April 2025

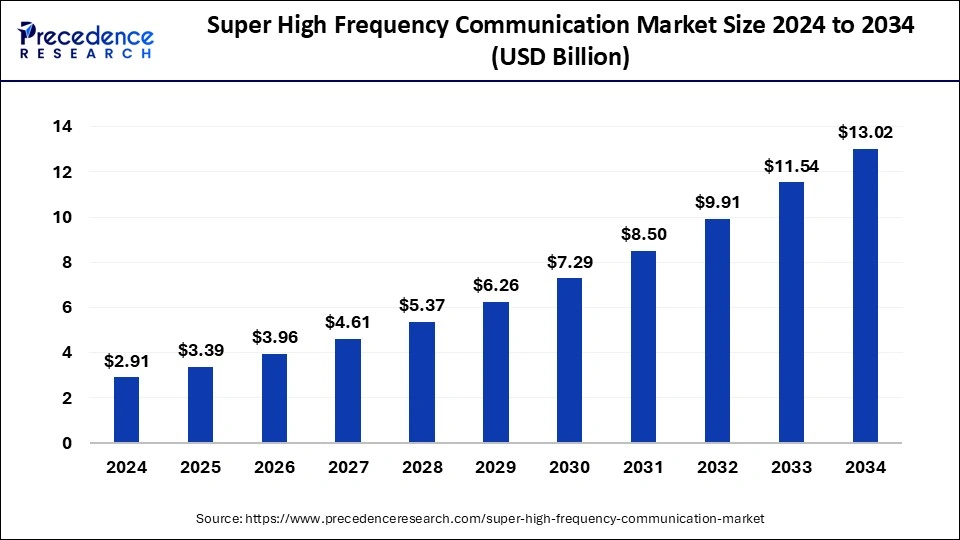

The global super high frequency communication market size is calculated at USD 3.39 billion in 2025 and is forecasted to reach around USD 13.02 billion by 2034, accelerating at a CAGR of 16.16% from 2025 to 2034. The North America super high frequency communication market size surpassed USD 1.11 billion in 2024 and is expanding at a CAGR of 16.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global super high frequency communication market size was estimated at USD 2.91 billion in 2024 and is predicted to increase from USD 3.39 billion in 2025 to approximately USD 13.02 billion by 2034, expanding at a CAGR of 16.16% from 2025 to 2034. The growing demand for high-frequency communications in a wide range of military applications is expected to drive the growth of the global super high frequency communication market during the forecast period.

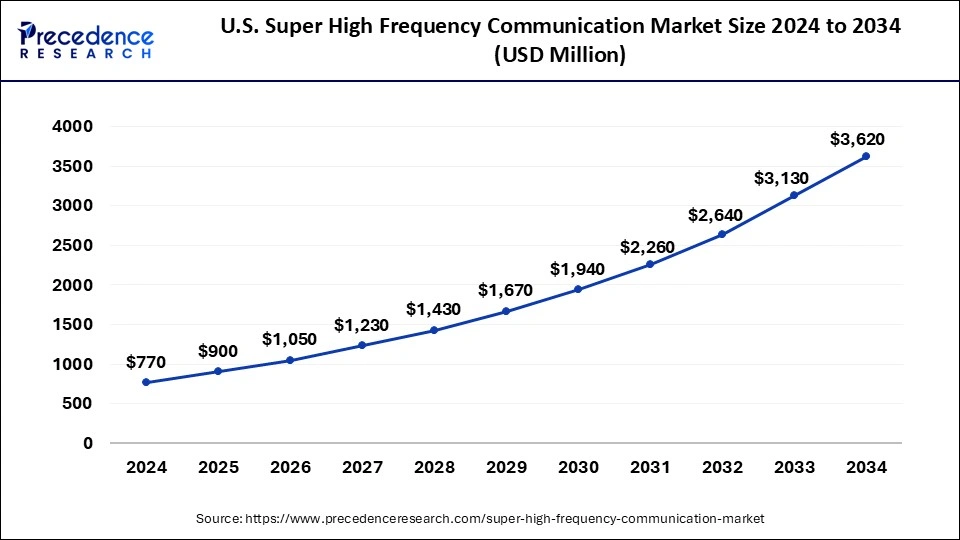

The U.S. super high frequency communication market size was exhibited at USD 770 million in 2024 and is projected to be worth around USD 3,620 million by 2034, poised to grow at a CAGR of 16.74% from 2025 to 2034.

