The global thermostat market size is calculated at USD 6.47 billion in 2024, grew to USD 7.30 billion in 2025 and is predicted to surpass around USD 21.77 billion by 2034, expanding at a CAGR of 12.90% between 2024 and 2034. The North America thermostat market size accounted for USD 2.46 billion in 2024 and is anticipated to grow at a fastest CAGR of 13% during the forecast year.

The global thermostat market size accounted for USD 6.47 billion in 2024 and is anticipated to reach around USD 21.77 billion by 2034, expanding at a soild CAGR of 12.90% between 2024 and 2034.

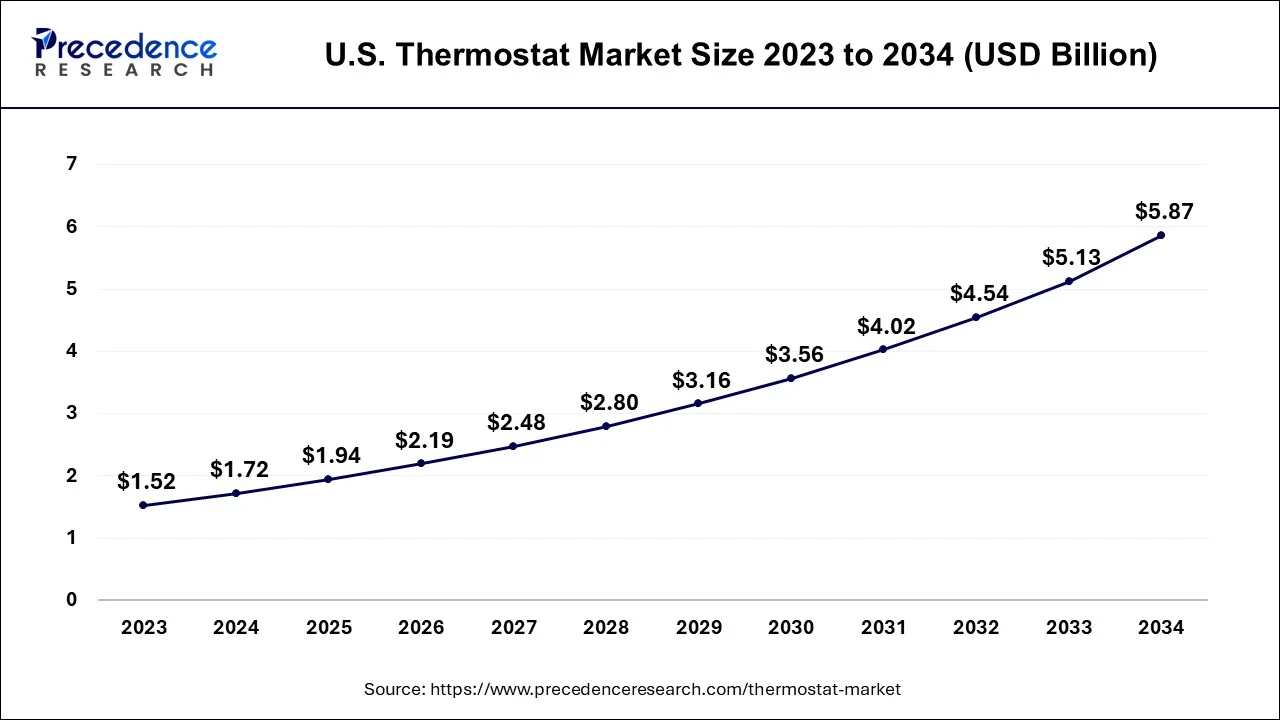

The U.S. thermostat market size ie estimated at USD 1.72 billion in 2024 and is expected to be worth around USD 5.87 billion by 2034, poised to grow at a CAGR of 13.06% from 2024 to 2034.

