October 2024

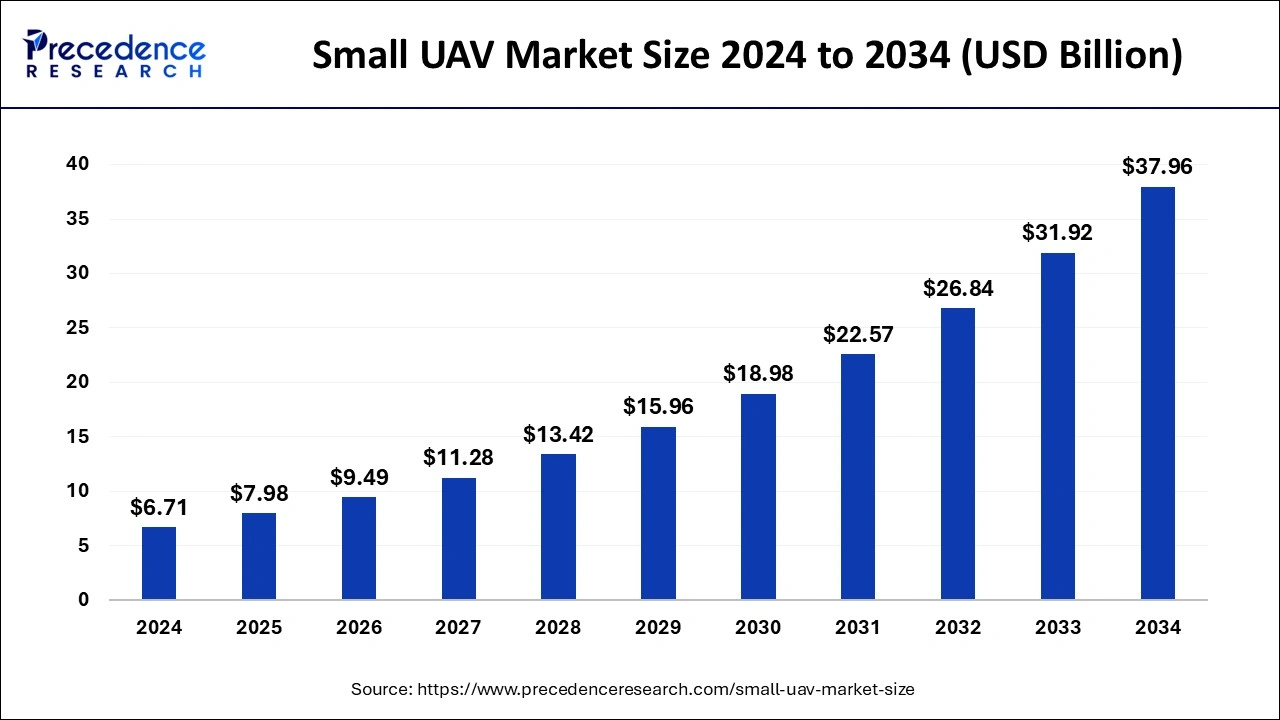

The global small UAV market size is calculated at USD 7.98 billion in 2025 and is forecasted to reach around USD 37.96 billion by 2034, accelerating at a CAGR of 18.92% from 2025 to 2034. The North America small UAV market size surpassed USD 2.48 billion in 2024 and is expanding at a CAGR of 19.09% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global small UAV market size was estimated at USD 6.71 billion in 2024 and is anticipated to reach around USD 37.96 billion by 2034, expanding at a CAGR of 18.92% from 2025 to 2034. The small UAV market has seen a growth with rising demand for its applications across the military sector.

Artificial Intelligence (AI) has many applications in UAVs. They can help these machines interact in an intelligent way. AI technology can easily combine with other technologies like Internet of Things (IoT) and machine learning (ML) which further widens its scope of application. AI technology can help enhance aerial imaging, data collection, predict patterns etc., which can be extremely useful for different sectors. For example, in defense industry, AI enabled small UAV can detect thermal signatures and objects that can prove crucial for the military objective. The other application of AI technology in small UAV includes crowd counting, tracking, compliance checking, license plate reading, face recognition, smoke detection etc. The integration of AI technology into small UAV infrastructure could change the landscape of the small UAV market in the forecast period.

