March 2025

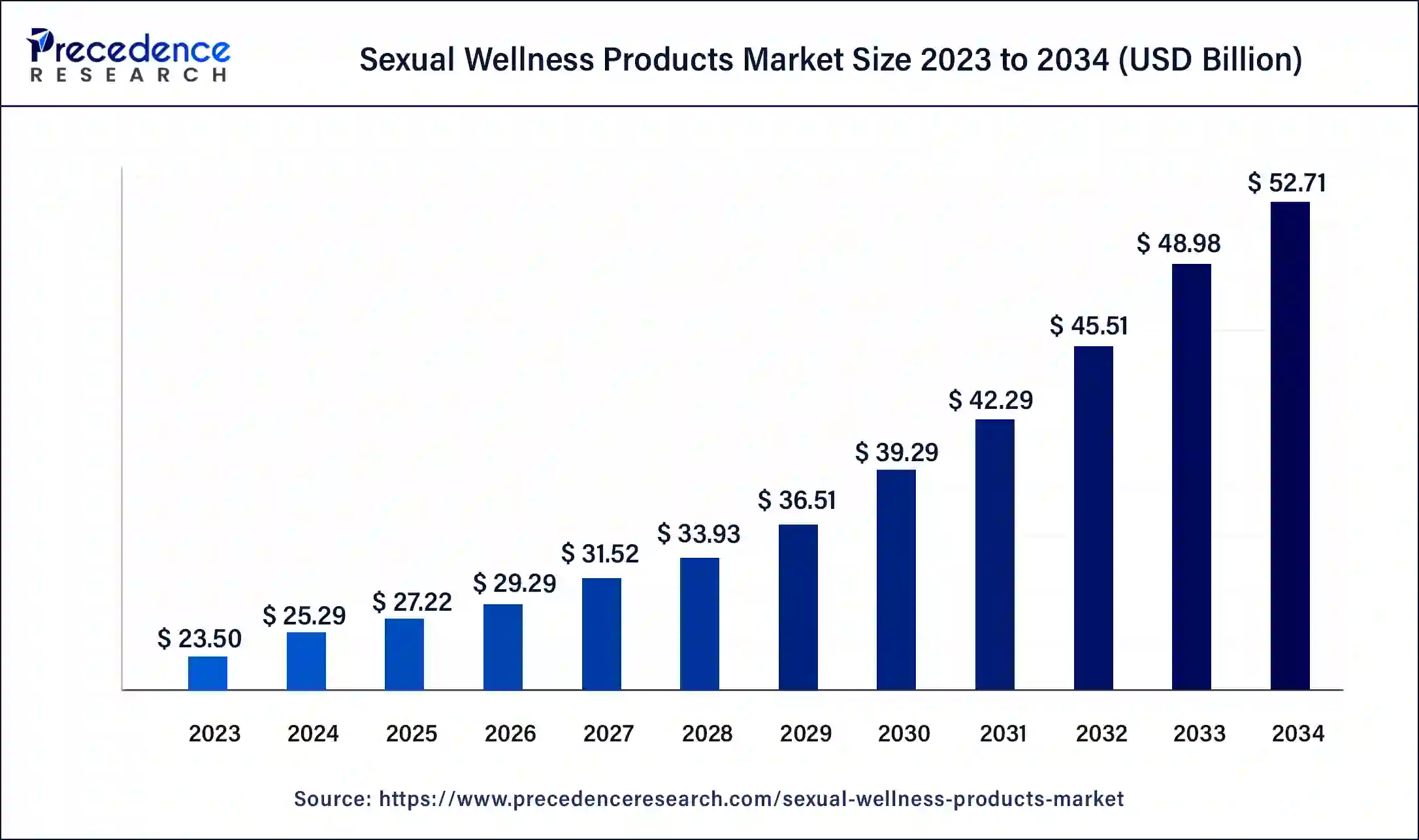

The global sexual wellness products market size surpassed USD 23.50 billion in 2023 and is estimated to increase from USD 25.29 billion in 2024 to approximately USD 52.71 billion by 2034. It is projected to grow at a CAGR of 7.62% from 2024 to 2034.

