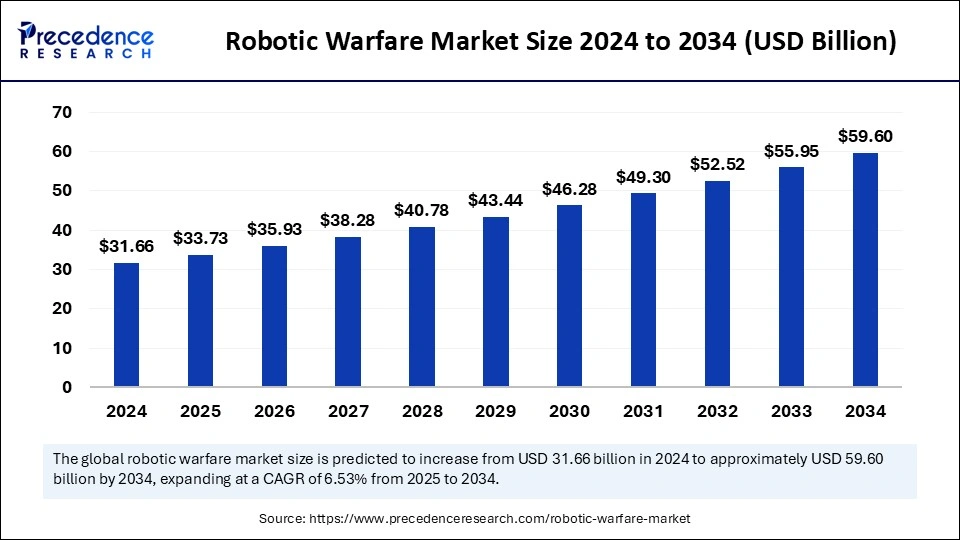

The global robotic warfare market size is calculated at USD 33.73 billion in 2025 and is forecasted to reach around USD 59.60 billion by 2034, accelerating at a CAGR of 6.53% from 2025 to 2034. The North America market size surpassed USD 12.98 billion in 2024 and is expanding at a CAGR of 6.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global robotic warfare market size accounted for USD 31.66 billion in 2024 and is predicted to increase from USD 33.73 billion in 2025 to approximately USD 59.60 billion by 2034, expanding at a CAGR of 6.53% from 2025 to 2034. The demand for autonomous systems has increased in military operations, driving the growth of the robotic warfare market. The increased demand for advanced force protection and rapid support for complex scenarios are the major factors contributing to the market growth.

The implementation of artificial intelligence in robotic warfare is playing a transformative role in modern warfare to advance its capabilities. AI integration enabling improved precision, efficiency, and strategic capabilities. AI provides rapid and accurate autonomous decision-making abilities. AI in robotic systems is to operate at rapid speed with greater accuracy and reduce the risk of complications.

Autonomous systems are meant to perform dangerous tasks and reduce the risk to human personnel, making them ideal for warfare. AI not only enables the development of novel technologies to enhance military capabilities but also enables the detection and quick response to cyber threats in real time and improves the security of robotic systems. The regulatory standards associated with ethical and legal concerns about autonomy, accountability, and the potential for escalating conflicts are the significant maintenance challenges. However, AI makes it easier to operate robotics along with complying with regulations.

