January 2025

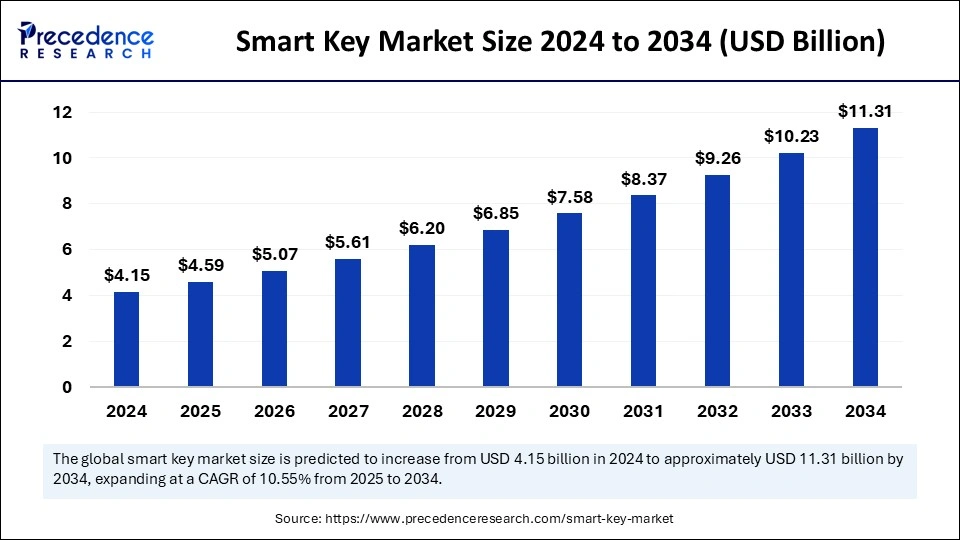

The global smart key market size is calculated at USD 4.59 billion in 2025 and is forecasted to reach around USD 11.31 billion by 2034, accelerating at a CAGR of 10.55% from 2025 to 2034.The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart key market size was calculated at USD 4.15 billion in 2024 and is predicted to increase from USD 4.59 billion in 2025 to approximately USD 11.31 billion by 2034, expanding at a CAGR of 10.55% from 2025 to 2034.The increased security, convenience, and access control demands for smart homes and vehicles are rapidly driving the global smart key market. The growing emphasis on integrating smart technology with smart keys is likely to emerge as part of further market growth in the future.

Artificial Intelligence has transformed the experience in every area. AI integration in the smart key market involves the scale-up condition for smart home devices, city infrastructure, and automotive AI in smart keys. It improves the functionalities of personalized access control and enhances security measurements, context-aware procedures, and predictive sentences. Growing developments in biometric integration, virtual smart keys, voice activation, and assistance are the recent trends in smart key infrastructure.

Technological advancements, including the integration of Internet of Things, AI, and Machine Learning, to improve data security and safety are holding market potential for global smart keys. AI is a significant algorithm to provide performance services and solutions. The growing advancement in AI technology allows personalized and customized door-unclosing solutions, making essential and crucial steps in smart key advancement technologies.

Smart keys are a vital step toward keys, and this is a mobile trend. Having keys in phones or watches, rather than misplacing them or forgetting them and fumbling around, is a significant motivation for the adoption of smart keys. Technology integration of Bluetooth, Wi-Fi, infrared, biometrics, and RFID is transforming the picture of smart keys not only for vehicles but also for smart homes and city infrastructures. There are several challenges, including the high cost of digital keys and the risk of hacking and cyber threats; however, the growing emphasis of major manufacturers to implant OEMs is helping to overcome such hindrances.

The demand for security and access control has increased due to increased digitalization, the adoption of smart home devices, and city infrastructure, leading to a surge in the adoption of smart keys. Manufacturers are focusing on advancing technologies to improve vehicle safety and security, which will generate a major impact on the automotive smart key market. Additionally, the rising incidence of vehicle thefts and the adoption of hybrid and electric vehicles are playing crucial roles in the adoption of smart keys. Several companies, including Audi, Acura, BMW, Buick, Cadillac, and Chevrolet, are the major developers and deliver smart keys for automobiles.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.31 Billion |

| Market Size in 2025 | USD 4.59 Billion |

| Market Size in 2024 | USD 4.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.55% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising concerns about security

The concern of security has been driven by the increased incidence of theft and burglary. The demand for convenient and accessible smart key technologies has emerged due to increased concern about consumer security. The adoption of advanced smart keys is high in the automotive industry as rising concerns about vehicles' security and safety standards have led to the integration of cutting-edge technologies with existing systems. Advancements in technologies like Wi-Fi connections, Bluetooth, and biometric connections are enabling the development of smart keys to provide more and improved security features to automotive mobiles and smart houses.

Implementation of secure anti-theft features is a more advanced approach compared to traditional keys. With the adoption of smart homes and smart automobiles rising, the focus on security and convenience will grow significantly. Emerging technology implementations, including AI, ML, and IoT devices, are expected to improve convenience, accessibility, and security standards in smart keys.