The global sexual wellness products market size is projected to be worth around USD 52.71 billion by 2034 from USD 25.29 billion in 2024, at a CAGR of 7.62% from 2024 to 2034. The rising development in the healthcare sector is driving the market growth. Also, the growing infertility issue among couples has contributed to the market growth. Additionally, advancements in medical technology have driven the growth of the sexual wellness products market.

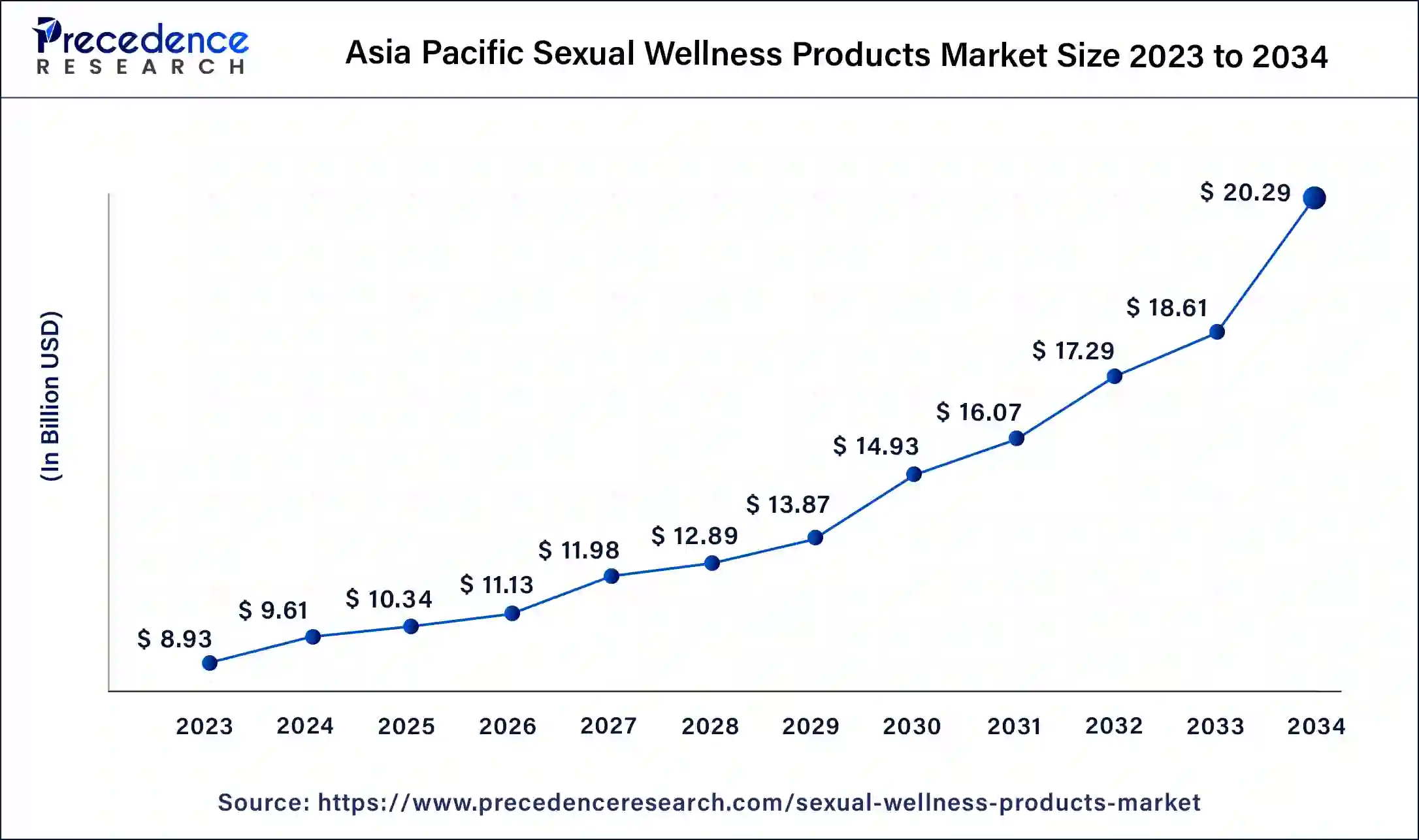

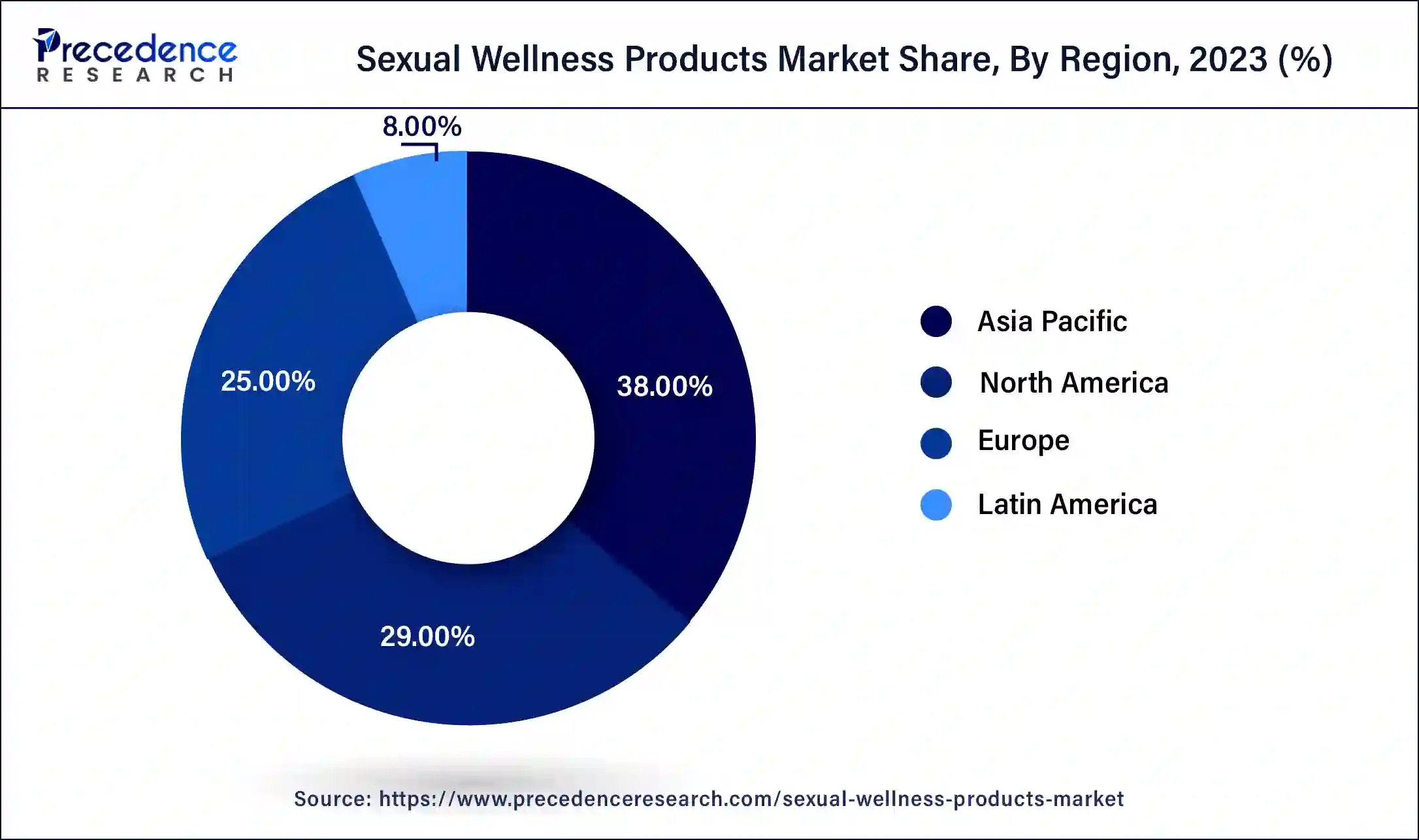

The Asia Pacific sexual wellness products market size was exhibited at USD 8.93 billion in 2023 and is projected to be worth around USD 20.29 billion by 2034, poised to grow at a CAGR of 7.74% from 2024 to 2034.

