October 2024

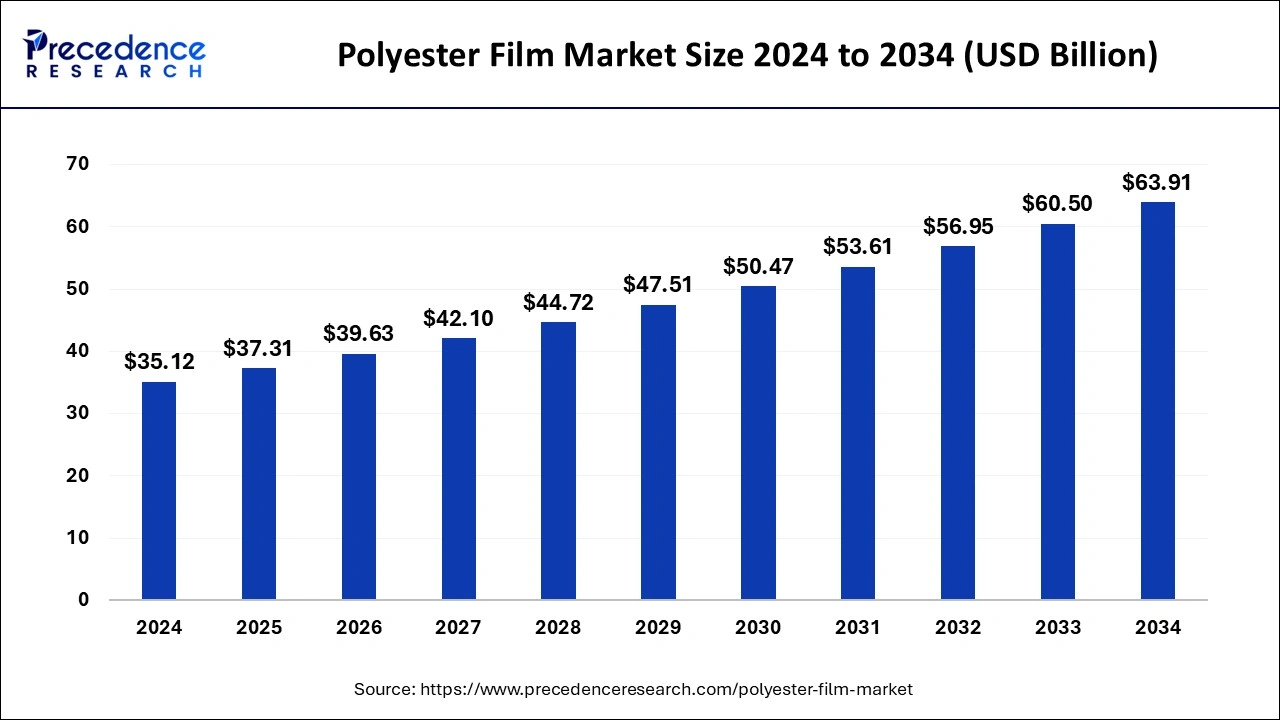

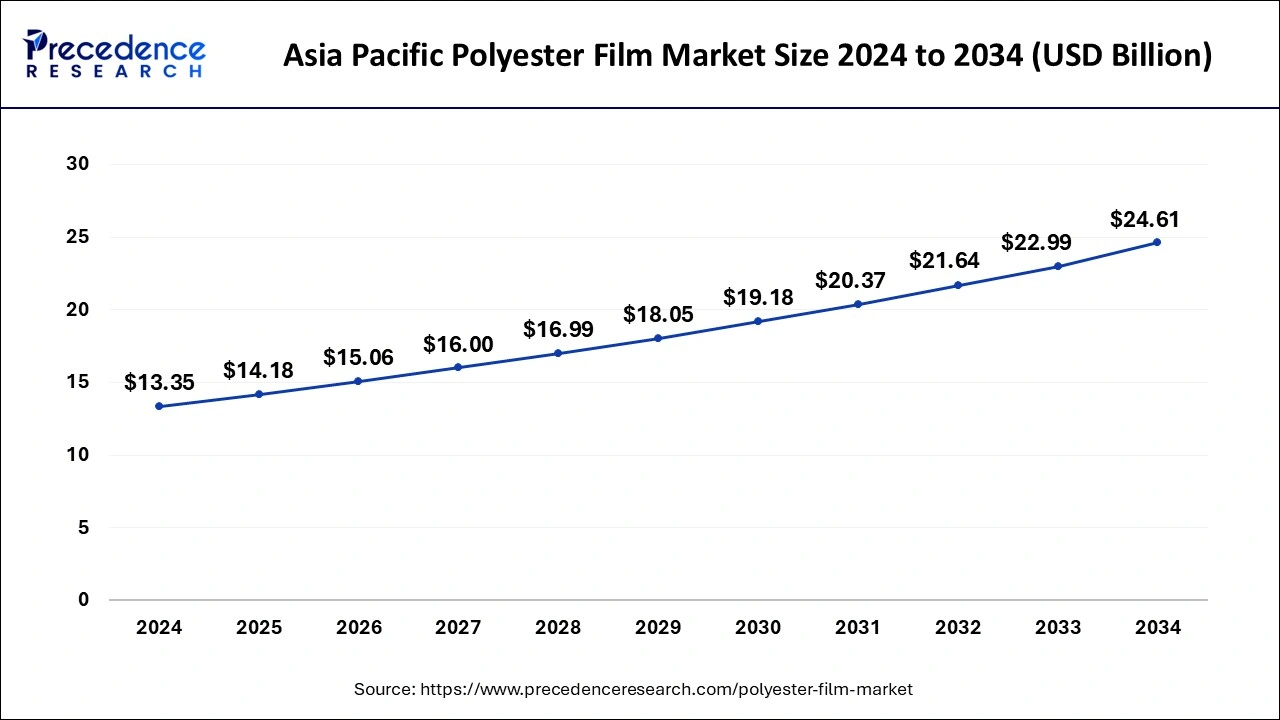

The global polyester film market size is calculated at USD 37.31 billion in 2025 and is forecasted to reach around USD 63.91 billion by 2034, accelerating at a CAGR of 6.17% from 2025 to 2034. The Asia Pacific polyester film market size surpassed USD 14.18 billion in 2025 and is expanding at a CAGR of 6.31% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polyester film market size was estimated at USD 35.12 billion in 2024 and is predicted to increase from USD 37.31 billion in 2025 to approximately USD 63.91 billion by 2034, expanding at a CAGR of 6.17% from 2025 to 2034.

The Asia Pacific polyester film market size reached USD 13.35 billion in 2024 and is expected to be worth around USD 24.61 billion by 2034 at a CAGR of 6.31% from 2025 to 2034.

