September 2024

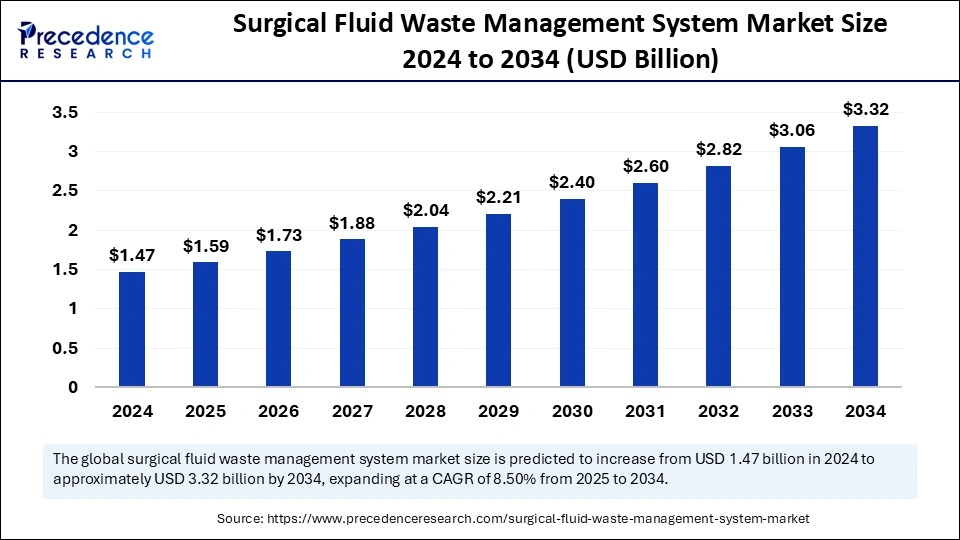

The global surgical fluid waste management system market size is calculated at USD 1.59 billion in 2025 and is forecasted to reach around USD 3.32 billion by 2034, accelerating at a CAGR of 8.50% from 2025 to 2034. The North America market size surpassed USD 590 million in 2024 and is expanding at a CAGR of 8.54% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global surgical fluid waste management system market size accounted for USD 1.47 billion in 2024 and is predicted to increase from USD 1.59 billion in 2025 to approximately USD 3.32 billion by 2034, expanding at a CAGR of 8.50% from 2025 to 2034. The concern over health-associated infections has driven the adoption of surgical fluid waste management systems in healthcare infrastructure. The number of surgical procedures has increased.

The healthcare system has a significant need for an advanced, efficient, and convenient surgical fluid waste management system. Technological advances like automated systems play a vital role in enhancing the adoption rate of this system. The integration of artificial intelligence with surgical fluid waste management systems is a transformative approach in the field. AI is a well-proven tool to enhance customer experiences.

AI-enabled systems, aka automated fluid management tasks, reduce human needs and complications and increase surgical procedure efficiency. AI has become a cost-effective technology, as AI-powered systems reduce waste and optimize fluid usage; it helps to save costs for healthcare settings. Additionally, the data-driven decision-making ability of AI makes it an ideal tool for emergencies. The increased healthcare focus on improving patient safety and the integration of AI has become an essential approach.

