January 2025

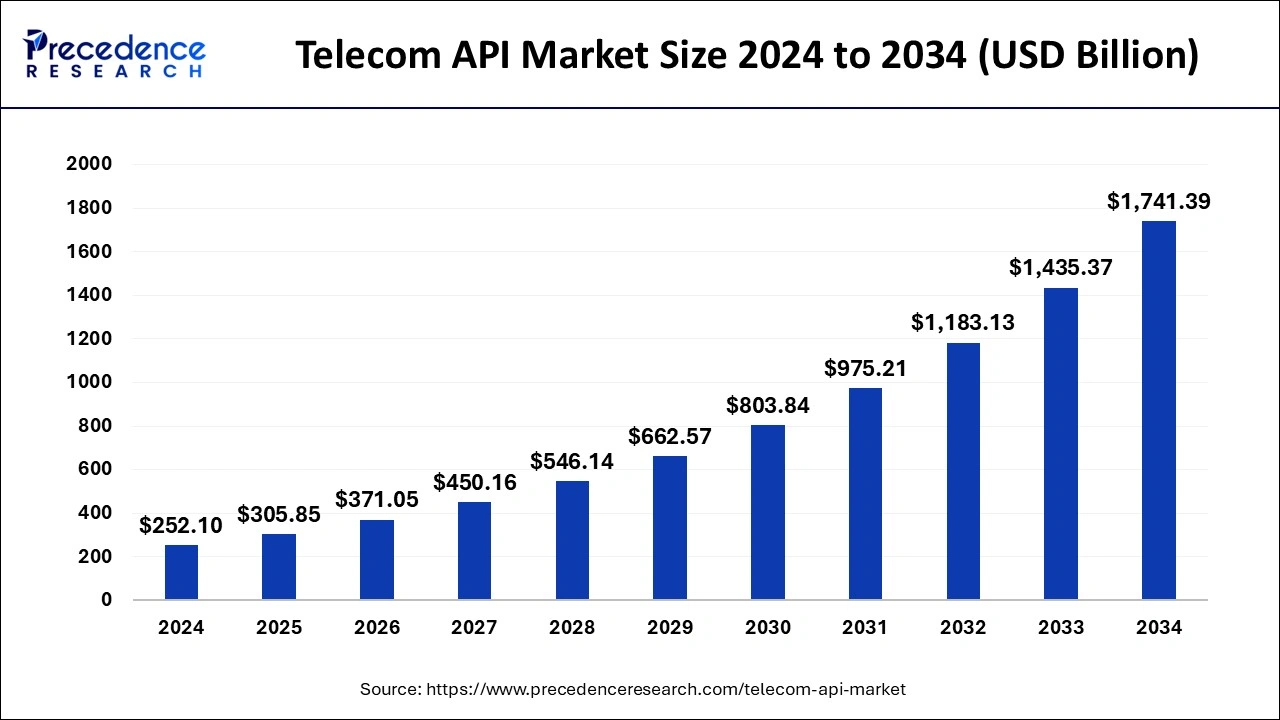

The global telecom API market size is calculated at USD 305.85 billion in 2025 and is forecasted to reach around USD 1741.39 billion by 2034, accelerating at a CAGR of 21.32% from 2025 to 2034. The Asia Pacific telecom API market size surpassed USD 94.81 billion in 2025 and is expanding at a CAGR of 21.51% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global telecom API market size was estimated at USD 252.10 billion in 2024 and is anticipated to reach around USD 1741.39 billion by 2034, expanding at a CAGR of 21.32% from 2025 to 2034.

