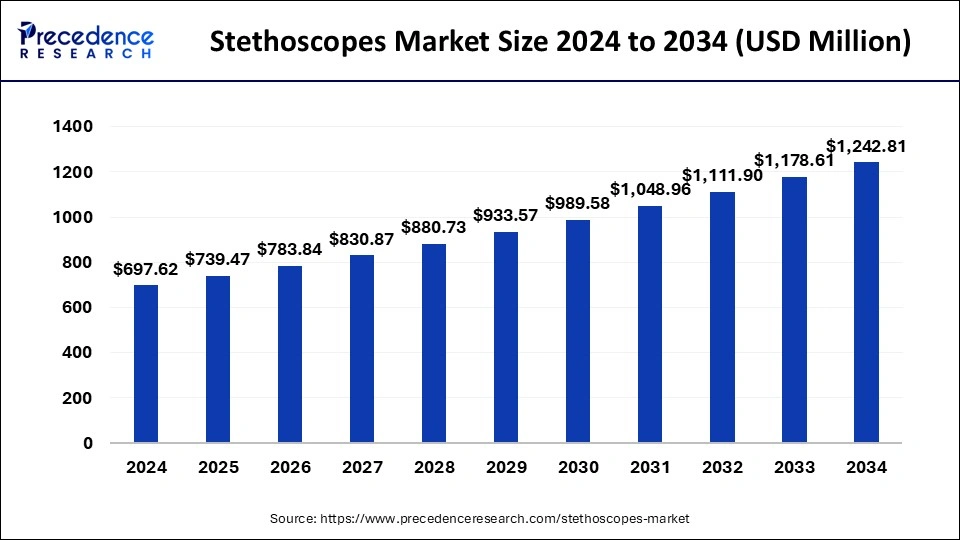

The global stethoscopes market size accounted for USD 739.47 million in 2025 and is forecasted to hit around USD 1,242.81 million by 2034, representing a CAGR of 5.94% from 2025 to 2034. The North America market size was estimated at USD 237.19 million in 2024 and is expanding at a CAGR of 6.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global stethoscopes market size was calculated at USD 697.62 million in 2024 and is predicted to increase from USD 739.47 million in 2025 to approximately USD 1,242.81 million by 2034, expanding at a CAGR of 5.94%. A spike in cardiovascular and pulmonary disorders has stimulated global market growth.

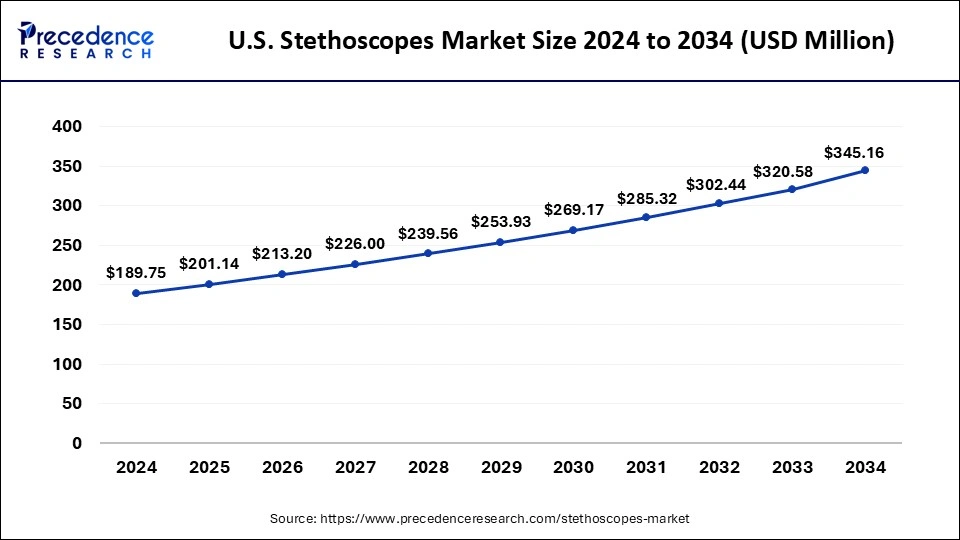

The U.S. stethoscopes market size was exhibited at USD 189.75 million in 2024 and is projected to be worth around USD 345.16 million by 2034, growing at a CAGR of 6.17%.

