December 2024

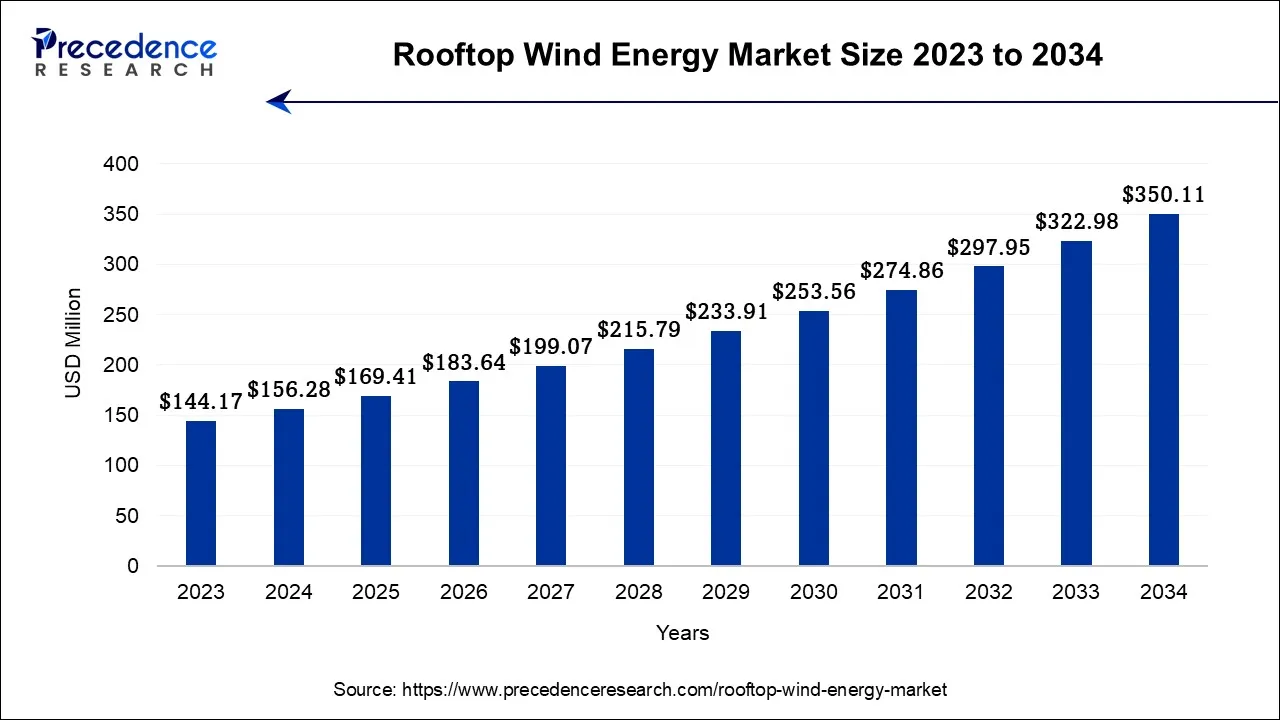

The global rooftop wind energy market size is calculated at USD 156.28 million in 2024, grew to USD 169.41 million in 2025, and is predicted to hit around USD 350.11 million by 2034, poised to grow at a CAGR of 8.4% between 2024 and 2034. The North America rooftop wind energy market size accounted for USD 70.33 million in 2024 and is anticipated to grow at the fastest CAGR of 8.51% during the forecast year.

The global rooftop wind energy market size is expected to be valued at USD 156.28 million in 2024 and is anticipated to reach around USD 350.11 million by 2034, expanding at a CAGR of 8.4% over the forecast period from 2024 to 2034.

