April 2024

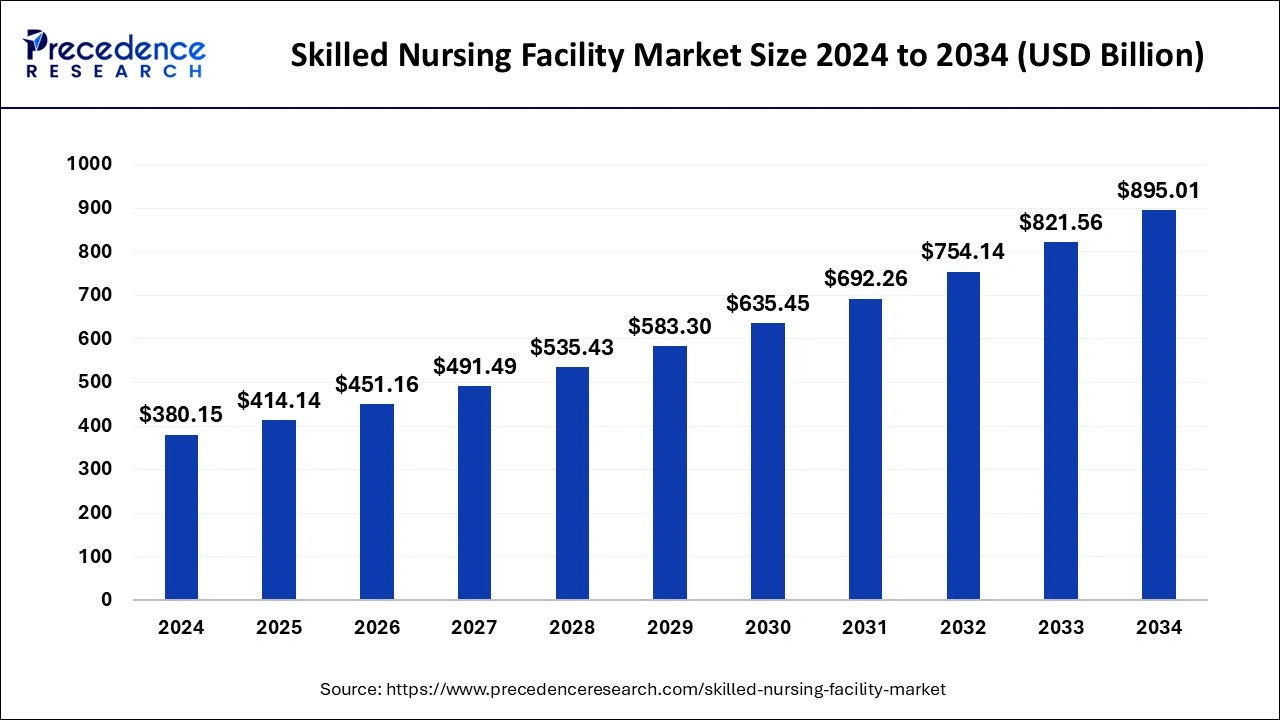

The global skilled nursing facility market size is calculated at USD 414.14 billion in 2025 and is forecasted to reach around USD 895.01 billion by 2034, accelerating at a CAGR of 8.94% from 2025 to 2034. The North America skilled nursing facility market size surpassed USD 171.07 billion in 2024 and is expanding at a CAGR of 9.06% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global skilled nursing facility market size was estimated at USD 380.15 billion in 2024 and is anticipated to reach around USD 895.01 billion by 2034, expanding at a CAGR of 8.94% from 2025 to 2034. The growth of the skilled nursing facility market is majorly driven by the growing geriatric population across globe.

Artificial intelligence has become a milestone for every sector. AI emerged as a crucial support system for nursing facilities in today's fast-paced life, where geriatric individuals seek personal care attendants to take care of them. AI can streamline administrative work in nursing facilities by reducing human errors, which further allows staff to focus on other work, thereby enhancing productivity. AI can provide valuable insights and predictions about patient care to support decision-making. AI also helps in designing customized care plans according to patient needs.

