October 2024

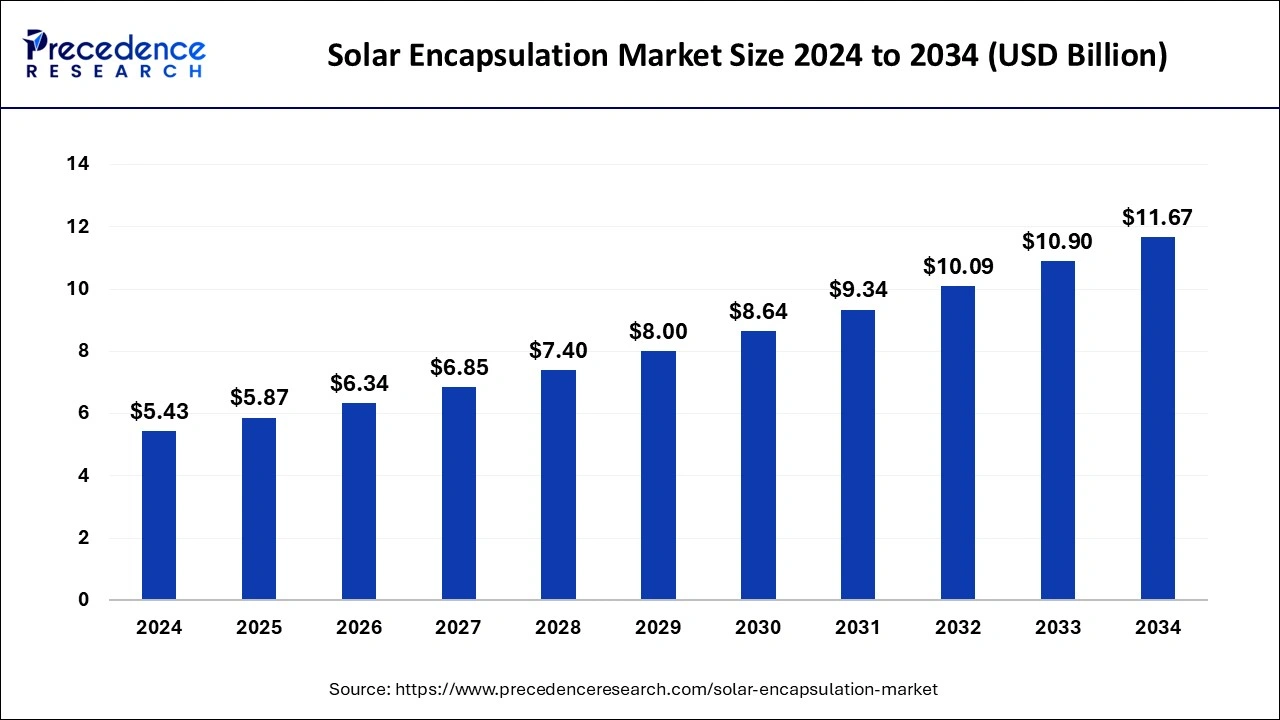

The global solar encapsulation market size is calculated at USD 5.87 billion in 2025 and is forecasted to reach around USD 11.67 billion by 2034, accelerating at a CAGR of 7.95% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global solar encapsulation market size accounted for USD 5.43 billion in 2024 and is predicted to increase from USD 5.87 billion in 2025 to approximately USD 11.67 billion by 2034, expanding at a CAGR of 7.95% from 2025 to 2034. The use of renewable energy resources, sustainability, and improvement in environmental conditions are driving the market.

