September 2024

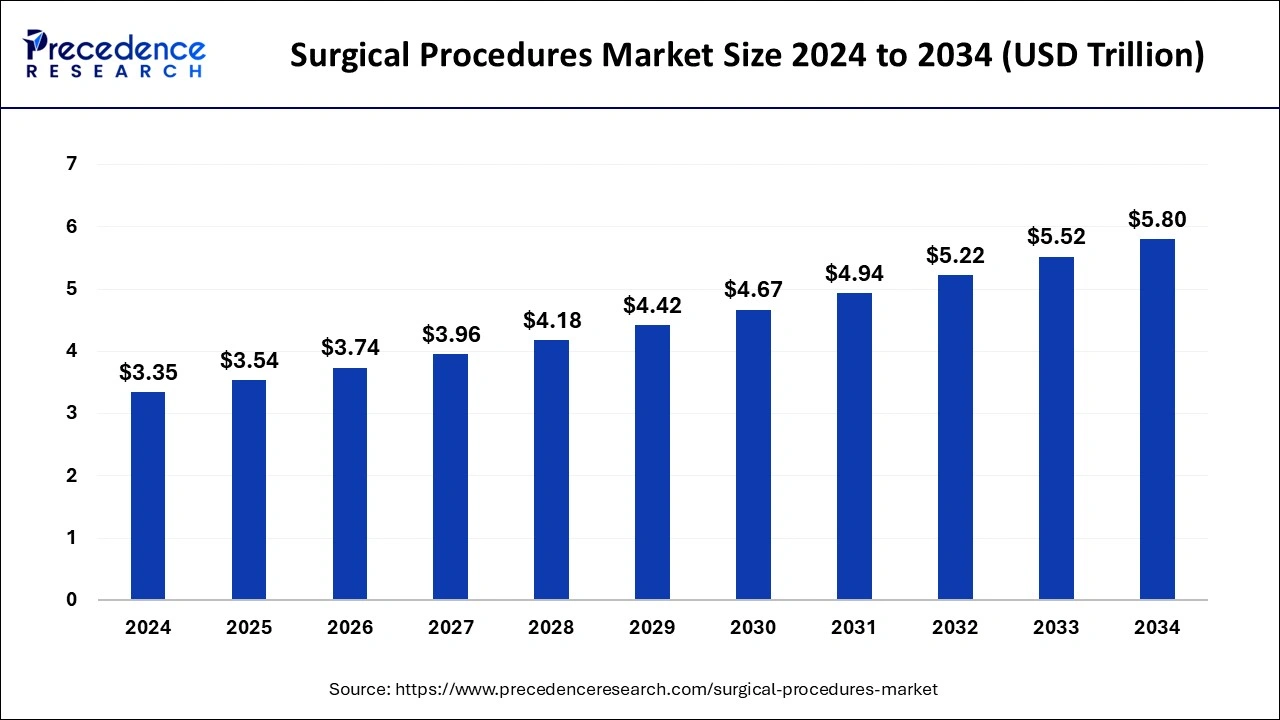

The global surgical procedures market size is calculated at USD 3.54 trillion in 2025 and is forecasted to reach around USD 5.80 trillion by 2034, accelerating at a CAGR of 5.64% from 2025 to 2034. The North America surgical procedures market size surpassed USD 1.27 trillion in 2024 and is expanding at a CAGR of 5.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global surgical procedures market size was accounted for USD 3.35 trillion in 2024, and is expected to reach around USD 5.80 trillion by 2034, expanding at a CAGR of 5.64% from 2025 to 2034. The surgical procedures market is expanding due to technological advancements in surgical tools, rising geriatric populations, and chronic health conditions, which are propelling the market's growth.

AI is impacting the surgical procedures market in various ways, including enhancing surgical precision using AI, post-surgical care, and assisting healthcare professionals. AI possesses immense potential to transform surgical methods with unprecedented accuracy, efficiency, and patient care. Advanced algorithms can analyze comprehensive medical data, which aids surgeons in making data-based decisions. By considering the patient's unique medical history, AI-driven tools can solve complications and advise on the optimal surgical approach, showcasing a significant forward leap in surgical care.

Moreover, AI’s role extends to post-surgical care by beating the odds of the traditional human care method. AI-driven post-care tools can track recovery on-time medications and easily identify health complications. Such a proactive approach ensures reduced re-admission and aids in faster recovery.

