August 2024

The global safety valve market size is calculated at USD 8.44 billion in 2025 and is forecasted to reach around USD 16.94 billion by 2034, accelerating at a CAGR of 8.05% from 2025 to 2034. The North America safety valve market size surpassed USD 3.12 billion in 2024 and is expanding at a CAGR of 8.22% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global safety valve market size was accounted for USD 7.81 billion in 2024 and is anticipated to reach around USD 16.94 billion by 2034, growing at a CAGR of 8.05% from 2025 to 2034. The increasing demand among consumers to protect their property and the environment from the consequences of overpressure is raising the adoption of the safety valve market.

The integration of artificial intelligence into safety valves is transforming the industrial and manufacturing setting, bringing precision, efficiency, and reliability. AI-powered safety valves help in predictive maintenance when a valve fails to perform or requires maintenance. The predictive model helps schedule maintenance, which ultimately reduces downtime and prevents costly damages. The automated control systems brought by AI help regulate valve operation by offering real-time data and pre-defined parameters.

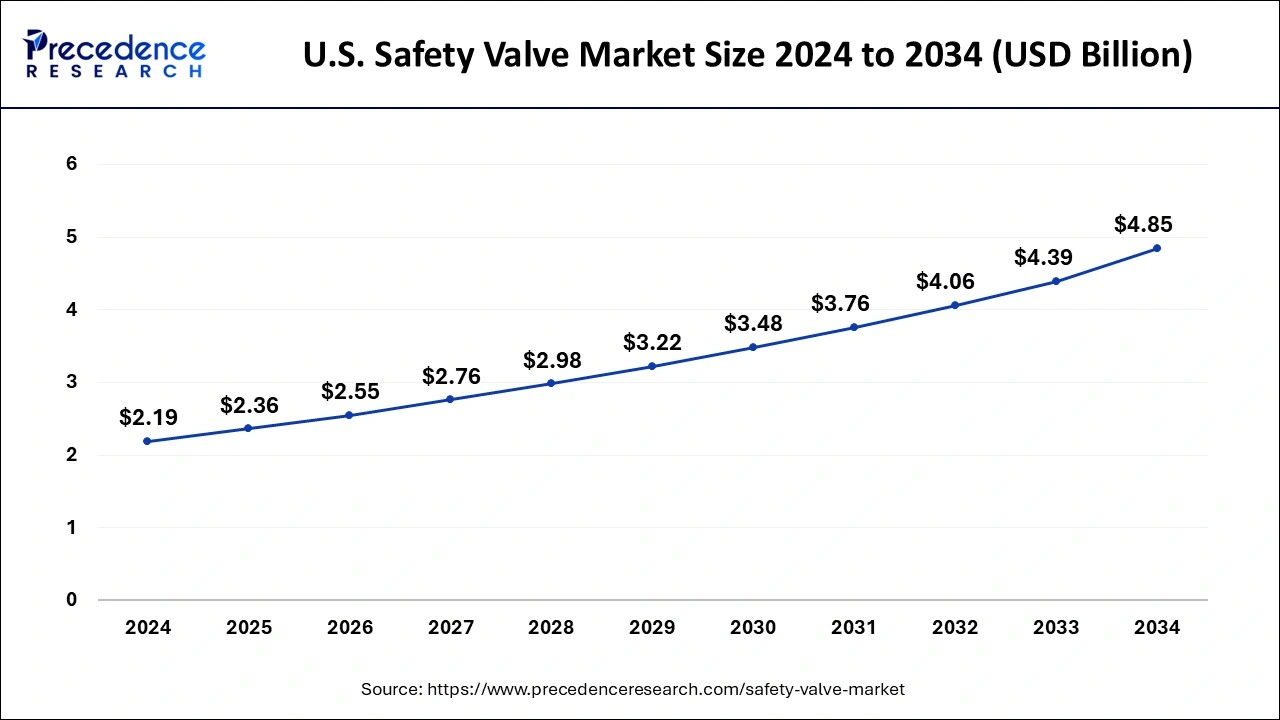

The U.S. safety valve market size was evaluated at USD 2.19 billion in 2024 and is predicted to be worth around USD 4.85 billion by 2034, rising at a CAGR of 8.27% from 2025 to 2034.