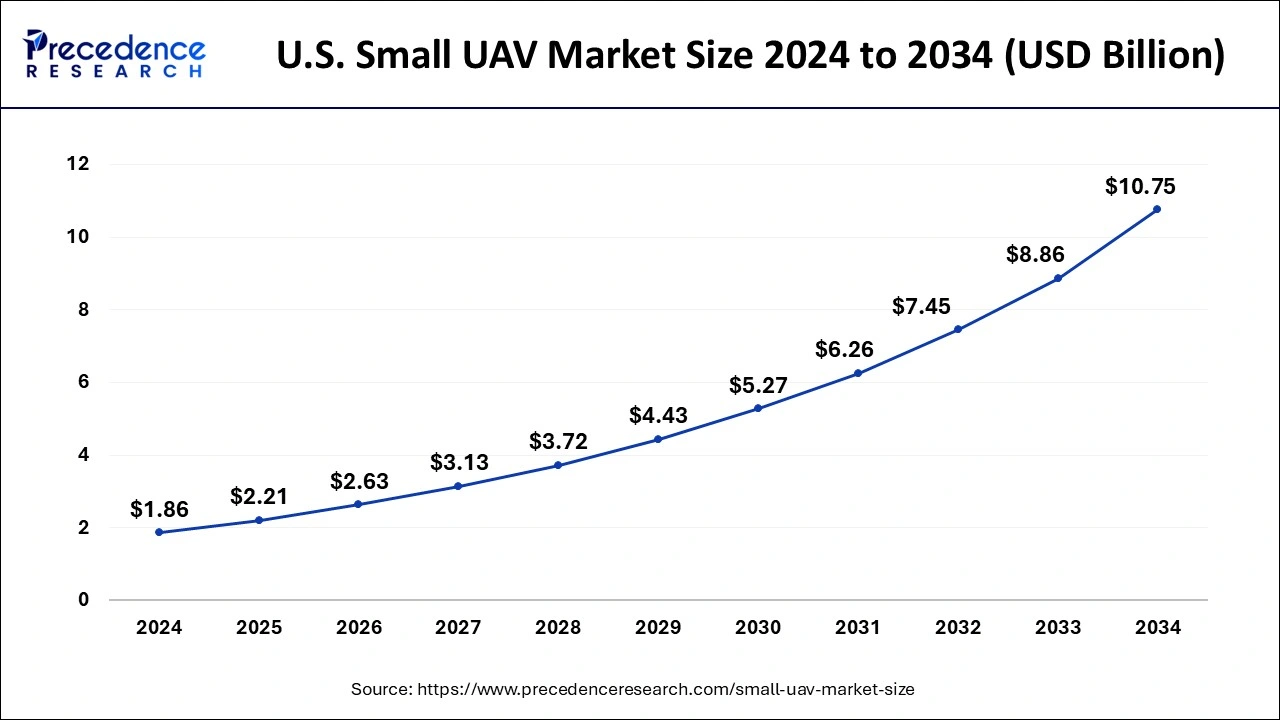

The U.S. small UAV market size was evaluated at USD 1.86 billion in 2024 and is predicted to be worth around USD 10.75 billion by 2034, rising at a CAGR of 19.17% from 2025 to 2034.

