April 2025

Skin Packaging Market (By Material: Plastics, Paper & Paperboard, Others; By Type: Carded, Non-carded; By Application: Food, Consumer Goods, Industrial, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

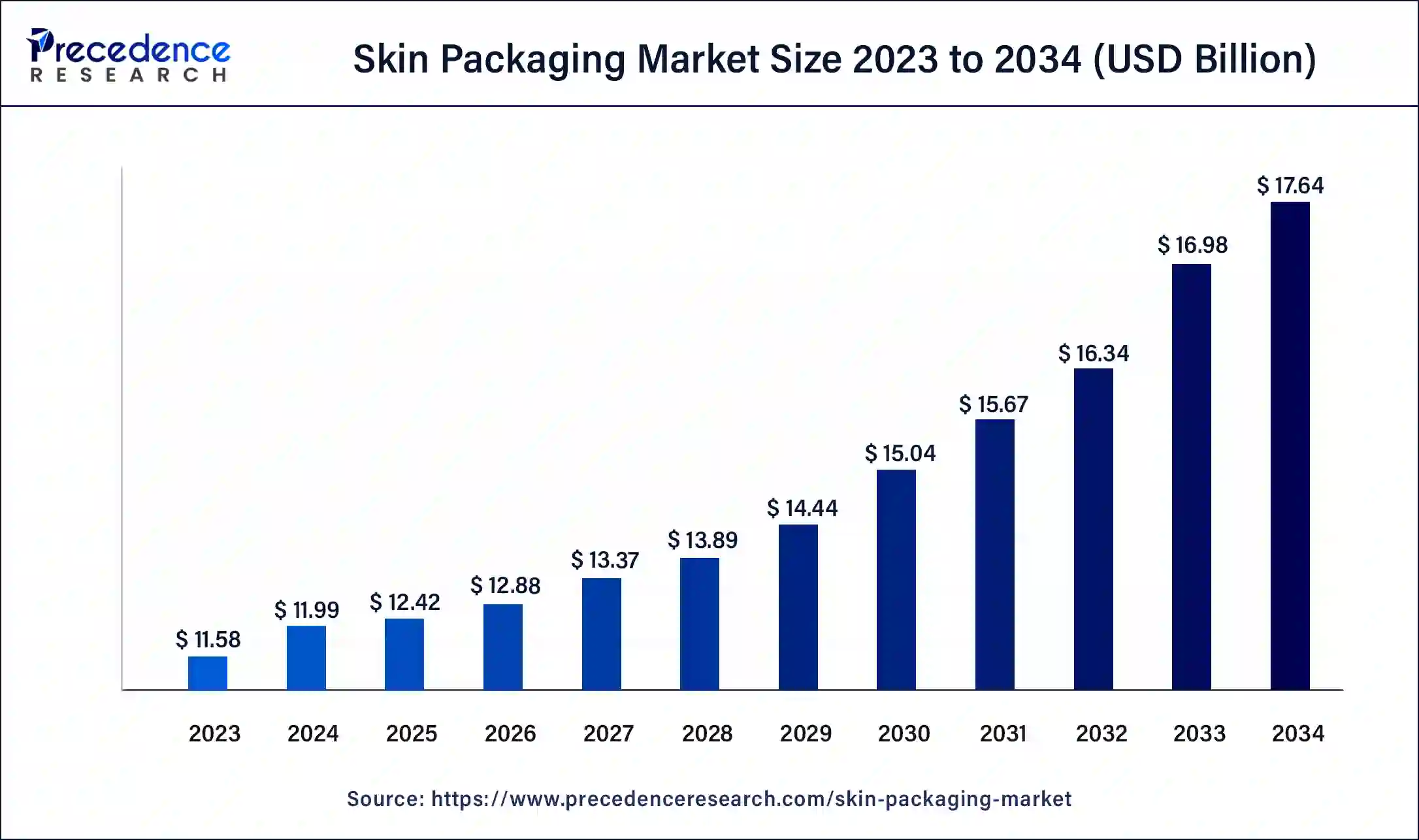

The global skin packaging market size was USD 11.58 billion in 2023, calculated at USD 11.99 billion in 2024 and is expected to reach around USD 17.64 billion by 2034, expanding at a CAGR of 4% from 2024 to 2034.

