January 2025

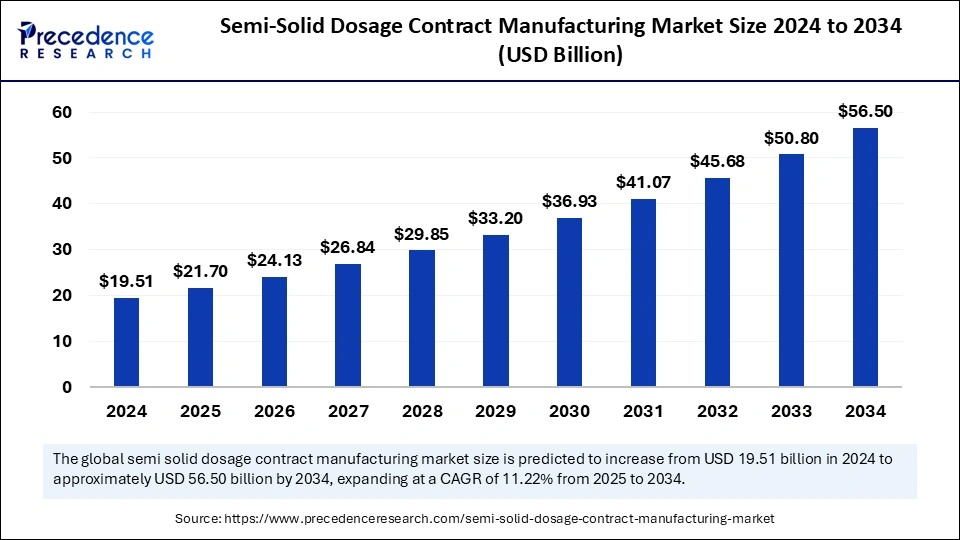

The global semi-solid dosage contract manufacturing market size is calculated at USD 21.70 billion in 2025 and is forecasted to reach around USD 56.50 billion by 2034, accelerating at a CAGR of 11.22% from 2025 to 2034. The Asia Pacific market size surpassed USD 6.44 billion in 2024 and is expanding at a CAGR of 11.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global semi-solid dosage contract manufacturing market size accounted for USD 19.51 billion in 2024 and is predicted to increase from USD 21.70 billion in 2025 to approximately USD 56.50 billion by 2034, expanding at a CAGR of 11.22% from 2025 to 2034. The market is driven by rising topical treatment demand with modern drug delivery progress and cost savings from outsourcing with regulatory expertise and better patient drug usage.

The market benefits from artificial intelligence through better manufacturing processes, which drive efficiency and better product outcomes. Machine learning technologies and predictive analytics tools help optimize formulation developments, simplify production workflows, and detect potential manufacturing problems through early detection. AI functions as a monitoring system to enforce strict quality requirements that follow regulatory standards during production. The market grows due to AI integration that helps improve operational efficiency as well as decrease the time needed for product development.

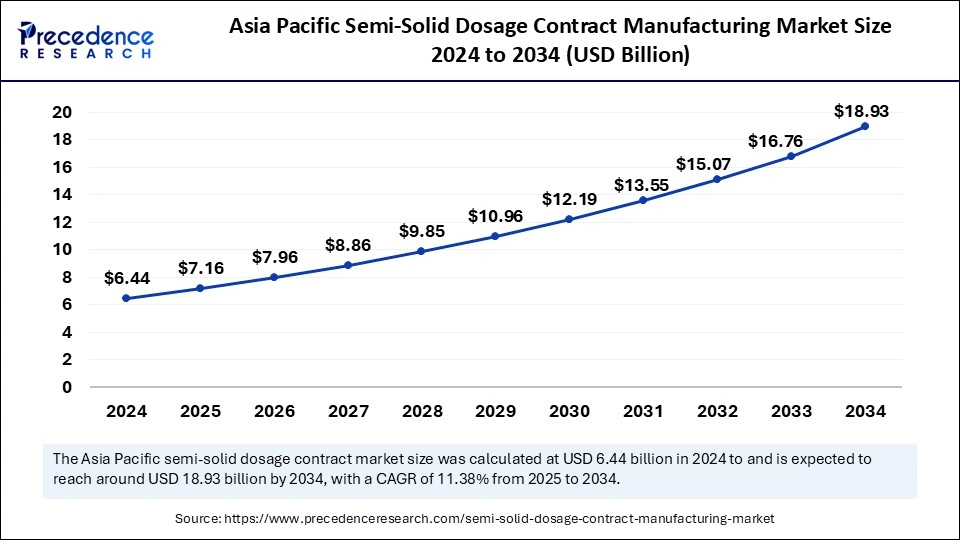

The Asia Pacific semi-solid dosage contract manufacturing market size was exhibited at USD 6.44 billion in 2024 and is projected to be worth around USD 18.93 billion by 2034, growing at a CAGR of 11.38% from 2025 to 2034.