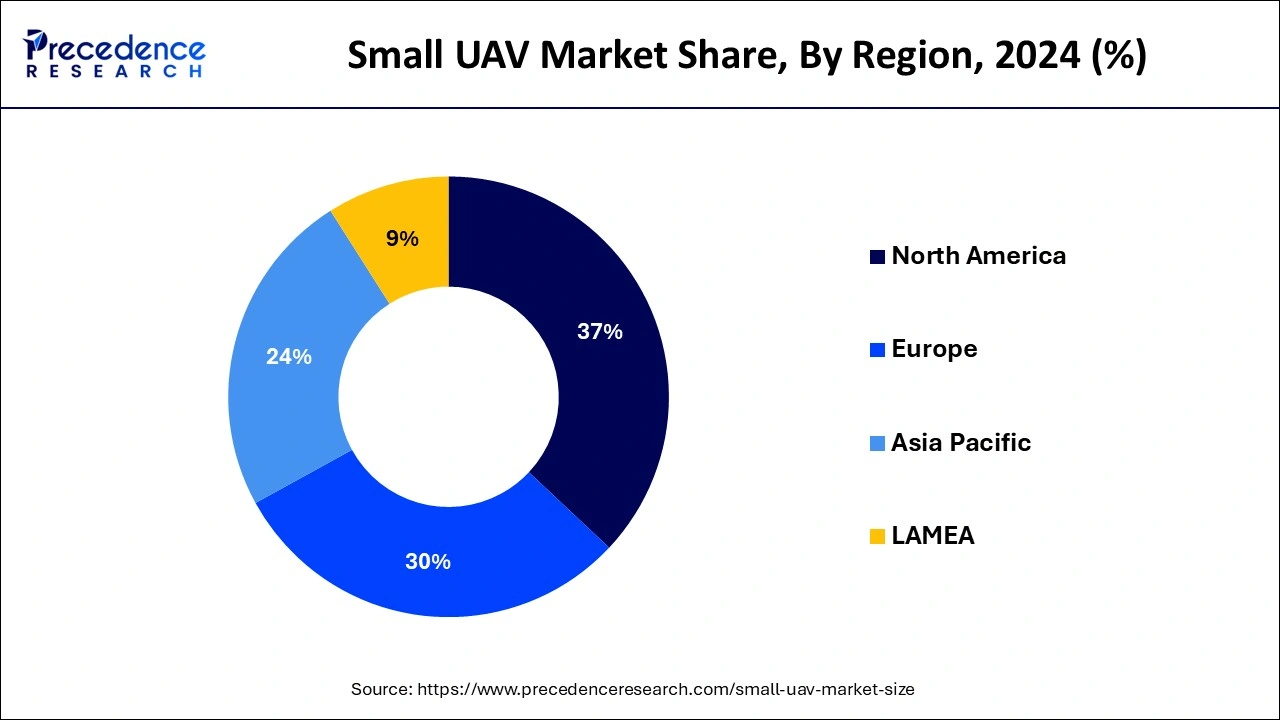

The research report covers key trends and prospects of small UAV products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. Geographically, small UAV market is conquered by North America owing to cumulative practice of UAVs for border and maritime surveillance actions in nations like the U.S. and Canada. North America dominated the global market with the highest market share of 37% in 2024. It is expected to continue a stronghold during the forecast period. On the other hand, Asia-Pacific is anticipated to witness the rapid growth rate, on account of expansion of defense capabilities in crucial economies such as India, China, Japan, and South Korea.

The region of Europe was the second biggest market for the small UAV market in 2024. It held approximately 30% of market share. European Union Aviation Safety Agency has established proper regulations and compliances for safe operations of drones which has increased their applications across different industries. Germany, UK and France are the countries which are adopting small UAVs on a larger scale for different sectors like agriculture, infrastructure inspections and defense.

The intensifying realization of the UAV implementation in military operations has encouraged vendors to present UAVs that can be employed in plentiful commercial applications. These UAVs are also receiving receptions in other applications such as aerial photography, internet provision in remote places, and video recording, document wildlife and survey, and public service missions. Numerous corporations mainly offer small-UAVs that are utilized in aerial photography, agricultural, and data collection applications. As numerous nations seek to upsurge their military surveillance capability, enormous investments are being made in the advancement of small drones. The market growth is also driven by an increasing need for efficient monitoring and data collection in agricultural practices. The expanding applications of small UAVs in industries like environmental monitoring, public safety, inspection of infrastructure etc. are further pushing the demand for the small UAV market.