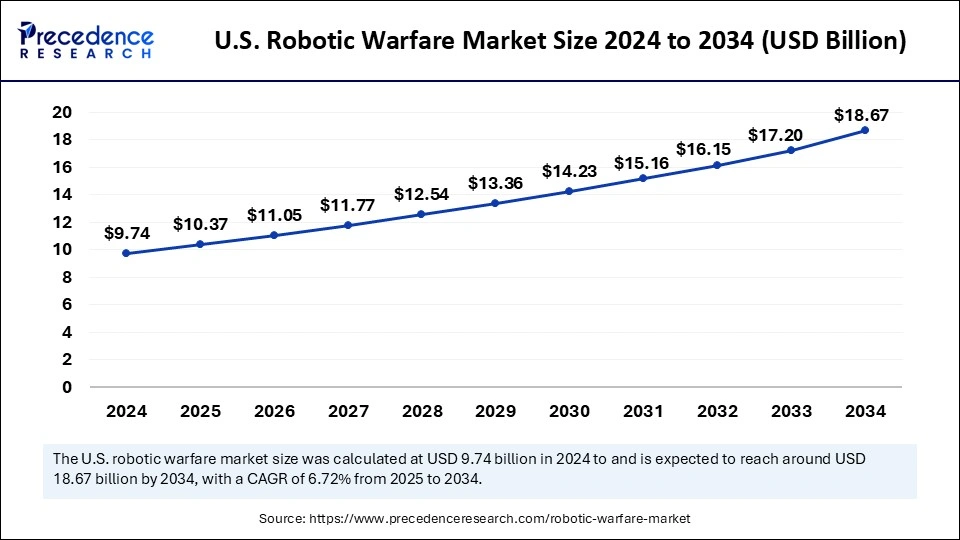

The U.S. robotic warfare market size was exhibited at USD 9.74 billion in 2024 and is projected to be worth around USD 18.67 billion by 2034, growing at a CAGR of 6.72% from 2025 to 2034

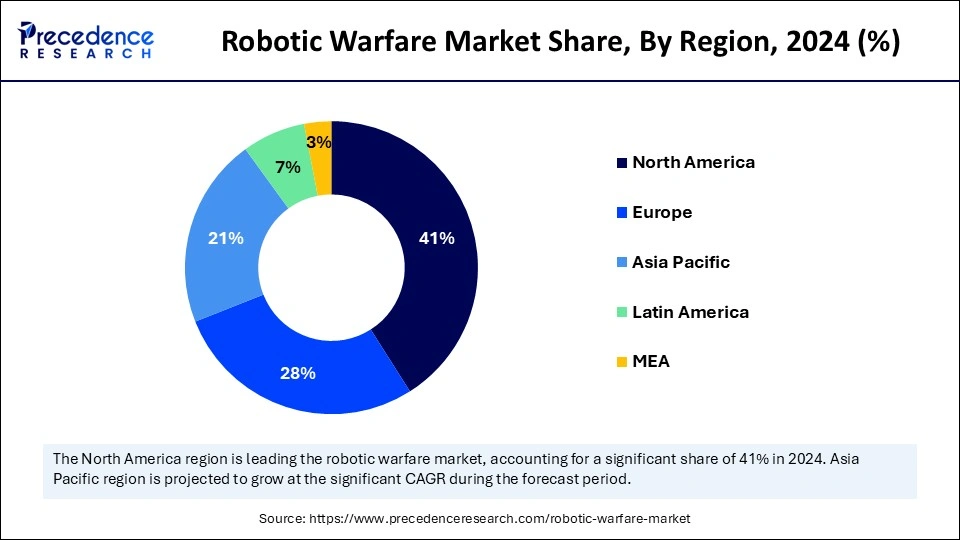

North America to Lead the Robotic Warfare Market

North America dominated the global robotic warfare market in 2024. High defense expenditure, military modernization, and early adoption of advanced technologies are the key factors contributing to this growth. The military of North America is undergoing modernization efforts, driving the need for advanced technologies like robotics and autonomous systems. The high adoption of unmanned systems in the military is playing a favorable role in market expansion.

U.S. Market Trends

The United States leads the regional market due to the country's high defense expenditures and investment in technological advancements. The United States is a key competitor in the global market, bringing emerging technologies to enhance military capabilities and reduce the risk of human personnel. The U.S. Army is the prior adapter of unmanned systems for various applications, such as intelligence, surveillance, reconnaissance, and targeted attacks. Government initiatives such as the U.S. Army’s next-generation combat vehicle program and the U.S. Navy’s unmanned system integrated road map are emerging future military applications.

Factors Contributing to Asian Market Expansion

Asia Pacific is projected to grow at a solid CAGR in the robotic warfare market over the coming years. The growth is majorly driven by increased investments in unmanned systems and AI-powered technologies. The adoption of robotic systems has witnessed growth in Asia Pacific due to factors like increased regional geopolitical tensions and modernizations of military forces. Countries China, India, Japan, and South Korea are leveraging regional market expansion with heavy investments in edge technologies, focusing on advancing defense capabilities, and responding to regional security challenges.