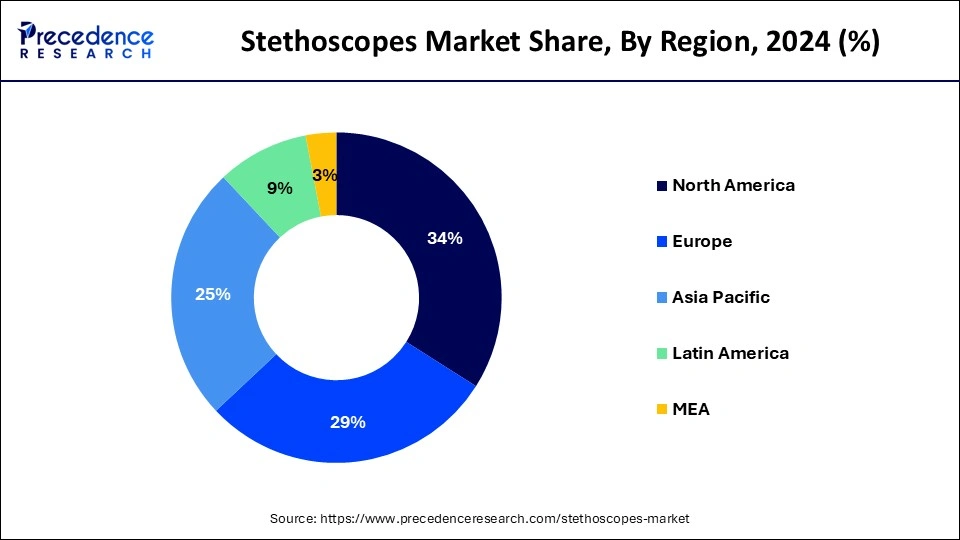

North America led the market with the biggest market share of 34% in 2024, driven by the presence of advanced healthcare infrastructure and high healthcare expenditure. Healthcare facilities in the region are quick to adopt advanced stethoscope technologies, such as digital stethoscopes with tele-auscultation capabilities. For instance, In the United States, the demand for digital stethoscopes has surged, with market leaders like 3M Littmann and Welch Allyn introducing innovative products tailored to healthcare professionals' needs. Unhealthy eating habits and undisciplined lifestyles lead to illness, which is irreversible and needs to be treated in the long run and is increasing in the U.S. population.

Asia Pacific is the fastest-growing region in the stethoscopes market. The rising culture of preventive care in the Asian Pacific is fueling the market growth. Key players ' high investment in research and development is leading the market further. Emerging companies in developing nations like India and China are trying to establish themselves in the market by launching innovative and cost-effective medical products.

Asia Pacific is expected to gain a promising portion of the stethoscopes market, driven by rapid urbanization, improving healthcare infrastructure, and rising healthcare spending. Efforts to expand access to healthcare services in countries like China and India contribute to the growing demand for medical devices, including stethoscopes. For instance, In India, the government's initiatives to strengthen primary healthcare facilities and increase healthcare access in rural areas boost the adoption of stethoscopes among healthcare providers.

The stethoscopes market has witnessed significant growth and innovation in recent years, driven by advancements in healthcare technology, increasing demand for diagnostic tools, and a growing emphasis on preventive medicine. Stethoscopes remain essential for healthcare professionals across various specialties, including primary care, cardiology, and emergency medicine.

One of the key drivers of growth in the stethoscopes market is the continuous development of advanced features and functionalities. Manufacturers constantly introduce stethoscopes with improved acoustics, innovative designs, and enhanced connectivity options. Digital stethoscopes equipped with Bluetooth capabilities and mobile data management and analysis apps have gained popularity among healthcare professionals seeking more efficient and accurate diagnostic tools.

Moreover, the COVID-19 pandemic has highlighted the importance of telemedicine and remote patient monitoring, further fueling the demand for stethoscopes with tele-auscultation capabilities. These devices allow healthcare providers to conduct remote consultations and monitor patients' heart and lung sounds in real time, facilitating timely interventions and reducing the need for in-person visits.

The stethoscopes market is poised for continued growth in the coming years, driven by technological advancements, increasing healthcare expenditure, and the growing adoption of telemedicine and remote patient monitoring solutions. Manufacturers will continue to develop innovative products that meet the evolving needs of healthcare professionals and patients, further propelling market expansion and diversification.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.94% |

| Market Size in 2025 | USD 739.47 Million |

| Market Size by 2034 | USD 1,242.81 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Sales Channel, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing healthcare expenditure

Continuous innovation leads to the development of stethoscopes with enhanced features like digital connectivity, improved acoustics, and tele-auscultation capabilities, driving market growth. Rising healthcare spending globally, especially in emerging economies, fuels the demand for diagnostic tools like stethoscopes. Increasing awareness about preventive healthcare measures encourages individuals to monitor their health regularly, boosting the demand for stethoscopes.

