April 2025

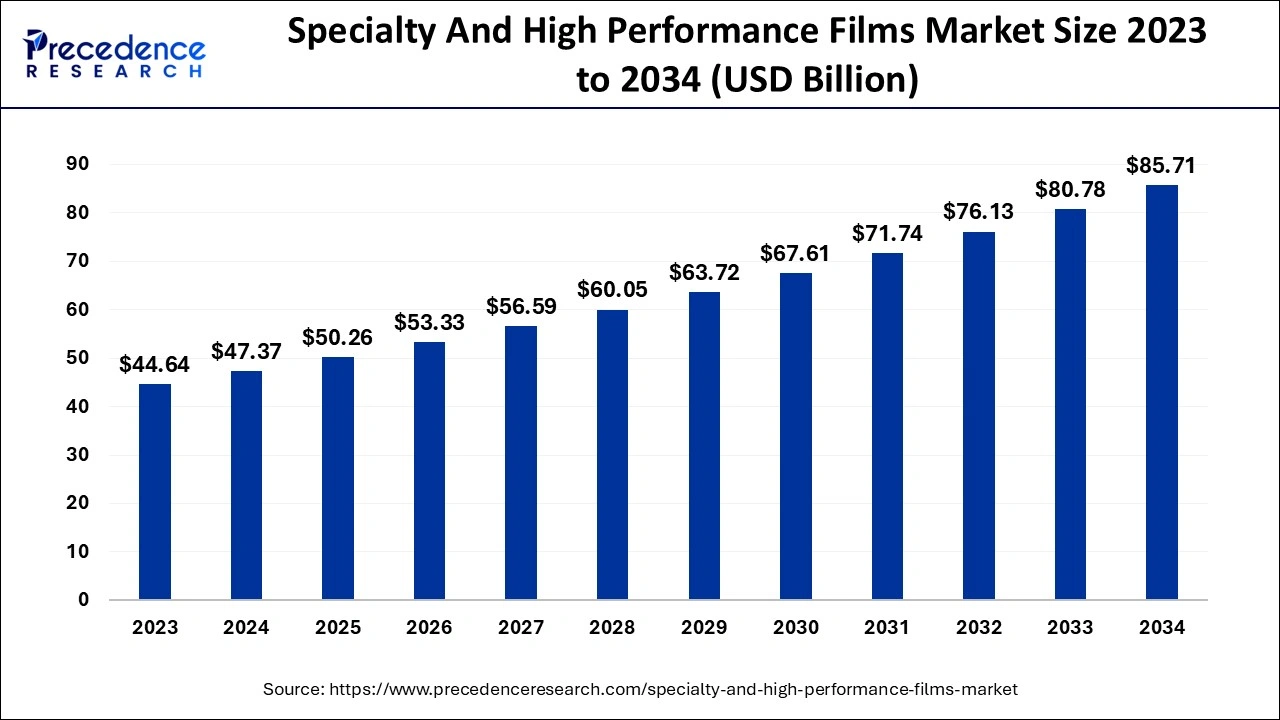

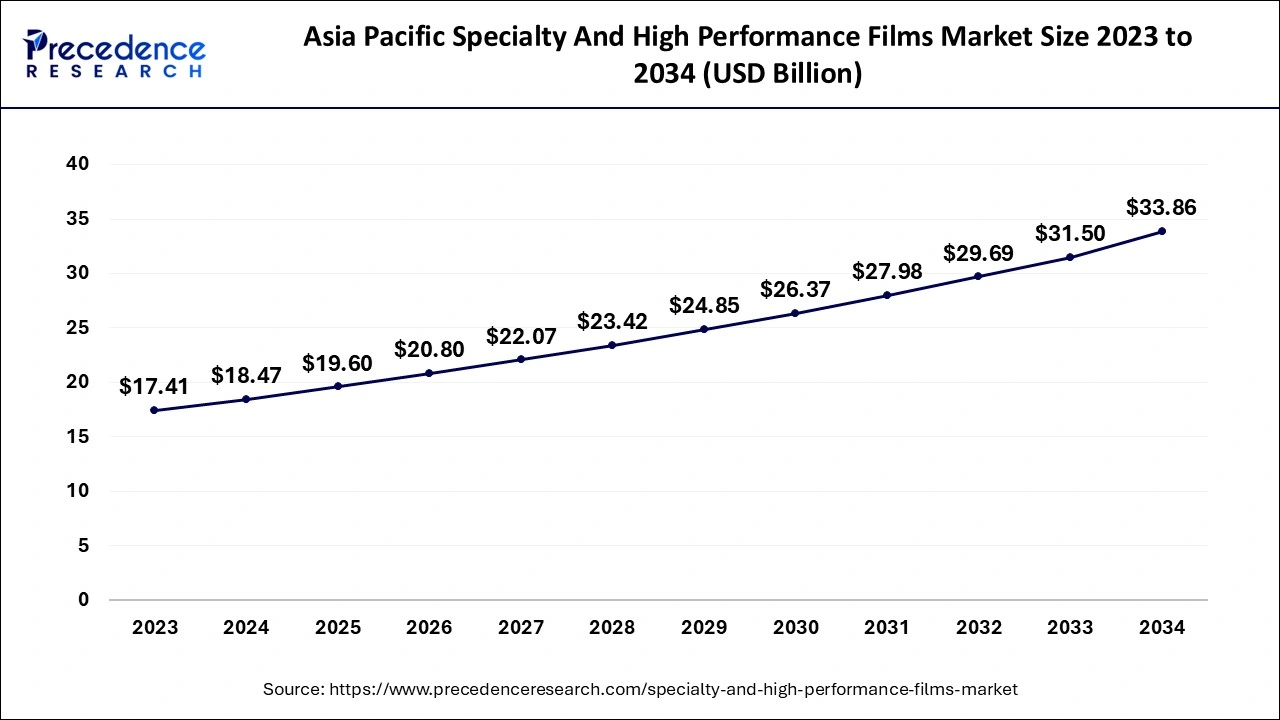

The global specialty and high performance films market size accounted for USD 47.37 billion in 2024, grew to USD 50.26 billion in 2025 and is expected to be worth around USD 85.71 billion by 2034, registering a CAGR of 6.11% between 2024 and 2034. The Asia Pacific specialty and high performance films market size is calculated at USD 18.47 billion in 2024 and is expected to grow at a CAGR of 6.23% during the forecast year.

The global specialty and high performance films market size is calculated at USD 47.37 billion in 2024 and is projected to surpass around USD 85.71 billion by 2034, expanding at a CAGR of 6.11% from 2024 to 2034. Advancements in materials science are the key factor driving market growth. Innovations in film manufacturing techniques, along with increasing regulatory pressures, are also fuelling market growth.

The Asia Pacific specialty and high performance films market size is evaluated at USD 18.47 billion in 2024 and is projected to be worth around USD 33.86 billion by 2034, growing at a CAGR of 6.23% from 2024 to 2034.

