April 2025

Specialty Polyamides Market (By Product: Long Chain Specialty Polyamide, MXD6/PARA, High Temperature Specialty Polyamide; By End-Use: Automotive & Transportation, Consumer Goods & Retail, Energy, Electrical & Electronics, Industrial Coatings, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

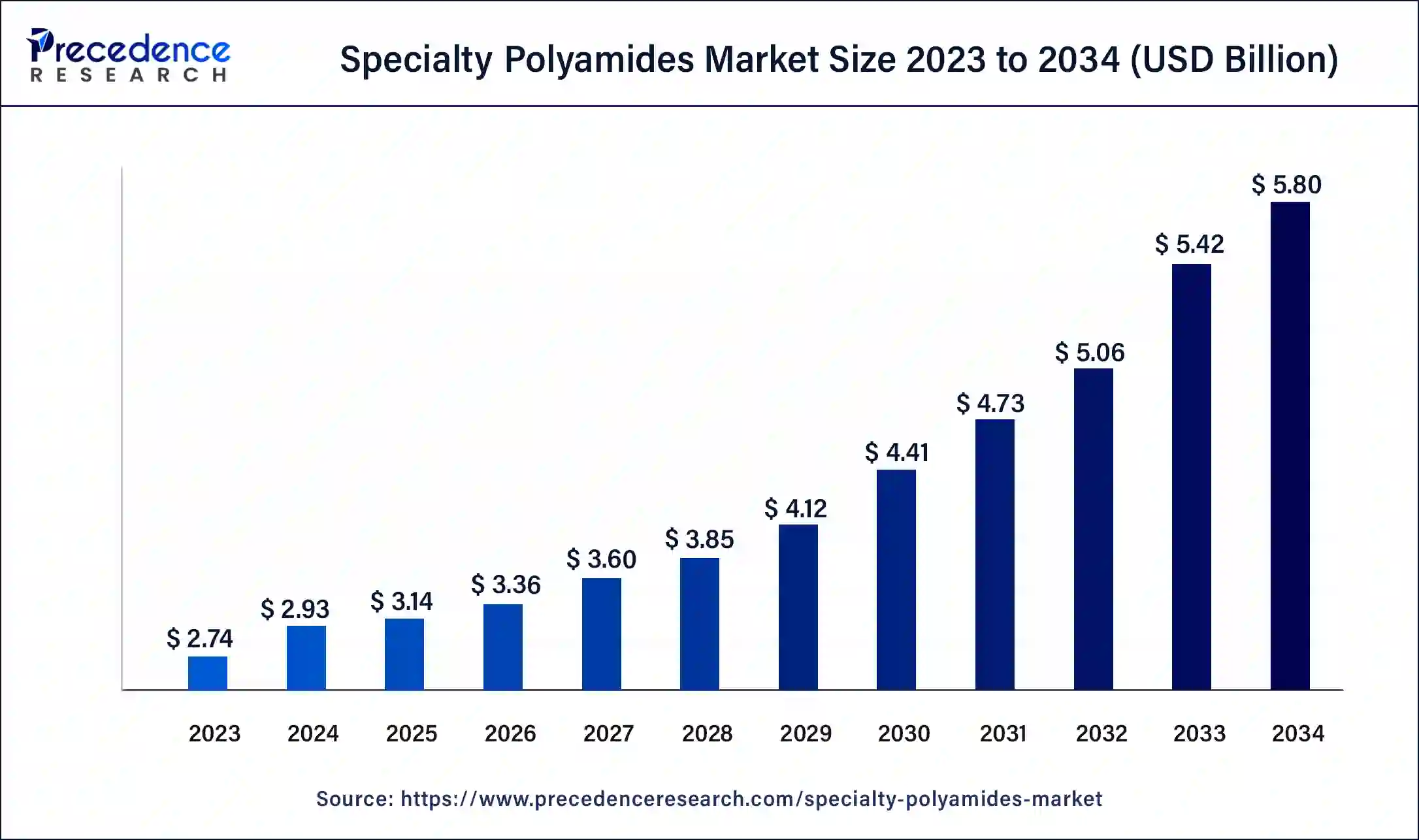

The global specialty polyamides market size was USD 2.74 billion in 2023, calculated at USD 2.93 billion in 2024 and is expected to reach around USD 5.80 billion by 2034, expanding at a CAGR of 7.05% from 2024 to 2034. The rising demand for lightweight materials across the world is driving the growth of the specialty polyamides market.

