What is the Snack Food Packaging Market Size?

The global snack food packaging market size is valued at USD 24.19 billion in 2025 and is predicted to increase from USD xx billion in 2026 to approximately USD 35.95 billion by 2034, expanding at a CAGR of 4.50% from 2025 to 2034.

Snack Food Packaging Market Key Takeaways

- North America contributed more than 36% of revenue share in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By Packaging, the pouches and bags segment captured more than 38% of revenue share in 2024.

- By Packaging, the boxes segment is expected to expand at the fastest CAGR of 7.8% during the projected period.

- By Material, the plastic segment contributed the largest market share of around 41% in 2024.

- By Material, the glass segment is anticipated to expand at the fastest CAGR from 2024 to 2034.

- By Application, the wafers segment held the highest revenue share of 46.8% in 2024.

- By Application, the food segment is anticipated to show noticeable growth.

Snack Packaging: Preservation, Appeal, and Innovation

Snack food packaging is a specialized type of packaging tailored to store, safeguard, and promote a variety of snacks, including chips, nuts, candies, and cookies. Its primary functions encompass preserving product freshness, prolonging shelf life, and upholding the overall quality and safety of the snacks. Snack food packaging materials range from flexible options like bags and pouches to rigid containers and boxes. These packages often incorporate features like resealable zippers, portion control, and barrier films to maintain flavor and texture. Eye-catching graphics and branding elements are crucial for attracting consumers and conveying product information. Overall, snack food packaging plays a pivotal role in both product preservation and consumer appeal.

Market Outlook

- Industry Growth Overview:

The snack food Packaging Market is growing, driven by the US having a large, recognized market for snack foods, including bakery, confectionery, and savory snacks. Stringent regulation related to food safety and quality needs high-standard packaging and increasing novelties. - Global Expansion:

The snack food packaging market is increasing globally, driven by increasing snack consumption, e-commerce growth, and a consumer emphasis on sustainability and convenience. The demand for specific types of snacks, like healthy, gluten-free, organic, and plant-driven choices, drives the growth of the market. North America is dominated in the market by robust retail infrastructure and strict government regulations on food safety and quality. - Major investors:

Major investors in the snack food packaging industry include multinational corporations such as Amcor Plc, Berry Global Group, and Sealed Air Corporation, as well as private equity and venture capital firms that acquire stakes in organizations.

Snack Food Packaging Market Growth Factors

The snack food packaging market is witnessing dynamic growth, driven by a confluence of factors. Firstly, the rising demand for convenient and on-the-go snacks has propelled the need for innovative packaging solutions that offer convenience and preservation. Additionally, health-conscious consumer preferences have spurred a demand for snack packaging that highlights nutritional information and portion control. Eco-friendly packaging is also on the rise, aligning with sustainability concerns.

However, the industry faces challenges such as stringent regulations related to food safety and labeling, as well as increasing concerns about the environmental impact of packaging materials. Balancing sustainability with functionality remains a significant challenge. Furthermore, the COVID-19 pandemic accelerated the trend of e-commerce and home consumption, driving a surge in single-serve snack packages and online retail-friendly packaging designs. These trends have opened up opportunities for packaging companies to adapt and cater to evolving consumer behaviors. In terms of opportunities, companies in the snack food packaging sector can explore innovations in materials and designs that reduce waste and environmental footprint. Collaboration with snack manufacturers to create customized and eye-catching packaging that stands out on the shelves and online can also be a lucrative avenue. Ultimately, the snack food packaging market continues to evolve in response to changing consumer habits and sustainability pressures, offering numerous avenues for growth and innovation.

Technological Advancement

Technological advancements in the snack food packaging market feature smart packaging, personalized and interactive packaging, and sustainable materials. Furthermore, smart packaging is subdivided into sensors, QR codes, and NFC tags. Time temperature sensors and freshness indicators play an important role by alerting consumers regarding reduced waste and providing a product safety policy. QR codes and NFC tags help consumers with detailed information about products, enabling connection and two-way loyalty between consumers and products.

