January 2025

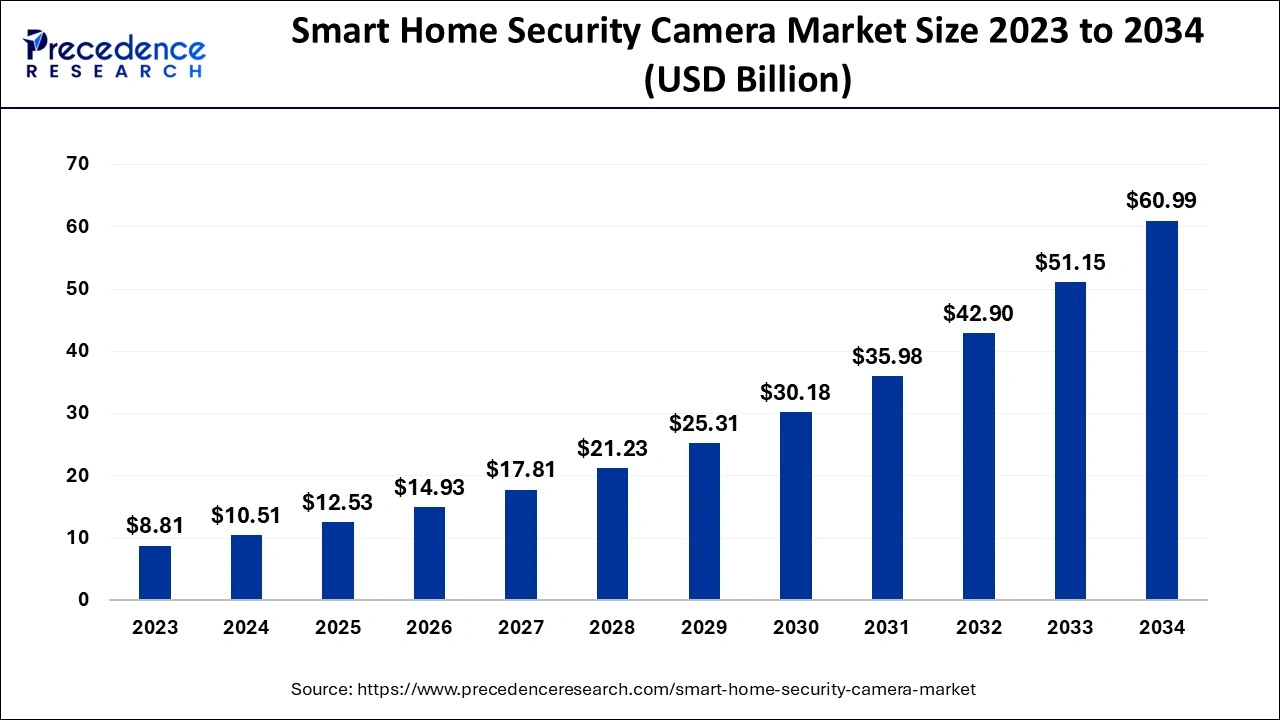

The global smart home security camera market size accounted for USD 10.51 billion in 2024, grew to USD 12.53 billion in 2025 and is expected to be worth around USD 60.99 billion by 2034, registering a double-digit CAGR of 19.23% between 2024 and 2034. The North America smart home security camera market size is exhibited at USD 4.31 billion in 2024 and is expected to grow at a CAGR of 19.37% during the forecast year.

The global smart home security camera market size is calculated at USD 10.51 billion in 2024 and is predicted to reach around USD 60.99 billion by 2034, expanding at a CAGR of 19.23% from 2024 to 2034. An increase in regional thefts is the key factor driving the market growth. Also, the increasing connectivity landscape along with the use of the Internet of Things (IoT) is expected to fuel the smart home security camera market growth shortly.

Artificial Intelligence (AI) plays a significant role in the smart home security camera market by improving security and decreasing the risk of threats. AI can differentiate between irrelevant movement and real threats to ensure appropriate security measures. Surveilling systems can utilize raw data to predict future security breaches. Furthermore, AI-powered cameras can be accessed remotely, enabling companies or individuals to keep watch on their possessions regardless of location.