The skin packaging sector pertains to a niche within the packaging industry, wherein products undergo a meticulous process of hermetic enclosure within a transparent plastic film that molds closely to their contours. This technique elevates product visibility and safeguarding while concurrently mitigating packaging-related waste. Skin packaging primarily caters to items like comestibles, electronics, and consumer merchandise. The burgeoning of this market is attributed to the heightened appetite for environmentally-conscious packaging, visual allure, and product preservation. This approach offers manufacturers an economical and effective means to encase their wares, rendering it an avant-garde choice across diverse industries, especially those emphasizing sustainability and aesthetics.

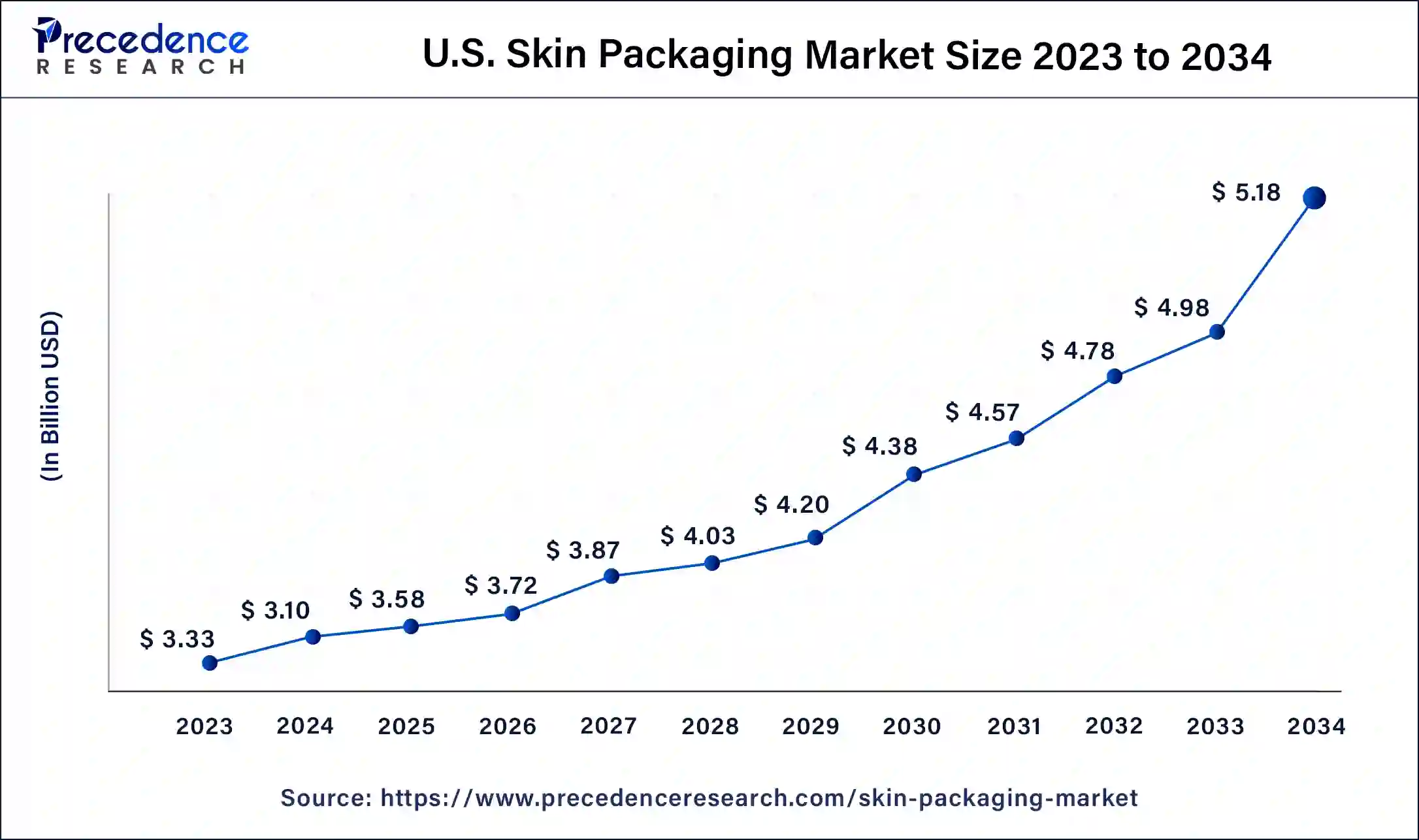

The U.S. skin packaging market size was valued at USD 3.26 billion in 2023 and is projected to reach USD 5.03 billion by 2033, registering a CAGR of 4.47% from 2024 to 2033.

