October 2024

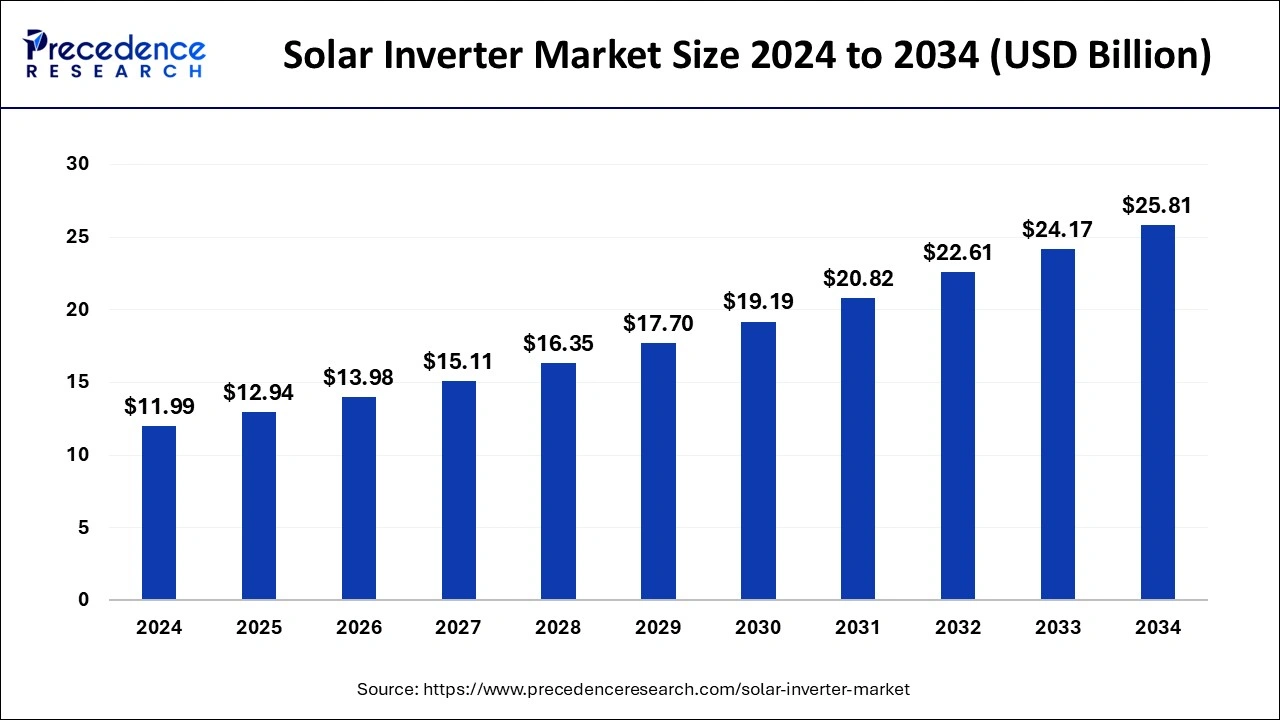

The global solar inverter market size is estimated at USD 12.94 billion in 2025 and is predicted to reach around USD 25.81 billion by 2034, accelerating at a CAGR of 7.97% from 2025 to 2034. The Asia Pacific solar inverter market size surpassed USD 5.56 billion in 2025 and is expanding at a CAGR of 8.09% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global solar inverter market size was estimated for USD 11.99 billion in 2024 and is anticipated to reach around USD 25.81 billion by 2034, growing at a CAGR of 7.97% from 2025 to 2034. The power of solar inverters to regulate the flow of electric power accelerates the growth of the solar inverter market.

Artificial intelligence maximizes the efficiency of solar panels. Advanced AI algorithms help analyze vast datasets, weather patterns, solar irradiance, and historical performance metrics. AI ensures the maximum amount of sunlight captured by solar panels, which significantly boosts energy output. AI-driven predictive maintenance systems use machine learning algorithms to manage solar farms and monitor the condition of solar panels and related equipment. AI can forecast potential failures and schedule maintenance before any breakdown by analyzing sensor data and historical performance. The integration of AI into energy storage systems is essential to optimize solar power usage. AI-powered robots and drones can perform tasks such as panel inspection, panel cleaning, and repair.