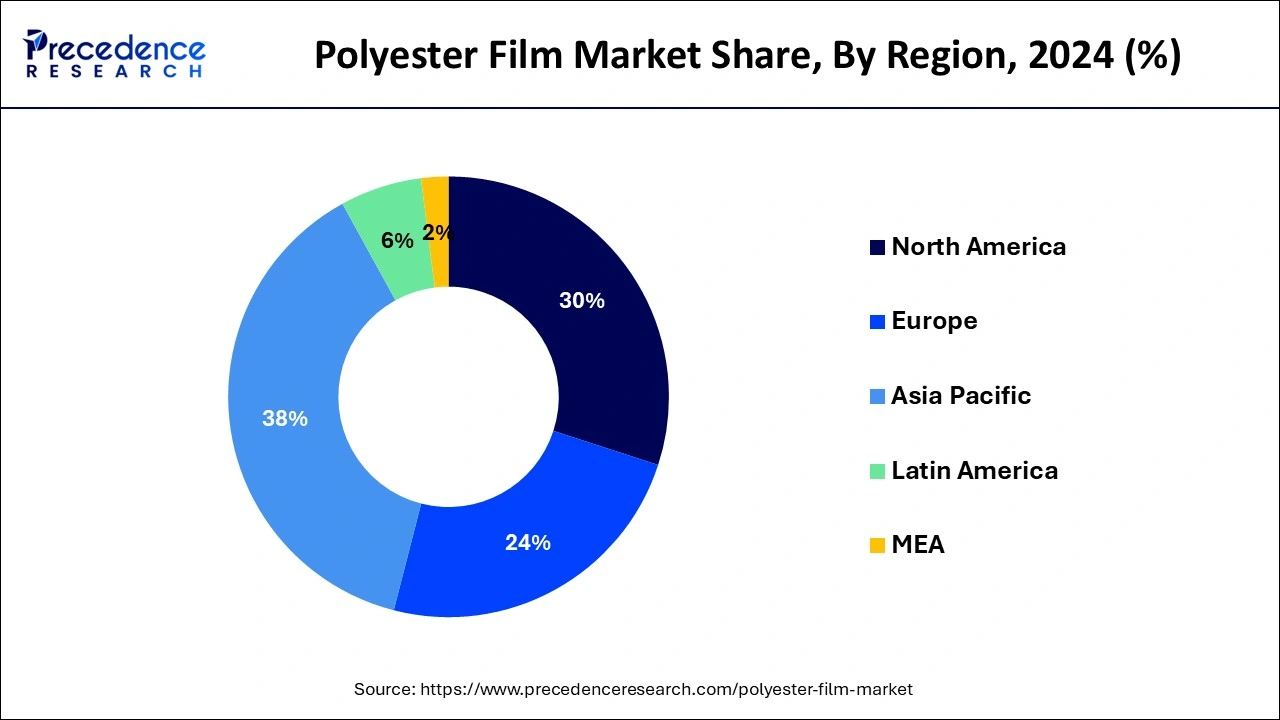

Asia Pacific led the polyester film market with the largest market share in 2024. The growth of the region is attributed to the rising industrialization and urbanization in the economically developing countries such as India, China, and Japan that are driving the demand for the polyester films in the various industrial applications, such as packaging, insulation of the electronic components, and others.

Moreover, the rising investment by the private and public investors in the upgradation of industries and the expanding requirement of consumer goods are observed to promote the market’s expansion in the region. Furthermore, the rapid expansion of online food delivery sector is observed to help the polyester film market to grow.

The availability of abundant raw material along with the presence of low-cost laborers in the region, the manufacturing activities have become more potential in recent years. This factor is observed to support the market’s expansion in the upcoming period. Manufacturers' potential for product innovation and development onwards creates a supportive factor for the industry to boost in the region.

North America is expected to witness the fastest growth in the polyester film market during the forecast period. The growth of the region is attributed to the well-established commercialization and industrialization in the region. The rising demand for the food and beverage, and FMCG industry creates the higher demand for the efficient packaging which driving the demand for the polyester film market. The presence of major manufacturing firms and the rising investments in research and development activities in the development and innovatory products are collectively contributing to the expansion of the polyester film market in the region.

The polyester film market revolves around the production, innovation and distribution of materials based on polyester films for multiple industry applications. Polyester has exceptional properties like physical, optical, chemical, and thermal that can be used in various end-use applications. Polyester films are observed to be ideal in balancing dimensional stability, and it regains its properties in the extreme temperature.

Polyester films are available in different grades which can be used in the different applications. These are the transparent layer of film which is used in the several applications such as flexible packaging, labels, touch pads, control panels, and membrane switch outlays, nameplates, industrial laminates, electrical insulation, face shields, and others.

The increasing demand for the effective and convenient solutions in packaging are driving the demand for the polyester films, and the demand for the polyester fiber from the construction, textiles, consumer electronic, and manufacturing industries are further propelling the growth of the polyester film market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.23% |

| Market Size in 2025 | USD 60.5 Billion |

| Market Size by 2034 | USD 6.23 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Product, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for the consumer goods

The increasing demand for polyester films in the fast-moving consumer goods industries is driving the growth of the market. The rise in urbanization and the increasing disposable incomes among the population are driving the demand for consumer goods, especially in developing countries. The significant rise in the packaging standards is driving the demand for polyester films. The advancements in ultraviolet-protected polyester films in the packaging industry are also driving the expansion of the market. Polyester films have higher temperature resistance and reduced level of contamination, which becomes an ideal solution for the packaging industry. Polyster films have higher durability, and shelf-life that also contributes to the growth of the polyester film market.

