January 2025

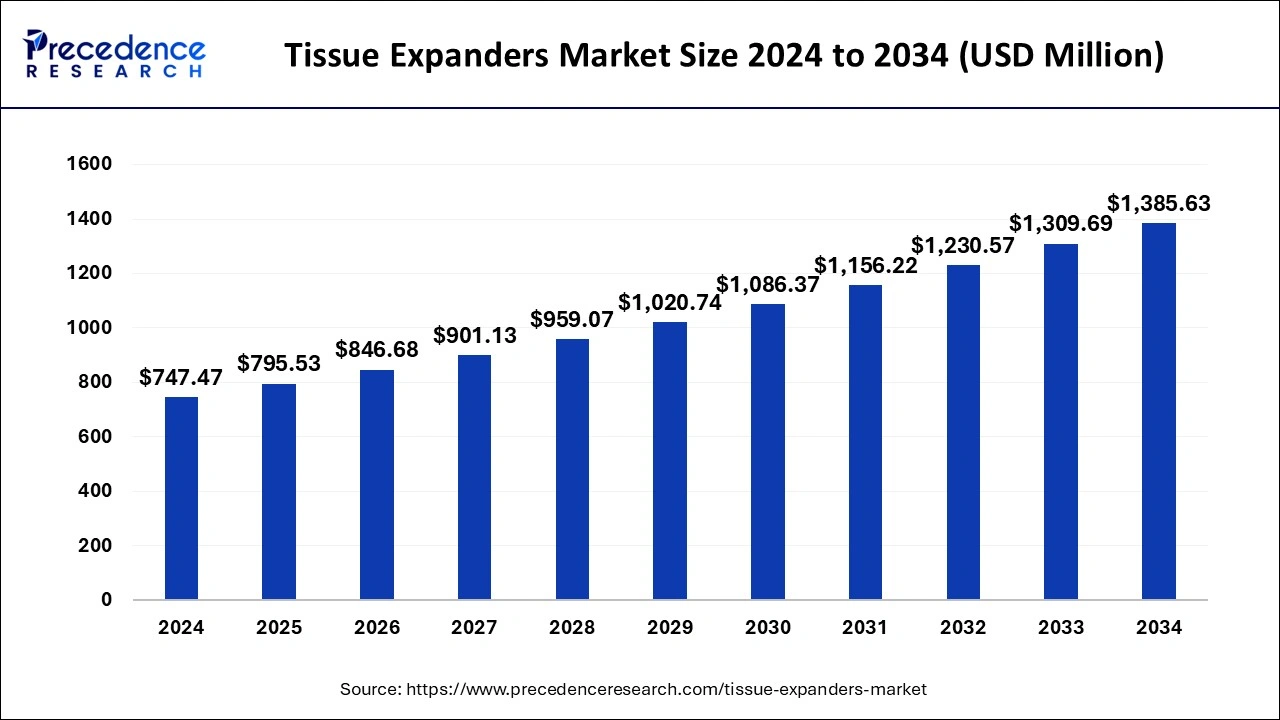

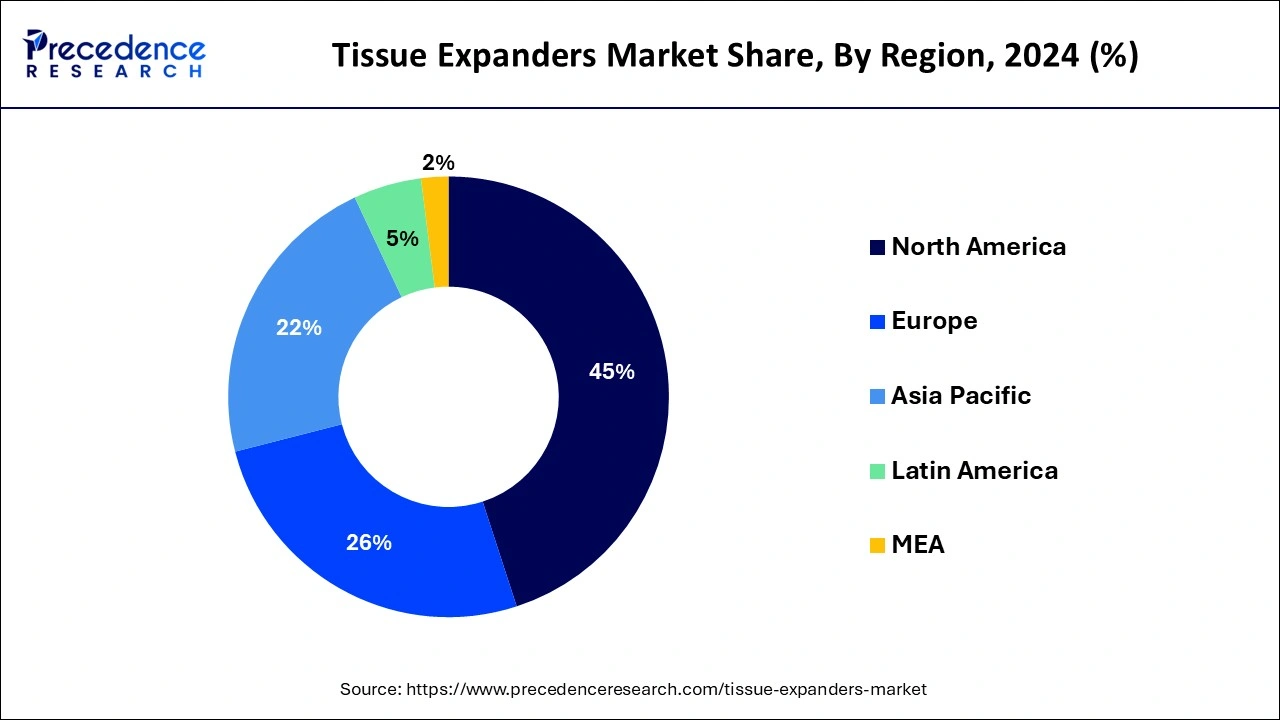

The global tissue expanders market size is calculated at USD 795.53 million in 2025 and is forecasted to reach around USD 1,385.63 million by 2034, accelerating at a CAGR of 6.37% from 2025 to 2034. The North America tissue expanders market size surpassed USD 357.99 million in 2024 and is expanding at a CAGR of 6.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global tissue expanders market size was estimated at USD 747.47 million in 2024 and is predicted to increase from USD 795.53 million in 2025 to approximately USD 1,385.63 million by 2034, expanding at a CAGR of 6.37% from 2025 to 2034. The tissue expanders market is driven by a global increase in the number of reconstructive procedures.