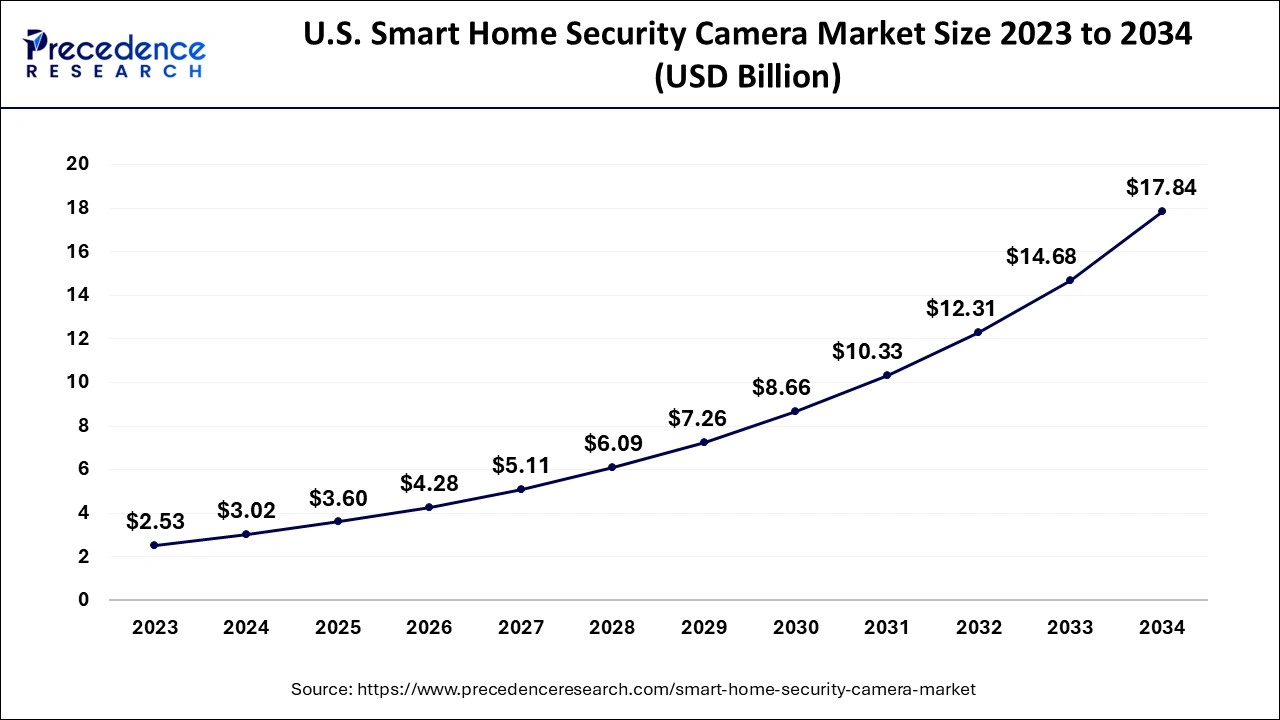

The U.S. smart home security camera market size is evaluated at USD 3.02 billion in 2024 and is projected to be worth around USD 17.84 billion by 2034, growing at a CAGR of 19.43% from 2024 to 2034.

