dynamic market environments. Additionally, robots as a service enables SMEs to leverage specialized robotic solutions tailored to their industry-specific requirements, ranging from manufacturing to logistics, healthcare, retail, and others. By embracing RaaS, SMEs can harness the transformative power of robotics to optimize efficiency, drive innovation, and propel business growth without the hindrances that are typically associated with traditional robotics investments.

The handling application segment caters to enterprises seeking robotic solutions to streamline their material handling tasks with the least interference from human work. In the robot as a service market, the handling application segment held the largest market share in 2023. This segment has a wide range of industries, including manufacturing, warehousing, logistics, and e-commerce fulfillment centers.

RaaS providers offer flexible subscription-based models tailored to the specific needs and scale of handling applications. This allows businesses to access robotic solutions without the burden of huge capital investment or long-term financial commitments. Businesses are able to leverage robots as a service to deploy robotic systems that automate the movement, sorting, and distribution of goods and materials within the enterprise. Therefore, optimizing operational efficiency aids in reducing manual labor costs.

By embracing RaaS for handling applications, enterprises can enhance efficiency, accuracy, and safety in their operations so that they can adapt quickly to fluctuating demand and evolving market conditions. In addition, robots as a service enable businesses to leverage advanced technologies such as robotic arms, autonomous mobile robots (AMRs), and robotic palletizers to address the diverse range of handling challenges, achieve greater productivity, and meet the competence requirements in their respective industries.

In the realm of the robot as a service market, the automotive industry segment caters specifically to automotive manufacturers and suppliers seeking robotic solutions to optimize their production processes. The automotive industry segment accounted for the highest market share in 2023. This segment incorporated a broad range of applications within the automotive sector, including assembly, welding, painting, inspection, and material handling.

Automotive companies leverage RaaS to access state-of-the-art robotic technologies, which means that recently highly developed technologies are out for industrial use without the need for substantial investments in equipment and infrastructure. The robot as a service provider offers flexible subscription-based models that allow automotive manufacturers to scale their robotic deployments according to production demands and market fluctuations. Companies with a cost-effective and scalable approach to encompass robotics into their manufacturing processes. Hence, this enables them to remain competitive in an ever-evolving industry landscape.

By embracing RaaS, automotive companies can enhance efficiency, precision, and safety in their manufacturing operations. Advanced robotic systems enable tasks such as repetitive assembly, precise welding, consistent painting, and thorough quality inspection to be performed with greater speed and accuracy than manual labor. Furthermore, RaaS empowers automotive manufacturers to adapt quickly to changes in production requirements and technological advancements. They can easily integrate new robotic solutions into their existing workflows and leverage data-driven insights to optimize performance and drive continuous improvement.

Segments Covered in the Report

By Enterprise Size

By Application

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

August 2024

April 2025

August 2024