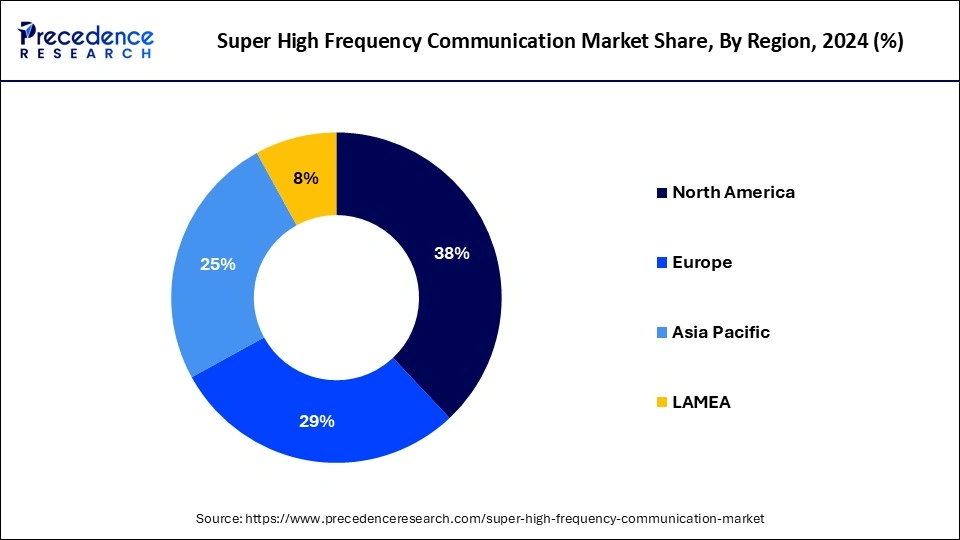

North America dominated the super high frequency communication market in 2024. The region's dominance is due to the significant demand for super-high frequency in military radars, 5G radio antennas, and LEO satellite antenna systems. Furthermore, ongoing government initiatives in the U.S. and Canada to deploy next-generation radar technologies are expected to drive market growth. In North America, the U.S. held the largest market share in the super high frequency communication market, while Canada experienced the fastest growth.

Asia Pacific is expected to host the fastest-growing super high frequency communication market during the forecast period. The growth is driven by significant investments in deploying radar antennas, advanced systems, and other technologies. In Asian part, there is a rapid expansion in the deployment of both sub-6.0GHz and 5G mm-wave equipment. However, China dominated the super high frequency communication market in terms of market share, while India experienced the fastest growth in the region.

Tsinghua University was granted a wireless frequency license and a space radio station license by China's Ministry of Industry and Information Technology (MIIT) in May 2024 for the Smart SkyNet-1 01 satellite. This allowed the university to carry out technical verification of medium-orbit wideband communication satellite synchronization.

The super high frequency communication market is at the forefront of technological innovation and is set to transform global communication systems. Operating within the radio frequency spectrum, SHF communication offers numerous advantages, making it essential across various industries. These technologies provide enhanced bandwidth and data transfer capabilities, which are ideal for military communication, aerospace and defense, and telecommunications. Advancements in wireless communication and the increasing adoption of IoT devices are expected to further propel the growth of the SHF communication market in the coming years.

| Report Coverage | Details |

| Market Size by 2034 | USD 13.02 Billion |

| Market Size in 2025 | USD 3.39 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.16% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Frequency Range, Radome Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for low earth orbit (LEO) satellite constellations

The low-Earth orbit (LEO) satellite market is anticipated to be driven by growing investments and technological advancements. The growing use of LEO satellites for uses like HD video conferencing, gaming, important financial transactions, and remote asset monitoring is the cause of this development. Consequently, a number of major satellite service providers are making significant investments in the global launch of LEO satellite constellations. Satellites that use ultra high frequency communication systems can benefit from high data transfer speeds, improved security, narrow beams, and fewer antennas.