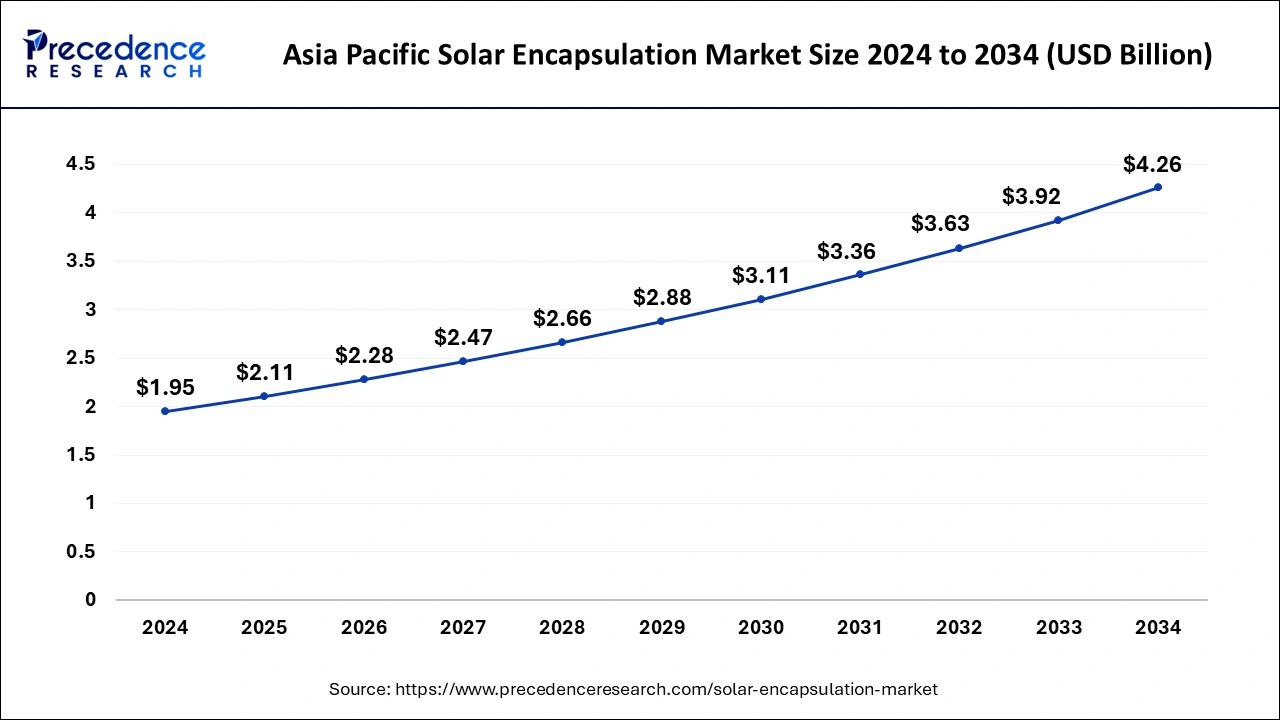

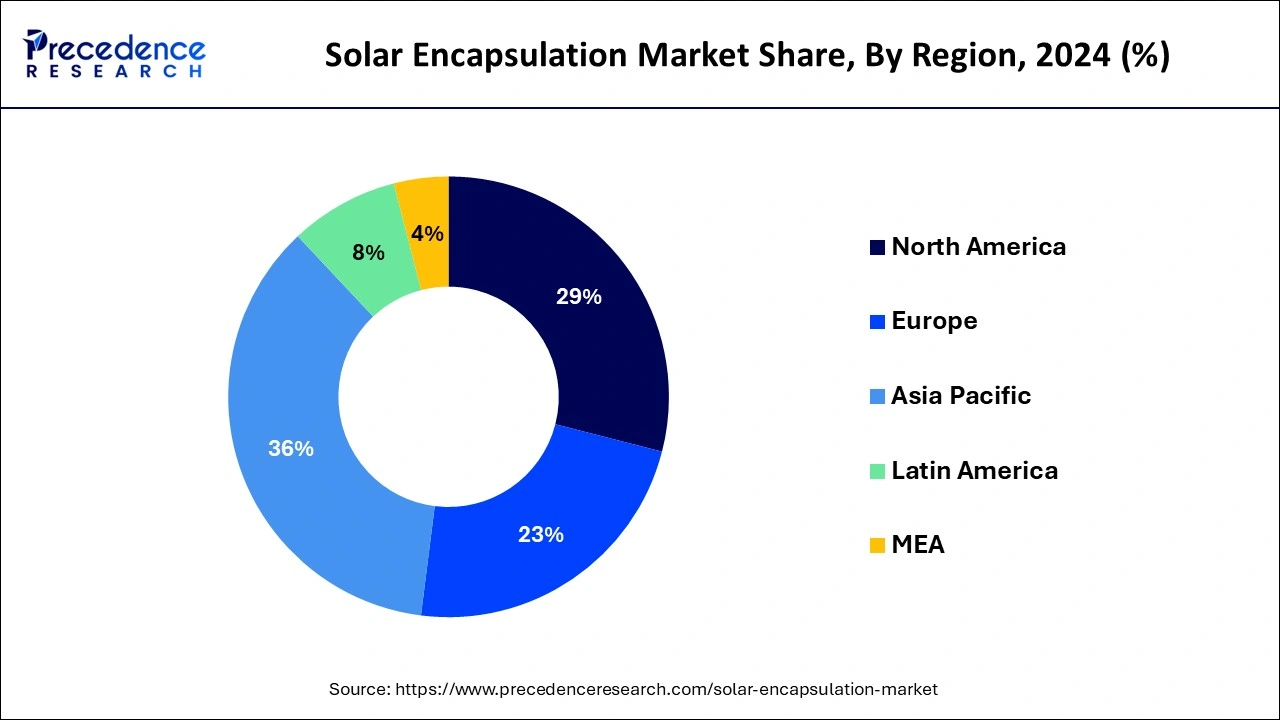

The Asia Pacific solar encapsulation market size was exhibited at USD 1.95 billion in 2024 and is projected to be worth around USD 4.26 billion by 2034, growing at a CAGR of 9.04% from 2025 to 2034.

Asia Pacific dominated the solar encapsulation market in 2024. Some countries have an incredible manufacturing infrastructure and great technology, which reduces the manufacturing cost of solar cells. In some countries, the use of solar encapsulation is growing, such as South Korea's use of encapsulation in producing different devices, including semiconductors, consumer electronics, and displays. China is also using encapsulation in the manufacturing sector; encapsulation is a vast range of products, including computers, consumer electronics, and smartphones. Along with that, in Asia Pacific, Japan is also a booming country in the market; Japan uses solar encapsulation mostly in automobiles and electronics, and technological advancements include semiconductors, consumer electronics, and electronics manufacturing. In Japan, the adoption of solar encapsulation is increasing frequently, which leads to market growth.

Europe is expected to grow during the forecast period; in Europe, the adoption of solar encapsulation is booming in some countries, such as the United Kingdom. In this country, the demand for solar encapsulation is increasing in the automotive industry and renewable energy sectors. The automotive industry depends on encapsulation in different applications, including sensors, automotive electronics, and control units. Encapsulation also helps to protect these elements from powerful operating conditions and confirm their longevity. The UK is investing in renewable energy infrastructure.

North America is also experiencing significant growth in the solar encapsulation market. In this region, people are aware of solar encapsulation and their benefits. In this region, some countries such as the US experienced remarkable growth, and in the U.S., government initiatives and policies such as tax credits, subsidies, and state-level incentives, the U.S. ongoing research and development are helping to develop new technology and enhance solar encapsulation materials so that they can survive in unfavorable conditions.