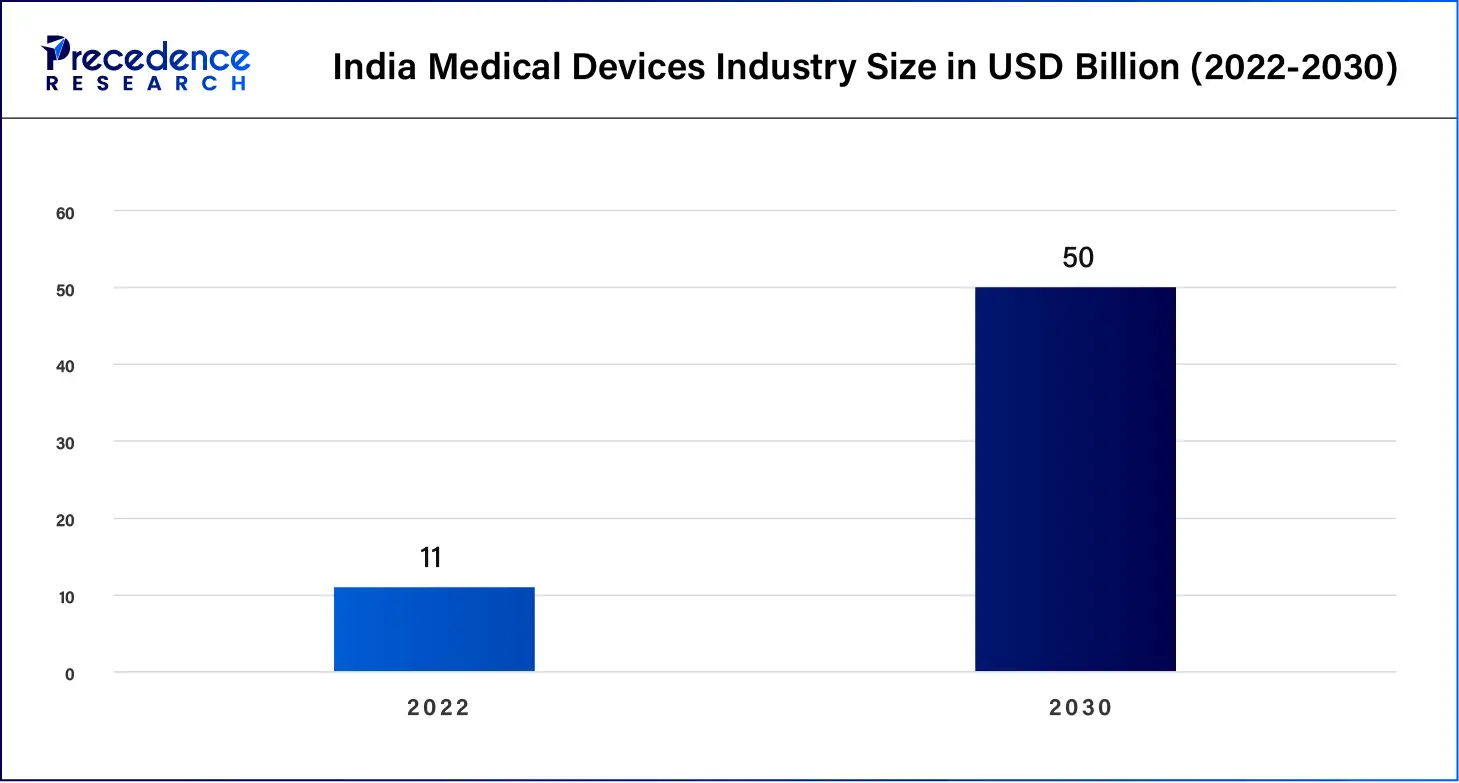

Asia Pacific led the dominant share of the sexual wellness products market in 2023. The rising development in the medical devices sector in countries such as India, China, Japan, South Korea, Singapore, and others has contributed to the development of the industry. Also, the increasing emphasis on birth control has increased the demand for contraceptives, which is fostering market growth. The rising interest of men in masturbation has increased the application of sex toys such as vibrators, anal sex toys, masturbators, artificial vaginas, robots, prostate massagers, and others. Moreover, the rising cases of STIs such as syphilis, gonorrhea, and trichomoniasis have increased the demand for protective sexual products in this region. This region comprises several local manufacturers of sexual wellness products, such as Tenga Co., Ltd., Karex Berhad, Fuji Latex, TTK Healthcare, and some others, which are regularly engaged in manufacturing superior-grade sexual wellness products for people in this region.

