May 2025

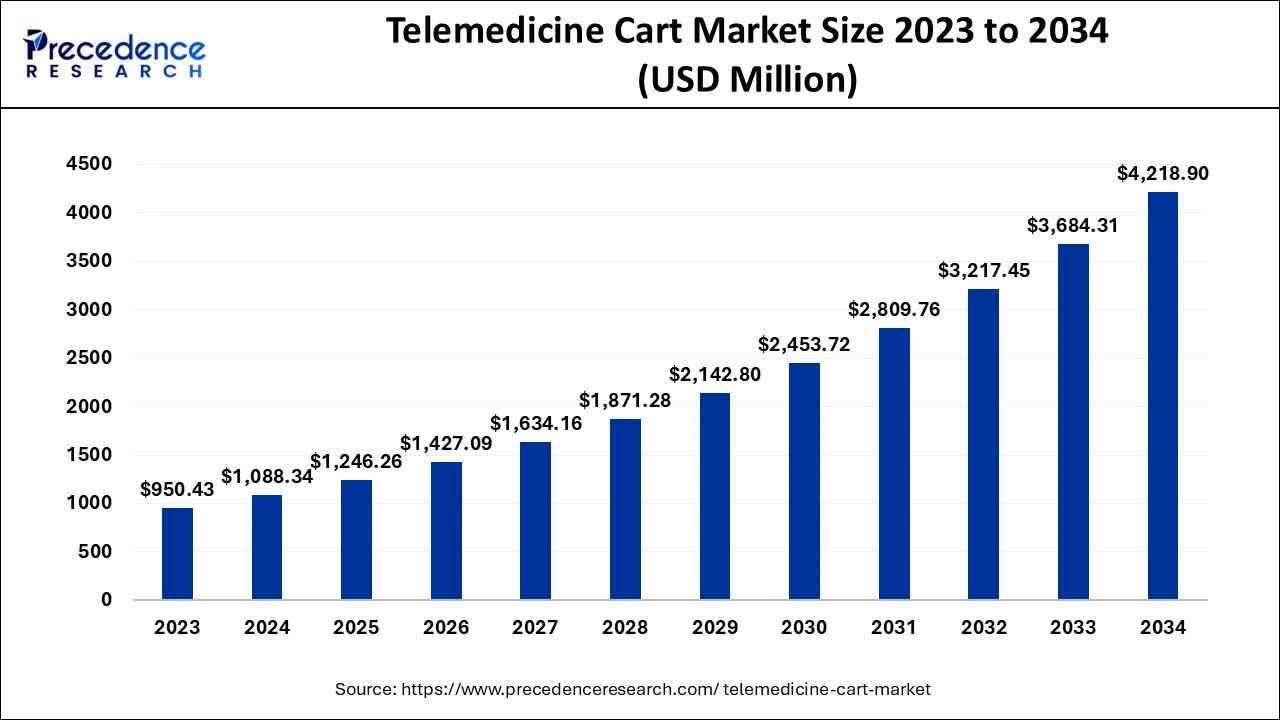

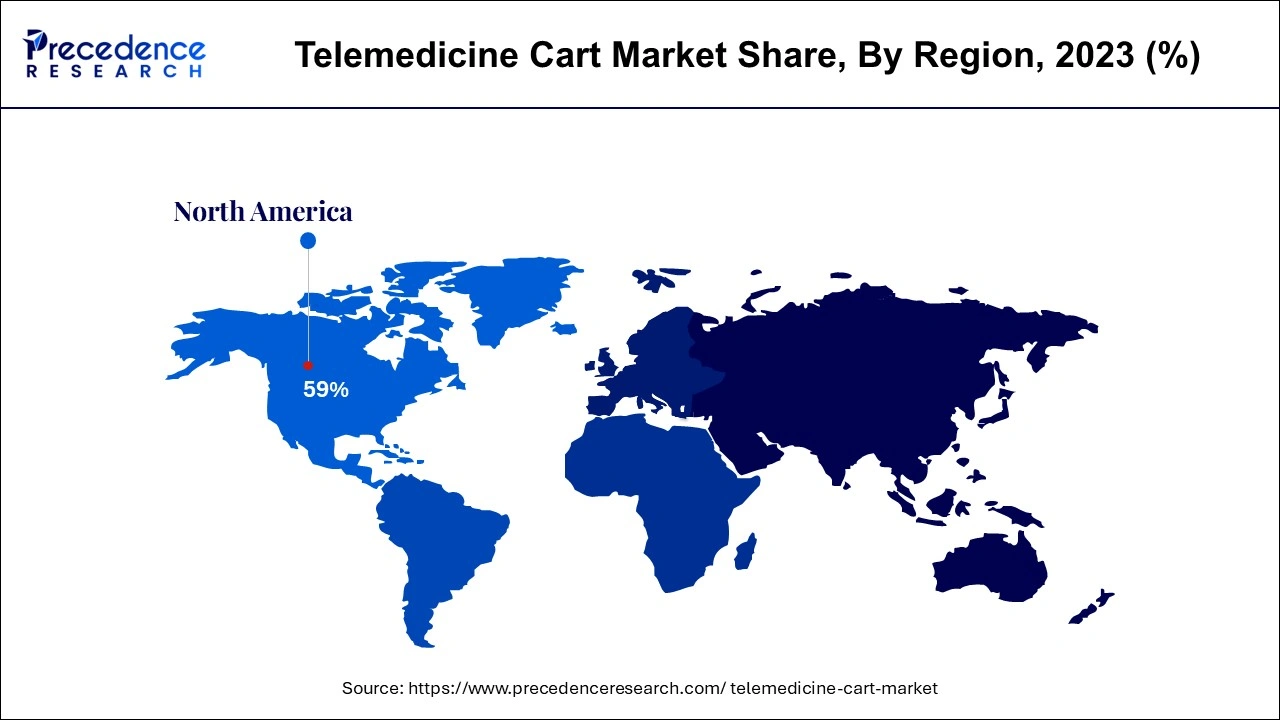

The global telemedicine cart market size accounted for USD 1,088.34 million in 2024, grew to USD 1,246.26 million in 2025 and is expected to be worth around USD 4,218.9 million by 2034, registering a healthy CAGR of 14.51% between 2024 and 2034. The North America telemedicine cart market size is calculated at USD 642.12 million in 2024 and is expected to grow at a fastest CAGR of 14.59% during the forecast year.

The global telemedicine cart market size is worth around USD 1,088.34 million in 2024 and is anticipated to reach around USD 4,218.9 million by 2034, growing at a CAGR of 14.51% from 2024 to 2034. The telemedicine cart market is driven by advancements in audio and video technologies that guarantee that patients and healthcare professionals can communicate clearly and effectively. Strong security measures safeguard data integrity and patient privacy. Telemedicine carts can easily interface with current EHR systems, making patient data access and management more efficient.

