February 2025

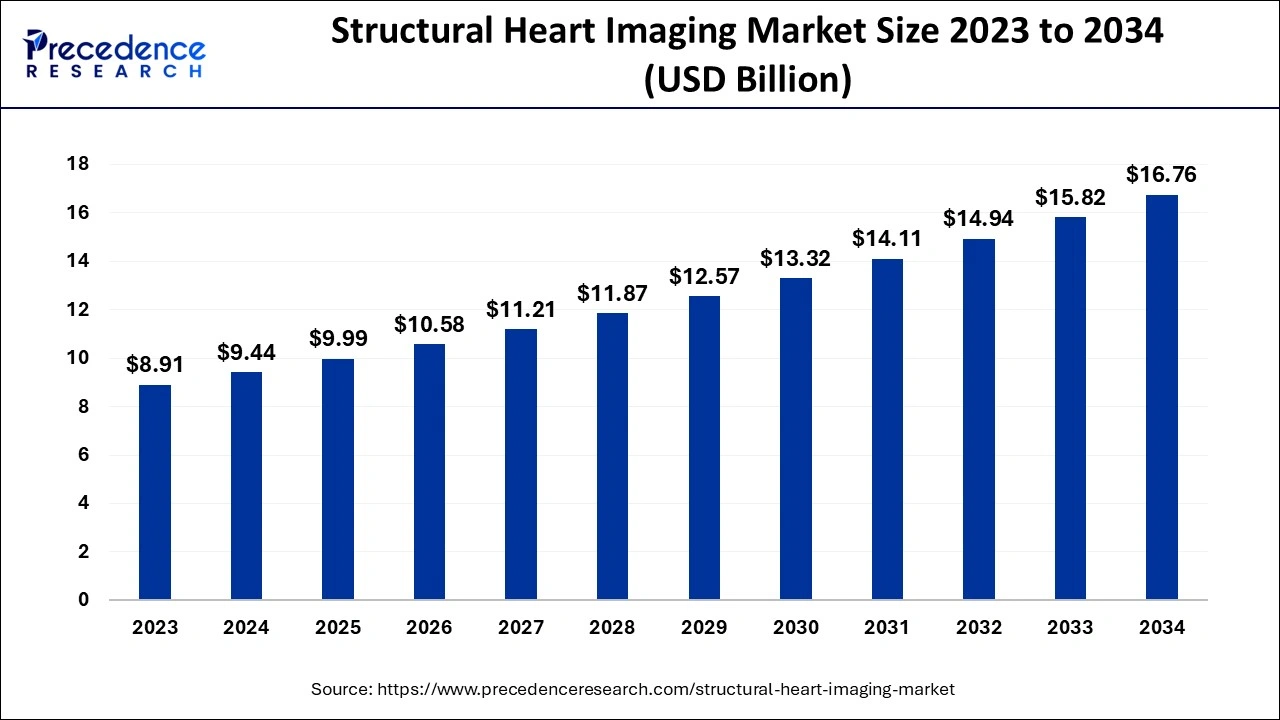

The global structural heart imaging market size is calculated at USD 9.44 billion in 2024, grew to USD 9.99 billion in 2025 and is projected to reach around USD 16.76 billion by 2034. The market is expanding at a CAGR of 5.91% between 2024 and 2034. The North America structural heart imaging market size is evaluated at USD 3.40 billion in 2024 and is expected to grow at a CAGR of 5.89% during the forecast year.

The global structural heart imaging market size accounted for USD 9.44 billion in 2024 and is expected to exceed around USD 16.76 billion by 2034, growing at a CAGR of 5.91% from 2024 to 2034. The increasing incidence of various congenital diseases is the key factor driving the growth of the structural heart imaging market. Also, the rise in lifestyle-related diseases coupled with the growing prevalence of cardiac disorders can fuel market growth further.