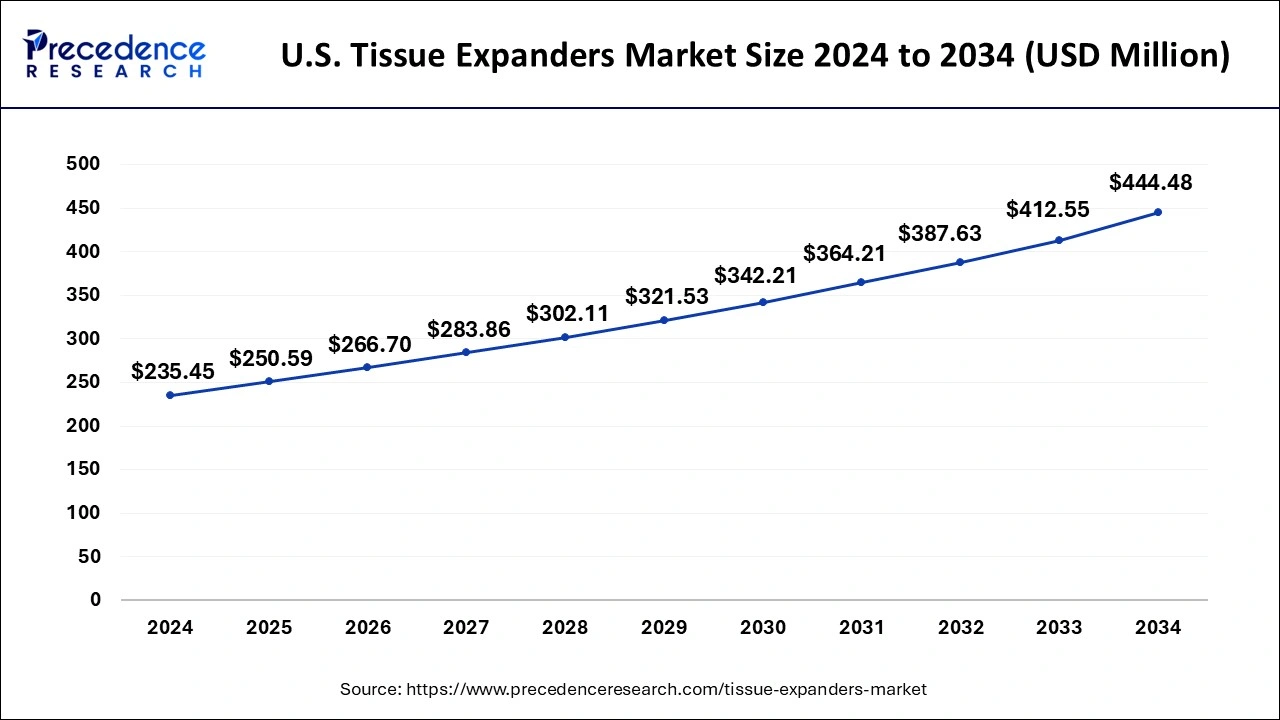

The U.S. tissue expanders market size was estimated at USD 235.45 million in 2024 and is predicted to hit around USD 444.48 million by 2034 at a CAGR of 6.56% from 2025 to 2034.

North America has its largest market share in 2024 in the tissue expanders market. The demand for tissue expanders is primarily driven by procedures related to breast reconstruction, especially those performed after mastectomy for breast cancer. Breast reconstruction surgeries are more common in North America than in other regions due to the region's comparatively higher incidence of breast cancer. Tissue expanders are essential because they assist in stretching the skin to make room for breast implants during the reconstruction procedure. The North American tissue expanders market's share is mainly attributed to the region's growing acceptance and accessibility of breast reconstruction operations.

Asia-Pacific is the fastest-growing in tissue expanders market during the forecast period. The economy of the Asia-Pacific region is expanding, and with it is healthcare spending. Public and private healthcare providers are making significant investments to modernize medical facilities, including specialized plastic and reconstructive surgery divisions. The area's governments have strongly promoted medical tourism and strengthened the medical supplies and procedures regulations. This has facilitated access to state-of-the-art medical care and attracted people from nearby and around the globe. Reconstructive procedures aided by tissue expanders are among these services.

An area of the medical device business dedicated to producing and distributing tissue expanders is known as the tissue expanders market. In plastic and reconstructive surgery, tissue expanders are tools used to add extra skin and tissue to the body. Typically, they are utilized in operations like congenital deformity correction, scar revision, and breast reconstruction following mastectomy.

The tissue expanders market aims to give medical professionals cutting-edge, practical instruments for carefully expanding tissue. By progressively stretching the existing tissue, these devices help surgeons minimize the risk of problems like tissue necrosis or severe scarring while encouraging normal tissue growth. Tissue expanders contribute to improved functional and aesthetic results in reconstructive and cosmetic surgeries by generating more tissue.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.37% |

| Market Size in 2025 | USD 795.53 Million |

| Market Size by 2034 | USD 1,385.63 Million |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Shape, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of breast cancer

The market for tissue expanders has expanded due to improvements in breast reconstruction materials and surgical methods. These days, surgeons have access to a wide range of expanders with unique features, including textured surfaces for better tissue integration, changeable volume, and increased biocompatibility, improving patient outcomes and satisfaction. A growing number of patients are placing increasing importance on aspects like comfort, appearance, and general quality of life after surgery as they learn about their treatment options. Meeting these patient choices is facilitated by tissue expanders that provide better esthetic outcomes and customizable alternatives.

Rising cases of trauma and burns

Traumatic injuries from violent incidents, sports injuries, falls, or accidents can cause substantial tissue damage that necessitates reconstructive surgery. In these situations, tissue expanders provide extra skin and tissue where there has been trauma. This enables surgeons to efficiently restore the injured area.