Digital printing technology helps in customizing designs, names on packaging, and messaging for the product to seem informative and attractive. At the same time, barrier technologies contribute to the protection of snacks from oxygen and other factors to avoid spoilage. Nanotechnology is used in intelligent packaging to enhance and improve food quality, helping products to sustain and maintain food taste the same as processed.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.95 Billion |

| Market Size in 2026 | USD 25.28 Billion |

| Market Size in 2025 | USD 24.19 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.50% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging, Material, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Changing consumer lifestyles and healthy snacking trends

Changing consumer lifestyles and the growing emphasis on healthy snacking have significantly contributed to the surging demand in the Snack Food Packaging market. As consumers lead busier lives, they increasingly seek convenient, ready-to-eat snack options that fit their on-the-go routines. This shift has driven the need for packaging solutions that offer portability, ease of use, and preservation of snack freshness, stimulating the market for snack packaging. Moreover, the rise in health consciousness has reshaped snack preferences.

Consumers are actively seeking snacks that are not only delicious but also nutritious. Consequently, packaging has evolved to accommodate the display of essential nutritional information, portion control, and sustainable, health-focused designs. Health-conscious consumers are willing to pay a premium for snacks that align with their well-being goals, making effective and appealing packaging vital in capturing this market segment. In essence, changing consumer lifestyles and the health-driven snack revolution have propelled the snack food packaging market, compelling packaging manufacturers to innovate and cater to evolving consumer demands for convenience, healthiness, and sustainability in their snack choices.

Restraints

Product shelf life and environmental concerns

Product shelf life and environmental concerns present contrasting challenges for the snack food packaging market. On one hand, consumers seek longer shelf life for snacks to ensure product freshness and reduce food waste. Packaging innovations, such as modified atmosphere packaging and barrier films, address this demand by extending product durability. The rising awareness among consumers about excessive plastic waste has prompted brands to pivot toward more sustainable packaging options, such as recyclable, biodegradable, or compostable materials. However, a challenge arises as these eco-friendly alternatives might not always match the shelf-life extension capabilities of traditional packaging materials.

This potential limitation can impact product quality and increase the risk of food waste. Striking a balance between addressing environmental concerns and maintaining product freshness remains a complex task for snack food packaging manufacturers, requiring ongoing innovation in sustainable packaging solutions that can deliver both extended shelf life and reduced environmental impact. Balancing the need for extended shelf life with environmental responsibility is a complex challenge for snack food packaging manufacturers. Meeting both demands will require continued innovation in sustainable packaging materials and technologies that can maintain product freshness while minimizing environmental impact.

Opportunities

Sustainable packaging and innovative designs

While sustainability is a major trend in the snack food packaging market, it can also be a restraint. The shift towards eco-friendly materials and practices, while commendable, often involves higher production costs. Sustainable materials, such as biodegradable plastics or recycled paper, can be more expensive than traditional options, impacting profit margins for snack manufacturers. Additionally, the complexity of recycling and disposal processes for some sustainable materials can create logistical challenges and increased costs. This can hinder smaller players in the snack industry who may have limited resources to invest in sustainable packaging solutions. Thus, while sustainability is vital for the long-term health of the planet, it can temporarily restrain market demand due to these cost-related issues.

Moreover, while innovative packaging designs can be a boon for brand differentiation and attracting consumers, they can also pose challenges. Intricate and unique designs can be costly to produce, and their production may require specialized equipment or techniques. Moreover, overly complex designs may not always align with sustainability goals, as they can result in more packaging waste or the use of non-recyclable materials. Additionally, designs that prioritize aesthetics over functionality may lead to issues with product protection and preservation, which is a critical aspect of snack food packaging. Thus, while innovation is crucial for staying competitive, it must strike a balance between aesthetics and practicality to avoid potential restraints on market demand.

