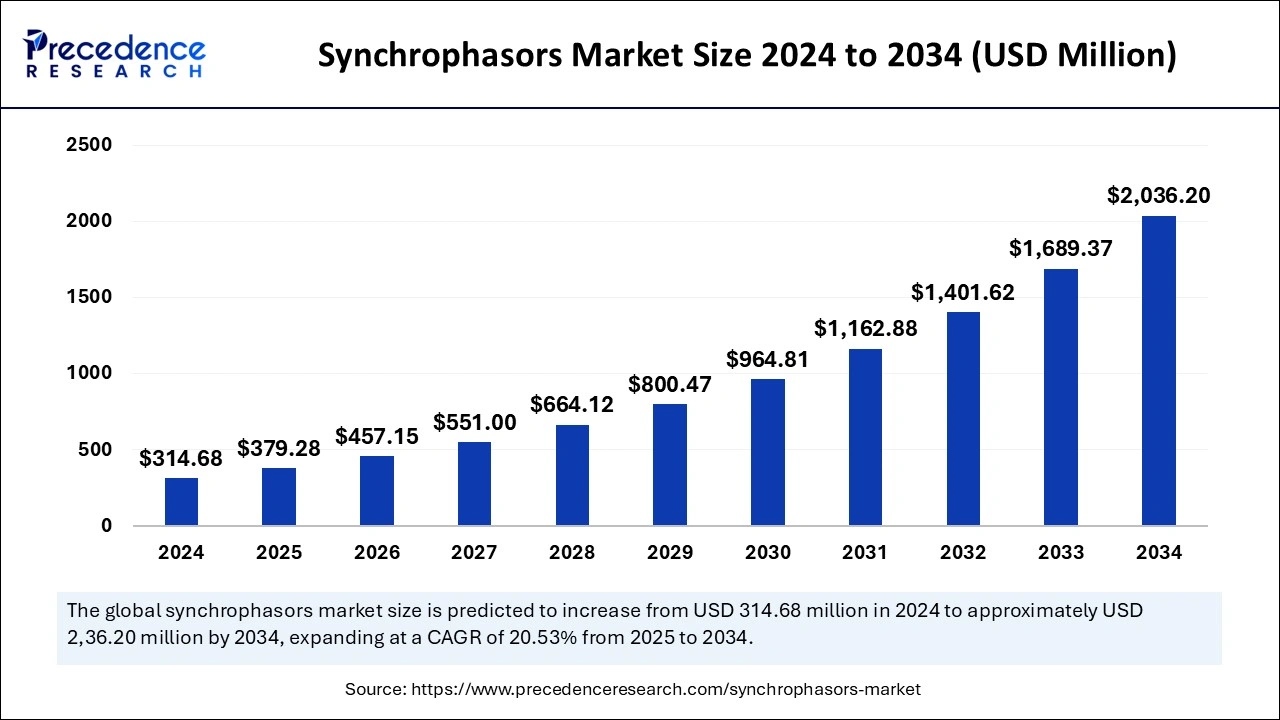

The global synchrophasors market size is calculated at USD 379.28 million in 2025 and is forecasted to reach around USD 2,036.20 million by 2034, accelerating at a healthy CAGR of 20.53% from 2025 to 2034. The Asia Pacific market size surpassed USD 151.05 million in 2024 and is expanding at a CAGR of 20.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Million), with 2024 as the base year.

The global synchrophasors market size was estimated at USD 314.68 million in 2024 and is predicted to increase from USD 379.28 million in 2025 to approximately USD 2,036.20 million by 2034, expanding at a CAGR of 20.53% from 2025 to 2034. The market growth is attributed to the increasing demand for advanced grid technologies, particularly synchrophasors, to ensure grid stability, reliability, and the efficient integration of renewable energy sources.

Artificial intelligence transforms synchrophasors through advanced grid surveillance with automated fault recognition alongside immediate operational choices. TMU-generated datasets provide analysis through AI-driven algorithms, which lead to accurate grid examinations that support power system stability and power outage avoidance. The detection of voltage and frequency patterns through machine learning models enables predictions for utility disruptions and their subsequent management. The integration of renewable power systems benefits from AI algorithms that control voltage and frequency fluctuations to achieve stable connections to operational power networks.

