October 2024

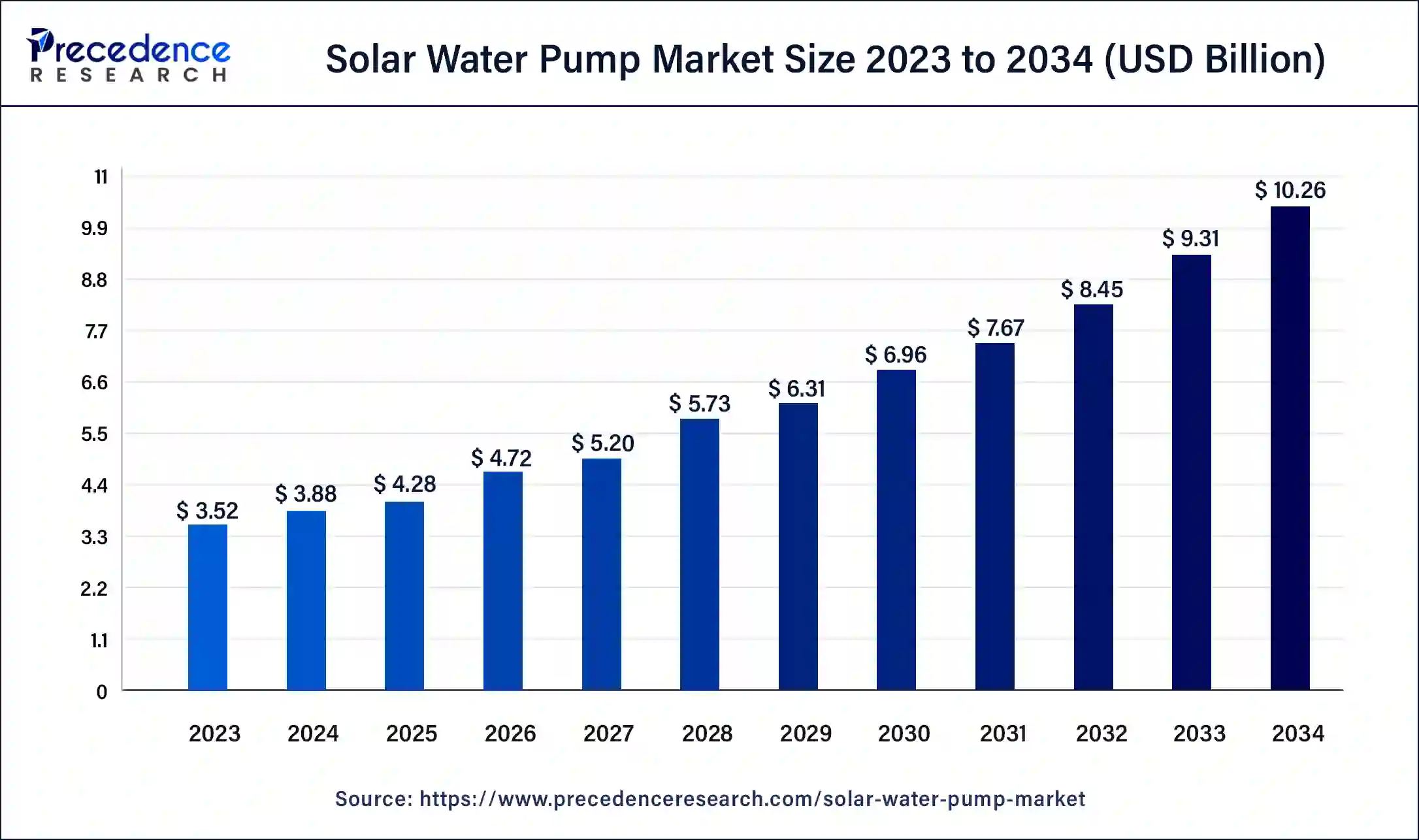

The global solar water pump market is worth around USD 3.88 billion in 2024 and is expected to reach around USD 10.26 billion by 2034, representing a healthy CAGR of 10.21% during the forecast period from 2024 to 2034.

The global solar water pump market size is worth around USD 3.88 billion in 2024 and is anticipated to reach around USD 10.26 billion by 2034, growing at a solid CAGR of 10.21% over the forecast period 2024 to 2034. The market growth is attributed to the increasing demand for sustainable and efficient irrigation solutions driven by water scarcity and environmental concerns.

