August 2024

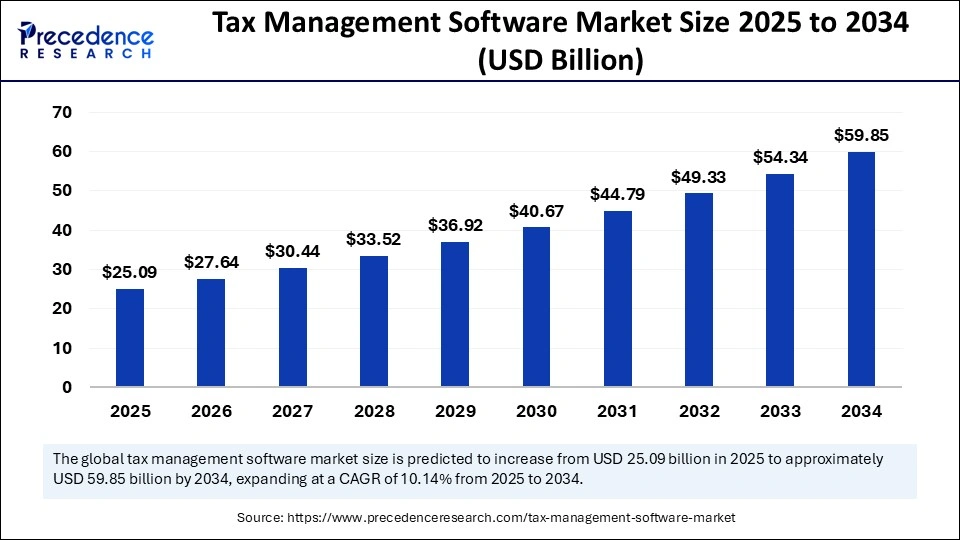

The global tax management software market size is accounted at USD 25.09 billion in 2025 and is forecasted to hit around USD 59.85 billion by 2034, representing a CAGR of 10.14% from 2025 to 2034. The North America market size was estimated at USD 6.61 billion in 2024 and is expanding at a CAGR of 10.33% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global tax management software market size was calculated at USD 22.78 billion in 2024 and is predicted to increase from USD 25.09 billion in 2025 to approximately USD 59.85 billion by 2034, expanding at a CAGR of 10.14% from 2025 to 2034. The growth of the market is driven by the increasing regulatory complexities and the rising demand for automated, digital tax compliance solutions.

Artificial intelligence (AI) is reshaping the tax management software market by streamlining routine processes, boosting accuracy, and enabling real-time compliance. Automation has greatly reduced manual labor and the possibility of errors in tasks like data entry, invoice classification, and reconciliation. By interpreting complicated tax codes, identifying irregularities, and proposing possible deductions based on past data, these intelligent systems can also speed up and improve the accuracy of tax filing.

Beyond automation, advanced analytics provide valuable insights for forecasting liabilities and improving tax planning. Smart dashboards, virtual assistants, and real-time alerts are some features that improve user experience and compliance. In sectors like e-commerce, BFSI, and logistics, intelligent tax platforms are becoming indispensable as businesses in these sectors are looking for more flexible and scalable financial tools. Furthermore, tax management is now more proactive rather than reactive thanks to AI, which guarantees adherence to evolving tax laws and lowers the possibility of fines.