High cost of advanced stethoscopes

The price of stethoscopes with advanced features may hinder adoption, especially in resource-constrained settings. In regions with inadequate healthcare infrastructure, the adoption of stethoscopes may be limited due to factors like affordability and availability. Advancements in imaging technologies and point-of-care devices pose a challenge to the traditional use of stethoscopes for diagnosis.

Integration of artificial intelligence (AI) technologies

One significant opportunity for the stethoscopes market lies in integrating artificial intelligence (AI) technology. AI-powered stethoscopes can analyze auscultatory sounds more accurately and efficiently. This is helpful to healthcare professionals in diagnosis and decision-making. By leveraging machine learning algorithms, these smart stethoscopes can detect subtle abnormalities and patterns in heart and lung sounds, providing valuable insights about patients' health status more precisely.

AI-enhanced stethoscopes can streamline workflow by automating routine tasks such as documentation and data analysis, saving time and improving overall efficiency in healthcare settings. This integration of AI technology presents a promising avenue for advancing diagnostic capabilities and enhancing patient care with stethoscopes.

The traditional acoustic stethoscope segment held the largest market share in 2024. A traditional acoustic stethoscope is relatively economical, simple, and widely available for use by professionals in healthcare and nurses in hospitals. A stethoscope plays an essential role in diagnosing cardiac and pulmonary disorders. In emerging countries, medical imaging penetration in rural areas is limited. Hence, stethoscopes play a crucial role here. Moreover, smart or digital stethoscopes are not more accessible to the African region due to their high cost. All these factors are responsible for the growth of the traditional stethoscope segment in the market, and it is expected to boost the market further in the foreseen period.

The smart stethoscope segment is the fastest-growing segment in the stethoscopes market. The incorporation of AI technologies into stethoscopes will surge the use of smart stethoscopes over the forecast period. The rapid increase in the number of patients suffering from cardiac diseases and lung disorders is responsible for the higher demand for smart stethoscopes by medical professionals. Also, marketers are more interested in developing a smart stethoscope with various monitoring features. Hence, they invested in research and development of stethoscopes to strengthen their portfolio in the market. For instance, John Hopkins University researchers have established a lab known as Sonavi Labs, which has created an AI-powered stethoscope with clever, cutting-edge technological features like noise filtering. This technology is helpful for hearing the heartbeats clearly without interference from outside noises. Hence, such initiatives are boosting the growth of the stethoscopes market globally.

The distributor's segment dominated the market in 2024. Hospitals and clinics have tie-ups with manufacturers and distributors. Major players in the market are adopting partnerships to expand their reach to consumers and strengthen their portfolios in the market. This is expected to boost market growth over the forecast period. Authorized dealers have local warranties for defective stethoscopes. Warranties include repairing and replacement of defective pieces. The collaboration of distributors provides easy delivery in less time and is also helpful for minimum-quantity orders. This is anticipated to boost the market growth owing to the rising demand of this segment.

The e-commerce segment is expected to show the fastest growth over the foreseen period. Increasing online accessibility of stethoscopes is likely to foster this segment's growth. E-health is the fastest-growing part of online sales. These online stores offer customer support and access to exclusive deals, and in case of any defective product, a return policy is also applicable. They also provide solutions if the product fails to meet the consumer's expectations, which builds trust between consumers and online dealers and, in turn, increases the consumer's inclination toward online purchasing. Hence, the availability of several stethoscopes on online platforms is projected to drive the stethoscopes market growth on a larger scale.

The hospital segment dominated the market in 2023 and is expected to grow further at a significant rate. Regarding the volume of stethoscopes purchased, the hospital segment is observed to be the largest consumer of products and services. The rising prevalence of chronic illness and its diagnosis takes place at a very young age for most populations is a key factor that driving the market growth owing to the increasing rate of hospitalization of patients. Also, stethoscopes have a longer life than any other medical device, which is a fundamental requirement for physicians in clinics and hospitals.

It is used to detect a patient's heart rate or cardiac activity in real-time with respiratory changes in the patient. It is useful even in the intestinal examination, which aids in further procedures on the basis of better, faster, and more accurate details. Hence, these are the primary factors driving the stethoscopes market's growth. The higher demand for stethoscopes in hospitals will lead to the further development of this segment based on end-use.

By Technology Type

By Sales Channel

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client