September 2024

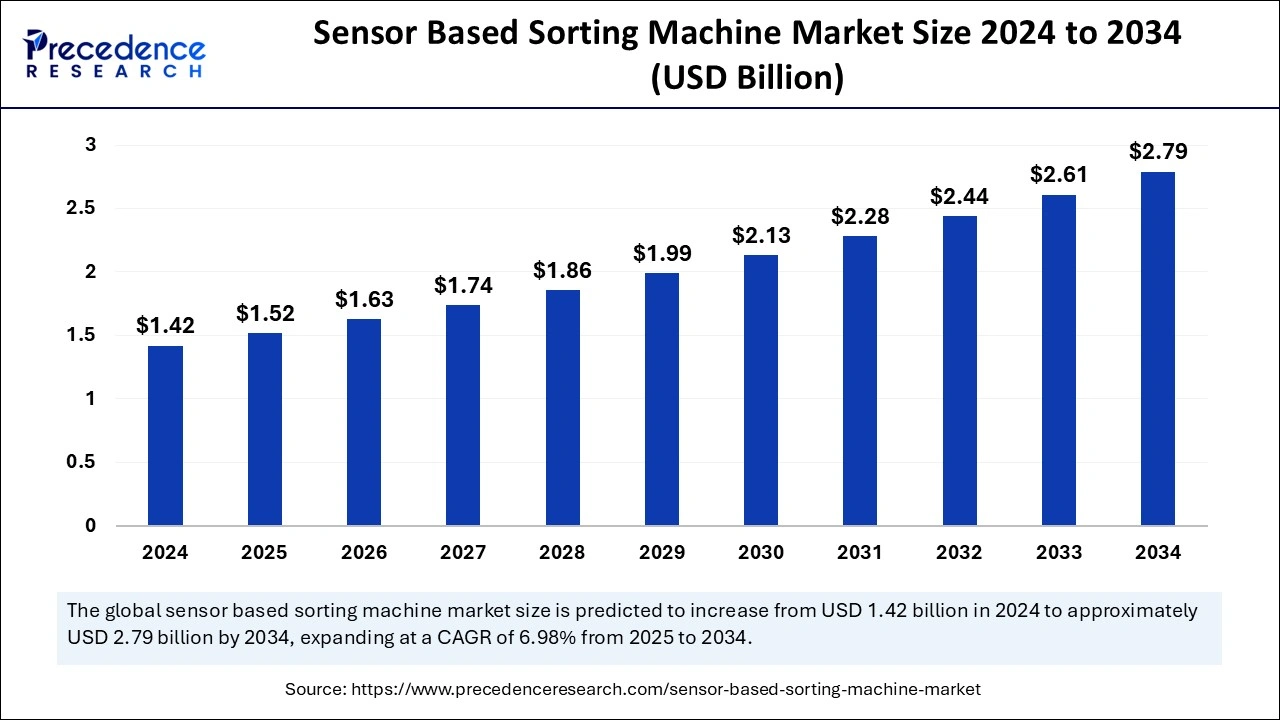

The global sensor based sorting machine market size is accounted at USD 1.52 billion in 2025 and is forecasted to hit around USD 2.79 billion by 2034, representing a CAGR of 6.98% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global sensor based sorting machine market size was calculated at USD 1.42 billion in 2024 and is predicted to increase from USD 1.52 billion in 2025 to approximately USD 2.79 billion by 2034, expanding at a CAGR of 6.98% from 2025 to 2034. The market is increasing due to the growing need for resource optimization, advancements in sensor technologies, and increasing uses in mining, recycling, and food sectors, driven by cost efficiency, automation advantages, and requirements for quality assurance.

Advancements in sensor technology, including machine learning, artificial intelligence, and near-infrared (NIR) sensors, are improving sorting accuracy and increasing applications in diverse industries, including the sensor based sorting machine market. AI and machine learning help sort equipment and recognize different materials under changing environmental conditions. The Internet of Things (IoT) and Artificial Intelligence (AI) with sensor sorting systems upgrade their performance by enabling real-time monitoring and predictive maintenance analysis. By putting advanced sensors into sorting systems, this technology boosts workflow and accuracy so operations face fewer stoppages and expenses while creating a smart solution for production efficiency.

Several sorting equipment that rely on sensors can identify objects by their features, including size, shape, color, and material composition. Sensor based sorting machines achieve faster processing at lower operating costs and require less manual labor in industries including food production, recycling, mining, and drug development. The demand for the sensor based sorting machine market is increasing as companies invest more in automated quality control systems.

The sensor based sorting machine market is the rising need for high-speed and accurate sorting solutions in industries such as recycling, mining, and food processing. Growing waste volumes and stricter waste management laws create intense demand for advanced sorting systems. Sensors like optical, X-ray, and near-infrared sensors provide precise sorting capabilities, which significantly improve operational efficacy and reduce manual labor costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.79 Billion |

| Market Size by 2025 | USD 1.52 Billion |

| Market Size in 2024 | USD 1.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.98% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Improved automation across industries

The expansion of sensor based sorting machines results from the rising need for automated systems in recycling plants, food production facilities, and mining operations. These machines help tasks move faster at lower costs to workers. Economic sectors, including food production facilities, enhance both their efficiency and automation through the use of sensor based sorting equipment.

Sensor based sorting machines provide continuous monitoring plus fast sorting and precise detection functions to make operations run better and enhance product output. These systems help detect foreign materials and ensure food products' quality and safety. The pharmaceutical business uses sensor based sorting systems to meet their high-quality standards while this sector grows fast.