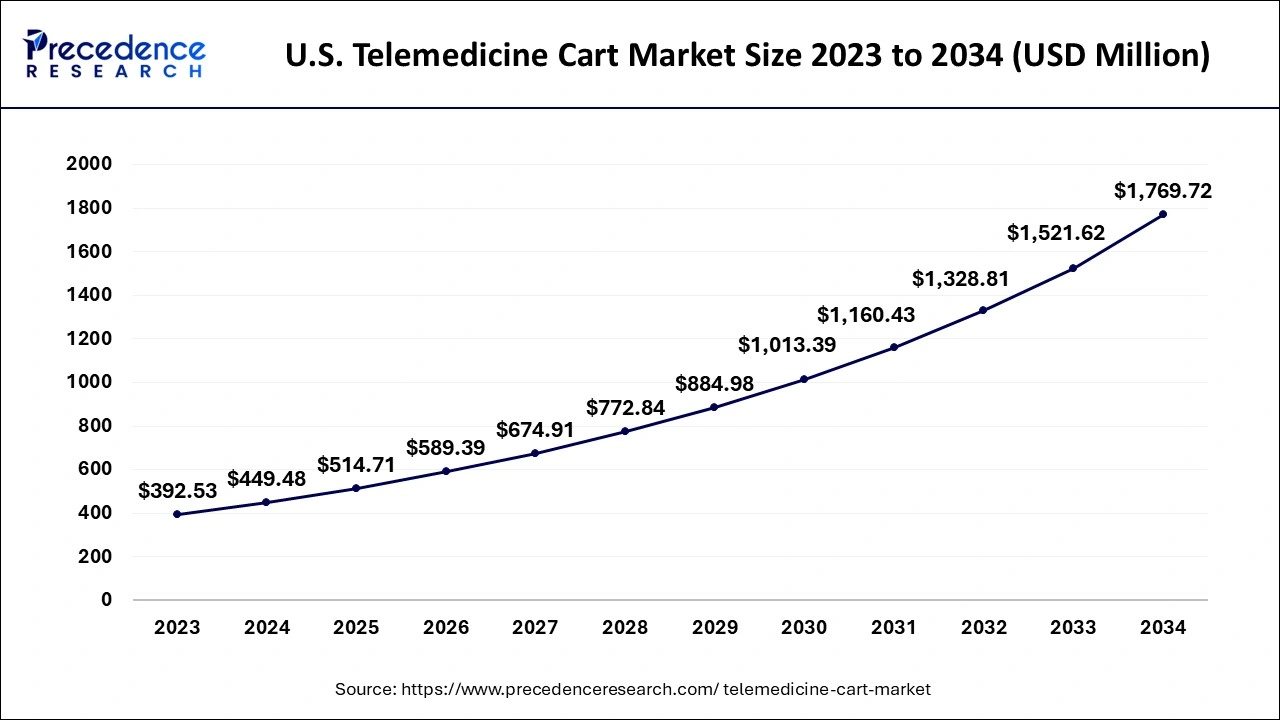

The U.S. telemedicine cart market size is exhibited at USD 449.48 million in 2024 and is projected to be worth around USD 1,769.72 million by 2034, growing at a CAGR of 14.67% from 2024 to 2034.

North America dominated the telemedicine cart market in 2023. The healthcare system in North America is very advanced, especially in the US and Canada. This includes vast networks of clinics, hospitals, and specialty medical facilities that are adequately funded and outfitted to incorporate cutting-edge medical technology, such as telemedicine carts. The infrastructure in the area facilitates the use of advanced telemedicine technologies to improve healthcare provision. Consumers in North America increasingly prefer convenient and available healthcare services. Telemedicine carts satisfy the need for more flexible healthcare options by providing virtual visits and distant consultations, which aligns with this preference.

Asia-Pacific is observed to be the fastest growing in the telemedicine cart market during the forecast period. A sizable portion of the population in Asia-Pacific lives in isolated, rural locations with no access to medical care. Telemedicine carts bridge the healthcare gap in these areas by enabling remote consultations, testing, and treatment. The governments in the region are putting policies into place to encourage the use of telemedicine, such as financial incentives, legal frameworks, and support for initiatives related to digital health. Patients can receive care in a more accessible and convenient manner with telemedicine carts, which increases patient satisfaction and adoption.

The telemedicine cart market is the industry devoted to creating, producing, and marketing mobile carts with technology that enables remote medical services. These carts usually contain diagnostic tools, medical imaging equipment, and video conferencing systems, which allow medical professionals to give care remotely. They facilitate telemedicine consultations and remote patient monitoring in various contexts, such as clinics, hospitals, and retirement homes. Telemedicine carts allow consultations to be conducted remotely, negating the need for expensive physical equipment.

They also save patient wait times and simplify the healthcare system. Because of their easy mobility and setup in multiple places, these carts are adaptable instruments for several healthcare settings and circumstances.

Role of Artificial Intelligence in Remote Healthcare

Telemedicine carts equipped with artificial intelligence (AI) systems can examine patient data in real-time, providing accurate diagnoses and supporting medical professionals in making decisions. They can anticipate patient requirements and possible health issues based on past data and trends, which makes proactive care and more efficient use of resources possible. Artificial intelligence (AI) algorithms assist in customizing treatment regimens based on patient data, enhancing the standard of care delivered remotely. Virtual assistants and natural language processing improve communication between patients and healthcare professionals, increasing the efficacy of remote consultations.

| Report Coverage | Details |

| Market Size by 2034 | USD 4,218.9 Million |

| Market Size in 2024 | USD 1,088.34 Million |

| Market Size in 2025 | USD 1,246.26 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.51% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Operation, Lift Technology, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for remote healthcare services

With the increasing integration of technology into daily life, patients are looking for flexible and convenient healthcare options. Patients are looking for alternatives to get medical care without traveling, particularly for follow-ups and routine check-ups. As a result, there is an increasing demand for remote healthcare services. Advanced technology-equipped telemedicine carts enable medical professionals to monitor patients' conditions virtually, conduct virtual consultations, and deliver care remotely, aligning with the patient's desire for convenience.

Growing prevalence of chronic diseases

Chronic conditions like diabetes, high blood pressure, heart disease, and respiratory issues need to be continuously monitored and managed. Due to their modern diagnostic instruments and communication systems, telemedicine carts allow medical professionals to monitor patients from a distance. This lessens the need for frequent in-person visits, facilitating the successful management of chronic illnesses. Electronic health records (EHRs) and other health information systems are frequently connected with telemedicine carts.

Better data management, simple access to patient histories, and more coordinated care are made possible by this seamless connectivity. To manage chronic diseases, comprehensive and current information is crucial for efficient treatment planning.