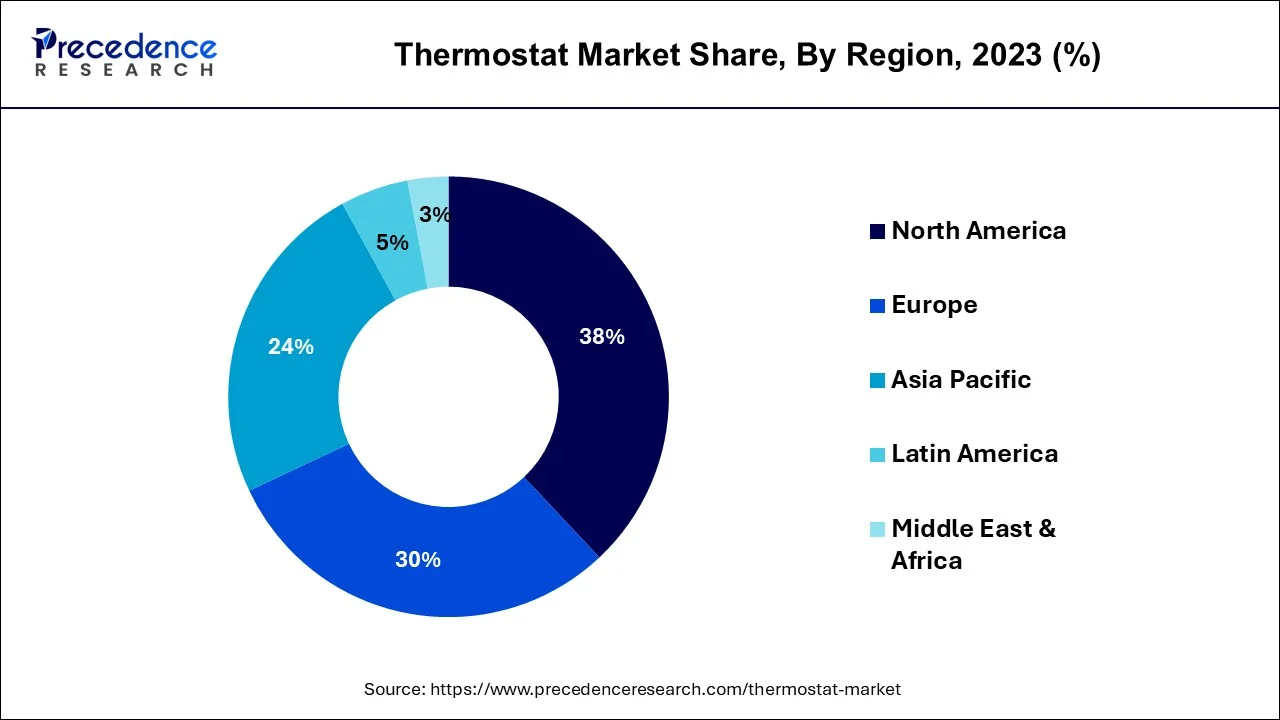

North America has held the largest revenue share 38% in 2023. North America's commanding position in the thermostat market is underpinned by a confluence of distinctive factors. The region boasts a robust technological infrastructure, affluence, and a thriving construction sector, all of which have fostered the adoption of smart thermostats and cutting-edge HVAC systems. Furthermore, stringent energy efficiency mandates, burgeoning environmental consciousness, and governmental incentives for energy-smart solutions act as catalysts, motivating both individuals and businesses to invest in these innovative devices. North America also stands out as the epicenter for prominent thermostat manufacturers, amplifying the market's presence.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific commands substantial growth in the thermostat market for a multitude of compelling reasons. The rapid urban expansion, burgeoning infrastructure projects, and the construction of new structures have generated a robust demand for HVAC systems, wherein thermostats play an indispensable role.

Furthermore, the region's escalating consciousness of energy conservation and the embrace of intelligent home technologies have increased demand for smart thermostats. Government-backed incentives and regulatory measures aimed at fostering energy-efficient solutions have added impetus to market expansion. Notably, the presence of prominent manufacturing hubs in the region has streamlined the production and distribution of thermostats, enhancing their accessibility and affordability for consumers.

The thermostat industry encompasses the creation and distribution of tools designed for controlling indoor temperatures, a pivotal element for ensuring comfort and optimizing energy usage in both residential and commercial settings. This sector is currently undergoing significant transformation, with a particular spotlight on intelligent thermostats that offer remote control via smartphones and seamless integration with smart home ecosystems. The market's evolution is strongly influenced by the growing importance of sustainable and energy-efficient solutions, driven by environmental considerations. Key industry leaders like Nest (a Google-affiliated company), Honeywell, and Ecobee offer diverse product lines to address varying consumer requirements.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 12.90% |

| Market Size in 2024 | USD 6.47 Billion |

| Market Size by 2034 | USD 21.77 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Deployment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Smart home and IoT integration

The expansion of the commercial sector is a prime catalyst for the growth of the thermostat market. As commercial establishments like offices, hotels, and retail spaces continue to multiply, the demand for advanced climate control solutions has seen a sharp uptick. Commercial buildings require precise temperature control to ensure the comfort and productivity of their occupants, making thermostats a crucial component of their infrastructure.