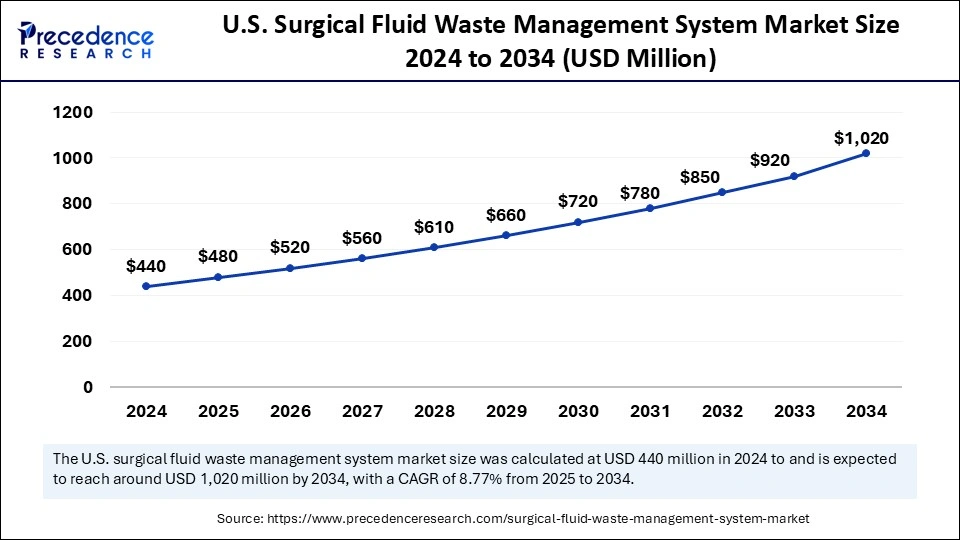

The U.S. surgical fluid waste management system market size was exhibited at USD 440 million in 2024 and is projected to be worth around USD 1,020 million by 2034, growing at a CAGR of 8.77% from 2025 to 2034.

Regulatory Pressure to Boost the North American Market

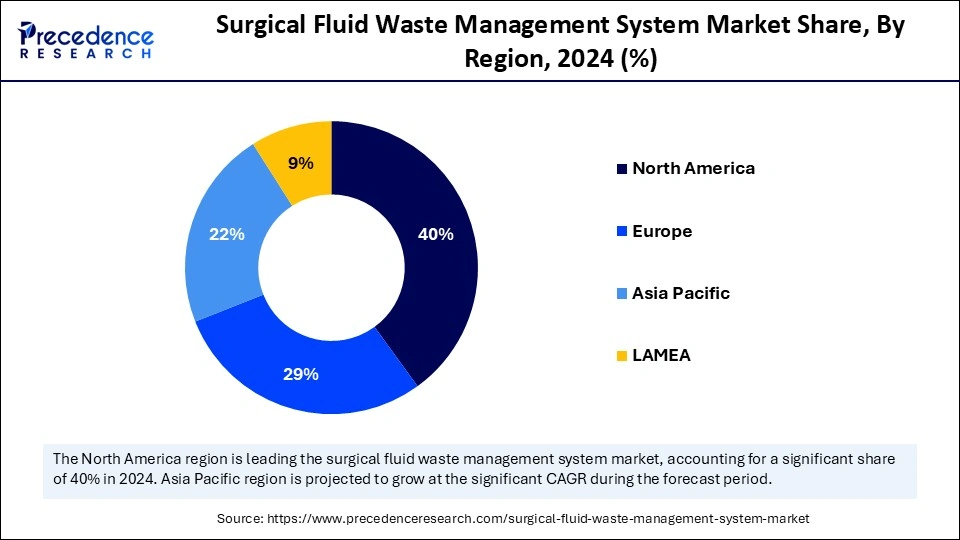

North America accounted for the largest surgical fluid waste management system market share in 2024 with various factors, including the presence of key vendors, advanced healthcare infrastructure, and a high number of surgical procedures in the region. North America has a high adoption rate of minimally invasive surgery. The strength of regulations and guidelines for healthcare waste management drives a high demand for effective fluid management systems. Regulatory pressure on large market competition encourages key market players to invest in the development of advanced and efficient surgical fluid waste management systems.

The United States is leading the regional surgical fluid waste management system market, driven by a high number of surgical procedures and the presence of key market players. The United States is the leader in innovation and development of advanced technologies. The well-established healthcare infrastructure of the country is the primary adopter of automation and technological advancements.

Europe to Witness Growth by Government Initiatives

Europe is projected to expand at the fastest CAGR in the surgical fluid waste management system market during the forecast period. Several key factors include increased adoption of minimally invasive surgeries, government funding for improving healthcare waste management settings, and technological advancements in surgical fluid waste management systems. Various regulations like EU Circular Economy Frameworks, Health Care Without Harm Europe, and OSHA guidelines drive the importance of protection, prevention, recycling, disposal, and management of surgical fluid in healthcare. The strict waste management regulations and government emphasis on maintaining environmental sustainability play a vital role in market expansion.

Germany is leading the original market due to the high volume of surgical procedures, driven by a high prevalence of chronic disease in the country. Developed healthcare infrastructure and robust waste management regulations are contributing to this expansion. Government and public demand for sustainable solutions and key vendors' commitment to offering automated solutions are leveraging the market to expand in Germany.

