September 2024

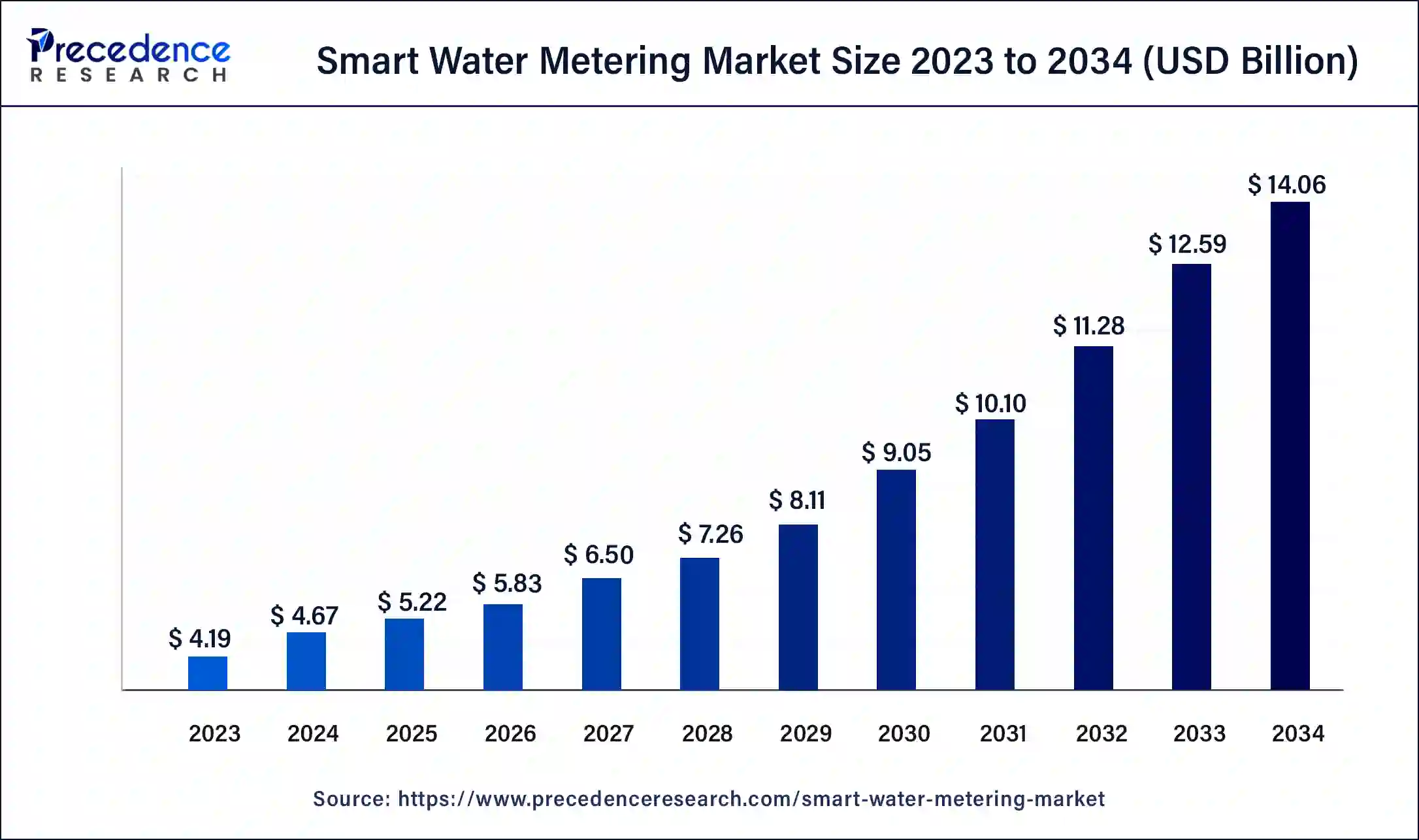

The global smart water metering market size surpassed USD 4.19 billion in 2023 and is estimated to increase from USD 4.67 billion in 2024 to approximately USD 14.06 billion by 2034. It is projected to grow at a CAGR of 11.64% from 2024 to 2034.