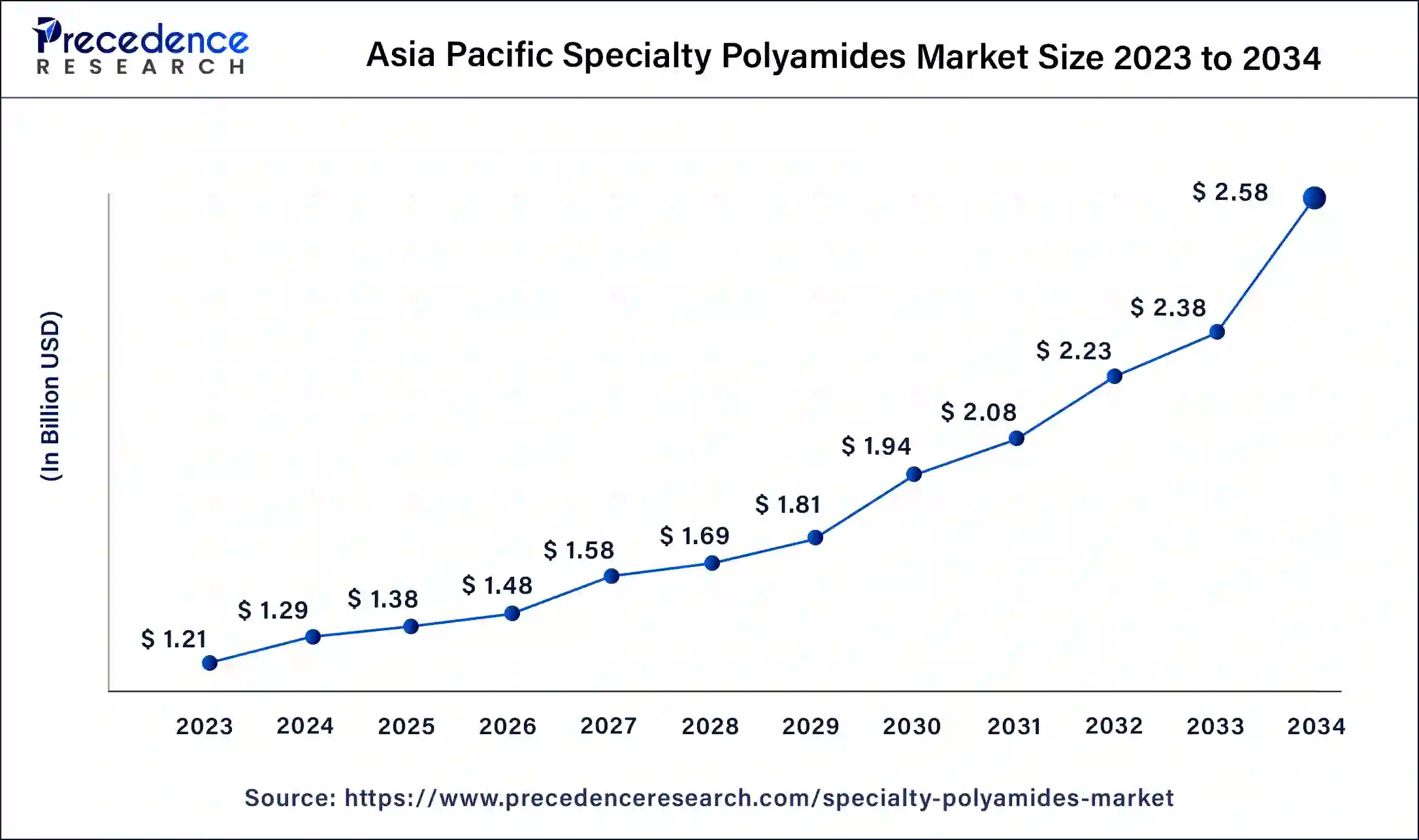

The Asia Pacific specialty polyamides market size was exhibited at USD 1.21 billion in 2023 and is projected to be worth around USD 2.58 billion by 2034, poised to grow at a CAGR of 7.12% from 2024 to 2034.

