March 2025

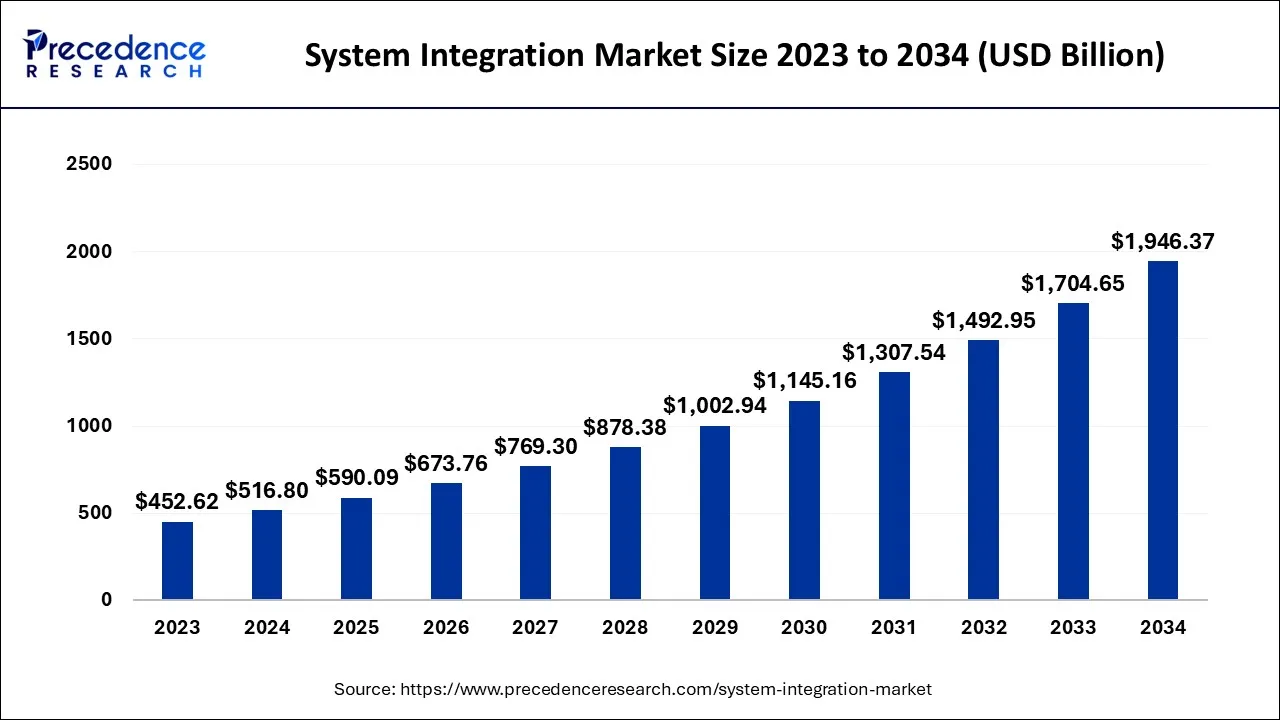

The global system integration market size accounted for USD 516.80 billion in 2024, grew to USD 590.09 billion in 2025, and is expected to be worth around USD 1,946.37 billion by 2034, poised to grow at a CAGR of 14.18% between 2024 and 2034. The North America system integration market size is predicted to increase from USD 186.05 billion in 2024 and is estimated to grow at the fastest CAGR of 14.34% during the forecast year.

The global system integration market size is expected to be valued at USD 516.80 billion in 2024 and is anticipated to reach around USD 1,946.37 billion by 2034, expanding at a CAGR of 14.18% over the forecast period from 2024 to 2034.

