October 2024

Transcatheter Aortic Valve Replacement Market (By Implantation Procedure: Transfemoral, Transapical, Transaortic, Stainless Steel, Nitinol, Cobalt Chromium, Others; By Material: Stainless Steel, Nitinol, Cobalt Chromium, Others; By Mechanism: Balloon-expanding Valve, Self-expanding Valve; By End-Use: Hospitals, Ambulatory Surgical Centers, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

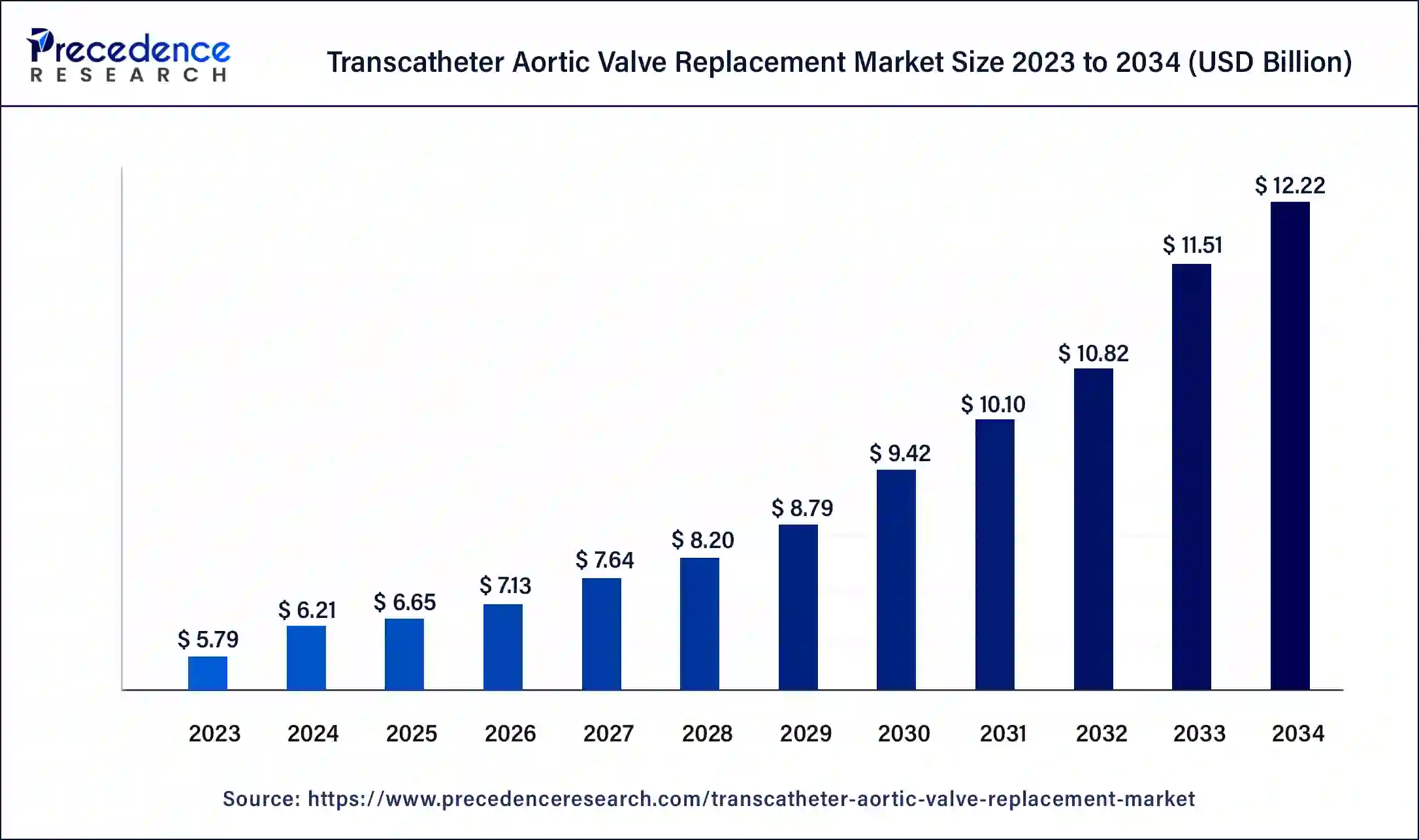

The global transcatheter aortic valve replacement market size was USD 5.79 billion in 2023, calculated at USD 6.21 billion in 2024, and is expected to reach around USD 12.22 billion by 2034, expanding at a CAGR of 7% from 2024 to 2034.