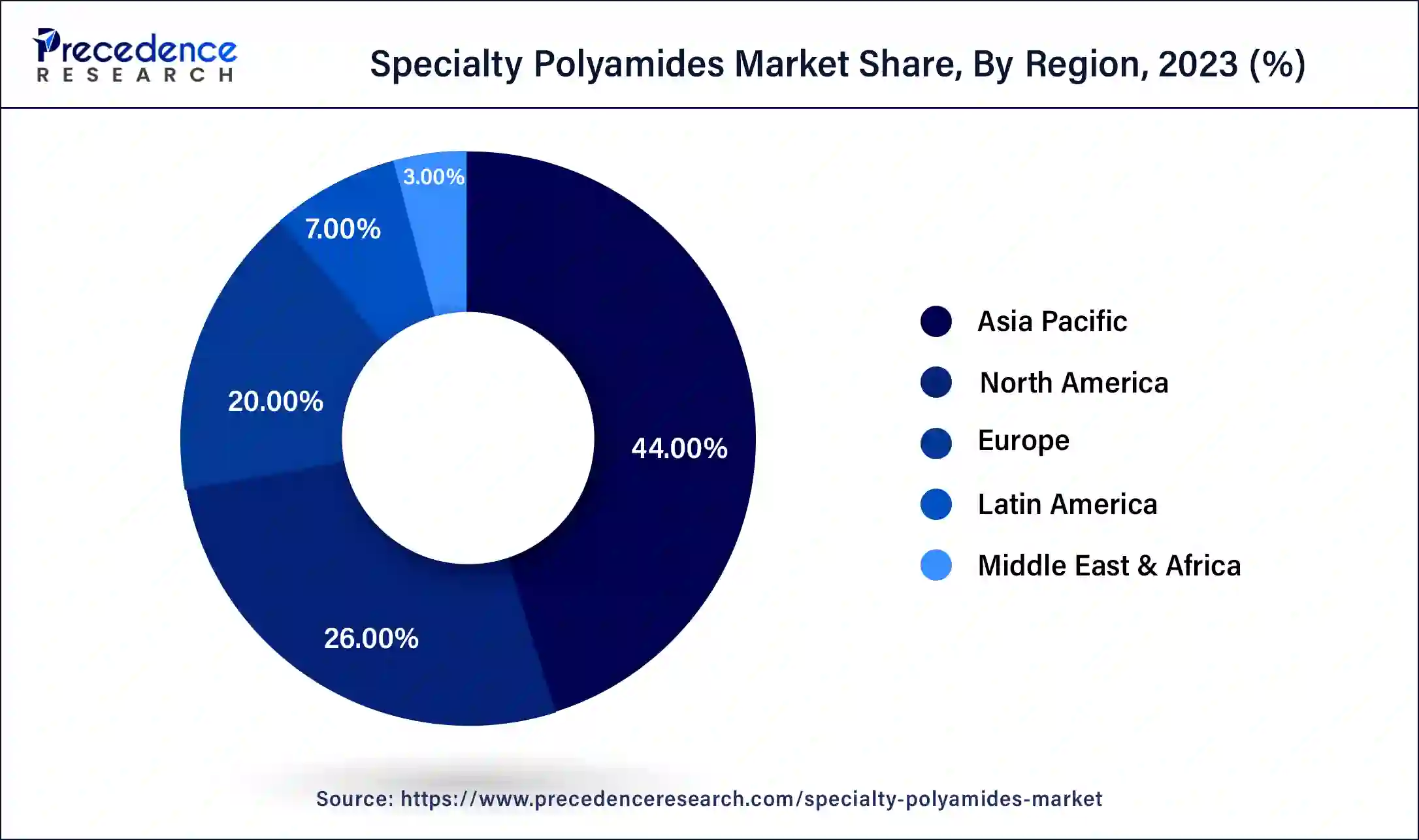

Asia Pacific held the largest share of the specialty polyamides market in 2023. The growth of the market in this region is mainly driven by the rising demand for specialty polyamides with the developments in textile industries with the presence of several companies such as Arvind Ltd., Bombay Dyeing and Manufacturing Company Ltd., Bombay Rayon Fashions Ltd., Fabindia Overseas Pvt Ltd., Raymond Ltd., Shenzhou International Group, Weiqiao Textile., Texhong Textile Group and some others, thereby driving the market growth.

The growing development in the transportation manufacturing industry in countries such as China, India, South Korea, Japan, and some others has increased the demand for specialty polyamides in several applications, such as the manufacturing of boats and trains, and has boosted market growth. Also, the presence of numerous electronics brands such as Xiaomi, Sharp, Samsung, Panasonic, Sony, LG, and some others has increased the demand for specialty polyamides due to their superior properties, such as heat and abrasion resistance, which is likely to drive the growth of the specialty polyamides market in this region.

Moreover, the presence of several local market players of specialty polyamides, such as LG Chem, Asahi Kasei Corporation, Kuraray Co., Ltd., and some others, are continuously engaged in developing specialty polyamides for several end-user industries and adopting several strategies such as partnerships, collaborations, and business expansions, which in turn drives the growth of the specialty polyamides market in this region.

North America is expected to be the fastest-growing region during the forecast period. The rising developments in the automotive industry with the presence of numerous automotive companies such as Ford, Rivian, Tesla, Chevrolet, and others have increased the demand for specialty polyamides for numerous applications such as powertrain components, airbag containers, door handles, fuel caps, mirrors, wheel covers, which in turn drives the market growth. Moreover, the presence of several aerospace companies, such as Boeing, L3Harris, SpaceX, Lockheed Martin, and Northrop Grumman, has increased the demand for specialty polyamides for several military and defense applications such as manufacturing components of military aircraft and helicopters, which in turn is driving the market growth.