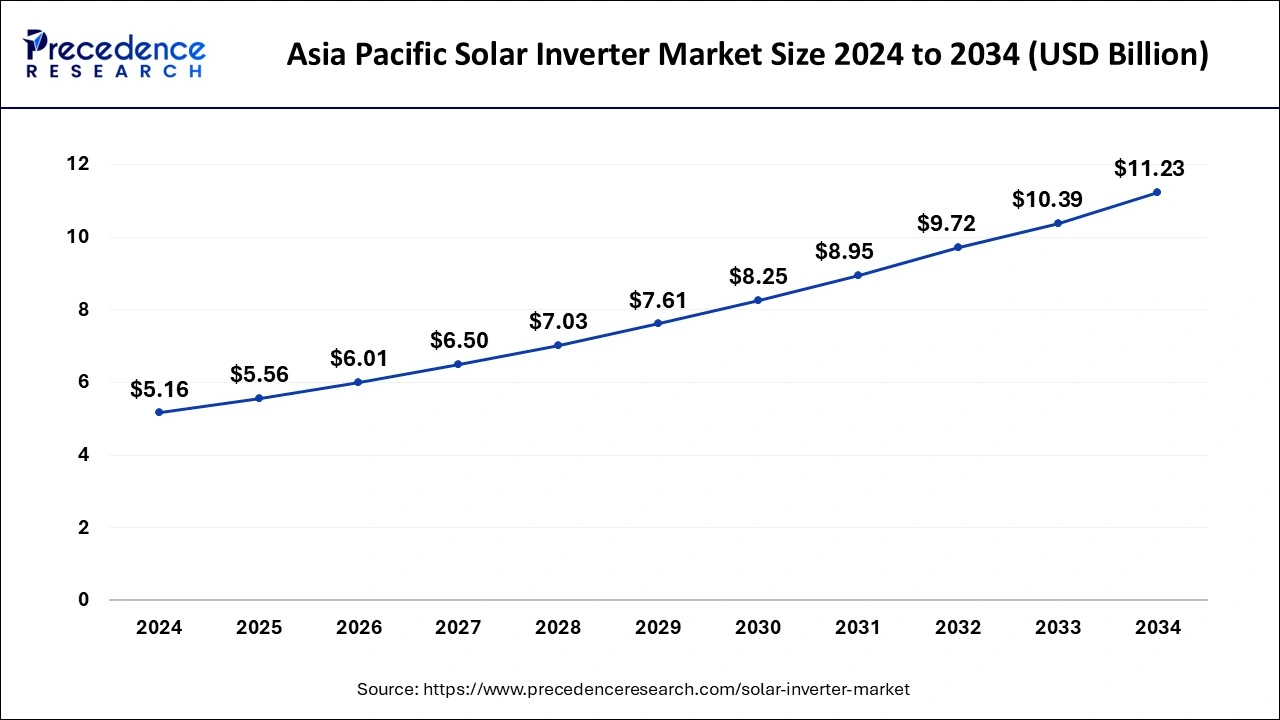

The Asia Pacific solar inverter market size was estimated at USD 5.16 billion in 2024 and is anticipated to be surpass around USD 11.23 billion by 2034, rising at a CAGR of 8.09% from 2025 to 2034.

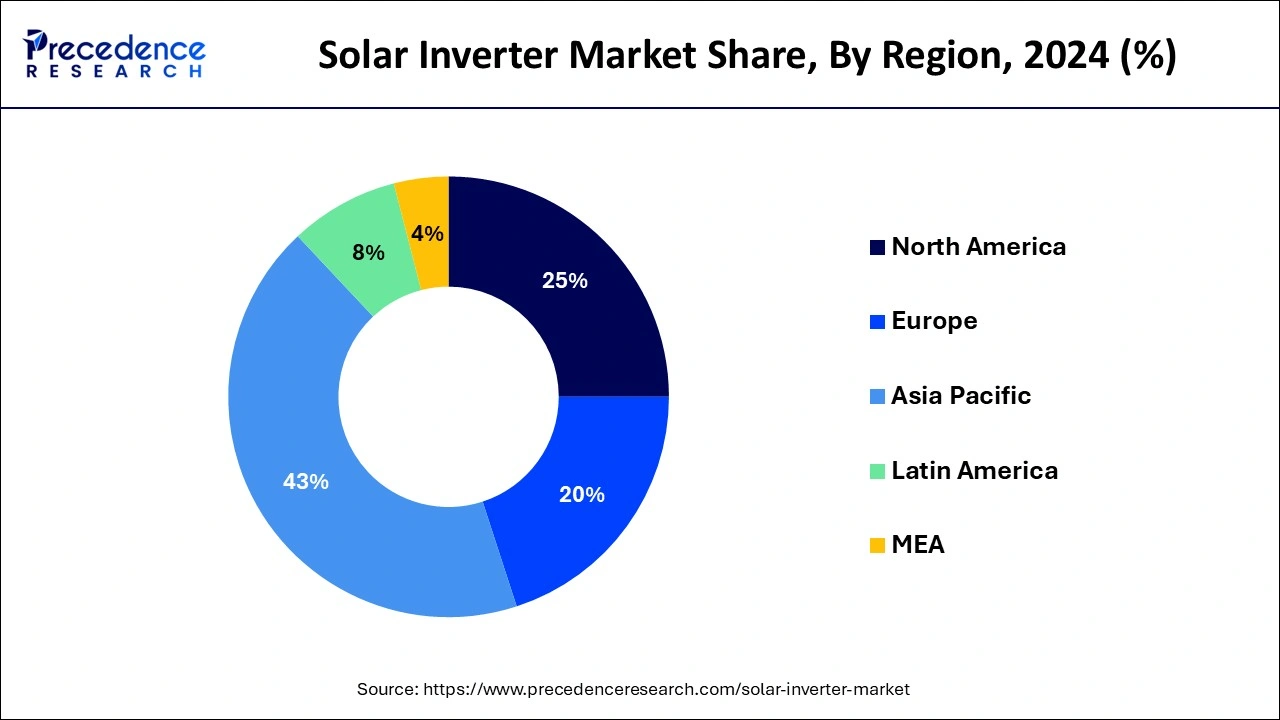

Asia-Pacific accounted for the largest revenue share of around 43% in 2024. Factors such as rising government initiatives and the presence of major market players in the region are propelling the expansion of the solar (PV) inverter market in Asia-Pacific.