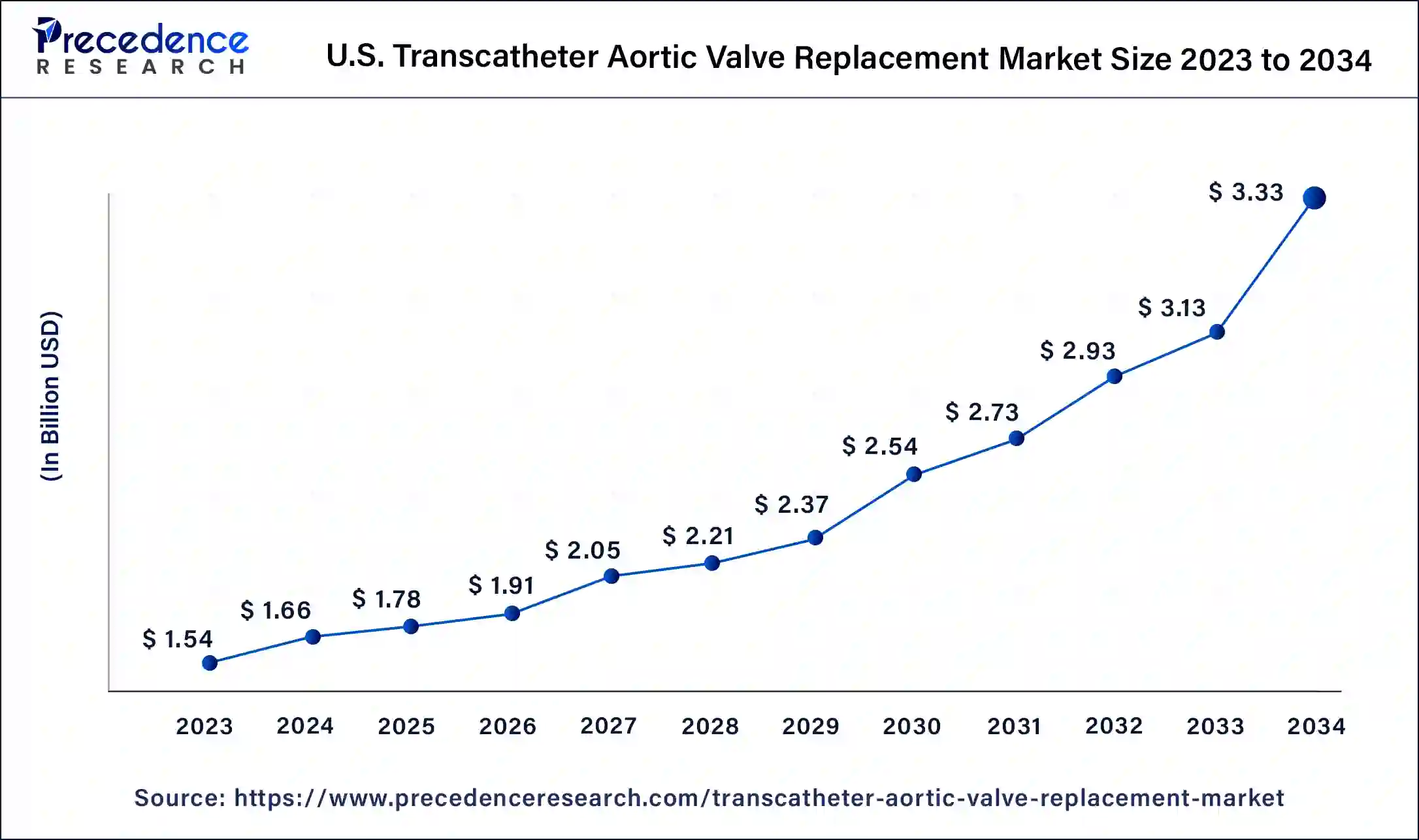

The U.S. transcatheter aortic valve replacement market size was valued at USD 1.54 billion in 2023 and is estimated to reach around USD 3.33 billion by 2034, growing at a CAGR of 7.2% from 2024 to 2034.

