What is the Surge Protection Devices Market Size?

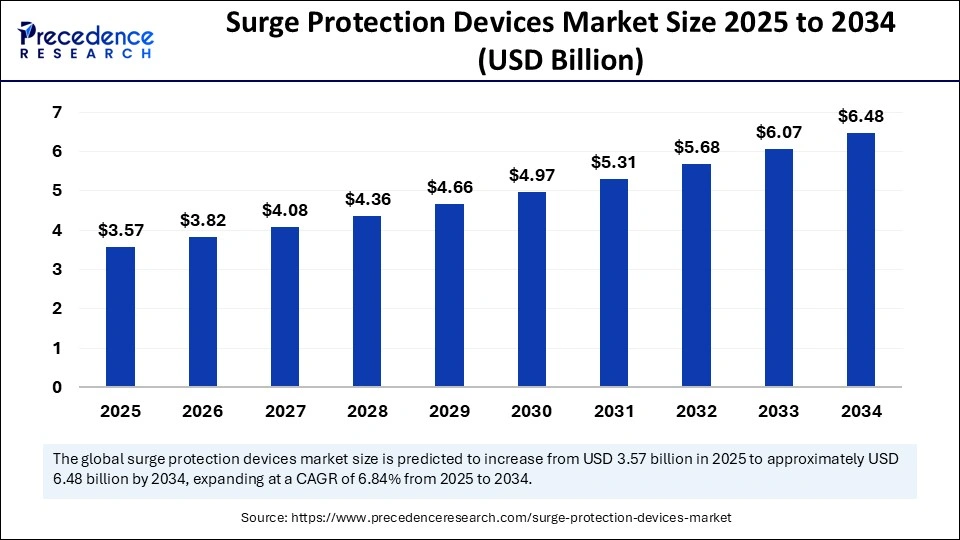

The global surge protection device market size is valued at USD 3.57 billion in 2025 and is predicted to increase from USD 3.82 billion in 2026 to approximately USD 6.87 billion by 2035, expanding at a CAGR of 6.76% from 2026 to 2035. The key factor driving market growth is the growing demand for surge protection devices to safeguard electrical gadgets. Also, increasing demand for smart power strips, coupled with the ongoing advancements in smart homes across the globe, can fuel market growth soon.

Market Highlights

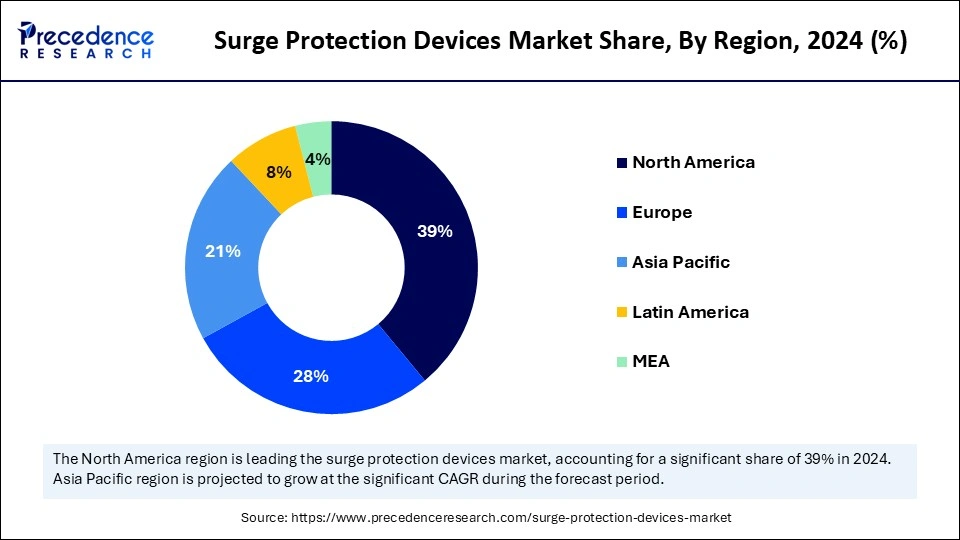

- North America dominated the global market with the largest market share of 39% in 2025.

- Asia Pacific is expected to show the fastest growth over the period studied.