Stringent quality and safety regulations.

Stringent quality and safety regulations in different industries act as drivers for the sensor based sorting machine market. Manufacturing sectors, including pharmaceuticals and food processing, are subject to strict regulations and standards to confirm product quality, safety, and compliance. These industries use sensor based sorting machines to achieve high-quality results by spotting and removing bad products from production. Businesses use sensor based sorting technology to follow safety rules and improve product protection. Companies use sensor based sorting technology because it helps them follow government rules, so they need more of these systems.

High initial investment

Small and medium-sized companies face high start-up costs when adding sensor based sorting machines to their operations. The high upfront costs of sensor based sorting technology act as a key barrier to deployment. Organizations struggle to integrate sensor based sorting systems into their existing operations while needing trained staff to operate and support these systems. Implementing sensor based sorting machine solutions requires significant upfront investments that limit market acceptance.

Growing focus on sustainability and waste management

The rising focus on sustainability and waste management practices acts as an opportunity for the sensor based sorting machine market, mainly in the recycling and waste management sectors. The governments and companies reduce waste by recycling more materials to protect the environment.

Sensor based sorting systems establish both high-quality results and fast performance which makes them ideal solutions for market expansion. The demand for sustainable waste management practices and the demand to achieve recycling targets initiative the embracing of sensor based sorting machines in the recycling and waste management sectors.

The optical segment generated a significant sensor based sorting machine market share in 2024. Optical sorting machines lead the market in several fields, such as food production and waste recycling. Through cameras and sensors, the color, shape, and size of the materials are detected, allowing precise sorting. The growing amount of waste worldwide creates new opportunities for optical sorting machines to recycle waste. Optical sorting machines help industries extract valuable recyclables from waste streams while cutting disposal amounts and using resources better. Optical sorting machines using X-ray and laser technology sort and locate reusable materials from electronic waste effectively. Urban needs and industrial growth create more waste that needs efficient sorting solutions. Optical sorting machines offer superior accuracy and speed in separating different waste materials compared to traditional methods.

The X-ray segment is projected to witness the fastest growth during the forecast period. The sensor based sorting system with X-ray detection uses XRT technology to place materials into different groups based on their composition and density. X-ray sorting technology finds particular success in mining and recycling operations, especially where the identification of materials based on their density and atomic composition is crucial. The sorting machine uses X-ray rays to spot minerals and split them into groups based on their density and atomic number patterns. Mining operators discover gold and silver efficiently with X-ray sorters. The capability to drive in harsh environments and sort materials with high accuracy has made X-ray sorting systems a vital component in the mining sector.

The recycling segment noted the largest sensor based sorting machine market share in 2024. Recycling plants use sensor technology to identify different materials, which allows them to automate their sorting process. These systems at recycling plants break waste into groups based on plastics, metals, textiles, and construction materials. The recycling systems break down plastic, metal, and paper waste into groups that industries can reuse. Sensor based sorting machines at recycling plants recognize materials and separate products based on item properties. Sensor based sorting technology makes recycling processes run better and more precise to recover materials and protect our environment.

The mining segment is estimated to witness the fastest growth in the forecast period. Sensor based sorting helps the mining industry produce more valuable minerals and ores by identifying them within their waste rock. These systems recognize material properties by sensing color and form as well as size and density. The technology boosts mining productivity and lowers workforce expenses while bringing out more valuable minerals. Modern mining operations depend on sensor based sorting systems because they analyze materials for density characteristics and reflectivity plus atomic composition.

The industrial segment noted the largest sensor based sorting machine market share in 2024. Sensor based sorting machines help different industries sort materials according to their physical properties. These devices work in mining, recycling, food manufacturing, and garbage disposal businesses. Leading industries turn to sensor based sorting systems because they need better methods that help their operations run smoothly while helping them save money and produce better products.

The commercial segment is predicted to witness the fastest growth in the forecast period. Sensor based sorting machines use measuring equipment to identify and separate items according to their characteristics. Companies employ across different industries such as food production and recycling, mining, and pharmaceutical manufacturing. The commercial sector deploys sensor based sorting systems for both warehouse and retail activities to sort distribution and customer materials. Growing online shopping and supply chain needs drive organizations to use sensor based sorting systems more often. Business operations use sensor based sorting systems because they handle large item volumes quickly while maintaining minimal mistakes.

North America accounted for the largest sensor based sorting machine market share in 2024. Strict environmental rules and established industry leaders push this sector's growth. The United States and Canada lead all investments in waste treatment facilities and recycling systems throughout their market region. North America stands out because its industries heavily use sensor based sorting solutions due to the strong adoption of automation and Industry 4.0 technologies. Advanced economic sectors in mining, recycling, and food processing equipment. North America works actively to protect the environment through recycling, so sensor based sorting machines are widely used.

Asia Pacific is anticipated to witness the fastest growth in the sensor based sorting machine market during the forecasted years. The market is expanding because of industrialization, urbanization, and growing awareness about waste management and recycling. Top economies, including China, India, and Japan, invest heavily in industrial automation systems while creating new waste management structures. Rising demand for higher-quality food products and advanced recycling processes drives industry growth.

China has developed sensor based sorting tools that help to sort materials with speed and accuracy. The country dedicates substantial funds to building precise detectors and advanced processing systems for mineral separation technology. China advances its mining sector through advanced sorting solutions because their growth assists in efficient resource utilization and environmental protection.

By Type

By Application

By End-User

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

October 2024

December 2024