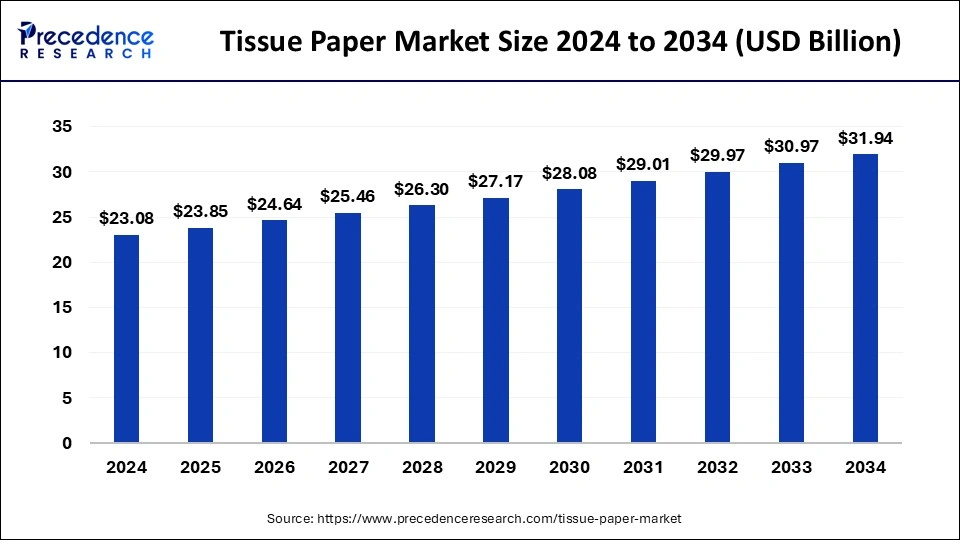

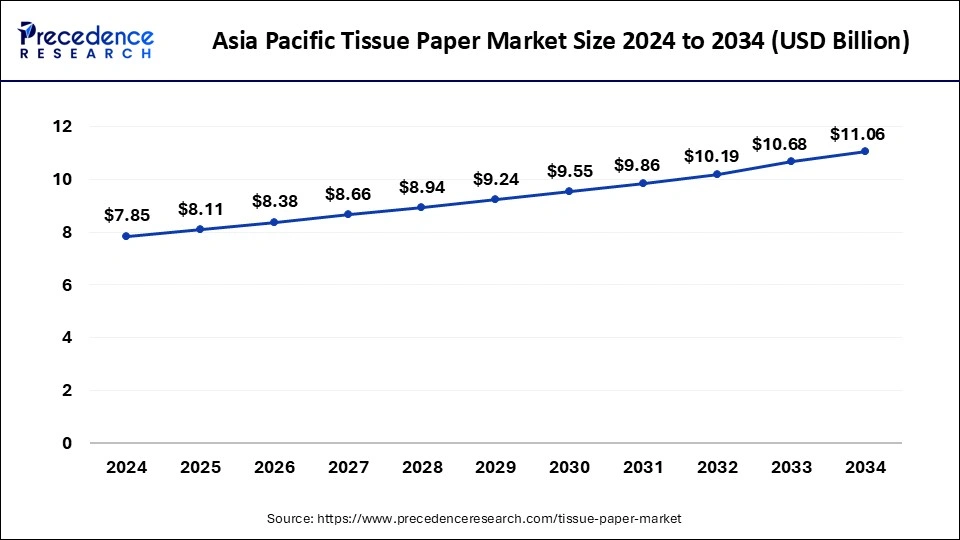

The global tissue paper market size is calculated at USD 23.85 billion in 2025 and is forecasted to reach around USD 31.94 billion by 2034, accelerating at a CAGR of 3.30% from 2025 to 2034. The Asia Pacific tissue paper market size surpassed USD 8.11 billion in 2025 and is expanding at a CAGR of 3.49% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global tissue paper market size was estimated at USD 23.08 billion in 2024 and is predicted to increase from USD 23.85 billion in 2025 to approximately USD 31.94 billion by 2034, expanding at a CAGR of 3.30% from 2025 to 2034. The tissue paper market is driven by the increasing awareness among homes and business facilities of the importance of putting essential sanitation and hygiene procedures into place.