- By product, the hard-wired segment contributed the biggest market share of 45% in 2025.

- By product, the plug-in segment is expected to grow at the fastest CAGR over the forecast period.

- By type, the type 2 segment captured the highest market share of 31% in 2025.

- By type, the type 1 segment is anticipated to grow at the fastest CAGR over the forecast period.

- By power rating, the 100.1-200 kA segment generated the major market share of 33% in 2025.

- By power rating, the 50.1-100 kA segment is projected to grow at the fastest CAGR over the forecast period.

- By end use, the industries and manufacturing units segment held the largest market share of 34% in 2025

- By end use, the commercial complexes segment is estimated to grow fastest during the studied period.

Artificial Intelligence: The Next Growth Catalyst in Surge Protection Devices

Artificial intelligence plays a key role in the surge protection devices market by improving operational efficiency and enhancing customer experiences through innovative technologies such as AI-driven analytics and digital solutions. Furthermore, AI-driven SPDs can process large amounts of data to predict potential issues, identify trends, and recommend corrective actions to reduce downtime. They can be smoothly integrated with smart grids and IoT devices to improve control and monitoring.

Strategic Overview of the Global Surge Protection Devices Industry

Surge protector devices (SPDs) are created to safeguard electrical appliances from potential voltage spikes. These devices limit the voltage provided to an electric device by shorting or blocking any unwanted voltages beyond a safe limit to the ground. They are also utilized in electric power supply networks, automatic control buses, various communication systems, and telephone networks. Governments across the globe are deploying policies that encourage the adoption of these devices, especially in the context of grid modernization and renewable energy projects.

Surge Protection Devices Market Growth Factors

- The growing requirement to prevent downtime in industrial settings is expected to boost the surge protection devices market growth shortly.

- Raised awareness regarding the potential damage caused by power surges can propel market growth soon.

- The growth of renewable energy projects, especially those using 5G infrastructure, requires efficient surge protection, which will likely contribute to the market expansion further.

Market Outlook

- Market Growth Overview: The surge protection devices market is expected to grow significantly between 2026 and 2035, driven by increased reliance on electronics, expansion of smart infrastructure, and infrastructure development and urbanisation.

- Sustainability Trends: Sustainability trends involve waste reduction and recyclability, the use of sustainable materials, and integration with renewable energy.

- Major Investors: Major investors in the market include ABB Ltd., Schneider Electric, Eaton Corporation plc, Siemens, and JPMorgan Chase & Co.

- Startup Economy: The startup economy is focused on startup activity in adjacent sectors, component innovation, and IoT and connectivity.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.57 Billion |

| Market Size in 2026 | USD 3.82 Billion |

| Market Size by 2035 | USD 6.87 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.76% |

| Dominated Region | North America |

| Fastest Growing Market | Aisa Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Type, Power Rating, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing energy investment

The surge protection devices market is substantially impacted by the rise in investments in electrical infrastructure. These significant investments showcase an increasing need for efficient protection against electrical surges, such as surge protection devices. In addition, this investment facilitates the growing demand for high-quality SPDs to protect upgraded and new infrastructure from threats caused by voltage surges and spikes, which is positively impacting overall market growth.

- In October 2024, Schneider Electric, the global leader in the digital transformation of energy management and next-generation automation, introduced its latest range of switches, sockets, and home connectivity solutions in the Indian market. The Miluz ZeTa collection includes cutting-edge innovations such as a patented switch socket for space-saving installation, an AQI, and a VSP.

Restraint

Increasing availability of counterfeit products

The rising availability of cheap counterfeit surge protection devices, especially from Asian countries, creates a substantial threat to established brands. This can facilitate lower sales of genuine SPDs and shorten overall market demand. Moreover, fluctuations in the cost of raw materials utilized in SPD manufacturing can affect the profit margins of market players.

Opportunity

Growing need for protection systems for electronic equipment

The utilization of electronic equipment in production facilities, residential sectors, and companies is propelling the demand for power-quality protection systems. Hence, surge protection is becoming more crucial for the entire facility. Furthermore, increasing demand for technologically innovative appliances like personal computers, printers, LED televisions, and industrial control systems like PLCs is rising rapidly, presenting future market opportunities soon.

