September 2024

Seed Treatment Market (By Type: Insecticides, Fungicides, Chemicals, Non-chemicals; By Crop: Corn, Soybean, Wheat, Canola, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

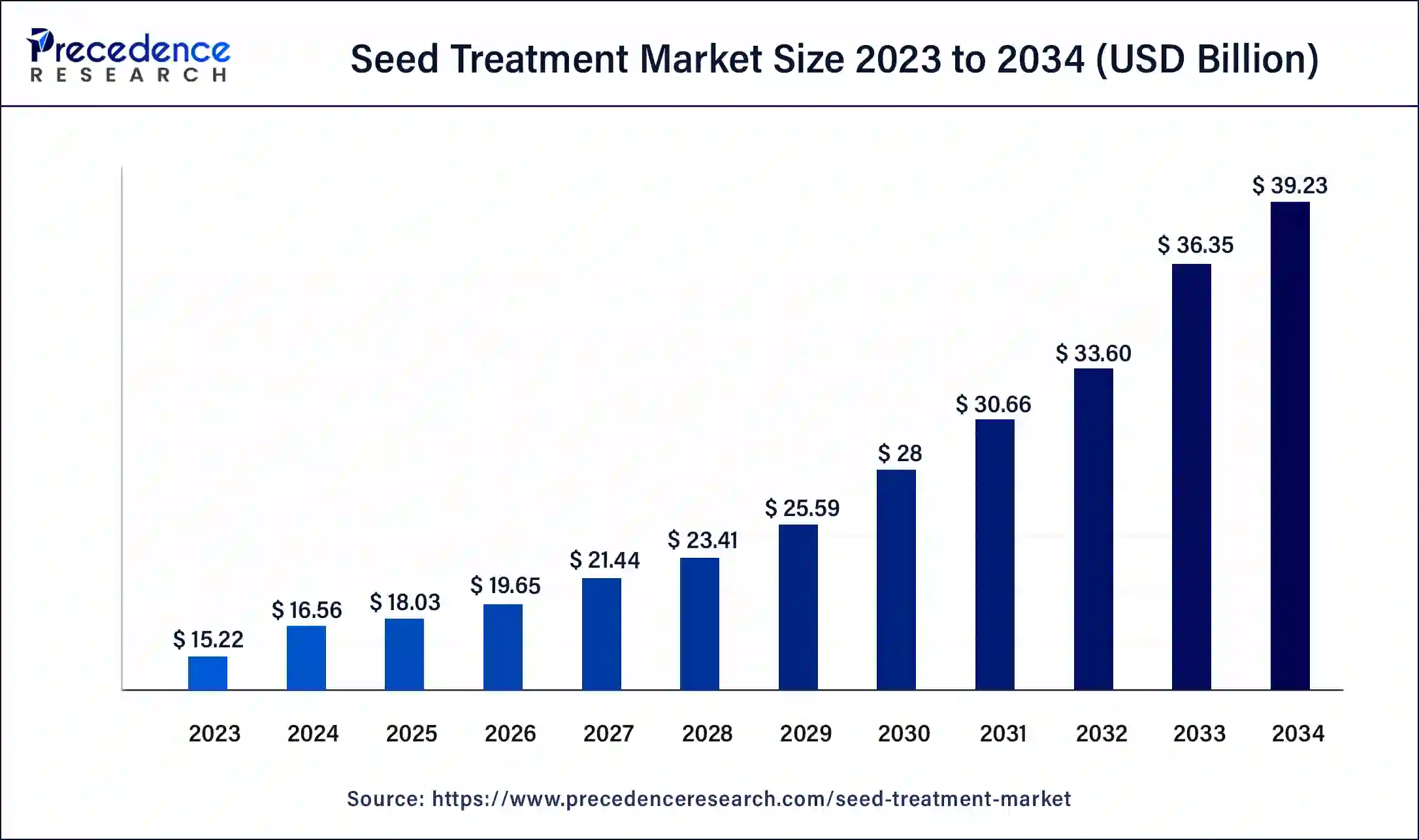

The global seed treatment market size was USD 15.22 billion in 2023, calculated at USD 16.56 billion in 2024 and is expected to reach around USD 39.23 billion by 2034, expanding at a CAGR of 9% from 2024 to 2034.