The Asia Pacific tissue paper market size was exhibited at USD 7.85 billion in 2024 and is projected to be worth around USD 11.06 billion by 2034, poised to grow at a CAGR of 3.49% from 2025 to 2034.

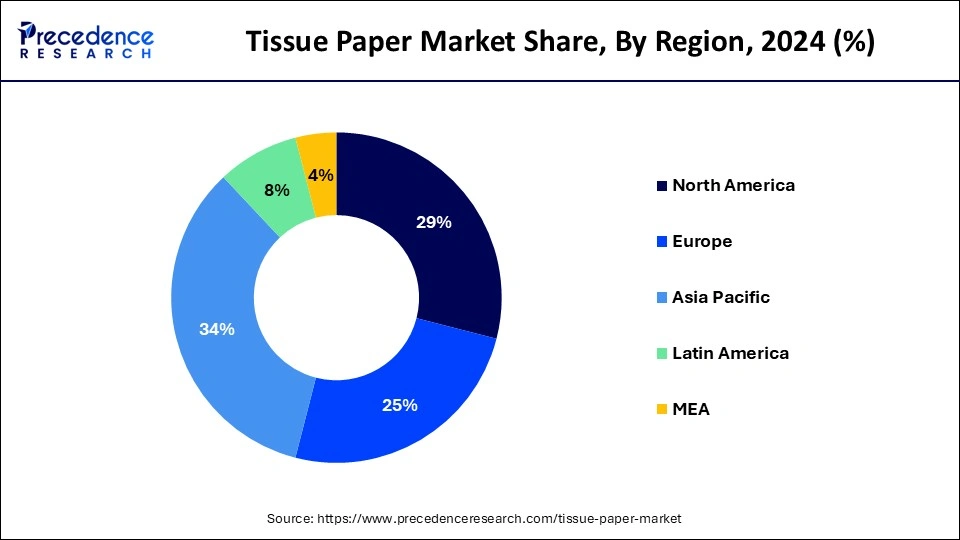

Asia-Pacific dominated the tissue paper market in 2024. Consumers in Asian countries are increasingly spending money on tissue paper and other personal care and hygiene products. The market is expanding due to the increased demand for premium and higher-quality tissue paper goods brought about by rising disposable incomes. Asia-Pacific countries' consumer preferences have been impacted by exposure to Western lifestyles and cleanliness standards, which has resulted in a rise in the use of tissue paper products. The increasing awareness of hygiene and convenience among urban populations drives the demand for disposable tissue products.

The well-established retail and distribution networks in Asia Pacific ensure the efficient availability and accessibility of tissue paper products. Supermarkets, hypermarkets, convenience stores, and online retailers provide a wide array of tissue paper brands and products, catering to diverse consumer preferences and needs.

North America shows a significant growth in the tissue paper market during the forecast period. Sustainable products are becoming more and more popular as consumers show a preference for eco-friendly tissue created from recycled materials. Major North American corporations are implementing sustainable practices to appeal to environmentally sensitive consumers, such as decreasing carbon footprints and procuring raw materials responsibly.

Europe is a significant marketplace for the tissue paper industry. Europe boasts one of the highest per capita consumption rates of tissue paper products in the world. This high demand is driven by the widespread use of tissue paper in households, workplaces, and public facilities. Products such as toilet paper, facial tissues, kitchen towels, and napkins are staples in European homes and institutions, reflecting the continent’s developed and hygiene-conscious consumer base.

The tissue paper market includes producing, supplying, and marketing tissue paper goods such as paper towels, napkins, toilet paper, and facial tissues. These goods are mainly used for cleanliness and hygiene in the commercial, industrial, and residential sectors. The market is diverse, with players ranging from big multinational firms to smaller regional producers, and it is defined by a persistent need for products that are creative, sustainable, and reasonably priced.