- In October 2024, Secure Connection, the Hong Kong-based global electronic products manufacturer, announced the launch of its latest platinum range of Honeywell-licensed surge protectors. Honeywell-licensed surge protectors are the market leaders in the surge protector category in Thailand.

Segment Insights

Product Insights

The hard-wired segment led the surge protection devices market in 2025. The dominance of the segment can be attributed to their permanent and robust installation, offering comprehensive protection for critical equipment and electrical systems. These devices can be directly integrated into the electrical system, providing long-term protection and high reliability against voltage spikes caused by electrical disturbances or lightning. Hard-wired SPD can be used in various industrial, commercial, and residential applications.

The plug-in segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rising application of plug-in SPDs along with the benefits they can provide at different endpoints. Additionally, the plug-in SPDs include features such as noise filtering, surge protection, and data line protection. This segment is important for small businesses, residential, and consumer applications.

- In December 2024, TESSAN, a leader in power management solutions, announced the next generation of power management solutions, TESSAN Surge Protector Power Strip. TESSAN's latest product is designed to provide a truly natural charging and power management experience, which will cater to the individual needs of consumers while providing its inherent advantages.

Type Insights

The type 2 segment held the largest surge protection devices market share in 2025. The dominance of the segment can be linked to the growing preference for type 2 SPDs due to their affordable cost and effective performance, which makes them a primary choice for light commercial and residential applications. Also, type 2 improves system durability and minimizes the risk of damage to delicate equipment. Therefore, market players are launching innovative variants specific to the growing demand.

The type 1 segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by rising demand for lightning surge protection in different applications. These devices are mainly installed at the initial points of electrical systems to safeguard against huge-scale surges. However, the increasing awareness regarding surge protection, especially in areas susceptible to lightning strikes, is further driving the segment growth.

Power Rating Insights

The 100.1-200 kA segment led the surge protection devices market in 2025. The dominance of the segment is owing to the growing need for reliable power systems and the need to protect expensive electronic equipment from potential damage. These devices provide strong protection against voltage spikes and high-energy transients, which are very common in these environments due to equipment use and heavy machinery.

The 50.1-100 kA segment is projected to grow at the fastest rate over the forecast period. The growth of the segment is due to the good protection and balance offered by this segment, which makes it suitable for different applications such as commercial, residential, and industrial settings. Furthermore, the growing use of electronic devices and the increasing awareness regarding the importance of surge protection are fueling segment growth.

End-Use Insights

In 2025, the industries and manufacturing units segment held the largest surge protection devices market share. The dominance of the segment can be linked to the increasing use of SPDs in protecting control systems and machinery from electrical surges that can pose safety hazards and substantial disruptions. This device was created to safeguard equipment from overvoltage events that last for a few seconds, hence minimizing downtime and costly damage.

The commercial complexes segment is estimated to grow at the fastest rate during the period studied. The growth of the segment can be driven by insurance requirements and regulatory compliance often requires the use of surge protection in commercial facilities. In addition, a strong focus on electrical designers is being given on the installation of commercial SPDs in accordance with the regulatory requirements, also addition to the segment expansion.