The seed treatment market encompasses the agricultural strategy of subjecting seeds to a range of treatments, including pesticides, fungicides, and insecticides, prior to planting. This method is employed to shield seeds from pests, diseases, and adverse environmental conditions, ultimately enhancing crop yields and the overall vitality of plants. It plays a pivotal role in modern agriculture, bolstering the effectiveness and eco-friendliness of crop production.

This market comprises diverse technologies and products geared towards augmenting seed quality and performance, thereby contributing to the global agricultural sector's efficiency and sustainability. It is a constantly evolving and dynamic industry driven by advances in agricultural science and technology.

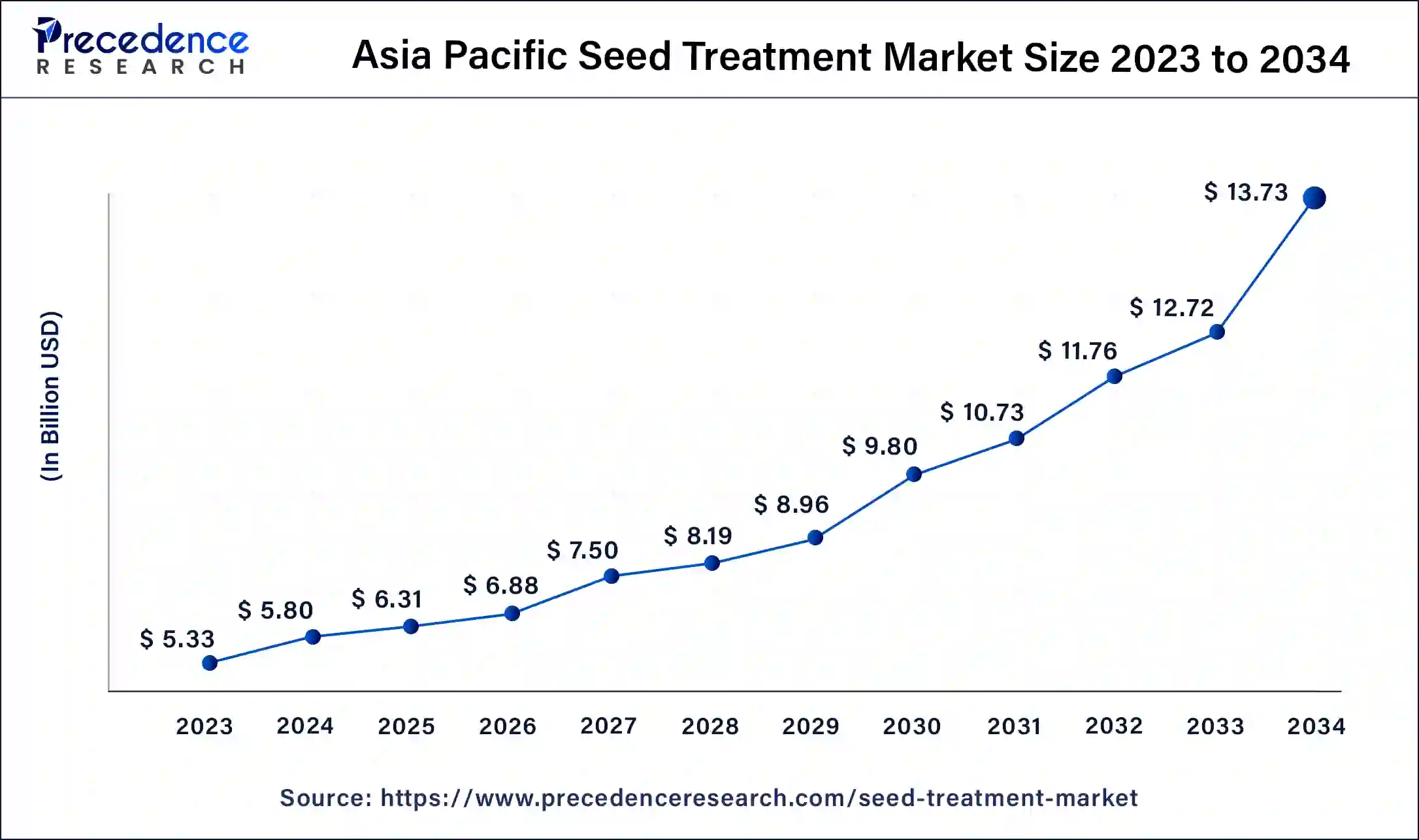

The Asia Pacific seed treatment market size was valued at USD 5.33 billion in 2023 and is projected to reach USD 13.73 billion by 2034, registering a CAGR of 9.20% from 2024 to 2034.