Segmental Insight

Packaging Insights

The pouches and bags segment has held 38% revenue share in 2024. Pouches and bags are versatile snack food packaging options, known for their convenience and portability. In the snack food packaging market, a prevailing trend is the rise of resealable and eco-friendly pouches and bags. Consumers prefer easy-to-open, portion-controlled packaging that maintains snack freshness. Sustainable materials, such as compostable films and recycled plastics, are gaining traction, aligning with the industry's commitment to eco-conscious packaging solutions.

The boxes segment is anticipated to expand at a significant CAGR of 7.8% during the projected period boxes, in snack food packaging, refer to rigid containers made of various materials like cardboard or paperboard. These containers are commonly used to hold and protect snacks like cereals, cookies, and chocolates. In the snack food packaging market, current trends involve sustainable box designs, with a focus on recyclable or biodegradable materials to reduce environmental impact. Additionally, visually appealing, resealable, and portion-controlled box packaging is gaining popularity to cater to consumer preferences for convenience and freshness.

Material Insights

The plastic segment held the largest market share of 41% in 2024. Plastic, a versatile synthetic polymer, plays a pivotal role in snack food packaging. It offers durability, flexibility, and cost-effectiveness. In recent snack food packaging trends, there's a growing emphasis on sustainable plastic materials, such as bioplastics and recyclable options, to address environmental concerns. Additionally, innovations in plastic packaging include thinner, lightweight designs to reduce material usage and waste. Anti-microbial and barrier-enhancing coatings are also gaining popularity to maintain snack freshness. Overall, plastic remains a dominant material in snack food packaging, with a focus on sustainability and functionality.

The glass segment is projected to grow at the fastest rate over the projected period. Glass, a rigid and transparent material, is used in snack food packaging due to its ability to preserve product freshness and offer an upscale presentation. However, the snack food packaging market is witnessing a trend towards glass alternatives. This shift is driven by concerns over glass's fragility, weight, and environmental impact. Manufacturers are increasingly exploring lightweight, shatter-resistant materials like plastics and eco-friendly options such as biodegradable packaging. These trends aim to enhance convenience, reduce transportation costs, and align with sustainability goals in the snack food industry.

Application Insights

In 2024, the wafers segment had the highest market share of 46.8% on the basis of the installation. Wafers are thin, crispy snacks consisting of multiple layers, often filled with cream or flavored coatings. In the snack food packaging market, wafers have seen a trend towards portion control and convenience packaging. Single-serve packs and resealable options are gaining popularity, catering to on-the-go consumption. Moreover, there's a growing demand for eco-friendly packaging for wafers, reflecting broader sustainability concerns. Brands are also investing in vibrant and eye-catching designs to enhance shelf appeal and attract consumers to this delectable snack option.

The Ready-to-eat (RTE) food is anticipated to expand at the fastest rate over the projected period. Ready-to-eat (RTE) food refers to prepared meals or snacks that require no additional cooking or preparation by the consumer. In the snack food packaging market, RTE snacks are a significant application segment. Recent trends include a growing demand for healthier RTE options, leading to packaging innovations that emphasize nutritional information and portion control. Eco-friendly packaging materials are also on the rise, aligning with sustainability goals. Moreover, single-serve and on-the-go packaging designs have gained popularity, catering to consumers' busy lifestyles and the rise of e-commerce.

