January 2025

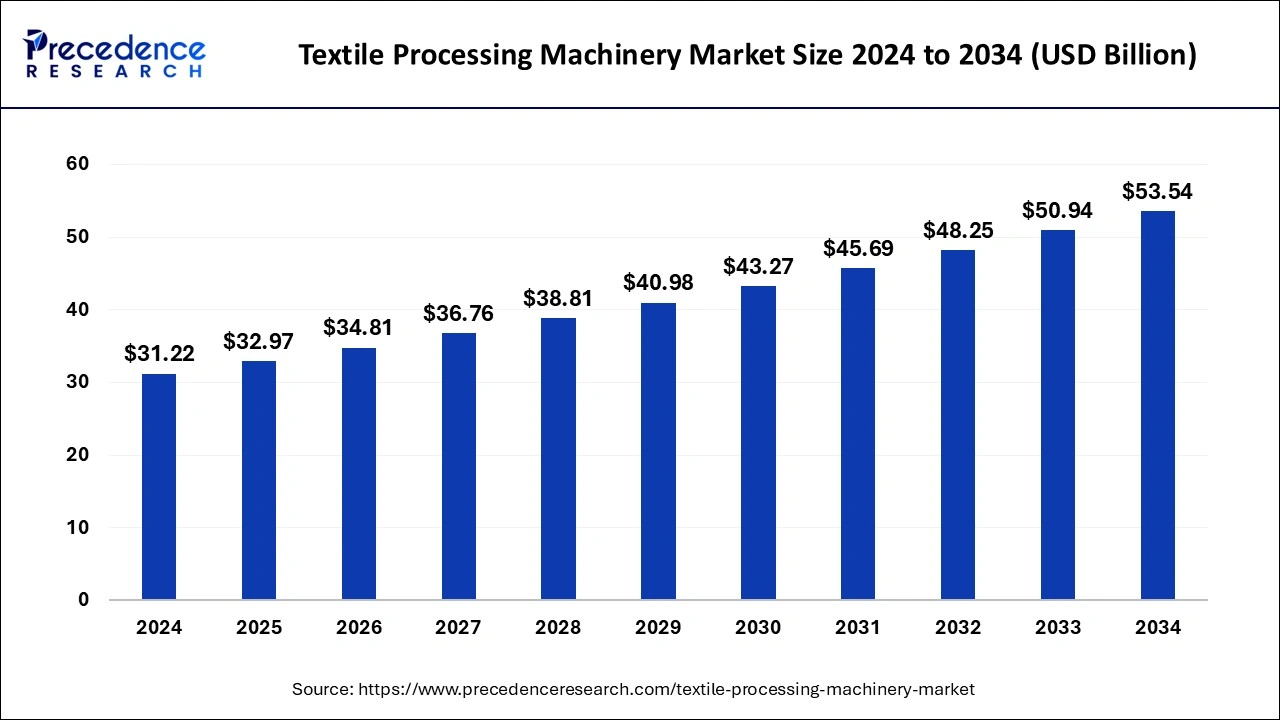

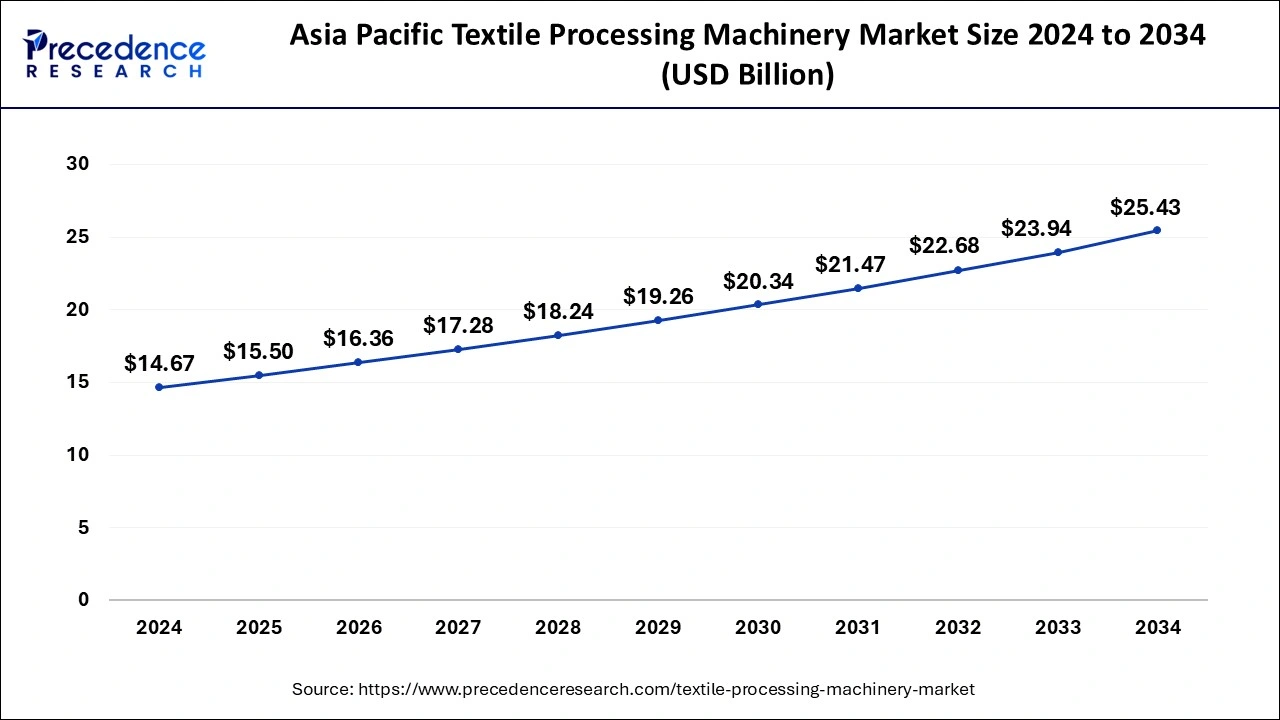

The global textile processing machinery market size is calculated at USD 32.97 billion in 2025 and is forecasted to reach around USD 53.54 billion by 2034, accelerating at a CAGR of 5.54% from 2025 to 2034. The Asia Pacific textile processing machinery market size surpassed USD 15.50 billion in 2025 and is expanding at a CAGR of 5.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global textile processing machinery market size was estimated at USD 31.22 billion in 2024 and is predicted to increase from USD 32.97 billion in 2025 to approximately USD 53.54 billion by 2034, expanding at a CAGR of 5.54% from 2025 to 2034. Enhancements in textile productivity can boost the market.

The asia pacific textile processing machinery market size was estimated at USD 14.67 billion in 2024 and is predicted to be worth around USD 25.43 billion by 2034 with a CAGR of 5.66% from 2025 to 2034.

