October 2024

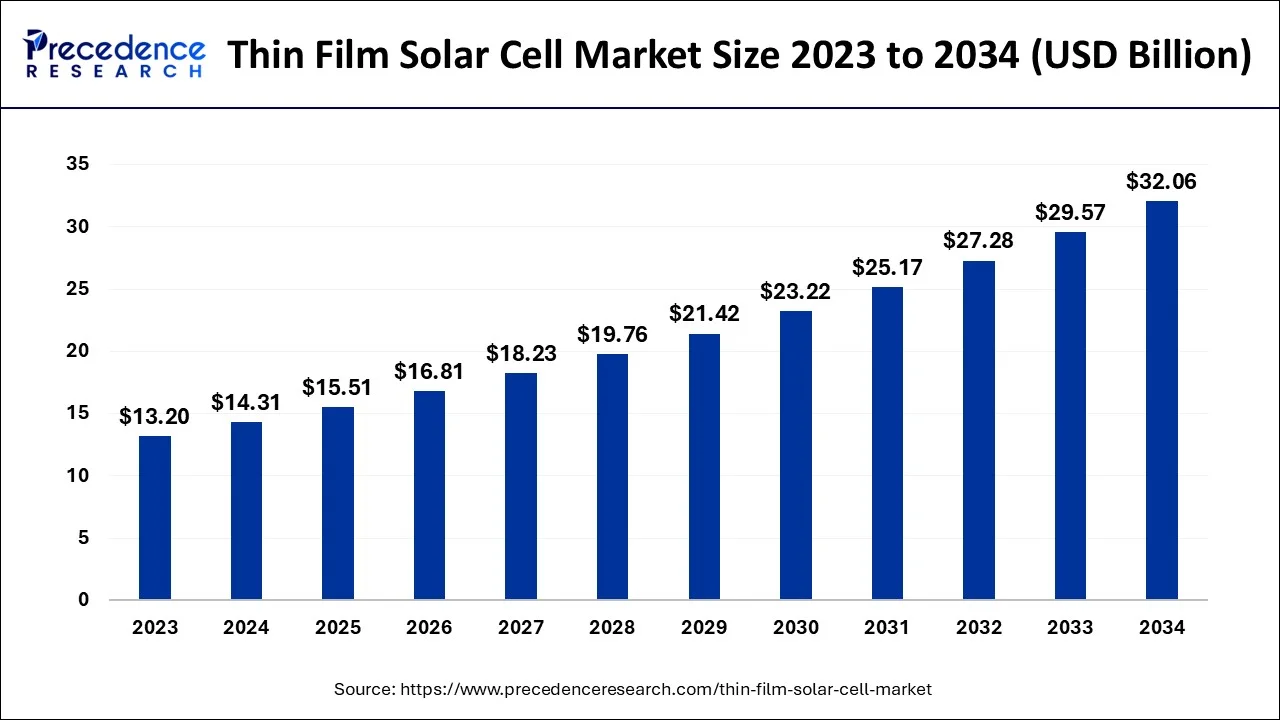

The global thin film solar cell market size accounted for USD 14.31 billion in 2024, grew to USD 15.51 billion in 2025 and is predicted to surpass around USD 32.06 billion by 2034, representing a healthy CAGR of 8.40% between 2024 and 2034.

The global thin film solar cell market size is accounted for USD 14.31 billion in 2024 and is anticipated to reach around USD 32.06 billion by 2034, growing at a CAGR of 8.40% from 2024 to 2034.