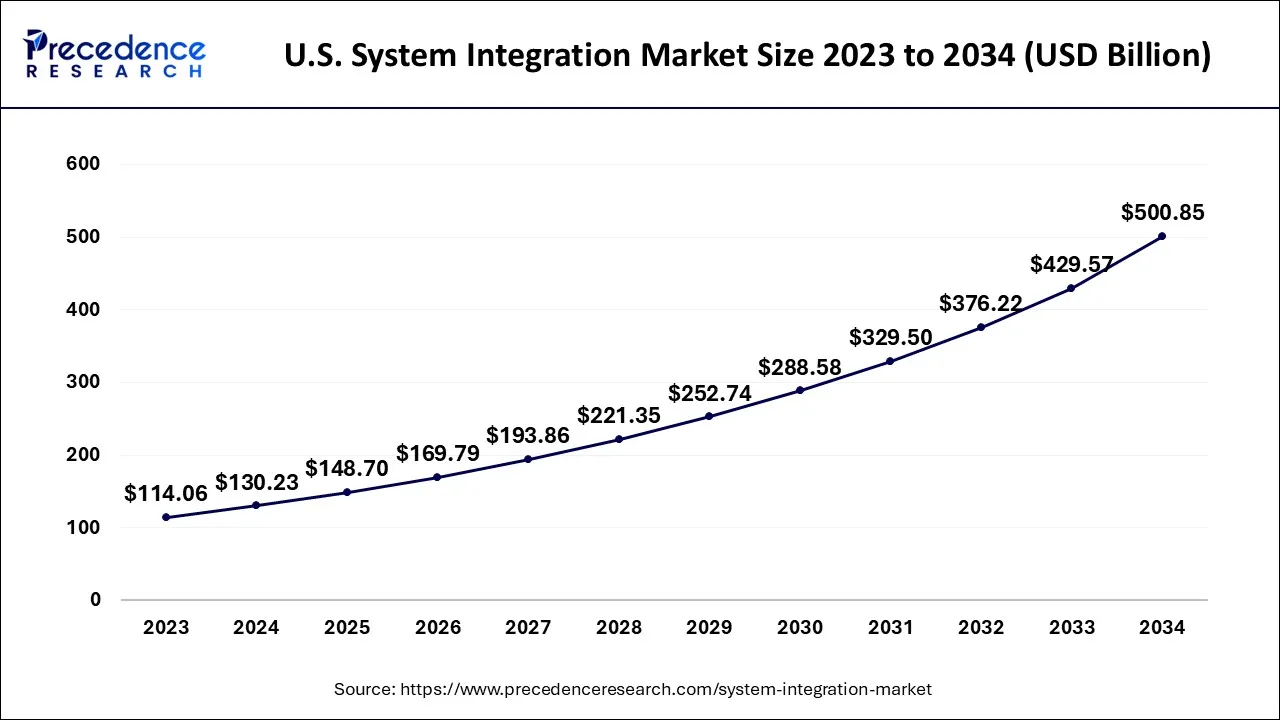

The U.S. system integration market size is exhibited at USD 130.23 billion in 2024 and is projected to be worth around USD 500.85 billion by 2034, growing at a CAGR of 14.42% from 2024 to 2034.

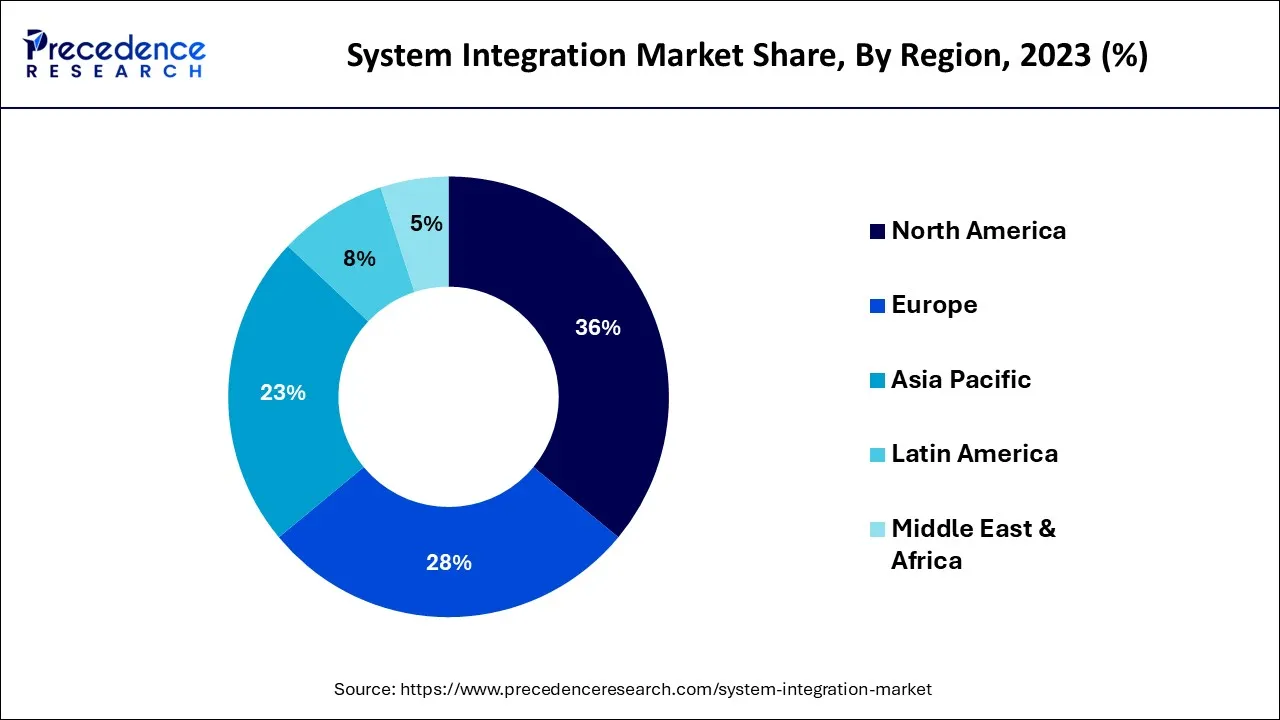

In 2023, North America dominated the system integration Market accounting for the highest market share of about 36%. This is due to the rising adoption of cloud-based services among large organisations and the increasing use of IoT in industrial automation. Moreover, the region's BFSI sector has embraced modern technology, presenting significant growth opportunities for the North American system integration market. To that end, banks are taking great care to ensure every client's needs are met. Bank of America, for example, reports that 70% of its customers use digital services for their financial needs.