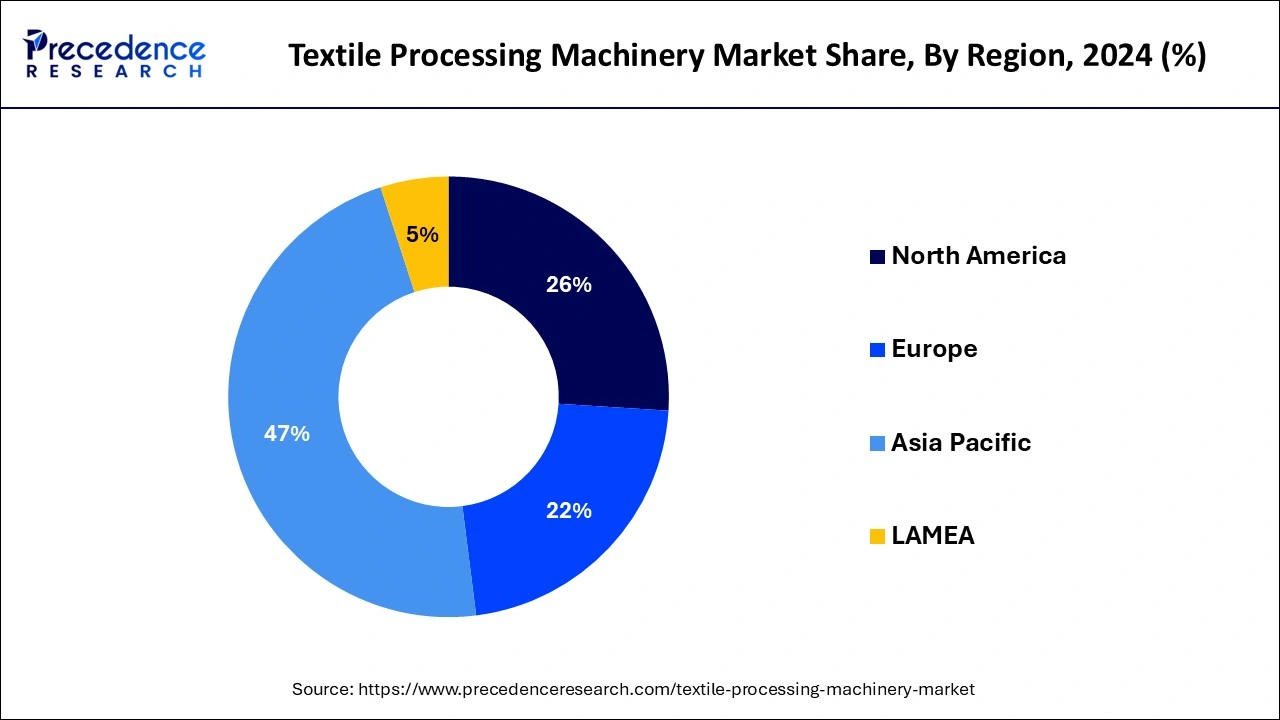

North America is observed to witness a significant rate of growth during the forecast period. There are various reasons for North America's market supremacy in textile processing machinery. The area boasts a highly developed textile sector with cutting-edge infrastructure and equipment. Furthermore, the region places a high priority on innovation and research, which results in the creation of state-of-the-art gear. Furthermore, the development of the textile machinery industry is aided by favorable government policies and a sizable pool of skilled labor in North America. The area leads this market due to a combination of these factors.

The U.S. textile industry supply chain, from textile fibers to apparel and other sewn products employed 501,755 workers in 2023. The government estimates that one textile manufacturing job in this country supports three other jobs.

Asia Pacific dominated the textile processing machinery market in 2024 by region and the region is observed to sustain the position during the forecast period. Some of the biggest textile-producing nations in the world, including China and India, are located in this region. To support their booming textile industries, these nations have a sizable need for textile processing machinery. The demand for textiles is rising due to the fast industrialization and urbanization of many Asia Pacific nations. This is driving the need for sophisticated processing equipment to keep up with the increasing demands of manufacturing. The area is also a desirable location for textile manufacture due to the accessibility of inexpensive labor, which increases the need for processing equipment.