Furthermore, the commercial sector is increasingly emphasizing energy efficiency and sustainability to trim operational costs and reduce its environmental footprint. Sophisticated thermostats with programmable features and smart capabilities are instrumental in achieving these objectives by optimizing heating, ventilation, and air conditioning (HVAC) systems and curtailing energy consumption. This aligns with the mounting awareness of environmental responsibility, which further drives the adoption of eco-friendly thermostat solutions within commercial settings.

In addition, the ascent of smart building technologies and the necessity for centralized control systems in vast commercial complexes are boosting the demand for thermostats that can be seamlessly integrated into these advanced building management systems. Collectively, the expansion of the commercial sector and its evolving needs create a thriving market for innovative and energy-efficient thermostat solutions.

Privacy and security concerns

Privacy and security apprehensions act as substantial shackles on the thermostat market's expansion. As the thermostat landscape becomes increasingly intertwined with the Internet of Things (IoT) and smart home technologies, it garners access to a wealth of personal data, encompassing user habits, occupancy patterns, and climate preferences. The specter of unauthorized data access triggers concerns, particularly in an age riddled with high-profile data breaches.

Security vulnerabilities within smart thermostats expose them to potential cyber threats and hacking, engendering fears of privacy invasion and home security compromises. These misgivings instigate resistance to the embrace of smart thermostat and IoT-integrated climate control systems.

Furthermore, governmental bodies are cognizant of the need to address these apprehensions, translating into the imposition of stringent data protection and cybersecurity mandates. Compliance with these regulations can be resource-intensive for manufacturers, potentially inflating costs and impacting the affordability and accessibility of smart thermostat solutions. In summary, cultivating user trust and surmounting the privacy and security hurdles is not merely desirable but imperative for the thermostat market to perpetuate its growth trajectory.

Energy efficiency programs

Energy efficiency programs are emerging as a pivotal force, sculpting new prospects in the thermostat market. These programs, propelled by a collective environmental consciousness and government mandates, serve as a driving factor for consumers and businesses to embrace energy-efficient heating and cooling solutions. In this landscape, smart thermostats take center stage by delivering precision control, automation, and data-driven insights that optimize energy utilization. Manufacturers, recognizing this symbiotic relationship, can harmonize their offerings with these programs, doling out incentives, rebates, and subsidies to consumers who install energy-efficient thermostats.

These incentives not only render smart thermostats more accessible but also accentuate affordability, broadening their appeal to a wider demographic. Moreover, the imperatives of energy efficiency programs underscore the call for eco-conscious solutions. This compels a heightened focus on research and development, fostering the creation of greener and more energy-efficient thermostat technologies. Thus, the thermostat market is not only fortified through program incentives but is also galvanized to pioneer innovations, harmonizing with the prevailing global momentum toward a more sustainable future.

Impacts of COVID-19

The smart thermostat segment has held 35% revenue share in 2023. The smart thermostat segment dominates the thermostat market primarily due to its advanced features and growing demand for home automation. Smart thermostats offer remote control, learning capabilities, and compatibility with IoT systems, enhancing user convenience and energy savings. They align with the trend of smart homes and IoT integration, making them increasingly popular among consumers.

The ability to customize settings and the potential for substantial energy cost reductions have made them a preferred choice for residential and commercial applications. As energy efficiency and automation gain importance, the smart thermostat segment continues to expand its market share.

The other segment is anticipated to expand at a significant CAGR of 13.8% during the projected period. The dominance growth of the other segments in the thermostat market is attributed to its role as a catch-all category that encompasses a diverse array of thermostat products that extend beyond the conventional smart and programmable variants.

This eclectic segment caters to a spectrum of niche applications, including industrial-grade thermostats used in diverse settings such as refrigeration, industrial ovens, incubators, and large-scale commercial HVAC systems. These specialized thermostats are tailored to meet precise temperature control demands and offer a level of customization not found in mainstream thermostat categories. As a result, the "Others" segment seizes a substantial market share, driven by its adaptability and ability to address a wide spectrum of unique temperature control requirements.