Products for everyday usage, such as tissue paper, are necessary and consistently in demand. As a result, the market for tissue paper is more stable and less vulnerable to economic changes compared to other industries. The tissue paper market, present in both developed and developing countries, reflects a wide range of customer preferences and financial circumstances.

| Report Coverage | Details |

| Market Size by 2034 | USD 31.94 Billion |

| Market Size in 2025 | USD 23.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.30% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing global population boosts the demand for essential consumer goods

Basic hygiene supplies become increasingly crucial as population density increases. This covers tissue paper for sanitary, home, and personal hygiene needs. Population expansion increases the total volume of tissue paper needed, even in constant per capita consumption. Increased infrastructure spending often results from population increase, especially in developing nations where it helps to distribute better and make consumer goods like tissue paper more accessible. Improved distribution networks guarantee that tissue paper reaches outlying and underdeveloped areas, increasing usage in the aggregate.

Fluctuating pulp prices

The primary raw material used in tissue paper production is pulp. Changes in pulp prices directly impact the costs of production. Manufacturers' profit margins may be negatively affected by increased production costs brought on by rising pulp prices unless they can pass these costs down to customers. Tissue paper is a high-volume, generally low-margin product. Cost increases for raw materials, even modest ones, can have a significant financial impact. This limits the growth of the tissue paper market.

Advancements in manufacturing technologies

Using automated equipment, the entire production process, from pulp processing to packaging, can be streamlined. This lowers labor expenses and speeds up production. Because robots can perform operations like cutting, folding, and packaging accurately, there will be less waste and a consistent output quality.

Technologies like digital printing and laser cutting, which appeal to niche markets, make customized tissue paper goods with distinctive patterns and designs possible. By experimenting with alternative materials and procedures, manufacturers can create novel products that appeal to consumers who are concerned about their health and the environment. Examples of such products are hypoallergenic or biodegradable tissue papers. This opens an opportunity for the tissue paper market.

The paper tissues (made from pulp) segment dominated the tissue paper market in 2024. Customers now prefer paper tissues over cloth ones due to increased hygiene and health consciousness. The COVID-19 pandemic further raised this awareness, resulting in an increase in demand for disposable hygiene products. Paper tissues are convenient for use as face tissues, napkins, and paper towels, among other things. Because of their single-use nature, they are perfect for rapid clean-ups and personal hygiene.

In general, it is less expensive to make and buy paper tissues. Manufacturing-scale economies make mass-market-friendly pulp-based tissues affordable. Because the production processes are well-established and the raw materials (wood pulp) are easily obtainable, a steady supply and stable prices are guaranteed.

The facial tissue segment shows a significant growth in the tissue paper market during the forecast period. Facial tissues are now more practical and aesthetically pleasing for customers due to various packaging alternatives such as pocket packs, travel-sized packs, and beautiful box designs. With the availability of facial tissues in a wider range of retail locations, such as supermarkets, convenience stores, and online platforms, their accessibility has increased.

Because of their convenience and hygienic advantages, disposable face tissues are replacing traditional fabric handkerchiefs in some areas. Adopting Western lifestyles in developing nations has resulted in a rise in the use of face tissues, as these tissues are commonly utilized for personal cleanliness in Western societies.