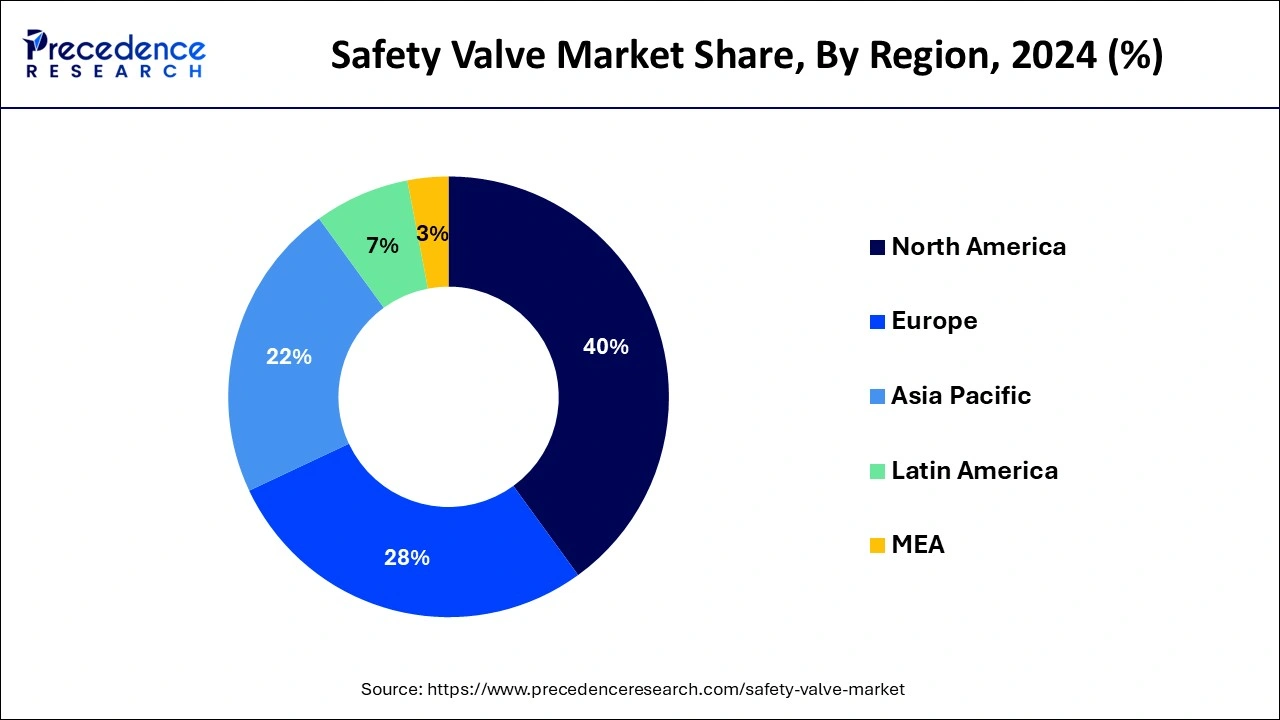

North America dominated the safety valve market with the largest market share of 40% in 2024. The growth of safety valve market in North America is driven by its diverse industrial base, encompassing sectors like oil and gas, chemicals, and manufacturing. Strict safety standards and regulations contribute to market growth. Furthermore, a focus on digitalization and smart technologies has led to an increasing adoption of intelligent safety valves. The region continues to witness innovations aimed at enhancing safety and efficiency in industrial operations.

Asia Pacific is observed to be the fastest growing region for the market during the forecast period due to rapid industrialization and a burgeoning manufacturing sector. Stringent safety regulations and an increased focus on environmental protection have driven demand. Additionally, technological advancements and a rising awareness of safety standards are key trends in this region. Countries like China and India are significant players, with their expanding industries contributing to market expansion.

Europe is another notably growing region for the safety valve market. Europe's safety valve market is characterized by a mature industrial landscape, where safety standards and regulations are rigorously enforced. The region's market is marked by a shift toward smart safety valve solutions that offer real-time monitoring and predictive maintenance. Additionally, increasing investments in research and development to enhance valve efficiency and reduce environmental impact are prevalent trends. Europe remains a hub for advanced safety valve technologies and innovation.