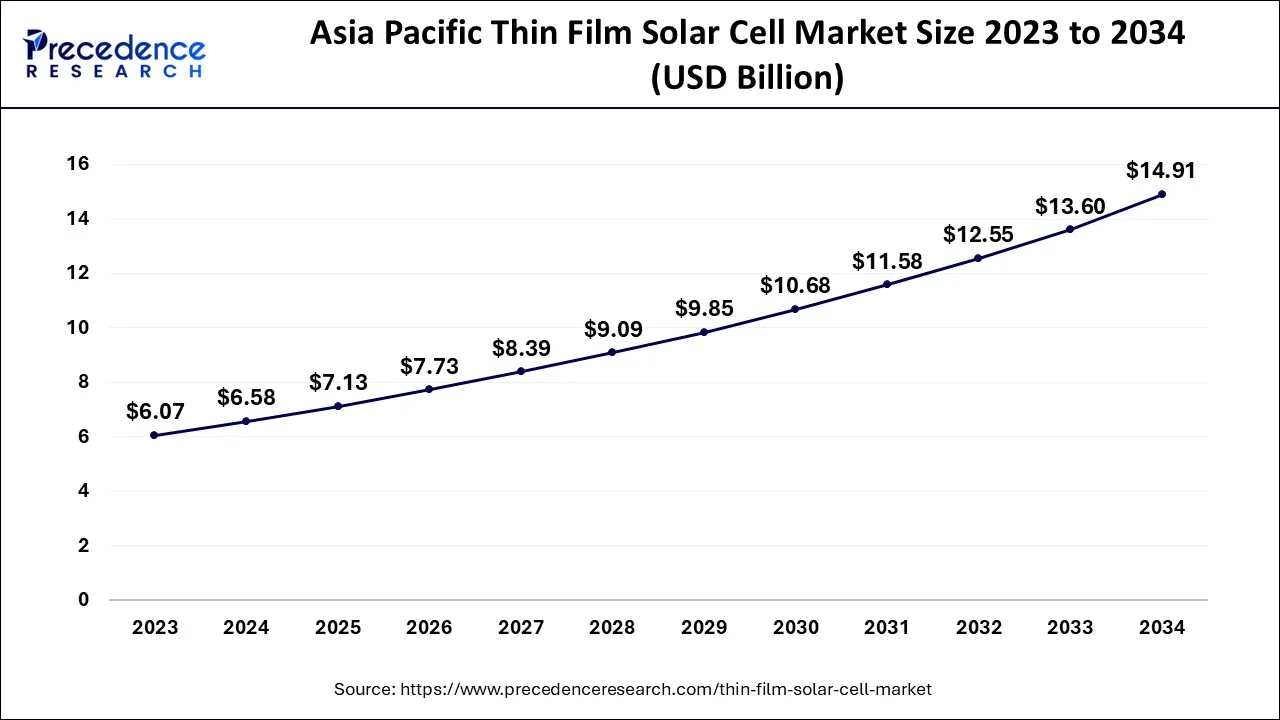

The Asia Pacific thin film solar cell market size is evaluated at USD 6.58 billion in 2024 and is predicted to be worth around USD 14.91 billion by 2034, rising at a CAGR of 8.51% from 2024 to 2034.

Asia-Pacific was the largest region in the world for thin-film solar cells in 2023, and it is anticipated that it will continue to expand at the highest rate. Numerous factors, including industrialization, a sizable consumer base, and urbanization, are to blame for this. China is among the largest solar Photovoltaic markets around the world, accounting for around 50% of the world's consumption of solar energy in 2018.

APAC has accounted for a significant portion of the thin layer solar PV market due to the growing implementation of solar Photovoltaic panels in commercial, utility-scale, and residential applications. Utility-scale solar Photovoltaic facilities in China mostly employ thin-film technology. A draught policy was published by China's National Commission for Development and Reform in 2018 that would raise the target for renewable energy from 20% to 35% by 2032. In 2019, it's anticipated that over 40 GW of new renewable energy capacity will be linked to the grid, with about 50% of the capacity coming from large-scale solar projects. Smaller, decentralized systems are anticipated to provide the remainder of the market share. The Tokyo Olympic Games' organizing committee from Japan declared its intention to use only sustainable power in 2018.

Additionally, the planners want to buy sustainable power from utility providers and put solar panels up everywhere they can. To produce a portion of the energy required for the 2020 Games, the board is planning to construct several solar roadways built of polymer crystalline silicon. In consequence, it is anticipated that this will increase the request for thin-coating solar PV shortly. Thin-film photovoltaic is anticipated to have substantial growth throughout the projection period because of reasons such as the impending utility-scale projects, supporting legislation, and incentives.

The market for thin-film solar cells appears to be relatively fragmented on a global scale. The industry for slender solar panels is very competitive, as evidenced by the presence of numerous international and local manufacturers. To take the top spot in the market, businesses operating in it are using a variety of organic and inorganic methods, including mergers, partnerships, acquisitions, and collaborations. Market players for thin-film solar cells are expanding their investment in R&D initiatives. They can able to strengthen existing product portfolios and build next-generation items thanks to their efforts.