Regional Insights

U.S. Surge Protection Devices Market Size and Growth 2026 to 2035

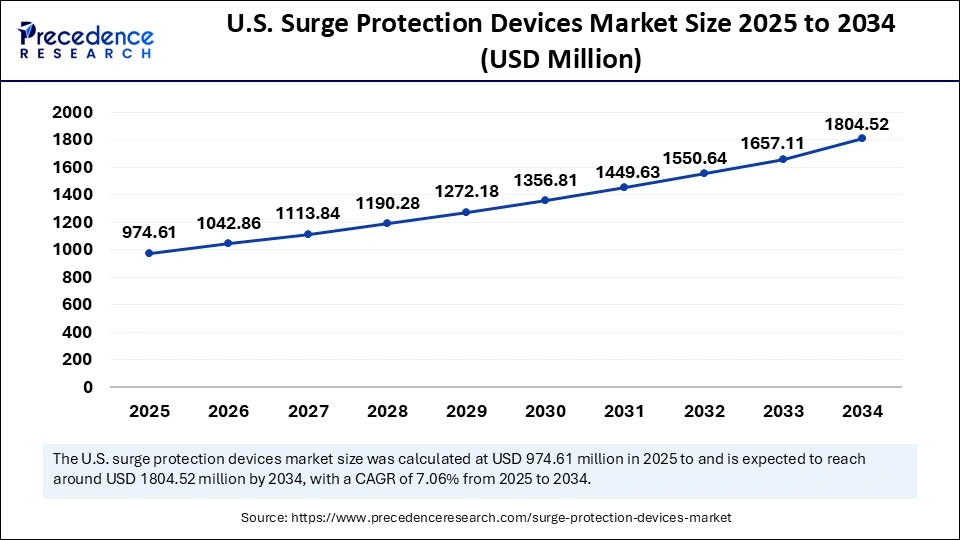

The U.S. surge protection device market size is evaluated at USD 974.61 million in 2025 and is projected to be worth around USD 1,908.26 million by 2035, growing at a CAGR of 6.95% from 2026 to 2035.

North America held the largest surge protection devices market share in 2025. The dominance of the region can be attributed to the increasing adoption rate of innovative technologies, coupled with the strict government regulations about electrical safety. Moreover, the region's robust infrastructure and substantial investments in renewable energy projects and smart grids are further propelling the expansion of the regional market.

- In July 2023, Raycap, a global provider of electronic components specializing in surge protection, connectivity, and monitoring systems, is broadening its range of surge protection junction boxes for photovoltaic (PV) inverters with the introduction of a new model designed to safeguard DC-side power.

U.S. Surge Protection Devices Market Trends

In North America, the U.S. led the surge protection devices market owing to the increasing electricity consumption in commercial and residential applications. The U.S. is also home to states like Louisiana, Mississippi, Florida, and Alabama, which are highly susceptible to lightning strikes and require surge protection devices.

Asia Pacific is expected to show the fastest growth over the period studied. The growth of the region can be credited to the increasing awareness in countries like India, China, and Japan regarding the benefits provided by SPDs.Furthermore, the surge in disposable income in emerging economies is allowing individuals to spend on electronic products like washing machines, LED television sets, and refrigerators.

China Surge Protection Devices Market Trends

In Asia Pacific, China dominated the surge protection devices market. The dominance of the country can be driven by increased investments in infrastructure development and rapid urbanization in the country. Also, the increasing shift towards clean energy, like lithium battery production, solar cells, andelectric vehicle manufacturing, can impact market growth positively.

European Regulatory Development & Adoption of Smart Protection Solutions

Surge protection devices are well represented and supported by the high level of regulation and structuring in the electrical safety industry through various media. In Europe, the combination of stringent electrical safety regulations, harmonized standards, and the rapid and growing integration of smart grid systems and renewable energy generation is fuelling an increased level of demand for surge protection devices in the region.

Within Europe, Germany, France, and the UK are currently leading the surge in demand across all three of the commercial, industrial, and residential segments, while both retrofit installations and newly constructed facilities play a significant role in increasing the number of surge protection devices installed across Europe.

Emerging Demand in Latin America Driven by Urbanization and Grid Modernization

Latin America's surge protection device market is still developing, but there are several areas where there is currently strong growth occurring due to increased levels of urbanization and grid modernization in this region. In Latin America, Brazil and Mexico are the primary drivers of this growth in the surge protection device market because of the large number of installations occurring within commercial complexes, telecommunications sites, and homes.

Brazil and Mexico's populations always face frequent variations in voltage due to poor grid infrastructure and aging equipment, prompting the need for reliable and effective surge protection devices. In addition, the growth of renewable energy generation projects and the expansion of medium-sized data centres will add further demand to the already strong demand for surge protection devices.

Emerging Smart Cities Across the Middle East and Africa

The proliferation of urbanisation across the MEA region has led to a significant increase in demand for surge protection devices to support this ongoing growth, as well as the transformation of traditional business models into more connected, collaborative, and digital environments.