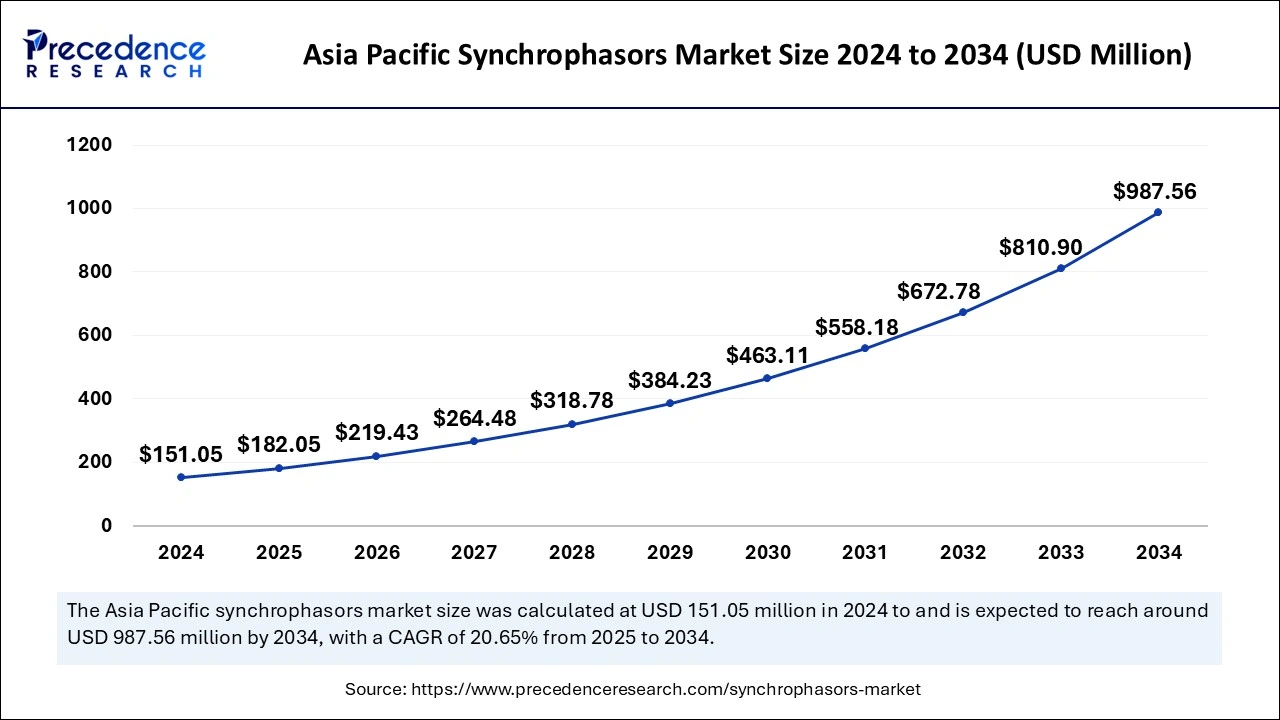

The Asia Pacific synchrophasors market size was exhibited at USD 151.05 million in 2024 and is projected to be worth around USD 987.56 million by 2034, growing at a CAGR of 20.65% from 2025 to 2034.