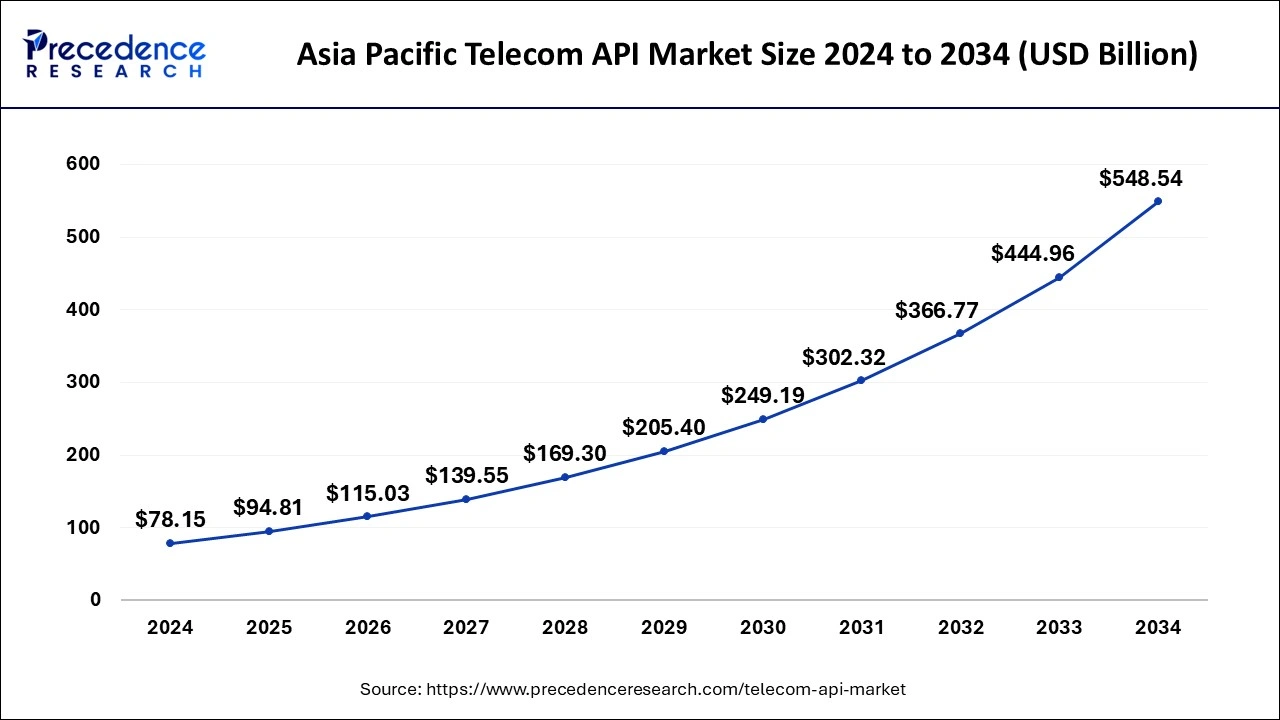

The Asia Pacific telecom API market size was evaluated at USD 78.15 billion in 2024 and is predicted to be worth around USD 548.54 billion by 2034, rising at a CAGR of 21.51% from 2025 to 2034.