Large Patient Pool Contributing to Asian Market Growth

The Asia Pacific surgical fluid waste management system market is growing at a notable rate globally, with a large patient population, expanding healthcare infrastructure, and the presence of key vendors. Asia Pacific is contributing to expanding healthcare infrastructure by building multiple hospitals and healthcare facilities. The demand for surgical fluid waste management systems has increased. The increased prevalence of chronic diseases in large and aging populations has driven a shift toward the adoption of minimally invasive surgeries, driving the need for fluid waste management solutions. Additionally, government initiatives and regulations to improve healthcare waste management highly contribute to market expansion.

China is the largest surgical fluid waste management system market in Asia Pacific, driven by the large patient population and expanding well-established healthcare infrastructure. Japan is the second largest country, leading the Asian market with a high adoption of minimally invasive surgeries and the presence of key market players. The Japanese market is witnessing expansion with technological expertise and innovation factors. However, India is expected to grow rapidly with government initiatives to improve healthcare infrastructure and waste management solutions.

The surgical fluid waste management system market has witnessed significant growth due to various factors affecting it. Healthcare has witnessed increased demand for systems, products, and services to manage and dispose of surgical fluid waste generation during surgical procedures. The demand for surgical fluid waste management systems has increased due to the growth in several surgical procedures like laparoscopy, arthroscopy, neurology, and cardiology. Concerns over surgery-associated infections have taken place, leading to the adoption of advanced, cost-effective, and convenient systems in healthcare.

Government regulations, policies, and guidelines to maintain environmental sustainability and medical waste management drive the need for efficient and advanced systems. Technological advancements such as automated fluid management systems like mobile, wall-mounted, and floor-standing systems are highly contributing to the increasing popularity of these systems. Additionally, several key vendors are continuously trying to advance their technologies to improve efficiency and acceptance by hospitals around the world. This approach is majorly due to high market competition.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.32 Billion |

| Market Size in 2025 | USD 1.59 Billion |

| Market Size in 2024 | USD 1.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.50% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End use, and Regions |

| Regions Covered North | America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Government regulations and healthcare policies

The government regulation framework and healthcare policies are the major drives increasing the adoption of surgical fluid waste management systems in the healthcare infrastructure. Bio-Medical Waste Management Rules, 2016, Environment (Protection) Act, 1986 (India), and World Health Organization (WHO) Guidelines are the regulated disposal of medical waste, including surgical fluids. Hospitals focus on adopting advanced surgical fluid waste management systems to comply with regulatory requirements.

Several countries have state-level regulations and policies that supplement national regulations and ensure advanced approaches in medical waste management. These regulations and policies are responsible for monitoring waste management regulation compliance. Government regulations and healthcare policies encourage manufacturers to develop advanced technologies like automated systems to enhance efficiency and reduce the cost burden.

High cost of endo-surgical procedures

Endosurgical procedures are quite expensive. These procedures require cutting-edge technologies like endoscopes and laparoscopic equipment. These procedures require skilled professionals and medical staff. Longer procedure time of endosurgery increases operation room costs. Additionally, the high cost associated with the disposal of fluid causes a cost burden. The high cost of endo-surgical procedures restrains the adoption of surgical fluid waste management systems, as it limits their budget allocation.

Increasing minimally invasive surgeries

The increasing number of minimally invasive surgeries holds great potential in the surgical fluid waste management system market. These surgeries are considered outpatient healthcare services. Factors like insurance coverage for minimally invasive surgeries and shorter recovery time make them popular. They reduced trauma, faster recovery, and fewer risk of complications, driving demand for minimally invasive surgeries. This surgery often required the utilization of surgical fluids. Increase the number of minimally investor surgeries, driving the need for effective lead waste management systems to prevent contaminations, reduce waste, and comply with regulatory requirements. The development of fluid waste management technologies, such as automated fluid waste management systems, is likely to highly adopt minimally invasive surgeries.