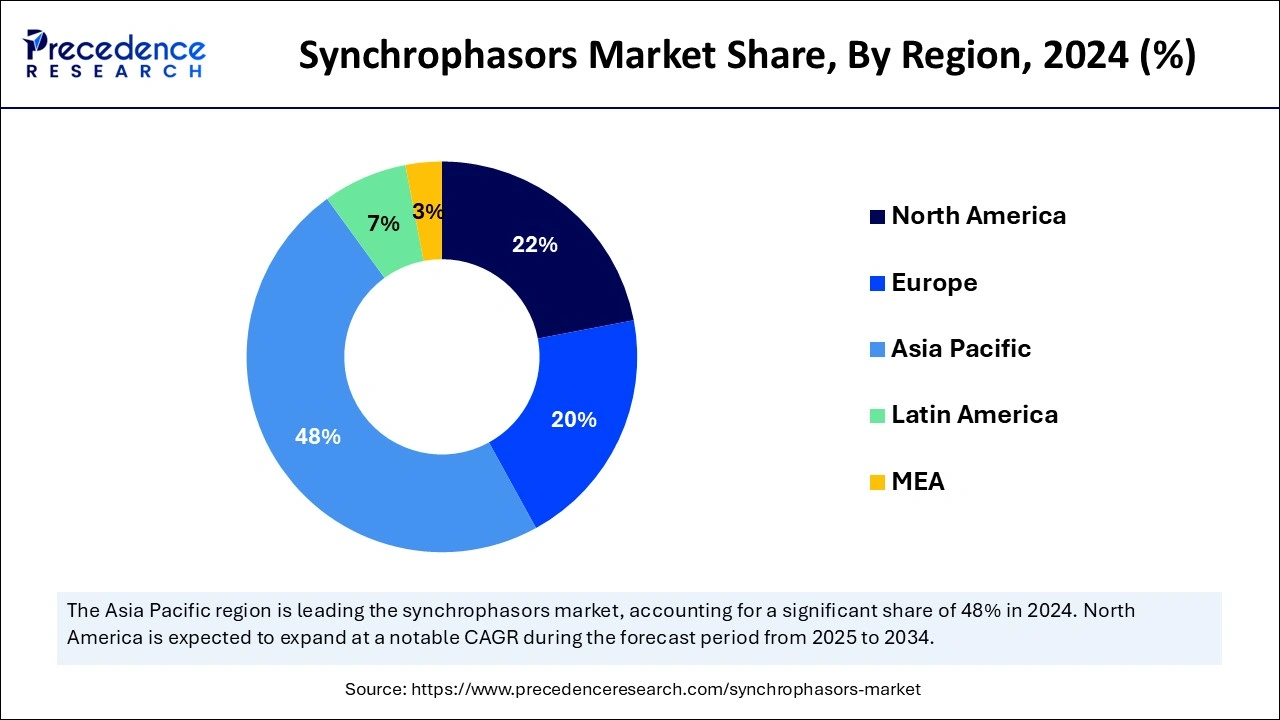

Asia Pacific dominated the global synchrophasors market in 2024, owing to the rapid urbanization combined with industrial expansion and the mounting need for efficient power grid operations that drive this growth. Modern power system investments from countries, including China, India, and Japan, remain significant as these nations move toward integrating solar and wind power sources into their electric grids.

Modern-day statistics from China's National Energy Administration 2023 report show steady growth in renewable energy installation at 15% each year. The demand intensifies the necessity for state-of-the-art grid monitoring solutions, including synchrophasors.

India’s innovative Smart Grid Mission seeks to evolve its power infrastructure delivery and align with projected synchrophasor market requirements. The quick advancement of energy systems coupled with rising power requirements creates multiple opportunities for synchrophasors market development in the region.

North America is anticipated to grow at the fastest rate in the synchrophasors market during the forecast period due to high investments in grid modernization efforts coupled with the growing use of smart grid technology. The combination of favorable regulatory support through robust utilities and fast-moving progress toward cleaner energy sources further fuels the market in the coming years.

The U.S. leads the global synchrophasors market because of support from programs, including the U.S. Department of Energy’s Grid Modernization Initiative. Real-time monitoring needs fuel sector growth, as industry experts recognize renewable energy integration and grid resilience enhancement are essential. Synchrophasors have become key assets in Canada as both a grid stability solution and a facilitator for power sector transformations.

The synchrophasors market expansion depends heavily on increasing investments in grid modernization. Synchrophasors enable the monitoring and collection of real-time power system data that serves as fundamental equipment for modernizing power networks. Electrical waves on electricity grids are measured by phasor measurement units attached to devices, which transfer data to operators for assessment.

Improved power system monitoring combined with better grid reliability results in efficient renewable energy source integration. Synchrophasor-based solutions experience growing demand from governments and utilities as they invest in grid upgrades, thereby building a resilient energy infrastructure.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,036.20 Million |

| Market Size by 2025 | USD 379.28 Million |

| Market Size in 2024 | USD 314.68 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.53% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Surging investments in grid modernization

Increasing investments in grid modernization are anticipated to propel the demand for synchrophasor technology, thus fuelling the synchrophasors market. Synchrophasor technology demand grows as funding investments in grid modernization activities increase. These substantial investments in grid modernization underscore the growing reliance on advanced technologies, including synchrophasors, which offer precise real-time data for better monitoring and control of power systems. Furthermore, the growing national commitments to upgrade aging infrastructure lift industry demand for synchrophasor-based systems at a time when sustainable energy networks become a strategic focus for the sector.