Government Support Encourages China’s Leadership

China is leading the regional market, driven by the rise in defense expenditure and modernization of military forces in the country. China Aerospace Science and Industry Corporation (CASIC) is well determined in the development of advanced robotic warfare systems such as unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs). The Chinese government is promoting automation in the country via the Robotics+ action plan. This plan is projected to double the country’s manufacturing robot density by 2025 relative to 2020 levels.

'Make in India’ Initiatives: to Leverage Market Growth in India

India is still the second largest country, leading the regional market due to countries' growing defense budgets and focus on the adoption of advanced technologies. India witnessed rapid investments in the development of emerging technologies to enhance its military capabilities. Furthermore, government initiatives and regulatory support for the development of cutting-edge technologies are making essential impacts on the Indian robotic warfare area. ‘Make in India’ initiatives play a vital role in empowering key vendors to develop, manufacture, and assemble products in India, including automation and robotic warfare.

The European Market Trends

Europe is expected to grow at a considerable rate in the upcoming period. The strong industrial robotics research and a high focus on technological sovereignty are the major factors contributing to the growth of the European robotic warfare market. Europe has a strong defense industry and high defense expenditure. Europe is a hub for major research and development institutes, which drives innovation in robotic warfare systems. Additionally, collaborative approaches between universities, industry, and research institutions are advancing defense projects, including robotic warfare initiatives.

Germany's Focus on Automation

Germany is leading the regional market due to its strong defense industry and high defense expenditure. Germany is the hub for engineering and automation. Countries' continuous focus on improving their military capabilities is the key factor boosting market expansion. European defense funds and unmanned system initiatives further include advanced means of defense technologies, an integration of emerging systems, including robotic warfare systems in military operations. The "Industry 4.0" focus of Germany for enhancing digitalization and automation contributed to robotic warfare system advancements.

The robotic warfare market refers to the utilization of robotic systems in military operations. The military sector has seen a surge in autonomous systems in military applications to improve security, safety, speed, and soldier surveillance. The integration of AI with robotics is a significant factor enabling the development of more sophisticated and capable robotic systems for military applications. The military sector has witnessed an extreme need for improved situational awareness and force protection systems. Robotics facilitates great protection and real-time monitoring to prevent and support surveillance in complex scenarios. Technological advancements are covering military operations by ensuring the efficient adoption of robotics systems and AI leverage. The year 2025 is all about the Military Robotics & Autonomous Systems Conferences.

The increased adoption of unmanned aerial vehicles, unmanned ground vehicles, unmanned underwater vehicles, and drones is the key factor contributing to the market. Additionally, focusing on advancing ISR (Intelligence, Surveillance, and Reconnaissance) capabilities for gathering real-time intelligence, monitoring enemy movements, and providing situational awareness is transforming robotic areas. Countries are focusing on enhancing their defense capabilities and countering emerging threats to improve security. Market competition for technological advancements and regulatory compliance are fulfilling their missions. The ongoing war between America and China for artificial intelligence supremacy in warfare is anticipating opportunities for various strategies, programs, and developments in the upcoming time.

| Report Coverage | Details |

| Market Size by 2034 | USD 59.60 Billion |

| Market Size in 2025 | USD 33.73 Billion |

| Market Size in 2024 | USD 31.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.53% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mode of Operation, Capability, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing need for unmanned systems

Military operations have witnessed the rapid need for unmanned systems, including Unmanned Aerial Vehicles (UAVs/drones), Unmanned Ground Vehicles (UGVs), Unmanned Surface Vehicles (USVs), and Unmanned Underwater Vehicles (UUVs). The need for unmanned systems has occurred rapidly in military areas, driven by demand for improved intelligence, surveillance, and reconnaissance (ISR) capabilities. The demand for cost-effective technologies and the reduction of risk to human personnel contribute to the need for unmanned systems in military operations. Unmanned systems enable the reduction of risk to soldier personnel and improve efficacy, productivity, and situational awareness capabilities. This system is cost-effective as it can reduce the cost associated with military operations like maintenance and personnel, making them ideal for warfare.

high development and deployment costs

Complexity and high costs associated with the development and deployment of robotic warfare are the major restraints for the market expansion. The development of advanced robotic systems needs significant investment in research and development. The testing and training of robotic warfare further contribute to the cost, the burden. The manufacturing of robotic solutions can be expensive, especially with the advanced materials and technologies required in military operations. Furthermore, the requirement of high investment in logistics, training, and support can hinder the manufacturing of robotic warfare.