Risk of hacking

Smart keys give access to different smart devices, which creates the risk of cyber threats and hacking. Hackers can gain unauthorized access to the informative data, leading to a risk of data breaches. In past years, smart key technology has witnessed major RF attacks. Future risks of hacking threats can hamper consumer confidence and the adoption of smart keys. However, the ongoing focus of OEMs to advance security features of smart keys in tandem with the uncertainty of risks presented by virtual keys and advancements in smart key technologies for vulnerable to cyberattacks are likely to boost consumer trust and preference.

Virtual key technology

The growing emphasis of manufacturers to develop virtual key technologies is projected to cover the market in the forecast period. The growing surge for digitalization is the major factor driving a market shift toward the development and adoption of virtual key technologies. As the risk of smart locks and keys has increased, the demand for digitalization and integration of advanced technologies has increased. Increased adoption of smart cars and smart houses has witnessed high demand for virtual key technologies.

Virtual keys allow users to access existing smart devices like smartwatches and smartphones. They ensure access to cloud-based key management with virtual key technology, enabling users to grant and devote remote access. Virtual key technologies provide advanced security features, including biometric authenticity, real-time alerts, and encryption. The demand for virtual key technologies is projected to witness major growth in the upcoming period.

The RFID technology segment accounted for the largest smart key market share, mostly due to increased consumer demand for advanced and smart features and smart keys. RFID technologies offer smart security features, convenience, and accuracy. Smart home devices are the major adopters of RFID technology-based smart keys. This technology not only ensures improved security but also enables real-time tracking, convenient access control, and improved data analysis, which is particularly applicable to smart home access, vehicle immobilization, and asset tracking. This technology allows advanced features of customized notifications and alerts, which makes them more preferred by consumers.

The Bluetooth segment is growing rapidly. The accessibility of smart locks and smart keys with existing smart devices like smartphones is in trend. Bluetooth technology enables wireless connectivity with smartphones, tablets, smartwatches, and smart home devices. Bluetooth technology is easily compatible with different devices and operating systems, which improves convenience. Additionally, low power consumption makes Bluetooth technology ideal for better-power smart keys.

The smart car keys segment dominates the smart key market. The segment growth is attributed to increased concerns about the security and safety of vehicles. Various types of smart car keys, including Remote keyless entry, Passive keyless entry, and Biometric entry systems, are trending in the market. Biometric entry systems enable cars to start with smart technology access by using their authorizations, which helps to overcome the risk of security. A remote keyless entry, like the integration of technologies like Bluetooth, Wi-Fi, and IoT devices, makes it easier to unlock or lock cars remotely, making it more convenient for customers. Additionally, passive keyless entry systems enable keyless entry to unlock the care automatically. The adoption of smart care keys has increased with increased concerns about security and convenience.

The mobile-based keys segment is projected to witness notable growth in the forecast period due to technology advancements enabling controlling access to smartphones. The mobile-based keys are compatible with various mobile devices and operating systems, making them advanced and convenient. Easy setup of mobile-based keys enables user-friendliness. Additionally, advanced security features like secure authentication and encryption make them ideal for consumers. The growing adoption of smart homes is likely to enhance demand for mobile-based keys for automotive speed-up access and convenience.

The commercial application is leading the smart key market due to its high adoption range. The concern of improved security in business is driving demand for smart keys in commercial sectors. Industries have surged for the adoption of smart keys to enable control access in sensitive areas and easy integration with existing systems for more scalability. Smart keys can reduce administrative burdens in business and improve access control for overall processes. With the increased adoption of smart security solutions in business, the segment is expected to continue to dominate the market.

The automotive sector expects significant growth in the market. The segment growth is accounted for by increased security and safety concerns in the vehicles. The increased demand for advanced vehicle access adopting smart key technology. Additionally, automotive manufacturers are integrating OEM features in their automobiles, making it essential to utilize smart keys. Technological advances allow the multi-function applications of smart keys. Additionally, the integration of IoT devices with smart keys is enhancing efficiency, making it ideal for smart automotive.

North America is leading the global smart key market due to various factors, like the presence of major manufacturing players and the region's advanced infrastructure. North America has a wide adoption range of smart home devices. The high disposable income of the region allows for spending on smart technologies, leading to an impact on the adoption of smart keys. The growing consumer demand for security and convenience is leveraging market competition. Additionally, early adoption of emerging technologies like AI, ML, and IoT devices significantly transforms the smart key industry.

The United States is leading the regional smart key market due to countries' increased adoption of smart homes and smart automobiles. The well-established industry infrastructure of the United States was the prior adopter of smart key technologies. The leading OEM manufacturing company in the United States is contributing significantly to market expansion. Companies' determination to develop and integrate cutting-edge technologies to edge over their competitors is emerging in the market.

Asia Pacific contributes a significant share of the market, mainly due to the region's video automotive infrastructure. The increased consumer demand and integration of smart keys with smartphones and smartwatches are transforming the emphasis of the smart key market in the Asia Pacific. The increased adoption of smart devices and the shift to the adoption of smart homes are emerging opportunities for the market.

Countries like China, Japan, India, and South Korea play favorable roles in the smart key market expansion. China dominates the regional market due to the presence of advanced OEM infrastructure. The adoption of high-end luxury cars is driving the essential utilization of smart devices to improve control access and convenience. Japan is fueling the market with countries engaging in the adoption of cutting-edge technologies and smart device culture. India, on the other hand, significantly drives the market due to growing urbanization and adoption of smart homes.

By Technology

By Type

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025