Asia Pacific Market Trends

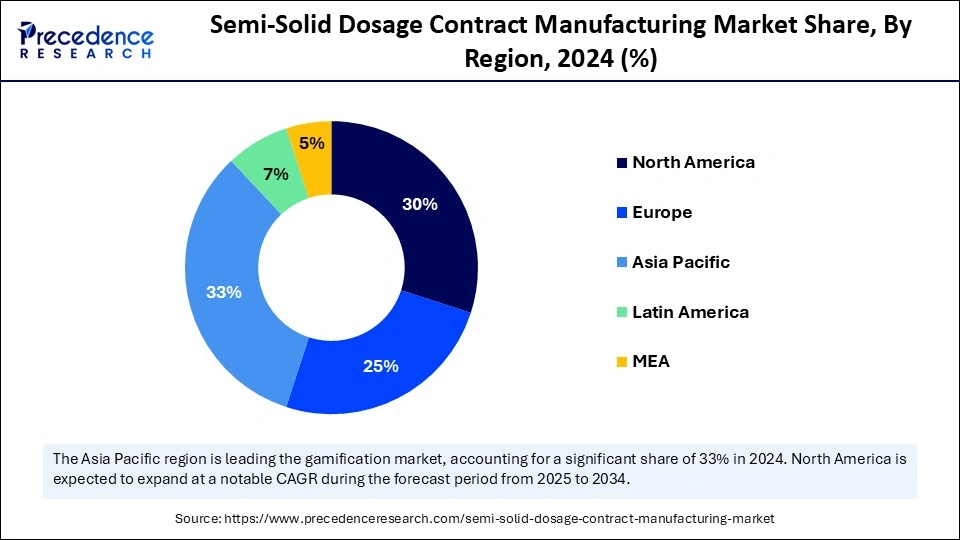

Asia Pacific accounted for the largest share of the semi-solid dosage contract manufacturing market in 2024. The growth of semi-solid dosage outsourcing services stems from components such as healthcare expenditure growth, rising dermatology and skincare demand, and rising R&D investments. The semi-solid dosage contract manufacturing market is showing rapid expansion because China, Japan, and India have developed their contract manufacturing abilities.

China dominates the market expansion because domestic pharmaceutical companies require high-quality semi-solid dosage products. The market will expand in China due to its developing pharmaceutical and biopharmaceutical industry and improvements in its production capacity.

North American Market Trends

North America is anticipated to witness the fastest growth in the semi-solid dosage contract manufacturing market during the forecasted years. Research and development of semi-solid formulations by pharmaceutical and biopharmaceutical companies prompts market expansion. Advanced technologies and modern infrastructure create an ideal situation for pharmaceutical enterprises to collaborate with contract manufacturers to outsource their production.

The rapid growth of fast pharmaceutical and biotechnology companies allows the United States to dominate the market for semi-solid dosage contract manufacturing. The rise of R&D investments and growing demand for semi-solid dosage products motivates U.S.-based pharmaceutical firms to direct their manufacturing activities through contract manufacturing organizations.

European Market Trends

The European semi-solid dosage contract manufacturing market has shown substantial growth in recent years because companies offer investment in biopharmaceutical research and development. This market is supported by Germany, Switzerland, Italy, and France, where manufacturers demonstrate robust capabilities in contract manufacturing and enhance European pharmaceutical industry customer service. The semi-solid dosage market expands in the region because of its established manufacturing capabilities, stringent regulatory frameworks, and leading technological advancements.

Germany maintains a vital position in the market because its strong manufacturing ability allows pharmaceutical and biotechnology companies to reach the market rapidly. Research and development activities are rapidly increasing across the area, which drives product innovation development.