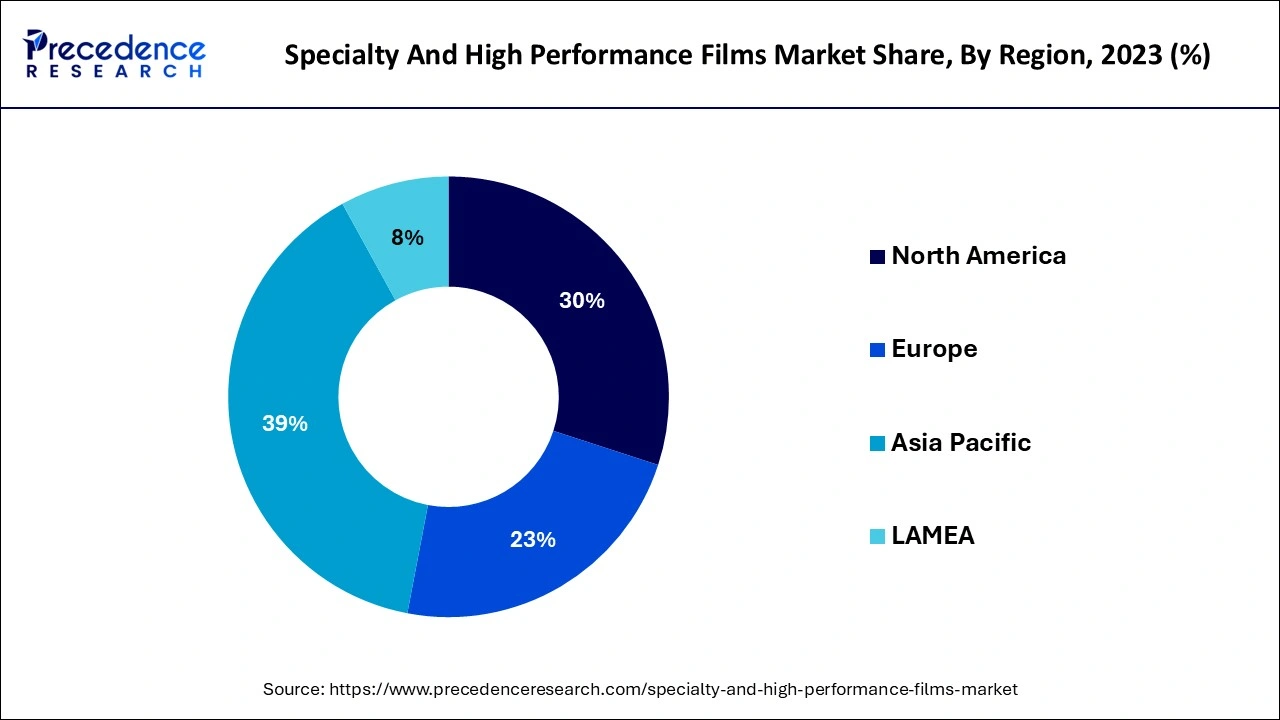

Asia Pacific dominated the specialty and high performance films market in 2023. The dominance of the segment can be attributed to the rising need for innovative building materials, such as protective films and efficient glazing for construction applications. Furthermore, developing countries in the region, like China, India, and others, experience substantial growth in the packaging industry, such as food & beverage packaging, which can impact market growth positively.

North America held a significant share of the specialty and high performance films market in 2023. The growth of the region can be driven by increasing demand for specialty films that provide improved performance properties, including flexibility, durability, and resistance to atmospheric factors. However, technological advancements and a surge in demand for specialty films in industries like automotive and electronics are driving the market growth.

The specialty and high performance films market covers a wide range of innovative materials designed to fulfill particular technical and functional demands across different industries. These films are created to offer exceptional features like flexibility, durability, and thermal resistance. Film applications range from the medical sector to electronics and packaging, where efficiency and reliability are important as industries continue to develop the requirements for advanced film solutions that improve sustainability and product efficiency, which impact market growth positively.

10 Biggest Construction Companies in the World (2024)

| Companies | Revenue in billions |

| ACS Actividades de Construcción y Servicios S.A. | €39 billion |

| HOCHTIEF | €21.1 billion |

| Vinci | €48.05 billion |

| China Communications Construction Group Ltd. | $79.8 billion |

| Bouygues | €35.55 billion |

| Strabag | €15.7 billion |

| Power Construction Corp | ¥347.7 billion |

| China State Construction Engineering Corporation (CSCEC) | ¥203 billion |

| Skanska AB | KR160.3 billion |

| Ferrovial | $13 billion |

Impact of AI on Specialty and High-Performance Films Market

AI is transforming the market significantly due to its ability to process data. The implementation of AI-driven analytics has streamlined production operations, increased efficiency, and decreased costs. AI integration in materials science impels the development of innovative film properties and customization. Furthermore, AI ensures scalability and consistent quality in the production process, driving the specialty and high performance films market growth over the forecast period.

| Report Coverage | Details |

| Market Size by 2034 | USD 85.71 Billion |

| Market Size in 2024 | USD 47.37 Billion |

| Market Size in 2025 | USD 50.26 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.11% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for packaging applications