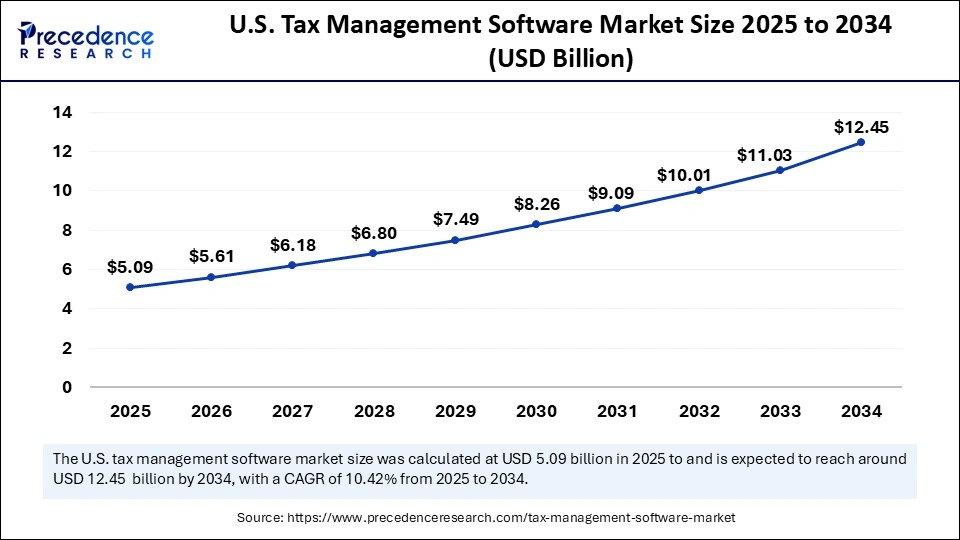

The U.S. tax management software market size was evaluated at USD 4.62 billion in 2024 and is projected to be worth around USD 12.45 billion by 2034, growing at a CAGR of 10.42% from 2025 to 2034.

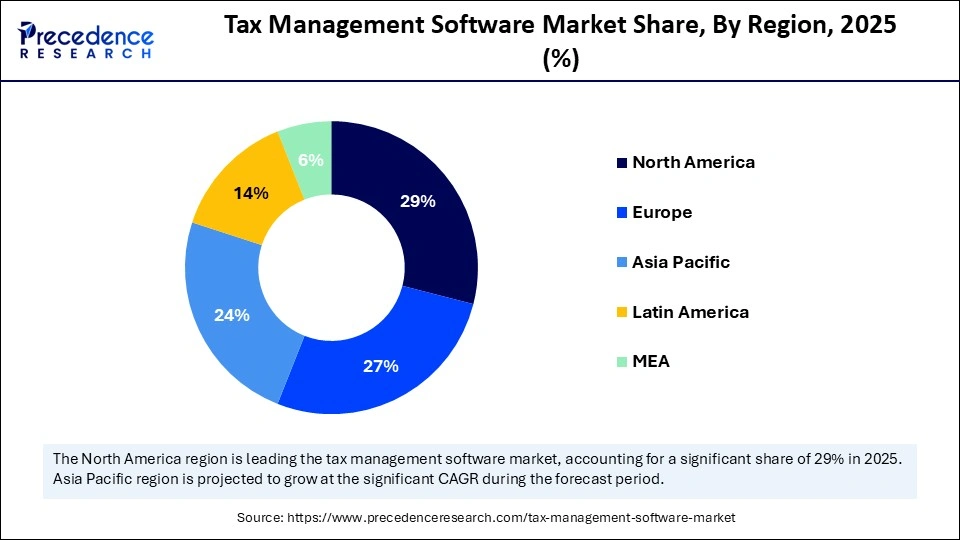

North America dominated the tax management software market in 2024. The regional market growth is driven by the rapid development of sophisticated digital infrastructure, stringent tax laws, and a rapid rate of technological adoption. The region is an early adopter of tax automation solutions. North American businesses are investing heavily in compliance tools to minimize fines and simplify financial processes. Widespread reliance on tax software is a result of the maturity of enterprise ecosystems and frequent updates to tax laws, such as changes to the IRS code. The region's position in the market is further reinforced by the existence of international financial centers and a strong emphasis on corporate governance.

Asia Pacific is expected to witness the fastest growth in the upcoming years, driven by growing tax reforms, digital transformation, and quick economic growth. Businesses in the region are being pushed to adopt automated tax solutions. Nations like China, Japan, Australia, and India are aggressively focusing on improving their tax systems with frameworks like GST and e-invoicing. There is an increasing need for scalable and reasonably priced tax management tools due to the growth of SMEs and cross-border trade. Moreover, the rapid expansion of the BFSI sector supports market growth.

The tax management software market is experiencing steady growth, driven by the increasing need for efficient, automated solutions to handle complex and ever-evolving tax regulations. Companies are quickly implementing digital tools to save time, guarantee compliance, minimize manual errors, and expedite tax filing. The capabilities of tax software are being further enhanced by the integration of cutting-edge technologies like cloud computing, artificial intelligence, and machine learning, which makes it more intelligent and adaptive. Across a range of industries, there is an increasing need for strong tax management solutions as businesses place a higher priority on accuracy and transparency in financial operations.

| Report Coverage | Details |

| Market Size by 2034 | USD 59.85 Billion |

| Market Size in 2025 | USD 25.09 Billion |

| Market Size in 2024 | USD 22.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.14% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, Tac Type, Deployment, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Emphasis on Real-Time Tax Reporting

Tax authorities and government entities are shifting to real-time reporting systems. This trend increases the need for sophisticated automation solutions among businesses seeking to generate and submit tax data as quickly as possible. To track liabilities, which on the go tax software now incorporates real-time data syncing and analytics. Sectors with a lot of complicated transactions (e.g. finance and e-commerce) gain a lot. For both taxpayers and authorities, this change improves cash flow planning, lowers fraud, and increases transparency.