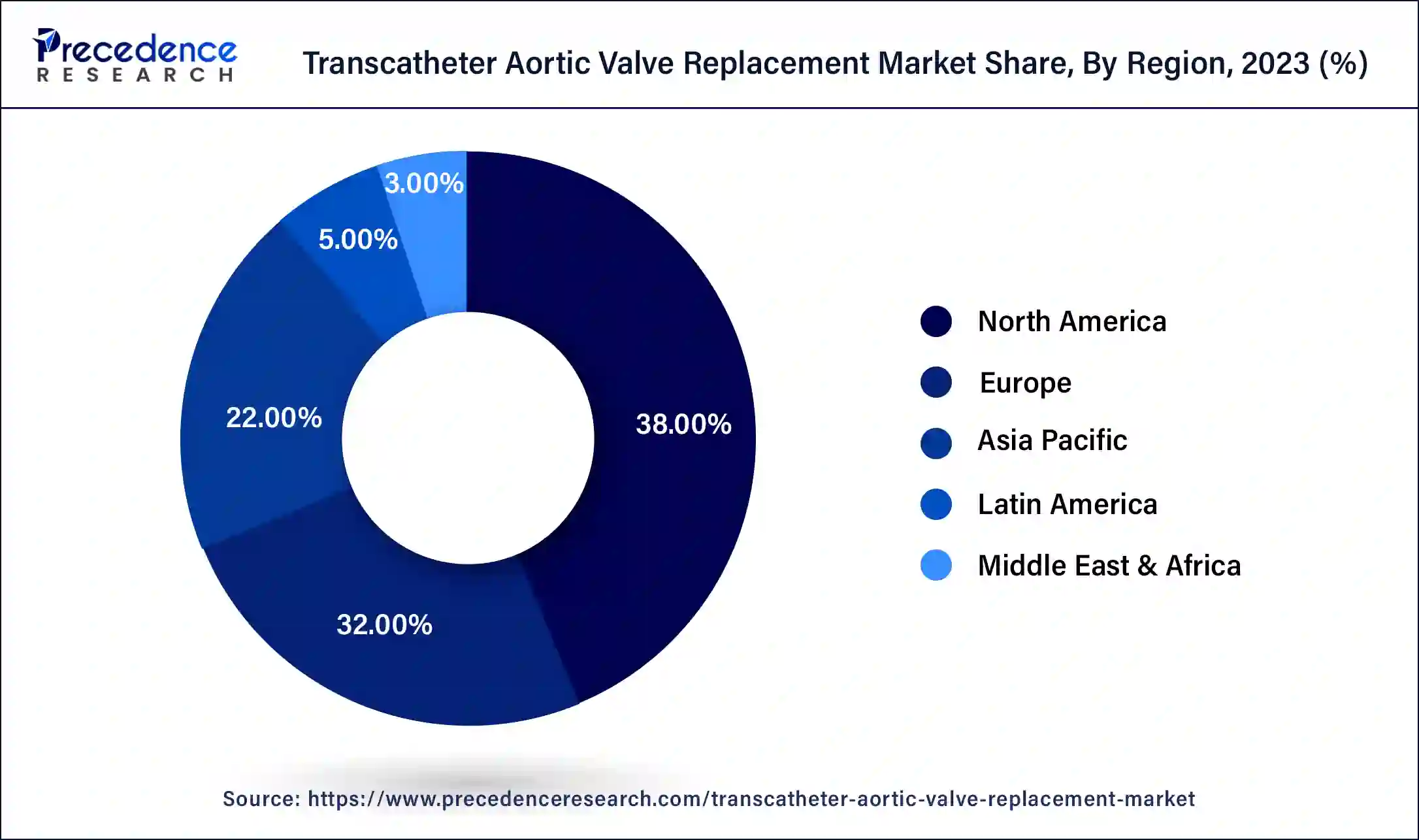

North America has held the largest revenue share 38% in 2023. North America holds a significant share in the transcatheter aortic valve replacement market primarily due to factors like advanced healthcare infrastructure, a large aging population, and robust reimbursement systems. The region's well-established network of healthcare facilities and skilled healthcare professionals supports the widespread adoption of TAVR procedures. Furthermore, the high prevalence of aortic valve diseases in North America, driven by the aging demographic, has led to a substantial demand for TAVR. Favorable reimbursement policies and regulatory approvals have also contributed to North America's prominent position in the global TAVR market.

Europe is estimated to observe the fastest expansion. Europe maintains a prominent growth in the transcatheter aortic valve replacement market due to several factors. The region boasts a rapidly aging population, increasing the prevalence of aortic valve diseases and the demand for TAVR procedures. Moreover, Europe has a well-established healthcare infrastructure, a robust regulatory framework, and extensive clinical experience with TAVR, which fosters innovation and adoption. Additionally, reimbursement policies in many European countries favor TAVR, making it accessible to a broader patient population. These combined elements position Europe as a significant growth leader in the global TAVR market.

The transcatheter aortic valve replacement (TAVR) market has been undergoing substantial growth within the realm of medical devices. TAVR serves as a minimally invasive solution for addressing aortic valve ailments, particularly among elderly or high-risk patients. This surge can be attributed to its less intrusive nature, abbreviated recovery periods, and favorable patient outcomes. Factors propelling this expansion include a burgeoning aging demographic, heightened awareness of TAVR as a viable treatment avenue, and the continuous evolution of device technology.

The transcatheter aortic valve replacement (TAVR) sector is currently experiencing robust expansion within the sphere of medical devices. TAVR, a groundbreaking minimally invasive procedure tailored for aortic valve ailments, is gaining prominence, especially among elderly and high-risk patients. This burgeoning market's growth is underpinned by several distinct factors.