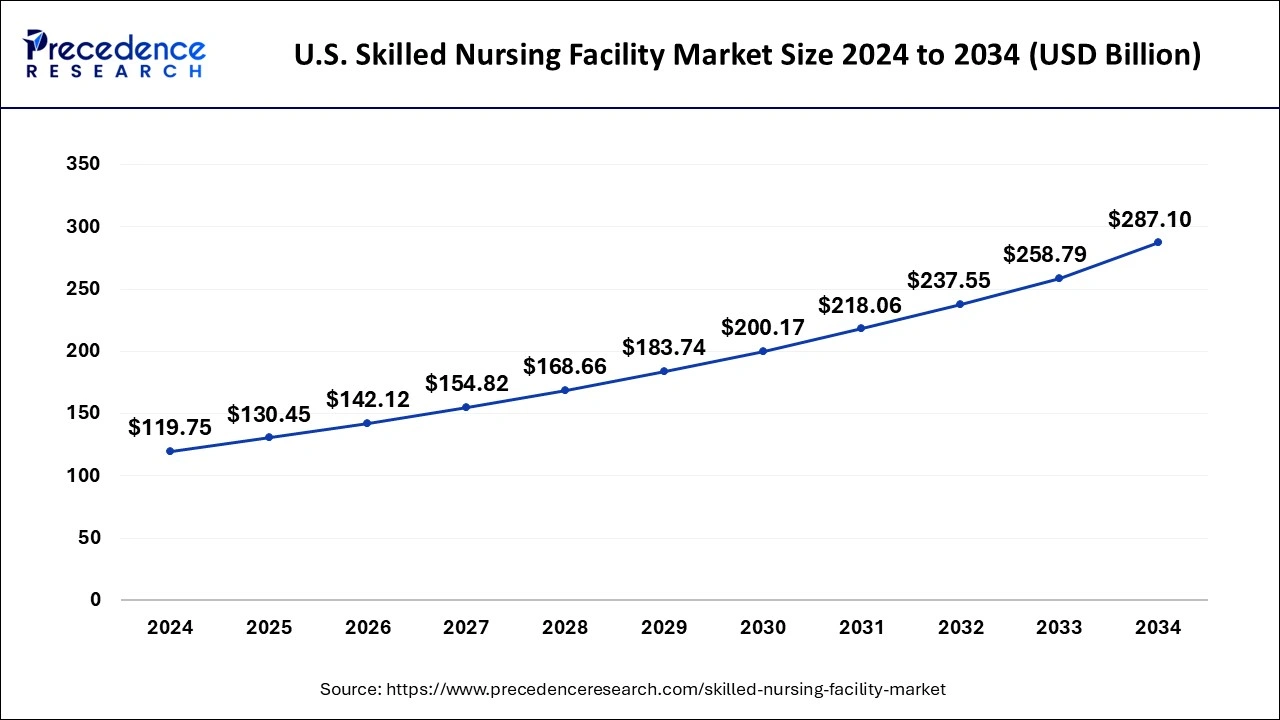

The U.S. skilled nursing facility market size was evaluated at USD 119.75 billion in 2024 and is predicted to be worth around USD 287.10 billion by 2034, rising at a CAGR of 9.14% from 2025 to 2034.

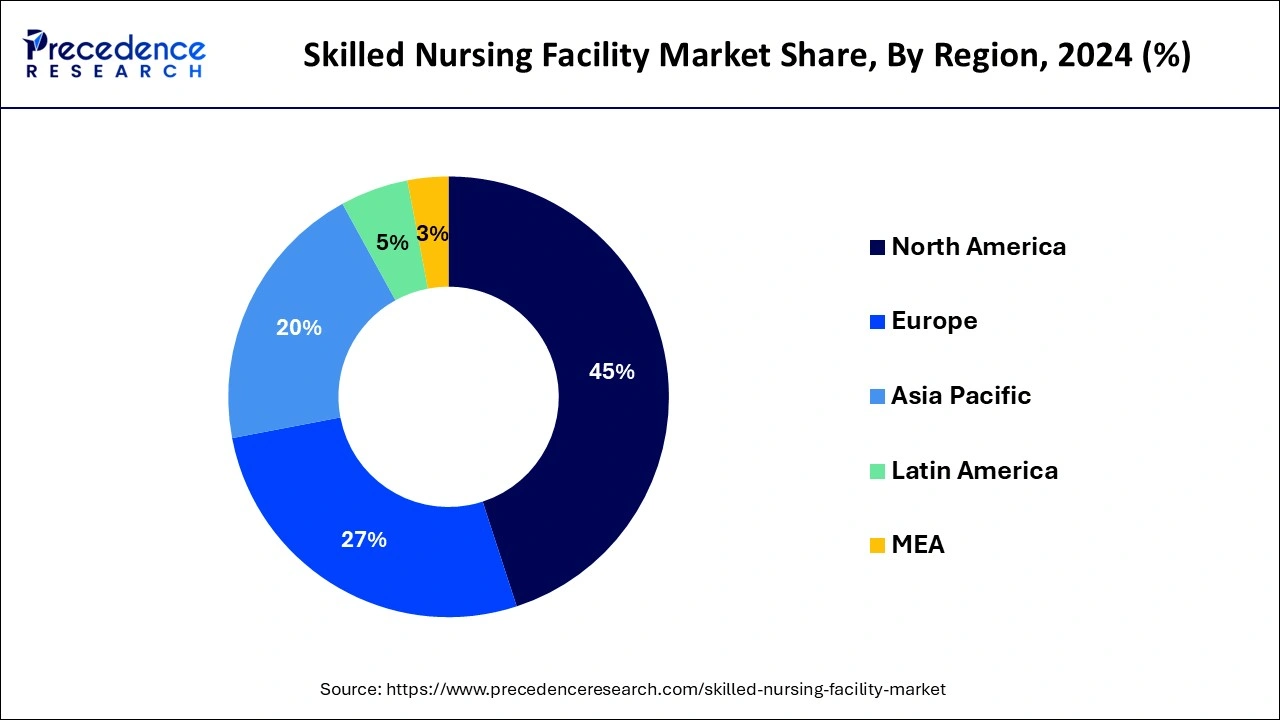

North America dominated the global skilled nursing facility market with the largest market share of 45% in 2024. This can be attributed to the increased prevalence of chronic diseases, growing geriatric population, increased adoption of skilled nursing facilities, and increased healthcare expenditure. According to the Population Reference Bureau, the number of people aged 65 years and above is expected to reach at 95 million in US by 2060. In 2018 this number was 52 million. Moreover, it is estimated that around 60% of the USA population is suffering from one or more chronic diseases. Furthermore, the favorable reimbursement policies and implementation of necessary updates in the policies is fueling the growth of the market. For instance, in 2019, the Centers for Medicare and Medicaid Services (CMS) introduced a patient driven payment model that categorizes the skilled nursing facility inpatient stays.