As per the report published in August 2023, Larsen & Toubro (L&T) is in talks to acquire space technology from the Indian Space Research Organization (ISRO) to build launch vehicles for low earth orbit satellites (LEOs).

Spectrum congestion

As the demand for high-frequency spectrum increases, congestion becomes a significant concern for the super high frequency communication market. The limited availability of spectrum bands for super high-frequency communication can lead to interference and reduced system efficiency, posing challenges for seamless and reliable communication. Furthermore, integrating super high-frequency communication systems into existing infrastructures can be complex. Compatibility issues and the need for specialized expertise in implementation may create challenges for organizations looking to adopt or upgrade their communication systems.

Satellite communication evolution

The continuous evolution of satellite communication technologies is driving growth in the super high frequency communication market. As satellites become more advanced and versatile, the demand for high-capacity data transfer via SHF systems in satellite communication applications is expected to increase. The rise in the proliferation of IoT devices across various industries necessitates robust and reliable communication systems. Super high-frequency communication, with its high-speed capabilities and low latency, is well-suited to meet the growing connectivity demands of the IoT ecosystem, presenting a lucrative opportunity for market participants.

The radar segment dominated the super high frequency communication market in 2024. The extensive use of the super high frequency communication market in military, maritime, and commercial radar applications contributes to the high segment share. Radar systems are essential for critical military tasks such as target identification, detection, missile guidance, and enemy tracking. The increasing use of radar systems in military and defense applications is driving market growth.

The 5g mm wave segment is expected to grow at the fastest rate in the super high frequency communication market during the forecast period. Important industry participants like Nokia, Ericsson, Huawei, and others are substantially investing in the development and implementation of new 5G small-cell antenna equipment in response to the evolution of 5G technologies. These radio antennas are compatible with a range of frequency bands, such as millimeter-wave (beyond 24.0 GH) and 5G sub-6.0 GHz (below 6.0 GHz).

The 10 - 20 GHz segment accounted for the largest share of the super high frequency communication market in 2024. The wide variety of communication systems that handle frequencies between 10 GHz and 20 GHz is the reason for the large market share. This frequency range is mostly used by applications such as airborne weather radar, surface-moving target identification, military ground mapping radar, missile tracking radar, aircraft, and fire control radar. The military, commercial, and naval sectors' increasing need for these applications is anticipated to fuel the segment's expansion.

The 20 - 30 GHz segment is expected to grow at the fastest rate in the super high frequency communication market over the forecast period. Major telecom companies, including Vodafone, AT&T, T-Systems, NTT Docomo, China Telecom, China Mobile, SK Telecom, BT Group, and China Telecom, are heavily focused on rolling out 5G sub-6.0 GHz equipment in their respective nations. The overall need for extremely high-frequency communication systems is anticipated to rise as a result.

The sandwich segment dominated the super high frequency communication market in 2024. Major items from well-known manufacturers in the global market, such as L3Harris, Inc., Saint-Gobain, Cobham Limited, and others, are the main drivers of the high segment share. Sandwich radomes are more popular than other radome kinds because of their straightforward construction, outstanding broadband performance, and superior strength-to-weight ratio.

The multi-layer system segment is projected to grow at the fastest rate in the super high frequency communication market in the coming years. Multi-layer radomes offer high bandwidth and an extended scanning range. Also, their superior strength-to-weight ratio makes them ideal for key applications such as spacecraft. Furthermore, multi-layer radomes provide excellent thermal resistance and high bending strength.

By Technology Type

By Frequency Range

By Radome Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

May 2025

October 2024

January 2024