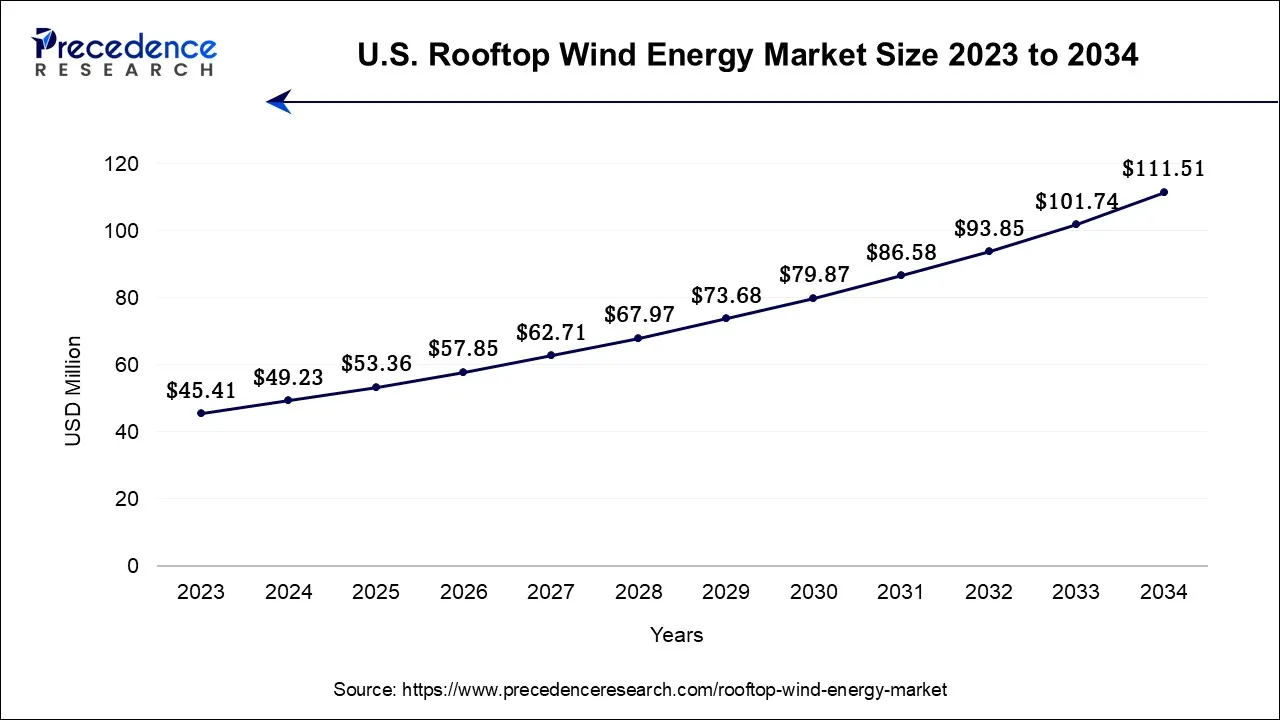

The U.S. rooftop wind energy market size is accounted for USD 49.23 million in 2024 and is projected to be worth around USD 111.51 million by 2034, poised to grow at a CAGR of 8.52% from 2024 to 2034.