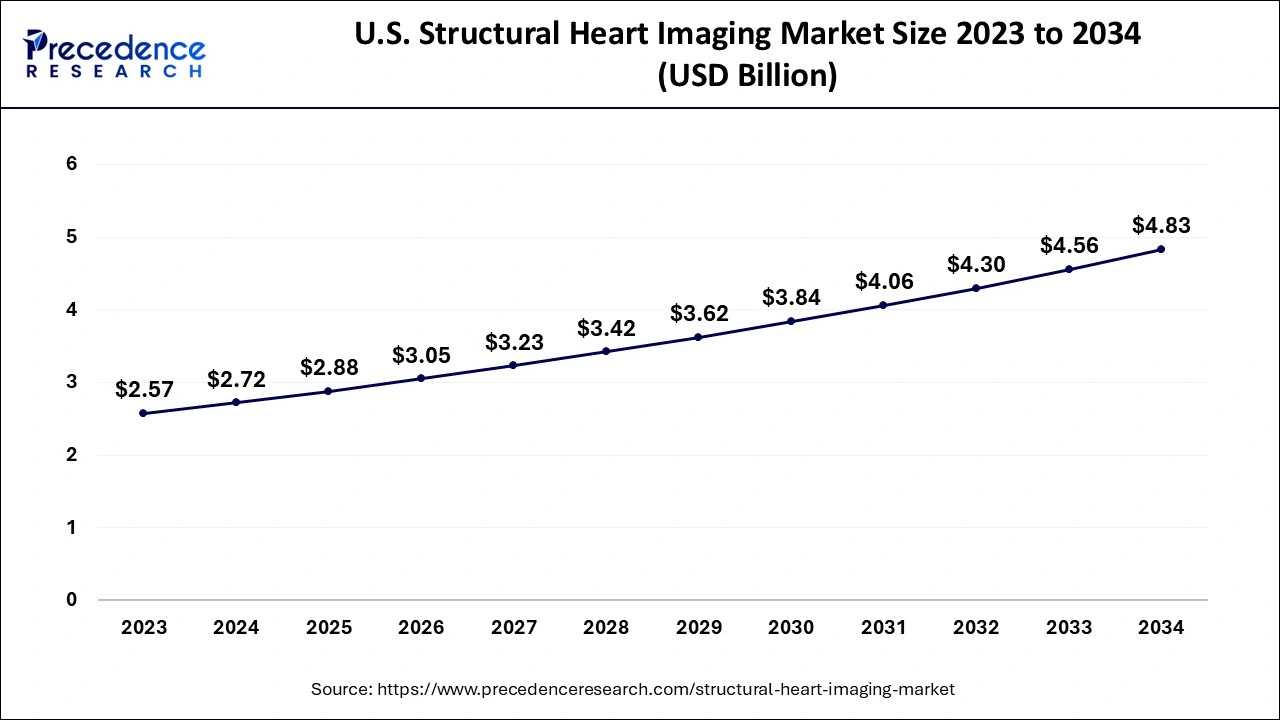

The U.S. structural heart imaging market size is exhibited at USD 2.72 billion in 2024 and is projected to be worth around USD 4.83 billion by 2034, growing at a CAGR of 5.90% from 2024 to 2034.