One prominent trend fueling the TAVR market is the global aging demographic. As the elderly population continues to grow, so does the prevalence of aortic valve diseases, creating a heightened demand for innovative treatments like TAVR. Moreover, TAVR has emerged as the preferred choice over traditional open-heart surgery due to its less invasive approach, quicker recovery periods, and reduced mortality rates, thus galvanizing its adoption and propelling market expansion.

In tandem with its rapid growth, the TAVR market grapples with certain challenges. Navigating intricate regulatory pathways and approval processes can be arduous and time-consuming, impacting the introduction of novel TAVR devices. Furthermore, variations in reimbursement policies and healthcare funding across regions pose hurdles, affecting patient access to TAVR procedures. Addressing these regulatory and reimbursement challenges while ensuring device safety and efficacy remains paramount within the industry.

Within the dynamic TAVR landscape, numerous lucrative business opportunities await. Ongoing technological advancements continually enhance device design, elevating procedural outcomes and broadening the pool of eligible candidates for TAVR. Increasing awareness of TAVR as a viable treatment option, both among healthcare providers and patients, presents an opportunity for expanded market penetration. Additionally, venturing into emerging markets with burgeoning healthcare infrastructure offers companies fresh avenues for growth and revenue diversification.

In summation, the TAVR market is experiencing impressive expansion due to demographic shifts, increased consciousness, and continuous technological evolution. While contending with intricate regulatory and reimbursement challenges, the sector is brimming with opportunities for creativity, market enlargement, and the augmentation of patient welfare. As the healthcare community further acknowledges the benefits of TAVR, this minimally invasive intervention is primed to take on an even more central role in the care of aortic valve disorders in the foreseeable future.

| Report Coverage | Details |

| Market Size by 2034 | USD 12.22 Billion |

| Market Size in 2023 | USD 5.79 Billion |

| Market Size in 2024 | USD 6.21 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Implantation Procedure, By Material, By Mechanism, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Less invasive approach

The less invasive approach offered by transcatheter aortic valve replacement (TAVR) is a pivotal driver of market growth. This minimally invasive alternative to traditional open-heart surgery has revolutionized the treatment of aortic valve diseases. Its impact on market expansion can be elucidated in several ways.