Rise in Cross-border E-commerce

The expansion of cross-border e-commerce drives the growth of the tax management software market. As International e-commerce grows rapidly, companies must deal with different tax rates on digital services and customs charges. Because of this complexity, there is a greater need for tax engines that can determine taxes and duties according to the location of the customer. Global payment gateways, shipping companies, and e-commerce platforms are all integrating with tax management platforms. They make sure that digital tax regulations (such as the EU VAT on digital goods) and destination-based tax laws are followed. Because noncompliance can result in sales being blocked or severe penalties, automated solutions are essential for global sellers.

High Initial Implementation Costs

The high costs associated with the integration of software solutions hamper the growth of the tax management software market. The implementation of tax management software necessitates a substantial investment. These expenses involve training, hardware upgrades, and software licensing and integration with current systems. These costs are frequently prohibitive for smaller businesses, which delay adoption. In the short term, some people still believe that tax processing done by hand or through outsourcing is more cost-effective. CFOs may be discouraged by lengthy ROI periods from making the quick transition to advanced solutions. Furthermore, a lot of small businesses have limited resources and are hesitant to spend money on technology they consider unnecessary. Adoption outside of tech-forward or regulated industries is constrained by this cost sensitivity.

Complex Integration with Legacy Systems

Older ERP or accounting systems are still widely used by many businesses, and they are challenging to integrate with contemporary tax platforms. Due to this incompatibility, middleware or customization requires more time and money. Inaccurate data syncing, incorrect tax calculations, or compliance gaps can result from integration delays. Businesses with intricate processes encounter substantial technological obstacles. Digitization attempts are slowed down by fear of disturbing current workflows. Integration of tax software may be neglected by IT teams that are already overworked. API development and customization may also turn into ongoing maintenance responsibilities.

Integration with ERP and Fintech Ecosystems

Integrating tax software with payroll platforms, fintech apps, and ERP adds value as businesses look for end-to-end automation. Real-time tax tracking and reporting are made possible by these integrations which simplify financial operations. As a result, vendors now have the chance to provide API-based models and packaged solutions. Partnerships with top ERP companies such as Oracle SAP and QuickBooks can open new clientele. Startups and mid-sized businesses seeking lean operations find integrated platforms particularly appealing. Efficiency and sound financial decision-making are enhanced by unified payroll accounting and tax dashboards. Automated reconciliation refunds and payments are also supported by fintech integration. This all-encompassing strategy is becoming more and more popular among digitally native companies.

Rising Demand for Real-Time Compliance Monitoring

The rising demand for real-time compliance monitoring solutions creates immense opportunities in the tax management software market. Businesses require tools that offer constant compliance updates as governments push for real-time tax filing and audits. It is increasingly essential to have tax software with real-time monitoring and alerting capabilities. This opens the door for solutions that provide live dashboards and automatically sync with government portals. Such real-time features are most advantageous for sectors like finance, e-commerce, and logistics. For suppliers, providing compliance as a service has the potential to become a steady source of income. Additionally, it increases transparency with internal and external stakeholders and lowers audit risks. During tax seasons, real-time reporting helps prevent last-minute scrambles. In places like Europe and Latin America, where leave returns and e-invoicing are required, the demand for tax management software is expected to rise.