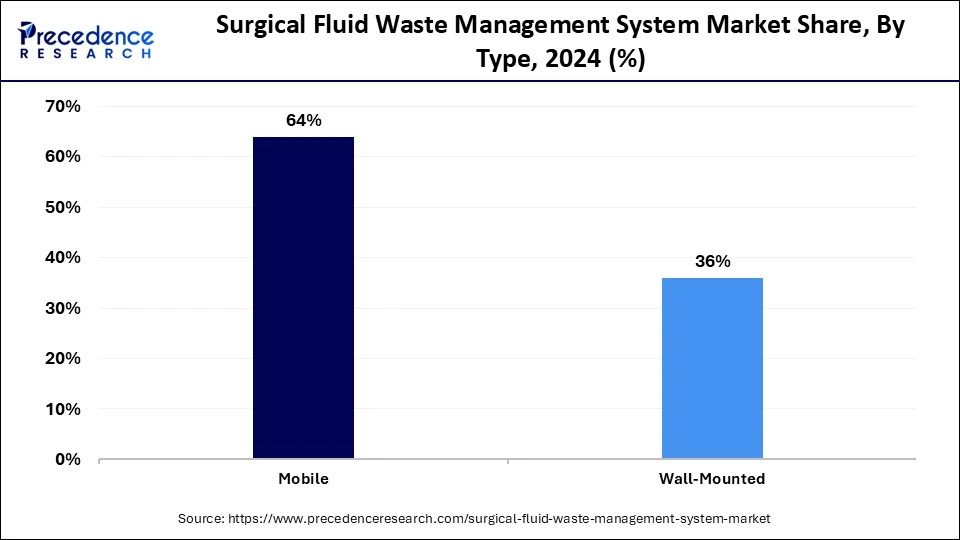

The mobile segment accounted for the dominating share of the surgical fluid waste management system market in 2024 due to its flexibility, portability, and easy-to-use nature. Mobiles keep users updated about the need for waste management. The technological advancements and regulatory encouragements to frequent device updating are driving innovations, architectures, and capabilities enhancement of mobile devices. Mobile surgical fluid waste management systems are cost-effective and allow medical staff to transport and use them easily in various settings. The increased demand for minimally invasive procedures and the number of surgeries is increasing the adoption of mobile systems in surgical fluid waste management.

On the other hand, the wall-mounted segment is expected to grow significantly in the coming years. The wall-mounted system is a space-saving design and is easy to integrate and install with existing medical infrastructure. This system is easy to maintain as it reduces the need for extensive maintenance. This system can be integrated with direct medical vacuum systems, reducing the need for extensive plumbing. The convenient nature of the wall-mounted system makes it cost-effective compared to mobile and portable systems. The increased demand for efficient fluid management systems is driving the adoption of wall-mounted systems.

The laparoscopy segment accounted for the largest surgical fluid waste management system market share in 2024. The increased adoption of laparoscopic surgeries, including cholecystectomy, appendectomy, colectomy, bariatric operations, and gynecology, is driving a significant impact on demand for surgical fluid waste management systems in healthcare. Laparoscopy is a minimally invasive procedure that reduces time and risk of complications, which increases its popularity. These procedures require a high volume of surgical fluids, which drives demand for advanced surgical fluid waste management systems. The increased number of laparoscopy surgeries raising concerns about environmental sustainability requires the management of medical waste, including the disposal of fluids and single-use items.

The arthroscopy segment is expected to grow at the highest CAGR over the forecast period of 2025 to 2034 due to increased numbers of arthroscopy procedures. Technological advancements in complying with regulatory requirements and approvals in procedures are expanding the adoption of procedures. Additionally, the demand for minimally invasive procedures is fulfilling segment growth. High-volume fluid utilization in arthroscopy drives the need for a precise fluid waste management system. Arthroscopy surgeries are major adopters of advanced, efficient, and effective surgical fluid management systems.

The hospital segment captured the largest surgical fluid waste management system market share in 2024 with a large patient volume and high setting of surgical procedures. The large number of surgical procedures leads to an increase in fluid waste generation. Hospitals have stringent regulatory requirements and protocols to follow, which drive demands for effective waste management systems. Government regulations and guidelines require proper surgical fluid waste management. Hospitals have raised investments in the development of advanced systems to improve waste management practices and reduce environmental impact.

The ambulatory surgical centers segment is poised to grow at a notable CAGR over the forecast period of 2025 to 2034. Ambulatory surgical centers are becoming significantly popular for outpatient procedures. The popularity has led to an increase in several surgical procedures, driving the need for efficient fluid management systems. The requirement to comply with stringent infection control protocols and the need for cost-effective solutions are driving the adoption of affordable and efficient surgical fluid waste management systems in ambulatory surgical centers.

By Type

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

January 2025