The need for tissue expanders is fueled in part by the rising frequency of traumatic injuries, particularly in cities with heavy traffic and industrial activity. Any substances, including fire, hot liquids, chemicals, and electricity, can burn someone severely, damaging the skin and tissues beneath. In burn reconstruction surgeries, tissue expanders repair the injured skin and enhance appearance and functionality.

Rejection caused by implanted tissues

Rejection happens when the immune system begins an attack on the implanted tissue expander because it perceives it as a foreign object. This reaction may result in tissue injury, inflammation, and implant failure. Individual differences in the immunological response mean it is difficult to anticipate who will be rejected. Tissue expander rejection or associated problems cannot usually appear immediately after implantation. Patients must be monitored for an extended period to identify any early indications of rejection. This surveillance entails routine check-ins with medical professionals, imaging tests, and teaching patients how to recognize signs of implant-related problems.

Increasing awareness about physical appearance and beauty among people

The need for cosmetic surgery is rising along with the acceptance of beauty consciousness among the populace. The popularity of procedures, including body contouring, breast augmentation, breast reconstruction after mastectomy, and facial reconstruction, has grown. In these surgeries, tissue expanders are essential because they make room for implants and help achieve natural-looking results.

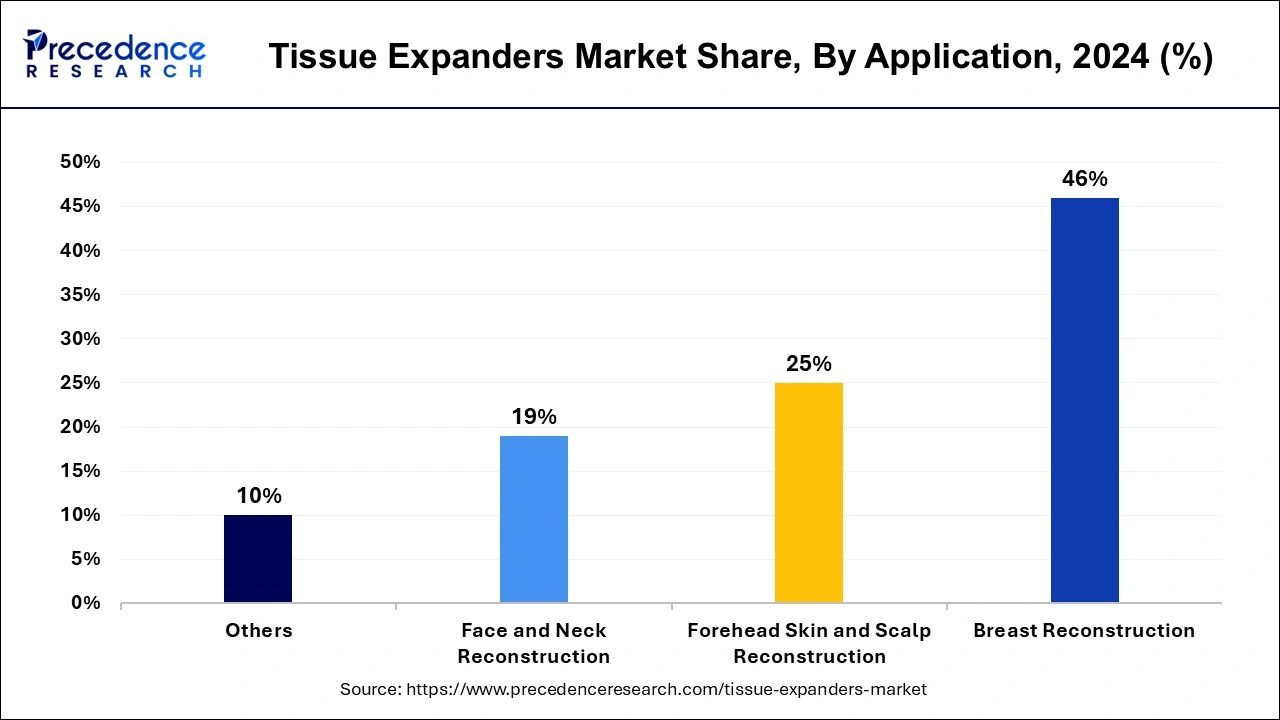

The anatomical segment dominated in the tissue expanders market in 2024. Anatomical tissue expanders are made to resemble the natural outlines and forms of body components, including the breasts or the characteristics of the face. Because of their anatomical design, these expanders fit better within the tissue pocket, lowering the possibility of displacement or distortion during the expansion process. Anatomical tissue expanders are used in facial plastic surgery to restore facial characteristics following trauma, birth defects, or cancer resections. They can be made specifically to fit the patient's face shape.

