September 2023

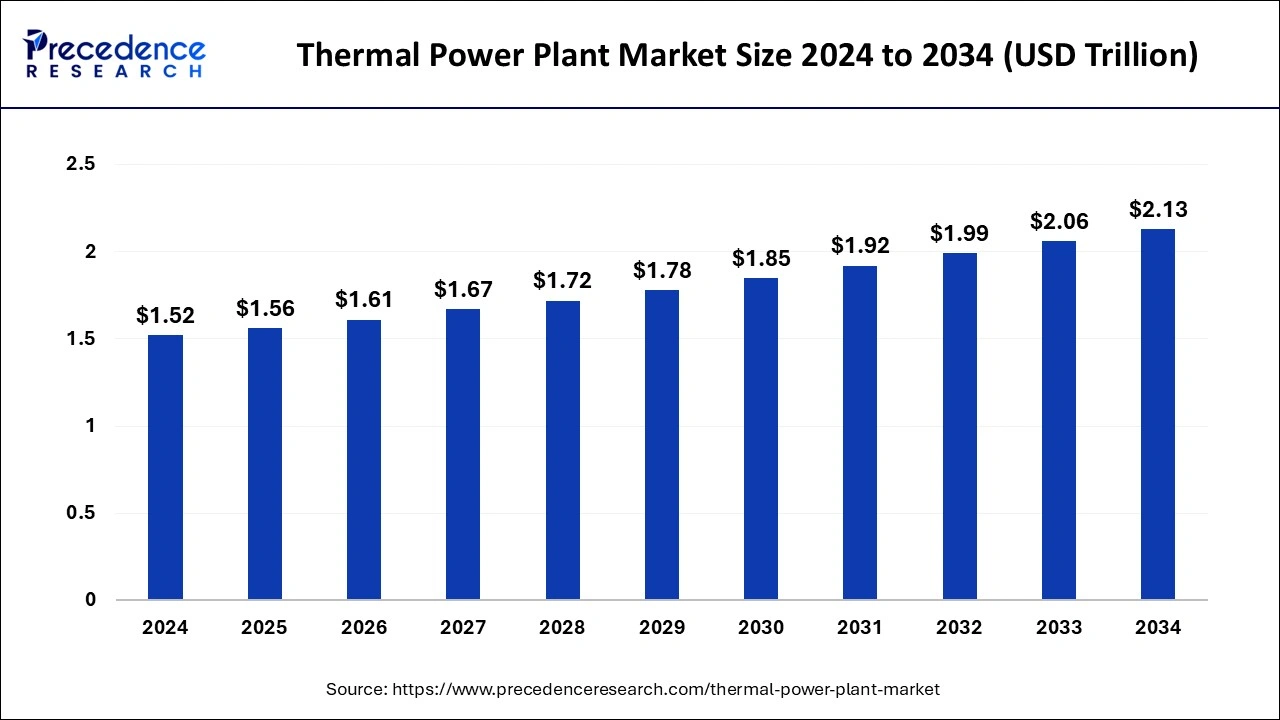

The global thermal power plant market size is calculated at USD 1.56 trillion in 2025 and is forecasted to reach around USD 2.13 trillion by 2034, accelerating at a CAGR of 3.43% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global thermal power plant market size was accounted for USD 1.52 trillion in 2024 and is projected to surpass around USD 2.13 trillion by 2034, growing at a CAGR of 3.43% from 2025 to 2034. The increasing dependence on electrification, growing urbanization, rapid industrialization, and surge in population are expected to drive the growth of the market during the forecast period.

The integration of artificial intelligence (AI) in thermal power plant operations, has emerged as a transformative force and its potential impact could be crucial. Artificial intelligence integration plays a vital role in efficiently managing power plant operations. Artificial intelligence (AI) integration can assist thermal power plants in several ways, including optimizing energy usage, optimal load management, improving resource utilization, safety and risk management, improving grid management, energy forecasting, improving operational efficiency, lowering carbon emissions, and others. AI-powered predictive maintenance systems can detect patterns and anomalies, allowing thermal power plant operators to identify potential equipment failures before they occur. By leveraging AI, the startups can create a 'digital twin' of the entire process. Therefore, by harnessing the power of AI, thermal power plants can minimize environmental impact, enhance energy efficiency, and pave the way for more reliable energy infrastructure.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.56 Trillion |

| Market Size by 2034 | USD 2.13 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.43% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fuel Type, Capacity, Turbine Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising energy consumption

The increase in electricity consumption around the world is expected to boost the expansion of the thermal power plant market in the coming years. Electricity has become the backbone of modern society, linked with a higher standard of living. The market has witnessed the increasing demand for electrification from various industries and sectors, including residential and commercial buildings, transportation, and industrial manufacturing. In addition, the surging investments in the industrialization and urbanization of rural areas have significantly increased the demand for efficient and uninterrupted power supply around the world, bolstering the growth of the market.