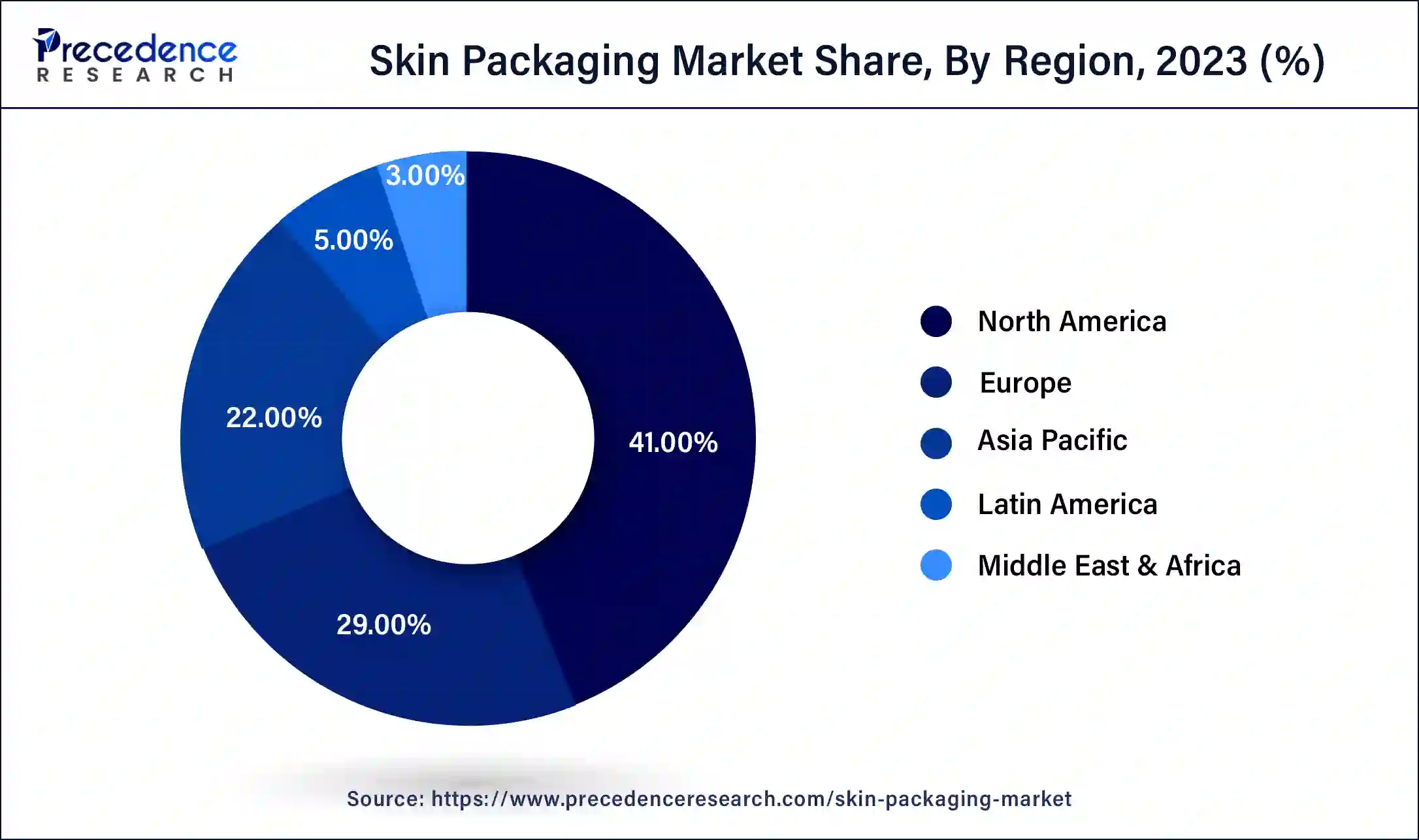

North America held the largest revenue share 40.14% in 2023. North America commands a substantial share of the skin packaging market due to several key factors. The region benefits from a strong consumer base with a penchant for eco-friendly and visually appealing packaging. Additionally, North American industries, such as food and electronics, rely heavily on efficient product protection and branding, areas where skin packaging excels. Regulatory compliance and quality standards in the region also favor the adoption of skin packaging. Furthermore, the well-established e-commerce sector in North America has further propelled the demand for secure and visually appealing packaging, solidifying the region's prominent position in the skin packaging market.

Asia Pacific is estimated to observe the fastest expansion. The dominant growth of Asia Pacific in the skin packaging market can be attributed to various compelling factors. This robust market share is driven by the flourishing manufacturing sectors, particularly in nations like China, India, and South Korea, which exhibit a heightened demand for packaging solutions that are not only cost-effective but also versatile.

Skin packaging aligns perfectly with this requirement, emerging as the preferred choice for a wide spectrum of products emanating from these vibrant economies. Furthermore, the thriving e-commerce landscape in the Asia-Pacific region has accentuated the necessity for packaging that combines both protective qualities and visual appeal, where skin packaging has emerged as a leader. Its remarkable adaptability to a diverse array of product shapes and dimensions further bolsters its prominence within this dynamic marketplace.

The relentless surge in ecological awareness and the call for sustainable packaging practices has become a pivotal driving force behind the skin packaging market's expansion. In response to the mounting demands from both consumers and regulatory authorities, skin packaging is rapidly gaining traction. It excels in its ability to minimize superfluous packaging materials, opting for a more compact and resource-efficient approach to product protection. This reduction in waste and the incorporation of recyclable materials contribute to a substantially reduced environmental impact, rendering skin packaging the preferred choice for companies dedicated to fulfilling their corporate sustainability commitments.