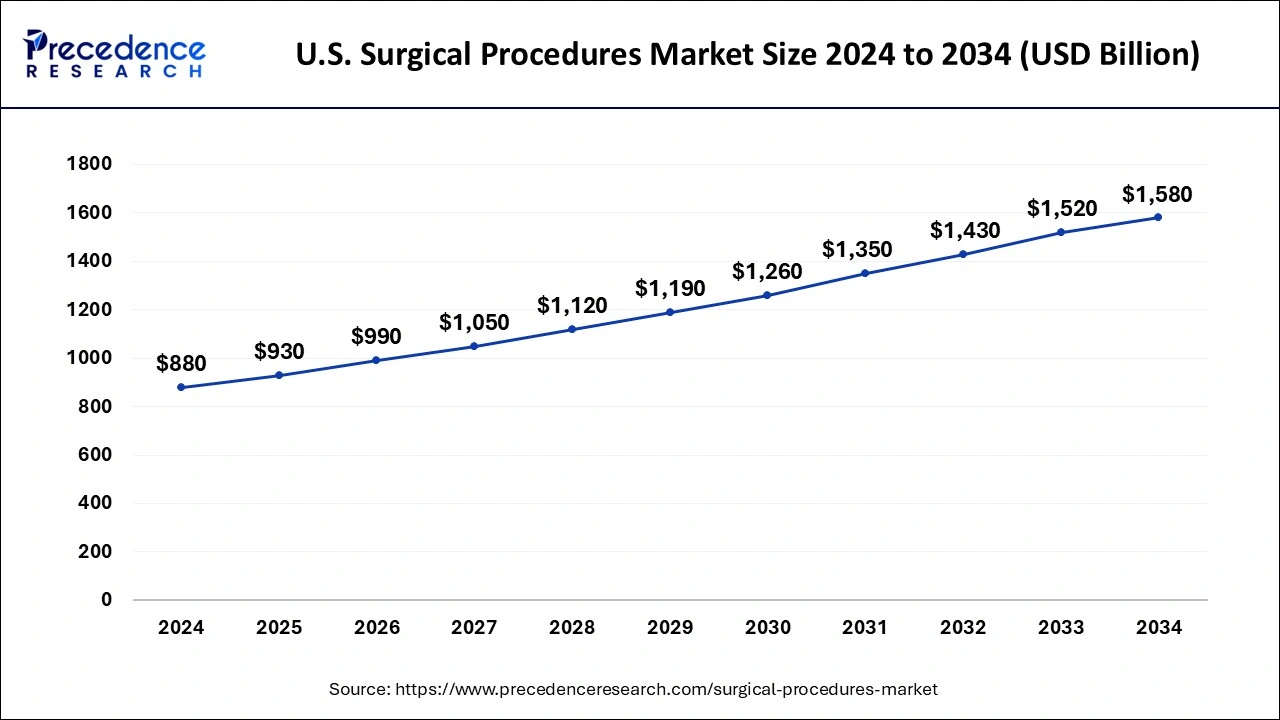

The U.S. surgical procedures market size was estimated at USD 880 billion in 2024 and is predicted to be worth around USD 1580 billion by 2034, at a CAGR of 6.03% from 2025 to 2034.