The safety valve market refers to the industry involved in the manufacturing, distribution, and maintenance of safety valves. Safety valves are crucial mechanical devices used to protect industrial equipment and processes from excessive pressure, which can lead to catastrophic failures. These valves automatically release excess pressure to prevent accidents and damage to assets.

The safety valve market serves diverse industries, including oil and gas, chemical, pharmaceutical, and manufacturing, all of which prioritize safety. This market offers a variety of safety valve types, such as relief valves, pressure relief valves, and pilot-operated safety valves, among others.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.44 Billion |

| Market Size by 2034 | USD 16.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.05% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Material, By End Use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Industrial growth and rising focus on preventive maintenance

The sustained expansion of industries plays a pivotal role in surging the market demand for safety valves. As sectors like oil and gas, chemicals, pharmaceuticals, and manufacturing continue to grow and evolve, the need for safeguarding industrial processes and equipment becomes increasingly paramount. With industrial operations becoming more complex and larger in scale, the potential risks associated with overpressure events are amplified.

Safety valves offer a reliable solution to mitigate such risks by automatically releasing excess pressure, thus preventing catastrophic failures and ensuring uninterrupted production. This growth in industrial activity not only spurs the demand for safety valves but also fuels innovation, leading to the development of more advanced and efficient safety valve technologies to meet the evolving needs of these expanding industries.

The shift towards preventive maintenance strategies is another key factor driving the demand for safety valves. Industries are increasingly recognizing the benefits of proactive maintenance in minimizing downtime and preventing costly equipment failures. Safety valves are integral to these strategies as they provide an essential layer of protection for critical processes and assets. Regular inspection, testing, and maintenance of safety valves ensure they remain in optimal working condition.

As industries prioritize preventive maintenance, the demand for reliable safety valves with enhanced performance and predictive maintenance capabilities rises, further boosting the safety valve market. In essence, the focus on maintaining safety and operational integrity through preventive measures has become a significant catalyst for safety valve adoption and market growth.

Maintenance complexity and stringent regulations

Maintenance complexity and stringent regulations pose significant challenges that can restrain the market demand for safety valves. Maintenance complexity is a critical issue. Safety valves require regular inspection and maintenance to ensure they function correctly. This complexity can lead to increased downtime for industrial processes and higher operational costs, which can discourage businesses from investing in safety valves. In some cases, organizations may opt for less complicated pressure relief solutions to mitigate these challenges, potentially impacting the demand for safety valves.

Moreover, stringent regulations, while also driving demand, can create barriers for some businesses. Compliance with these regulations is often costly and requires ongoing monitoring and reporting. Failure to meet these standards can result in penalties and operational disruptions. The intricacies of adhering to various safety and environmental regulations can be a deterrent for smaller businesses, affecting their willingness to invest in safety valve solutions, despite their critical importance. Therefore, finding a balance between compliance and cost-effectiveness is essential for manufacturers and users of safety valves to ensure market growth.

Technological advancements, customization and specialization

Technological advancements, customization, and specialization play pivotal roles in surging market demand for safety valves. Technological advancements have revolutionized safety valve capabilities. Advanced materials and innovative designs have improved the performance and reliability of safety valves, making them more efficient and effective in managing pressure-related risks. These innovations are highly sought after by industries where safety is paramount, such as the oil and gas sector and chemical manufacturing, as they ensure enhanced protection of equipment and processes.

Customization is another significant factor driving market demand. Industries have unique requirements and operating conditions, and safety valves can now be tailor-made to suit these specific needs. Customized solutions allow for a precise fit and optimized performance, reducing the risk of overpressure incidents. This trend towards tailored safety solutions is gaining momentum as industries seek maximum safety and efficiency. Moreover, specialization is increasingly shaping the safety valve market.

Companies are focusing on producing safety valves designed for specific applications or industries. This specialization ensures that safety valves are fine-tuned for the exact requirements of a particular sector, thus boosting their demand in specialized areas, including pharmaceuticals, where precise control and compliance with industry standards are critical. These factors collectively contribute to the growth and diversification of the safety valve market.