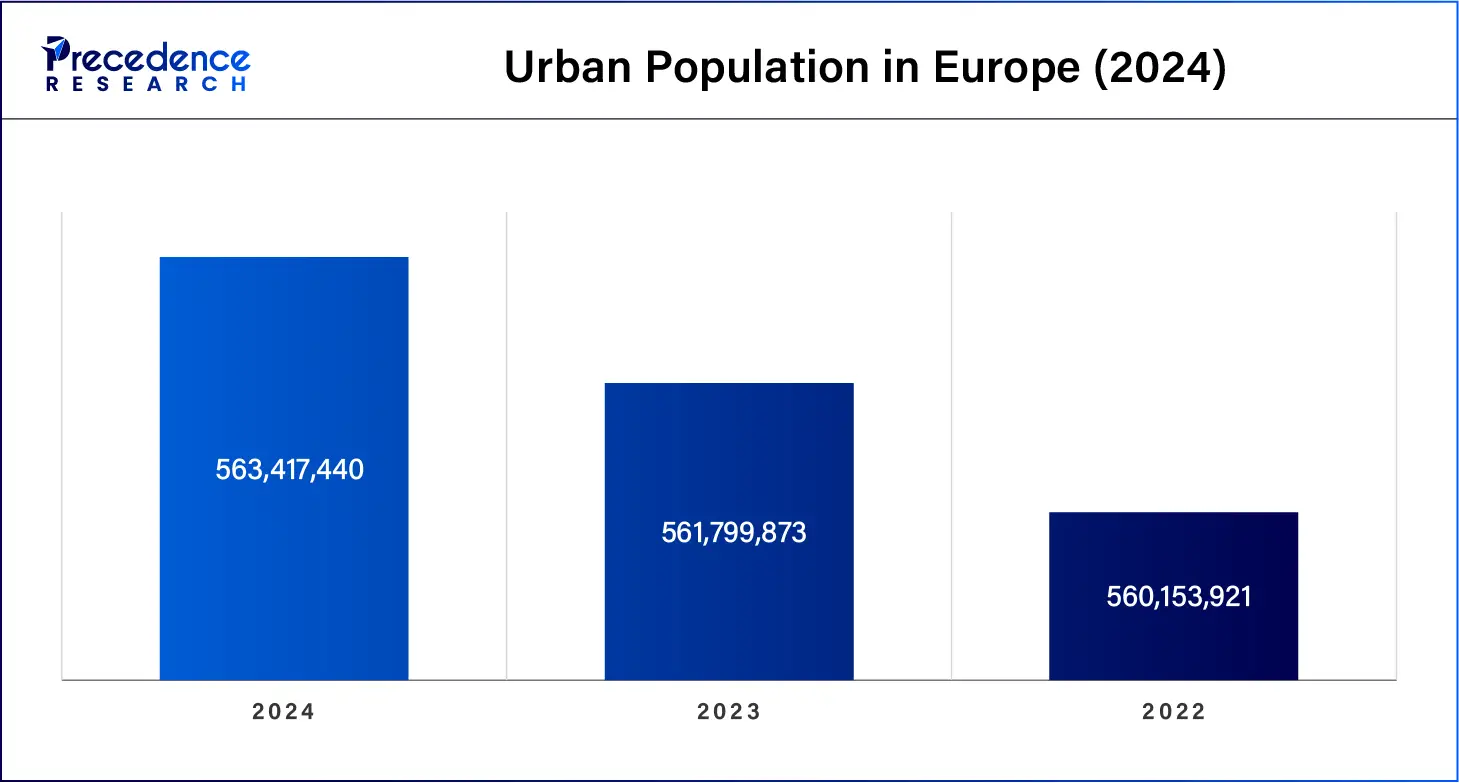

Europe is expected to grow with a significant CAGR during the forecast period. The rising urbanization in countries such as the UK, Germany, Spain, France, Denmark, Norway, Netherlands, and some others has increased the demand for sexual wellness products. Additionally, the trend of having sexual relationships with multiple partners is very common in Europe, which, in turn, increases the applications of condoms and other contraceptives as a protective measure. The popularity of sex toys among women for enhancing sexual pleasure, along with advances in modern technologies related to sexual wellness, has contributed positively to the market. Also, the legalization of prostitution in various European nations such as Denmark, Spain, Greece, Belgium, Switzerland, and some others has increased the applications of sexual contraceptives.

Europe consists of various market players in sexual wellness, including Reckitt Benckiser Group PLC, Bijoux Indiscrets SL, Pjur Group Luxembourg S.A., Lelo, Kessel Medintim GmbH, and some others that are constantly engaged in manufacturing sexual wellness products. Also, these companies are adopting several strategies such as partnerships, acquisitions, collaborations, launches, and business expansions that are driving the growth of the sexual wellness products market in this region.

The sexual wellness products market is an important industry in the healthcare sector. This industry deals in the manufacturing and distribution of sexual wellness products for numerous customers. This industry is mainly driven by the rising trend of comfortable sex toys along with the growing awareness regarding sexual health. The sexual wellness products market deals in developing various types of products, including personal lubricants, sex