High initial investment cost

Complex technology is usually needed for telemedicine carts, such as high-definition cameras, complex communication systems, and medical equipment. Purchasing and integrating this technology can come at a high expense. Telemedicine carts require training for administrative personnel and medical specialists to operate correctly. The cost and time needed for training programs may increase the original investment. Budgets are tight for many healthcare practitioners, especially those in smaller practices and remote locations. These organizations might be unable to afford the high initial cost of telemedicine carts, which would restrict their ability to invest in such technology.

Data security concerns

Advanced technology installed on telemedicine carts enables virtual consultations between medical professionals and patients. These carts handle Sensitive patient data, including medical history, personal health information (PHI), and real-time health data. Such data storage and transmission carry risks if they are not adequately safeguarded. Patients and healthcare professionals who use telemedicine carts need to be informed about the best standards for data protection. Inadequate training might result in unintentional security breaches, like data handling errors or the disclosure of login passwords. Educating users about security procedures is crucial, but it might require a lot of resources.

Expansion in rural and underserved areas

Healthcare providers and facilities are frequently lacking in rural and neglected areas. Long travel times to the closest healthcare provider are a common problem for the residents of these areas, which may discourage people from seeking care and cause treatment to be delayed. Telemedicine carts improve the effectiveness of healthcare delivery by being outfitted with a range of diagnostic and communication instruments. They raise the standard of care available to local healthcare practitioners by enabling them to remotely access modern diagnostic capabilities and confer with specialists.

Healthcare infrastructure investment by public-private bodies

| Underdeveloped countries | Public/ Private initiatives towards building healthcare infrastructure |

| Uganda | In October 2023, Uganda’s medical facilities attracted U.S. investors, especially in private medical care and oncology. Health obtained 6% of the 2023/24 national budget, but donor funding has nearly 80% of resources. Uganda has 23 sites licensed to make medicines and health supplies, even if only 13 are used in the commercial production of pharmaceuticals. |

| Nepal | In September 2023, it was estimated that nearly 97,787.32 million Nepali rupees would be used to set up and expand the fundamental/primary healthcare facility. |

| Africa | In December 2022, USTDA disclosed the launch of its Coalition for Healthcare Infrastructure in Africa. The Coalition is a partnership between USTDA and the U.S. industry that aids in meeting our African partners' healthcare needs and raising access to quality healthcare products and services for millions of individuals across the continent. |

The dual display cart segment dominated the telemedicine cart market in 2023. Electronic medical records (EMR), real-time video consultations, and diagnostic data can be displayed simultaneously on dual-display carts. This feature makes remote consultations more accurate and efficient, enabling medical professionals to obtain and review vital information instantly without switching between displays. Dual display carts can be integrated with various medical instruments, including cameras, ultrasound machines, and digital stethoscopes. Their ability to integrate makes them more appealing and versatile to healthcare providers who want to simplify their telemedicine offerings.

The single display cart segment shows notable growth in the telemedicine cart market during the forecast period. The growing adoption of telemedicine, driven by the need for remote healthcare services, has significantly increased the demand for telemedicine carts. Single display carts, which are more compact and cost-effective, are increasingly preferred by healthcare providers, especially in small to medium-sized facilities. Single-display carts are typically more compact and lighter than dual-display models, making them easier to maneuver within healthcare facilities. This portability is particularly valuable in settings where space is limited. These carts are well-suited for use in diverse environments, including hospitals, outpatient clinics, nursing homes, and even home healthcare settings. Their adaptability contributes to their growing popularity.