For instance, U.S. company Solutia Solar is an advanced solar encapsulant provider for long-term durability and high-performance solar modules. They are the world’s leading supplier of films for automotive, architectural, and photovoltaic applications. Along with that, Canada is also showing significant growth in the market. Canadian Solar is one of the largest suppliers of solar photovoltaic modules worldwide, and it is also one of the largest power plant developers.

The solar encapsulation market is experiencing significant growth due to factors such as the demand for solar photovoltaics. (PV) Worldwide, there has been a huge rise in the production of solar PV in some countries. Increasing awareness about the encapsulant technology among people and the booming demand for solar encapsulant technology, solar encapsulant technology is used in electronic, automotive, and construction applications; in these applications, solar encapsulant technology use is found highest in construction applications. There are some benefits of using solar enclosures, such as protecting solar panels against climate change and rust. This increases the demand in the market. Along with that, there is investment by key players, and government support also plays a significant role in the market growth.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.95% |

| Market Size in 2025 | USD 5.87 Billion |

| Market Size in 2024 | USD 5.43 Billion |

| Market Size by 2034 | USD 11.67 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Materials, Technology, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Cost reduction

The installation cost of solar panels is high, and continuous protection from weather conditions such as intense sunlight, rain, and UV radiation is needed. Without the protection, the solar panels will wear and tear quickly, requiring high replacement or repair costs. The use of solar encapsulation increases the shelf-life of solar panels, reducing the cost of repairing and replacing them.

