January 2025

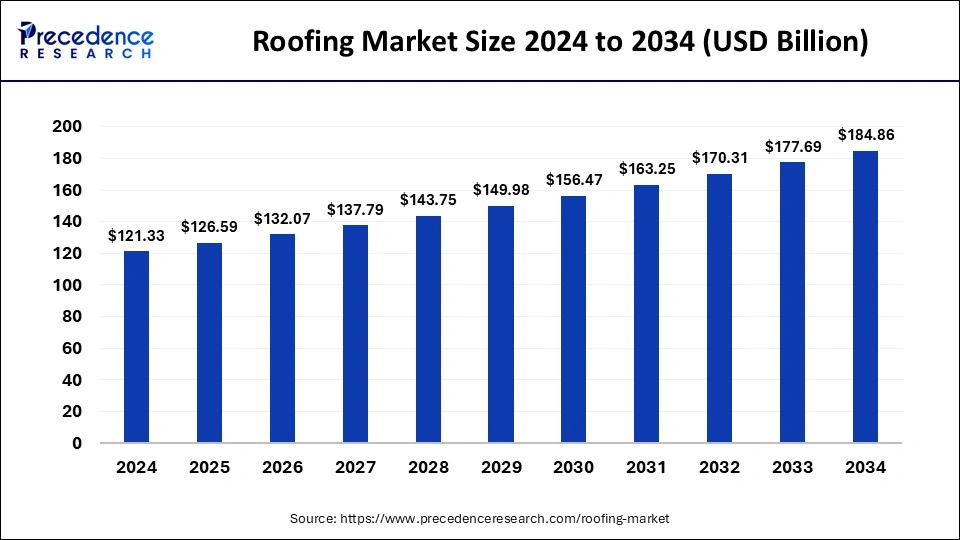

The global roofing market size is calculated at USD 126.59 billion in 2025 and is forecasted to reach around USD 184.86 billion by 2034, accelerating at a CAGR of 4.30% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global roofing market size was estimated at USD 121.33 billion in 2024 and is predicted to increase from USD 126.59 billion in 2025 to approximately USD 184.86 billion by 2034, expanding at a CAGR of 4.30% from 2025 to 2034. The usage of cutting-edge roofing solutions is encouraged by government laws and incentives that support sustainable and energy-efficient architecture.

Growth is mostly driven by increased construction activity and rapid urbanization, especially in developing nations. The need for both new construction and the remodeling of existing buildings is rising, which is driving up the use of roofing materials. The roofing market dynamics are being impacted by innovations in roofing materials, such as energy-efficient options and robust materials that can survive harsh weather. Because they save money over time and are better for the environment, solar and green roofing are growing in popularity. The use of sustainable materials and green building projects is becoming more and more popular. Vegetable-covered rooftops, or "green roofs," are becoming more popular in cities due to their ability to save energy and look good.

Metal, tiles, asphalt shingles, and green roofs are examples of roofing materials. Because they are inexpensive and simple to install, asphalt shingles dominate the roofing market, but metal roofs are becoming more and more well-liked because of their resilience to fire and long-term use. Residential and non-residential sectors make up the market segments. The need for single-family houses and the updating of aged infrastructure are the main drivers of the residential sector's dominance. Several major companies are present in the roofing business, such as Owens Corning, CertainTeed Corporation, GAF Materials Corporation, and IKO Industries. These businesses are growing their product lines and investing in new technologies in response to the growing need for high-performance roofing solutions.

| Report Coverage | Details |

| Market Size in 2025 | USD 126.59 Billion |

| Market Size by 2034 | USD 184.86 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.30% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Industry, Sales Channel, Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Commercial and industrial construction

The roofing market represents a sizeable portion of the larger building sector. It includes roofing system installation, maintenance, and repair for industrial and commercial structures, including factories and manufacturing plants, as well as commercial buildings like offices, retail stores, and warehouses. Regulatory restrictions, economic situations, environmental concerns, and technical improvements are some of the variables that impact this industry.

Increased commercial and industrial construction activity is a direct result of economic prosperity. Improvements in installation methods and roofing materials lead to increased longevity and efficiency. Demand for environmentally friendly roofing solutions, such as green roofs and solar-integrated systems, is driven by growing environmental consciousness.

Insurance and liability issues

Working on roofs exposes employees to heights, heavy equipment, and other risks, making it a dangerous profession. To cover accidents or injuries that happen on the job site, worker's compensation insurance is necessary. Contractors need to make sure they have sufficient insurance to safeguard their staff. To lawfully conduct business in their area, contractors need to possess the necessary licenses and permissions.

In addition to fines, noncompliance with licensing requirements may render insurance coverage void. To clearly define obligations and liabilities, roofing contractors and their clients must enter into written contracts. To reduce the possibility of legal problems, contracts should specify insurance requirements, warranty terms, and dispute resolution procedures.

Roofing consulting and inspection

Make sure you have a solid foundation in roofing, including an understanding of the materials, building methods, building rules, and safety requirements. This knowledge will be essential to provide your clients with insightful information. Give clients advice on a range of roofing-related topics, including material selection, design considerations, budgeting, and project management. Examine possible roofing project risks, including those linked to structural integrity, weather-related difficulties, and safety threats.

Reach out to roofing contractors who could need your help with complicated projects or independent quality-control inspections. Invest in equipment and technology to perform comprehensive roof inspections, such as thermal imaging cameras to find leaks, drones to conduct aerial assessments, and software to provide comprehensive reports.