The growing solar installation in developing nations significantly contributes to the market’s growth in this region. The growing need to reduce carbon emissions and the growing awareness about environmental issues accelerate the need for solar inverters in this region. The constant economic growth in China and India and the developments in the supply chain propel the demand for this equipment. The increased utilization of solar energy and the increased manufacturing of solar equipment such as solar panels, solar devices, and solar PV inverters drive the market’s growth significantly.

North America is expected to develop at the fastest rate during the forecast period. The U.S. dominated the solar (PV) inverter market in the North American region. The U.S. is dominating the solar (PV) inverter market in the North American region. In a few years, the region has seen substantial growth in the sales of central and string inverters.

The United States is prominent in the market. Moreover, central inverters are expected to drive the market’s growth in the coming years. Industrial players are trying to provide consumers with industry-leading utility-scale solutions that help them achieve higher efficiency and reduced balance-of-system costs with their pre-integrated power stations. The increased demand for clean energy solutions is also driving the market’s growth in this region. The favorable government policies also boost the demand and need for solar inverters in the North American market.

The solar inverter refers to the most important equipment in a solar energy system, which is an excellent example of a class of devices called power electronics that regulates the flow of electrical power. This equipment provides energy in several areas, such as commercial, industrial, and residential. It can be connected on-grid or off-grid. The types of this essential equipment include string inverter, central inverter, and microinverter. The commercial and industrial areas represent the main target markets for this. The rising awareness of consumers about solar inverters and the growing environmental concerns are establishing the importance of this equipment globally. It is an integral part of electricity generation. This solar power is free and adequate, while the production and manufacturing process is easy for prominent industries. The processes benefit end users because they do not need any further costs except installation and operating costs. Financially, the process is feasible and is in high demand all over the world.

| Report Coverage | Details |

| Market Size in 2025 | USD 12.94 Billion |

| Market Size by 2034 | USD 25.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.97% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Connection, Phase, End User, Nominal Power Output, Nominal Output Voltage, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The favorable government policies and initiatives, the declining cost of solar panels, technological advancements in solar power, and the rising energy demand are the major rationales behind the growth of the solar inverter market. Moreover, the International Solar Alliance (ISA), rural electrification programs, solar financing, investment opportunities, etc., accelerate the market’s growth. Technological innovations, including solar tracking systems, thin-film solar panels, energy storage solutions, and solar-wind hybrid systems, are shaping the future of solar energy in India.

More solar installations connected to the grid impose challenges regarding grid integration, stability, and power quality. Solar inverters need higher efficiency to maximize the energy yield from solar installations. The need arises to ensure the durability and reliability of inverters over their lifespan to minimize maintenance costs and downtime.

With the high investments in high-quality solar inverters, people can enjoy reliable and cost-effective electricity in the coming years. Efforts are made to design inverters that can work in remote locations or areas with unreliable grid power. Solar power will help people reduce electricity bills and provide energy independence due to high electricity rates and limited access to the national grid.

The central inverter segment dominated the market with largest market share in 2024. The central solar (PV) inverter is widely applicable in industries. This type of inverter is used in huge buildings and industrial centers. The solar panels are installed in the rooftops of buildings which enables the smooth power supply.

The string inverter segment is fastest growing segment of the solar (PV) inverter market in 2021. The installation of string inverters is economic friendly and it is easy to install in commercial and residential areas. This type of solar (PV) inverter is effective and efficient in nature.

In 2024, the on-grid segment dominated the solar (PV) inverter market. This is due to growing investments in the electricity and power generation. The on-grid solar (PV) inverter is cost effective in nature. The on-grid solar (PV) inverters are mostly installed in residential areas.

The off-grid segment, on the other hand, is predicted to develop at the quickest rate in the future years. The off-grid solar (PV) inverters are increasingly common and often come with a backup power supply. The solar (PV) inverters that are not connected to the grid are known as off-grid inverters.

The utilities segment accounted largest market share of in 2024. The factors such as surge in demand for renewable energy and rising government initiatives are driving the growth of the segment. In addition, the solar (PV) inverter is cost effective solution for various utilities.

The residential segment is fastest growing segment over the forecast period. The people living in residential areas use large number of home gadgets and appliances. It means that the people require more amount of electricity for these gadgets. This factor is creating demand for electricity in residential areas on a large scale. Thus, the expansion of the segment is expected due to this factor.

By Product Type

By Connection

By Phase

By End User

By Nominal Power Output

By Nominal Output Voltage

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

January 2025

August 2024