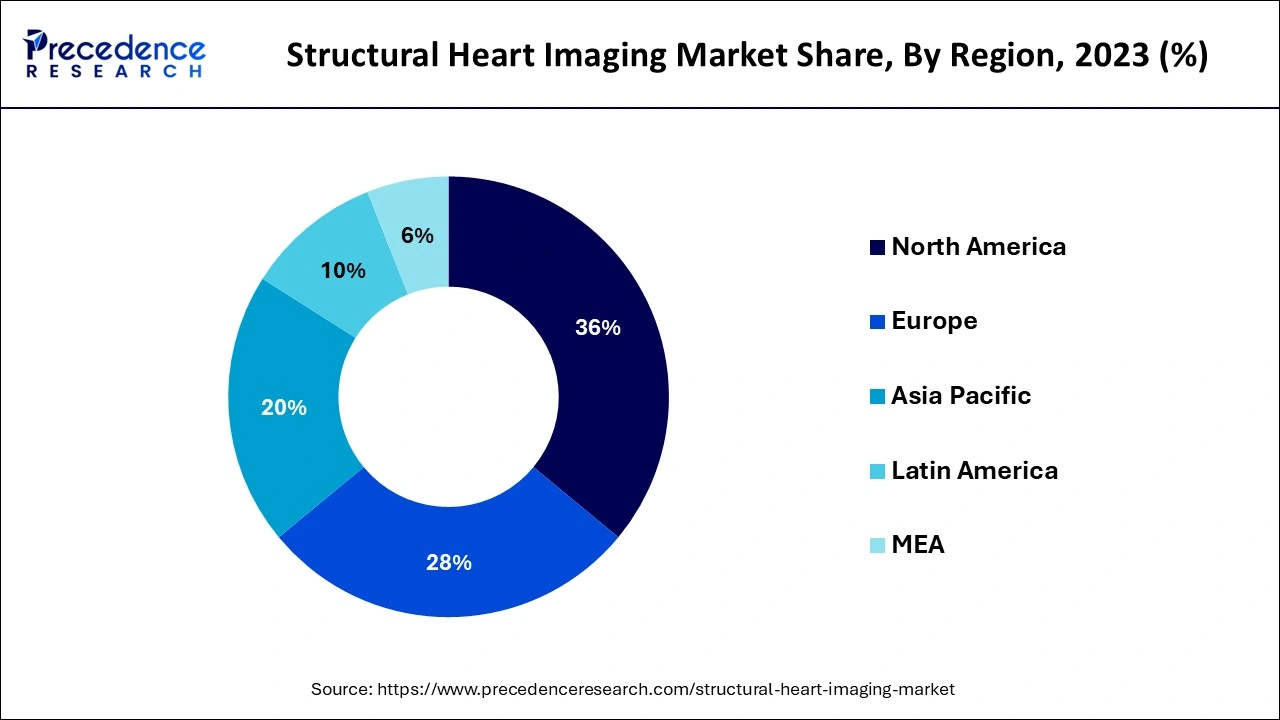

North America dominated the structural heart imaging market in 2023. The dominance of the region can be attributed to the rise in the number of patients suffering from cardiovascular diseases coupled with the heavy spending on medical infrastructure. Furthermore, the U.S. led the market in North America due to the high consumption of alcohol, which has led to an increasing prevalence of heart diseases among the majority population.

Asia Pacific is expected to grow at the fastest rate in the structural heart imaging market over the projected period. The growth of the region can be linked to the increase in expenditure on research for cardiovascular diseases and the rise in the older population in the region. Moreover, the high number of the population suffering from work-related stress along with the lack of physical activities are crucial factors contributing to market growth in the region.

Structural heart imaging is a technique that is widely used in the medical industry to examine and screen the heart at the molecular level. The procedure involves the use of reflection of light for creating the interior parts images along with the 2D cross-section analysis. It is then used in assessing and enabling professionals while doing many operative procedures, including detecting blockages in the arteries.

Top 5 Medical Device Companies and their R&D spending in 2022

| Company | 2022 R&D spending |

| Medtronic | USD 2.75 billion |

| Abbott Laboratories | USD 2.89 billion |

| Johnson & Johnson MedTech | USD 2.49 billion |

| Siemens Healthineers | € 1.79 billion |

| Fresenius Medical Care | € 229 million |

Role of Artificial Intelligence in the Structural Heart Imaging Market

The application of Artificial Intelligence (AI) increasingly relies on robust data and appropriate computational tools in the structural heart imaging market. AI may decrease cost and enhance value at the stages of interpretation, image acquisition, and decision-making. Furthermore, high precision is possible with cardiovascular imaging, integrated with big data” from the pathology and electronic health record, which is likely to better personalize therapy and characterize the disease.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.76 Billion |

| Market Size in 2024 | USD 9.44 Billion |

| Market Size in 2025 | USD 9.99 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.91% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Modality, Procedure, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing the use of the TAVR procedure

TAVR is a minimally invasive procedure that can replace a shallow aortic valve without opening the heart. It's also becoming a crucial option for individuals at high risk of complications from open-heart surgery. In the structural heart imaging market, innovations in imaging technology, including 3D imaging and 4D imaging, real-time visualization, and virtual procedures, are commonly observed.

Safety concerns

Safety concerns are a major challenge to the structural heart imaging market growth. Safety concerns include a high risk of radiation exposure for (SHDI)s specialists, etc. Moreover, there is a lack of customized training for SHDIs, such as fellowships that emphasize procedural guidance and planning. Also, the adoption of innovative structural heart devices has been frozen, especially in developing economies.

Improved accuracy and resolution

Enhanced accuracy and resolution in structural heart imaging are essential for various reasons. Improved resolution can offer high-quality, accurate diagnosis of heart conditions. Furthermore, precise imaging can help identify individuals at greater risk of complexities during or after the medical procedure. Additionally, imaging offers provide accurate measurements to ensure proper device placement.

The angiogram segment dominated the structural heart imaging market in 2023. The dominance of the segment can be attributed to the improved devices, rise in research activities, and effective angiography techniques. Also, heavy funding from private and government organizations is prevalent.

The computed tomography (CT) segment is anticipated to grow at the fastest rate in the structural heart imaging market over the forecast period. The growth of the segment can be linked to the increase in the elderly population, rising demand to seek treatment efficiency, etc. Additionally, CT scanners are increasingly becoming common in medical settings, which helps in decreasing hospitalization times and enhancing disease treatment further.

The transcatheter aortic valve replacement (TAVR) segment led the global structural heart imaging market in 2023. The dominance of the segment can be linked to the increasing prevalence of high-risk heart disorders among individuals in the middle-aged population, which is a minimally invasive option as compared to conventional treatment. Because of the less invasive nature of this surgery, the rapid recovery of patients is possible.

The surgical aortic valve replacement (SAVR) segment is anticipated to grow at a significant rate in the structural heart imaging market during the forecast period. The growth of the segment can be driven by increasing aortic valve issues in the elderly population, enhanced valve designs, and the designing of advanced bio-compatible materials. However, the risk of procedural death for SAVR is among patients with old age, LV dysfunction, and chronic renal disease.