Countries in the Gulf Co-operation Council (GCC) Region, particularly the UAE and Saudi Arabia, have focused their investments heavily on the development of smart city projects, data centre construction and upgrades, and the advancement of oil and gas facilities; all of these ventures require increased levels of surge protection device deployment.

Value Chain Analysis of the Surge Protection Devices Market

- Inbound Logistics: This stage involves the procurement, receiving, and storage of raw materials and components necessary for manufacturing SPDs.

Key Players: Metal Oxide Varistors (MOVs), Gas Discharge Tubes (GDTs) - Operations: This stage converts the raw materials into finished SPD products through manufacturing and assembly processes.

Key Players: Schneider Electric, Eaton, and Siemens - Outbound Logistics: Outbound logistics covers the activities required to store and distribute finished SPDs to customers, including warehousing and transportation.

- Marketing and Sales: This stage encompasses all efforts to promote and sell the SPDs to potential buyers.

Key Players: Schneider Electric, Eaton, and Siemens - Service: This stage focuses on post-purchase support, including installation assistance, maintenance, repair, and customer service.

Top Companies in the Surge Protection Devices Market & Their Offerings:

- ABB Ltd. Contributes to the SPD market through its comprehensive portfolio of low-voltage products, including a full range of surge arresters and protection devices for various applications.

- General Electric Company (GE) offers surge protection solutions primarily through its industrial and power distribution segments, integrating SPDs into its broader electrical infrastructure products.

- Schneider Electric is a major contributor to the market, offering a wide array of SPDs that range from whole-home to industrial applications and include connected, "smart" devices.

- Eaton Corporation plc provides extensive SPD products and solutions, from point-of-use plug strips to whole-facility systems, integrated with their power management and circuit protection offerings.

- Legrand contributes with a range of residential and commercial-grade surge protectors designed for various electrical installations. Their focus is on building infrastructure systems, offering user-friendly and aesthetically integrated solutions.

- Emerson Electric Co. primarily focuses on surge protection for industrial automation and critical infrastructure, including data centers, through its network power and process management businesses.

- Siemens offers comprehensive surge protection solutions as part of its electrical infrastructure and smart grid technologies portfolio. They provide high-quality SPDs for diverse applications, from residential panels to complex industrial control systems.

- CG Power and Industrial Solutions Limited (formerly Crompton Greaves) contributes to the SPD market, particularly in high-voltage applications such as power transmission and distribution.

- Littelfuse, Inc. It is a leading player focused on circuit protection, offering a broad selection of discrete SPD components like MOVs, GDTs, and TVS diodes. They also provide comprehensive module solutions used in a wide array of industrial and consumer electronic products.

- Bourns, Inc. specializes in the manufacturing of components and modules for surge protection, with a strong focus on advanced technology for telecommunications, automotive, and industrial markets.

Latest Announcement by Market Leaders

- In May 2024, ABB Canada and Powrmatic Canada Ltd., a distributor of residential, commercial, and electrical supply equipment based in Eastern Canada, announced a new regional distribution agreement. Powrmatic will provide electrical contractors increased access to a complete portfolio of cutting-edge ABB products and smart building solutions, including safety switches, switchboards, panelboards, etc.

Recent Developments

- In July 2023, Bourns released the 1420A family of high-performance DC surge protectors. The device offers surge protection up to 50 kA in a variety of configurations and was designed for DIN Rail applications. It serves high-risk electrical service panels and entries, including solar energy generating systems, battery energy storage systems (BESS), and EV fast chargers.

- In June 2023, Littelfuse, Inc., an industrial technology manufacturer, unveiled the NEMA-style Surge Protective Device (SPD) series to protect equipment from brief overvoltage events lasting but a few microseconds and prevent costly damage and downtime.

Segments Covered in the Report

By Product

- Hard-wired

- Plug-in

- Line Cord

- Power Control Devices

By Type

- Type 1

- Type 2

- Type 3

- Type 4

By Power Rating

- 0-50 kA

- 50.1-100 kA

- 100.1-200 kA

- 200.1 kA and Above

By End-Use

- Commercial Complexes

- Data Center

- Industries & Manufacturing Units

- Medical

- Residential Buildings & Spaces

- Telecommunication

- Transportation

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting