November 2024

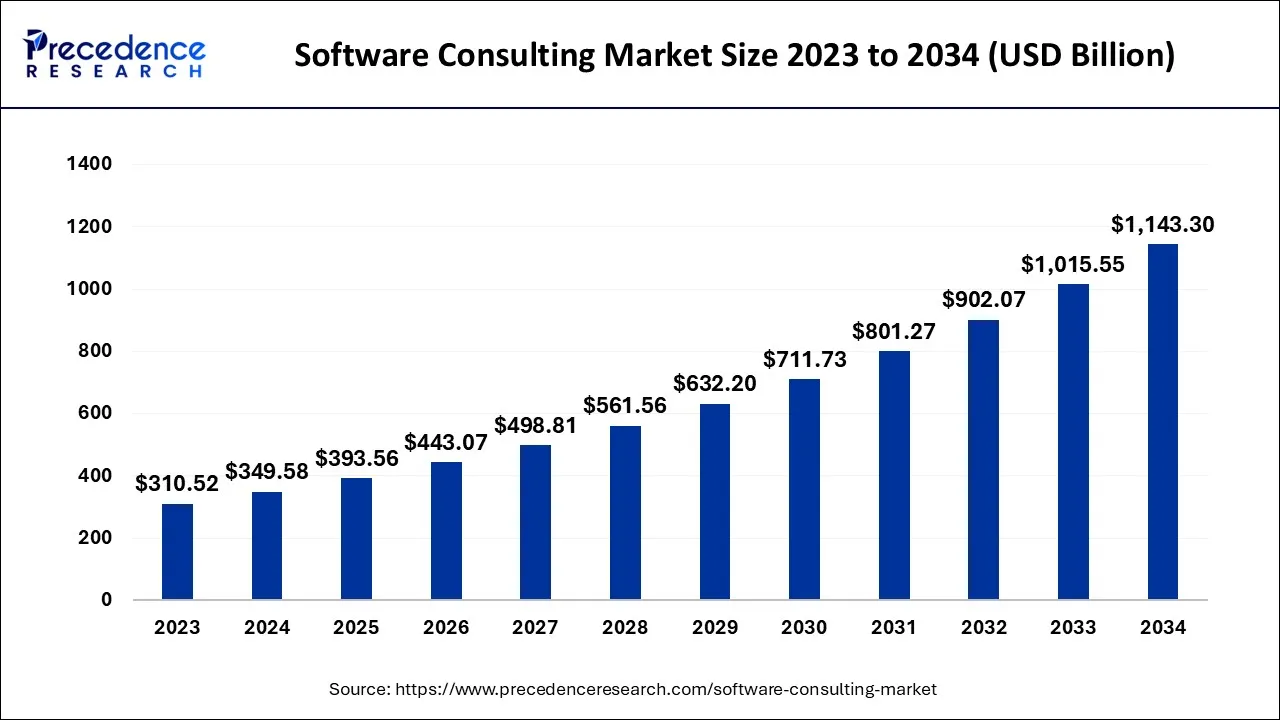

The global software consulting market size accounted for USD 349.58 billion in 2024, grew to USD 393.56 billion in 2025 and is expected to be worth around USD 1,143.30 billion by 2034, registering a CAGR of 12.58% between 2024 and 2034. The North America software consulting market size is calculated at USD 115.36 billion in 2024 and is estimated to grow at a CAGR of 12.75% during the forecast period.

The global software consulting market size is calculated at USD 349.58 billion in 2024 and is projected to surpass around USD 1,143.30 billion by 2034, growing at a CAGR of 12.58% from 2024 to 2034.

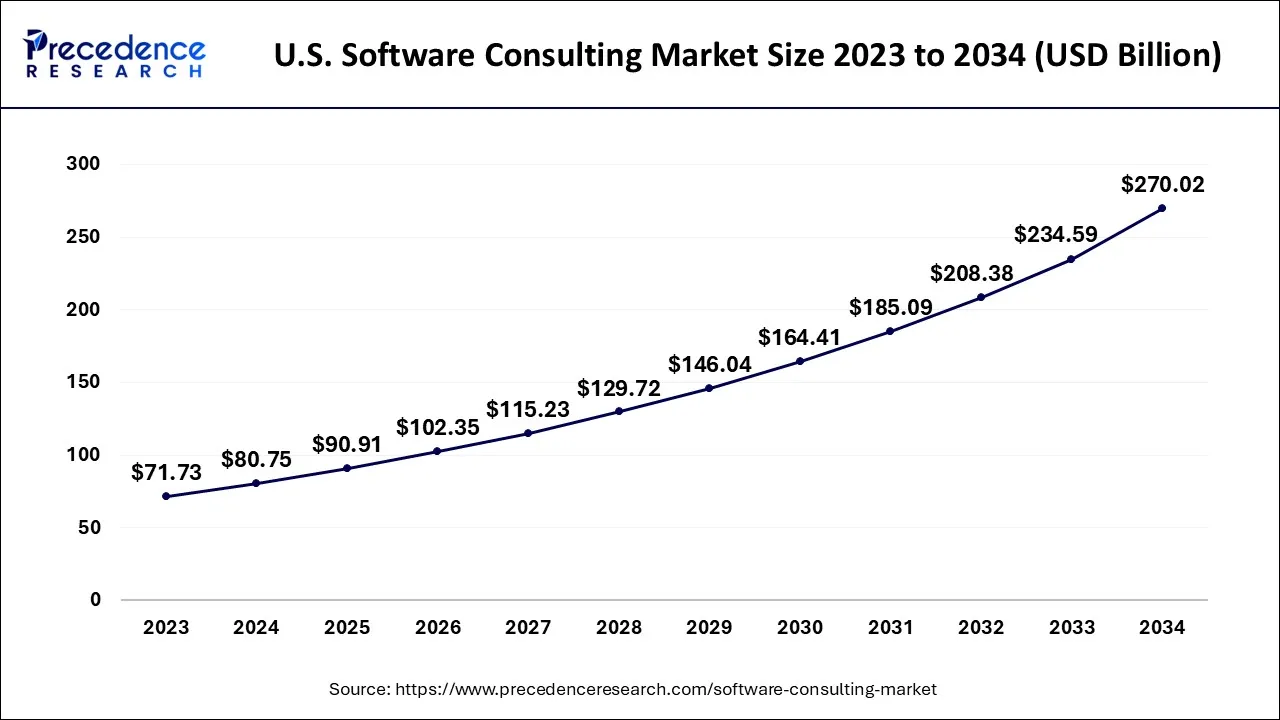

The U.S. software consulting market size is exhibited at USD 80.75 billion in 2024 and is projected to be worth around USD 270.02 billion by 2034, growing at a CAGR of 12.83% from 2024 to 2034.

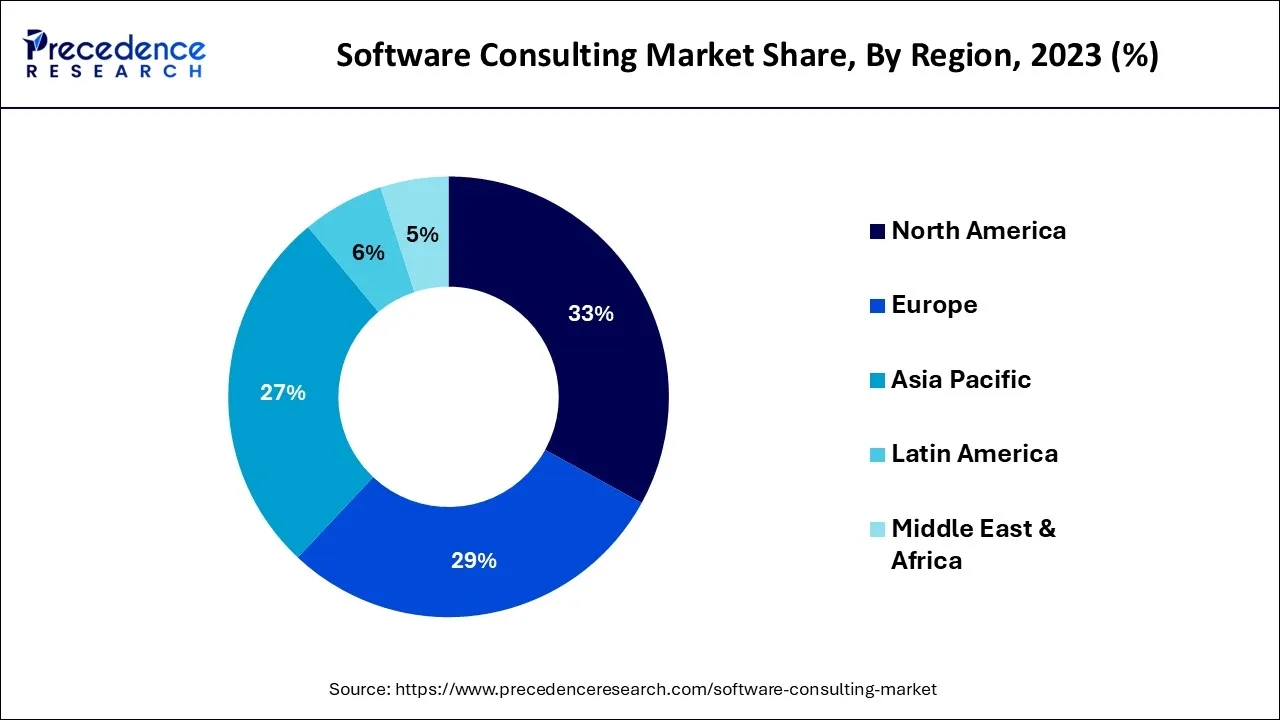

North America was the leading region in the global market, accounting for over 33% of the revenue share in 2023. The region is expected to continue expanding at a steady growth rate from 2024 to 2034, as various industries in the region are investing heavily in technological research and development. With an increased focus on the Internet of Things (IoT) and big data technologies, the demand for IT and software solutions is anticipated to rise further in the region.

Additionally, the rising trend of digital transformation is leading to a higher demand for software consulting services in North America, with U.S. enterprises exhibiting the highest demand. Furthermore, the growing number of technology start-ups and the adoption of ERP, CRM, and cloud services are expected to drive market growth in the region over the forecast period.

The Asia Pacific market is anticipated to register the fastest compound annual growth rate (CAGR) from 2024 to 2034. The growth in this region is attributed to the rapidly growing IT industry, improved government initiatives, the introduction of emerging start-ups, and growing digital transformation across this region. Asia Pacific is experiencing a rapid growth in the IT industry, driven by the increasing adoption of cloud-based services, big data analytics, and IoT technologies. This growth in the IT industry is leading to an increased demand for software consulting services to help companies implement and manage these technologies effectively.

The process of identifying a company's software needs and creating technology to support a company's processes is referred to as software consulting. It makes it possible for IT professionals to provide sage comments on software and e-commerce. Discussing the software used at work is beneficial because it may help them understand important software updates or use technology that workers may use.

The market growth in the software consulting industry is being driven by the increasing preference for the digitization of business processes across various industries. However, the COVID-19 pandemic and the resulting global economic slowdown have caused significant complications for many industries, leading to delays, reduced project scopes, or canceled projects among consulting clients. As a result, the market growth has been hindered in the short term, negatively impacting vendor revenues.

To counter these challenges, vendors are adopting a digital approach, offering virtual consulting platforms that eliminate the need for consultants to travel, reducing costs and enabling high-impact outcomes similar to physical training. Service providers are also targeting new clients looking to reduce operational spending through automation and innovative solutions to solve complex business problems.

The market growth is also driven by the increasing demand for software consulting services, aiding enterprises in their decision-making processes for software adoption. The digitization of industries and the evolution of the Enterprise 2.0 concept, involving social software and collaborative technologies for business processes, are also contributing factors. Moreover, technological advancements in cloud computing and data analytics are encouraging the adoption of novel and innovative solutions.

Organizations are emphasizing improving work quality, enhancing delivery speed, reducing work costs, and increasing transparency and accountability through software implementation. As a result of the global pandemic, organizations are finding it challenging to meet end-user demands, leading to a growing demand for software consulting solutions and services to accelerate service delivery.

| Report Coverage | Details |

| Market Size in 2024 | USD 349.58 Billion |

| Market Size by 2034 | USD 1,143.30 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.58% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Enterprise Size, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

A better yield on investment is achieved by having less expensive infrastructure and storage

Businesses are concerned about the implementation and upkeep costs associated with on-premises data storage. Businesses also worry about the expenses associated with hiring employees and the difficulties posed by outages. The use of cost-effective business model restructuring strategies has been accelerated by the present competitive climate and worldwide economic circumstances.

The growing trend among companies toward digital transformation and the acceleration of user experience, both of which are reducing company costs, are other factors pushing the use of cloud computing services. In addition, the cloud offers the pay-as-you-go model, which enables companies to pay for cloud services based on how frequently they use them. As a result, prices are cheaper.

There are more and more multi-sourcing tactics being used

A growing number of businesses are breaking up large consulting contracts into smaller sections and working with multiple suppliers to finish tasks rather than adopting a one-size-fits-all approach. Healthcare organizations are progressively adopting the multi-sourcing strategy because consulting firms do not always have expertise in all practice areas.

Government organizations, insurers, and healthcare providers are all urging various advisory firms to collaborate on projects. On the other hand, because it calls for efficient and dependable service collaboration among suppliers, multi-sourcing may present its own set of problems. The revenue of consulting companies may suffer as a result.

Cloud applications that are hybrid are gaining popularity

Businesses that already have an infrastructure in place are moving toward cloud computing services and are ready to employ a hybrid approach to profit from both on-premises and cloud services. In addition, SMBs are increasingly taking into account cloud computing services, which has many advantages including no initial equipment costs and processing resources that are accessible on demand. These factors are having an impact on how companies choose to use mixed cloud services. The hybrid cloud additionally offers enhanced task administration, increased security and compliance, and seamless communication between DevOps teams.

The enterprise solutions category held the largest share of the market, accounting for over 23% in 2023, and is expected to maintain its dominant position throughout the forecast period. According to Forbes' 2017 study, around 55% of North American companies were utilizing business intelligence and big data analytics software to solve their business challenges. The demand for software such as Enterprise Content Management (ECM), Enterprise Resource Planning (ERP), and Customer Relationship Management (CRM) has been on the rise, which is likely to fuel the demand for consulting services for enterprise solutions in the forthcoming years.

The software security services segment is expected to register the highest growth rate during the forecast period. This increase can be attributed to the growing usage of cloud servers to store data and the rising number of cyberattacks aimed at obtaining information. Furthermore, the adoption of cloud computing, e-commerce, and social networking is increasing worldwide, leading to a need for enhanced protection while storing large amounts of data in the cloud.

The software consulting market is being driven by the increasing demand for data-driven solutions, as companies look to leverage their data assets to gain a competitive edge. The ability to provide expertise in business intelligence and analytics, AI, and ML, and cybersecurity is crucial for software consulting firms looking to succeed in this market.

In 2023, the large enterprise segment held the largest market share of more than 63%. These enterprises have a significant amount of data that needs to be managed both locally and globally, leading to increased adoption of software security services for data management and monitoring. The B2B sector is experiencing a high demand for the Software-as-a-Service (SaaS) model, which uses technologies like artificial intelligence (AI) and machine learning (ML) for improved automation and data-driven decision-making. This is expected to create a demand for consulting services in the large enterprise segment.

Meanwhile, the small and medium enterprises (SMEs) segment is projected to have the fastest compound annual growth rate (CAGR) over the forecast period. Governments are initiating digital SME campaigns to support the growth of this segment. Advancements in SaaS tools have enabled SMEs to use affordable software solutions and compete with larger companies with similar efficiency levels. As a result, the demand for software consulting services in the SMEs segment is expected to increase during the forecast period.

The BFSI segment accounted for the largest market share of over 21% in 2023. Many financial service companies are using consulting services to concentrate their efforts on their resources, combine software across crucial business processes, and promote company expansion. In the upcoming years, segment development is likely to be fueled by the widespread use of digital payments, the adoption of blockchain technology in finance, and the rising popularity of digital wallets.

In addition, the BFSI segment's demand for software security consulting services is being driven by the increasing adoption of cloud-based solutions and services to store customers' critical information and the rising number of cyberattacks. With large amounts of data being stored on the cloud, there is a need for adequate security, presenting growth opportunities for software consulting firms offering security services to BFSI incumbents. The healthcare segment is predicted to exhibit the highest compound annual growth rate (CAGR) during the forecast period. Furthermore, mandatory government regulations and standards for quality and other compliances are expected to drive demand for software consulting services among healthcare providers.

Segments Covered in the Report

By Application

By Enterprise Size

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

January 2025

October 2024