October 2024

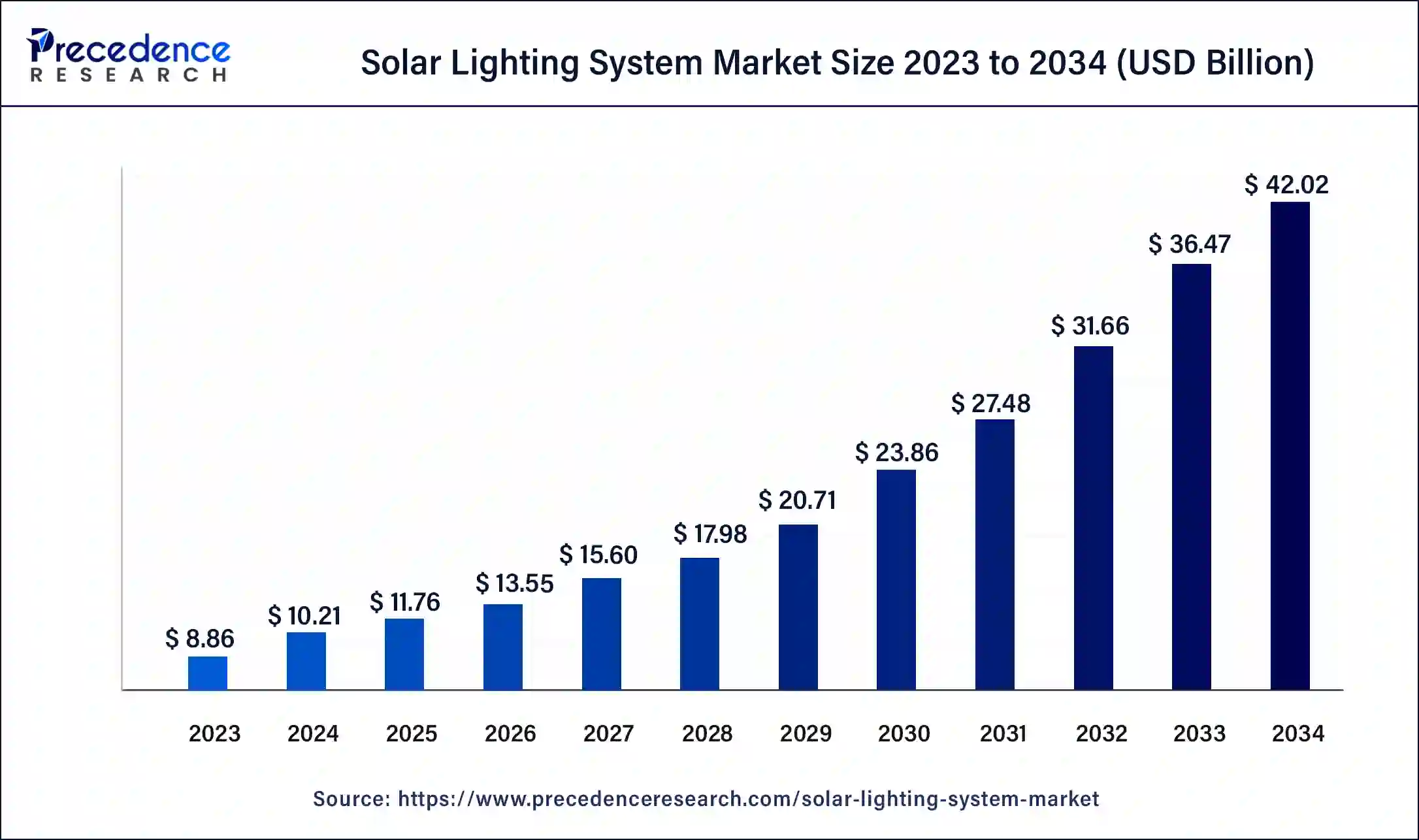

The global solar lighting system market size was USD 8.86 billion in 2023, calculated at USD 10.21 billion in 2024 and is expected to be worth around USD 42.02 billion by 2034. The market is slated to expand at 15.20% CAGR from 2024 to 2034.

The global solar lighting system market size is projected to reach around USD 42.02 billion by 2034 from USD 10.21 billion in 2024, at a CAGR of 15.20% between 2024 and 2034. Increasing environmental consciousness, as well as the desire to cut carbon emissions, is the key driver of the solar lighting system market.

