March 2025

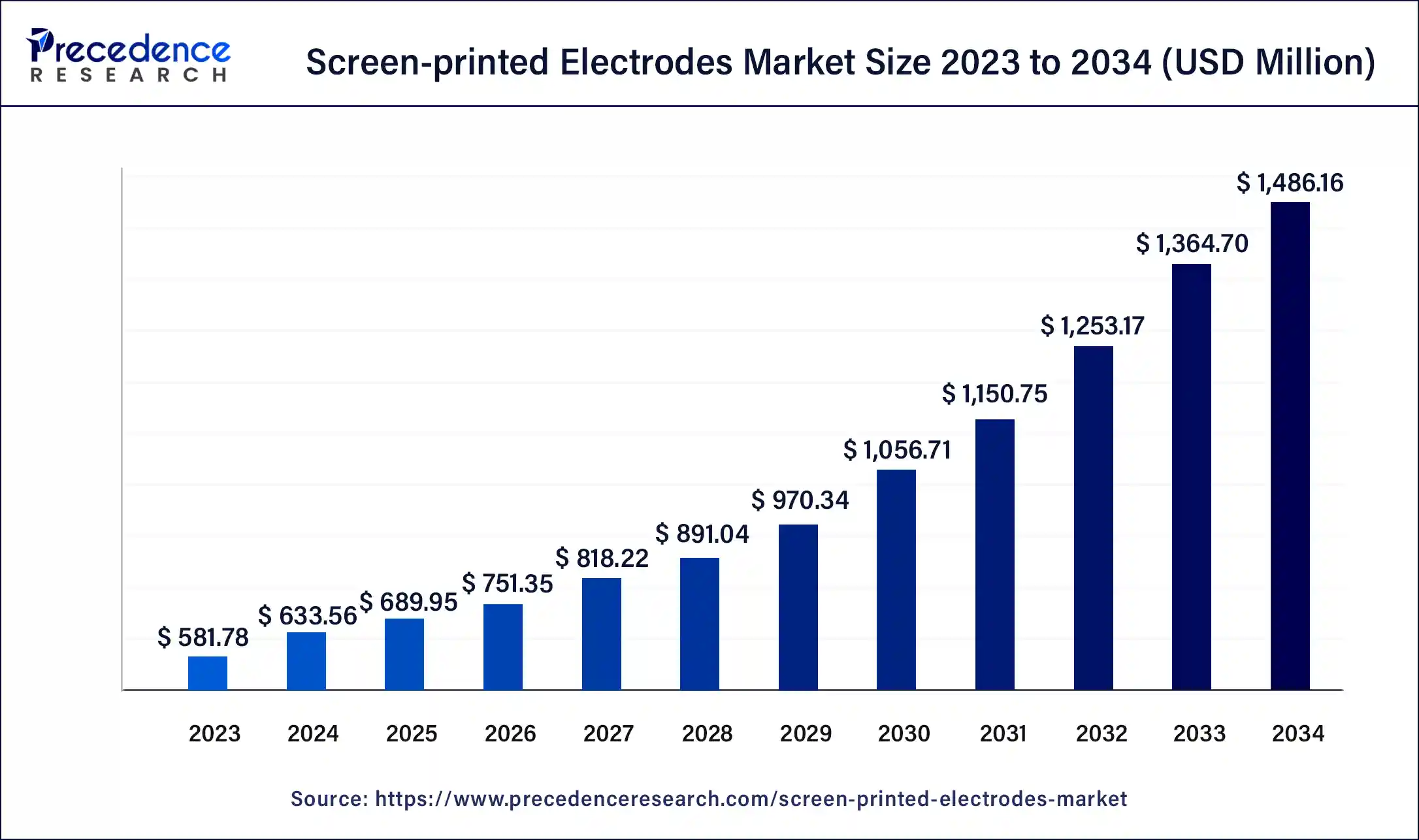

The global screen-printed electrodes market size was USD 581.78 million in 2023, estimated at USD 633.56 million in 2024 and is expected to be worth around USD 1,486.16 million by 2034, expanding at a 8.90% CAGR from 2024 to 2034.