The bitunumous led the roofing market in 2024. For a long time, bituminous roofing materials—like asphalt shingles—have been a mainstay in the roofing industry. Their price, ease of installation, and durability have made them popular. Thoughts of sustainability, energy efficiency, and aesthetics have led to a rise in interest in alternative roofing materials in recent years. In addition, new developments in roofing materials that are compatible with these systems have been facilitated by the rise of smart home technologies. For instance, sensors that track temperature, moisture, and other variables are now included in some roofing materials, which can assist homeowners in identifying and resolving concerns before they worsen.

The tiles segment is expected to gain a significant share of the roofing market during the forecast period. Clay tiles, well-known for their enduring beauty and toughness, provide superior defense against insects, rot, and fire damage. Their diverse shapes, including flat, ribbed, and interlocking ones, provide designers with a multitude of design options. While providing comparable durability to clay tiles, concrete tiles are more affordable. They come in flat, low, and high-profile forms, as well as a variety of colors and profiles. Slate tiles are highly valued due to their inherent beauty, durability, and ability to withstand environmental and fire hazards. Slate tiles are more costly than clay or concrete, but with the right care, they can last for generations. To replicate the look of natural materials like slate or wood shakes, composite roofing tiles blend several materials like plastic, rubber, and wood fibers.

The residential segment held the largest share of the roofing market in 2024. The market for residential roofing includes all goods and services associated with roofing for residential buildings. This industry offers a wide range of products, including wood shakes, metal roofing, tiles, and asphalt shingles. It also includes services for replacement, upkeep, repair, and installation. The number of buildings and remodeling that occur in the housing sector is directly correlated with the demand for residential roofing. This demand is influenced by housing preferences, population growth, and economic reasons. As homeowners look for more long-lasting and sustainable solutions, innovations in roofing materials and technology, like solar roofing tiles and energy-efficient materials, can propel market growth.

The slope roof segment is expected to grow rapidly in the roofing market in the upcoming years. The industry that specializes in providing roofing solutions for commercial buildings, including offices, retail establishments, warehouses, and industrial facilities, is known as the commercial segment of the roofing market. Compared to residential roofing, this segment frequently needs roofing systems and materials that can handle stronger loads, greater foot traffic, and larger expanses. Because of their enormous size and complexity, commercial roofs require careful planning and competent installation. In order to comply with building norms and regulations and to guarantee the integrity and longevity of the roof, proper installation is essential. The commercial roofing industry is seeing a rise in demand for eco-friendly roofing solutions, including cool roofs, green roofs, and solar roofing systems, as sustainability and energy efficiency become more and more important.

The flat roof segment led the roofing market in 2024. Common roofing materials include polyvinyl chloride (PVC), TPO (thermoplastic olefin), and EPDM (ethylene propylene diene terpolymer). These membranes are lightweight, easy to install, and provide good waterproofing. This type of membrane is made up of multiple layers of bitumen and reinforcing fabrics. It is durable and provides good waterproofing, but it can be heavy and requires professional installation. Green roofs, which are more and more well-liked for their environmental advantages, are made up of a layer of vegetation, a drainage system, and a waterproofing membrane. They enhance air quality, act as insulation, and lessen stormwater runoff. With these technologies, liquid coatings like polyurethane, silicone, or acrylic are applied straight to the roof's surface. They provide seamless waterproofing and work especially well on roofs with asymmetrical shapes. Although less typical on flat roofs, some homeowners choose to use shingles or tiles composed of synthetic polymers, clay, or concrete. These materials have good durability and a traditional appearance.

The slope roof expected to is expected to register significant growth in the roofing market during the forecast period. A common reason for choosing a sloped roof is its classic, ageless look. They can bring charm and character to a building's overall appearance. Water can quickly flow off of a sloped roof, which lowers the possibility of water gathering and possible leaks. This is especially crucial in regions that receive a lot of rain or snow. A variety of materials, such as metal, clay tiles, wood shakes, slate, and asphalt shingles, can be used to build a sloped roof. Because of its adaptability, homeowners can select a roofing material that fits both their style and budget. Ventilation systems, which help control the attic space's temperature and moisture content and help stop the spread of mold and mildew, are frequently installed on sloped roofs.

Asia Pacific held the largest share of the roofing market in 2024. Particularly in nations like China and India, the region's growing urban population and rising disposable incomes are driving up demand for residential and commercial real estate. The roofing market is being further propelled by growth in commercial building and industrial operations. Significant investments in industrial infrastructure are being made in China and India, which is increasing demand for residential and non-residential roofing solutions. Eco-friendly and energy-efficient roofing systems are examples of innovative roofing materials and technologies that are gaining popularity. Notable trends include the incorporation of solar tiles and cutting-edge metal roofing choices, which provide sustainability and longevity.

North America is expected to witness the fastest growth in the roofing market during the forecast period. The number of new residential and commercial construction projects has increased the demand for roofing materials. Low mortgage rates and more real estate investments are driving greater activity, particularly in the residential sector. The market is expanding due to innovations in roofing materials, such as the introduction of long-lasting and energy-efficient products. For instance, solar-integrated roofing systems and green roofs are growing in popularity because they provide possible economic savings in addition to environmental advantages. Extreme weather events are occurring more frequently and with greater intensity, which has raised demand for high-performance roofing materials resistant to adverse weather. As a result, stronger and more weather-resistant roofing has been developed.

By Roofing Material

By Roofing Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024