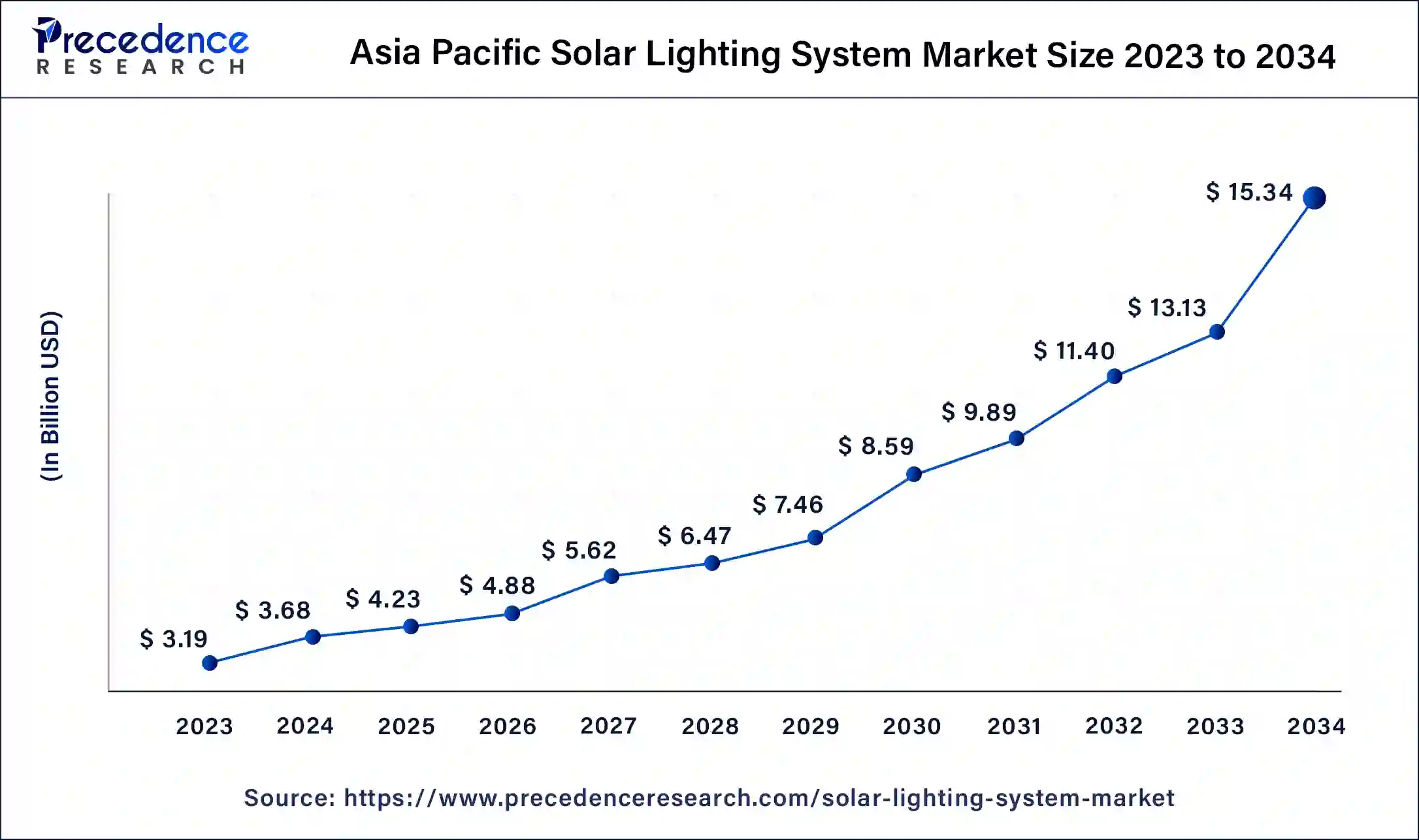

The Asia Pacific solar lighting system market size was exhibited at USD 3.19 billion in 2023 and is projected to be worth around USD 15.34 billion by 2034, poised to grow at a CAGR of 15.34% from 2024 to 2034.