It can assist the bank in expanding its client base and remaining competitive in the market. North America has been highly competitive in the industrial automation market due to technological advancements, with the United States being a developed country that accepts advanced technologies for industrial operations. Automation solutions are becoming more common across industries as 5G wireless technology becomes more widely available. Furthermore, the industrial automation and IoT markets are expanding as demand for augmented reality (AR) and virtual reality (VR) grows.

Market Overview

System integration refers to connecting sub-systems into a single, more extensive system that functions simultaneously. It links various IT systems, services, or software to enable them to work functionally collectively. Businesses use system integration to enhance the productivity and quality of their operations.

The systems integration industry manages the deployment-to-operation life cycle of complex IT solutions, offering a service that allows manufacturing processes and software to communicate in various markets, including oil and gas, automotive, aerospace and defense, healthcare, chemical and petrochemical, power generation, and others.

| Report Coverage | Details |

| Market Size in 2024 | USD 516.80 Billion |

| Market Size by 2034 | USD 1,946.37 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 14.18% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Services, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

System integration has become highly complicated as more industrial manufacturing companies automate their operations. Industrial manufacturers are integrating more automation and robotics into production lines to increase output, reduce labour, and control energy usage and plant maintenance costs. Businesses are looking for ways to improve communication throughout their manufacturing systems and handle numerous attributes of their diverse processes.

In many cases, these manufacturers combine predictive maintenance sensors and systems with software, machines, and data tools from various suppliers to ensure less downtime. This adds to the complexity as users work to integrate disparate data system technology designed to be separate data processing systems that do not usually exchange data or interact with other computer data processing systems. Thus, the rise in the adoption of industrial automation technologies is driving the market growth.

The instrument's dependability and accuracy are significant considerations in its adoption. As a result, manufacturers must continue to invest in R&D to provide the best solutions. A control valve is a crucial component of the process in the process industry. The size of the plant and the level of automation required determines the requirement and cost of the valve.

The process's automation also raises the overhead costs and the control valve costs between a thousand and more than a hundred thousand dollars. Although automation provides long-term benefits, the high initial investment prevents businesses from implementing full automation. This limits the market for process industry system integrators.

Many industrial companies are implementing digital transformation initiatives to improve business processes and outcomes. However, the operation technology (OT) groups in charge of industrial systems require assistance deploying IT systems. Such OTI/IT convergence is expected to open new opportunities for IT solution providers and industrial system integrators.

IT solution providers and industrial system integrators can assist businesses in bridging the OT/IT divide while also providing expertise in designing, deploying, and managing IT infrastructure that enables digitalization.

Moreover, consumer preference for virtualization is expected to drive the market. Virtualization validates the simultaneous execution of many applications and allows users to simultaneously perform multiple tasks on the same server. It improves computer hardware efficiency, utilization, and flexibility while lowering additional IT operating costs. Furthermore, market players' increasing demand for flexible manufacturing providers expands the advantageous opportunities for the growth of the system integration market in the coming period.

Based on services, the system integration market is segmented into infrastructure integration, application integration, and consulting. In 2023, the hardware integration segment accounted for the largest market share. The growth of this segment is driven by technological advancement with rising innovations in hardware devices with wireless technologies. Hardware integration refers to the process of connecting hardware and software. Companies use hardware integration services in the modern era to transform traditionally office-based computing functions into mobile functions.

As the accessibility and reliability of wireless internet connections have improved over the last few years, so has the use of apps. Industries such as technology and other gig-based businesses have transitioned to mobile applications. Businesses use app integrations to handle inventory management, video surveillance, cloud computing networks, payroll functions, and other functions.

Based on end-use, the system integration market is segmented into IT & telecom, defense & security, BFSI, oil & gas, healthcare, transportation, retail, food & beverages, automotive, and others. In 2023, the banking, financial services, and insurance (BSFI) segment accounted for the highest market share.

To address the banking sector’s crucial requirements, system integration enables safe, smooth, and quick banking operations by constructing an IT infrastructure. Various companies in the BFSI sector collaborate with system integrators to widen their banking services and enrich their brand representation, thereby driving system integration demand in the BFSI sector.

Moreover, rising fintech start-ups, significant demand for banking-as-a-service (BaaS), the proliferation of neo-services and shifting several governments’ focus toward the digital economy are the vital factors fueling the growth of this segment. Furthermore, due to the negative impact on offline banking services, the COVID-19 pandemic has accelerated the adoption of digital payment systems, contributing to market growth.

Segments Covered in the Report

By Services

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

February 2025

October 2024