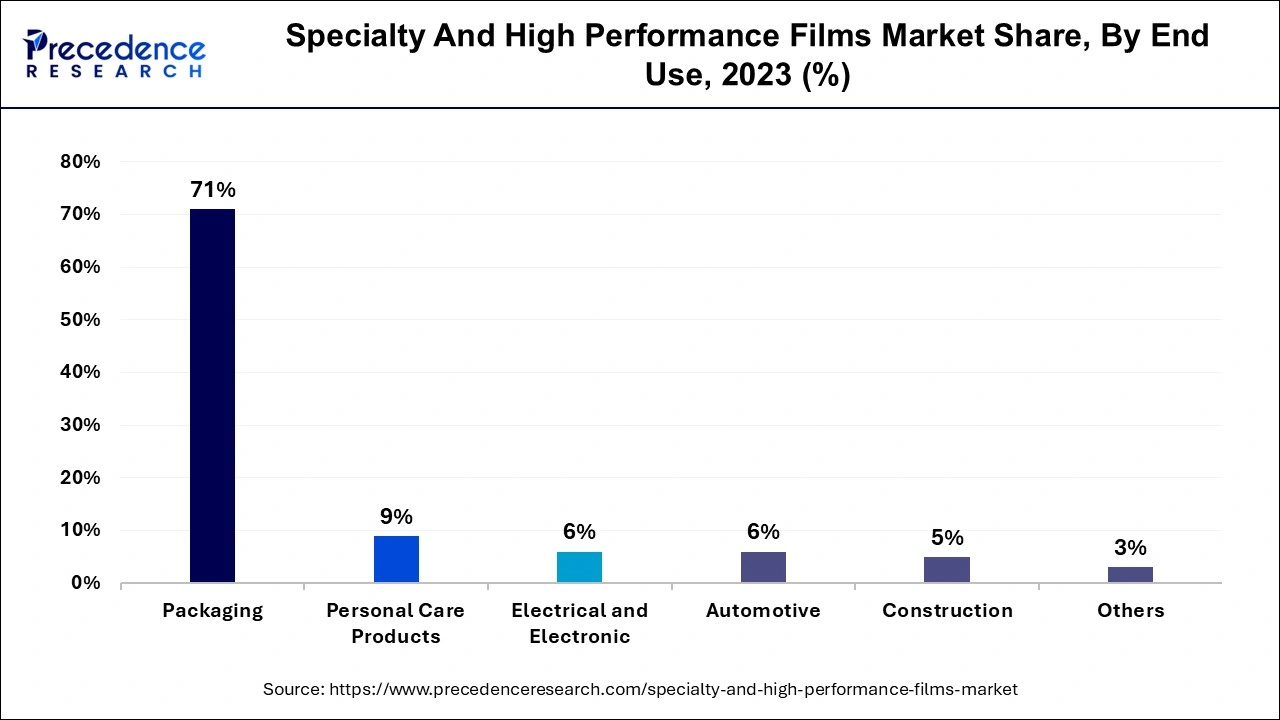

The specialty and high performance films market is witnessing significant growth due to the increasing demand for advanced packaging solutions across different industries, such as pharmaceuticals, food, and consumer goods. Additionally, these films provide improved barrier characteristics, ensuring increased shelf life and product safety, which are necessary for controlling quality and decreasing material waste. Also, there is a growing consumer preference for eco-friendly and sustainable products, which is driving producers to utilize environmentally friendly practices.

High competition from alternatives

The market confronts huge competition from alternative materials, including metal, glass, and traditional plastics, which may provide reduced costs and a well-established market presence. However, this competition can negatively impact growth opportunities and the share of specialty films, especially in cost-sensitive applications.

Rise in new installation of photovoltaic systems

There has been a surge in photovoltaic electricity generation, which is expected to fuel the demand for specialty and high-performance films in the market. Specialty films are compatible with both flexible and rigid thin-film photovoltaic modules and act as a base for highly functional barrier layers. Furthermore, these films offer excellent mechanical properties and dielectric strength and also provide environmental resistance. The new installation projects for this system can propel speciality and high performance films market growth.

The polyester segment led the specialty and high performance films market in 2023. The dominance of the segment can be attributed to the increasing utilization of these films as substrates for displays, circuits, and touchscreens because of their high thermal stability and electrical insulation properties. Additionally, the rapid evolution in the electronics industry, which is distinguished by the development of more compact and innovative devices, will shortly boost the demand for high-performance polyester films.

The polycarbonate segment is anticipated to show the fastest growth over the forecast period. The growth of the segment can be linked to the superior optical clarity and impact resistance properties offered by these films. Which makes them compatible for use in electronic displays and protective coatings. Furthermore, the rising adoption of sustainable building practices from the construction industry can facilitate the use of polycarbonate films in the specialty and high performance films market.

The barrier segment dominated the specialty and high performance films market in 2023. This is because the rising use of barrier films in photovoltaic systems and flexible packaging markets like food packaging is promoting this segment's expansion. Moreover, increasing consumer preferences for longer-lasting and convenience products continue to stimulate the demand for high-performance barrier films through the projected period.

The decorative segment is anticipated to grow at a significant rate over the studied period. The growth of the segment can be driven by the rising trend towards customizable and modern interiors, along with the need for cheap design solutions, which propels the adoption of decorative films in interior design and architecture. Also, Decorative films are extensively used in architectural applications such as wall coverings, surface finishes, and window film because of their ability to offer stylish improvements.

In 2023, the packaging segment dominated the specialty and high performance films market by holding the largest market share. The dominance of the segment can be credited to the increasing use of these films in packaging due to their durability and barrier properties, improving the shelf life of goods. Moreover, in the food market film packaging keeps the food fresh for a longer duration of time and prevents food wastage.

The construction segment is expected to grow at the fastest rate in the specialty and high performance films market during the projected period. These films are utilized in architectural facades, surface coverings, and decorative window films to create modern and unique designs. Also, the construction segment uses these films to determine structural reinforcement characteristics and weather resistance for buildings. Designers and architects also seek advanced paths to achieve aesthetically appealing spaces.

Segments covered in the report

By Product

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

January 2025

November 2024