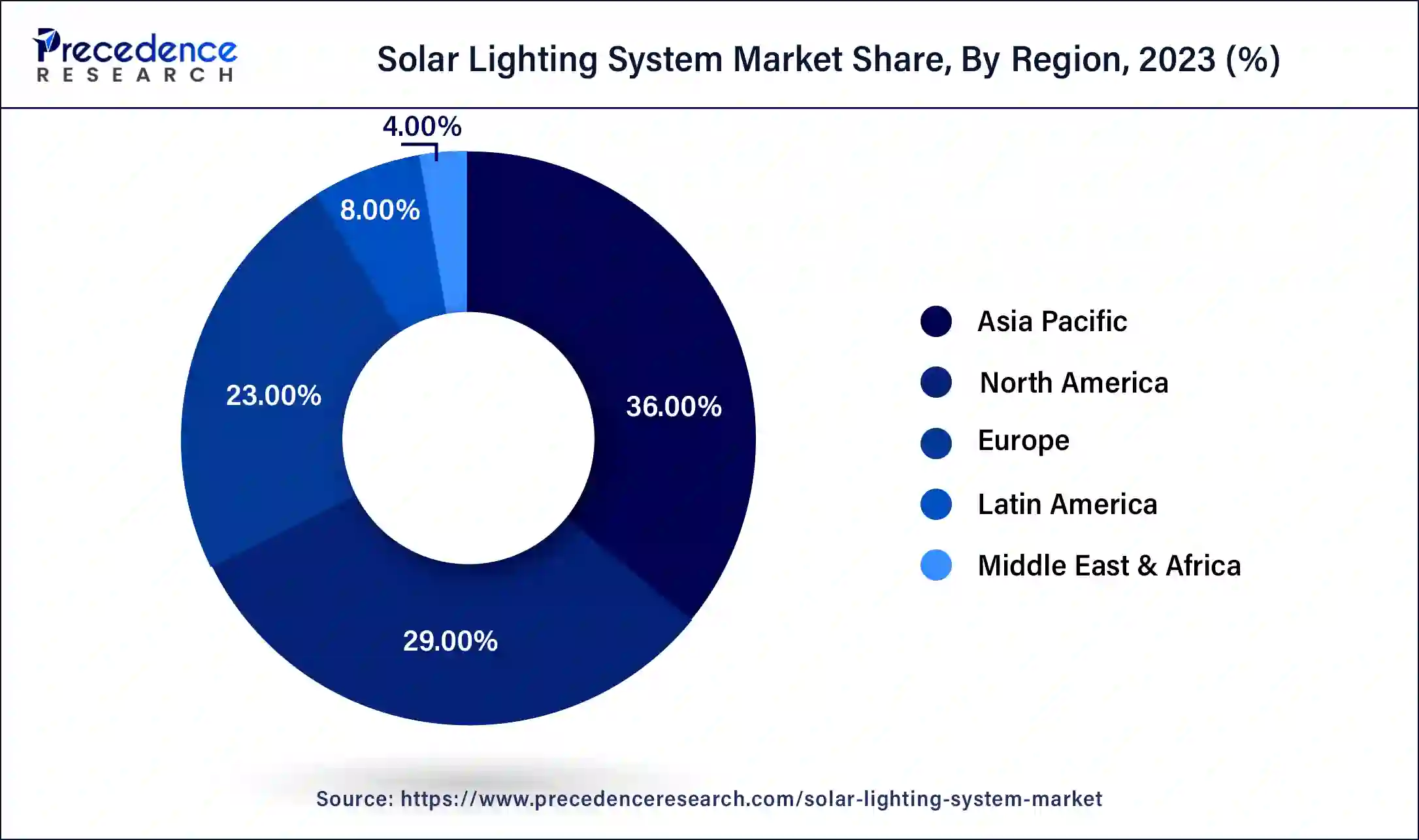

Asia Pacific dominated the solar lighting system market in 2023. The market is growing due to the surge in smart city developments, infrastructure projects, and city expansion efforts across various nations. China is leading this growth, driven by increased government spending on public infrastructure and a rise in commercial and industrial projects. Similarly, initiatives from the governments of India, South Korea, and China are focused on installing street lighting solutions. Solar LED lighting is favored for its cost-effectiveness and sustainability, requiring no trenching and proving highly efficient in areas with plenty of sunlight.

North America is expected to grow at a faster rate in the solar lighting system market over the projected period. By holding a significant share of the market, a focus on sustainable energy and the decreasing reliance on fossil fuels drives this trend. Moreover, the market's growth is supported by the presence of numerous solar lighting system manufacturers, which gives a diverse range of products and technological innovations. The efficient distribution network in North America also plays an important role in making solar lighting products widely available and accessible across the region.

Top Solar Power Generating States in India (2023)

| State/UT | Solar Power Generated in 2022-23 (MU) |

| Delhi | 236.11 |

| Andhra Pradesh | 8140.72 |

| Haryana | 555.20 |

| Gujarat | 10335.32 |

| Maharashtra | 4387.8 |

| Madhya Pradesh | 3839.30 |

The solar lighting system market includes the sector responsible for producing, distributing, and installing lighting systems that operate on solar energy. These systems use photovoltaic panels to convert sunlight into electrical power, which is stored in batteries for use when sunlight is insufficient or at night. Solar lighting solutions are employed in a variety of settings like residential, commercial, industrial, and outdoor and provide an eco-friendly and sustainable alternative to traditional grid-based lighting options.

How is AI Changing the Solar Lighting System Market?

Recent progress in artificial intelligence (AI), particularly through machine learning and computer vision, has shown great promise in enhancing the performance of the solar lighting system market. By examining large datasets from solar installations and using sophisticated algorithms, AI can fine-tune the setup of solar arrays to suit different environments. Additionally, machine vision technology can facilitate real-time tracking and adjustment of panels to optimize solar energy capture throughout the day and across seasons. On a more granular level, AI techniques can be used to design, simulate, and test innovative nano-scale structures by improving the efficiency of converting photons into electrons.

| Report Coverage | Details |

| Market Size by 2034 | USD 42.02 Billion |

| Market Size in 2023 | USD 8.86 Billion |

| Market Size in 2024 | USD 10.21 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 15.20% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Grid Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Urbanization's surge sparks demand for sustainable energy solutions

As the global population grows, new technologies emerge, infrastructure development is accelerating, and urbanization is growing rapidly. This shift has increased the demand for sustainable energy and efficient electricity use. As a result, there is a growing need for energy-efficient solutions, especially solar panels, to support the goals of smart city projects in developing countries. Moreover, solar lighting's appeal is boosted by its low maintenance and lower operational costs compared to traditional lighting systems, which is driving its adoption in various underdeveloped areas.

Lack of perception and awareness

Misunderstandings and limited awareness about the solar lighting system market may hinder its widespread adoption. Some organizations and consumers might not fully recognize the benefits of solar lighting systems or might believe that these systems are less reliable or efficient compared to traditional lighting options. Additionally, the lack of financial resources and access to funding could be a barrier to adopting solar lighting, particularly in developing or underserved communities where the initial investment can be challenging to afford.

Mainstream applications

As LED lighting continues to be adopted across residential, commercial, and industrial sectors, its potential for growth remains substantial. This widespread integration is expected to make LEDs a mainstream choice, driving prices down as technology advances. Also, supportive government initiatives and a shift toward sustainable lighting options are likely to benefit the market. Efforts from both the government and industry players to promote LEDs over CFLs and incandescent bulbs, such as offering subsidies, are poised to create significant growth opportunities for the solar lighting system market.

The off-grid segment dominated the solar lighting system market in 2023. Their increased use in developing countries is attributed to the lower installation costs and the absence of a need for wide cabling infrastructure. Furthermore, solar lights can provide illumination in remote areas lacking reliable or grid access. In a typical off-grid setup, solar panels capture sunlight and convert it into electricity, which is then stored in local batteries to power the lights during nighttime.

The hybrid segment is expected to grow at a significant rate in the solar lighting system market over the forecast period. This can be attributed to the rising demand for sustainable and innovative products alongside the broader adoption of new technologies. Hybrid solar lighting (HSL) systems, also known as hybrid lighting solutions, merge solar power with artificial lighting to illuminate indoor spaces. They work by directing sunlight through fiber optic cables into rooms without windows or skylights and then supplementing this natural light with artificial lighting.

The commercial segment led the solar lighting system market in 2023. This growth is driven by increasing efforts from governments and local authorities to adopt solar lighting and other renewable energy sources. Therefore, solar lighting solutions are being deployed in various locations, including streets, roadways, and commercial properties. Also, the rising demand for solar lighting in public spaces such as airports and parking lots and for perimeter security further boosts the expansion of the commercial market.

The highways & roadways segment is anticipated to grow at the fastest rate in the solar lighting system market during the forecast period. The growing popularity of off-grid solar streetlights can be attributed to their low cost and minimal maintenance needs. Additionally, the increased brightness and efficiency of LED lights contribute to their widespread adoption.

Segments Covered in the Report

By Grid Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

January 2025

August 2024