As the demand for anatomical segment products grows, market participants will probably concentrate on innovation, cost-effectiveness, and patient-specific customization to keep a competitive edge.

The round segment is the fastest growing tissue expanders market during the forecast period. In reconstructive surgery, tissue expanders are medical devices that produce and stretch skin and tissue for various uses, such as congenital deformity correction or breast reconstruction following mastectomy. The tissue expanders market offers various shapes, such as rounded and anatomical (teardrop-shaped) expanders.

Round tissue expanders are renowned for being easy to use and simple in design, making them appropriate for various surgical procedures and patients. Round expanders are more widely used and in higher demand than anatomical ones since they are simpler for surgeons to insert and modify. Round tissue expanders are favored since they are frequently less expensive than anatomical ones, especially in healthcare systems where financial concerns are essential.

The rectangular segment shows lucrative growth in the tissue expanders market during the forecast period. Most patients and surgeons find rectangular tissue expanders to have a customizable and adaptable design. With these expanders, you may customize the result to look more natural by adjusting them to accommodate different anatomical shapes and sizes. Surgeons use these expanders because they can accomplish adequate tissue expansion, improving the wound's appearance. Rectangular tissue expanders are becoming more used in other reconstructive surgeries, like those performed after bariatric treatments or in the head and neck area, even if breast reconstruction is still their principal use. Rectangular tissue expanders have a broader commercial potential thanks to this enlarged application.

The breast reconstruction segment dominated and sustained to be the fastest growing tissue expanders market in 2024. Over the past few decades, advancements in breast reconstruction techniques and technologies have been made. This includes developing state-of-the-art tissue expanders that provide patients with greater comfort, less complications, and better outcomes. Millions of individuals worldwide lose their lives to breast cancer each year, making it one of the most prevalent cancers globally. Together with improved awareness of early detection and screening for breast cancer, more women are undergoing mastectomies as part of their treatment.

The forehead skin and scalp reconstruction segment show lucrative growth in the tissue expanders market during the forecast period. Reconstructive surgery operations are in greater demand, particularly for situations involving burns, trauma, congenital malformations, and cancer surgeries. Tissue expansion procedures are frequently needed for forehead skin and scalp repair to achieve the best outcomes. The worldwide incidence of skin cancer has been rising, which has increased the need for skin cancer procedures and the reconstructions that follow. Skin cancer frequently affects the scalp and forehead skin, requiring reconstructive treatments that frequently entail tissue growth.

The hospital segment dominated the tissue expanders market in 2024. Hospitals have state-of-the-art medical equipment and highly qualified medical staff, such as oncologists, plastic surgeons, and reconstructive surgeons. These professionals are indispensable in the diagnosis, treatment, and care of disorders requiring tissue expansion, such as skin expansion for burn victims or breast reconstruction following mastectomy. Specialized tools, including surgical instruments, monitoring devices, and expandable implants, are frequently needed for tissue expansion treatments. These tools are available to hospitals, enabling doctors to carry out intricate tissue expansion procedures securely and efficiently.

Patients also believe in it because it stands for high-quality medical services and safety regulations. For intricate surgical treatments like tissue expansion, patients frequently select facilities based on rankings, referrals from medical professionals, or prior good experiences.

The cosmetology clinics segment shows a significant growth in the tissue expanders market during the forecast period. Patients are demanding more and more surgeries, including face rejuvenation, breast augmentation, and reconstruction, which is raising the demand for sophisticated methods and goods like tissue expanders. The public is increasingly conscious of and receptive to cosmetic and reconstructive surgery. The stigma attached to these operations has decreased because of this societal shift, encouraging more people to think about and choose tissue expander-based treatments.

Several cosmetology clinics collaborate with plastic surgeons and medical device manufacturers to provide complete treatments, including tissue expander-based operations.

By Shape

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

September 2024

June 2024