The textile processing machinery market refers to the tools and devices used in spinning, weaving, knitting, dying, printing, and finishing, among other textile production processes. The different kinds of fibers and fabric can be handled by the textile processing machinery, which can be used for cleaning, carding, spinning fiber into yarn, knitting or weaving yarn into fabric, dying and printing fabric, and finishing operations, including cutting, stitching, and pressing. The process of textile processing includes washing machines, bleaching or dyeing machines, drying machines, ironing machines, and presses. The market is driven by the enhancement in productivity of textiles and advancement in textile processing machinery.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.54% |

| Global Market Size in 2025 | USD 32.97 Billion |

| Global Market Size by 2034 | USD 53.54 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Process, Process, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Enhancement in productivity

The enhancement in the productivity of textiles can boost the textile processing machinery market. The ability of textile processing machinery to greatly increase productivity is one of its main advantages. Machines are capable of completing repetitive tasks faster and more accurately than humans. A number of labor-intensive activities, such as spinning, weaving, knitting, dying, printing, and finishing, among other textile production processes, are automated by the textile processing machinery, which results in the growth of the textile processing machinery market.

High initial capital investment

High initial capital costs can inhibit new businesses from entering the market and discourage established companies from modernizing or growing, which can slow down the market for textile processing gear. This could result in less demand for machines, which would hinder market expansion. High capital expenses can also lengthen the time it takes for a return on investment, which deters businesses from investing heavily in new machinery.

Advancement in textile processing machinery

The advancement in textile processing machinery can be an opportunity for the textile processing machinery market. The advancement in textile processing machinery allows more liberty to create, which is available when designing fabrics, creating patterns, and adjusting colors. The manufacturer is experiencing a revolution due to digital printing technologies, which eliminate the need for costly and lengthy setups and enable fast development and small-scale production. The integration of small textiles and functional fabrics, which include features like sensors, conductive thread, and antimicrobial qualities, has also been accelerated by textile machines. This technical development creates new opportunities for textiles in a number of industries, such as fashion, sports, healthcare, etc.

The drying machines segment dominated the textile processing machinery market by process in 2024. The drying machines are important in the finishing stage of textile production, ensuring fabrics are dried efficiently and evenly. The drying machines offer speed, consistency, and automation, reducing production time and costs for manufacturers. Additionally, advancements in drying technology have improved energy efficiency and environmental sustainability, further contributing to their widespread adoption.

The ironing machines and presses segment is expected to grow at the highest CAGR in the textile processing machinery market by process during the forecast period. The market for textile processing machinery is anticipated to see growth in the need for presses and ironing machines for a number of reasons. First off, in order to satisfy growing production demands, there is a greater need for automated and efficient operations as the textile industry expands globally. When compared to hand ironing, ironing presses and machines provide faster and more reliable results, increasing productivity and lowering labor expenses. Furthermore, technological developments have produced more environmentally friendly and energy-efficient ironing machines, increasing their appeal to textile producers who wish to lessen their environmental impact.

The cotton segment dominated the textile processing machinery market by raw material in 2024. Cotton is one of the most commonly used natural fibers in the manufacture of textiles. It commands a large share of the market for textile processing machinery. Because so much cotton is produced and processed worldwide, there is a huge demand for machinery designed specifically for the cotton industry. The qualities of cotton also make it adaptable and appropriate for a variety of textile applications, which increases the need for specialist equipment.

The polyester segment is expected to grow at the highest CAGR in the textile processing machinery market using raw materials during the forecast period. In the textile processing machinery market, polyester is expected to increase for a number of reasons. First off, polyester is a synthetic material that is becoming more and more popular in the textile industry due to its many benefits, including durability, resistance to wrinkles, and ease of maintenance. The growing demand for materials based on polyester necessitates the use of specialist machinery that can process polyester effectively.