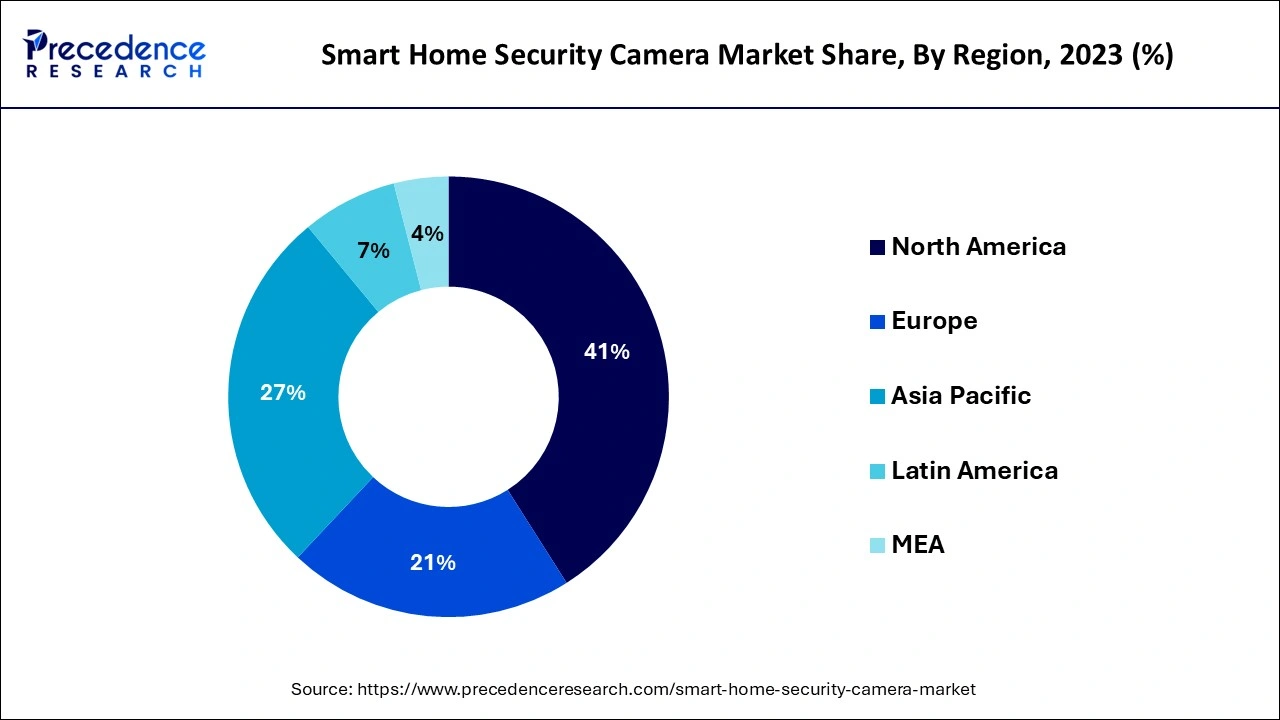

North America dominated the smart home security camera market in 2023. The dominance of the region can be credited to the ongoing integration of IoT technology and the increasing technological shift towards more automated systems. Furthermore, the growing emphasis on home remodeling projects, with the rising enthusiasm for these devices, is presenting lucrative opportunities in the region. The U.S. led North America owing to the growing utilization of home automation systems.

Asia Pacific is expected to show the fastest growth in the smart home security camera market over the studied period. the growth of the region can be attributed to the increasing middle-class population and ongoing urbanization in developing countries like India and China. Moreover, increasing concerns regarding safety, surveillance, and theft boost the adoption of these devices in the region.

The smart home security camera market includes the development and sale of smart security cameras that are controlled remotely as they are connected to the internet. These cameras are equipped with features like two-way audio, mobile application integration, and motion detection. Also, these hold applicability and versatility across numerous indoor environments; hence, they are more popular than conventional cameras. The market involves cloud-based, wireless, and hybrid cameras.

| Report Coverage | Details |

| Market Size by 2034 | USD 60.99 Billion |

| Market Size in 2024 | USD 10.51 Billion |

| Market Size in 2025 | USD 12.53 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 19.23% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Government Initiatives for the development of smart city

The increasing urbanization and rising middle-class population significantly contributed to the surge in demand for the smart home security camera market. Growing concerns about safety, property theft, and surveillance fuel the adoption of this technology. In addition, the new initiatives launched by the government to promote smart city development, along with the integration of Internet of Things (IoT) technologies.

Privacy concerns

The cost and privacy concerns are the major problems confronted by the smart home security camera market. The outdoor smart home camera can record the whole area of the house along with private areas. Moreover, the cost of purchasing this camera is very high and there is a great chance that they might get damaged by criminals or adverse climatic conditions.

The increasing number of smart cities globally

The smart home security camera market is witnessing robust growth due to the rising deployment of smart city initiatives across the globe. Smart cities use advanced data and technology to improve the overall quality of life leading to an increase in demand for cutting-edge security solutions. Furthermore, these systems contain technologies like wireless alarms, artificial intelligence, and biometric access to prevent crime by ensuring public safety.