The global screen-printed electrodes market size is estimated at USD 633.56 million in 2024 and is predictedc to be worth around USD 1,486.16 million by 2034, growing at a 8.90% CAGR from 2024 to 2034. The North America screen-printed electrodes market size reached USD 244.35 million in 2023

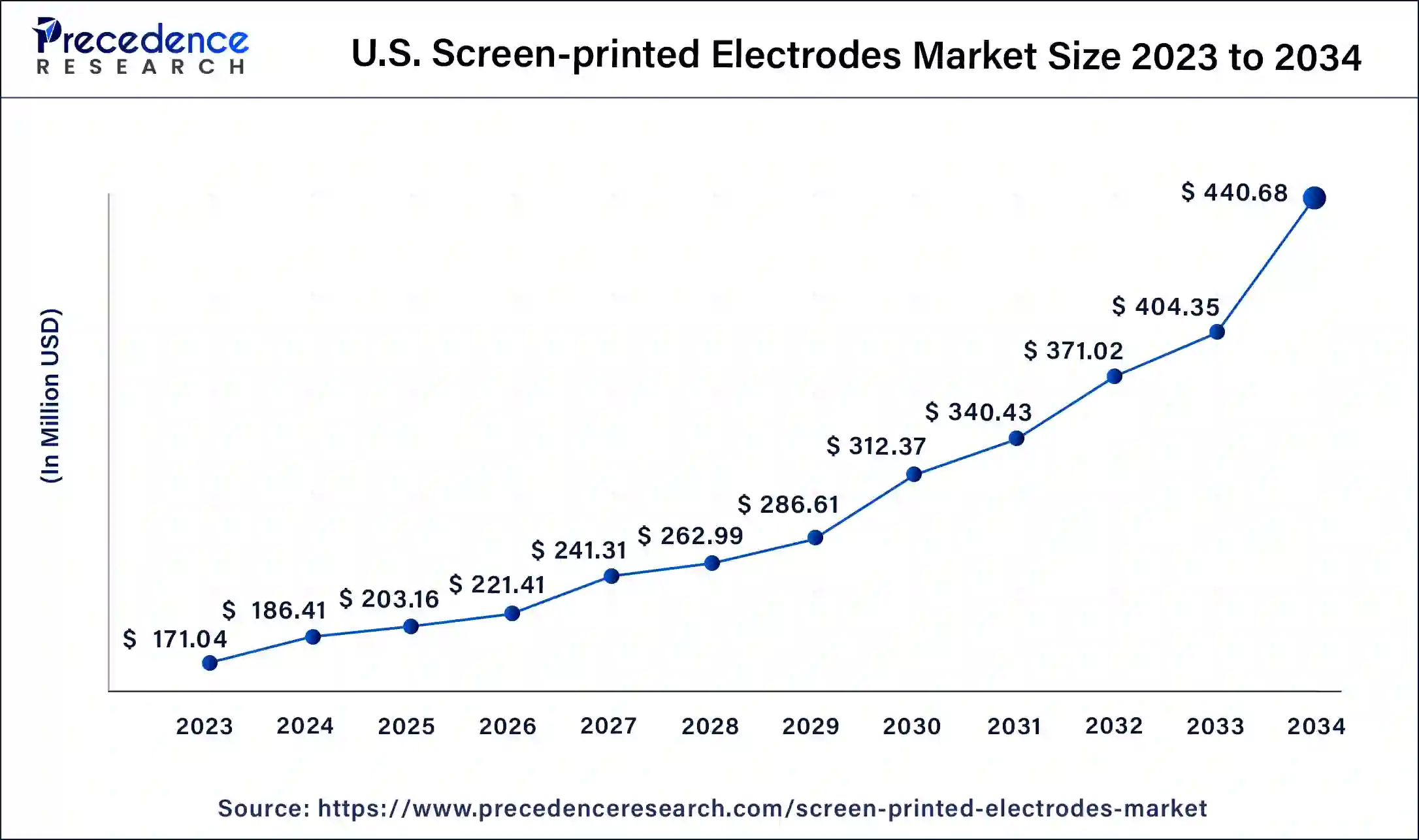

The U.S. screen-printed electrodes market size was valued at USD 171.04 million in 2023 and is anticipated to reach around USD 440.68 million by 2034, at a CAGR of 9% from 2023 to 2032.