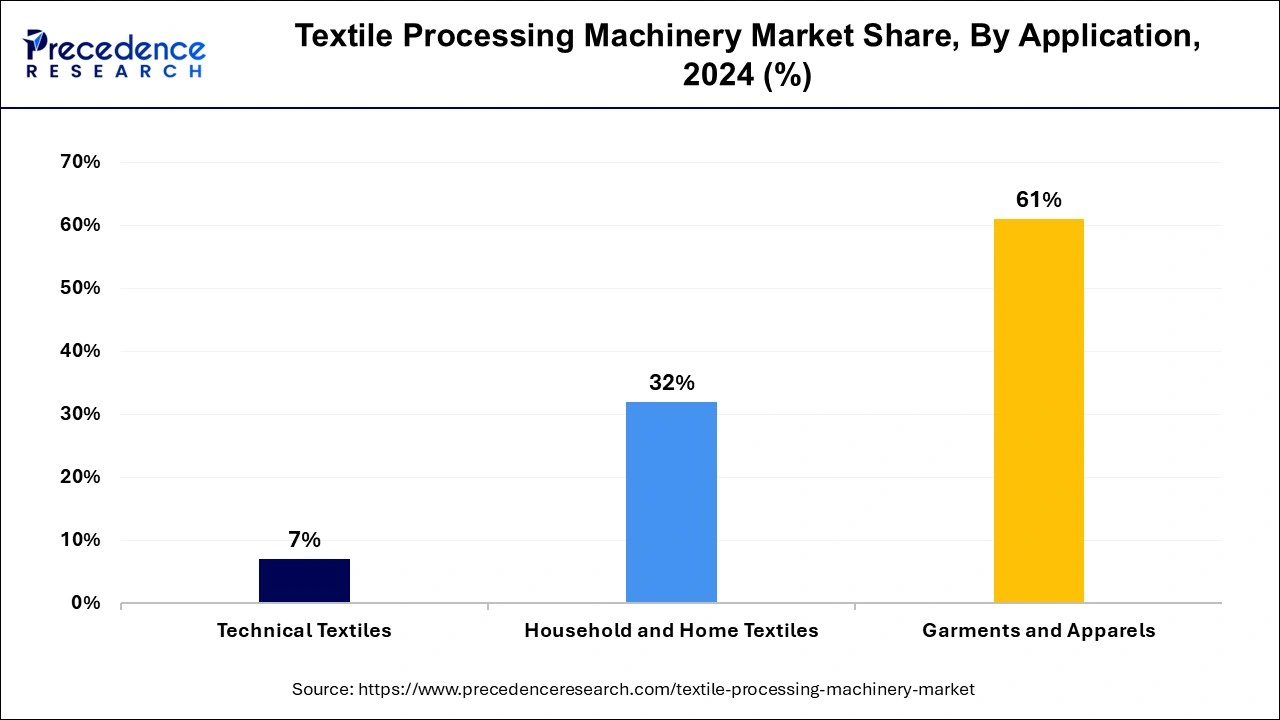

The garments & apparel segment dominated the textile processing machinery market by application in 2024 because they constitute the last phase of the textile manufacturing process and involve complex procedures like cutting, stitching, and finishing. Garments and apparel command a large share of the textile processing machinery market. Because of this, there is a great need for machinery that can perform these jobs well, which is encouraging innovation and investment in this market. The fashion industry's incessant quest for innovative designs and expedited production also drives up demand for sophisticated textile processing equipment specifically designed for the apparel sector.

The household & home textiles segment is expected to grow at the highest CAGR in the textile processing machinery market by application during the forecast period. Numerous reasons contribute to the growth of the textile processing machines market's household and home textile segment. First off, reasons including rising disposable income, urbanization, and shifting lifestyle choices are driving up demand for household textiles like curtains, upholstery, beds, and towels. Because they are the last complex step in the textile manufacturing process, garments and apparel command a large share of the market for textile processing machinery. Manufacturers are under pressure to create a wide variety of superior home textile items quickly as consumers want more individualized and aesthetically pleasant living spaces. Improvements in automation, flexibility, and customization capabilities in textile processing technology have further facilitated manufacturers' ability to meet these demands. For instance, sophisticated weaving and knitting equipment enables the creation of novel materials, while digital printing technologies allow for the printing of elaborate patterns and designs on home textiles. Concerns about sustainability are also changing consumer preference, which is driving up demand for organic and eco-friendly home textiles.

By Process

By Raw Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

February 2025

February 2025