Availability of the alternatives

Polyester films face competition from various alternative materials such as polypropylene, polyethylene, and biodegradable films. These alternatives may offer similar properties or even advantages in certain applications, such as improved flexibility, barrier properties, or environmental sustainability. As a result, customers may opt for alternative materials based on their specific requirements and preferences, leading to reduced demand for polyester films. Customers often consider factors such as cost-effectiveness and price competitiveness when choosing materials for their applications. If alternative materials are available at lower prices or offer better value for money, customers may switch away from polyester films, particularly in price-sensitive markets or industries.

Rising demand for the sustainable packaging material

The increasing demand for sustainable packaging materials due to the rising concern over the environment across the globe are observed to promote the expansion of the polyester film market. Polyester films have properties like higher strength, durability, lightweight nature, recyclability that meet the demand for the environmental concern. The rise in the demand for polyester film in the various end-use industries such as construction, fibers, electronics, consumer goods, and others are further propelling the growth of the market.

The biaxially oriented polyester film segment dominated the polyester film market in 2024. The growth of the segment is attributed due to the higher demand for the biaxially oriented polyester film by the various end-use industries such as packaging, construction, manufacturing, fabrics, and other that driving the expansion of the segment. The biaxially oriented polyester films come in different thickness and varieties, the properties and thickness which make them ideal use of the different industries and applications. Biaxially oriented polyester films offer resistance to oil and grease, this property offers an effective application of these polyester films into multiple industrial applications.

The <50 microns segment dominated the polyester film market with the highest market share in 2024. The growth of the segment is attributed to the rising adoption of the <50 microns polyester films in the electronics as an insulation medium. The <50 microns are used in the electrical applications such as wires, cable overwraps, membrane touch switches, transformers, and flexible printed circuit boards.

The increase in the use of <50 microns in the electrical applications due to its beneficial properties like higher temperature resistance, excellent mechanisms, machinability, and dimensionally stable at higher temperature. The <50 microns polyester films help in increasing the production value and reduces the cost of the operations that result in the higher profitability in the manufacturing. Thus, is rising demand for the <50 microns polyester films by the electronics and other electric based industries are driving the growth of the segment.

The packaging segment held the largest share of the polyester film market in 2024. The rising demand for the consumer goods along with the expansion of food and beverage industry across the glove has boosted the demand for effective packaging solutions, this factor is observed to sustain as a potential one to promote the segment’s expansion in the upcoming years. Polyester films serve beneficial properties in the packaging of food and beverages products which makes their shelf-life longer.

Polyester films have higher resistance over the temperature, strength, and durability makes it spill proof and less prone to get damage by accidents which expands the adoption of polyester film in the packaging industry. Additionally, the rising demand for consumer goods due to the shift in lifestyle is driving the demand for efficient packaging material which also propels the growth of the segment.

The imaging segment is observed to grow at a significant rate during the forecast period in the polyester film market. The rapid adoption of polyester films from the healthcare industry has supported the segment to expand. Polyester films are generally used in medical imaging technologies such as MRI, CT scans and X-rays. They are observed to offer high resolution surface for clear visualization of medical abnormalities through medical images. The versatility of polyester films again creates a potential application in the healthcare sector thereby, expanding its presence in the industry.

The electronic and electrical segment is expected to witness a significant rate of growth during the forecast period. The higher adoption of the polyester films in the manufacturing of the electronic components like electric boards, transformers, circuits, stability in high voltage, abrasion, and resistance to the fluctuating temperature is driving the growth of the segment. Polyester films have excellent mechanical properties and durability along with resistivity that increases the lifespan of the electrical components. These films are lightweight in nature that make it ideal material in various applications like automotive manufacturing which are evolving in the manufacturing of lightweight, environment friendly, and more efficient in use which boosts the growth of the market.

By Type

By Product

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

October 2024

February 2025

May 2024