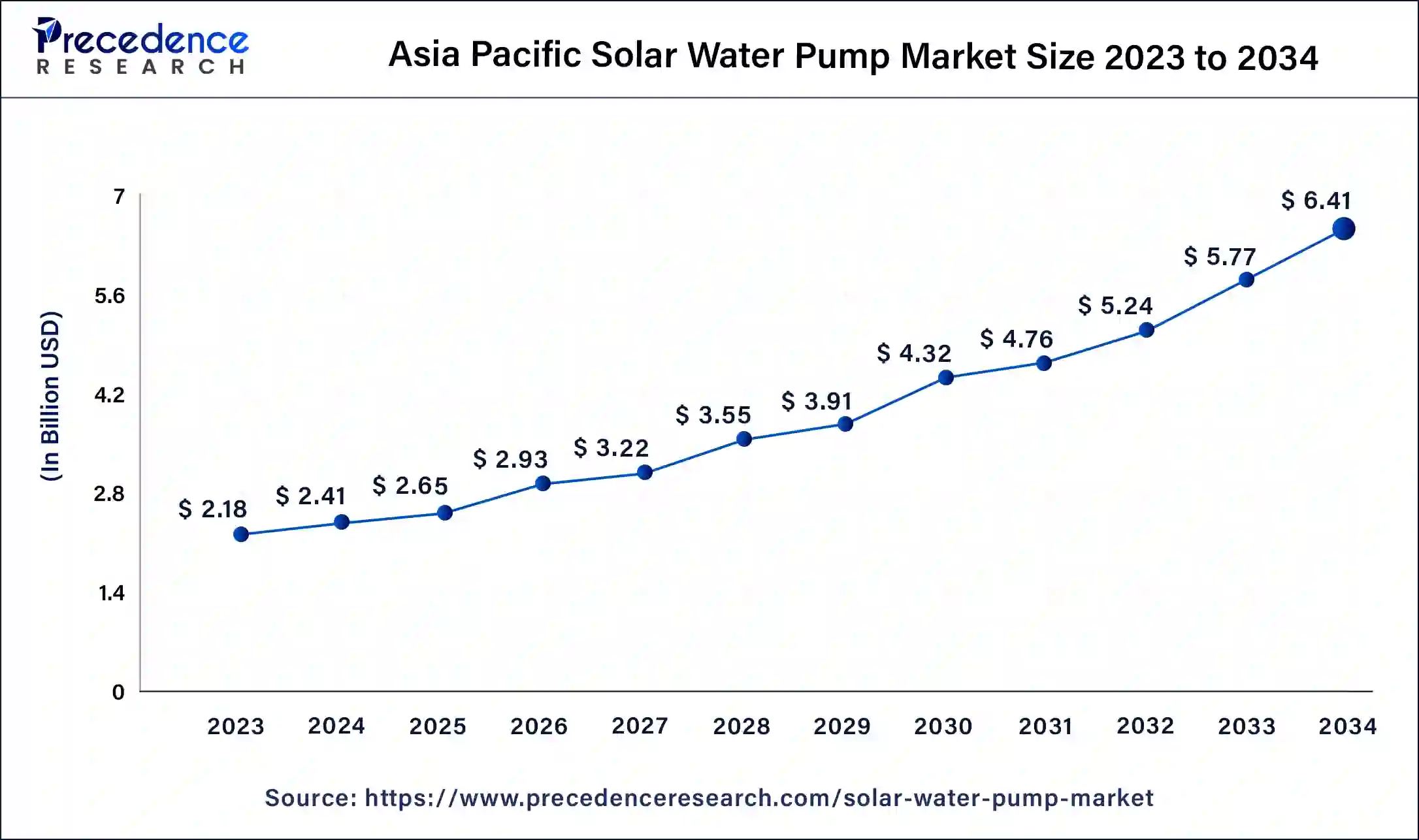

The Asia Pacific solar water pump market size was exhibited at USD 2.18 billion in 2023 and is projected to be worth around USD 6.41 billion by 2034, poised to grow at a CAGR of 10.30% from 2024 to 2034.