Additionally, the presence of various local companies of specialty polyamides such as INVISTA, DuPont de Nemours, Inc, AdvanSix, UBE, and some others are developing superior quality specialty polyamides to fulfill the demand from various industries such as automotive and electronics across the North American region, that in turn is expected to drive the growth of the specialty polyamides market.

The specialty polyamides market is one of the most important industries in the chemical sector. This industry mainly deals in the manufacturing and distribution of specialty polyamides around the globe. This industry consists of various types of products that mainly include long chain specialty polyamide, MXD6/PARA, high temperature specialty polyamide, and some others.

The demand for specialty polyamides has increased in recent times with the growing number of packaging companies around the world. There are several applications of specialty polyamides in end-user industries, including automotive & transportation, consumer goods & retail, energy, electrical & electronics, industrial coatings, and others. This industry is expected to grow exponentially with the growth in the chemicals and automotive industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.80 Billion |

| Market Size in 2023 | USD 2.74 Billion |

| Market Size in 2024 | USD 2.93 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.05% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising popularity of electric vehicles (EVs)

The trend of EVs has increased across the world in recent times. Nowadays, the adoption of electric vehicles has increased due to the rising prices in oil prices along with growing awareness of people regarding carbon emissions. The application of specialty polyamides in the EV industry has increased the manufacturing of EV components such as batteries, control units, connectors, and some others. Thus, with the growing demand for electric vehicles, the demand for specialty polyamides has increased rapidly, which is likely to drive the growth of the specialty polyamides market during the forecast.

Mechanical properties and environmental impacts

The usage of specialty polyamides is very prominent in several industries for numerous applications across the world. Although the application of specialty polyamides in various industries is worth mentioning, there are several problems associated with it. Firstly, the mechanical property, such as limited resistance to strong acids and bases, is a major problem faced by this industry. Secondly, after decomposition, these polyamides produce harmful gases that cause environmental imbalance. Thus, deformities in mechanical properties, along with environmental issues associated with the use of specialty polyamides, are expected to restrain the growth of the specialty polyamides market during the forecast period.

Growing developments in glass-fibers reinforced polyamides (PA6-GF)

Advancements in science and technologies related to the development of specialty materials have gained traction recently. Researchers and scientists are currently developing a special type of glass-fiber reinforced polyamide (PA6-GF) due to their superior properties, including shrinkage, stiffness, impact strength, and thermal durability, for use in various applications such as aerospace and automotive.

The high temperature specialty polyamide segment held the largest specialty polyamides market share in 2023. The growing demand for electrical drives and connectors has driven the market growth. Moreover, the rising application of high-temperature specialty polyamide for manufacturing high-temperature automotive parts, LED packaging, and some other applications is expected to boost the market growth. Furthermore, the ongoing developments in the production of superior-quality high-temperature specialty polyamides are likely to drive the growth of the specialty polyamides market during the forecast period.

The long chain specialty polyamide segment is expected to grow with the highest compound annual growth rate during the forecast period. The growing use of polyamide 610 and 612 for various end-user industries has driven the market growth. Moreover, the rising demand for long chain specialty polyamide due to their high dimensional stability and exceptional chemical resistance boosts the market growth. Furthermore, the increasing application of long chain specialty polyamide in manufacturing battery seals, sporting goods, brush bristles, automotive cooling lines, fuel systems, and other applications is likely to drive the growth of the specialty polyamides market during the forecast period.

The automotive & transportation segment held a dominant share in 2023. The growing developments in the automotive industry have increased the demand for specialty polyamides, thereby driving market growth. Moreover, with the rise in sales of automobiles across the world, the demand for specialty polyamides for manufacturing tires, fan blades, car upholstery, seat belts, air-intake manifolds, fuel systems, cooling systems, switch housing, oil pans, and some others is boosting the market growth. Furthermore, the rising developments in polyamide 66 (PA66), polyamide 6 (PA6), and polyamide 12 (PA12) for use in the automotive and transportation sectors are driving the growth of the specialty polyamides market.

The electrical and electronics segment is expected to attain the fastest CAGR during the forecast period. The growing developments in the electronics industry have increased the demand for specialty polyamides, thereby driving market growth. Also, the rising demand for electronic protection devices (EPDs) around the world has driven the market growth. Moreover, the upsurge in the application of specialty polyamides for the production of devices such as MCBs, MCCB, relays, contactors, terminal blocks, and some others boosts the growth of the specialty polyamides market during the forecast period.

Segments Covered in the Report

By Product

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

January 2025

November 2024