Investments in robotic solutions

The robotic warfare market is expected to expand further with increasing investment in robotic systems for the military battlefield. The adoption of unmanned systems has increased, making essential investments in robotic warfare technologies and systems. Furthermore, advancements in artificial intelligence and automation to advance the performance of high-risk tasks and reduce human personnel on the battlefield are fueling the market. Government and non-government organizations are committing to investment in robotic solutions to advance military operation capabilities. The investments in unmanned technologies and higher defense budgets worldwide are making an essential impact on the adoption of robotic warfare. Investment in robotic solutions has become a key area for the development of autonomous robots to minimize human intervention and improve operational efficiency, likely to boost the market in the forecast period.

The semi-autonomous segment held a dominant presence in the robotic warfare market in 2024 and is projected to lead the market continuously in the upcoming period. Semi-autonomous weapons provide a balance between human control and robotic autonomy. They include advancements in human-machine collaboration, which is a significant factor contributing to segment growth. The flexibility and safety of semi-autonomous systems make them popular in warfare. This system can reduce the risk of accidents as humans can take control over autonomous decisions. Semi-autonomous weapons provide real-time intelligence and recognition, making them ideal for military operations to improve effectiveness. Semi-autonomous systems are cost-effective compared to fully automated autonomous systems, making them ideal for military operations. This segment dominance in the market is expected to continue, driven by its operational safety, flexibility, improved effectiveness, and cost-effectiveness.

The unmanned platforms and systems segment accounted for a considerable share of the robotic warfare market in 2024. The unmanned platforms & systems include drones, UGVs, and UMVs. The increased adoption of unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and unmanned underwater vehicles (UUVs) in military operations is driven by the emphasis on improving the safety, efficiency, and adaptability of military applications. The growing development of sophisticated unmanned platforms and systems, with the help of advances in autonomy and AI, are leveraging the segment growth. The adoption rate of unmanned platforms and systems is expected to witness further growth to reduce the risk to human life in military applications.

The exoskeleton and wearables segment is expected to grow at a notable rate in the forecast period. The adoption of exoskeleton and variable systems has increased, driven to improve human performance and mobility and provide protection. Enhancing soldier capabilities and survivability in complex combat scenarios has become crucial in the military field. The exoskeleton & wearables can provide protection and surveillance to the soldiers by facilitating communication, situational awareness, and quick response in critical situations. Advancements in technology, increased demand, and the need to enhance soldier performance and survivability are driving the growth of exoskeletons & wearables in military operations.

In 2024, the intelligence, surveillance, and reconnaissance segment led the global robotic warfare market. The segment growth is attributed to the increased need for real-time battlefield intelligence and surveillance operations without risking soldiers' lives. Improved Intelligence, Surveillance, and Reconnaissance (ISR) systems and capabilities in the technologies are further contributing to the segment growth. The Intelligence, Surveillance, and Reconnaissance system provides real-time battlefield awareness, situational awareness to provide a comprehensive view of the battlefield. Advancement in sensor technologies Advancement in sensor technologies is enabling the development of more sophisticated intelligence, surveillance, and reconnaissance systems to boost their adoption in warfare.

However, the search and rescue segment is projected to expand rapidly in the coming years, with a growing need for robots with advanced capabilities in various operations. The search and rescue operations provide rapid response and efficient deployment. The need for reconnaissance, surveillance, and combat support in military operations is driving the demand for search & rescue applications. Increased demand for versatile robots, driving search & rescue influence on robotic warfare. Applications of search and secure an explosive ordnance disposal, improvised explosive devices detection, and command securing areas of military operations are trending in the market.

By Mode of Operation

By Capability

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client