In the realm of consumer allure and market attraction, skin packaging emerges as a frontrunner. It endows products with the gift of transparency, enabling consumers to intimately acquaint themselves with the items they intend to purchase. This transparency plays an instrumental role in fostering consumer trust and confidence, especially in industries like food and consumer goods. The capacity to emblazon branding and marketing messages directly onto skin packaging augments brand recognition and effectively conveys vital product information.

Skin packaging stands out as an exemplar of product preservation. The hermetically sealed plastic film acts as a formidable shield, safeguarding products against external pollutants, including dust and moisture, thus preserving their quality and extending their shelf life. This facet bears paramount importance in the food industry, where product freshness and hygiene are non-negotiable. Additionally, the capability to vacuum-seal products in skin packaging mitigates the risks of tampering and damage during transit.

Skin packaging presents itself as a financially judicious choice for manufacturers. Adhering closely to product contours, it diminishes the necessity for excessive packaging materials, thereby significantly reducing packaging expenditures. Furthermore, its streamlined design curtails the spatial requisites for warehousing and transportation, resulting in diminished logistical overheads. Such cost efficiency can be a potent motivator for enterprises aiming to optimize their packaging procedures.

The versatility of the skin packaging method extends its applicability across a myriad of industries, encompassing realms such as food, electronics, consumer goods, and pharmaceuticals. This adaptability heightens its appeal as an encompassing solution suitable for an eclectic range of products, ranging from perishable goods to fragile electronic components. Manufacturers can leverage this versatility to streamline their packaging operations and cater to diverse market segments, thus contributing to the sustained upswing of skin packaging.