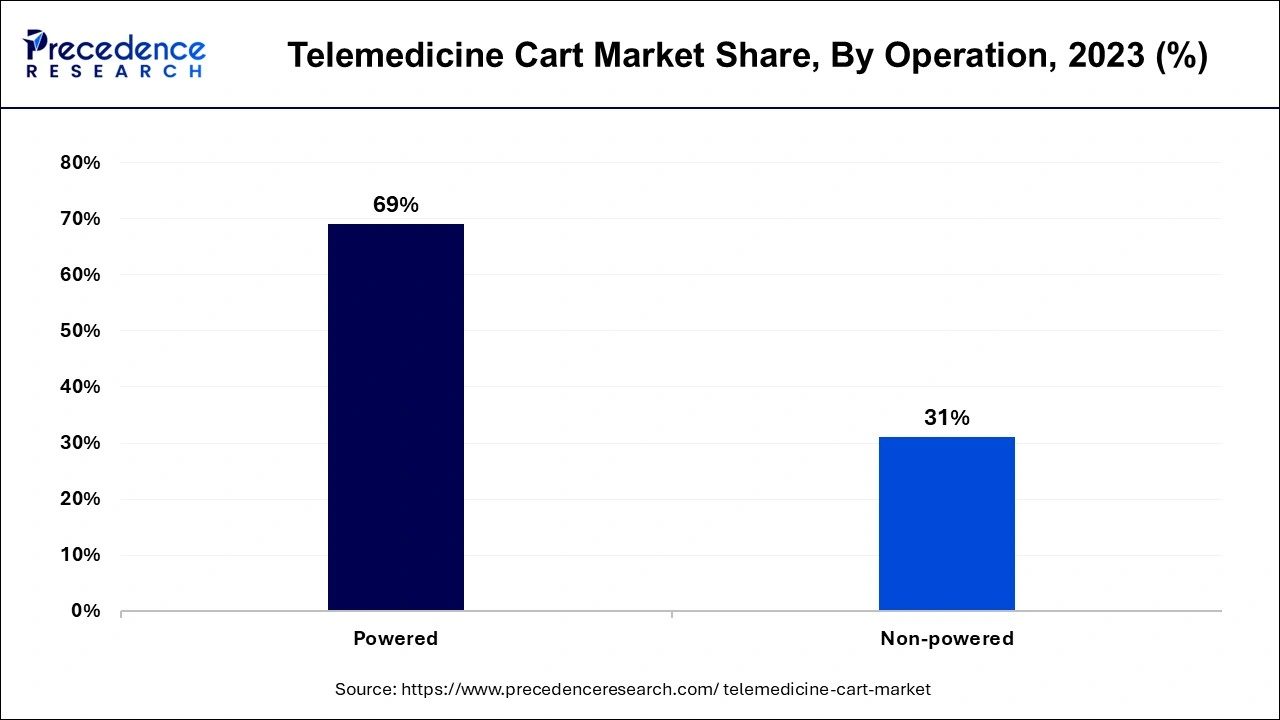

The powered segment dominated the telemedicine cart market in 2023. Advanced features like integrated power systems, which enable continuous operation without frequent battery replacement or recharging, are included in powered telemedicine carts. This guarantees constant telemedicine consultations, especially in critical care environments. Powered carts may be more expensive initially, but they can save money over time due to their dependability and effectiveness in supporting telemedicine operations. Clinics and hospitals can avoid coping with the constraints of manually or unpoweredly powered carts or the ongoing costs of battery replacements.

The electronic segment held significant and will continue to sustain segment dominated the telemedicine cart market during the forecast period. Electronic health records (EHR) and other healthcare IT systems are increasingly connected with electronic telemedicine carts. The effectiveness and caliber of patient care are enhanced by this integration, making it easy for healthcare providers to share data. Electronic carts have become an indispensable part of the infrastructure for telemedicine since they allow for real-time access to and updating of patient records during virtual consultations. To satisfy the changing demands of healthcare professionals, manufacturers in the telemedicine cart market are always coming up with new ideas.

New electronic carts with improved portability, longer battery life, and user-friendly interfaces are being created to appeal to a wider range of healthcare settings. Thanks to this ongoing innovation, the electronic sector is guaranteed to be powerful and competitive.

The hospitals segment dominated the telemedicine cart market in 2023. Hospitals often serve extensive and varied patient populations, from standard checkups to complicated, urgent, and emergency cases. The necessity for prompt, accurate consultations with professionals in several domains drives the introduction of telemedicine carts in hospitals. Critically crucial in critical care settings, these carts allow clinicians to consult with specialists off-site, offer real-time patient data, and receive prompt responses. Using telemedicine carts can result in significant cost reductions for hospitals. These savings result from fewer hospital stays due to earlier diagnosis and treatment, less need for patient transportation, and the best utilization of specialists.

Telemedicine carts are a cost-effective solution for hospitals seeking to control healthcare delivery expenses because of their increased efficiency.

The specialty centers segment is observed to be the fastest growing in the telemedicine cart market during the forecast period. Many places have limited access to specialized medical care, mainly in rural and underdeveloped areas. Specialty centers can now offer patients who might otherwise have to travel great distances for specialist treatment access to high-quality care because of telemedicine carts. This convenience is fueling the use of telemedicine carts in these facilities. The emergence of 5G networks and other high-bandwidth internet technologies has improved the telemedicine services' dependability and standard. The increased ability of specialty centers to provide consistent, high-quality telemedicine services, even in remote areas, has increased the appeal of telemedicine cart adoption.

Segments covered in the report

By Product

By Operation

By Lift Technology

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

November 2024

May 2024

May 2025