Asia Pacific is estimated to be the most opportunistic market during the forecast period. This is attributable to the rapidly growing geriatric population in the region coupled with the rising prevalence of chronic diseases. According to the United Nations, about 80% of the old age people are expected to live in low and middle income countries by 2050. Moreover, the rapid urbanization, rapid industrialization, unhealthy food habits, and rising pollution levels are contributing towards increasing the number of patients. The growing penetration of the skilled nursing facilities in this region is expected to have a significant impact on the market growth in the forthcoming years. Moreover, the growing number of nuclear families, improving access to healthcare services, and rising healthcare spending is expected to augment the growth of the Asia Pacific skilled nursing facility market.

Skilled nursing facilities are well-known for providing efficient and quality care services at affordable costs compared to hospitals. They provide high-quality care services to patients in the convenience of their own homes. Skilled nursing facilities provide important personal care and healthcare services like bathing, preparing meals, taking regular medication, dressing, and other chores. The skilled nursing facility market is experiencing significant growth due to the increasing demand for high-quality care services among older people, coupled with the growing geriatric population. According to the World Health Organization (WHO), the number of people aged 60 years and older outnumbered children younger than 5 years in 2020. By 2030, 1 in 6 people in the world will be aged 60 years or over.

| Report Coverage | Details |

| Market Size in 2025 | USD 414.14 Billion |

| Market Size by 2034 | USD 895.01 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.94% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Facility Type, Ownership Type, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rising occurrences of chronic disorders, such as diabetes, heart disease, and dementia, among elderly people drives the market growth. These diseases often necessitate specialized care, which is often best provided by skilled nursing facilities (SNFs). These facilities are equipped to offer comprehensive medical support, rehabilitation services, and daily living assistance tailored to the unique needs of older adults, ensuring they receive appropriate care in a structured environment. Moreover, the rising instances of age-related disorders and disability boost the growth of the market.

Despite the growing demand for skilled nursing services, there is a persistent shortage of qualified nursing professionals, including registered nurses and licensed practical nurses. This shortage can severely impact the quality of care provided, as well as the overall operational efficiency of SNFs, causing a hindrance to market growth. Furthermore, there is a significant rise in the number of home healthcare providers. This intensifies competition and poses challenges for existing facilities.

The advent of remote patient monitoring and virtual consultations presents a significant opportunity to enhance the quality of care delivered in skilled nursing facilities. These innovations can facilitate better communication between healthcare providers and patients, reduce the likelihood of hospital readmissions, and improve patient satisfaction. Additionally, skilled nursing facilities play an essential role in post-acute care, providing vital rehabilitation and support to patients transitioning from hospital settings back to their homes. This transitional care is crucial for ensuring optimal recovery outcomes and minimizing complications, making SNFs indispensable in the continuum of care for elderly populations.

The freestanding segment dominated the global skilled nursing facility market in 2024. Freestanding is the most affordable facility type that provides 24/7 services to the patients. The high Medicare payments is a major factor that boosts the growth of this segment. As per the MedPac, the average margin for Medicare for the freestanding skilled nursing facility was over 11%. As per the California Hospital Association, CMS, an increase of 2.4% in the Medicare payments to the skilled nursing facilities was implemented in 2020. Therefore, the growing Medicare expenses is expected to further boost the growth of the freestanding segment in the forthcoming years.

On the other hand, the hospital segment is expected to witness a considerable growth rate during the forecast period. The hospital-based skilled nursing facilities provides better and specialized nursing services to a patient due to the joint operations of the hospitals and its skilled nursing facilities. The adoption of the better infrastructure in hospitals and better communication and co-ordinations helps the hospital skilled nursing facilities to enhance their services based on the patients’ requirements.

The profit segment dominated the global skilled nursing facility market in 2024. The for-profit skilled nursing facilities are wholly driven by generating maximum revenues and profit for the owners and the investors by providing customer centric and quality services. The urge to generate more profits among the for-profit skilled nursing facilities motivates them to put extra efforts in providing quality care to the patients that boosts the demand for the for-profit skilled nursing facility.

On the other hand, the non-profit is estimated to be the fastest-growing segment during the forecast period. This is attributed to the reinvestment of the generated revenues to improve services, increase staffing, and providing services at much lower or minimal costs to the geriatric people.

The skilled nursing facility market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

By Facility Type

By Ownership Type

By Services Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2024

July 2024

July 2024

February 2024