The ongoing evolutionary journey of packaging technology plays an instrumental role in the flourishing trajectory of the skin packaging market. Technological innovations in machinery and materials have unlocked new horizons, making skin packaging more efficient and accessible to a broader spectrum of businesses. For instance, the advancements in skin packaging equipment have not only augmented the pace and precision of the packaging process but also rendered it a more viable option for high-volume production scenarios.

| Report Coverage | Details |

| Market Size by 2034 | USD 17.64 Billion |

| Market Size in 2023 | USD 11.58 Billion |

| Market Size in 2024 | USD 11.99Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Type, Application, by Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sustainability and eco-friendly packaging

Sustainability and eco-friendly packaging represent a driving force behind the notable growth of the skin packaging market. In an era marked by heightened environmental consciousness and increasing demand for responsible business practices, skin packaging has emerged as a prominent solution. It is revered for its capacity to align with sustainability objectives in several ways.

Firstly, skin packaging minimizes environmental impact through its reduction of packaging material usage. The tight, conforming fit of the plastic film to the product significantly decreases the amount of material required, thereby reducing waste and conserving resources. This aspect resonates strongly with environmentally conscious consumers who favor products with reduced ecological footprints. Secondly, the use of recyclable and environmentally friendly materials in skin packaging adds to its eco-credentials. This aspect contributes to the circular economy by promoting the use of materials that can be recycled or reused, thus reducing the overall strain on natural resources.

Furthermore, the compact nature of skin packaging allows for efficient transportation and storage. Reduced packaging volume translates to lower carbon emissions during transportation and the optimization of storage space, which aligns with sustainability goals aimed at reducing energy consumption and emissions. In essence, sustainability and eco-friendliness are pivotal in driving the growth of the skin packaging market.

Higher initial equipment costs

The higher initial equipment costs present a significant restraint to the growth of the skin packaging market. Skin packaging requires specialized machinery and equipment to achieve the precise sealing and vacuum-forming necessary for this packaging method. These machines can be considerably more expensive compared to equipment used for other packaging techniques. For smaller businesses or those with limited financial resources, the high upfront investment in skin packaging machinery can be a substantial barrier to adoption. It may hinder their ability to leverage the benefits of skin packaging, which includes improved product visibility, sustainability, and brand recognition.

The cost of the machinery, coupled with training and maintenance expenses, can strain budgets and delay the decision to embrace skin packaging. Furthermore, these high initial costs can deter companies from exploring the potential benefits of skin packaging, limiting market growth. To overcome this challenge, manufacturers and equipment suppliers need to find ways to make skin packaging machinery more accessible and cost-effective for a wider range of businesses, thus facilitating market expansion.

E-commerce packaging

E-commerce packaging is opening doors of opportunity within the skin packaging market, catering to the distinctive requirements of the digital retail realm. As the e-commerce landscape expands, there's an escalating need for packaging that simultaneously safeguards products during shipping, amplifies their visual appeal, and strengthens brand recognition. Skin packaging emerges as an ingenious solution for e-commerce entities, ensuring products remain unscathed in transit while presenting them in a crystal-clear, captivating manner. This not only elevates the unboxing experience for customers but also instills trust in the product's quality.

Skin packaging is particularly well-suited for petite items and those with unconventional shapes common occurrences in the e-commerce sector, making it an enticing choice for businesses navigating this virtual market. Its adaptability to diverse product dimensions and forms establishes it as the ideal answer to meet the evolving packaging requisites of the e-commerce industry, solidifying its role as a principal growth avenue in the skin packaging domain.

Impact of COVID-19

The COVID-19 pandemic wreaked havoc on global supply chains, impacting the skin packaging market. Lockdowns, travel restrictions, and labor shortages disrupted the production and transportation of packaging materials and equipment. This led to delays in manufacturing and increased costs. The pandemic also highlighted vulnerabilities in supply chains, prompting companies to reevaluate and strengthen their sourcing strategies, potentially reshaping the landscape of suppliers and materials within the skin packaging market.

