January 2025

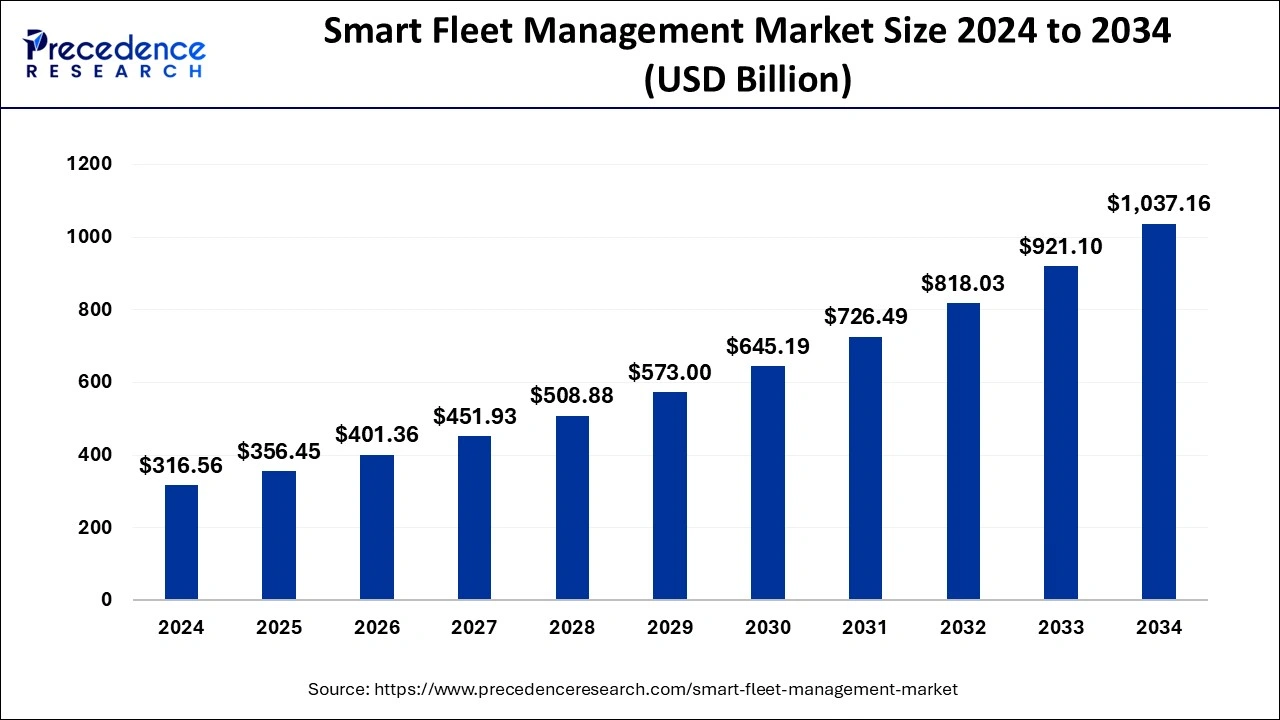

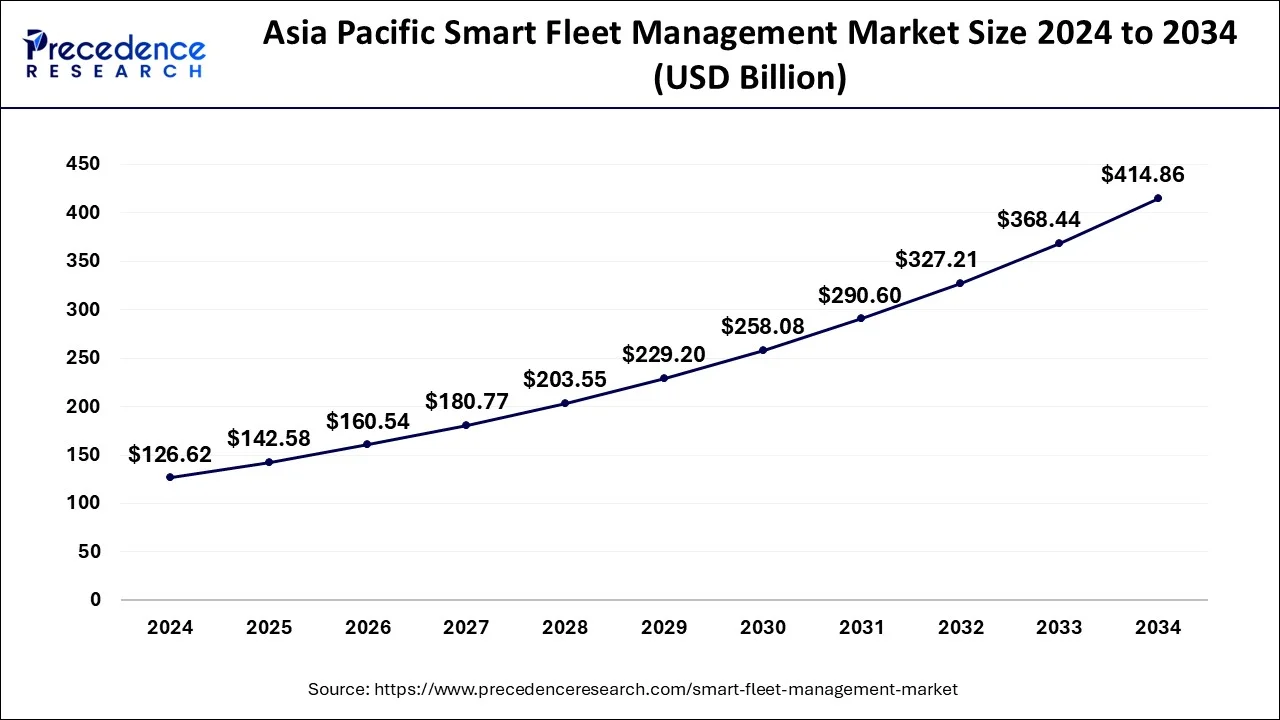

The global smart fleet management market size is calculated at USD 356.45 billion in 2025 and is projected to surpass around USD 1,037.16 billion by 2034, expanding at a CAGR of 12.6% from 2025 to 2034. The Asia Pacific smart fleet management market size is estimated at USD 142.48 billion in 2025 and is expanding at a CAGR of 12.8% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart fleet management market size accounted for USD 316.56 billion in 2024 and is expected to be worth around USD 1,037.16 billion by 2034, at a CAGR of 12.6% from 2025 to 2034. The increasing demand for connected and enhance performance fleet management for improving driver performance, increased vehicle lifespan, and reduce overhead costs that collectively drives the growth of the market.

The evaluation of artificial intelligence into the automotive industry is having the potential to revolutionize the landscape of fleet management. AI aims to streamline and improve operational efficiency with combining new standards and strategic foresights. AI helps in adapting the proactive approach to vehicle maintenance. AI predict and analyze the potential breakdown in the vehicle by predictive maintenance technologies which helps in mitigating the heavier cost of maintenance and unexpected failure of system.

The Asia Pacific smart fleet management market size was estimated at USD 126.62 billion in 2024 and is predicted to be worth around USD 414.86 billion by 2034, at a CAGR of 12.8% from 2025 to 2034.