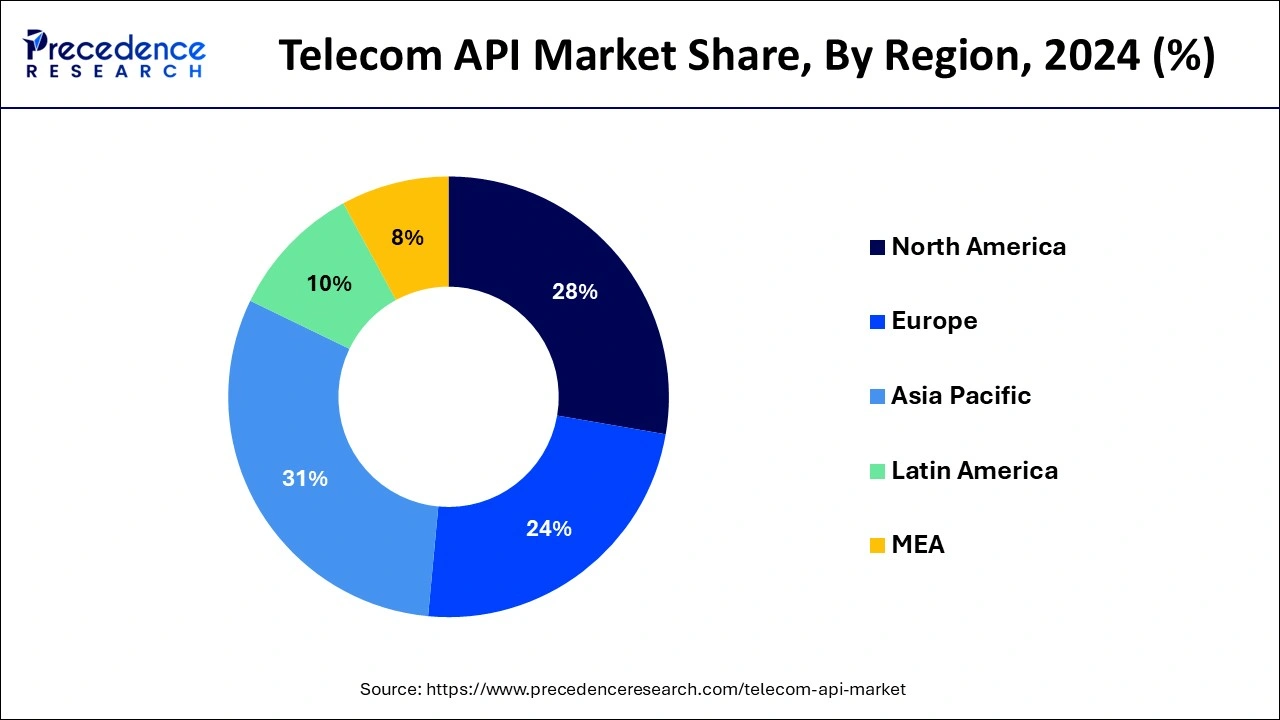

Asia Pacific dominated the global telecom API market with the largest market share of 31% in 2024. This is due to rising usage of numerous cloud-based services by way of manufacturing systems and several sales channels. Furthermore, due to increased funding, the web-based information technology industry . In addition, major emerging nations have seen an increase in demand for various software-based services. Thus, all of these factors are driving the growth of North America telecom application programming interface (API) market.

North America is expected to expand at a double digit CAGR during the forecast period. China and India dominated the telecom application programming interface (API) market in Asia-Pacific region. The growing deployment of telecom application programming interface (API) by various market players is driving the growth of Asia-Pacific telecom application programming interface (API) market. In addition, technological developments are paving way for the expansion of telecom application programming interface (API) market in Asia-Pacific region. The market demand is projected to be driven by some of the ongoing partnerships among the region’s key players. For example, China Unicom, one of the top mobile network service providers in terms of subscribers, and Alibaba Group Holding are aiming to partner in the sector of networking services, which is likely to boost telecom application programming interface (API) market growth in the region.

One of the factors driving the growth of global telecom API market is growing deployment of 5G technologies and networks. For example, the Small Cell Forum launched a 5G functional application programming interface (API) in April 2020 to allow a 5G small cell vendor ecosystem. The 5G technical application programming interface (API) specifications, which build on the scope of the 5G physical layer application programming interface (API) specification, allow tiny cells to be built piece by piece with components from various suppliers.

Another factor boosting the growth of global telecom application programming interface (API) market is growing number of mobile service subscribers. According to GSMA data, 5.2 billion individuals had enrolled to mobile services by the end of 2021, with that number expected to rise to 5.7 billion by 2025, presenting additional prospects for telecom application programming interface (API) in mobile based applications. The government all around the world is taking constant efforts for the growth and development of global telecom application programming interface (API) market. The government is highly investing in latest technological projects for the development of various types of telecom application programming interface (API) in the global market. Thus, this factor is supporting the telecom application programming interface (API) market growth.

The widespread acceptance of application programming interface (API) related technologies are due to the increased utilization of mobile and smartphones applications. All market participants profit from the growing number of innovative technological breakthroughs. On the other hand, the telecom application programming interface (API) market is restrained by a commercial gap between developer needs and carrier product offerings as well as government regulations and policies governing the telecom sector.

The telecom application programming interface (API) market is highly competitive, and important firms in each region compete fiercely. A few renowned players dominate each region or nation, the most of whom are the region’s vendors. In order to expand their market position, these market players are focused on growth and expansion methods like partnerships, acquisitions, joint ventures, mergers, and collaborations.

| Report Coverage | Details |

| Market Size by 2034 | USD 252.10 Billion |

| Market Size in 2025 | USD 305.85 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 21.32% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | API Type, End Use, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Messaging (API) segment contributed the highest market share of 36% in 2024. Any service that allows developers to incorporate numerous messaging technologies in an application through a single programmable interface is referred to as a messaging application programming interface (API). The rising demand for SMS services that use messaging application programming interface (APIs) is driving the expansion of messaging application programming interface (APIs).

The interactive voice response (IVR) API segment is projected to grow at a notable CAGR during the forecast period. The smart interactive voice response helps businesses improve their sales and marketing efforts. Using an interactive voice response system, call centers can process millions of calls each hour to manage real time data. As a result, interactive voice response application programming interface (API) allows developers to create high quality applications with interactive voice response capabilities and voice calling.

The enterprise developer segment has held the biggest market share of 37% in 2024. The demand for telecom application programming interface (API) is growing among large scale enterprises, which is driving growth of enterprise developer segment. The growing utilization of application to person messages for promotion of certain products and services is driving the demand for telecom application programming interface (API) in enterprise developer segment.

The partner developer segment is expanding at the fastest CAGR of 21% over the forecast period. The partner telecom application programming interface (APIs) aid in the development of services such as streaming and payment services by providing a centralized data exchange platform for developers. The developers can create these services with the help of telecom organizations. In addition, compared to corporate developers, the consumer base for partner developers is fast rising, resulting in their increase during the predicted period.

By API Type

By Type

By End User

By Deployment

By Industry Verticals

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

October 2024