toys, sprays, condoms, and others. These products are manufactured for numerous end-users, including men, women, and the LGBT community. Sexual wellness products are mainly found in various distribution channels, including e-commerce/online and retail outlets/offline. This market is expected to rise significantly with the growth in the healthcare and lifestyle industry.

What is the role of AI in the Sexual Wellness Products Market?

The healthcare industry has encountered several developments due to advances in modern technologies. These technologies mainly consist of AI, ML, blockchain, and others that help develop superior products and ensure quality checks of finished goods. Nowadays, sexual wellness companies have started adopting AI in their laboratories and manufacturing facilities to improve sexual health by enhancing STI diagnosis and prevention along with the production of safer sex toys and other products.

Top 10 Sex Toy Companies

| Report Coverage | Details |

| Market Size by 2034 | USD 52.71 Billion |

| Market Size in 2023 | USD 23.5 Billion |

| Market Size in 2024 | USD 25.29 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.62% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, End-User, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Prevalence of STDs (Sexually Transmitted Diseases) among the people

The prevalence of STDs has increased around the world due to unhealthy sexual habits. The increase in number of patients suffering from bacterial infections such as trichomoniasis, gonorrhea, syphilis, and chlamydia has increased the demand for protective products. Also, the cases of viral infections such as herpes simplex virus (HSV), hepatitis B, HIV, and human papillomavirus (HPV) have also increased the application of sexual wellness products.