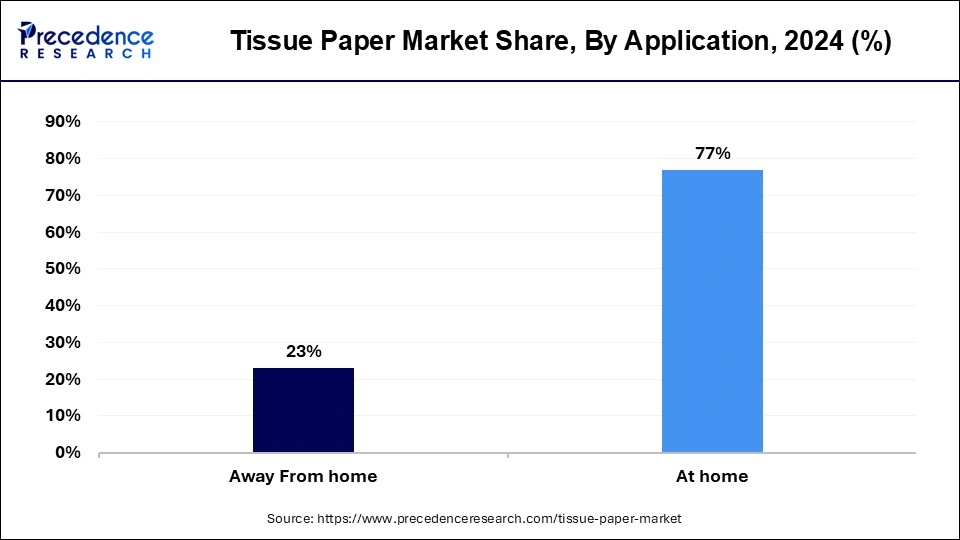

The at home segment dominated in the tissue paper market in 2024. Tissue paper goods, such as paper towels, napkins, facial tissues, toilet paper, and other tissue paper items, are available in the at-home market. Their diversity makes them more enticing and versatile, meeting consumers' varying demands and tastes. Tissue paper goods are a household staple since they are readily available and practical for daily use. The convenience of acquiring these products from brick-and-mortar establishments and internet retailers has increased their use.

Well-known brands of tissue paper have developed a significant consumer base and commercial presence. Efficient marketing techniques and reliable product quality have maintained dominance in the at-home market. The at-home market is growing due to ongoing product innovation, such as introducing premium and eco-friendly tissue paper products that have drawn quality-sensitive and environmentally conscious consumers.

The away from home segment is observed to be the fastest growing in the tissue paper market during the forecast period. Disposable income rises with economic growth, especially in emerging nations. This economic growth increases the demand for AFH tissue goods, raising expenditures on upgraded infrastructure and amenities in public and commercial areas. Manufacturers constantly develop innovative items, including eco-friendly tissue alternatives, more absorbent paper towels, and sophisticated dispensers specifically for the AFH market. These innovations support market expansion by meeting the unique requirements of many industries.

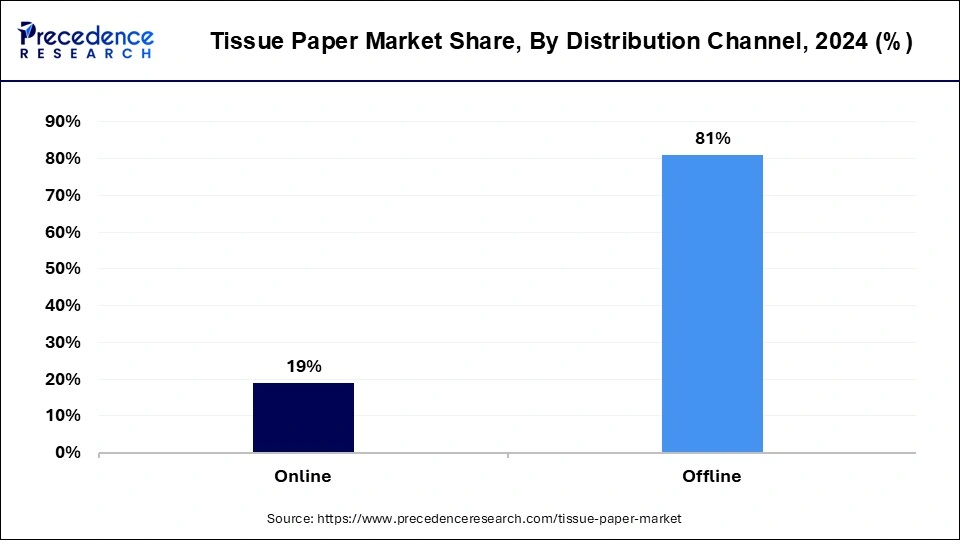

The offline segment dominated the tissue paper market in 2024. One significant benefit of offline shopping is that items may be acquired immediately, especially for regular needs like tissue paper. Customers don't have to wait for delivery schedules, which, for many, is a decisive issue. In offline environments where they can easily carry large quantities, bulk buying is more convenient for consumers who would otherwise choose to stock up on tissue paper to avoid making frequent purchases.

The online segment shows a significant growth in the tissue paper market during the forecast period. Online purchases of tissue paper items have become simpler for customers because of the growth of e-commerce platforms worldwide. Online shopping is becoming increasingly popular among consumers since it's convenient. It lets them explore a wide selection of products, compare prices, and read reviews from other customers without leaving their homes. This change in customer behavior is anticipated to increase demand for tissue paper items sold online.

By Product Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client