Regional Insights

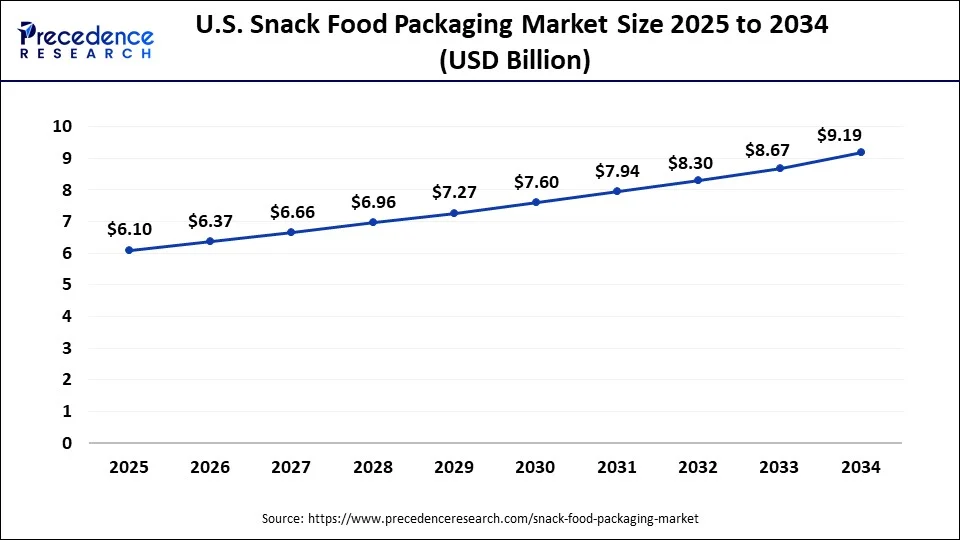

U.S. Snack Food Packaging Market Size and Growth 2025 to 2034

The U.S. snack food packaging market size is accounted at USD 6.10 billion in 2025 and is projected to be worth around USD 9.19 billion by 2034, poised to grow at a CAGR of 4.66% from 2025 to 2034.

North America: Snack Packaging's Health & Green Future

North America has held the largest revenue share 36% in 2024. In North America, the snack food packaging market is witnessing notable trends. Health-conscious consumers are driving demand for packaging that highlights nutritional information and portion control. Eco-friendly and sustainable packaging options are gaining prominence as environmental concerns grow. The COVID-19 pandemic has accelerated the demand for single-serve and online retail-friendly packaging solutions. Additionally, there's a focus on innovative designs to enhance brand visibility in a competitive market. Regulatory compliance and safety measures continue to shape packaging practices in the region.

North America is dominating the snack food packaging market with the highest regional revenue. The expansion of the food and beverages sector instantly increases the demand from consumers. Consumers' expectations are directly correlated to the packaging standards of the product to be approached. The attitude and preferences of eatables help packaging industries to stronglyconnect with the food and beverages market for further formation and required developmental skills in packaging.

U.S.: Developed retail and e-commerce

In the U.S., an increasing health-conscious customer base is pushing the demand for convenient, functional, and portable snacks such as protein bars, while demanding environment-friendly packaging materials like recyclable or compostable choices. A healthy retail sector and a noteworthy shift towards e-grocery and food delivery solutions.

Convenience and Health Drive Asia Pacific Packaging

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the snack food packaging market is marked by several noteworthy trends. Rapid urbanization and changing lifestyles are driving the demand for convenient, single-serve snack packages. Consumers are also showing a preference for healthier snacks, influencing packaging designs that emphasize nutrition and portion control. Sustainable packaging materials, such as biodegradable plastics and recyclable options, are gaining traction in response to heightened environmental awareness. Additionally, the growth ofe-commerce is spurring innovation in packaging for online snack purchases, with a focus on protective and visually appealing designs.

China: Technological advancements

China has a massive and growing consumer market for snacks, driven by a rapidly urbanizing population that demands suitable, on-the-go food choices. The increasing expansion of e-commerce platforms makes it simple for a large number of both domestic and international brands to reach customers. Increasing flexible packaging formats, like pouches and films, which driving the growth of the market.

Europe: Growing innovation in green technology

Europe is significantly growing in the market as increasing consumer demand for appropriate and healthy food, supported by strict government sustainability guideline that drives innovation in biodegradable and recyclable materials. Europe has a well-established food processing market that generates major investment and demand for packaging services.