According to data published by WHO, the estimated increase of 376 million new STD cases every year. It also stated that trichomonas cases are the most commonly found STDs globally, comprising 156 million cases annually.

Unhealthy materials and mental disorders

The sexual wellness products market faces numerous problems in its day-to-day operations. Some of the sex toys and condoms are manufactured using harmful chemicals such as carbon disulfide, cadmium, phthalates, and others that can cause harm to the body. Also, the excessive use of sex toys can cause mental trauma among young people. Thus, the use of harmful materials along with mental disorders is expected to restrain the growth of the sexual wellness products market during the forecast period.

Advancements in VR-enabled sex toys

The healthcare industry has developed significantly due to the advancement in several technologies. Nowadays, sexual wellness brands have started developing VR-enabled sex toys to enhance consumer experiences and gain the utmost market reach. Thus, the advancements associated with VR-enabled sex toys are expected to create growth opportunities.

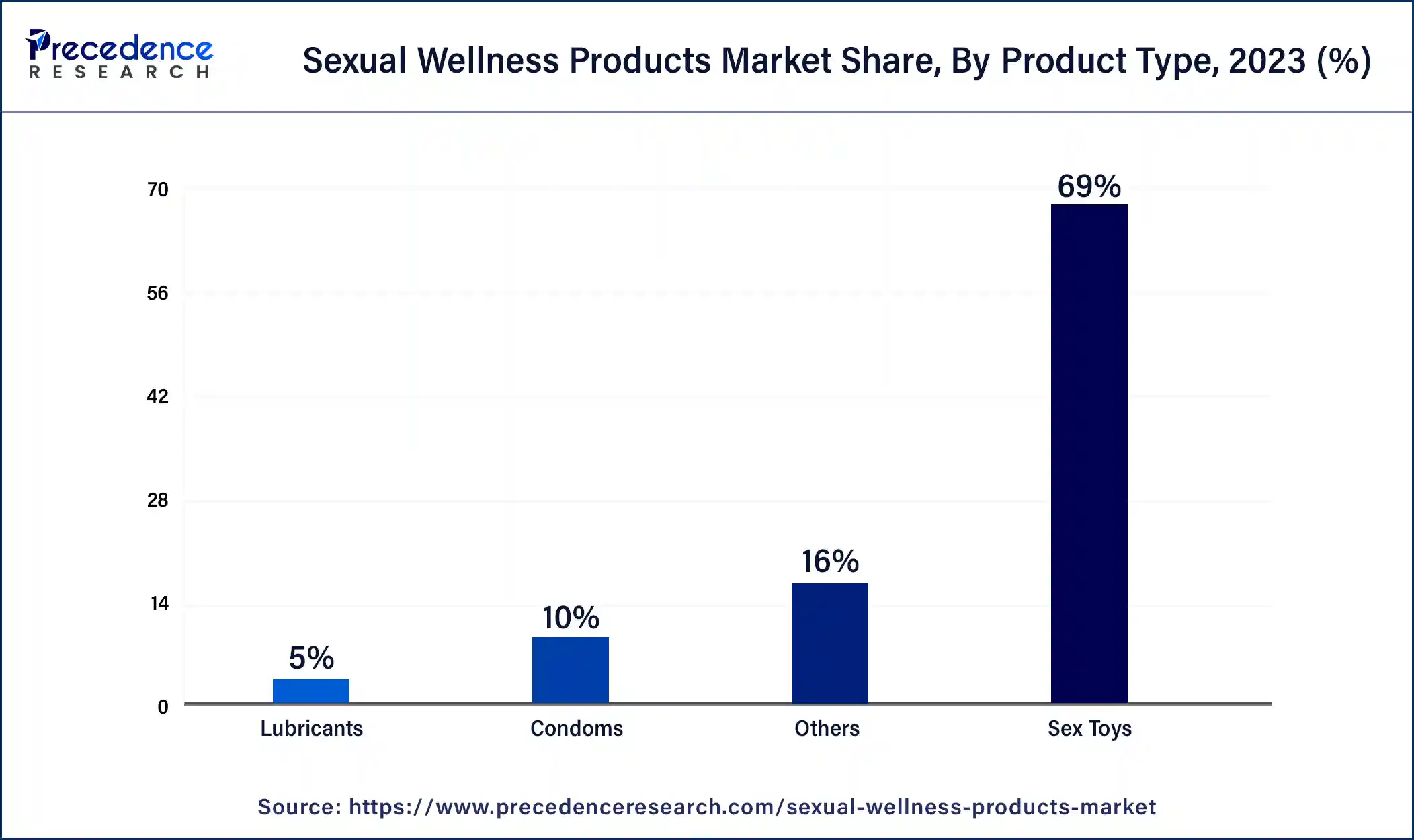

The sex toys segment dominated the sexual wellness products market in 2023. The demand for sex toys has increased among the middle-aged population to enhance sexual experiences, which is a major contributor to industrial growth. Also, the rising use of female sex toys such as dildos, vibrators, discreet clitoral massagers, butt plugs & strap-ons, wand massagers, clit-sucking, and others for providing improved mood has boosted the market growth. Moreover, the growing applications of male sex toys such as penis rings, dildos, masturbators, anal sex toys, artificial vaginas, and some others for removing loneliness and enhancing sexual pleasure are likely to proliferate.

The condom segment is anticipated to grow at the fastest growth rate in the sexual wellness products market during the forecast period. The rising cases of HIV AIDS among people of different nations have increased the demand for sexual wellness products for ensuring safety during intercourse. Also, the growing trend of casual sex among unmarried couples has increased the application of condoms to avoid pregnancy. Moreover, the increasing usage of condoms for preventing STDs and other communicable diseases is promoting the segment’s growth.