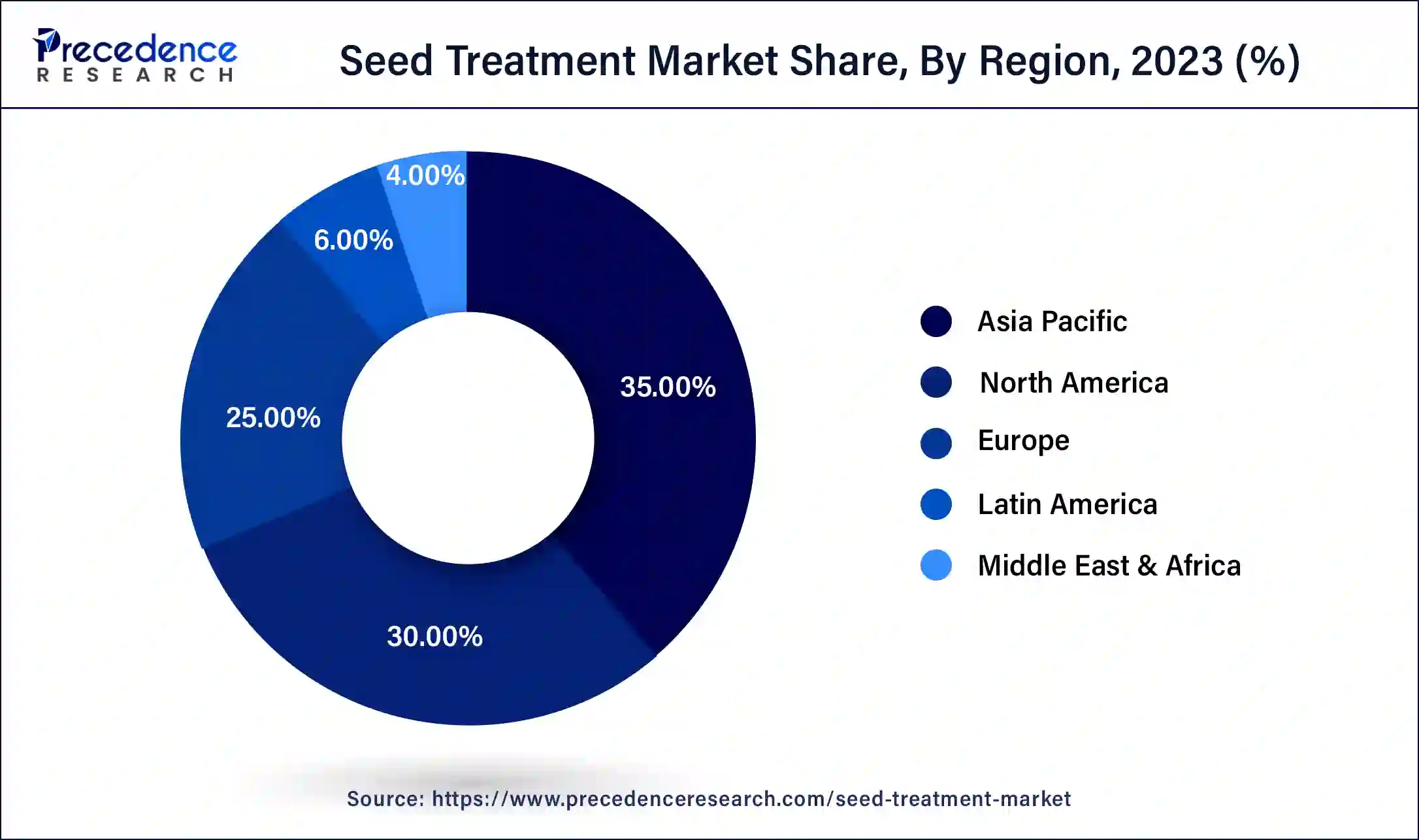

Asia Pacific held the largest revenue share 35% in 2023. North America dominates the seed treatment market due to several key factors. First, the region is home to numerous major aerospace and defense companies, fostering a strong industrial base for electronics production. Second, North America's robust military and civil aviation sectors drive substantial demand for advanced electronics systems.

Third, significant investments in research and development and government contracts further bolster the industry's presence. Moreover, the region's commitment to innovation and technological advancements maintains its competitive edge. These factors collectively contribute to North America's significant share in the Seed Treatment market, setting it apart as a global leader in this sector.

North America is estimated to observe the fastest expansion. North America holds substantial growth in the seed treatment market due to several key factors. The region benefits from a well-established and technologically advanced agricultural sector, which emphasizes the adoption of innovative farming practices. Favorable government policies, stringent regulations, and a strong focus on sustainable agriculture drive the demand for seed treatments.

Additionally, North American farmers increasingly recognize the benefits of seed treatments in optimizing crop yields and quality. The region's diverse crop portfolio, including staple crops like corn and soybeans, further contributes to its dominant position in the global seed treatment market as these crops often require treatment for pest and disease protection.

| Report Coverage | Details |

| Market Size by 2034 | USD 39.23 Billion |

| Market Size in 2023 | USD 15.22 Billion |

| Market Size in 2024 | USD 16.56 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Crop, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing global food demand