UK: Technological and regulatory advantages

The UK is a significant market for snack food consumption and packaging, driven by busy lifestyles, increasing demand for healthy snack choices. Elastic working schedules and an increase in convenience store usage are increasing demand for products and packaging that cater to local requirements and desire purchases.

Snack Food Packaging Market- Value Chain Analysis

Raw Material Sourcing:

Raw material sourcing for snack food packaging is required to create the containers, which are predominantly plastic, metal, and paper or paperboard.

- Key Players: Sonoco Products Company and Constantia Flexibles

Package Design and Prototyping:

Creating a visually appealing and functional product wrapper that aligns with the brand and targets the appropriate audience.

- Key Players: Amcor, Berry Global, and Huhtamaki Oyj

Recycling and Waste Management:

Efficient waste management involves the 3Rs, such as Reduce, Reuse, and Recycle, using more sustainable materials such as paper or plant-driven plastics, and confirming proper disposal procedures.

- Key Players: PepsiCo and Mondelez

Top Vendors in the Snack Food Packaging Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Amcor Limited |

Switzerland |

Focus on innovation and sustainability |

In April 2025, Amcor collaborated with Riverside Natural Foods to introduce MadeGood Trail Mix bars in AmFiber paper-driven packaging. |

|

Berry Global Group, Inc. |

Indiana |

A strong global presence |

Berry Global Group, Inc. generated innovative packaging services that we believe make life better for people and the planet. |

|

Mondi Group |

England |

Flexible packaging |

In September 2025, Mondi introduced white digital printing for corrugated packaging, unlocking novel branding possibilities. |

|

Sealed Air Corporation |

North Carolina |

Innovation and R&D |

The CRYOVAC brand offers a varied array of food packaging solutions, from vacuum shrink bags and automated systems tailored for primal cuts to our award-winning sustainable options for retail-ready meats. |

|

Sonoco Products Company |

Hartsville, South Carolina |

Diverse product offerings |

Sonoco Asia is a worldwide leader in sustainable food packaging, well-known for delivering novel, customized services in a broad array of businesses. |

Other Key Players

- Huhtamaki Group

- Bemis Company, Inc. (now part of Amcor)

- WestRock Company

- Constantia Flexibles Group

- ProAmpac Holdings, Inc.

- Winpak Ltd.

- Printpack, Inc.

- Ball Corporation

- Tetra Pak International S.A.

- DS Smith plc

Recent Developments

- In April 2025, FESTIVE chickpea hearts announced new flavors and new packaging. To increase consumer engagement and acceptance, the company has initiated an innovative and thoughtful idea.

- In December 2024, the Korozo group helped Zertus UK and Ireland develop a stand-up pouch for snack mix. The partnership's clear intention is to approach and extend the idea of packaging progress to the market as a whole.

- In February 2025, TIPA, known as the global leader in compostable packaging innovation, launched advanced home compostable metallized high-barrier film, which protects the product with its strong packaging skills.

- In 2019,Nestlé and Danimer Scientific partnered to create a biodegradable water bottle. They will use Danimer's PHA polymer Nodax™ to develop bio-based resins for Nestlé's water business, aiming to advance sustainable packaging solutions in the industry.

- In 2019, Amcor solidified its position as a global packaging industry leader with the successful US$6.8 billion acquisition of Bemis, creating a formidable packaging giant that offers a comprehensive range of packaging solutions worldwide.

- In 2017,Ball Corporation successfully completed its acquisition of Rexam PLC, creating a global powerhouse in the metal beverage business. With 75 manufacturing facilities worldwide, the company operates across multiple continents, solidifying its presence in North and Central America, Europe, Russia, South America, Asia, and the Middle East.

Segments Covered in the Report

By Packaging

- Pouches & Bags

- Boxes

- Composite Cans

- Others

By Material

- Plastic

- Paper

- Metal

- Glass

- Others

By Application

- Wafers

- Nuts & Dry Fruits

- Baby Food

- Ready-to-Eat Food

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344