High implementation costs

Deploying synchrophasor technology requires significant capital investment, which is expected to restrain the synchrophasors market growth. Western power and other energy organizations need to invest extensive funds in upgrading their grid networks while installing phasor measurement units (PMUs) along with modern data management programs. Smaller and medium-sized energy providers lack sufficient funds to support these upgrades, which decreases their market access. Grid modernization deployment remains delayed in developing regions because of budget constraints, which undermine the obvious advantages of improved grid infrastructure.

Growing shift towards renewable energy integration

Increasing reliance on renewable energy sources, such as solar and wind, creates a growing demand for the synchrophasors market. The emergence of renewable energy sources creates operational challenges within power grids, as they produce unpredictable power fluctuations that require sophisticated operational tools for grid stability and efficient energy transfer.

Through real-time monitoring, synchrophasor systems enable grid operators to maintain supply-demand equilibrium, although renewable generation can fluctuate. Modern grid operation technologies and renewable energy integration methods have gained importance through government backing of initiatives such as the European Union’s Green Deal and the U.S. renewable energy initiatives.

The hardware segment held a dominant presence in the synchrophasors market in 2024 due to the fact that real-time power grid monitoring using PMUs provides essential stability functions and supports better renewable energy control management. The planned USD 3.5 million investment from the U.S. Department of Energy in 2023 for grid modernization fuels substantial growth for synchrophasor technology adoption. Furthermore, the global government, along with its ambitious goals for grid infrastructure improvement, is expected to fuel continuous demand for PMUs.

The software segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034, owing to the growing utility's need for improved data analysis capabilities and artificial intelligence-based grid supervision mechanisms. Moreover, the growth of global smart grid infrastructure drives governments to adopt priority software solutions that execute predictive analyses and handle real-time data to improve power delivery efficiency and reduce system downtime.

The wide area situational awareness and monitoring segment accounted for a considerable share of the synchrophasors market in 2024. Utility operators nationwide benefit from using this application, which delivers complete grid condition visibility for massive power grid monitoring tasks in real-time. Synchrophasors help utility companies detect grid problems during faults, enabling immediate responses before major system-wide outages occur. Additionally, the integration of solar and wind energy resources into power grids has created complex power networks that now require situational awareness systems based on synchrophasors.

The state estimation segment is anticipated to grow with the highest CAGR in the studied years, owing to the increasing need for real-time data analysis and predictive grid management. State estimation functions as a fundamental assessment method for power utilities because it helps them build accurate models of grid behavior to maintain stable and efficient electrical network operations. Power system management requires increasingly accurate real-time data because renewable energy generation continues to expand across the power sector. Utilities achieve better grid state estimation precision through integrated synchrophasors and state estimation tools and this enables improved power outage prevention alongside enhanced grid administration. Future projections indicate these technologies will grow indispensable with growth in smart grid integration and decentralized energy system implementation.

In 2024, the power transmission segment led the global synchrophasors market due to the growing need for efficient management and monitoring of electricity flow over long distances. Power grid operation stability and transmission system efficiency depend on the real-time data monitoring capabilities of synchrophasors. Synchrophasor technologies function as critical elements to reduce transmission losses, improve grid stability, and optimize energy distribution across networks. The growing need for global electricity quantity alongside developing markets emphasizes the rising necessity of powerful, efficient transmission systems.

The power distribution systems segment is projected to expand rapidly in the coming years. Power distribution systems play a vital role as they transport electricity from power plants to consumer outlets through an efficient operation mechanism. Utilities worldwide participate in grid modernization projects that target improvements to distribution networks to build operational efficiency, manage outages, and support emerging energy integration. Synchrophasor technology implementations in distribution networks enable utilities to enhance stability while protecting systems from overloads to achieve maximum energy flow. Furthermore, the increasing prevalence of distributed energy sources, including wind and solar power, prompts wider integration of these resources into distribution networks and thus drives greater synchrophasor utilization.

By Component

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client