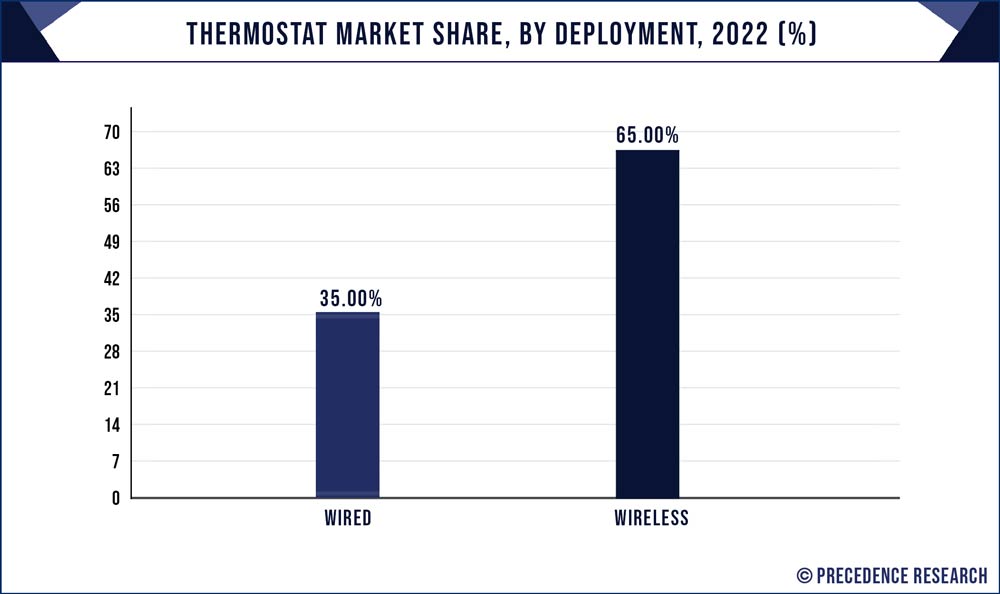

The wireless segment is anticipated to hold the largest market share of 65% in 20223. The wireless segment holds a significant share in the thermostat market due to its inherent advantages. Wireless thermostats are favored for their easy installation, as they do not require extensive wiring, making them suitable for retrofitting and new construction. They offer greater flexibility, enabling users to place them conveniently within a space.

Wireless connectivity allows for remote control via smartphones and seamless integration with other smart home devices. This convenience and adaptability make wireless thermostats highly popular among consumers and businesses, contributing to their substantial market share in the thermostat industry.

The wired segment is projected to grow at the fastest rate over the projected period. The prevalence growth of the wired segment in the thermostat market can be attributed to its unwavering reliability and steadfast performance. Wired thermostats have earned their prominence over years of utilization, finding their niche in both residential and commercial domains. They have become synonymous with trustworthiness, particularly in scenarios where consistency is of utmost importance, such as industrial applications and expansive commercial edifices. Wired thermostats establish a direct, unswerving link with HVAC systems, ensuring precision in temperature regulation. While wireless alternatives offer modernity and convenience, wired thermostats remain the preferred choice for those who prize unfaltering operation and steadfast performance.

In 2023, the residential segment had the highest market share of 45% on the basis of the application. The residential sector's supremacy in the thermostat market can be attributed to several compelling factors. Firstly, the increasing consciousness about energy efficiency and the pursuit of cost savings in household energy expenditure have spurred a robust demand for smart thermostats. Furthermore, the ascent of smart homes and the internet of things (IoT) has significantly elevated the appeal of these devices among homeowners who seek enhanced control and seamless living.

The residential segment benefits from the ease of retrofit installations, making it an accessible choice for a diverse consumer base. Additionally, government incentives and monetary perks predominantly target residential energy efficiency, serving as a booster for adoption. This convergence of elements establishes the Residential sector as a paramount contributor to the thermostat market's substantial market share.

The industrial segment is anticipated to expand at the fastest rate over the projected period. The industrial segment holds significant growth in the thermostat market due to several key factors. In industrial settings, precise temperature control is essential for processes, manufacturing, and storage. Smart thermostats and advanced climate control systems enable businesses to optimize energy usage, reduce operational costs, and ensure consistent product quality.

Moreover, government regulations and sustainability goals have pushed industries to adopt energy-efficient solutions, making advanced thermostats an attractive choice. The integration of IoT technology also allows for centralized control, monitoring, and automation, making them indispensable for large-scale commercial and industrial applications.

Segments Covered in the Report

By Product

By Deployment

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client