The market with thin-film solar cells is expected to grow significantly in the upcoming years as a result of such factors. A revolutionary kind of solar cell called a thin film solar panel is constructed of several thin sheets of photovoltaic elements. Thin-film solar energy is also identified as thin-film photovoltaic solar cells (TFPV). Thinner than typical P-N junction solar cells, they come in a variety of thicknesses (a few nano-meters, frequently 20 times smaller than c-Si wafers).

Based on the kind of photovoltaic solar material they employ, thin-film solar panels can be categorized into four different categories. These include dye-sensitized solar cells (DSC) and other photovoltaics, cadmium sulfide, copper indium gallium di-selenide (CIS or CIGS), copper indium telluride (CdTe), and electrode materials (a-Si) and other slender silicon. The thin-film solar array is also made by depositing thin semiconductor films on plastic, glass, or metal.

People from all across the world have increased their use of sustainable energy during the past several years. This element is fueling the expansion of sales in the market for thin film solar cells worldwide. Furthermore, the utilization of solar energy has increased globally as a result of the steady drop in solar prices. As a result, chances for players in the worldwide solar cell thin film industry to generate revenue are increasing. The focus of businesses in the worldwide solar cell thin film industry is on technological development. This element is fueling the expansion of the solar cell thin film industry on a global scale.

Aside from this, the global urbanization trend is driving the demand for thin film solar cells. This is true for both established and emerging nations. Throughout the projected period, the thin film solar cells market is anticipated to expand at a consistent CAGR. The increasing government efforts to integrate green sources into the grid are what is driving the market for thin film solar cells globally. The market is also anticipated to develop in the coming years as a result of rising awareness about using renewable power and legislative actions to reduce carbon emissions.

Thin-film solar cells, the most recent generation of solar cells, feature multiple thin photovoltaic component coatings. Thin-film solar panels are upcoming in the planetary business because they are extremely economical, utilize less material, are safe, produce less waste, and are very simple to create. The rise in administrative prices and market aid initiatives has augmented the claim for renewable electricity as an effectual and complementary approach to reducing carbon emissions.

Additionally, as the need for rooftop solar photovoltaic (PV) installation has gained considerable traction, it is projected that the market for thin-film solar cells would present growth opportunities. The market for thin-film solar cells is also projected to be driven by R&D to enhance solar cell endurance and performance, which will create new opportunities for market growth. The sector is expanding as a result of things like enhanced deployment adaptability, a rise in global energy demand, and advancements in thin-film solar cells' efficiency and performance.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.31 Billion |

| Market Size by 2034 | USD 32.06 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.40% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Technology, Application, and Geography |

Development and research to create new and better energy-efficient alternatives

In 2023, the cadmium telluride category dominated the worldwide thin-film solar cell market, and it is anticipated that it will continue to grow at the quickest rate throughout the prediction period and is because it is non-toxic, absorbs a large broad range of spectrums, and works well enough in low lighting conditions, albeit it quickly lost efficiency. It also has cheap operation and production costs. Because cadmium may be produced as a byproduct of the smelting, mining, and refining of lead, zinc, and copper, cadmium-telluride (CdTe) solar cells with thin films could be produced at low prices. Cadmium telluride is used in this photoelectric technique to produce photovoltaic panels at a comparatively low cost. This is the only renewable power technology that uses the smallest amount of water during manufacturing.

Compared to those other thin film solar cells, CdTe thin coating PV solar panels have better cell efficiencies ranging from 16.7%. The production of CdTe PV is a leading industry in the US. Leading this field's development and research has been the National Renewable Energies Laboratory (NREL). In 2018, CdTe produced electricity at a price that was significantly lower than or on par with that of conventional fossil fuel sources of energy. There is scope for more development.

In 2023, the market for on-grid dominated the world's thin-film solar cell industry, and it is anticipated that it would continue to develop at the quickest rate throughout the forecast timeframe. This is due to an expanding electrical distribution and transmission system that will drive demand during the projected period because of the incorporation of electricity generated by renewable resources into the grid.

In 2023, the utility market dominated the worldwide thin-film solar cell market, and it is anticipated that it would continue to develop at the quickest rate throughout the forecast period. The implementation of significant developments is on the rise, and development and research spending are rising to lower installation and maintenance costs, which chance of boosts consumer needs.

By Type

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

January 2025

August 2024