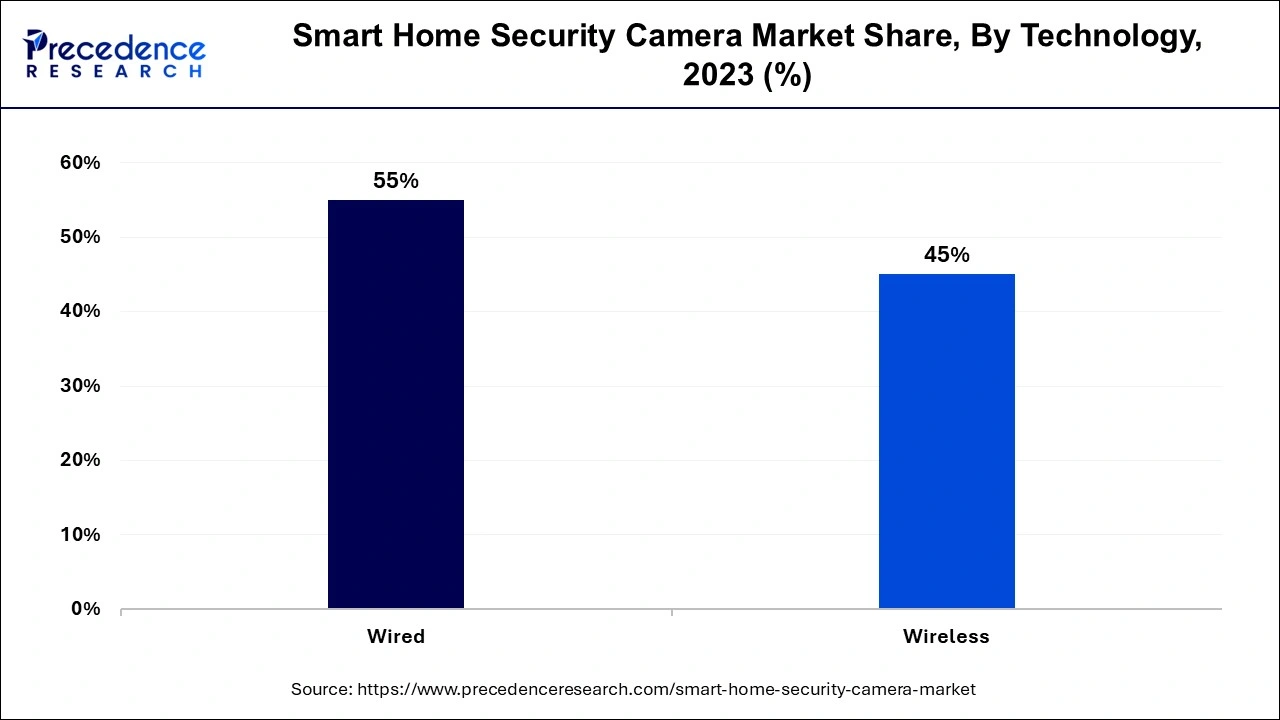

The wired smart home security cameras segment dominated the smart home security camera market in 2023. The dominance of the segment can be attributed to the increasing popularity of this system due to its low maintenance needs and cost-effectiveness. This economic benefit is an essential factor in fuelling their adoption. Additionally, wired systems offer reliability by tackling the potential issues associated with battery life or WiFi connectivity. These cameras also sustain operational continuity in case of a WiFi outage.

The wireless technology segment is expected to grow at the fastest rate in the smart home security camera market over the forecast period. The growth of the segment is credited to the ongoing advancements in IoT and home security solutions as lots of homeowners are selecting them for strong protection. Moreover, people are increasingly using smart devices, such as cameras, locks, and lighting to experience a unified living, which in turn improves their convenience with home security.

The indoor camera segment led the global smart home security camera market in 2023. The dominance of the segment can be driven by a rise in the number of burglary and theft cases, which increases awareness among the public regarding the importance of safeguarding one's house from unethical activity. Also, this camera provides a wide range of capabilities, like alarm activation and behavior recognition. Furthermore, these cameras are important for monitoring homes during work hours or vacations, etc.

The doorbell cameras segment is expected to grow at the fastest rate in the smart home security camera market during the projected period. The growth of the segment can be linked to the increasing desire to live in smart homes optimized by the growing internet penetration. Innovations in technology, like the integration of doorbell cameras with Amazon Alexa or Google Assistant, have made the segment more appealing. These devices can also provide special features, including accurate e-differentiation among packages, animals, people, etc.

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2024

April 2024