| Report Highlights | Details |

| Market Size in 2025 | USD 7.98 Billion |

| Market Size by 2034 | USD 37.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.92% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for aerial data collection

The growing necessity for aerial data collection is a major factor driving the small UAV market. Different organizations are utilizing and realizing the importance of drones in order to gather data that can assist in decision making as well as operational efficiency. Many organizations are seeking ways to streamline their operations and lower their costs. The adoption of UAV for the purpose of data collection is significantly increase. According to the World Bank, precision agricultural practices powered by UAV technology could rise the crop yields by almost 20%. Agriculture is one of sectors that is leveraging UAV technology for aerial data collection the most presently.

Limitations in infrastructure

A crucial challenge for the small UAV market is the lack of supportive or limited infrastructure. The lack of air traffic management systems that are designed to incorporate drones and their efficient operations in urban areas are lacking. These systems are traditionally designed for aircrafts and are not suitable to accommodate operations for drones. There is ongoing research for development of systems that can work for smooth drone operations. For example, the National Aeronautics and Space Administration (NASA) is working on systems of unmanned aircraft traffic management. These systems will require time for wide scale implementation. This s a major challenge for the small UAV market to tackle during the forecast period.

Regulations and Safety Standards

The ongoing efforts being taken to ensure safety and regulation by government and other agencies will help organizations. There is no specific set of compliances or standards for small UAV manufacturers. A proper framework will help create a quality standard to maintain for small UAV companies. The key players can improve upon their safety, reducing any operational errors. The consistent quality will automatically help improve operations and efficiency of these systems. The Federal Aviation Administration (U.S.) is working diligently on creating a standard of regulations and compliances that will help small UAV improve in quality and operate safely. The opportunity for enhancement in operational efficiency as well as technological innovations will be an easier task for the key players.

The rotary blade segment held the majority market share in 2024 and is anticipated to continue its growth during the forecast period. Rotary blade segment recorded the prime market share in the global small UAV Market in 2021. The key cause for the hefty share of the rotary blade segment is its ease-of-operation and capability to help in examination and surveillance, thus making them striking for both military and civilian usages. Rotary blade UAVs subsidized to above 70% of the global revenue in due to their ability to traverse numerous directions as well as hover in a specific position which makes them idyllic for a huge array of applications.

In the commercial and civil application sector, rotary blades mall UAVs find usage in meteorology, entertainment purposes, product delivery, disaster relief, firefighting, and search & rescue among others. Rotary blade type UAVs are preferred over fixed wing due to core downside of a fixed-wing aircraft is their failure to hover in one spot and high cost. Helicopters are very popular in manned aviation, nonetheless presently only fill a trivial niche in the drone marketspace.

On basis of application, the defense segment is expected to show the quickest growth during the forecast period. With ongoing conflicts in the Middle East and Europe is increasing countries interests in developing military infrastructure. Also, driven by lessons from the conflicts in Afghanistan and Iraq, countries across the globe are anticipated to endure adding UAVs to their military arsenals, boosting annual worldwide expenditure for defense drones by 36% over the impending decade. The paradigm shift in favor of unmanned systems imitates the military’s general tendency to be at par with the most cutting-edge technology accessible and insights of the advent of asymmetrical warfare.

Developing military powerhouses including India, China, and Iran are upgrading their UAV collection to counter the hazard of being outgunned on the aerial front. Almost all countries are tightening their military infrastructure to protect their sovereignty which has increased the demand for drones for defense application. This segment is expected to show promising growth.

Players with higher technical competences are likely to subsidize suggestively toward technological advancements in the payload and propulsion systems features of the UAVs. Leading competitors contending in global small UAV market are as follows:

In order to better recognize the current status of acceptance of UAVs, and policies adopted by the foremost countries, Precedence Research predicted the future evolution of the small UAV market. This research study bids qualitative and quantitative insights on small UAV market and assessment of market size and growth trend for potential market segments.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024