The valvular heart disease segment held the largest share of the structural heart imaging market. The dominance of the segment is due to the rising prevalence of diseases and infections such as blood infections, rheumatic fever, and high cholesterol among others. Additionally, if not treated well valvular heart disease can convert to fatal complications such as infection, arrhythmia, cardiac arrest, and heart failure.

The congenital heart disease segment is projected to grow at the fastest rate in the structural heart imaging market over the study period. The growth of the segment can be credited to the rise in birth rates because this disease is associated with heart shape and heart structure by birth. Furthermore, CHDs can significantly affect the heart structure, causing blood to flow too slowly, abnormally, or not at all. Congenital heart disease is the most common type of birth defect, affecting nearly 1 in 100 babies.

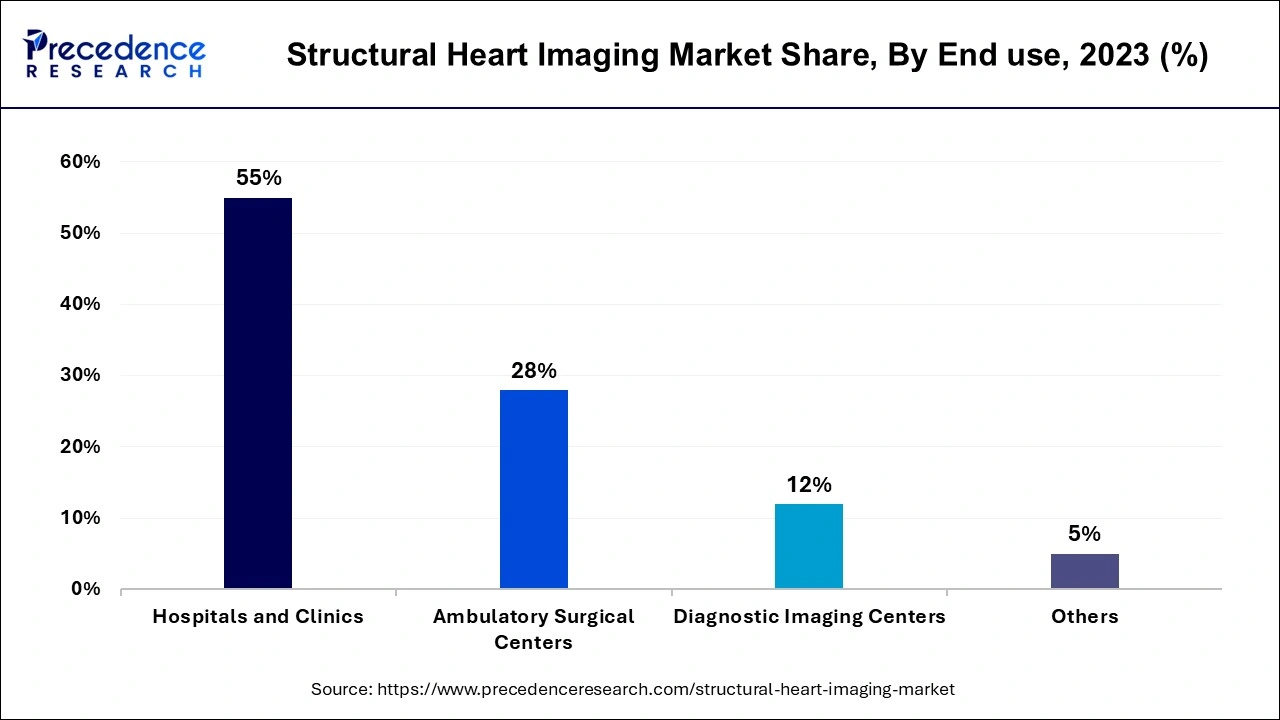

The hospital segment dominated the structural heart imaging market in 2023. This is due to the enhanced medical infrastructure of clinics and hospitals, innovative devices, and the availability of skilled medical professionals. Hospitals provide comprehensive treatment and care for various heart conditions. In addition, hospitals are well equipped with innovative diagnostic tools that aid in precise and timely diagnosis of heart disorders.

The ambulatory surgical centers segment is expected to show the fastest growth in the structural heart imaging market over the projected period. The growth of the segment can be driven by the easy availability of equipment, expanding infrastructure, and cost-effective surgery options provided by these centers. Furthermore, ambulatory surgical centers offer a more convenient, comfortable, and patient-oriented experience than outpatient settings in hospitals.

Segments covered in the report

By Modality

By Procedure

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

October 2024

September 2024