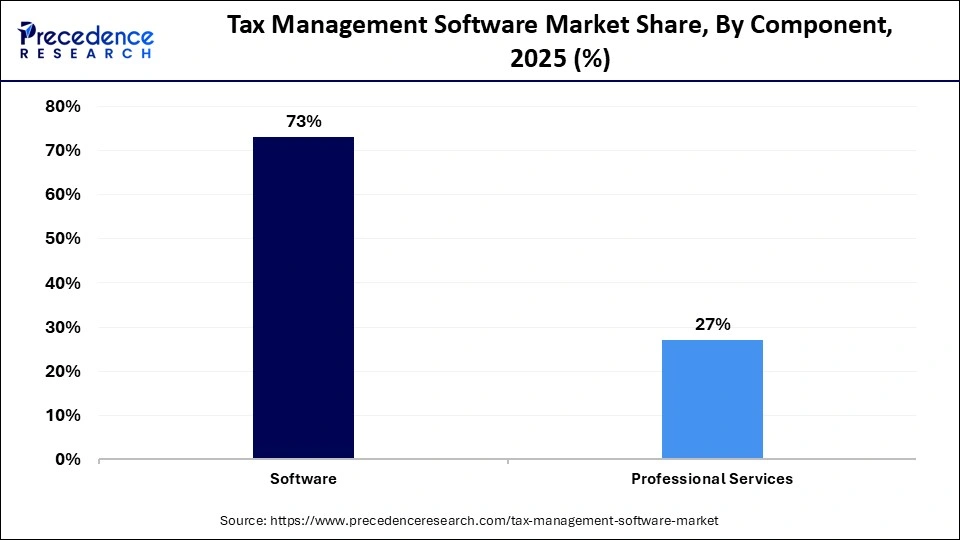

The software segment dominated the tax management software market with the largest share in 2024. This is mainly due to the increased usage of digital solutions among businesses for effective tax management. To guarantee adherence to evolving tax laws, reduce mistakes, and optimize processes, businesses in a variety of sectors are incorporating sophisticated tax software. The rising demand for automated, real-time data processing and cloud-based tax solutions further supports this segment’s dominance. Furthermore, tax platforms that incorporate AI and machine learning are improving decision-making and predictive analysis. Software's broad adoption is also influenced by its smooth integration with financial and ERP systems.

The professional services segment is expected to grow at the fastest rate in the coming years because of its capacity to improve the precision and effectiveness of tax-related procedures. Businesses are depending more on reliable software solutions due to the complexity of multi-jurisdictional tax systems and ongoing regulatory updates. This, in turn, boosts the demand for services like training and consulting. From tax computation to filing and reporting, these services provide end-to-end management, making them essential for large and small corporations.

The tax compliance software segment dominated the tax management software market with the largest share in 2024. The need for accurate automated compliance and the growing complexity of international tax laws are the main causes of the segment’s dominance. Organizations from various industries implement compliance software to avoid fines, handle audits, and guarantee adherence to ever-changing tax regulations. The software's real-time tax tracking management and reporting capabilities have become essential for large corporations. Features like integrated compliance checks, regulatory updates, and automated tax filing further increase its usefulness. The importance of maintaining compliance across multiple jurisdictions has greatly aided in the segment's growth as globalization and cross-border trade continue to increase.

The tax prepared software segment is expected to grow at the fastest rate during the forecast period. This is mainly due to the growing number of freelancers and small and medium-sized businesses (SMEs) that are looking for user-friendly and reasonably priced tools to prepare and file taxes on their own. The segment's growth is also being accelerated by the increasing use of do-it-yourself (DIY) tax solutions. Because of their ease-of-use accessibility from various devices and flexibility, cloud-based preparation tools are particularly appealing to non-financial users. Step-by-step instructions and AI-powered support are frequently included with these tools, which lower errors and boost user confidence. Continuous innovation in this field is anticipated to be fueled by the need for tax preparation that is quick, easy, and affordable.