The increasing global food demand is a major driving force behind the growth of the seed treatment market. With the world's population steadily rising, the demand for food is escalating, challenging the agriculture sector to produce more with limited resources. Seed treatment technology plays a pivotal role in meeting this demand by optimizing crop yields. As the need for higher agricultural productivity intensifies, farmers are turning to seed treatments to protect their crops from various threats such as pests, diseases, and adverse weather conditions. By enhancing the resilience of seeds, these treatments ensure that a larger portion of crops successfully reaches harvest, ultimately increasing the global food supply.

Furthermore, the demand for diverse and nutritionally rich food is growing. Seed treatments contribute to crop quality by improving disease resistance and nutrient uptake. This not only helps meet the increasing food quantity demand but also aligns with the evolving food quality expectations of consumers. In summary, the surge in global food demand is a compelling factor driving the seed treatment market, as it offers an effective solution to boost agricultural productivity and ensure food security in a world with a burgeoning population.

Limited compatibility with certain crops

The limited compatibility of seed treatment with certain crops presents a significant restraint on the seed treatment market's growth. Not all crops are suitable for seed treatment, and this constraint affects the market in several ways. Firstly, it limits the scope of the application. Some crops, like root vegetables or certain ornamental plants, have characteristics that make seed treatment less effective or even impractical. This constraint reduces the overall market potential. Secondly, it hinders diversification.