Sustainable solutions and increased demand for encapsulation

There is a growing need for environmentally sustainable solutions and to reduce carbon footprints globally. This shift towards renewable energy sources has resulted in a high demand for solar panels. Growing urbanization has further increased the need for solar panels, which in turn has raised awareness about the benefits of renewable energy. The installation of solar panels directly impacts the utilization of solar encapsulation.

Recycling challenges and degradation of solar encapsulation materials

The complexity of recycling solar encapsulation materials can be a significant restraint for the solar encapsulation market. Existing solar PV panels were not designed to be recycled. The materials for encapsulating solar panels are hard to separate and also make the recycling process of solar panels difficult. This process is not only labor-intensive but also quite complex, which means it's not always cost-effective to recycle solar panels. If they are still recycled, some valuable materials inside often end up being lost or not fully recovered, which can be a real downer for the environment, and this can be a restraint for the market. To reduce the restraint, research & development can be done to improve existing materials used to develop solar encapsulations and also develop new and better materials so that encapsulations can be recycled easily.

For instance, according to research published in Nature Communications, the researchers developed a product that is a room-temperature non-destructive encapsulation of the self-crosslinked fluorosilicone polymer, which enables heat stability sustainably and able perovskite solar cells.

Research and development of encapsulation materials

Development in encapsulation presents a great opportunity for the solar encapsulation market. Research and development can be used to find a more cost-effective way to protect solar panels. By using materials and methods that are cheaper and more efficient, companies can make solar panels more affordable and easier to produce. This not only helps in making solar energy more accessible but also encourages more people to use it. Plus, solar panels can last longer and perform better, and it will be easy to recycle them, which is great for the environment and sustainability.

Adoption of off-grid solar systems

The adoption of off-grid solar equipment is a big opportunity for the solar encapsulation market. The need for renewable energy resources is increasing day by day, and solar energy is a major source. Off-grid solar panels are systems that are not connected to electricity grids but are collected to solar panels for energy generation. The increased adoption of off-grid solar systems will increase the use of solar panels, which will increase solar encapsulation.

The ethylene vinyl acetate segment dominated the solar encapsulation market in 2024. Ethylene-vinyl acetate (EVA) is made from ethylene and vinyl acetate, and this ethylene vinyl acetate (EVA) is used in excellent foamability performance and is lightweight. This material is also used in sports, footwear, and leisure applications and, due to flexibility, is used in solution packaging. Ethylene vinyl acetate has several benefits, such as staying powerful at low temperatures, giving good gloss and clarity, stress-cracking and maintaining its opposition to UV radiation, and keeping hot-melt bond waterproof possessions. Because of these reasons, demand for ethylene vinyl acetate (EVA) is increasing and leading to market growth.

The thermoplastic polyurethane (TPU) segment is expected to grow at the fastest rate during the forecast period. Thermoplastic polyurethane, also known as TPU, is used in various applications; due to the use of this material in new products, TPU is used as a replacement for other materials. Here are some benefits of thermoplastic polyurethane, such as TPU's unique structure, which allows high resilience & greater versatility. TPU is very durable and tough, making it convenient for different semi and soft, rigid applications; TPU can be utilized both as a soft engineering thermoplastic or tough rubber; it’s smoothly sterilized and washed, and thermoplastic polyurethane is also superior low-temperature flexibility. Because of these benefits, the demand for thermoplastic polyurethane (TPU) is increasing worldwide and leading to market growth.

The crystalline silicon solar technology segment dominated the solar encapsulation market in 2023; crystalline silicon PV cells that are used in commercially available solar panels, crystalline silicon solar are more cost-efficient than thin film technology, crystalline silicon technology needs less production process to complete, and this technology is environmentally friendly also contains no harmful material, due to these benefits crystalline silicon solar demand is booming in the market.

The thin-film solar technology segment is expected to grow in the solar encapsulation market during the forecast period. Thin-film solar technology is utilized to convert light energy into electrical energy. In the market, demand for this technology is booming because of its benefits, such as thin-film solar panels being light or other than they are more flexible due to their thin construction.

The construction segment dominated the solar encapsulation market in 2024 and is also expected to grow in the market during the forecast period. In the construction industry, the use of solar panels is very high, especially in households and other types of buildings. Encapsulation materials are needed to protect solar panels against various factors, including UV radiation, moisture, high temperature, and oxidation. These things can affect solar panels, which increases the demand for solar encapsulation in the construction industry.

By Materials

By Technology

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

January 2025

August 2024