Firstly, TAVR significantly reduces the physical trauma associated with surgery, resulting in shorter hospital stays and quicker recovery times for patients. This not only enhances the patient experience but also increases the overall capacity of healthcare facilities to accommodate more procedures, driving market growth.

Secondly, the less invasive nature of TAVR attracts a broader patient demographic, including those deemed high-risk or inoperable for traditional surgery. This expanded patient pool amplifies the demand for TAVR procedures and fosters market expansion. Additionally, healthcare providers favor TAVR due to its reduced morbidity and mortality rates compared to surgical alternatives. This preference further encourages its adoption, and as more physicians become adept at performing TAVR procedures, its utilization continues to grow. In conclusion, the less invasive approach of TAVR not only benefits patients but also propels market growth by broadening its applicability, enhancing healthcare capacity, and garnering support from healthcare professionals.

Restraints

Limited data for specific patient groups

Insufficient data for specific patient groups presents a noteworthy impediment to the burgeoning transcatheter aortic valve replacement (TAVR) market. Although TAVR has exhibited remarkable efficacy in managing aortic valve conditions in select demographics, such as the elderly and high-risk patients, there exists a conspicuous paucity of robust clinical information concerning other distinct cohorts, notably those with bicuspid aortic valves or younger individuals.

This shortage of comprehensive clinical insights raises legitimate concerns regarding the safety, effectiveness, and long-term consequences of employing TAVR in these unique patient subsets. Both healthcare practitioners and patients may exhibit hesitance in favoring TAVR over conventional surgical alternatives due to the absence of tailored data pertinent to their specific requirements.

Furthermore, regulatory authorities often necessitate substantial clinical substantiation for device approvals, and the deficiency of such data may hinder the timely introduction of TAVR devices for these particular patient categories. To surmount this challenge, concerted efforts in research and the initiation of clinical trials tailored to these populations are imperative to furnish the essential evidence base and broaden the scope of TAVR, thereby catalyzing its expansion within the market.

Opportunities

Patient and physician education

Patient and physician education plays a pivotal role in creating opportunities within the transcatheter aortic valve replacement (TAVR) market. By increasing awareness and understanding of TAVR's benefits, safety, and appropriateness, education facilitates market growth. For patients, comprehensive information about TAVR empowers them to make informed decisions regarding their treatment options. Greater awareness can lead to more patients considering and choosing TAVR, expanding the potential patient pool and driving demand for the procedure.

Physician education is equally critical. Training programs and continuous medical education initiatives ensure that healthcare providers are well-versed in the latest TAVR techniques and technologies. This not only enhances patient safety but also boosts physician confidence in recommending and performing TAVR procedures, further driving its adoption. Overall, patient and physician education fosters trust, acceptance, and increased utilization of TAVR, ultimately creating substantial growth opportunities within the market.

Impact of COVID-19:

The COVID-19 pandemic had both positive and negative effects on the transcatheter aortic valve replacement (TAVR) industry. Initially, elective TAVR procedures were postponed or canceled, leading to a temporary decline in market growth. However, as healthcare systems adapted to the pandemic and implemented safety measures, TAVR procedures resumed, and the market rebounded.

The pandemic also highlighted the advantages of TAVR's minimally invasive approach, driving interest and acceptance. Additionally, TAVR research and innovation continued, leading to new device approvals. Overall, the TAVR market demonstrated resilience and adaptability during the pandemic, with long-term growth prospects remaining strong due to increasing demand for minimally invasive cardiac procedures.

The transfemoral segment has held a 54% revenue share in 2023. The transfemoral segment holds a significant share in the TAVR market due to its minimally invasive approach and patient preference. Transfemoral TAVR involves inserting the valve through the femoral artery, avoiding the need for open-heart surgery. This less invasive procedure offers shorter recovery times, reduced postoperative complications, and improved patient comfort. As a result, it has become the preferred route for many TAVR candidates, contributing to its dominant market share. Additionally, advancements in device design and delivery systems have made transfemoral TAVR more accessible to a broader range of patients.