The global smart water metering market size is projected to be worth around USD 14.06 billion by 2034 from USD 4.67 billion in 2024, at a CAGR of 11.64% from 2024 to 2034. The smart water metering market growth is attributed to the growing demand for advanced and modern water metering technology.

Smart water meters are gadgets that quantify water consumption and convey information through the utilization of one or more techniques for remote data transmission, such as cellular, RF, or PLC. The meters also help utility companies to regulate and control the usage of water efficiently and effectively. The escalating need for reliable water billing systems has thereby enhanced the expansion of the smart water meter market.

The increasing awareness of focused aims such as the reduction of non-revenue water and the optimization of water distribution fuels the market growth due to the need for utilities to improve their water management. The capabilities of smart meters to offer accurate and timely information and consequent outputs are expected to drive new applications in the smart water metering market.

Impact of Artificial Intelligence on the Smart Water Metering Market

AI advances the water supply as resources are efficiently and effectively supplied with little or no wastage. The smart water metering market with artificial intelligence helps discern leaks, presage demand, and regulate water usage in real-time spheres. Such advancements allow utilities to realize substantial savings and are important for the sustainable use of water. Moreover, the growing degree of urbanization and the need for clean water are expected to boost the utilization of AI technology and improve water distribution performance and dependability.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.06 Billion |

| Market Size in 2023 | USD 4.19 Billion |

| Market Size in 2024 | USD 4.67 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.64% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Meter Type, Technology, Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing focus on water conservation

Governments and utilities worldwide are anticipated to drive the smart water metering market in the coming years, and growing investment in water conservation is anticipated to drive the market. Global water scarcity has become a pressing issue. These meters offer a precise and real-time method for monitoring and controlling water usage. They provide detailed consumption data and enable households, businesses, and municipalities to identify inefficiencies and implement targeted conservation strategies. This increasing focus on sustainability is expected to drive demand for smart water metering systems to efficiently manage water resources.

The smart water metering market products facilitate proactive maintenance by alerting users to leaks and abnormal usage patterns, thereby preventing water loss before it escalates. The integration of these meters into existing water management frameworks also supports compliance with stringent environmental regulations aimed at preserving natural resources. Moreover, technological advancements in smart meters to reduce water consumption in households are expected to expand their adoption, making them a cornerstone of future water conservation efforts.

Rising investments in smart city initiatives

A global push towards smart city development is anticipated to foster the growth of the smart water metering market. These measures are directed at applying high technologies in the urban setting to improve the standard of living and encourage sustainable activity. Smart water meters are used for efficient water management and support other applications of the smart grid. Growing interest in smart city projects in Asia Pacific and Europe is likely to drive near-essential systems like smart water metering technologies.

Other than precision water metering, these meters play another role in making smart cities achieve the aim of making decisions based on the data collected and resource management. They also support decreasing the operational expenses of utilities by handling the billing activities and the need for interventions. Furthermore, smart metering innovations are promoted through partnerships between governments, technology suppliers, and utilities, which contributes to boosting the smart water metering market.

Restrain limited interoperability

Lack of standardization and interoperability among different smart water metering systems is expected to impede the smart water metering market. Different manufacturing companies that produce these systems employ unique technologies that are incompatible with the others, which is a problem for the utilities that want to install them in their systems. This is not only a problem that is difficult to solve during implementation but also leads to higher total costs in system maintenance and further updates. Additionally, the absence of strategy and guidelines to support these smart meters further hinders the market in the coming years.

High demand for water efficiency solutions

The rising need for water efficiency solutions is anticipated to create immense opportunities for the players competing in the smart water metering market. The issue of water scarcity is rising as a major concern in most parts of the world, and utilities and governments are turning their attention to developing technologies that could augment water conservation. Smart water systems help monitor water usage, hence helping utility firms notice some of the losses. Manufacturing is developing and adopting new advanced metering solutions to help sustain water usage in regions that are experiencing water shortages. Furthermore, various smart water meters are expected to be integrated with other smart grid technology platforms' energy management systems, enhancing its value proposition and leading to higher adoption rates.