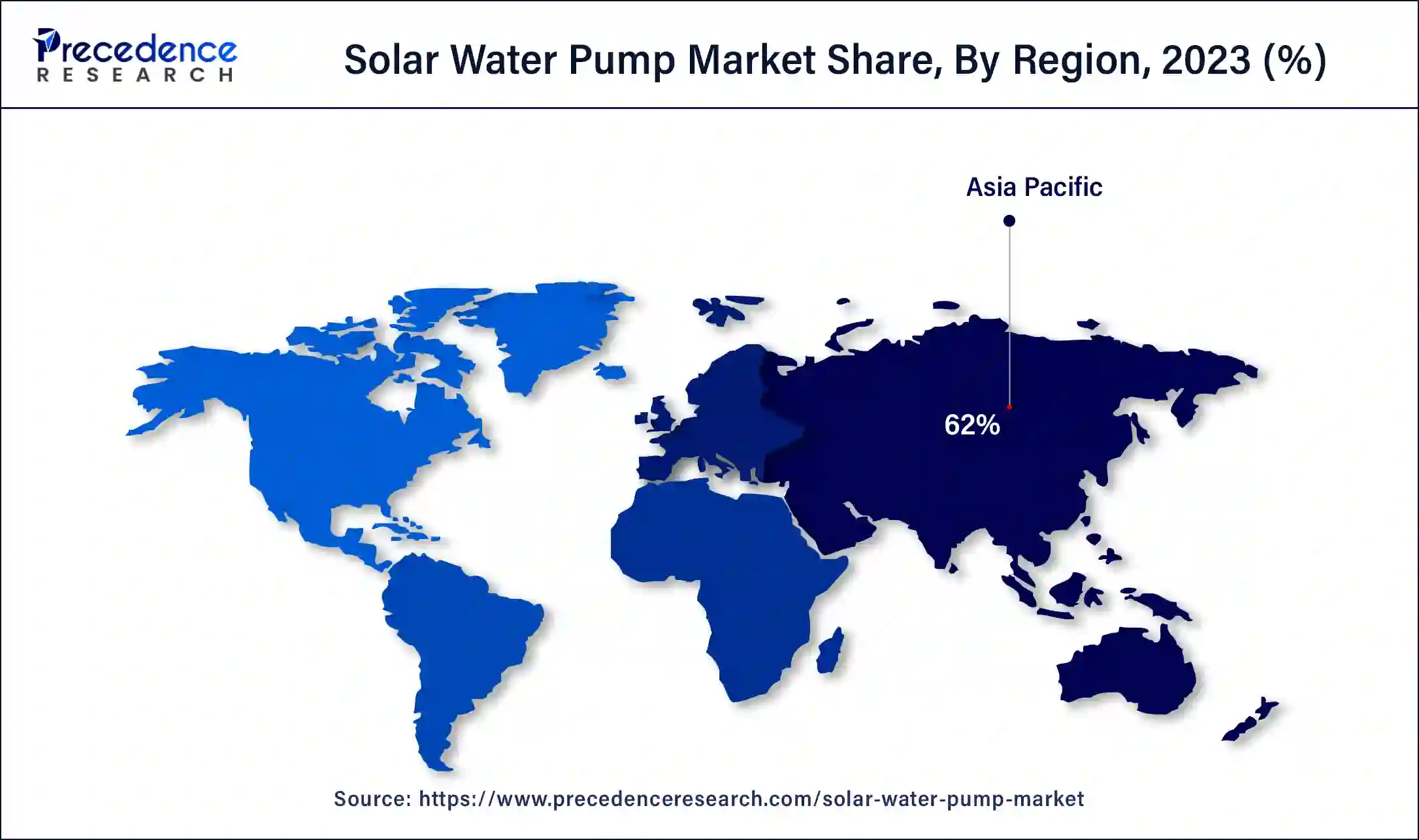

Asia Pacific led the solar water pump market, capturing the largest revenue share in 2023, due to the rising need for proper utilization of water especially concerning scarcity and need in agriculture. According to the Asian Development Bank, about 1.4 billion people in Asia lack access to water, and governments are turning to measures favoring renewable energy. Moreover, the increased solar investments and government policies for solar water pumping systems further increase the use of SWPS’s (solar water pumps) in the rural region.