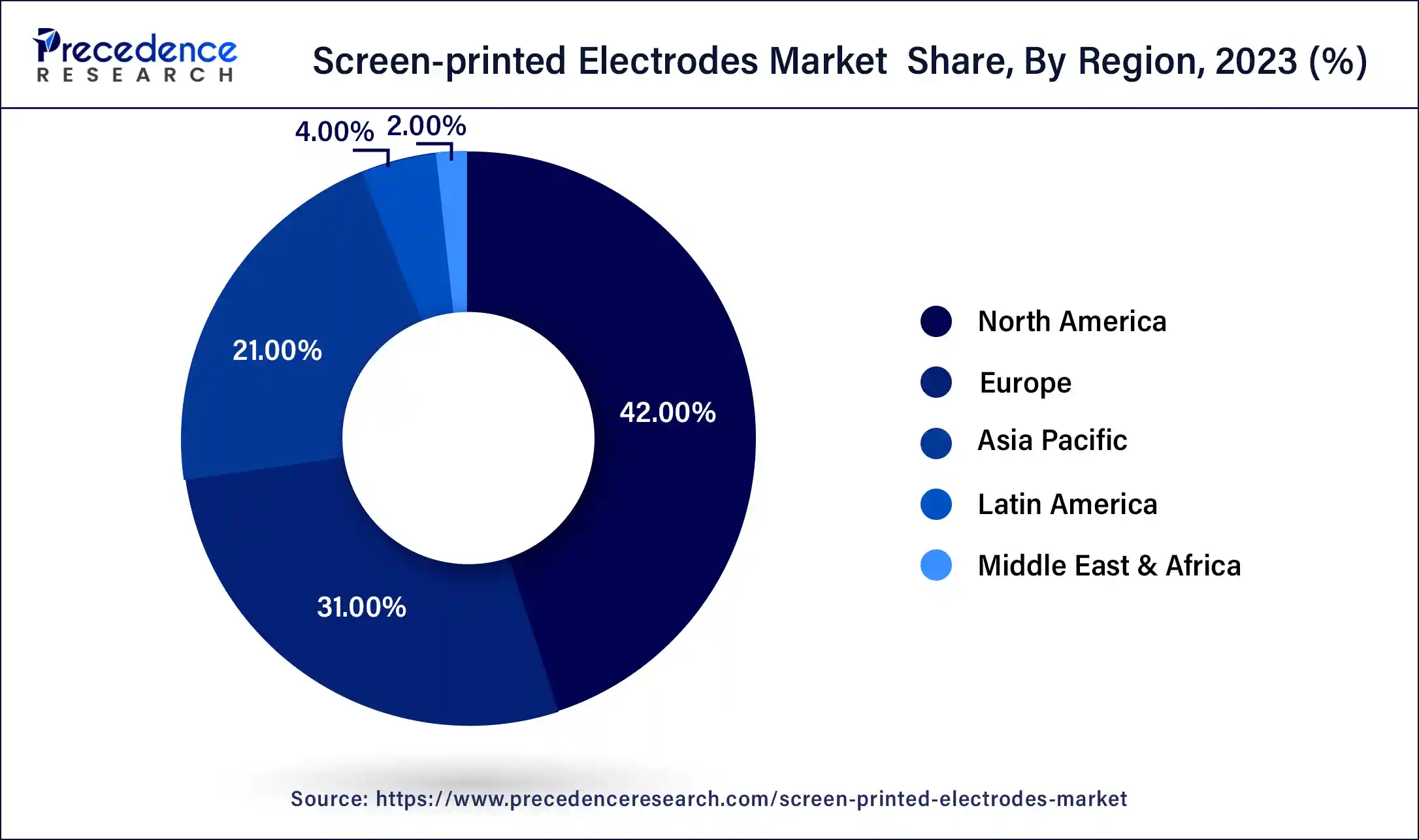

North America has held the largest revenue share of 42% in 2023. North America holds a major share in the screen-printed electrodes market due to robust research and development activities, particularly in the healthcare and environmental sectors. The region's advanced technological infrastructure and significant investments in innovative technologies contribute to the widespread adoption of screen-printed electrodes. Moreover, a well-established healthcare industry and the presence of key market players further fuel the growth. The increasing demand for portable diagnostic devices and biosensors, coupled with a supportive regulatory environment, solidify North America's position as a leader in the screen-printed electrodes market.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region dominates the screen-printed electrodes market due to factors such as increasing industrialization, a rising focus on healthcare infrastructure, and a growing demand for portable diagnostic devices. The region's burgeoning economies, including China and India, contribute to the market share with expanding applications in diverse sectors. Additionally, the presence of key manufacturing hubs, research initiatives, and a proactive approach toward adopting innovative technologies further solidify Asia-Pacific's position as a major player in the screen-printed electrodes market.

Screen-printed electrodes (SPEs) are a type of sensing platform widely used in electrochemical applications. These electrodes are created through a cost-effective and scalable screen-printing process, where conductive ink is deposited onto a substrate through a mesh screen. The resulting electrodes are characterized by their simplicity, versatility, and reproducibility. SPEs find applications in various fields, including biochemistry, environmental monitoring, and sensor development.