The market may become overly dependent on a handful of widely treated crops, which can make it vulnerable to market fluctuations and economic shifts. A limited range of compatible crops limits the diversification and resilience of the seed treatment market. Thirdly, it reduces adoption rates. Farmers who primarily cultivate crops that aren't compatible with seed treatment may be less inclined to invest in the technology or may seek alternative pest and disease control methods, hindering the broader adoption of seed treatments. In summary, limited compatibility with specific crops constrains the seed treatment market's growth by restricting its applicability, diversification, and adoption rates.

Biological seed treatments

Biological seed treatments are emerging as a significant opportunity in the seed treatment market. With increasing emphasis on sustainable and environmentally friendly agriculture, biological seed treatments offer a compelling solution. These treatments leverage beneficial microorganisms, such as bacteria and fungi, to naturally enhance crop resistance to pests and diseases. They minimize the need for chemical inputs, aligning with the growing demand for eco-conscious farming practices.

Additionally, biological seed treatments can contribute to improved soil health, nutrient uptake, and overall crop vitality. As consumers and regulators increasingly favor organic and sustainable agriculture, the market for biological seed treatments is poised for substantial growth. This represents a promising avenue for innovation and investment, as companies focus on developing and commercializing effective and environmentally responsible biological seed treatment solutions to meet the evolving demands of the agriculture industry.

Impacts of COVID-19

The insecticides segment has held a 33% revenue share in 2023. The substantial share of the seed treatment market held by insecticides can be attributed to their indispensable role in shielding crops from a diverse array of harmful pests. Insects like beetles, aphids, and caterpillars pose a significant and constant threat to crop yields. The application of insecticides during seed treatment offers a proactive and precision-oriented defense strategy right from the inception of the crop. This reliability in managing pest-related risks, coupled with the considerable economic impact of pest damage on crop yields, underscores the prominence of insecticides within the seed treatment market, underlining their crucial role in ensuring productive and economically viable agricultural practices.

The non-chemicals segment is anticipated to expand at a significant CAGR of 10.5% during the projected period. The non-chemicals segment holds a major growth in the seed treatment market due to several key factors. Firstly, increasing environmental concerns and a shift toward sustainable agriculture have driven demand for non-chemical alternatives. Secondly, regulatory pressures to reduce chemical pesticide use have favored non-chemical options. Thirdly, biological treatments, such as beneficial microorganisms, provide effective and eco-friendly solutions that resonate with consumers and farmers alike. Additionally, non-chemical treatments align with the growing trend towards organic and eco-conscious farming practices, making them a preferred choice. As a result, the non-chemical segment has gained prominence in the seed treatment market, reflecting the evolving preferences and priorities of the agricultural industry.

The wheat segment is anticipated to hold the largest market share of 31% in 2023. The wheat segment holds a significant share of the seed treatment market due to several factors. Wheat is one of the world's most widely cultivated staple crops, making it a crucial component of global food security. The susceptibility of wheat to various diseases and pests necessitates effective seed treatment to ensure optimal yields. Additionally, wheat farming practices are well-established and modernized, making it easier for farmers to adopt seed treatment technologies. The demand for high-quality wheat, driven by global food consumption patterns, further propels the need for effective seed treatments to protect and enhance wheat crops, cementing its dominant position in the market.

The others segment is projected to grow at the fastest rate over the projected period. The others segment in the seed treatment market holds a significant growth primarily because it encompasses a wide range of crops not individually classified. This category includes niche and specialty crops that are not as widely reported or analyzed. These crops often have unique treatment requirements that are not covered by standard categories.

Furthermore, as agriculture diversifies, the cultivation of newer and less conventional crop varieties is increasing. These crops may not fall into established categories, and their treatment needs are grouped under others. As the agriculture industry evolves and explores new crop types, the segment's share continues to grow, reflecting the industry's expanding diversity and adaptability.

Segments Covered in the Report

By Type

By Crop

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

July 2024

July 2024