The semi-solid dosage contract manufacturing market functions as a sector that allows pharmaceutical companies to outsource their specialized production of creams, gels, ointments, and pastes through contract manufacturing organizations (CMOs). Pharmaceutical organizations increasingly depend on CMOs to cut operational expenses, gain new technologies, and simplify manufacturing procedures while continuing to operate without constructing their manufacturing plants.

The semi-solid dosage contract manufacturing market is expanding swiftly because pharmaceutical industries require these drugs to treat growing skin conditions and manage chronic pain, as well as improve drug delivery systems. The pharmaceutical industry shows increasing interest in outsourcing production activities; thus, the market expects steady growth. This market demonstrates growth because healthcare providers focus on improving patient outcomes and efficient treatments.

| Report Coverage | Details |

| Market Size by 2034 | USD 56.50 Billion |

| Market Size in 2025 | USD 21.70 Billion |

| Market Size in 2024 | USD 19.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.22% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Company Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Reduced Time-To-Market

CMOs maintain specialized expertise and production infrastructure that produces efficient management of pharmaceutical processes for rapid delivery times. Through a partnership with CMOs, pharmaceutical organizations escape manufacturing facility setup and maintenance responsibilities so they can dedicate their operations to innovation research. CMOs reduce production delays with scalable operations for delivering regulatory compliance and high product quality standards. Semi-solid dosage form CMOs have become essential for manufacturers because their quality-preserving rapid production speed drives extended market interest in contract manufacturing.

Quality and Regulatory Compliance Challenges

With the development of semi-solid formulation products like creams, gels, and ointments, pharmaceutical companies experience major hurdles in meeting quality specifications and regulatory requirements. The production of these drugs requires complex procedures and testing, which ensures that all regulatory requirements, including the FDA and EMA's safety, efficacy, and quality standards.

Contract manufacturing organizations need to manage various regulatory standards across different regions because this increases operational complexities. The cost of regulatory compliance needs substantial investments in testing and documentation and regulatory validation exams to the extent that such expenses stress financial resources, especially for small-scale CMOs with minimal funding.

Advancements in drug deliver

Advanced drug delivery systems increasing across the market create new business possibilities for the semi-solid dosage contract manufacturing market. The semi-solid dosage forms include creams, gels, and ointments, delivering precise treatment to specific areas, thus making them optimal for dermatology therapy and treating pain and infections. The growing number of cases worldwide for these conditions drives market expansion, thus creating an extensive business prospect for contract manufacturers to fulfill increasing market needs.

Specialized CMOs benefit from the pharmaceutical industry outsourcing of manufacturing services, which helps companies decrease production costs and boost efficiency. Semi-solid formulation development for targeted patient needs creates a new growth opportunity within the rising personal medicine trend. The market can expand through CMOs that use production method innovations with improved scalability to serve new emerging trends.

The topical segment held the largest semi-solid dosage contract manufacturing market share in 2024. CMOs serve as essential service providers for pharmaceutical and biotechnology industries by integrating expertise in developing and manufacturing creams, gels, ointments, and additional topical products. The pharmaceutical industry has begun sending its manufacturing operations to external partners because companies need to control operational spending while also gaining access to specialized capabilities.

The growing market demand for skin care products creates an attractive business alliance between CMOs and cosmetic companies to jointly develop creams, serums, and lotions. A collaborative strategy between pharmaceutical producers and cosmetic manufacturers leads to the growing popularity of the topical segment in the market.

The transdermal segment is anticipated to show considerable growth over the forecast period. By utilizing transdermal drug systems, healthcare professionals gain control of dosage release, resulting in enhanced treatment performance and reduced unwanted side effects. Such advantages have made transdermal products more popular in treating chronic conditions, including pain, hormonal imbalances, and nicotine addiction.

The transdermal segment experiences expansion because users prefer non-invasive drug delivery methods that are easy to use. The market expansion of pharmaceutical firms into sophisticated drug delivery advancements requires specialized CMOs that can manage the manufacturing of these formulations, thus leading to the segment's growth in the semi-solid dosage contract manufacturing domain.

The creams segment contributed the largest semi-solid dosage contract manufacturing market share in 2024. The rising dermatological conditions, including eczema, psoriasis, and acne, and increasing consumer demand for skin care products for aging have substantially boosted cream market requirements. Modifications in bioavailability, skin penetration, and stability have resulted in modern creams that perform more effectively with extended-lasting action.

Market demand for high-quality creams increases continually because consumers look for targeted and effective skincare solutions, thus solidifying their market position. Pharmaceutical and skincare businesses partner with advanced production contract manufacturers to efficiently address rising consumer needs.