North America is expected to grow at the fastest rate in the solar water pump market, owing to the high technological innovation and higher levels of awareness regarding the degrading environment. The United States has given measures toward cutting down on greenhouse emissions together with improved water usability scale-up. The U.S. Department of Energy has laid out goals for the deployment level of solar technologies which is also expected to drive the adoption of solar water pumping solutions for residential and agricultural applications. Further, the increased use of decentralized or mini-grid-based water supply solutions across the rural segments boosts the market in this region.

Rising demand for clean energy is significantly fuelling the solar water pump market as stakeholders increasingly seek sustainable solutions for irrigation and water supply. The International Renewable Energy Agency (IRENA) reports that global renewable energy capacity reached 3,064 GW in 2021, reflecting the growing interest in solar technologies. Solar water pumps leverage photovoltaic technology to convert sunlight into energy, powering water pumps that transport water from various sources. This technology offers a sustainable and cost-effective solution for regions facing water scarcity, particularly in agriculture.

According to a study by the Food and Agriculture Organization (FAO), the agricultural sector, which consumes about 70% of global freshwater resources, benefits greatly from adopting solar irrigation systems. In areas with limited grid connectivity, these pumps provide reliable access to water, thereby enhancing crop yields and improving food security. Furthermore, governments worldwide are supporting the transition to renewable energy through incentives and policies aimed at reducing carbon footprints.

Integration of Artificial Intelligence in Solar Systems?

Solar water pumps are automated through the use of AI intelligent systems to analyze large amount of data which increases their efficiency while reducing operational costs. These systems also predict when any of the systems are likely to fail, and corrective measures taken to reduce on the time needed for repair. Additionally, the AI system also control weather conditions and water demands with the help of integrated sensors and analytics to control the pumping systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.26 Billion |

| Market Size in 2024 | USD 3.88 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 10.21% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Motor Type, Power Rating, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for clean energy

The growing emphasis on sustainable energy solutions is expected to drive demand for solar water pumps which further boost the market. Governments across the globe are implementing policies that promote the use of renewable energy to phase out the use of fossil energy. The IRENA in their report stated that there was a social emergence of renewable energy, where new electricity capacity increased to 82% of new renewable power in 2020. This trend is in harmony with such programs as the Paris Agreement to reduce emissions by 2030 to a minimum.

Solar water pumps are preferred technology to use for these goals, especially in agricultural use for crops as well as in supplying water to rural areas. Solar water pumping for irrigation is estimated by the United Nations Environment Programme (UNEP) to reduce emissions of CO2 by more than 100 million tons each year if widely tapped into. Moreover, the PM-KUSUM scheme was started by the Indian government, and aims to install at least 2,000,000 solar pumps by 2026, there is also a plan to push for more solar water pumps in underdeveloped regions.

High initial costs

High upfront cost of solar water pumps is anticipated to restrain their widespread adoption, particularly in developing regions. The use of solar pumps has long-term cost-effectiveness considering the initial costs incurred when installing solar panels, pumps, and batteries. These, installation costs remain a major challenge for smallholder farmers and businesses. IRENA stated that solar water pumps are between 20 to 30% expensive than electric or diesel pumps. This fact makes several prospective consumers stay away from them. This gap slows solar water pump market progress in regions where subsidies or financing opportunities are not accessible.

Surging technological advancements

Technological innovations in solar panel efficiency, pump design, and AI integration are anticipated to create immense opportunities for the players competing in the solar water pump market. Manufacturers are making advancements in photovoltaic devices enabling solar water pumps to work at lower light intensity than before and better pump motors and materials that add value to the product. Advanced technology with pertinence to the use of remote controlling, AI-based predictive maintenance has also enhanced the efficiency of the pumps. Such enhancements offer the users better reliability and reduced cost of the innovation to make solar water pumps remain an improving innovation in different sectors.

Furthermore, these developments, and presently introduced products are also driving the market in the coming years. In 2023, Tata Power Solar, one of India’s largest solar solutions providers launched a new range of Solar Water Pump (SWP) products for agricultural use in India. These pumps utilize state-of-the-art technology in photovoltaic systems that makes it feasible for them to operate in a variety of weather conditions such as at night.

The company has said that these innovations are expected to cause the pump to be 25% more efficient than the older pump. This product launch is in sync with the Indias PM-KUSUM scheme that expects to be installing 2 million solar pumps by 2026 and further showcases how such technological advancements are driving the market growth.

The submersible pumps segment dominated the solar water pump market during the forecasting period, due to their reliability and versatility. The operation of these pumps occurs underwater and is applied for pumping water from deep sources, such as wells or subterranean water sources. Advantage of their design is low losses and they are used in agricultural irrigation and water supply systems in homes.

Submersible pumps have become popular mainly due to increasing concerns about efficient water management practices and critical concerns such as the need to source water in regions that are rural in nature. The International Renewable Energy Agency (IRENA) has projected the global solar water pump market to total USD 2 billion by 2027 with submersible pumps taking more considerable shares, as they are highly efficiency in deep water pumping. Furthermore, the growing demand for durable efficient, and cheaper pumping solutions for both agricultural and domestic use further boosts the segment in the coming years.

The surface pump segment is projected to grow at the fastest rate in the market in the future years, owing to its attributes like portability and easy installation. Surface pumps are positioned on the surface of the water and are thus suitable for installation where water is easily accessible than in the submersible pumps. These pumps need less capital with which to start and are also easier to install for the farmers and the inhabitants of such rural regions.

Increased awareness of water conservations that make the surface pump market geared for growth. According to the FAO, surface solar pumps have become common in the regions with many small farmers having enhanced shallow water tables. Additionally, the study from the World Bank shows that increased use of solar technologies such as surface pumps in agriculture leads to better water productivity enhancement of up to 50% in the region, thus fuelling the segment.

The AC pump segment held the largest revenue share in the solar water pump market during the forecasting period. These pumps use ACS and are preferred mainly for their high efficiency in large-scale farming and commerce. AC pumps also provide high power compared to DC pumps, thus they supply water flow rates. Stating the market share of AC pumps in the current year, the IEA indicated that the market was dominated by AC pumps at 65% due to rising agriculture demands and efficient irrigation systems. Moreover, recent developments in AC motors have enhanced the energy efficiency and cost of operation which further propels their demand.

The DC pump segment is projected to grow at the considerable rate in the market in the coming years. These pumps are developed solely for usage in solar products and easily transform light solar energy into mechanical energy to propel water. This efficiency makes DC pumps particularly attractive to smallholder farmers and rural areas where grid electricity is difficult to access. The FAO also reports that the markets for these DC pumps are expected to be boosted due to the ongoing positive trend towards incorporating solar applications in combating water shortages in different parts of the world.

Research by the United Nations Development Programme (UNDP) has indicated that the DC pump growth rate is rising to as much as 20% annually up to 2025, with improvements in solar technology and boosting government support for renewable power sources. Moreover, DC pumps and other automated versions of these pumps are expected to make it even more attractive thus increasing the use of the pumps in both agricultural and domestic practices.

Up to 5 HP segment dominated the solar water pump market, due to its relatively cheap nature and widespread use across different areas of endeavor. It is able to provide this much power rating for smallholders in agricultural usage, water supply to houses, and gardening activities. This makes it very accessible to individuals and small-scale farmers.

These include the rise in concerns about sustainable farming methods, and the need for efficient water sources in rural areas in particular, which have greatly influenced the uptake of the pumps within this category. As per the IRENA report, 2022, the market share for pumps with 5 HP and above was considered as a small portion and was estimated to be about 45%. Moreover, subsidies from the government to support the use of renewable energy technologies further make these types of pumps popular among small holders seeking efficient and cheaper water technologies.