The transapical segment is anticipated to expand at a significantly CAGR of 8.1% during the projected period. The transapical segment holds a significant growth in the transcatheter aortic valve replacement market due to its effectiveness in addressing specific patient needs. Transapical TAVR is preferred for patients with complex anatomies or conditions that make transfemoral access challenging. This approach provides an alternative access point, allowing TAVR procedures to be performed on a broader range of patients. As a result, transapical TAVR has gained popularity, contributing to its substantial market growth. Its versatility and ability to cater to a diverse patient population make it a vital component of the TAVR market's success.

The nitinol is anticipated to hold the largest market share of 40% in 2023. The Nitinol segment holds a substantial share due to its unique material properties. Nitinol, a nickel-titanium alloy, combines flexibility and shape memory, making it ideal for TAVR device construction. Its ability to self-expand within the aorta offers precise deployment and secure positioning of the valve, reducing the risk of complications. This material's reliability, durability, and compatibility have made it the preferred choice for TAVR devices, solidifying its dominance in the market and contributing significantly to its growth and success.

The cobalt-chromium segment is projected to grow at the fastest rate over the projected period. The cobalt-chromium segment holds a major growth in the market due to its superior material properties. Cobalt-chromium alloy offers excellent strength, durability, and corrosion resistance, making it an ideal choice for TAVR device construction. These qualities ensure the longevity and reliability of TAVR valves, which are crucial for patient outcomes. Furthermore, cobalt-chromium devices often feature thinner struts, reducing the risk of valve thrombosis and improving hemodynamic performance. As a result, the cobalt-chromium segment is favored by both physicians and patients, driving its significant market growth in the TAVR industry.