Stringent Government regulations

The stringent government regulations are anticipated to hamper the growth of the market. Several governments around the world have implemented strict regulations regarding greenhouse gas emissions and health issues associated with coal-fired power generation. In addition, the rising preferences for renewable energy sources and growing efforts to reduce the reliance on conventional fuels to produce electricity may restrict the expansion of the global thermal power plant during the forecast period.

Rising investments in natural gas-based thermal power plants

The surging investments in natural gas-based thermal power plants are projected to create lucrative growth opportunities for the market. Natural gas combined-cycle plants are among natural gas-fired power plants. They cost significantly less than gas turbine cycle plants in construction cost and can provide a significant amount of energy by using the heat released during the process. In addition, Thermal power plants play a crucial role in electricity production, particularly in areas where renewable energy sources are not reliable or not yet widespread. Such factors are propelling the growth of the thermal power plants market in the coming years.

Based on the fuel type, the global thermal power plant market was dominated by the coal segment in 2023. Coal is the most abundantly found fuel source in the globe and the majority of the electricity produced is through the use of coal. The major factor that has significantly fostered the growth of the coal segment is its abundant availability and low cost as compared to any other fuel type. Coal is expected to remain the most significant segment in the production of electricity from thermal power plants across the globe throughout the forecast period.

Natural gas is expected to be the most opportunistic segment during the forecast period. Natural gas combined cycle power plants are more efficient than other gas-fired power plants. It costs comparatively low than the gas turbine plant. Gas is a major source of electricity after coal and is expected to retain its position throughout the forecast period.

Based on the capacity, the global thermal power plant market was dominated by the more than 800 MW segment in 2023. This growth is attributed to the higher demand for over 800 MW of power across various industries. Rapid industrialization and significantly rising demands for power across the globe have led to the growth of this segment in the past decade. The rising investments in the industrialization of underdeveloped economies are expected to further fuel the growth of this segment in the foreseeable future and drive the growth of the overall thermal power plant market.

Asia Pacific dominated the global thermal power plant market in 2023. The Asia Pacific is the home to the world’s leading coal companies like The Coal India Limited. Coal India is one of the leading suppliers of coal across the globe. The abundant availability of coal in the Asia Pacific region has led to the availability of cheap coal. Furthermore, the rapid industrialization and urbanization in the nations like China, India, South Korea, and Indonesia have significantly contributed to the rising demand for thermal power across the region. China and India are the manufacturing hub of the globe and the presence of several huge industries in the region has significantly fostered the consumption of thermal electricity. The rising government investments in urbanization and industrialization are expected to boost the growth of the market significantly during the forecast period. The rising government investments in the establishment of thermal power plants such as the Phulkari Coal Powered Plant in Bangladesh, Patratu Super-Thermal Power Plant (Coal) in India, Fuyang Power Station, and HuadianLaizhou Power Station in China is a major factor that is expected to fuel the growth of the Asia Pacific thermal power plant market during the forecast period.

FOSSIL FUEL INSTALLED GENERATION CAPACITY IN INDIA (FUELWISE) AS ON 31.05.2023

| CATAGORY | INSTALLED GENERATION CAPACITY(MW) | % of SHARE IN Total |

| Coal | 205235 | 0.491% |

| Lignite | 6,620 | 1.6% |

| Gas | 24824 | 0.06% |

| Diesel | 589 | 0.001% |

| Total | 237269 | 0.568% |

North America occupied the second position in the global thermal power plant market in 2022, followed by the Europe thermal power plant market. Natural gas is the major fuel type that drives electricity generation from thermal power plants. The abundant availability of gas from the nations like Russia and the US has significantly contributed to the growth of the thermal power plant market. There is a high demand for natural gas in the US and Europe for generating electricity from thermal power plants. The presence of a well-established and strong infrastructure for thermal power plants is a major driver of the thermal power plant market. The rising investment in the US to expand the thermal power capacity and rising consumption of electricity is expected to fuel the growth of the North American thermal power plant market in the upcoming years.

By Fuel Type

By Capacity

By Turbine Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2023

September 2024

January 2025

October 2024