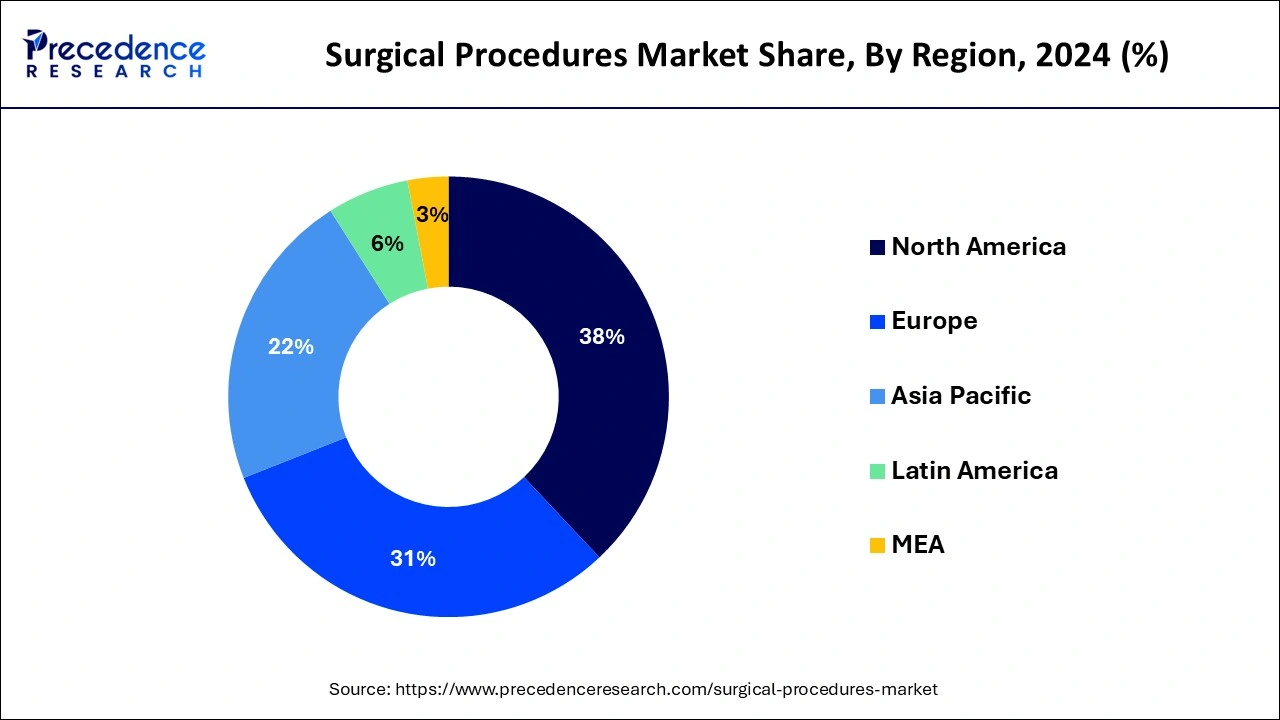

North America has held the largest revenue share of 38% in 2024. North America holds a major share in the surgical procedures market due to robust healthcare infrastructure, advanced medical technologies, and high healthcare spending. The region benefits from a well-established surgical ecosystem, including skilled healthcare professionals and cutting-edge surgical facilities. Additionally, a growing aging population and the prevalence of chronic diseases contribute to the demand for various surgical interventions. Favorable reimbursement policies and a strong focus on healthcare innovation further solidify North America's position as a leader in the global surgical procedures market.

Asia Pacific is estimated to witness the highest growth. Asia Pacific commands a significant share in the surgical procedures market due to factors such as a large patient population, rising healthcare investments, and increasing access to advanced medical technologies. The region experiences a surge in demand for surgical interventions driven by lifestyle changes, aging populations, and a growing incidence of chronic diseases. Additionally, improvements in healthcare infrastructure and a focus on medical tourism contribute to the expansion of the surgical procedures market in Asia Pacific, making it a key player in the global landscape.

Surgical procedures are diverse medical interventions involving incisions or tissue manipulation to diagnose, treat, or prevent health conditions. They fall into categories like elective (planned), emergency (urgent), and minimally invasive surgeries. Elective surgeries, such as joint replacements, enhance patients' quality of life through planned interventions. Emergency surgeries address critical conditions requiring immediate action.

Minimally invasive techniques, like laparoscopy, use smaller incisions and specialized tools, reducing recovery time and scarring. Skilled surgeons, often part of a healthcare team, conduct these procedures. Constant innovation in technology, materials, and techniques shapes the field, continually improving patient care globally. Surgical procedures play a pivotal role in advancing medical science, demonstrating the dynamic nature of healthcare practices.

| Report Coverage | Details |

| Growth Rate from 2025to 2034 | CAGR of 5.64% |

| Market Size in 2025 | USD 3.54 Trillion |

| Market Size by 2034 | USD 5.80 Trillion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type and By Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global health infrastructure development and patient preferences

The expansion of global health infrastructure plays a vital role in boosting the demand for surgical procedures. As countries invest in upgrading healthcare facilities, the availability of advanced surgical services increases, driving a greater need for various surgical interventions. Improved medical infrastructure, equipped with modern technology, becomes a key factor in the growth of the surgical procedures market. Simultaneously, changing patient preferences has a significant impact on market demand.

With a better understanding of healthcare options, patients increasingly favor surgical solutions that align with their individual needs. This includes a preference for minimally invasive procedures, personalized treatment approaches, and thorough pre-and post-operative care. The emphasis on patient-centric care is reshaping the landscape, influencing a higher acceptance and demand for surgical procedures, and encouraging healthcare providers to adapt to these evolving preferences.