The large-sized companies segment dominated the global semi-solid dosage contract manufacturing market in 2024. The pharmaceutical market depends on the ability to use contract manufacturing services for semi-solid dosage forms. The high penetration of the segment exists because pharmaceutical organizations choose to concentrate on their fundamental areas while using third-party manufacturers to cut expenses and maximize operations efficiency.

Large companies engage in extensive production orders that need strict regulatory adherence to make sure contract manufacturers fulfill superior industry criteria regarding product quality and safety needs. This method allows them to serve increasing market requirements and efforts to develop new products. Markets seeking semi-solid formulations and their requirement for affordable, scalable production platforms are the main forces behind segment growth.

The medium and small-sized companies segment is projected to show considerable growth in the forecast period. SME pharmaceutical and cosmeceutical companies depend more often on contract manufacturing organizations (CMOs) to access affordable industry technology solutions and advanced manufacturing processes.

These companies do not possess enough capital to build their production buildings they find CMO services appealing. The cosmeceutical industry has started to outsource semi-solid dosage form production, including creams, serums, and lotions, for small-to-medium enterprises to enhance their response to high-quality skincare and personal care product market demand.

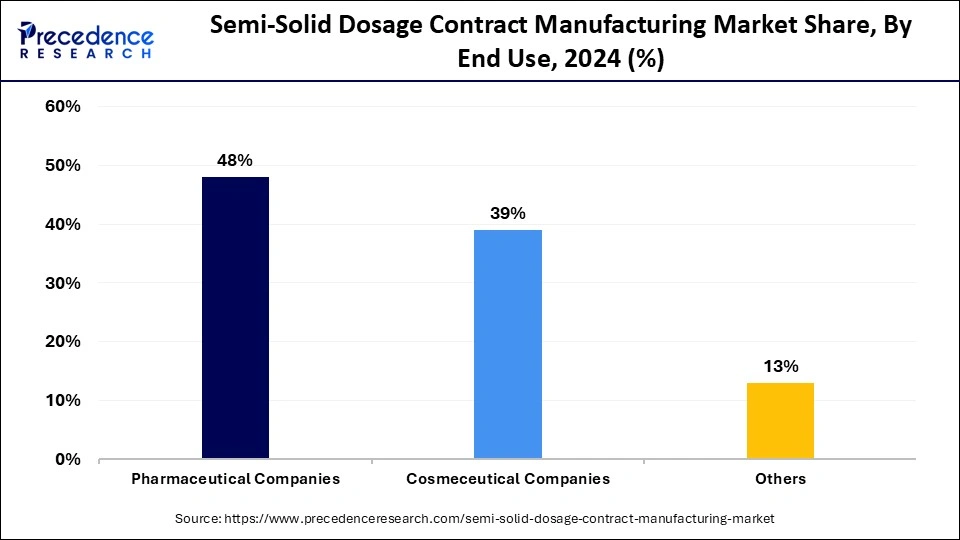

The pharmaceutical companies segment accounted for the largest semi-solid dosage contract manufacturing market share in 2024. The pharmaceutical industry keeps outsourcing its production activities because of the increasing need to work with contract manufacturing organizations. The production services of CMOs constitute a fundamental solution for smaller and medium-sized pharmaceutical companies that want to concentrate on their research and development activities while lowering expenses and enhancing manufacturing effectiveness.

The manufacturing of semi-solid dosage forms through outsourcing enables pharmaceutical companies to gain established, cost-effective production without building extensive in-house facilities while ensuring consistent outputs of creams, gels, and ointments. The demand for market expansion in pharmaceutical production continues to rise due to contract manufacturers' delivery of advanced production technology and experienced workforce capabilities.

The cosmeceutical companies segment is anticipated to show considerable growth in the forecast period. Cosmeceuticals represent cosmetic products that use pharmaceutical-grade elements, which enables their manufacturing through third-party vendors so companies maintain operational focus.

Customers seek a wide range of cosmeceutical solutions, which include skincare, haircare, personal care, and specialized organic and vegan cosmetic categories because they seek comprehensive beauty solutions that match their specific requirements. The growing market segment where wellness and health industries produce a combination of beauty and therapeutic products supports the expansion potential of cosmeceutical contract manufacturing services.

By Type

By Product

By Company Size

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

December 2024