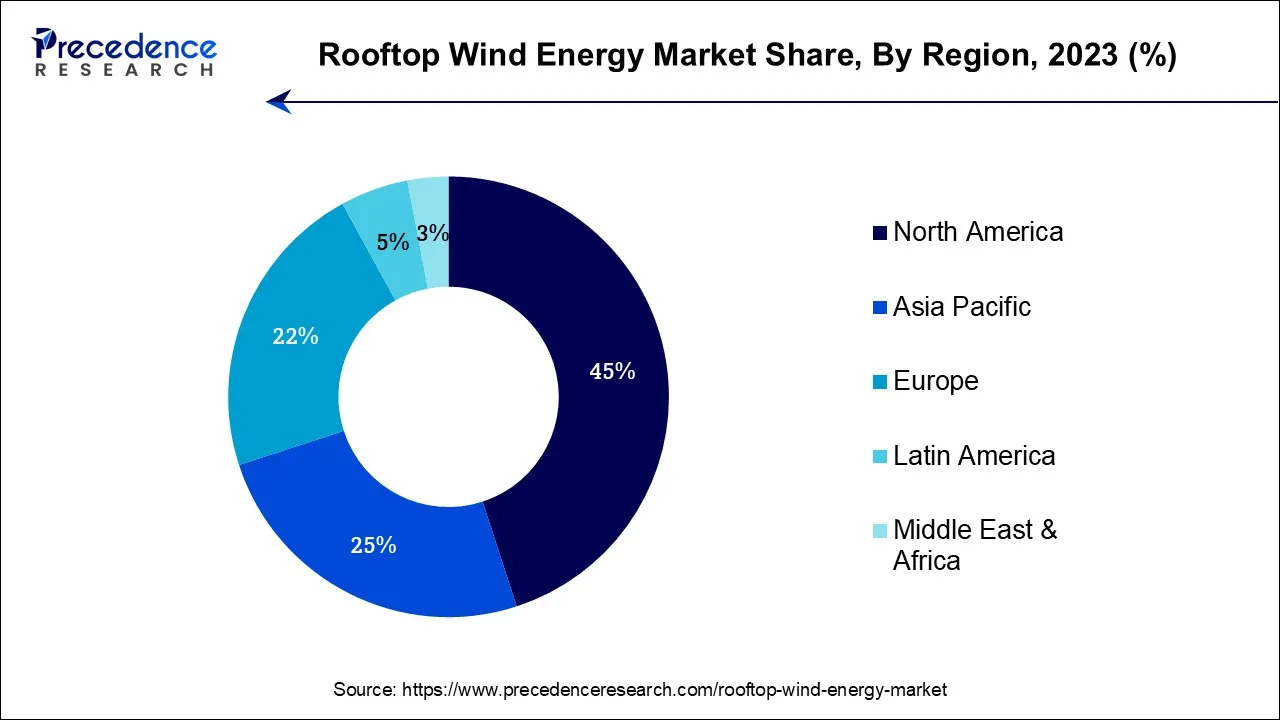

North America has held the largest revenue share 45% in 2023. North America commands a substantial share in the rooftop wind energy market due to a combination of factors. The region has seen robust government support through incentives and policies promoting renewable energy adoption. High energy demand, particularly in urban areas, has accelerated the adoption of distributed energy solutions like rooftop wind systems. Technological advancements, a strong renewable energy infrastructure, and a growing commitment to sustainability have further boosted market growth. Moreover, the region's well-developed construction sector and favorable regulatory environment have facilitated the installation of rooftop wind turbines, making North America a major player in the market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific holds a substantial share in the rooftop wind energy market due to several key factors. The region's rapid industrialization and urbanization have spurred energy demand, prompting a focus on diverse energy sources, including rooftop wind. Government initiatives in countries like China, India, and Japan have incentivized renewable energy adoption, fostering market growth. The region's favorable wind conditions, particularly in coastal areas, make rooftop wind energy a viable choice. Additionally, the growing awareness of environmental sustainability and the need to reduce greenhouse gas emissions further drive the adoption of rooftop wind solutions, solidifying Asia-Pacific's significant market presence.

The rooftop wind energy market represents a burgeoning market in sustainable power generation. It encompasses the installation of compact wind turbines on the rooftops of diverse structures, including homes, businesses, and industrial facilities, to produce electricity. This approach capitalizes on the proximity of energy production to consumption points, diminishing energy losses during transmission and elevating overall energy efficiency.

This industry's surge is propelled by the mounting global appetite for eco-friendly energy sources, cost-saving potential, and environmental consciousness. Continuous innovations in wind turbine technology have enhanced their effectiveness and accessibility, contributing significantly to the sector's expansion. Additionally, governmental incentives and policies endorsing the adoption of renewable energy sources further propel its growth.

The realm of rooftop wind energy represents a dynamic segment within the renewable energy sphere, where compact wind turbines are perched atop structures to harvest electricity. This decentralized approach offers compelling benefits, including diminished energy loss during transmission and heightened overall energy efficiency.

The market is thriving in response to surging demand for eco-friendly energy solutions, underpinned by environmental concerns and the imperative for sustainable alternatives. Technological innovations have elevated the efficacy and accessibility of rooftop wind turbines, further accelerating their adoption. Concurrently, governmental incentives and policies championing the cause of renewable energy are playing a pivotal role in propelling the market's expansion.

A multitude of notable industry dynamics and growth catalysts are shaping the rooftop wind energy landscape. Firstly, strides in wind turbine technology have notably enhanced their performance and reliability, rendering them an attractive choice for property owners and enterprises alike. Furthermore, the burgeoning demand for environmentally responsible energy sources is propelling market advancement, as consumers and organizations actively seek to curtail their carbon footprint. Government-driven initiatives, including tax incentives and feed-in tariffs, are instrumental in incentivizing the embrace of rooftop wind energy. Moreover, the quest for energy resilience and self-sufficiency is motivating enterprises and homeowners to invest in rooftop wind solutions.

While the rooftop wind energy sector enjoys upward momentum, it also grapples with certain challenges. Foremost among these is the intermittent nature of wind, which can precipitate fluctuations in energy generation. Moreover, the initial capital outlay for installing rooftop wind turbines can be substantial, dissuading potential investors. However, avenues for addressing these challenges do exist. Energy storage solutions, exemplified by batteries, can mitigate the issue of intermittency, rendering rooftop wind energy more dependable. Furthermore, financial inducements and inventive financing models can ameliorate the initial investment burden, opening doors to broader adoption.

In summation, the rooftop wind energy domain is a burgeoning sector galvanized by the burgeoning demand for clean energy, technological breakthroughs, and supportive governmental policies. Notwithstanding challenges such as intermittency and upfront costs, innovative remedies and financial incentives are charting the course for further expansion. As the significance of sustainability continues to burgeon, rooftop wind energy emerges as a promising choice for individuals and enterprises alike, seeking to harness the force of the wind while curbing their environmental footprint.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 8.4% |

| Market Size in 2024 | USD 156.28 Million |

| Market Size by 2034 | USD 350.11 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Technology, By Capacity, By Installation, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Environmental awareness and sustainability

The burgeoning environmental consciousness and unwavering commitment to sustainability are pivotal drivers propelling the rooftop wind energy market forward. In a world increasingly alarmed by pressing environmental issues like climate change, there is an amplified emphasis on embracing clean and sustainable energy sources. Rooftop wind energy, characterized by its renewable and eco-friendly attributes, perfectly aligns with these imperatives. This heightened environmental awareness has ignited a surge in demand for rooftop wind systems, representing a tangible means for individuals and enterprises to actively engage in the transition towards cleaner energy.

Moreover, governments and regulatory bodies worldwide are instituting a spectrum of policies and incentives that actively promote the integration of renewable energy technologies, including rooftop wind. These proactive measures not only foster the installation of wind turbines but also imbue them with financial attractiveness. In essence, the ever-growing environmental consciousness fuels the rooftop wind energy market's growth, forging a path forward towards sustainability through a swelling community of environmentally conscious consumers and bolstered by supportive governmental initiatives.

Intermittent wind resources

Intermittent wind resources pose a significant restraint on the growth of the rooftop wind energy market. The inconsistency in wind speed and direction can result in erratic energy production from rooftop wind turbines. This intermittency makes it challenging to rely solely on rooftop wind energy as a consistent and dependable power source. Energy production that fluctuates with the wind can lead to unpredictable energy supply, potentially causing disruptions in electricity generation and usage.

In commercial and industrial settings, this unreliability can pose operational challenges and increase the need for supplementary power sources or energy storage solutions, adding to the overall cost of rooftop wind energy systems. Furthermore, in residential applications, the intermittent nature of rooftop wind energy can lead to uncertainty in meeting daily energy needs, undermining the confidence of homeowners in the technology.

To address this constraint, energy storage systems, like batteries, are often integrated, but this adds additional cost and complexity to rooftop wind installations. In regions with inconsistent wind patterns, the reliance on rooftop wind energy becomes less practical, limiting its widespread adoption and hindering market growth.

Healthcare transformation

Hybrid energy systems, which amalgamate rooftop wind energy with other renewable sources such as solar panels or energy storage solutions, are fostering substantial opportunities within the market. These integrated setups offer heightened dependability, adaptability, and energy optimization. By complementing the intermittent nature of wind power with more consistent sources like solar energy, hybrid systems provide a more stable and reliable electricity supply, rendering rooftop wind energy a more enticing choice for consumers and businesses. Furthermore, the synergy achieved by combining diverse renewable energy technologies within a hybrid system can result in heightened overall efficiency, maximizing energy output while concurrently reducing long-term costs.

The incorporation of energy storage further elevates the utility of these systems, permitting the storage of surplus energy for utilization during periods of minimal wind or solar generation. In response to the escalating demand for dependable and sustainable energy solutions, the evolution and acceptance of hybrid energy systems present an auspicious pathway for the rooftop wind energy market, broadening its reach and attractiveness to a wider array of users.

According to the technology, the horizontal axis wind turbine (HAWT) sector has held 41% revenue share in 2023. The horizontal axis wind turbine (HAWT) segment commands a substantial market share for several compelling reasons. HAWTs have an established track record of reliability and successful operation, instilling confidence among investors and users. They boast higher efficiency levels and scalability, rendering them versatile for various applications, spanning residential to utility-scale projects. Their adaptability to fluctuating wind conditions ensures a consistent energy output. Moreover, ongoing innovations in HAWT technology, encompassing larger rotor diameters and enhanced materials, have reinforced their market dominance, drawing the interest of investors and energy industry participants alike.