Limited access to healthcare and postoperative recovery time

Limited access to healthcare serves as a significant restraint on the demand for surgical procedures. In regions with inadequate healthcare infrastructure, individuals may face challenges in accessing necessary surgical interventions. This limitation stems from a lack of available medical facilities, skilled healthcare professionals, and resources, preventing a portion of the population from seeking or receiving surgical treatments. The resulting disparity in access hampers the overall growth potential of the surgical procedures market, creating barriers to healthcare equality.

Furthermore, the extended postoperative recovery time associated with certain surgical procedures acts as a deterrent for both patients and healthcare providers. Lengthy recovery periods can disrupt patients' daily lives and may lead individuals to opt for alternative, less invasive treatment options. The time commitment and potential impact on productivity and lifestyle choices contribute to hesitancy in choosing surgical interventions, influencing market demand. Addressing these challenges is crucial for ensuring broader accessibility to surgical procedures and improving overall market dynamics.

Advancements in robotic surgery and preventive surgery emphasis

Advancements in robotic surgery are pivotal in creating significant opportunities within the surgical procedures market. The continuous improvement and adoption of robotic-assisted surgical systems offer enhanced precision, reduced invasiveness, and shorter recovery times. This not only improves patient outcomes but also expands the range of surgeries that can be performed robotically. The evolving field of robotic surgery presents a niche for specialized procedures, attracting both patients and healthcare providers seeking advanced and efficient surgical solutions.

Simultaneously, the increasing emphasis on preventive surgeries represents a strategic opportunity for market growth. As healthcare systems shift towards proactive healthcare models, there is a growing focus on identifying and addressing health issues before they become more severe. This trend opens avenues for preventive surgeries, catering to high-risk populations or individuals with genetic predispositions. By promoting early intervention, this emphasis on prevention creates a unique space within the Surgical Procedures market, aligning with broader healthcare goals of improving long-term health outcomes and reducing the burden of chronic conditions.

In 2024, the cardiovascular segment held the highest market share of 24% on the basis of the type. In the surgical procedures market, the cardiovascular segment deals with surgeries related to the heart and blood vessels. This includes procedures like coronary artery bypass grafting and angioplasty. Current trends indicate a rising preference for less invasive methods, like transcatheter aortic valve replacement (TAVR), which shortens recovery periods and enhances patient results. The adoption of advanced technologies, such as robotic-assisted cardiac surgeries, underscores a noticeable shift towards innovative approaches in cardiovascular interventions within the overall realm of surgical procedures.

The orthopedic segment is anticipated to witness the highest growth at a significant CAGR of 6.2% during the projected period. In the surgical procedures market, the orthopedic segment deals with surgeries related to the musculoskeletal system, including joint replacements, fracture repairs, and spinal procedures. Current trends in orthopedic surgery emphasize the adoption of minimally invasive techniques like arthroscopy and robotic assistance, offering patients faster recovery and decreased post-operative discomfort. As the aging population contributes to a rise in orthopedic conditions, ongoing innovations in surgical methods and implant technologies are shaping the segment's growth, enhancing overall patient care and outcomes.

According to the channel, the hospitals segment has held 45% revenue share in 2024. The hospital segment in the surgical procedures market refers to the channel where surgical interventions are primarily conducted within healthcare facilities. Hospitals serve as critical hubs for various surgical procedures, ranging from routine surgeries to complex interventions.

A notable trend in this segment includes an increasing adoption of advanced technologies, such as robotic-assisted surgery, to enhance precision and minimize invasiveness. Additionally, there's a growing emphasis on streamlined processes, interdisciplinary collaboration, and patient-centric care within hospital settings to optimize surgical outcomes and patient satisfaction.

The physician offices segment is anticipated to witness the highest growth over the projected period. The physician offices segment in the surgical procedures market refers to medical practices where physicians perform various surgeries. This channel is witnessing a trend towards increased in-office surgical procedures due to advancements in minimally invasive techniques, allowing for quicker recovery and reduced hospitalization.

Physicians are embracing technologies that enable them to conduct certain surgeries in their offices, offering convenience for patients and potential cost savings. This trend aligns with a broader shift towards outpatient and ambulatory surgical care in the healthcare landscape.

Recent Developments

By Type

By Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

March 2025