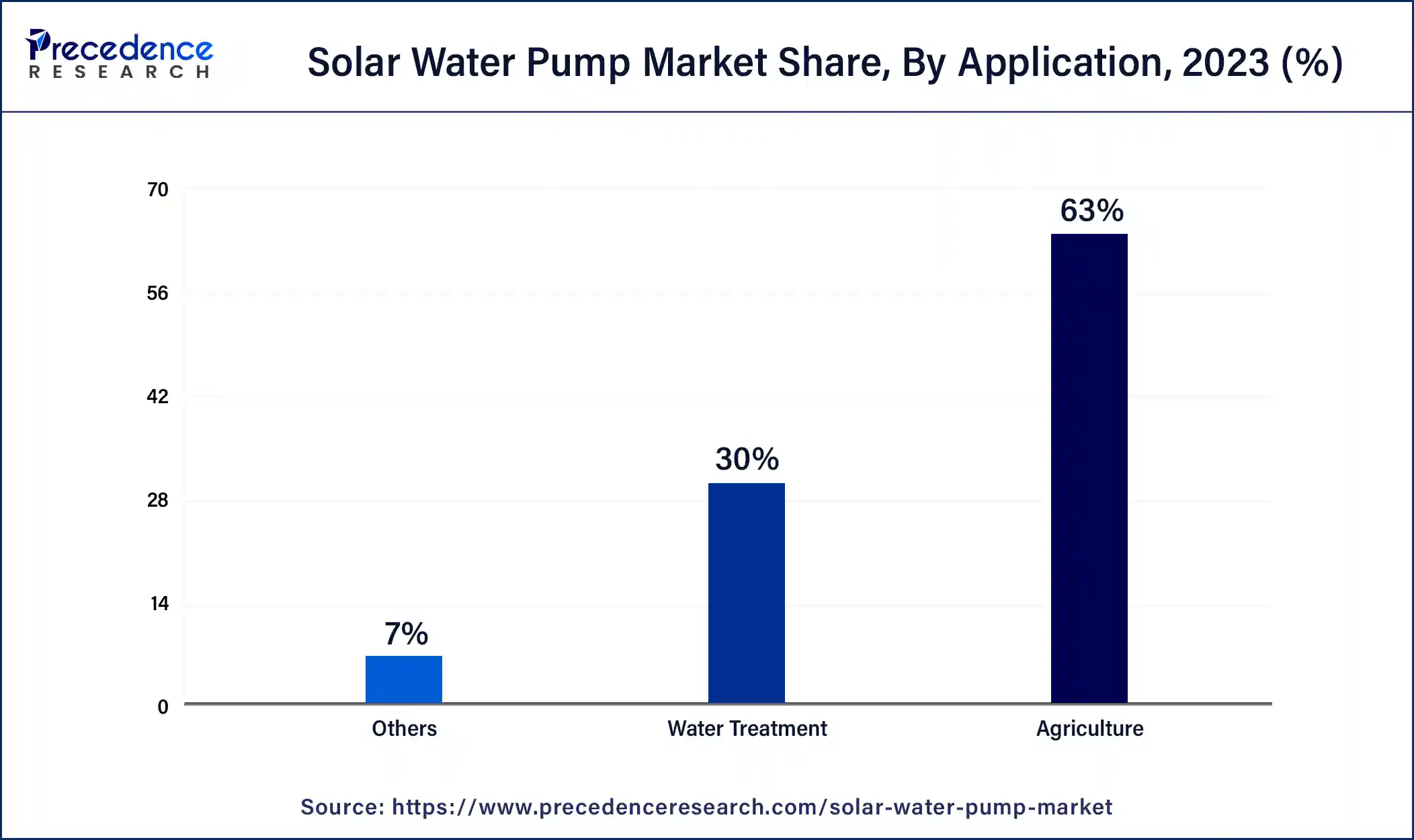

The agriculture segment held the largest revenue share in the solar water pump market during the forecasting period, due to the growing popularity of irrigation systems powered with solar energy. Electrification of pumping technology through solar energy has also made farmers to use solar pumps for enhanced water use efficiency. FAO estimates that about 70% of the global freshwater resources are consumed in agriculture and therefore water-saving irrigation is essential.

In South Asia and Sub-Saharan Africa where access to power is limited which creates high utility for solar water pumps. Furthermore, the increased consumers’ awareness of benefits derived from clean energy production and the abundance of government policies supporting efficient farming further propel the market.

The water treatment segment is projected to grow at a notable rate in the solar water pump market in the coming years, owing to the growing global concerns and demand for efficient methods of water use technology around the world. They are very useful in many treatment processes, such as desalination, filtration, and wastewater treatment where areas in which renewable energy sourced from solar water pumps is very vital. According to the United Nations Educational, Scientific and Cultural organization UNESCO, the global demand for clean water is projected to rise by 2050 to 55%. Additionally, the increased use of solar systems in the cities to support water provision and management further boost market growth.

Segments Covered in the Report

By Type

By Motor Type

By Power Rating

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

January 2025

August 2024