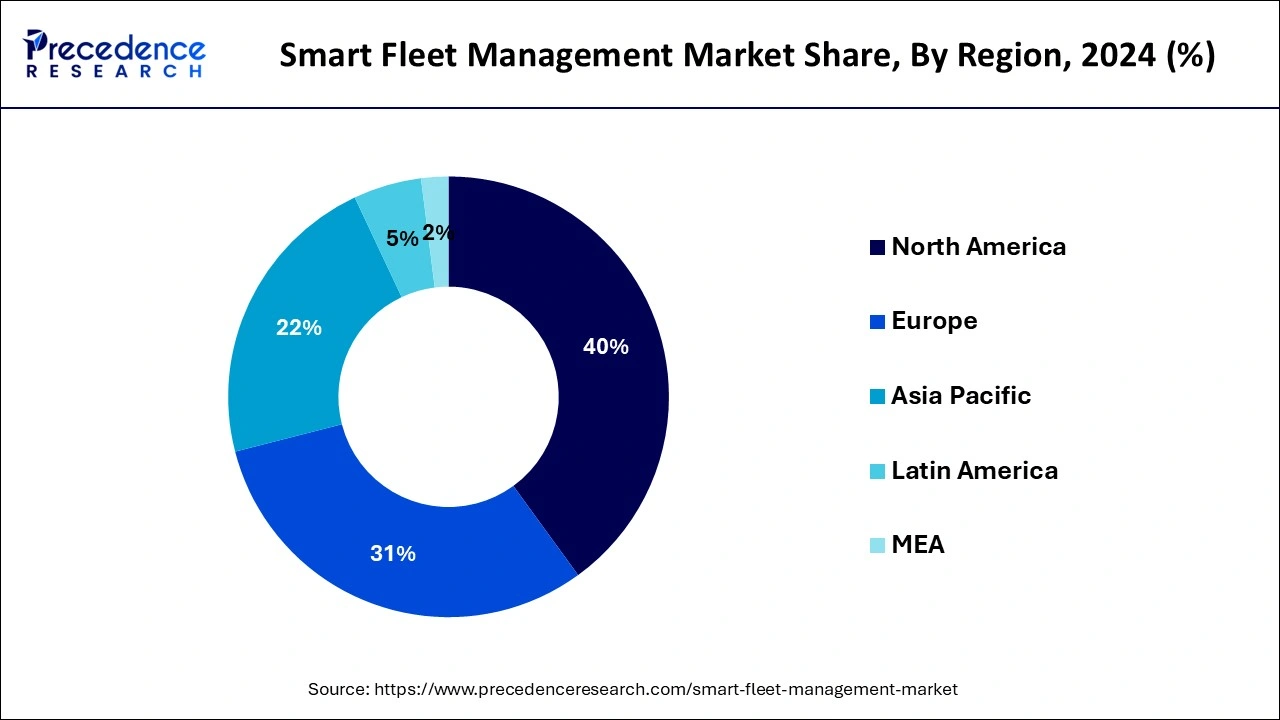

The Asia Pacific accounted for the largest market value share in the global smart fleet management market in the year 2024 and anticipated to register lucrative growth during the foreseen period. This is attributed to the increasing transportation facilities in the developing countries such as India, Japan, China, Singapore, Korea, and Malaysia. This is analyzed that with the rise in the adoption of connectivity solutions, the market for ADAS technology would grow prominently in the forthcoming period.

Furthermore, increasing number of accident cases across the region also significantly boost the requirement for vehicle safety features to curtail the number of deaths due to road accidents across the Asia Pacific. As per the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), the region accounted for nearly 62% of the total deaths occurred due to road accidents that is one of the leading causes of disability and death in the region. In the wake of same, the government of the various countries in the Asia Pacific has mandated the implementation of vehicle safety technology to curtail the number of increasing accidents and road fatalities.

The increasing demand for the efficient transportation system and the production and demand for the automotive industry from the countries like India, China, and Japan, owing to rising population and disposable income in people. Additionally, the demand for connected or advanced fleet management boosts the growth of the smart fleet management market.

North America is expecting a significant growth in the market during the forecast period. the rising demand for the automobile industry and the technological advancements in the automobile and fleet management in the countries like the United States and Canada is contributing in the growth of the smart fleet management market.

Need to enhance the vehicular safety and higher operational efficiency is one of the major factors to drive the growth of the market. Further, the integration of connected car technology in the vehicles has enhanced the fleet management operation. Initiatives taken by the government that aimed to create more secure and reliable transportation network plays an important role in the development of intelligent transport systems. Increasing road congestion, energy consumption, and carbon emission has significantly contributed towards the promotion of connected vehicles. Smart fleet management system helps the operator to obtain real-time information regarding fleet as well as saves cost and enhances the operational efficiency. Connected vehicles provide numerous advantages such as real-time tracking and monitoring.

However, lack of proper infrastructure for transfer of information in real time and to ensure seamless connectivity some of the prime factors that may restrict the market growth in the near future. Lack of adequate infrastructure especially in developing countries such as India and Mexico is a major challenge that hampers the growth of smart fleet management market. Moreover, rising concern for data breach and cyber-attack are the other prominent factors that equally diminish the growth prospect of the smart fleet management market.

| Report Highlights | Details |

| Market Size in 2024 | USD 316.56 Billion |

| Market Size in 2025 | USD 356.45 Billion |

| Market Size by 2034 | USD 1,037.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Hardware, Transportation, Connectivity, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

In 2024, automotive segment captured maximum market value share in the global smart fleet management market and projected to register the fastest growth over the forecast period. Numerous advantages offered by the connected vehicles such as remote diagnostics, fuel management, remote monitoring, route optimization, vehicle idle time, and predictive maintenance contribute prominently towards the growth of the segment. These solutions enable the operators in the fleet management business to reduce business risk as well as to optimize their fleet operations. Such operational benefits along with government support & initiatives for road and vehicle safety are likely to propel the market growth for automotive segment.

In terms of hardware, the Advanced Driver Assistance System (ADAS) expected to demonstrate the fastest growth over the analysis period. Although, governments of various regions have issued mandatory laws for the adoption of vehicle safety equipment, autonomous car technology has encountered stupendous growth in the recent past and predicted to exhibit the same trend in the coming years. This serves as one of the prime factor for the growth of ADAS segment in smart fleet management market.

ADAS comprises of various components such as LiDAR, RADAR, sensors, and image processing units that enhance the safety and also helps to avoid collisions. They also provide adaptive features such as automated lighting, cruise control, GPS navigation, automated brakes, and compatibility with smart devices, all of which contribute towards enhancing the driving experience.

By Hardware

By Transportation

By Connectivity

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

March 2025