The women segment held a dominant share of the sexual wellness products market in 2023. The demand for female sex toys such as discreet clitoral massagers, butt plug & strap-ons, dildos, vibrators, wand massagers, clit-sucking, and others has contributed to the market growth. Also, the increasing trend of female condoms for prevention against STDs and avoiding pregnancy is likely to boost the market growth. Moreover, there is a rising demand for sexual wellness products among women to increase libido, ensure safety, and improve sexual experience.

The male segment is expected to grow at a significant CAGR in the sexual wellness products market during the forecast period. The growing demand for male condoms to avoid pregnancy and ensure safety against STDs is a major contributor to industrial growth. Also, the rising application of male sex toys such as dildos, masturbators, penis rings, anal sex toys, artificial vaginas, and others for enhancing sexual pleasure among men has boosted the market growth. Moreover, the increasing usage of sexual wellness products among men for improving sexual safety is likely to foster growth.

The retail outlets/offline segment dominated the sexual wellness products market in 2023. The rising availability of sexual wellness products in retail shops has propelled the market growth. Also, the increasing number of pharmacies that consist of huge stocks of condoms and sex toys is contributing to the market growth. Moreover, there is a growing preference for consumers to buy sexual wellness products directly from retail.

The e-commerce/online segment is expected to grow at a significant rate in the sexual wellness products market during the forecast period. The rising proliferation of smartphones, along with advancements in internet facilities around the world, is driving industrial growth. Also, the availability of a variety of sexual wellness products in a single platform is likely to boost the development of the industry. Moreover, the growing concerns about privacy among teenagers have increased the use of e-commerce sites for buying sex toys.

Segments Covered in the Report

By Product Type

By End-User

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

December 2024

March 2025