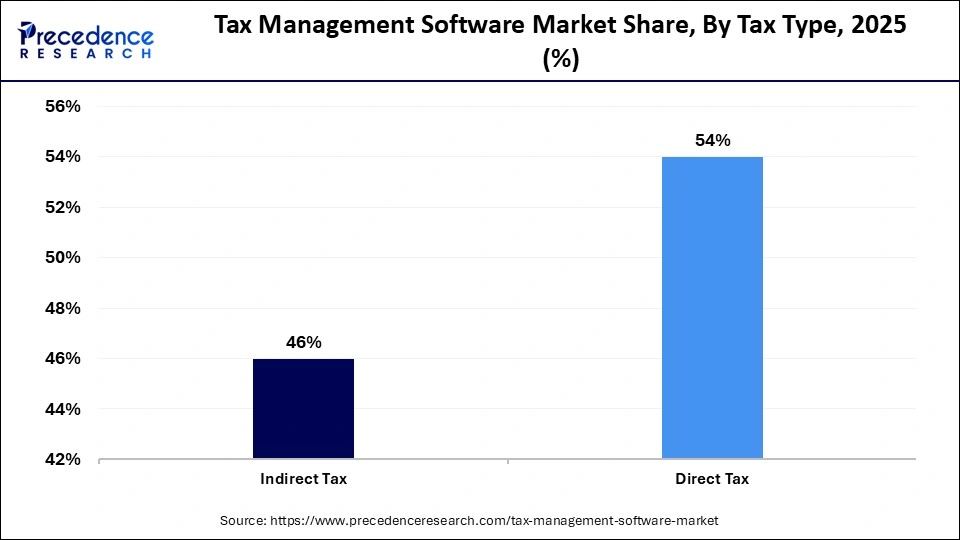

The direct tax segment held the largest share of the tax management software market in 2024. Direct taxes like income tax, corporation tax, and capital gains tax are required to be calculated accurately, filed on time, and supported by the right paperwork. Software is essential to accurately managing direct tax obligations for both individuals and businesses. Because of the large number of direct tax transactions and the severe consequences for noncompliance trustworthy tax software has become crucial. Auto-updates to reflect policy changes, audit trials and integration with financial systems all contribute to this segment's dominance. These solutions are especially useful for large businesses to handle intricate direct tax situations in various geographical locations.

The indirect tax segment is projected to grow at the fastest rate during the projection period. Due to their dynamic nature, indirect taxes like excise duty, sales tax, GST, and VAT necessitate ongoing updates and flexibility. Because indirect taxes are subject to frequent rate changes and jurisdictional variations, businesses are increasingly turning to automated solutions that guarantee accurate and timely compliance. Agile systems are essential for organizations to maintain compliance with global frameworks like the GST in India and the VAT expansions in the Middle East and Africa. Multinational firms and e-commerce enterprises find indirect tax software essential since it facilitates invoice validation, tax reconciliation, and cross-border transaction tracking.

The on-premise segment dominated the tax management software market with the largest share in 2024. This is mostly because on-premises solutions are a preferred option for big businesses and financial institutions. After all, they provide a high degree of data control customization and security. Many businesses that handle sensitive financial data would rather host software on their infrastructure to adhere to stringent legal and internal regulations. Businesses can customize their tax solutions to fit specific workflows thanks to on-premises systems, which offer complete control over the hardware and software environments. On-premises deployments are still in high demand among industries that prioritize data sovereignty and internal governance despite the higher upfront costs and maintenance obligations.

The cloud segment is expected to grow at the fastest rate in the coming years, driven by its affordability, scalability, and adaptability. Because cloud-based solutions do not require a significant upfront investment in hardware and infrastructure, they are particularly appealing to startups, SMEs, and businesses that are undergoing digital transformation. In today's remote and hybrid work environments, these platforms are especially helpful because they provide real-time updates, automated backups, and convenient access from any location or device. Rapid adoption is facilitated by the pay-as-you-go models' ability to scale up or down in response to seasonal demands or expansion plans.

The large enterprises segment dominated the tax management software market in 2024. This is mainly due to the heightened adoption of cloud-based software among large enterprises. Since these enterprises often handle vast amounts of data, they require efficient solutions, including tax management software, to streamline workflows. This software is especially helpful in today's remote and hybrid work environments because it provides real-time updates, automated backups, and convenient access from any location or device.

The small & medium enterprises segment is expected to grow at the fastest rate in the upcoming period. SMEs increasingly seek inexpensive, user-friendly tax solutions as tax laws become more complicated. Cloud and subscription-based software models have made tax tools available to both new and expanding companies. These solutions streamline automation and provide user interfaces and fundamental reporting capabilities to meet the unique requirements of smaller businesses. A major factor in the growth of this segment is the increasing trend of digitalization among SMEs.

The BFSI segment dominated the tax management software market with the largest share in 2024. This is mainly due to the intricate tax structures and highly regulated environment. Corporate tax, capital gains, withholding tax, and GST/VAT are just a few of the taxes that financial institutions deal with, boosting the demand for efficient solutions. Tax management software ensures regulatory compliance, increases accuracy, and streamlines tax processes. Tax software is essential for BFSI organizations due to its integration with risk assessment, audit management, and financial reporting tools.

The retail segment is expected to grow at the fastest rate in the coming years because of its intricate tax systems and highly regulated environment. Retail institutions must make accurate calculations and comply with deadlines for a variety of taxes, such as corporate tax, capital gains, withholding tax, and GST/VAT. These chores are made easier, more accurate and in compliance with regulations thanks to tax management software.

By Component

By Type

By Tax Type

By Deployment

By Industry Vertical

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

September 2024

November 2024