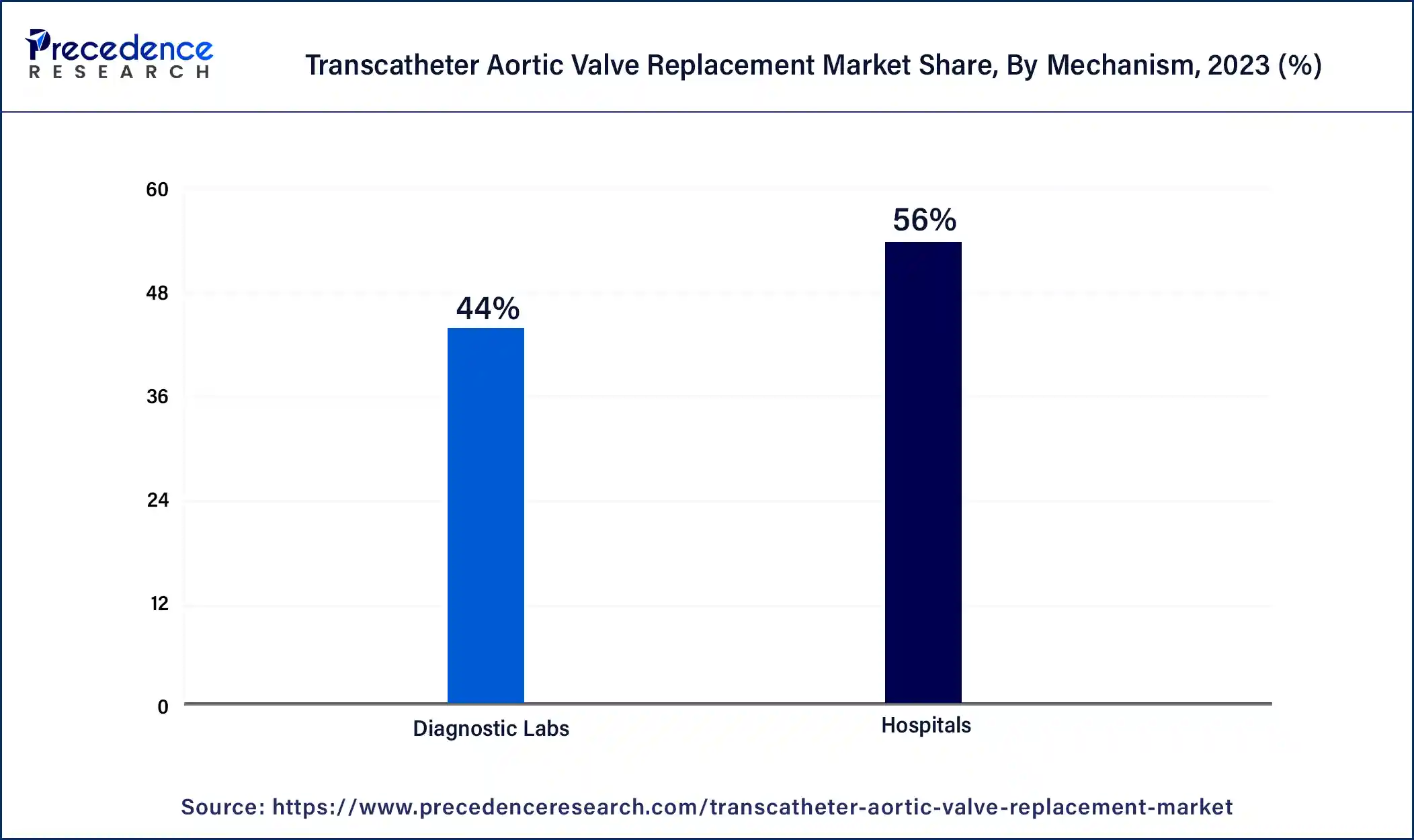

The balloon-expanding segment held the largest revenue share of 56% in 2023. The balloon-expanding segment holds a significant share in the transcatheter aortic valve replacement market primarily due to its well-established track record and effectiveness. Balloon-expandable TAVR devices have been in use for a longer period, accumulating extensive clinical data and demonstrating consistent positive outcomes. They are recognized for their precise deployment and reduced risk of valve migration. Moreover, physicians often favor the familiarity and predictability of balloon-expandable systems, contributing to their dominant market position. While self-expanding TAVR devices are gaining ground, the established reputation of balloon-expandable options continues to drive their major share in the TAVR market.

The self-expanding valve sector is anticipated to grow at a significantly faster rate, registering a CAGR of 9.9% over the predicted period. The self-expanding valve segment holds significant growth due to its unique advantages. These valves offer a self-deployment mechanism, which simplifies the implantation process and reduces procedure time. Their flexibility allows for precise positioning, reducing the risk of complications. Moreover, self-expanding valves are suitable for a wider range of anatomies, expanding the eligible patient population. These factors, coupled with favorable clinical outcomes, have led to increased adoption among healthcare providers, making the self-expanding valve segment a major player in the TAVR market.

The hospital sector has generated a revenue share of 88 % in 2023. Hospitals hold a significant share in the transcatheter aortic valve replacement (TAVR) market primarily because TAVR procedures are complex and require specialized facilities and skilled healthcare teams. Hospitals are well-equipped to provide the necessary infrastructure, including catheterization labs and surgical suites, and have the expertise to perform TAVR safely. Additionally, hospitals often serve as referral centers for TAVR, attracting patients from surrounding areas. Their ability to offer comprehensive cardiovascular care, including TAVR, consolidates their dominant position in this market, making them the preferred choice for patients seeking this life-saving procedure.

The Ambulatory surgical centers is anticipated to grow at a significantly faster rate, registering a CAGR of 7.8% over the predicted period. Ambulatory surgical centers (ASCs) hold substantial growth due to several key factors. ASCs offer a cost-effective and efficient setting for performing TAVR procedures, appealing to healthcare providers and patients. They often have advanced facilities and experienced staff, ensuring safe and high-quality care. Additionally, ASCs are known for their shorter wait times and reduced hospitalization periods, aligning with the minimally invasive nature of TAVR. As the demand for TAVR grows and healthcare systems emphasize outpatient care, ASCs are positioned to continue playing a significant role in delivering these procedures.

By Implantation Procedure

By Material

By Mechanism

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

December 2024

January 2025

January 2025