The vertical axis wind turbines (VAWTs) sector is anticipated to expand at a significant CAGR of 9.1% during the projected period. Vertical axis wind turbines (VAWTs) hold significant growth in the market due to several advantages. VAWTs are known for their versatility, as they can capture wind from any direction, making them ideal for urban and constrained spaces where wind direction is unpredictable. They are also quieter and less intrusive, making them more acceptable in residential areas. Additionally, VAWTs have a lower cut-in wind speed, meaning they can generate power at lower wind speeds compared to horizontal axis turbines. These characteristics contribute to their popularity and market growth in specific applications, particularly in urban and residential settings.

Based on the capacity, micro-wind turbine is anticipated to hold the largest market share of 39% in 2023. The dominant market share of the micro-wind turbine segment can be attributed to its adaptability and applicability across diverse scenarios. These compact turbines excel in residential and urban settings where spatial constraints exist. Their accessibility makes them an appealing option for those seeking wind energy solutions, allowing localized energy production and enhancing energy security. Furthermore, continuous innovation in micro-wind turbine technology has elevated their performance and cost-effectiveness, cementing their prominence in the market landscape.

On the other hand, the small -wind turbines sector is projected to grow at the fastest rate over the projected period. The dominance growth of the small-wind turbines segment in the market can be attributed to its adaptability and applicability across diverse scenarios. These compact turbines excel in rooftop installations within urban and residential environments where spatial constraints prevail. Their cost-effectiveness and seamless integration options extend their accessibility to a broader spectrum of consumers and enterprises.

Furthermore, ongoing technological enhancements have elevated the effectiveness and dependability of small-wind turbines, strengthening their market desirability. In a climate where sustainability and energy self-sufficiency are paramount, small-wind turbines offer a pragmatic and scalable solution for decentralized electricity generation, underpinning their commanding growth in the market.

The residential segment held the largest revenue share of 30.9% in 2023. The residential segment holds significant growth in the rooftop wind energy market primarily due to its suitability for urban and suburban settings. Rooftop wind turbines can be installed on existing homes with limited space requirements, making them accessible to a broad homeowner base. The rising interest in renewable energy among environmentally conscious homeowners, coupled with government incentives and net metering programs, has further accelerated adoption. Additionally, the desire for energy independence and cost savings drives residential installations, contributing to the segment's major market growth.

The industrial applications is anticipated to grow at a significantly faster rate, registering a CAGR of 10.9% over the predicted period. The industrial applications segment commands significant growth in the rooftop wind energy market due to several factors. Industrial facilities often have large, flat rooftops that provide ample space for installing wind turbines. These installations offer cost-effective on-site power generation, reducing energy expenses and enhancing sustainability efforts.

Moreover, industries prioritize energy resilience, making rooftop wind energy an attractive choice for reliable electricity production. Government incentives and corporate sustainability goals further drive adoption in this segment. Overall, the combination of available space, cost savings, energy reliability, and environmental objectives positions industrial applications as a major contributor to the market growth.

The on-grid systems sector has generated a revenue share of 55.1 % in 2023. The on-grid systems segment holds a significant market share due to its alignment with existing electrical grids and widespread adoption. These systems seamlessly feed excess energy back into the grid, allowing users to earn incentives or credits. On-grid systems are favored for their reliability and cost-effectiveness, making them the go-to choice for urban areas with established grid infrastructure.

Additionally, government incentives and policies often incentivize on-grid installations, further driving their prominence. The convenience of staying connected to the grid while contributing to clean energy generation makes on-grid systems a dominant force in the market.

The off-grid systems sector is anticipated to grow at a significantly faster rate, registering a CAGR of 9.8% over the predicted period. The off-grid systems segment holds significant growth in the rooftop wind energy market due to its ability to provide energy autonomy in remote and isolated areas. Off-grid systems are not reliant on centralized power grids, making them ideal for regions with limited access to electricity infrastructure. They offer energy solutions for off-grid homes, rural communities, and industrial sites, addressing energy access challenges. Additionally, these systems contribute to environmental sustainability by reducing reliance on fossil fuels in areas without reliable grid connections. This unique capacity to address energy gaps and promote sustainability has propelled the off-grid segment's prominence growth in the market.

Segments Covered in the Report

By Technology

By Capacity

By Installation

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

March 2025

August 2024