With lockdowns and social distancing measures in place, e-commerce experienced a surge in demand during the pandemic. This boosted the need for effective packaging solutions, including skin packaging, to protect products during shipping. E-commerce businesses turned to innovative packaging solutions to ensure products reached consumers safely and attractively. This created an opportunity for the skin packaging market, as e-commerce players sought solutions that could combine product protection, visual appeal, and cost-effectiveness to meet the growing demands of online shoppers.

The pandemic altered consumer behavior, with more people opting for packaged and pre-packaged goods due to safety concerns. This change in behavior impacted the types of products being packaged and the design of packaging, presenting an opportunity for innovation within the skin packaging market. Companies had to adapt to meet the needs of consumers who prioritized hygiene and safety, leading to modifications in packaging design and materials. This shift in consumer preferences created a potential avenue for the skin packaging market to provide solutions that catered to these evolving demands, emphasizing product protection and tamper-evidence.

According to the material, the plastics segment has held a 46% revenue share in 2023. The plastics segment holds a major share in the skin packaging market due to its versatility, cost-effectiveness, and the ability to offer a strong protective barrier around products. Skin packaging primarily involves using a transparent plastic film to tightly encase items, providing excellent product visibility while safeguarding against environmental contaminants. Plastics are the preferred choice as they can conform to various product shapes, allowing for customization and branding. Additionally, plastic materials can be sourced sustainably, aligning with the growing emphasis on eco-friendly packaging. This combination of adaptability, protection, and sustainability has propelled plastics to dominate the skin packaging market.

The others segment is anticipated to expand at a significant CAGR of 4.8% during the projected period. The others segment holds a substantial growth in the skin packaging market due to its diverse and versatile nature. This category encompasses various packaging materials beyond traditional plastics and boards, such as recycled materials, sustainable alternatives, and specialty films. As sustainability gains prominence, businesses are increasingly exploring innovative and eco-friendly materials for skin packaging. This segment allows for customization and adaptation to specific product needs, making it a popular choice for companies seeking environmentally responsible solutions and those looking to differentiate their products with unique, specialized materials. The flexibility and adaptability of the others segment contribute to its significant market growth.