The manufacturing process allows for the customization of electrode designs, enabling the integration of different materials and configurations to meet specific application requirements. The simplicity of production makes SPEs an attractive choice for mass production and disposable sensor applications. Due to their miniaturized and portable nature, screen-printed electrodes have become integral components in point-of-care diagnostic devices and wearable sensors, facilitating rapid and on-site analysis. The versatility and accessibility of SPEs contribute to their growing popularity in research and industry, making them essential tools for electrochemical measurements in diverse fields.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,486.16 Million |

| Market Size in 2023 | USD 581.78 Million |

| Market Size in 2024 | USD 633.56 Million |

| Growth Rate from 2024 to 2034 | CAGR of 8.90% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for portable and point-of-care diagnostics

The rising demand for portable and point-of-care diagnostics is a key driver propelling the growth of the screen-printed electrodes (SPEs) market. As the healthcare industry undergoes a paradigm shift toward decentralized and patient-centric approaches, the need for compact, portable diagnostic devices is escalating. SPEs play a pivotal role in this trend due to their miniaturized form factor and suitability for on-the-go testing. Their lightweight nature and ease of integration make them essential components in biosensors and diagnostic platforms, enabling rapid and accurate analysis outside traditional laboratory settings.

Moreover, the increasing prevalence of diseases and the emphasis on early detection are fueling the adoption of portable diagnostic devices, where SPEs contribute to the development of efficient and sensitive sensors. This surge in demand aligns with the broader goal of providing accessible and timely healthcare solutions, driving the market for screen-printed electrodes across various medical applications.

Challenges in mass production uniformity

Challenges in achieving mass production uniformity pose a significant restraint on the screen-printed electrodes (SPEs) market growth. The intricacies of large-scale manufacturing introduce variability in the printing processes and materials used, impacting the consistency and reproducibility of SPEs. Maintaining uniformity across electrodes is crucial for ensuring reliable and predictable performance, especially in applications demanding precision.