The smart mechanical meter dominated the smart water metering market in 2023 due to the high usage of smart mechanical water meters in residential and commercial sectors. Due to their reliability, relatively low cost, and compatibility with existing infrastructure, such meters are expected to have already attracted considerable interest. The mechanical durability and sophistication of remote monitoring and real-time data transmission have made these meters popular among consumers. Furthermore, the lack of an external power supply, with their resilience in adverse conditions, further boosts their demand.

The ultrasonic meters segment is projected to expand rapidly in the smart water metering market in the future years owing to their contactless means of measuring water flow by use of sound waves. Ultrasonic meters do not have mechanical components, which makes them extremely durable and less costly to maintain. Its capability to give highly accurate flow measurement even at low flow rates is expected by utilities interested in improving the measurement of water and control of NRW loss. Moreover, the need for real-time analysis of data increases, along with the usage of IoT in water management systems is likely to propel the demand for ultrasonic meters.

The AMR segment held the largest of the smart water metering market in 2023 due to their potential to capture meter readings from a distance without physically reading the meters. This technology offers utilities accurate and timely information on consumption to aid in billing, besides cutting other expenses involved in hands-on data gathering. Organizations have embraced AMR technology as it does not require the massive overhaul of infrastructure required and is easily implemented with little investment. Moreover, implementing AMR systems offers less labor cost and enhanced data reliability, boosting segment growth.

The AMI is expected to grow rapidly in the smart water metering market over the forecast period, owing to the escalating need for efficient water management technologies. AMI synchronizes communication networks with smart meters, tracks water utilization increases, and identifies leakages. Moreover, AMI offerings to handle dynamic pricing models and real-time alerts further fuel their demand.

The meter & accessories segment dominated the smart water metering market in 2023, as it offers basic hardware components of smart water metering systems. Such components are crucial for utilities with plans to update their systems and increase the level of precise water usage reporting. Moreover, the hardware upgrade is a relatively simpler solution than various IT systems or communication, and it has become a preferred option for instant changes in water management efficiency. All these factors will further fuel the market in the coming years.

The IT solution segment is projected to grow rapidly in the smart water metering market in the coming years owing to the rising requirements for enhanced data management, analytics, and integration solutions. Advanced IT solutions, such as DMP, software applications, and analytical tools, are used by utilities and municipalities in meters to enhance them. These solutions provide complex features, including monitoring, prediction, and reporting, which are essential for effective water management and organizational performance. Furthermore, the increased use of smart water meters and the focus on data-driven decision-making and connection with overarching utility management systems are expected to boost the segment.

The water utilities segment held the largest share of the smart water metering market in 2023 due to the facility’s importance in the administration of public water supply networks and assets. Smart meters offer water utilities proper meter reading ways, cost reductions, enhanced legitimate uses, and lower non-revenue water through constant monitoring and leakage detection. Additionally, the focus on enhancing service quality and meeting various regulatory standards is expected to propel the demand for smart metering solutions.

The industries segment is projected to expand significantly in the smart water metering market during the forecasting period owing to the growing use of smart water metering to reduce wastage. The necessity to save resources and to meet the continually changing requirements of the legislation facilitates the utilization of smart meters. The implementation of an efficient metering system that provides comprehensive readings and analyses and low-level indication of the failures and problems with the industrial processes. Smart meters assist industries in gauging water use and detecting areas that have the potential for wastage to enable them to enforce conservation procedures. Furthermore, industries are extremely focused on incorporating smart technologies for their water management, which further fuels the market.

Asia Pacific dominated the smart water metering market in 2023 owing to the heightened rate of urbanization and the regional emphasis on smart infrastructure investments. The increasing rate of urbanization in China and India creates demand for smart water meters and other sophisticated water management technologies. Furthermore, the increased focus on smart city projects and government support towards technology infrastructure further fuels the market in this region.

North America is expected to grow at the fastest CAGR in the smart water metering market during the forecast period due to its advanced infrastructure and strong regulations. North America has invested in the modernization of water management systems. The efforts to rationalize operational costs, reduce NRW, and address mandatory regulatory requirements create demand for smart water metering in this region. Furthermore, the presence of the biggest water conservation technology solutions providers in this region will further boost the market in the coming years.

Segments Covered in the Report

By Meter Type

By Technology

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2024

October 2024

November 2024