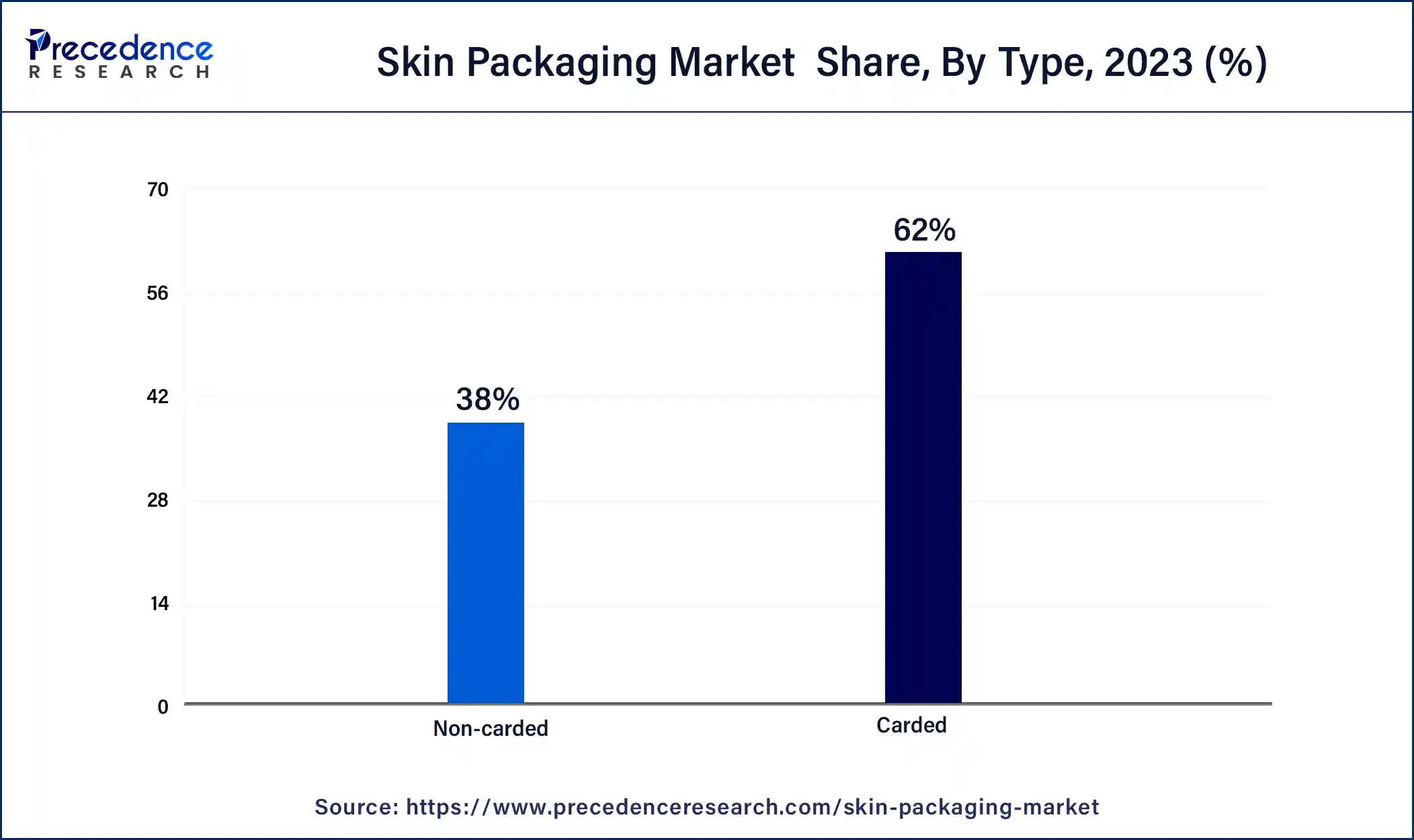

The type, non-carded segment is anticipated to hold the largest market share of 61.80% in 2023. The dominance of the non-carded segment in the skin packaging market can be attributed to its adaptability and economic advantages. Non-carded skin packaging stands out for its capacity to securely encase products without the requirement of a supporting card, rendering it suitable for a diverse array of product contours and dimensions. Its efficiency, affordability, and eco-friendly attributes have made it an alluring choice across a spectrum of industries, notably in the realms of food and consumer goods. Moreover, its ability to reduce material consumption aligns seamlessly with sustainability objectives, further solidifying its preeminence in the market.

On the other hand, the carded segment is projected to grow at the fastest rate over the projected period. The carded segment holds a major growth in the skin packaging market primarily due to its versatility and cost-effectiveness. Carded skin packaging involves sealing products to a cardboard or paperboard backing, which provides excellent product visibility and protection. This method is widely adopted because it is suitable for a diverse range of product shapes and sizes, making it appealing to various industries. The cost efficiency and customizable branding opportunities also contribute to its popularity. Moreover, carded skin packaging aligns with sustainability goals as it minimizes material waste, resonating with the increasing demand for eco-friendly packaging solutions.

The food segment had the highest market share of 36%in 2023 based on the sales channel. The food segment holds a significant share in the skin packaging market due to the method's effectiveness in preserving food quality and extending shelf life. Skin packaging provides a secure and airtight seal that protects perishable items, preventing contamination and spoilage. Its transparent nature enhances product visibility, fostering consumer trust. Furthermore, it minimizes food waste by reducing the risk of damage during transportation and storage. These advantages make skin packaging a preferred choice for the food industry, aligning with the sector's critical needs for food safety, freshness, and presentation, thus contributing to its major share in the market.

The industrial segment is anticipated to expand at the fastest rate over the projected period. The industrial segment holds a significant share of the skin packaging market due to its unique packaging requirements. In the industrial sector, where items can vary in size, shape, and weight, skin packaging offers a versatile and protective solution. It secures heavy machinery parts, delicate electronic components, and irregularly shaped industrial goods with ease. This protective packaging reduces the risk of damage during transit, ensuring that products reach their destinations intact. Additionally, the ability to print branding and crucial information directly on the skin packaging enhances product identification and traceability, a critical need in industrial applications.

Segments Covered in the Report

By Material

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

March 2025