The difficulty in achieving consistent quality across a high volume of produced electrodes can deter manufacturers and end-users, limiting the scalability of SPEs. Variations in thickness, composition, or other key parameters can lead to performance disparities, hindering the widespread adoption of SPEs in critical applications. Addressing these challenges requires continuous advancements in manufacturing technologies and quality control measures to enhance the reproducibility of SPEs and instill confidence in industries relying on consistent and uniform sensor performance.

Rapid expansion in healthcare diagnostics

The rapid expansion of healthcare diagnostics is creating substantial opportunities for the screen-printed electrodes (SPEs) market. With an increasing emphasis on point-of-care testing and portable diagnostic solutions, SPEs have become pivotal components in the development of advanced biosensors. The miniaturized and cost-effective nature of SPEs makes them well-suited for integration into wearable health technologies and compact diagnostic devices, aligning with the evolving trends in personalized and continuous healthcare monitoring. SPEs offer precise and efficient electrochemical sensing capabilities, enabling the detection of biomarkers and analytes critical for disease diagnosis.

As the demand for quick and on-the-spot diagnostic results continues to surge, the versatility of SPEs positions them as key contributors to the development of innovative healthcare solutions. Their role in biosensors and wearable devices presents a promising avenue for growth, allowing for real-time health monitoring and early detection of various medical conditions, ultimately driving the expansion of the SPEs market in the healthcare diagnostics sector.

In 2023, the carbon-based segment had the highest market share of 40% based on the type. The carbon-based segment in the screen-printed electrodes (SPEs) market includes electrodes predominantly composed of carbon materials such as graphite, carbon nanotubes, or graphene. These materials offer excellent electrical conductivity, chemical stability, and biocompatibility. In recent trends, there's a growing focus on enhancing the electrochemical performance of carbon-based SPEs for applications in biosensing, environmental monitoring, and energy storage. Innovations in carbon nanomaterials and advanced fabrication techniques contribute to improved sensitivity and selectivity, driving the adoption of carbon-based SPEs in diverse electrochemical applications.

The metal-based segment is anticipated to expand at a significant CAGR of 9.2% during the projected period. The metal-based segment in the screen-printed electrodes (SPEs) market refers to electrodes fabricated using various metals like gold, platinum, and silver. These metal-based SPEs exhibit excellent conductivity and stability, making them suitable for diverse electrochemical applications. A notable trend in this segment involves the increasing preference for gold-based electrodes due to their biocompatibility and corrosion resistance, particularly in biosensing applications. Additionally, ongoing research focuses on optimizing the design and composition of metal-based SPEs to enhance their sensitivity and selectivity, further driving advancements in electrochemical sensing technologies.

According to the application, the medical diagnosis segment has held a 35% revenue share in 2023. In the screen-printed electrodes (SPEs) market, the medical diagnosis segment involves the utilization of SPEs in biosensors and diagnostic devices for the accurate detection of biomarkers, pathogens, and other relevant analytes. The trend in this segment includes a growing focus on point-of-care testing and portable diagnostic solutions, leveraging the miniaturized and cost-effective nature of SPEs. As the demand for rapid and on-site medical diagnostics rises, the medical diagnosis segment is witnessing increased adoption of SPEs for their versatility and suitability in enabling quick and reliable electrochemical sensing in various healthcare applications.

The food analysis segment is anticipated to expand fastest over the projected period. In the screen-printed electrodes (SPEs) market, the food analysis segment involves the use of SPEs for detecting and quantifying analytes in food samples. SPEs are employed in food safety testing to identify contaminants, allergens, and quality parameters. A trend in this application is the development of portable and rapid testing devices for on-site food analysis. The demand for cost-effective, easy-to-use, and efficient sensors in the food industry is driving the adoption of SPEs, facilitating quick and reliable detection processes, and enhancing overall food safety and quality control measures.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

June 2024

December 2024