The pring-loaded pressure-relief valves segment has held the biggest market share in 2024. Spring-loaded pressure-relief valves are safety valves that use a spring to maintain a constant force on the valve disc, which keeps the valve closed until system pressure reaches a predetermined level. These valves are known for their simplicity and reliability. In the safety valve market, a notable trend is the integration of smart technology into spring-loaded valves, allowing for remote monitoring and real-time data collection, enhancing maintenance and operational efficiency.

The pilot-operated pressure-relief valves segment is anticipated to grow at a remarkable CAGR during the forecast period. Pilot-operated pressure-relief valves, on the other hand, use a pilot valve to control the opening and closing of the main valve. They offer precise pressure control and are ideal for applications with fluctuating pressures. In the safety valve market, a trend is the development of pilot-operated valves that can handle higher pressures and flow rates, meeting the demands of industries with evolving needs, such as oil and gas, where pressure control is critical for safe operations.

The cryogenic segment contributed the highest market share in 2024. Cryogenic safety valves are specialized components crafted to function effectively in extreme low-temperature settings, typically below -150°C (-238°F). They play a pivotal role in upholding the integrity and safety of cryogenic storage and transportation systems, notably within industries like liquefied natural gas (LNG) and medical applications. These valves are instrumental in preventing excessive pressure build-up, ensuring the secure management of cryogenic fluids and gases.

Within the safety valve market, the demand for cryogenic safety valves is steadily increasing, primarily due to the expanding adoption of cryogenic technology across diverse sectors, including healthcare, energy, and aerospace. As cryogenic applications continue to gain prominence, safety valve manufacturers are focusing on developing advanced materials, such as stainless steels and specialized alloys.

This material innovation is essential for enabling these safety valves to withstand the extreme cold and effectively address the unique challenges posed by cryogenic environments. This trend closely aligns with the growing necessity for precise and dependable pressure relief solutions in the expanding cryogenic sector.

The stainless-steel segment is expected to expand at the fastest CAGR over the projected period. Stainless steel, widely employed in safety valves, is a corrosion-resistant alloy. It mainly comprises iron, chromium, and nickel, rendering it exceptionally durable and impervious to corrosion. This makes it an excellent choice for crafting safety valve components. Stainless steel safety valves are favored for their capacity to endure challenging industrial conditions while retaining their structural integrity over extended periods. This resilience ensures their reliability when it comes to vital pressure relief operations.

In the safety valve market, a notable trend is the increasing preference for stainless steel due to its exceptional corrosion resistance. Industries, especially those handling corrosive fluids or operating in harsh conditions, are opting for stainless steel safety valves to prolong service life and reduce maintenance costs. This trend reflects a growing emphasis on longevity and reliability in safety valve solutions as industries prioritize the safety and efficiency of their operations.

The oil and gas segment generated the biggest market share in 2024. Safety valves in this industry are crucial for safeguarding equipment and facilities from excessive pressure, and preventing potential explosions or leaks. One notable trend is the increasing adoption of advanced safety valve technologies, such as smart valves with real-time monitoring capabilities, to improve safety and operational efficiency. Moreover, stringent regulations and a growing emphasis on environmental protection are driving the demand for safety valves in the oil and gas sector, ensuring its sustained relevance.

The energy power segment is expected to expand at the fastest CAGR over the projected period. In the context of the safety valve market, the energy power sector encompasses the production and distribution of energy, including electricity generation and oil and gas operations. Safety valves are essential components in this industry to prevent overpressure situations that could lead to catastrophic accidents. They are critical for safeguarding power plants, refineries, and other energy-related facilities, ensuring uninterrupted and secure operations.

Recent trends in the energy power sector point toward increased adoption of smart and predictive maintenance solutions in safety valves. These advanced technologies offer real-time monitoring and data-driven insights, allowing for proactive maintenance and minimizing downtime. Additionally, there is a growing emphasis on environmental sustainability, pushing the development of safety valves that address emissions control and energy efficiency concerns, aligning with the industry's pursuit of greener energy solutions. These trends reflect the industry's commitment to enhancing safety and efficiency while reducing its environmental footprint.

By Type

By Material

By End Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024